Most physical people currently use the services of banks and carry out a lot of transactions through credit and debit cards issued by these banks. But there are situations when at the most inopportune moment the card stops working. You cannot get cash from an ATM, mobile banking does not work, and you cannot make card-to-card transfers.

And there are many reasons why a bank can block a card. One of the possible options is the bank blocking funds in the account for conducting suspicious transactions. The list of such operations is contained in Federal Law No. 115.

What is Law 115 and what does it require from banks?

A plastic card gives you access to the money in your account. Using cards nowadays is convenient, safe and has long been commonplace. Cards have become part of people's everyday life so much that sometimes bank clients do not immediately realize that the bank has blocked the card.

115 of the Law “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism” was adopted in Russia quite a long time ago - on August 7, 2001. The law (often called simply anti-money laundering) requires credit institutions, microfinance and insurance companies, as well as pawnshops, to monitor the movement of funds through citizens’ accounts.

The purpose of this law is to put barriers to the financing of terrorism and combat the laundering of any illegal income. For example, this is the fight against income on which citizens or companies do not pay taxes.

The Central Bank of the Russian Federation, based on the norms of the law, created and sent out a lot of instructions to banks and other financial organizations. It follows from them that it is necessary to monitor and analyze all settlement transactions of legal entities and individual entrepreneurs, as well as individuals.

According to Regulation 3 375-P of March 2, 2012, the purpose of monitoring transactions is to identify illegal transfers, facts of cashing out money, and their illegal withdrawal abroad. Suspicious transactions also include intricate payment schemes of companies and individuals. persons for goods and services.

All instructions created after 2012 only “tightened the screws” of control over customer transactions.

But banks began to actively implement the requirements of Law 115 from about mid-2022, when, for example, banks began to block individual entrepreneurs’ accounts for the slightest defect. For example, if taxes for several companies were paid from one IP address, when the individual entrepreneur’s accounting was outsourced. The reason is a change in the requirements of the Central Bank for the analysis of customer transactions by banks. Banks are strictly required to carefully monitor customer transactions and block suspicious payments and transfers.

And by June 2022, the Bank of Russia The Bank of Russia presented to business the concept of an information service for assessing the risk of clients of credit institutions. It was called “Know Your Client”. It is expected that the KYC platform (Know Your Customer), or, as it is also called, the KYC platform, will eventually be created on the basis of the Bank of Russia.

And although the KYC requirements relate more to the operations of clients - legal entities, as well as individual entrepreneurs, cards of ordinary citizens can also be blocked. The requirements of 115 Federal Law apply to everyone who has a bank account and uses it to make payments, for example, to transfer “borrowed money”, fees for services, to receive funds from part-time jobs, personal payments or regular transfers to the accounts of other individuals. persons or companies.

These can be entrepreneurs and citizens who conduct ordinary business or even do not conduct any business, but simply transfer funds to relatives. And at the same time they do not violate any norms of Russian legislation.

How to avoid blocking a current account according to Law No. 115-FZ

If an individual entrepreneur or organization makes financial transactions from the above list, this does not mean immediate blocking of the account - all cases are considered individually. Compliance with simple rules will reduce the risks of account “freezing” and suspension of business activities:

- Keep your number of accounts to as few as possible and pay taxes on the account at each bank you use.

- Withdraw and deposit cash into your account as little as possible.

- Eliminate or minimize interaction with unreliable partners operating in illegal sectors of the economy.

- Work in accordance with the OKVED codes specified when opening a current account, and promptly transmit data on changes in codes to the bank.

- Fill out the payment purpose in detail and ask your counterparties about it.

- Maintain document flow, promptly prepare supporting documents for the provision of services or shipment of goods, so that if something happens, you can promptly submit them to the financial institution.

Individuals are recommended to promptly notify the bank of changes in contact information and provide documents on account transactions in advance. In many cases, this will avoid blocking.

For what reason can a bank block the account and card of a business or individual entrepreneur under Federal Law 115?

If a company or individual entrepreneur filled out documents incorrectly, drew up a payment order incorrectly, tried to cut taxes, or simply did not inform the bank about changes in important data, then the bank must punish the client for this.

For example, a company, according to its charter documents, was engaged in the transportation of rolled metal, and then decided to transport apples from neighboring Belarus. And then one terrible day, the account and the cards linked to it may be blocked. The bank may find such a sudden change in activity, not supported by documents, suspicious. And he will require the client to explain incomprehensible transactions.

Let’s take another example: the company’s charter documents state that the company provides consulting services in the field of office leasing. And at one point the bank receives a payment order, which says that it is transferring funds to the counterparty “for the supply of cement.”

This will be clearly interpreted as money laundering, since the activity profile and the purpose of the payment do not match. That is, in the payment slip the purpose of the payment is indicated “out of the blue.” Until the client explains to the bank where such a payment came from, transactions on his account will most likely be suspended.

What should have been done to avoid blocking and explanations with the bank? It was necessary to warn the bank in advance that the client decided to renovate the office found by the consulting company. But he asked to pay for the supply of cement for repairs from the consultant’s account. Of course, you will need to attach documents for the provision of services to such a payment. But this is the only way to avoid getting your account blocked.

Customer mistakes when communicating with banks under 115-FZ

The worst thing you can do if the bank requests documents is to start arguing with the employees and claim that their demands are illegal. It is best to provide documents and written explanatory notes. This way you will solve the problem much faster and will not spoil your relationship with the bank.

Another mistake if you don’t know what to answer is ignoring the requirements. If the money remains in the account, then they will not give it to you without proof of its “legitimacy,” and shirking your responsibilities will cause even more suspicion. Even if you managed to withdraw money before the blocking, still communicate with the bank. Otherwise, you may be blacklisted not only by this particular organization, but also on the blacklist of the Central Bank. This means that no bank will work with you.

The last mistake is the formal provision of documents, without additional explanations. You can collect all the papers that you find, but if the “overall picture” of the financial monitoring staff does not work out, you will be sent for new documents again and again. Write a detailed explanatory note and support your words with documents so that no further questions arise for you.

How to protect yourself

There is no 100% guarantee that the bank will not be interested in your financial transactions, even if all your actions are completely legal. Try to save all receipts, contracts, statements, etc., so that in case of an audit, you can quickly provide evidence.

If you are going to be given a large sum of money, which you plan to place in a bank deposit in the future, then draw up a gift agreement in writing and not verbally.

Also, annually request 2-NDFL certificates from the accounting department at your place of work and keep them - this way you can prove to the bank that your savings were earned honestly, and that you have kept the money at home for years. Keep in mind that you will not be able to order a certificate that is 10 years old, since such documents are stored only for 4 years.

4 / 5 ( 6 votes)

about the author

Tatyana Kurchanova - received her education at the Altai State Pedagogical University - AltSPU (formerly AltSPA, BSPU). She worked for several years as a call center operator at FinPromBank. She has repeatedly improved her qualifications by completing educational programs and trainings. For more than 3 years, she wrote articles for major financial and credit portals in Russia. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

What happens after blocking the account and card?

If employees of the bank’s special compliance control service detect what they consider to be a suspicious transaction, the bank may:

- block the account and card transactions until the circumstances are clarified. In this case, the bank will require the client to bring a pile of paper documents;

- disable access to the account via the Internet (the so-called bank-client service);

- carry out all operations on client accounts only in the office and with the consent of the bank. Yes, yes, this is an old and almost forgotten by modern accountants “walking to the bank with your feet with a paper payment”;

- refuse to withdraw or transfer funds;

- refuse to open an account or issue (re-issue) a card.

In this case, the client must contact the bank branch. Operators sitting in the hall do not make decisions about blocking. A number of banks have a special unit that deals with these problems. And in other banks, the blocking is introduced by an algorithmic program (for example, with frequent transfers of the same type to the same amount and to the same account).

How can you withdraw money from the card in this case? In the current bank, if after the client has written an application to unblock the account and submitted all the documents requested by the bank, and they have satisfied the bank, the account is unblocked. True, this takes anywhere from a week to infinity. If the bank doesn’t like something, it will request more and more documents. Some individual entrepreneurs complain that they have to carry hundreds of kilograms of documents to the bank, which then no one reads.

According to the requirements of Federal Law 115, the bank is prohibited from informing the client about the measures being taken. And it's true. Why tell a terrorist to his face that he is a terrorist? Therefore, bank employees will not give any clear explanations.

The worst consequence of such a situation is that the bank will offer to close the card and account and terminate the contract. And go look for a “more accommodating” bank to transfer money there. The most unpleasant thing for the client is that for transferring money to another bank there can be a rather extortionate fine - up to 10%.

The bank can block the account and card for any suspicion

Fortunately for physical For persons suspected of money laundering and terrorist financing, the cards of ordinary citizens are blocked quite rarely. If suddenly the bank demands an explanation of all “conditionally recent” transactions on a blocked card, then it will be easier and cheaper to explain than to download your rights.

In banks, as part of the implementation of the requirements of 115 Federal Law, sometimes it reaches the point of absurdity. Thus, the president of one of the oldest banking associations - ARB - Garegin Tosunyan said that he himself unexpectedly became a “source of dangerous operations” for one respected bank. When transferring funds from his individual entrepreneur account to his own individual account, the bank withheld 4% of the transferred amount from Tosunyan. Tosunyan sarcastically said that a “protection from scoundrels” tariff was introduced against him.

But Tinkoff Bank demanded from a man with the status of an individual entrepreneur, who was engaged in consulting in the field of marketing and advertising, “a lot of things” to unlock the card, but including documents on higher education. The bank did not like the fact that this entrepreneur pays taxes not at Tinkoff Bank, where he has an individual entrepreneur account, but at Sberbank.

Moreover, in the department, and not by transfer. This is what this person was used to doing even before he opened an individual entrepreneur account and a card in Tinkoff. But in the end, he provided the bank with a diploma, which included a specialization in marketing, and the account and card were unblocked.

Account blocking by decision of the Federal Tax Service

According to Art. 76 of the Tax Code of the Russian Federation, tax authorities may demand that banks block taxpayer accounts. The reasons for this action may be:

- failure to pay taxes or insurance premiums;

- failure to submit a tax return or DAM within 10 days after the due date. Do not forget that when submitting tax returns from 1C programs using electronic reporting, you must receive a notification from the Federal Tax Service that your declaration has been accepted;

- failure to receive documents from the Federal Tax Service Inspectorate in electronic format via TKS through an electronic document management operator;

- failure to fulfill the obligation to transfer a receipt of receipt of demands or notifications from tax authorities to the company.

Blocking of current accounts is lifted only if the taxpayer has fulfilled his obligations to the Federal Tax Service.

If the tax authorities demanded to freeze the account for other reasons not specified in Art. 76 of the Tax Code of the Russian Federation, then such an action is considered unlawful. The taxpayer has the right to demand payment of interest, which is calculated based on the refinancing rate for each calendar day of illegal suspension of account transactions.

The period for calculating interest is determined from the date the credit institution receives the request to suspend operations until the date of receipt of the decision to unblock, inclusive.

The interest rate is determined by the following formula:

Amount of funds for which operations are suspended * Number of calendar days of blocking * Refinancing rate / Number of calendar days per year.

Important! The taxpayer needs to prove that due to unlawful actions of employees of the Federal Tax Service, he missed out on possible economic benefits, for example, investing money in a deposit with interest, violation of payment deadlines under contracts with counterparties or under loan agreements.

For what reason can a bank block the account and card of an ordinary individual? faces?

The most common reasons for blocking cards that occur within the framework of compliance with the norms of 115-FZ:

- regular transfers of large sums of money from card to account, from account to card. For example, you transferred 30-40 thousand rubles a month, and then you started transferring money in hundreds of thousands;

- a one-time transfer of a fairly large amount of money (but this is a more rare situation);

- receiving or repaying a loan from an individual or legal entity. Here, to unblock the card, you will need to present a receipt to the bank, preferably notarized;

- admission to a physical card persons funds from the account of an individual entrepreneur. Moreover, the cards belong to different people;

- regular payments for insurance compensation. Well, you can’t have an accident in your insured car every week, can you?

In addition, according to the law, banks do not have the right to work with individuals. persons whose names are included in the list of those involved in the financing of terrorism, extremism and the proliferation of weapons of mass destruction. The list of such persons is maintained by Rosfinmonitoring.

How are transfers tracked and cards blocked? The process goes like this: when transferring funds from one card to another, or from account to card, special service employees pay attention to an operation that is atypical for the client. If a control service employee has questions about the counterparty or the purpose of the funds transfer, the card may be blocked.

Very often banks block cards of conscripts. This happens in cases where young men, while serving in the army, give their card to “use” their colleagues. And they pass other people's money through it. As a rule, this is how banks track, for example, drug trafficking. Drug couriers do not care about the card and financial reputation of the owner of someone else’s account.

But, having returned from the army, such a “good Samaritan” may face the fact that all banks will refuse to issue him a salary card. After all, one of his cards has already been blocked under Federal Law 115, which means he no longer has faith.

Sometimes a bank employee may call to clarify the details of the transfer. In this situation, it is very important not to confuse such a call with a call from a scammer and not to hang up. And don’t send a bank employee, so to speak, to the “stump.”

Remember - scammers will try to trick you out of your card details and password via SMS. And when you call a compliance specialist, he will simply methodically ask you to explain the essence of the translation. For example, such calls began to appear when transferring funds from Russia to cards of residents of Ukraine. And they will ask you - to whom and why are you transferring funds abroad?

However, such cases of customer care still do not happen often; usually the card is blocked without a preliminary call. After the blocking, the client will be forced to come with his own feet to the bank branch, where he will be informed about the reason for the blocking - in accordance with the requirements of Federal Law No. 115.

How to unlock a card

How to unblock a card if it has already been blocked? Each case of blocking is considered individually. Physical cards persons, as we said above, are blocked quite rarely. In order to attract the attention of fin. monitoring, you need to drive hundreds of thousands a month through cards. But sometimes one atypical operation is enough.

For example, if the card has not been used for a long time, and then they try to transfer a large amount of money from it, then the card may also be blocked. But the bank will not tell you the exact reason for the blocking. Maximum - for suspicious wiring.

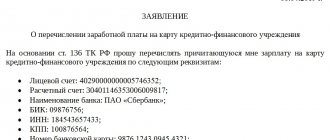

If the client is convicted of suspicious transfers, it is necessary to provide the bank with documents confirming the legal origin of the income. These can be any documents that prove the legality of funds in the account and explain the essence of the operations being carried out. When the bank requests supporting documents, it informs you how to submit them. They usually suggest sending scans of documents by e-mail, or bringing the originals to the bank office.

If the client does not have the opportunity to deliver the required documents to the credit institution within the time period specified by the bank, the current situation must be explained to the bank as soon as possible. The right of banks to request documents is stated in Federal Law No. 115, and the obligation of clients to provide the requested data is also stated there.

What will be required from individuals? faces

There is no single list of documents. At physical of a person working for hire, it will most likely be the same passport, INN, SNILS and certificate 2 of personal income tax from the accounting department from the place of work. If you are self-employed, the bank will require tax payment screenshots and confirmation of registration on the Federal Tax Service website.

But if you transferred funds, for example, to an individual. If you tell the person and the bank - I repaid the debt that I borrowed from my brother, then they may require documents from you about the degree of relationship. Such cases occur in practice.

What will be required from the individual entrepreneur

The most common supporting documents for individual entrepreneurs include:

- documents on calculating wages to employees;

- charter documents of individual entrepreneurs indicating activity codes;

- agreements with counterparties;

- loan agreements;

- lease agreements - it is believed that an individual entrepreneur must also have at least a minimal office;

- certificates from the tax office;

- contract agreements;

- rental agreements for premises, for example, for shops;

- invoices for payment of goods and services;

- payment receipts;

- statements from accounts in other banks.

In addition, there must be confirmation of taxes paid on income (this is required by the tax legislation of the Russian Federation).

If the documents confirm the validity of the financial transactions, the blocking is removed and then the account and card are serviced as usual.

Rosfinmonitoring blocked the account - what to do?

Blocking an account based on financial monitoring data is an unpleasant thing in itself. Not only is there a suspicion of involvement in criminal acts, which does not allow opening another current account (clause 5.2 of Article 7 of Law No. 115-FZ), but the verification period itself turns out to be quite long. Of course, the account owner always wants to speed up the process of lifting sanctions. Moreover, there may be quite good reasons for this:

- The document that provided the basis for inclusion in the list of persons associated with criminal acts, including in relation only to a specific person, has been canceled or expired.

- The inclusion in the register of persons associated with criminal acts occurred by mistake.

- An individual whose account is blocked for good reason has no other means of living.

In the first two cases, a request for exclusion from the register should be sent to Rosfinmonitoring. Based on the results of its consideration (within 10 working days), a decision will be made (clause 2.3 of Article 6 of Law No. 115-FZ). Its negative version can be appealed in court.

The latter situation gives an individual the right to partially use blocked funds at the rate of 10 thousand rubles. per month for one person (himself, as well as family members supported by him) and make payments on obligations created before he was reflected in the Rosfinmonitoring list (clause 2.4 of Article 6 of Law No. 115-FZ).

For legal entities and individuals suspected of terrorism on an international scale, but not yet included in the relevant international list, Rosfinmonitoring (by agreeing with the international structure that forms such a register) can lift the block (in whole or in part) before the date of inclusion in the list (clause 2.5 Article 6 of Law No. 115-FZ). Such a decision is made within one working day from the moment it is agreed upon with the international structure upon an application sent to Rosfinmonitoring.

What to do if the bank persists in its decision not to unfreeze the account

If the bank has decided that after providing all the documents the account will still remain blocked, then such a client has the right to file a complaint with the interdepartmental commission at the Central Bank. There, the documents of the person or company will be reviewed by Central Bank employees with the involvement of specialists from Rosfinmonitoring. If necessary, employees of other departments are also involved.

You can submit documents through the Central Bank website or by regular mail. The application must be accompanied by:

- Contacting the bank and responding to it.

- Documents that were submitted to the bank to verify the transaction.

The commission must process the complaint within 20 working days. The client receives a response in the same way as he submitted the complaint - via regular mail or email.

As a result, the commission:

- will review the bank’s refusal decisions and make a decision in favor of the client;

- decides that revision is impossible - the account will remain blocked.

How is this List communicated to banks?

Access to such information can only be obtained through personal accounts on the official website of Rosfinmonitoring after pre-registration.

In addition, on the official website of the supervisory authority, a search is organized on the List of companies and individuals in relation to which there is information about their involvement in extremist activities or terrorism.

Let us immediately note that technically Rosfinmonitoring does not block accounts ; operations to block and suspend transactions on client bank accounts are carried out by banks.

Banks have the right to block customer accounts if they identify signs established both by Law No. 115-FZ and according to the recommendations of Rosfinmonitoring and the Central Bank.

How to avoid being suspected of financing terrorism

There are a number of very simple recommendations, compliance with which usually allows you to avoid close attention to yourself from the control departments of banks and Rosfinmonitoring.

In general, they consist of what you should not do under any circumstances:

- You should not succumb to the persuasion of acquaintances and friends to give your card details “in order to transfer funds through it,” that is, go along with requests to transfer funds to the card, especially large sums of money, and then withdraw them to the card accounts of persons unknown to you.

- Do not withdraw large amounts of cash from your card at someone else’s request. Or if the bank calls with a question - where do you need so much cash - be able to quickly answer - why do you need such a large amount of cash. Yes, the bank can block the card while withdrawing money from an ATM.

- Try to use more non-cash methods of paying for goods and services.

- Do not use the card for illegal business without registering as an individual entrepreneur and opening a business card.

- If you are self-employed, do not ask customers to transfer money to accounts and cards that do not have the “self-employed” status.

- Do not pay from a personal card for goods and services by transferring money to a physical card. persons, and not on business cards of individual entrepreneurs.

- Take care of documents or at least explanations confirming any transactions on the account.

- Pay taxes and not come up with gray schemes to avoid them.

- Providing documents upon request of the bank on time. The more detailed explanation of financial transactions the bank receives, the greater the chances of a favorable resolution of the issue for the client.

- Work according to foreign economic activity codes (OKVED) and comply with currency control rules.

- Maintain compliance of the information declared about yourself in the Unified State Register of Legal Entities with the data in the payment order. Business changes - change the information about yourself in the registry. In the payment slip, you must write a detailed purpose of the payment, and not just provide the contract and account numbers.

- Follow the principle of “documents in the morning, chairs in the evening,” that is, payment must take place after the payment has been justified. And you must always be prepared for the fact that it will be necessary to confirm the legality of the operation with documents.

- You should not participate in financing “gray” imports.

Which operations fall under greater control by banks?

There are a number of instructions of the Central Bank of the Russian Federation 18-MR, 19-MR, 5-MR, which indicate the most risky operations. Such operations include:

- the salary fund of the client’s employees is set at a rate below the official subsistence level;

- personal income tax is paid on the account, but insurance premiums are not paid;

- there are no or insignificant balances in the account compared to the volume of transactions usually carried out by the client on the account;

- the grounds for payments made on the client’s account are not related to the costs inherent in business entities engaged in the types of activities declared by the client when opening/maintaining the account;

- there is no connection between the reasons for the prevailing volumes of money credited to the client’s account and the reasons for their subsequent debiting;

- turnover on the client’s account increases sharply, exceeding that stated when opening (maintaining) the account;

- payments are not made from the account as part of the client’s business activities (for example, rent payments, payments for utility bills, purchases of office supplies, etc.);

- funds are credited to the client's account from counterparties-buyers under contracts for goods and services with the allocation of VAT and are almost completely written off by the client in favor of counterparties for items not subject to VAT.

The bank also checks the following signs:

- the ratio of the volume of cash received per week to the turnover on the client’s bank accounts for the corresponding period is 30 percent or more;

- less than two years have passed since the date of creation of the legal entity;

- the client’s activities, within the framework of which operations are carried out to credit money to a bank account and write them off from the account, do not create obligations for its owner to pay taxes or the tax burden is minimal;

- money is received into the client’s bank account from counterparties on whose accounts operations are carried out that have signs of transit operations;

- the receipt of funds from the counterparty to the client’s bank account occurs with the simultaneous receipt of funds from the same counterparty to the bank accounts of other clients;

- funds are transferred to the client’s bank account in amounts usually not exceeding 600 thousand rubles.

Risks will also include operations:

- regular cash withdrawals, usually daily or within a period not exceeding three to five days from the date of their receipt;

- Cash withdrawals are carried out, as a rule, in an amount not exceeding 600 thousand rubles, or in an amount equal to or slightly less than the maximum amount of cash determined by the credit institution, which can be issued to a client, legal entity, individual entrepreneur, in within one business day;

- Cash withdrawals are carried out at the end of the operating day, followed by cash withdrawals at the beginning of the next operating day;

- The client has several corporate cards and primarily uses them to carry out transactions to receive cash.

Thus, you should not be afraid of blocking 200 rubles that you transferred to a friend or “chips in” for a gift.

The list of risky transactions is clearly defined and banks operate in accordance with strict standards. Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

What new did the Central Bank come up with for physicists within the framework of the anti-money laundering law?

The Central Bank of Russia will begin the hunt for transfers between physical cards. persons And this could result in a new wave of blocking of card accounts in accordance with the requirements of Law 115. The point is that the financial regulator plans to apply the operating standards of its “Know Your Client” platform to record dubious, from the point of view of this law and the requirements of the Tax Code, transactions of bank clients on citizens’ accounts.

Having put its finger on (or believing that it has done so) the operations of legal entities and individual entrepreneurs, the Central Bank intends to take on transfers using the cards of ordinary citizens. Such an initiative was announced in mid-September 2022 by Ilya Yasinsky, director of the department of financial monitoring and currency control of the Bank of Russia. According to him, the Central Bank will deal with this issue over the next year or year and a half.

True, the Central Bank has long charged banks with the responsibility of monitoring transfers of individuals. persons In fact, the implementation of this control is still limited by the lack of resources among the banks themselves. It’s no joke - according to data for 2022 alone, the number of cards issued by all Russian banks exceeded 300 million.

And, besides this, the matter is stalled due to flaws in the organization of interaction between the Central Bank and other departments. After all, the tasks of the Bank of Russia do not include catching criminals or increasing tax collection to the treasury.

But the fact that in the coming years the requirements for transfers between physical cards. individuals may become stricter, this is a fact. And calls from banks asking to explain the feasibility and reasons for a particular transfer are becoming more frequent.

About the grounds for refusal of service

What are the grounds for terminating a bank account agreement or refusing to carry out a transaction?

The right of credit institutions to refuse services to clients is enshrined in paragraph 5.2 of Article 7 of Law 115-FZ. In particular, banks have the right :

- Refuse to enter into an agreement if there are suspicions that the purpose of the operation is the laundering of criminal proceeds or the financing of terrorism.

- Terminate the contract if during the calendar year 2 or more times a decision was made to refuse to execute the client’s order on the basis of paragraph 11 of Article 7 of Federal Law No. 115-FZ.

As for the last point, banks have the right to refuse a client to execute his order if the documents required for internal control are not submitted . And also if a bank employee has suspicions that the operation may be related to extremism or terrorism.

The procedure for refusing clients to carry out a transaction or making a decision to terminate an account is fixed in the internal documents of the bank. The bank is obliged to report all such cases to Rosfinmonitoring.

How the Bank of Russia implements its initiatives in practice

The Bank of Russia has launched a serious war against illegal payments, and this time card-to-card transfers have come under suspicion, writes Kommersant. So far, the regulator is only conducting a survey of credit institutions, but, as bankers say, in informal conversations, representatives of the Central Bank advise banks to minimize the volume of such transfers between individuals.

Several years ago, the Bank of Russia invited banks to make transfers through the Central Bank system - the “Fast Payment System” (SBP), where the “tail” of any transaction can be tracked and the operation itself can be blocked. But when working through SBP, as opposed to working through their own payment gateways, credit institutions lose the profit they receive by charging commissions for transfers.

Thus, the Central Bank sent a request to payment market participants asking them to provide data on identifying frequently made transfers (so-called dropper operations). The request from the Bank of Russia concerns transfers of funds from individual cards to individual cards. In particular, the request must indicate restrictions and limitations on such transactions; parameters for tracking them by banks, that is, the number of transfers per unit of time (week, month, year) and the volume of such transfers.

In this case, the emphasis is on the fact of using a card belonging to one individual. The Central Bank also requires an explanation of the methods that credit institutions use when making transfers to individuals, identifying non-taxable transactions, and mechanisms for monitoring and suppressing such payments. In addition, the Central Bank requests from banks registers of transactions, including those canceled by cardholders and blocked by the banks themselves, as well as the amount of commissions on such transactions.

Shortly before sending out this request, the Central Bank published criteria by which banks must identify and prevent payment transactions aimed at transferring funds to shadow businesses. Transfers from card to card are indeed actively used for fraudulent transactions. In fact, a card can be opened in almost any bank, then transferred to anyone, receive funds on it, and then cash it out.

Some payment market participants have already begun to refuse to provide their clients with the service of transferring money from card to card. Thus, RNKO Payment Center (operator of the Zolotaya Korona system) decided, in principle, to stop providing such a service as transfer from card to card on all Internet pages.

There are no effective methods for monitoring card-to-card transactions when the service is provided to external clients, according to Zolotaya Korona. In this case, the bank is objectively deprived of the opportunity to assess the legalization risks of a specific transaction.

In any case, in the coming year we should expect banks to tighten their control over transfers between cards of individuals.

About maintaining blacklists

There is information in the business environment about the existence of blacklists of persons who are involved in dubious transactions. Does Rosfinmonitoring maintain such lists?

The RFA answered this question as follows: it only maintains a list of persons who are involved in terrorism and extremist activities. Persons are included in this list on the basis of paragraphs 2.1 and 2.2 of Article 6 of Law 115-FZ of 08/07/2001. Rosfinmonitoring does not maintain any other lists, including those of persons involved in questionable transactions.

How to find out about blocking of a current account by the tax office or bank

The tax office sends a copy of the decision to block the current account. Payments will be suspended until the payer corrects the problem.

You can also check your account blocking yourself at the tax office. In this service you can view information about blocking your current account for free.

If the bank has blocked the account, you can find out about this by phone or by sending an official request to the bank. In some cases, the bank may send a notification via the Internet or SMS message.

After the entrepreneur has learned about the blocking of the account and the reasons, he must bring the necessary documents to the bank that will confirm his innocence.