How to appeal a tax authority's decision

An appeal to a higher tax authority or in court against an inspection decision that does not suit the taxpayer is provided for in Art. 138 Tax Code of the Russian Federation. You cannot immediately appeal the decision in court. The provisions of the Tax Code of the Russian Federation establish a mandatory pre-trial procedure for appealing the decision of the tax authority and the results of the audit to a higher tax authority (as a rule, the Federal Tax Service Department for the subject).

Decisions of the tax office or its officials can be appealed to a higher tax authority or to the same authority that issued the tax act.

In the tax authority that issued the tax act, you can appeal against documents signed by other employees of the tax authority, for example, an inspector or the head of a department. You can appeal to a higher tax authority any documents that are signed by the head or deputy head of the tax authority.

There are two types of mandatory appeal:

- appeal - submitted before the expiration of a month from the date the taxpayer receives the audit decision;

- complaint - filed within one year from the date of issuance of the appealed document, if it has not been appealed.

As a general rule, a higher authority considers a complaint without the participation of a representative of the taxpayer.

If the outcome of the consideration of the complaint by a higher authority does not satisfy the taxpayer, then he has the right to appeal it in court. In accordance with Part 4 of Art. 198 of the Arbitration Procedure Code of the Russian Federation, the corresponding application can be submitted to the arbitration court within three months from the day when the person became aware of the violation of their rights and legitimate interests by the disputed decision of the tax authority. When challenging it in an arbitration court, the period established by Part 4 of Art. 198 of the Arbitration Procedure Code of the Russian Federation, must be calculated from the moment of expiration of the period for consideration of the complaint by a higher authority.

After a mandatory pre-trial appeal of the decision to a higher tax authority, you can not go to court, but file a complaint with the Central Office of the Federal Tax Service of Russia (paragraph 3, paragraph 2, article 138 of the Tax Code of the Russian Federation).

The tax has been added. What's next?

So, let’s say the tax office has assessed additional taxes - what to do next? And the second important question: for what period can additional taxes be assessed?

To answer these questions, you need to understand the procedure for conducting an on-site tax audit. Art. is devoted to this type of checks. 89 Tax Code of the Russian Federation.

Let us answer the question for what period the tax office can assess additional taxes.

The IRR may cover a period of no more than three years preceding the year of the inspection. Thus, there will be additional charges for this period.

If you disagree with the tax authority’s decision, you can file a complaint with the Federal Tax Service of the Russian Federation. If everything remains unchanged there, then we need to go to court. Moreover, this procedure is relevant for both GNP and CNP.

But if the court doesn’t support you, you’ll have to put up with additional tax assessments based on a court decision.

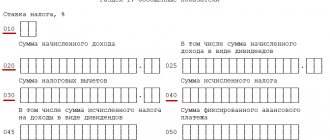

The fact of additional tax assessment based on the on-site inspection report must be reflected in the organization’s accounting records.

What entries should be made in accounting for additional tax assessments? Sign up for a free trial access to ConsultantPlus and find out how to add additional taxes to your accounting.

And ConsultantPlus experts talked about how to reflect additional taxes, penalties and fines in tax accounting. If you don't have access to K+, sign up for a free trial and get straight to the recommendations.

Here are examples of some entries for additional tax assessments for past periods:

| Dt | CT | |

| Sample entries for additional property tax assessments for previous periods | 91-2 “Other expenses” | 68. Subaccount - Property tax |

| What entries should be made in the accounting department for additional assessment of transport tax for the previous year? | 68. Subaccount - Transport tax | |

| How to additionally charge land tax for last year - postings | 68. Subaccount - Land tax |

Stages of appeal to the Federal Tax Service

1. First of all, you need to draw up objections to the claims contained in the tax audit report and send them to the inspectorate within a month from the date of receipt of the tax audit report. You can submit written objections to the act as a whole or to individual provisions of the act.

The date of receipt of the act is considered to be the date that the taxpayer himself indicated upon receipt. If the act was sent by mail, then the date of its delivery is considered to be the 6th day from the date the Federal Tax Service Inspectorate sent the registered letter.

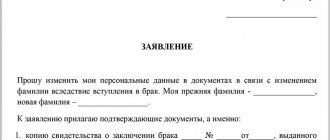

In your objections you must indicate the number and date of the inspection report and state in as much detail as possible what exactly the taxpayer disagrees with. It will be very good if the taxpayer can support his arguments with documents. Each attached document must be indicated in the list of attachments to avoid disputes about the composition of the application.

The taxpayer is informed where and when the audit and objection report will be considered - he can be present, give oral explanations and submit supporting documents. In this case, the taxpayer’s arguments must be indicated in the protocol, which is kept during the consideration (clause 4 of Article 101 of the Tax Code of the Russian Federation).

As a rule, based on the results of consideration of the act and objections, one of the following decisions is made:

- on holding the taxpayer accountable;

- on refusal of liability;

- about additional control.

Decisions to prosecute and refuse can be appealed to a higher tax authority and later in court. And the results of additional tax control measures may themselves be the subject of filing objections (clause 6.1 of Article 101 of the Tax Code of the Russian Federation).

Objections can be submitted personally or through a representative, who must have a power of attorney (Articles 185-189 of the Civil Code of the Russian Federation). Objections are submitted to the office of the tax authority or the window for receiving documents of the tax authority. You can send objections by mail.

2. If the acts of the tax authority have already entered into force and violate the rights of the taxpayer, a complaint is filed. It can be sent within a year to a higher tax authority through the same authority, whose decision must be appealed.

If the tax authority's decision to prosecute has not yet entered into force, an appeal is filed. The filing deadline is within 10 days from the moment the tax authorities’ decision is received. At the end of this period it comes into force (clause 2 of article 101.2 of the Tax Code of the Russian Federation).

A complaint can be submitted in writing or electronically, including through the taxpayer’s personal account. It must be signed by the manager or representative. If it is filed by authorized representatives of the taxpayer, a power of attorney must be submitted along with the complaint.

Information that must be included in the complaint and appeal is indicated in Art. 139.2 Tax Code of the Russian Federation:

- Full name and address of the applicant or name and address of the applicant organization;

- the act being appealed against, actions or inactions of its officials;

- name of the tax authority whose actions are being appealed;

- the grounds on which the applicant’s rights were violated;

- requirements of the person filing the complaint;

- method of obtaining a decision on a complaint: on paper, electronically or through the taxpayer’s personal account.

The deadline for making a decision on the complaint is within a month after filing (Clause 6 of Article 140 of the Tax Code of the Russian Federation). It can be extended for another 15 days if the head or deputy head of the tax authority decides so.

Within another three working days, the taxpayer will be informed of the decision made. From the day the decision on the appeal is made, the decision of the tax authority based on the results of the audit comes into force.

3. The appeal is filed with the same tax authority that made the decision. He must transfer the complaint to a higher tax authority within 3 days. While the complaint is being considered by a higher tax authority, accrued payments are not collected.

A decision of a tax authority that has entered into force, which has not been appealed, may be appealed to a higher tax authority in the general manner within a year from the date of the appealed decision.

If you missed the deadline for filing a complaint for a good reason, you can restore it by filing a petition with the tax authority.

Article 138 of the Tax Code of the Russian Federation. Appeal procedure (current version)

1. Acts of tax authorities of a non-normative nature, actions or inactions of their officials may be appealed to a higher tax authority and (or) to court in the manner prescribed by this Code and the relevant procedural legislation of the Russian Federation.

A complaint is an appeal by a person to a tax authority, the subject of which is an appeal against acts of a tax authority of a non-normative nature that have entered into force, actions or inactions of its officials, if, in the opinion of this person, the appealed acts, actions or inactions of officials of a tax authority violate his rights.

An appeal is recognized as a person's appeal to a tax authority, the subject of which is an appeal against a decision of a tax authority that has not entered into force on bringing to responsibility for committing a tax offense or a decision on refusing to bring to responsibility for committing a tax offense, made in accordance with Article 101 of this Code, if, in the opinion of this person, the appealed decision violates his rights.

2. Acts of tax authorities of a non-normative nature, actions or inactions of their officials (except for acts of a non-normative nature adopted following the consideration of complaints, appeals, acts of a non-normative nature of the federal executive body authorized for control and supervision in the field of taxes and fees, actions or inaction of its officials) can be appealed in court only after their appeal to a higher tax authority in the manner prescribed by this Code.

If a decision on a complaint (appeal) is not made by a higher tax authority within the time limits established by paragraph 6 of Article 140 of this Code, acts of tax authorities of a non-normative nature, actions or inactions of their officials may be appealed in court.

Acts of tax authorities of a non-normative nature, adopted based on the results of consideration of complaints (appeals), can be appealed to a higher tax authority and (or) in court.

Non-normative acts of the federal executive body authorized for control and supervision in the field of taxes and fees, actions or inactions of its officials are appealed in court.

3. In case of appeal in court against acts of tax authorities of a non-normative nature, actions or inactions of their officials (with the exception of acts of a non-normative nature adopted following the consideration of complaints, appeals, acts of a non-normative nature of the federal executive body authorized for control and supervision in area of taxes and fees, actions or inactions of its officials), the period for filing a lawsuit is calculated from the day when the person became aware of the decision taken by a higher tax authority on the relevant complaint, or from the date of expiration of the deadline for making a decision on the complaint (appeal), established paragraph 6 of Article 140 of this Code.

4. Appeals by organizations and individuals in court against acts (including normative ones) of tax authorities, actions or inactions of their officials are carried out in the manner prescribed by the relevant procedural legislation of the Russian Federation.

In the event of a judicial appeal against acts of tax authorities, the actions of their officials, the execution of the appealed acts, the commission of the appealed actions may be suspended by the court in the manner prescribed by the relevant procedural legislation of the Russian Federation.

5. Filing a complaint to a higher tax authority does not suspend the execution of the appealed act of the tax authority or the commission of the appealed action by its official, except for the case provided for in this paragraph.

In the event of an appeal against a decision that has entered into force to bring to justice for committing a tax offense or a decision to refuse to bring to justice for committing a tax offense before a decision on the complaint is made, the execution of the appealed decision may be suspended upon the application of the person who filed this complaint, upon provision of a bank account. a guarantee under which the bank undertakes to pay an amount of money in the amount of taxes, fees, insurance premiums, penalties, fines not paid under the appealed decision.

An application to suspend the execution of the appealed decision is submitted simultaneously with a complaint against a decision that has entered into force on bringing to responsibility for committing a tax offense or a decision on refusing to bring to responsibility for committing a tax offense. A bank guarantee is attached to the application to suspend the execution of the appealed decision.

The bank guarantee specified in this paragraph is subject to the requirements established by paragraph 5 of Article 74.1 of this Code, taking into account the following features:

the validity period of the bank guarantee must expire no earlier than six months from the date the person filed an application to suspend the execution of the appealed decision;

the amount for which the bank guarantee is issued must ensure the fulfillment by the guarantor bank of the obligation to pay an amount of money in the amount of tax, fee, insurance premiums, penalties, fines not paid under the appealed decision.

The higher tax authority considering the complaint, within five days from the date of receipt of the application to suspend the execution of the appealed decision, makes one of the following decisions:

on suspension of execution of a decision to bring to justice for committing a tax offense or a decision to refuse to bring to justice for committing a tax offense;

on the refusal to suspend the execution of a decision to prosecute for committing a tax offense or a decision to refuse to prosecute for committing a tax offence.

The basis for a decision to refuse to suspend the execution of a decision to prosecute for committing a tax offense or a decision to refuse to prosecute for committing a tax offense is the non-compliance of the bank guarantee provided by the person who filed the complaint with the requirements established by this article and (or) paragraph 5 of Article 74.1 of this Code.

The decision made is notified in writing to the person who filed the complaint within three days from the date of its adoption.

The decision to suspend the execution of the decision is valid until the day the higher tax authority makes a decision on the complaint.

In case of non-payment or incomplete payment of a tax, fee, insurance premiums, penalties, fine within the period established in the request of the tax authority by the person who filed the complaint, whose fulfillment of the obligation to pay the tax, fee, insurance premiums, penalties, fine is secured by a bank guarantee, the tax authority does not later than five days from the date of expiration of the deadline for fulfilling the specified requirement and no earlier than the day the higher tax authority makes a decision on the complaint, sends to the guarantor bank a demand for payment of the amount of money under the bank guarantee in the part payable after the higher tax authority makes a decision on the complaint of the unpaid amount of tax, fee , insurance premiums, penalties, fines.

The tax authority notifies the bank that issued the bank guarantee of its release from obligations under this guarantee no later than five days from the date the person who filed the complaint fulfills the obligation to pay the amount of tax, fee, insurance premiums, penalties, fines that were secured by such a bank guarantee , or no later than five days from the date of the decision on the complaint, according to which the person who filed the complaint does not have an obligation to pay the amount of tax, fee, insurance premiums, penalties, fines secured by such a bank guarantee.

6. Repeated filing of a complaint (appeal) is made within the time limits established by this chapter for filing the relevant complaint.

7. The person who filed the complaint (appeal), before making a decision on the complaint (appeal), may withdraw it in whole or in part by sending a written application to the tax authority considering the relevant complaint.

Withdrawal of a complaint (appeal) deprives the person who filed the corresponding complaint of the right to re-file a complaint (appeal) on the same grounds and in the same manner.

Conclusion

The court justified this approach with the position of the Supreme Arbitration Court of the Russian Federation: taxes should be considered excessively paid or excessively collected taking into account the basis on which the obligation was fulfilled.

If the taxpayer transferred amounts to the budget based on the tax return data, then we are talking about an overpayment. If he paid them based on the decision of the inspectorate based on the results of the audit, then the amounts should be considered excessively collected, even when there was no forced collection. Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up