Unified State Register of Individual Entrepreneurs (for individual entrepreneurs) or Unified State Register of Legal Entities (for organizations) are registers into which data about individual entrepreneurs and enterprises is entered. Starting from 2022, the tax service provides each company with a Unified State Register of Legal Entities. It is needed to confirm the fact that the data is entered into the registry . What kind of document is this, what is it regulated by, how and where can I get it?

Regulatory framework for 2019

Legal regulation of the procedure for obtaining information is ensured by the following legislative norms:

- Federal Law No. 129 of August 8, 2001 (Article , ) - contains information on the procedure for completing and receiving this sheet, as well as the nuances of interaction with government services;

- Decree of the Government of the Russian Federation No. 462 of May 19, 2014 describes the design features;

- Order of the Ministry of Finance of Russia No. 165n dated October 30, 2014;

- Order of the Ministry of Finance of Russia No. 5n dated January 15, 2015;

- Order of the Federal Tax Service of Russia No. ММВ-7-14/ [email protected]

These orders allow you to obtain detailed information about the register and the changes that occur in it. This is just a basic list of papers regulating the procedure under consideration. In practice, their list is wider.

What is the Unified State Register of Legal Entities

The Unified State Register of Legal Entities is commonly understood as the Unified State Register of Legal Entities . An alternative name is a centralized base of business entities that receive income independently or use funding from the state budget . The list of those included in the database is as follows:

- the name of the organization in full and abbreviated form (it can be created in the national language or in any other);

- description of the organizational and legal form of the enterprise;

- legal address at which the company actually carries out commercial activities;

- email address (mail);

- method of creating a company (creation from scratch or reorganization);

- detailed information about all founders of the organization;

- information about shares owned by a legal entity;

- dates of drawing up the constituent documents;

- the essence of the changes that were made.

To enter information into the register, you will need to provide a corresponding application and constituent documents. They must be presented to the registration authority in the form of an original and a photocopy.

What is the difference between a sheet and an extract

To confirm the fact that the data was entered into the register, the authorized body accepts the following documents:

- Unified State Register of Legal Entities sheet;

- extract from it.

Until July 4, 2013, the main confirmation was a certificate. But the rules have changed.

The record sheet includes the following information :

- full name belonging to the legal entity;

- OKPO code;

- the essence of the changes made (for example, a change in information about the enterprise - from the name to the direction of commercial activity);

- the date on which the new data was recorded;

- the position of the responsible person who is responsible for this procedure, including his full name and signature.

As for the extract from the Unified State Register of Legal Entities, it represents a slightly different document. It reflects the following data :

- legal name of the enterprise;

- detailed information about the person who manages it;

- the method by which the legal entity was formed;

- detailed information about the founders;

- complete information about the essence of the company’s commercial activities;

- information about the availability of a license;

- dates on which all changes were made to the Unified State Register of Legal Entities.

So, the key distinguishing feature is that the extract contains generalized information about the organization.

How does a record sheet differ from an extract from the Unified State Register of Legal Entities?

When creating a legal entity or changing the statutory documents of an existing organization, the relevant information is entered into the Unified State Register of Legal Entities and transferred to the taxpayer. The form of the record sheet is approved by Order of the Federal Tax Service No. ММВ-7-14 / [email protected] and is assigned the number P 50007. The document contains the following data:

- corporate name of the organization;

- number assigned during registration (OGRN);

- content of the entry;

- date of entry of information into the register;

- number under which the entry is registered;

- list of documents according to which information was entered;

- name of the authority that issued the document;

- date of issue;

- position of the responsible person, signature with transcript.

You can see what the Unified State Register of Legal Entities sheet looks like at this

. Thus, this document contains brief information about the organization. More detailed information about the legal entity is presented in the extract from the Unified State Register of Legal Entities, which indicates:

- full and abbreviated name;

- the address at which the legal entity is registered;

- method of education and OGRN;

- TIN and date of registration with the Federal Tax Service;

- size of the authorized capital;

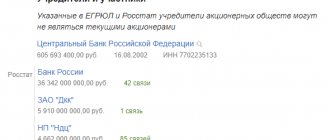

- information about the founders;

- list of branches and representative offices;

- types of activities according to OKVED, etc.

You can order a Unified State Register of Legal Entities or an extract for your own organization or for another legal entity. This is necessary to check the counterparty in the process of business activities.

The FTS submits the entry sheet to the Pension Fund and the Social Insurance Fund within the next working day after the creation of a legal entity or change of any information about it in electronic form.

Receipt procedure

In practice, a special procedure is used to obtain an entry sheet in the Unified State Register of Legal Entities. This can only be done with a certain procedure. You can receive a sheet in two ways - via the Internet (for a fee) or through a personal visit to the tax office with a power of attorney.

In accordance with the norms of current legislation, obtaining a sheet will become available the very next day from the moment the relevant application is submitted.

A representative of an organization has the right to come to the Federal Tax Service for documents in person or request them by registered mail to the legal address of the enterprise. If you place an order online, you first need to pay for the service of the organization that issues the sheet at the tax office. If you use regular mail, it will take approximately 1-2 weeks to receive it.

The Unified State Register of Legal Entities entry sheet represents an important type of documentation. Its presence at the enterprise indicates legitimacy and allows it to carry out its activities without hindrance.

The form can be used as forensic evidence. For example, a competitor attempted to prove the fact that the register indicated one legal address, but in fact the company was re-registered to another. The presence of this document will refute this position and confirm the correctness of the company’s representatives. This paper is also important when organizing inspections.

How to get a document

On the Internet you can find information that the Unified State Register of Legal Entities cannot be obtained online. It is possible that such sources were written before May 2022, since it is from this time that all information is presented to the applicant in electronic format. In accordance with paragraph 3 of Art. 11 of Law No. 129-FZ, the registration authority sends a document confirming the entry into the register of a legal entity to the organization’s email address. This happens within one business day after the entry is made. No applications need to be submitted either when creating an organization or when making changes to the Unified State Register of Legal Entities,

Information in paper form is provided upon separate request. They, in fact, will be a copy, that is, confirm the contents of the electronic document. The Unified State Register of Legal Entities will be issued by the body through which the applicant applied.

- The Federal Tax Service will issue information if the applicant sent documents by post, by email, or submitted them to the tax authority in person.

- MFC - when contacting the center directly or through the State Services website;

- A notary, if documents were submitted with his help.

According to Resolution No. 462 of May 19, 2014, information about a legal entity on paper is provided for a fee. If the document is received in the usual manner within 5 working days, you need to pay 200 rubles. For urgent provision of information within 1 working day after the request, the cost increases to 400 rubles. They pay for the service regardless of whether they request it in relation to their own organization or another legal entity. If you need to receive several copies of a document, you need to pay for each. This payment is not a state duty, it is a fee for providing information.

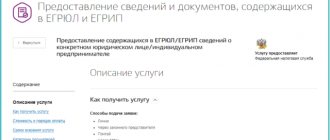

Information is provided in electronic format free of charge in any case. For this purpose, on the Federal Tax Service website there is a service “Providing information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs in the form of an electronic document.”

How to obtain a Unified State Register of Legal Entities sheet from the tax office if the document is lost or damaged? You need to request a duplicate of it. The procedure for receiving and paying for the document is the same as for issuing the original. It will be presented electronically free of charge, the paper version is paid for in accordance with Resolution No. 462. A duplicate will be issued, like other information, within 5 working days after the application.

Filling out form P50007

To receive a sheet, you need to fill out an application using a special form P50007 . The procedure for filling it out is as follows :

- Name of the addressee and address of its location. The addressee is usually the tax service, which belongs to a certain area or city.

- Sender's name indicating OKPO, INN.

- The essence of applying to the public service. This is how it is written: “Application for issuance of a sheet...”.

- Indication of the reasons for receipt if an authorized person acts on behalf of the organization.

- Application – power of attorney in the name of (name of the authorized person), date of preparation.

The representative of the company submits such a document to the tax service to which the enterprise is assigned. As for the P50007 form, it is standard. The form was approved within the framework of Order of the Federal Tax Service of Russia No. ММВ-7-6/843 dated November 13, 2012. The general appearance of this document is as follows :

- The name of the addressee “In the Unified State Register of Legal Entities in relation to a legal entity...” is indicated at the top. The registration number is also written here.

- At the next step, the document contains the phrase that “the record contains the following information.” After this, a colon is inserted and a transcript is provided.

- After this, a table is created that includes 4 rows and 3 columns. This is the name of the indicator and its value. A list of changes that occurred due to the decisions made is indicated.

- Below the table, information about the name of the Federal Tax Service that issued the corresponding record sheet is displayed.

- Along with this, it is worth paying attention to a few more important details:

- the position held by the person authorized to issue such documentation;

- the date on which the sheet was issued;

- its registration number;

- wet print.

Sample sheet of Unified State Register of Legal Entities (form P50007)

Sample application for obtaining information from the Unified State Register of Legal Entities about another legal entity

Sample application for obtaining information from the Unified State Register of Legal Entities about yourself

In practice, you can often find form P50007, which also contains information about the documents on the basis of which the corresponding decision was made. This:

- Name;

- name of the compiler (or company name);

- the essence of the information contained in the document;

- date of registration;

- registration number.

When is the Unified State Register of Legal Entities issued?

Starting from 07/04/2013, the Unified State Register of Legal Entities entry sheet acts as a document that helps confirm the entry of data about a legal entity into the register. As already noted, evidence was previously used for these purposes. The purpose of the document is to provide a complete certificate about the legal entity and the changes made in the course of its activities.

The Federal Tax Service will send the document no later than the day following the date of registration of the changes . This legislative norm is spelled out in paragraph 3 of Art. 11 Federal Law No. 129. When you apply for a sheet again, the Federal Tax Service will issue it, according to administrative regulations, based on urgency - either no later than 1 day after receiving the request, or 5 days (in an ordinary case).

Starting from April 29, 2022, the Federal Tax Service is issuing sheets exclusively in electronic form . Each document is subject to electronic digital signature. To receive a paper form, you will need to create a separate request. It is most advisable to send it along with the documents submitted during the process of registering data in the registry.

Most often, a document is required in court in the following cases :

- proof of completion of certain registration procedures;

- making changes to the constituent documentation;

- changes in information about the new management;

- change of the official address of the company;

- change of owner.

The document may be needed in other situations specified in the current legislation.

When is the ERGYUL registration sheet issued?

What is a Unified State Register of Legal Entities? This is a document that replaced the certificate of registration of a legal entity. He has an official form approved by Order of the Federal Tax Service of Russia dated November 6, 2020 N ED-7-14 / [email protected] , and his number is P50007.

According to information from the tax service website, the main function of the entry sheet is to confirm the fact of creation of the organization.

The first sheet of the Unified State Register of Legal Entities after registering an LLC usually displays the following information:

- the reason for making the entry is the creation of a legal entity;

- OGRN, INN, KPP codes;

- corporate name of the organization;

- legal address;

- information on the amount of authorized capital;

- information about the founders and director of the LLC;

- activity codes according to OKVED;

- list of documents submitted for registration.

The entry sheet differs from the earlier document - the Unified State Register of Legal Entities certificate. You can find out what the certificate looks like in Decree of the Government of the Russian Federation dated June 19, 2002 N 439.

A certificate of entry into the Unified State Register was issued for legal entities registered before July 1, 2002. This document is still found in business correspondence, but the Federal Tax Service no longer issues it.

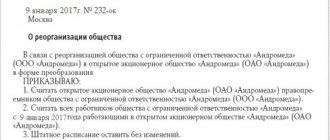

In addition, a record sheet is issued about making changes to the Unified State Register of Legal Entities. For example, when changing the legal address, manager, text of the charter and other situations. The basis for making changes will be form P13014.

The registration sheet for the register is issued to the applicant in digital form to the email specified in the registration form. If you also need a paper document, you need to make a mark on the last page of application P11001.

How to obtain a record sheet for making changes to the Unified State Register of Legal Entities via the Internet: step-by-step instructions

As already noted, you can receive the document exclusively in electronic form. There are two options:

- On one's own.

- Through a law firm.

In the first case, you need to draw up an appropriate application, avoiding mistakes in it, submit it to the tax service and wait for its employees to make a decision. This service is paid - 200 rubles. for a regular document and 400 rubles. for urgent.

In the second situation, you need to contact specialists, taking with you a pre-agreed package of documents. The intermediary will send a request to the Federal Tax Service, after which all that remains is to wait for the decision to be made and pick up the finished document, which has an official certification. The service is paid and includes not only compensation for the amount for the document, but also payment for the services of an intermediary.

Restoration procedure and issuance of a duplicate

In practice, situations often arise when important documentation is lost. In this case, its restoration is required. In order to obtain a duplicate of the Unified State Register of Legal Entities, you need to write a corresponding application to the Federal Tax Service and indicate the reasons why it is being submitted.

After this, you need to bring or send documents to the tax office and wait for a decision to be made. As a rule, within a few days, its employees send a duplicate, even if certain changes have been made to the register since then.

Thus, the Unified State Register of Legal Entities entry sheet represents an important document that will not be difficult to obtain. This can be done at the Federal Tax Service in just a few days - in person and through an intermediary .

To receive it, you need to draw up an appropriate application that has a template unified form, and also bring to the regulatory authority a list of required documents confirming the right to receive a sheet.

Instructions for obtaining a Unified State Register of Legal Entities through the website of the Federal Tax Service are presented in the video below.

Sample entry sheet for the Unified State Register of Legal Entities in 2022

Below is a sample entry sheet from the Unified State Register of Legal Entities issued after registration of an LLC:

Note

: If changes occurred in the LLC that were not timely entered into the Unified State Register of Legal Entities, the tax office will make an entry in it about the unreliability of the information.

Still have questions?

On this site you can ask your question to our specialist for free in the section

questions and answers

.