Structure of an extract from the Unified State Register of Legal Entities

The generated extract from the Unified State Register of Legal Entities contains the following sections:

- Name . The full and abbreviated name of the legal entity is indicated, as well as the state registration number and the date of making the corresponding entry.

- Organizational and legal form . Regarding international companies and funds.

- Address (location) . Information about the full postal address (zip code, subject of the Russian Federation, city, etc.) is displayed.

- Registration information . Information about the method of education, OGRN number and date of assignment.

- Information about the registration authority at the location of the legal entity . Name and address of the territorial body of the Federal Tax Service.

- Termination Information . Method of termination, date and name of the territorial body of the Federal Tax Service that made the corresponding entry.

- Information about the status of a legal entity . The company is in the stage of liquidation, bankruptcy.

- Information about registration with the tax authority . Information about the TIN/KPP, the date of assignment, as well as the name of the territorial body of the Federal Tax Service.

- Information about registration as an insurer in the territory . Pension Fund . The assigned number, date of registration, as well as the name of the territorial body of the Pension Fund are indicated.

- Information about registration as an insurer in the territory . FSS . Registration number, date of assignment, name of the territorial body of the Social Insurance Fund.

- Information about the authorized capital (share capital, authorized capital, share contributions) . The type of capital and its value expression are indicated.

- Information about a person who has the right to act on behalf of a legal entity without a power of attorney . Full name, TIN, position, date of making the corresponding entry.

- Information about the founders (participants) of the legal entity . The full name, tax identification number, nominal value of the share and its size in percentage are reflected.

- Information on types of economic activities according to OKVED . Information about the main type of activity is reflected, as well as about all additional ones, indicating the date of making the corresponding entries in the register.

- Information about the holder of the register of shareholders of the joint-stock company. The full name of the holder and OGRN number are indicated.

- License information . General information is provided on all available licenses, indicating the date of receipt and number, validity period, type of activity and licensing authority.

- Information about the legal successor or predecessor . Full name of the predecessor or successor organization, indicating the TIN and OGRN numbers.

- Information about branches . A detailed postal address is indicated for each existing branch.

- Information about the progress of the reorganization . Record of the beginning of the reorganization procedure

- Information about the process of reducing the authorized capital . Applies to business entities.

- Information about entries made in the Unified State Register of Legal Entities . Information about each change, indicating the date, reason, name of the document (if available).

Also, the Unified State Register must have the original or a notarized copy of the constituent document.

How to quickly and easily obtain an extract from the Unified State Register of Legal Entities

The hardest part:

Make a request for an extract in such a way as to obtain complete information from the inspection.

It will be easier if:

Follow the recommendations given in the instructions and use the application form.

For an accountant, an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs is the document that helps prove the due diligence of the organization.

It may be useful during an inspection if inspectors have questions about the validity of expenses or VAT deductions. The opposite situation is also possible: before signing the contract, the counterparty requires an extract about your company to ensure its integrity. An official extract from the Unified State Register of Legal Entities about your company or supplier can be obtained from the tax office, on paper. Such a document will have the inspection seal, as well as the signature of an employee of the Federal Tax Service, confirming the accuracy of the information specified in the extract.

Of course, it is worth going for an official statement if the issue of a transaction for a large amount or a significant amount of VAT deduction is being decided. To check basic information about small contractors, the Federal Tax Service website is enough.

Thus, the registration data of an organization or entrepreneur (TIN, KPP, OGRN, dates of making changes to the register, etc.) can be found out for free.

If more detailed information is required, the Federal Tax Service offers to use its paid service. However, this service is quite expensive. It is much cheaper to obtain information from the Unified State Register of Legal Entities online from private companies with access to databases.

Let's say a company plans to enter into a large contract. After checking the details of the counterparty via the Internet, the management decided, just in case, to request an official extract from the tax office about the future partner. Let's consider what needs to be done for this.

If your All recommendations given in this article are relevant both for companies using the general regime and for those using a simplified system.

Step No. 1

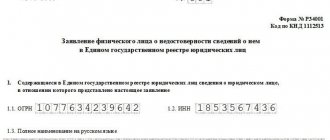

Submit an application to receive an extract

There is no approved application form for obtaining an extract from the register. The request is written arbitrarily, but you must indicate the name of the organization about which you would like to receive information, as well as its TIN or OGRN (a sample is presented below). If you need to check a businessman, you must write his full name in the request. and registration number. This data is sufficient to obtain information.

In addition, do not forget to provide the address to which the statement should be sent. Or indicate that you want to receive an extract in person from the inspectorate.

The application may not include the information you want to receive about the counterparty or your company. In theory, inspectors should by default provide an extract with a complete list of information that is contained in the register and is accessible. However, it is possible that employees of the Federal Tax Service will miss some column when creating an extract. As a result, the company will receive a statement that does not contain data that is important to it.

Therefore, it is better to list the information that should be in the extract. Of course, within the limits permitted by law. This is all the basic data: legal address, method of formation of the organization, etc.

As well as information about the founders (shareholders) of the organization, who can represent the counterparty without a power of attorney, complete information about the current licenses of the company, its branches and representative offices.

A complete list of information that is available to any organization is contained in Appendix No. 2 to the Rules for maintaining the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs (approved by resolutions of the Government of the Russian Federation dated June 19, 2002 No. 438 and dated October 16, 2003 No. 630, respectively).

It will not be possible to request only passport data, information about bank accounts and place of residence of individual entrepreneurs.

Sometimes inspectors require you to indicate the purpose for receiving the extract. For example, for submission to court, inclusion in tender documentation, checking information about a potential supplier. But controllers do not have the right to refuse to issue an extract only because the purpose is not clear.

By the way, the number of documents requested also does not matter. That is, you can request 30 copies of an extract from the Unified State Register of Legal Entities at once. Of course, if the duty is paid for each of them.

Step #2

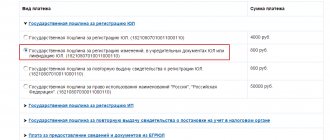

Pay for the service

In general, information about yourself in the form of an extract can be obtained free of charge. If information about counterparties is requested, you must pay 200 rubles. for each document. Any urgent statement, even about your own company, already costs 400 rubles. Such prices are established in paragraph 23 of the Rules for maintaining the Unified State Register of Legal Entities and paragraph 31 of the Rules for maintaining the Unified State Register of Legal Entities.

The money must be transferred according to the details of the inspection where the request is submitted - either at the applicant’s place of registration, or to a special tax registration office (if there is one in the region). As a rule, details can be found on the website of the relevant Federal Tax Service.

Please note: it is better to pay statements from a current account using a payment order. Instructing one of your employees to transfer money using a regular receipt to Sberbank risks the fact that tax inspectors will refuse to release information from the state register. According to officials from the Federal Tax Service, the information should be paid for by the company, and not by the individual.

If a company requests several statements at once, tax inspectors allow payment in total. Then in the “Purpose of payment” field you need to specify the number of statements.

Step #3

Send documents to the inspection

The application along with the payment document (if according to the rules you had to pay for the extract) must be sent to the inspectorate. As we mentioned above, this may be a special tax office that registers companies and entrepreneurs. In Moscow, in particular, this is Interdistrict Inspectorate of the Federal Tax Service No. 46.

At the same time, you can take the documents to your inspectorate at the place of registration. It does not matter whether there is a registration inspection in the city or not.

You can send documents by mail, preferably by registered mail. However, most often you need to get an extract as quickly as possible, so the director should personally take the papers to the inspectorate. Or instruct a trusted person to do this. But then a power of attorney must be attached to the application. Otherwise, the documents will not be accepted.

Step #4

Pick up statement

In accordance with the approved procedure, inspectors must issue an extract no later than 5 days after the company receives an application. If the organization paid 400 rubles. For urgency, an extract can be received on the next business day after submitting the request.

By the way, it may also happen that information about the counterparty will not be in the register. Then the inspection staff will issue a certificate confirming the absence of the requested information. The company will receive such a document even if the request provides insufficient information about the legal entity or entrepreneur to recognize it in the database.

If the applicant did not request that the statement be sent to him by mail, any authorized representative from the company can pick up the paper. The main thing is not to forget about the power of attorney.

To the head of the Interdistrict Inspectorate of the Federal Tax Service No. 46 for Moscow, Ivan Ivanovich Petrov

LLC "VESNA" INN 7715123489, checkpoint 771501001 Address: Moscow, st. Basmannaya, 34

APPLICATION to receive an extract from the Unified State Register of Legal Entities

I ask you to provide an extract from the Unified State Register of Legal Entities in relation to the legal entity "Velcom" LLC, INN 7704156254, containing the following information: - OGRN (main state registration number); — address (location); — information about the founders (participants); — name and details of documents submitted during state registration; — size of the authorized capital; — information about a person who has the right to act on behalf of a legal entity without a power of attorney (last name, first name, patronymic, position, details of an identification document in accordance with the legislation of the Russian Federation, TIN (if any)); — information about the licenses received (name of the licensing authority, license number, date of the decision to grant the license, validity period of the license, name of the territory in which the license is valid, licensed type of activity); — information about branches and representative offices.

The purpose of obtaining an extract is to present it to the court.

I ask you to hand over the extract personally to a representative of VESNA LLC.

General Director of VESNA LLC Nikolaev E. G. Nikolaev 04/12/2010

How to obtain information from the Unified State Register of Legal Entities and Unified State Register of Individual Entrepreneurs via the Internet

Information from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs about any Russian organizations and businessmen can be accessed electronically for a year through the Federal Tax Service website. So, for 50,000 rubles. The full database will be opened to the user once, and he will be able to access it in this form for a year. If the company later wants to update previously received information, you must pay another 5,000 rubles. Or you can immediately buy annual, weekly updated access to the registry databases for 150,000 rubles.

The procedure for obtaining online information is prescribed in the order of the Federal Tax Service of Russia dated March 31, 2009 No. MM-7-6/ [email protected] First, you need to fill out an application, the form of which is approved by the same order of the tax service. And also transfer money. Then the application and the original payment slip are sent directly to the Federal Tax Service of Russia. Within 10 working days, the company will be able to receive by email the database access attributes assigned to it - login, password, digital certificate.

All you have to do is go to the Federal Tax Service website and activate the certificate.

This must be done within 6 months from the date on which the decision to provide information was made. After activation, you will be able to use your password and other data for a year. Then the right of access can be extended by paying again and sending the documents to the Federal Tax Service. The article was published in the magazine “Glavbukh” No. 9, 2010

Hello, Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Legal entity statuses

A legal entity may have one of the following statuses (sections 1 and 7 of the extract):

- Current

- Excluded from the Unified State Register of Legal Entities on the basis of clause 2 of Article 21.1 No. 129-FZ (the legal entity did not submit reports and did not carry out transactions on bank accounts for 12 months)

- Exclusion from the Unified State Register of Legal Entities of an inactive legal entity

- Liquidated

- Liquidated due to bankruptcy

- Liquidated by court decision

- Ceased its activities (Liquidation of a legal entity)

- Ceased its activities (Liquidation of a non-profit organization by court decision)

- Non-profit organization liquidated by court decision

- Is in the process of liquidation

- Is in the process of reorganization in the form of a merger

- Is in the process of reorganization in the form of transformation

- The legal entity is in the process of reorganization in the form of transformation

- Is in the process of reorganization in the form of merger (ceases activities after reorganization)

- Is in the process of reorganization in the form of joining other legal entities to it

- The legal entity is in the process of reorganization in the form of merger with other legal entities

- Is in the process of reorganization in the form of merger with another legal entity

- The legal entity is in the process of reorganization in the form of merger with another legal entity

- The legal entity is in the process of reorganization in the form of separation

- Ceased its activities (Liquidation of a legal entity)

- Terminated activities (Cessation of activities of a legal entity through reorganization in the form of transformation)

- Terminated activities (Cessation of activities of a legal entity through reorganization in the form of merger)

- Terminated activity (Cessation of activity of a legal entity in connection with its liquidation on the basis of a ruling of the arbitration court on the completion of bankruptcy proceedings)

- Terminated activities (Cessation of activities of a legal entity due to exclusion from the Unified State Register of Legal Entities on the basis of clause 2 of Article 21.1 of the Federal Law of 08.08.2001 No. 129-FZ)

- Ceased its activities due to the acquisition of the status of individual entrepreneur by the head of the peasant farm

- Ceased activity upon joining

- Ceased operations during transformation

- Ceased operations upon merger

- Terminated activities (Cessation of activities of a legal entity through reorganization in the form of a merger)

- A decision was made on the upcoming exclusion of an inactive legal entity from the Unified State Register of Legal Entities

- Registration invalidated by court decision

- The case has been transferred to another authority

- Exclusion from the Unified State Register of Legal Entities of a legal entity due to the presence in the Unified State Register of Legal Entities of information about it, in respect of which a record of unreliability was made

- The registration authority has made a decision on the upcoming exclusion of a legal entity from the Unified State Register of Legal Entities (the presence in the Unified State Register of Legal Entities of information about a legal entity in respect of which a record of unreliability has been made)

- The registration authority has made a decision on the upcoming exclusion of a legal entity from the Unified State Register of Legal Entities (inactive legal entity)

The procedure for maintaining the register in the Federal Tax Service

Maintaining the register of legal entities is regulated by Federal Law No. 129-FZ of 08.08.2001 “On State Registration of Legal Entities and Individual Entrepreneurs” and is entrusted to the Federal Tax Service. Work with the registry is carried out at several “levels”:

Local level - the tax inspectorate is responsible for maintaining the register; it is to the inspection that the heads of organizations submit appropriate applications for registration of a legal entity, reorganization, amendments to the statutory documents, etc.

Regional level - the Federal Tax Service Department, accumulates all data from inspections and transfers them to the federal level.

The federal level - the Federal Tax Service Moscow, maintains a complete register of all legal entities in Russia. It is from the federal level register that the Kontur.Focus service receives information.

According to our experience with the registry, the period for transferring data from the local to the federal level ranges from 1 to 4 weeks.

How to receive using a digital signature

Along with drawing up a request on paper, it is possible to fill out and send it using the Internet service for legal entities, which is implemented on the website of the Federal Tax Service.

The applicant must have a valid signature verification key certificate (hereinafter referred to as ES), issued by a certification center that is accredited by the Ministry of Telecom and Mass Communications of Russia.

An extract from the Unified State Register of Legal Entities with an enhanced electronic signature is provided no later than the next day after registration of the request.

Intersection of data with Rosstat

The Kontur.Focus service also receives data on enterprises (composition of founders and their shares) from Rosstat. If these data differ from the information from the Federal Tax Service, both are displayed.

Rosstat information

Priority is given to information from the Federal Tax Service, because changes are made a few days after filing an application for state registration of changes in constituent documents (form No. P13001) to the tax office. And in Rosstat, information is updated once a year - during the submission of annual financial statements by organizations.

Restrictions on the provision of information

The following information may NOT be accessed :

- passport details of the founders (participants)

- manager's passport details

- bank account information

This information can only be obtained from the tax office by an organization when filing a request for itself. In this case, the request must be signed by the head of the organization, or an authorized person, and also certified with the round seal of a legal entity (Article 6 of Federal Law 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”).

Extract from the Unified State Register of Legal Entities in Kontur.Focus

An extract from the Unified State Register of Legal Entities provided by the Kontur.Focus service allows the user to obtain up-to-date information about the status of a legal entity, as well as about the types of activities carried out.

Request for an extract

To access information from the Unified State Register of Legal Entities for the organization of interest, you need to create a company card and the “Extract from the Unified State Register of Legal Entities ” block will be presented .

Block “Unified State Register of Legal Entities”

Next, you need to determine the date for which you need to generate an extract. It is worth noting that the Kontur.Focus system can provide information for any periods starting from 2016.

Generating a statement for a specific date

After selecting the date, you must click “Generate”, and the user will receive a statement in .pdf format corresponding to the selected date.

Generated statement as of 01/11/2016

Request for an extract certified by the Federal Tax Service

If you need to generate an extract as an official document, then on the “Summary” the “Extract from the Unified State Register of Legal Entities” block , then you need to click “Request with the signature of the Federal Tax Service.”

Request for an extract signed by the Federal Tax Service

The extract will be generated by default for the current date and will be certified by an enhanced qualified electronic signature of the Federal Tax Service.

(current as of 09/25/2020).

Extract from the Unified State Register of Legal Entities sheet 1-2

Extract from the Unified State Register of Legal Entities sheet 3-4

Extract from the Unified State Register of Legal Entities sheet 5-6

Extract from the Unified State Register of Legal Entities sheet 7-8

Extract from the Unified State Register of Legal Entities sheet 9-10

Extract from the Unified State Register of Legal Entities sheet 11-12

Extract from the Unified State Register of Legal Entities sheet 13-14

Extract from the Unified State Register of Legal Entities sheet 15-16

Extract from the Unified State Register of Legal Entities sheet 17-18

Extract from the Unified State Register of Legal Entities sheet 19-20

Extract from the Unified State Register of Legal Entities sheet 21-22

Extract from the Unified State Register of Legal Entities sheet 23-24

Extract from the Unified State Register of Legal Entities sheet 25-26

Extract from the Unified State Register of Legal Entities sheet 27-28

Extract from the Unified State Register of Legal Entities sheet 29

Planned changes to the Unified State Register of Legal Entities

On the “Summary” you can also familiarize yourself with the documents submitted for registration in the Unified State Register of Legal Entities. Such information will allow you to know in advance about planned changes regarding management, address, as well as possible liquidation.

Such information is highlighted in a separate block “Documents for changes in the Unified State Register of Legal Entities” .

Block “Documents for amendments to the Unified State Register of Legal Entities”

To study the documents in more detail, click “More details”. The user will see information regarding each application to the tax office.

Change cards

Each generated card indicates:

- date of application for amendments to the Unified State Register of Legal Entities

- type of changes , changes in the composition of founders, addresses, etc.

- incoming number assigned by the tax office

- Federal Tax Service Inspectorate , territorial circulation authority

- application form , indicate the form number, for example, P14001 or P13001

- document readiness , execution date

- type of decision , verdict of tax authorities, for example, refusal or registration

Entries in the Unified State Register of Legal Entities

On the “Summary” , a separate block “Records in the Unified State Register of Legal Entities” also provides information about the entries already made. Highlighted in orange are records in respect of which the Federal Tax Service has not yet made a decision (the inspection is given 6 working days for this) or a refusal has been issued.

Block “Records in the Unified State Register of Legal Entities”

To view records, click “Details”. The user will see cards generated for each individual entry.

Cards for making entries in the Unified State Register of Legal Entities

Depending on the outcome of the inspection decision, each card contains its own set of information:

- recording date

- post content

- documents that accompanied the process of creating an entry in the registry

- regorgan , the code and name of the territorial tax office is indicated

- GRN , the state registration number assigned to the record is written down

An extract from the Unified State Register of Legal Entities can be very useful from the point of view of assessing a potential counterparty, since it contains comprehensive information about the director, founders, registration with the tax authorities, and displays information about all changes made to the constituent documents. You can also use the following features of the Kontur.Focus system: extract from the Unified State Register of Individual Entrepreneurs, taxes and fees, messages from issuers.

How to get it remotely

There are a number of ways to get the information you need without leaving your home. Please note that only an extract from the Unified State Register of Legal Entities with an electronic signature of the tax service (endorsed electronic signature of an authorized person of the Federal Tax Service) is valid as a paper version.

The document must be ordered on the Federal Tax Service portal; an extract from the Unified State Register of Legal Entities with an electronic signature on tax.ru is generated through the service “Providing information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs”.

A document with enhanced electronic signature is generated within a few minutes.

An important question: is the extract from the Unified State Register of Legal Entities printed from the tax website an original? Yes, it is equivalent to a paper document issued by the inspectorate.

Formation of the document

Instructions on how to obtain an extract from the Unified State Register of Legal Entities in electronic form with a tax signature for free are as follows:

Step 1. Enter the TIN or OGRN, OGRNIP of the person you are looking for or his name or full name in the search field. individual entrepreneur.

Step 2. The second step in the instructions on how to obtain an extract from the Unified State Register of Legal Entities certified by the electronic signature of the Federal Tax Service is to click the “Find” button.

Step 3. Select the person you are looking for from the list that appears and click either on its name or on the “Get” button to the right of the name.

As a result, on the date of sending the application, a file with an enhanced digital signature is generated in pdf format, which is equivalent to a document drawn up on paper and certified by the signature and seal of the tax authority. After completing the described instructions, all that remains is to download an extract from the Unified State Register of Legal Entities from the tax website with an electronic signature and provide it at the place of request. The user has the right to generate an unlimited number of certificates for an unlimited number of companies.