Current assets include the following components

Let's look at the diagram to see what the company's current assets are.

From 01/01/2021, inventory accounting is regulated by the new FSBU 5/2019 “Inventories” (approved by Order of the Ministry of Finance dated 11/15/2019 No. 180n), PBU 5/01 has become invalid. Some accounting rules have been changed significantly. An analytical review from ConsultantPlus will help you learn about changes in inventory accounting. Get trial access to K+ for free and proceed to the material.

What is included in other current assets on the balance sheet

According to the norms of PBU 4/99, OA are displayed in section II of the balance sheet.

The balance sheet should also display information about non-material assets that are not included in other articles of Section II. Other current assets include:

- The cost of completed stages of unfinished work, recorded in the account. 46.

- VAT on advances, allocated separately to the account. 62 or 76.

- Shortages or damaged valuables for which a decision on write-off has not yet been made.

- VAT and excise taxes subject to reimbursement after the reporting period.

- VAT on goods shipped, revenue for which will be recognized in the next year.

This information is displayed in line 1260 “Other current assets”.

Classification of working capital

The classification of working capital of a commercial bank is represented by dividing the total amount of working capital into two subgroups, these are: working capital by the sources of their formation and working capital by the method of determining their needs.

Figure 1. Classification of bank working capital. Author24 - online exchange of student work

Classification of assets by sources of working capital. Such working capital is divided into own and borrowed. Own funds are formed from the profits received by the bank, and borrowed funds are generated from loans from other banks, as well as investments made in a commercial bank.

Classification of working capital according to the method of identifying needs: standardized and non-standardized.

Normalized ones include those working capital that can be used in the future to calculate the planned amount of inventory.

Non-standardized assets include those working capital that does not reveal planned costs.

Rationing of working capital is a process that involves the creation of norms and standards, in other words, the determination of the estimated values of working capital that will be necessary to create constant minimum reserves necessary and sufficient for the effective operation of a commercial bank.

The purpose of standardization is to identify the effective size of working capital.

What can be classified as low-liquid current assets?

Liquidity is an indicator of the speed at which an asset is converted into money. A very important aspect in making a company profit is the competent management and control of OA. To carry out the control functions of the company and determine risks, it is necessary to develop a gradation that will allow determining the possible liquidity of the asset in the event of a crisis situation. In the economic literature, a variant of risk gradation by degree has been proposed.

| Risk level | Type of asset | Liquidity |

| Minimum | Cash, short-term financial investments | High |

| Small | Inventory and finished products (subject to quick implementation) | High |

| Average | Unfinished production | Average |

| High | Unused goods, overdue accounts receivable, high volumes of work in progress | Low |

Low-liquid assets are considered to be those assets whose conversion into money takes more than a year. For example, a receivable with an expected return period of more than 12 months or goods stored in warehouses. That is, all OA that are considered high risk are considered the least liquid.

For details, see the material “Which current assets are the least liquid?”

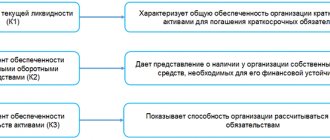

Formula for calculating the liquidity ratio of current assets

To calculate the rate of asset turnover and quickly track the solvency of the company, financiers calculate the current liquidity ratio of the company. This indicator shows whether the company can pay off current obligations at the expense of OA. Accordingly, the higher it is, the better for the company. Formula for calculation:

Ktl = OA/Co,

Where:

Ktl - current liquidity ratio,

OA - current assets,

Co - short-term liabilities.

Important! Hint from ConsultantPlus The source of information for financial analysis is the balance sheet... Possible type of formula (balance sheet line): Ktl = (line 1200 - line 1230 - line 1220) / (line 1510 + line 1520 - line 1550 ). Read more about liquidity analysis in K+. Trial access is free.

Find out which balance sheet lines to use to calculate the ratio in the publication “Current liquidity ratio (balance sheet formula).”

Net working capital, NWC

View this article in PDF

Formula for calculating net working capital

Net Working Capital (NWC) is calculated using the following formula:

NWC=Current Assets-Short Term Liabilities

where: Current Assets - total current assets of the company Short-Term Liabilities - total short-term liabilities of the company

The values of assets and liabilities are taken at the end of the period under study. The resulting net working capital is measured in the same currency as the balance sheet indicators, this distinguishes it from other liquidity indicators, which are calculated as ratios and display different ratios as percentages or fractions of a unit.

Analysis of net working capital values

Net working capital shows what the balance looks like between the company's most liquid assets and liabilities that must be repaid in the near future.

>If NWC > 0, then the company in the short term already has assets from which its liabilities can be paid. While not all of these assets will necessarily be converted into cash and used to pay off liabilities, the company's overall position appears to be stable.

If NWC<0, then in the short term the company does not have sufficient assets to pay off liabilities, that is, it plans to use income that will be received in the near future to pay off short-term liabilities. Although the situation itself does not mean financial problems, this situation is considered more risky and we can say that the company has problems with liquidity.

Another possible interpretation of NWC is the amount of short-term assets acquired with long-term sources of funds (if NWC>0) or the amount of long-term assets acquired with short-term funds (if NWC<0). Here you can pay attention to the fact that for the stable operation of a company, it is desirable that its assets be more liquid than liabilities, otherwise, even with significant assets, it may turn out that when it is necessary to pay obligations, the company will not have money and will not be able to get them quickly.

Although the recommendation to maintain NWC>0 is fairly universal, some industries and situations may require significantly different requirements for companies. Sometimes the value of normal net working capital will be significantly higher than zero. In other cases, it will be normal for a company to continually do business with a negative NWC. To more accurately determine the target value of working capital, the characteristics of the industry and the performance of competitors are usually studied.

Net working capital is similar to and can be used in conjunction with current liquidity ratio. Their combination allows you to quickly assess the significance of the result obtained when calculating CR. For example:

In this calculation, the CR indicator has a value of 0.7 - much lower than the usual recommendation to maintain current liquidity above 1. But the NWC indicator calculated in tandem with it immediately suggests that low current liquidity is unlikely to be a problem - after all, the value of net working capital is very small both in comparison to the company's total assets and in comparison to its turnover.

Working capital and planning

The indicator of net working capital and its change from period to period are of great importance when constructing predictive financial models of a company or investment project.

Investments in the development of a company or the launch of a project consist of two components: investments in fixed assets (CAPEX) and the formation of net working capital. However, net working capital planning is usually based on turnover cycles.

Calculation of investments that will be required to form net working capital looks something like this:

Here the assumption was made that inventories, receivables and payables are required by the company in an amount that is calculated as a certain share of revenue (this calculation is not shown in the example). You can then calculate the expected amount of net working capital in each period. And the growth of this value from period to period will mean the need for investment in the formation of working capital.

We publish such articles regularly. To receive information about new materials, as well as keep up to date with training programs, you can subscribe to the newsletter. If you need to develop specific skills in investment or financial analysis and planning, check out our seminar programs.

Results

Effective management of current assets is the key to the smooth operation of the company.

Each company determines the volume of OA required for work independently based on its own needs, the rate of resource consumption and the size of the business. At the same time, their lack can lead to a stoppage of production or the inability to pay off current obligations. Excess indicates inactivity of assets and the inability to quickly convert them into cash, i.e. low liquidity. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Composition of working capital

The composition of working capital is understood as a complex of all the elements that make up their composition.

Figure 2. Composition of working capital. Author24 - online exchange of student work

The composition of working capital of a commercial bank includes the following items:

- deferred expenses (amounts of bank funds that are allocated to future expenses);

- bank receivables (unreceived loans, unfulfilled customer obligations to the bank);

- funds in the cash register (this can also include collected proceeds and funds in ATMs);

- funds in accounts in a commercial bank (these are customer accounts: settlement, current, deposit, etc.).

The efficiency of the use of working capital by commercial banks is characterized by the following main indicators:

- Turnover ratio;

- Working capital utilization ratio;

- Duration of one revolution.

The working capital turnover ratio or the rate of turnover of working capital shows the amount of revenue from services provided, operations performed by the average value of working capital.