What determines the minimum and maximum maternity payments?

All women insured by the Social Insurance Fund (SIF) can receive a maternity benefit determined by calculation.

You can be insured there either compulsorily (if there is an employer who pays contributions to the Social Insurance Fund) or voluntarily (when there is no employer and insurance premiums are paid independently). The volume of maternity payments from the Social Insurance Fund is the product of the number of days of maternity leave and the average daily earnings of a woman for the two years preceding the year of maternity leave (Clause 1, Article 14 of the Law “On Compulsory Social Insurance...” dated December 29, 2006 No. 255- Federal Law).

When assigning benefits, it is allowed:

- if there are several places of work, calculate it separately by each employer or one place at a time, taking into account income received in all places of employment;

- shift the calculation period for which data will be taken by 1-2 previous years, if there was another maternity leave or parental leave in the calculation period, in order to obtain a higher average earnings.

If a woman gives birth to a child while on “children’s” leave, benefits are paid to her according to special rules, which were described by ConsultantPlus experts. Get free access to K+ and you will be able to find out the entire procedure for paying maternity leave in this situation.

The income from which the calculation is made is limited to the minimum and maximum possible values. The role of the first (if real earnings in terms of full working time is insufficient or the woman is insured in the fund voluntarily) is performed by the federal minimum wage in force on the start date of maternity leave (clauses 1.1, 2.1 of Article 14 of Law No. 255-FZ). The second value is determined by the legally established values of the income limits for each year of the billing period that are subject to contributions to the Social Insurance Fund (clause 3.2 of Article 14 of Law No. 255-FZ).

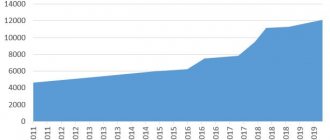

Both boundary indicators characterizing the income taken into account increase annually, and it is for this reason that the values of the maximum and minimum maternity benefits increased in 2022.

The number of days by which the amount of income related to the calculation period should be divided to obtain the average amount of earnings is equal to their real calendar number (730, 731 or 732, depending on which years fall within the calculation period). This amount is reduced by days corresponding to periods of payments not subject to insurance contributions (clause 3.1 of Article 14 of Law No. 255-FZ). The latter, in particular, includes time spent on sick leave, maternity leave and parental leave.

The coefficient taking into account the length of work experience is not applied to average earnings when calculating maternity benefits (clause 4 of Article 14 and clause 1 of Article 11 of Law No. 255-FZ).

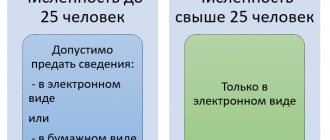

Important! Since 2022, maternity benefits to working women are paid directly by the Social Insurance Fund, and the employer only transfers to the fund the information and documents necessary for the assignment and payment of benefits. But despite the fact that the employer does not pay the maternity leave money, he must calculate her average earnings and indicate it in the sick leave for the Social Insurance Fund.

A sample from ConsultantPlus will help you fill out a sick leave certificate for a maternity leaver. You can get trial access to the legal system for free.

Maximum benefit amount for BiR in 2020

Maternity benefits, in general, should be calculated from the average earnings for the billing period, that is, for the two years preceding the onset of illness, maternity leave or vacation (from January 1 to December 31). Accordingly, if an employee goes on maternity leave in 2020, then the billing period will be 2022 and 2022 (Part 1, Article 14 of Federal Law No. 255-FZ of December 29, 2006).

Earnings include all payments to the employee for the billing period, from which the employer calculated contributions in case of temporary disability and in connection with maternity (Part 2 of Article 14 of the Federal Law of December 29, 2006 N 255-FZ). As for the number of calendar days in the billing period, there can be either 730 or 731 (if the billing period falls on a leap year). Excluded days include calendar days falling within the following periods:

- illness;

- holidays according to the BiR;

- maternity leave;

- releasing an employee from work with full (partial) retention of salary, if insurance contributions were not accrued on this salary.

The maximum maternity benefit that a worker can receive is limited to the maximum average daily earnings. In 2022 it is 2301.36986 rubles. (RUB 815,000 + 865,000) / 730.

In 2022, take the employee's earnings for 2022 and 2022 to calculate maternity benefits. The maximum amount of payments that can be taken into account in the calculation is RUB 1,680,000. (815,000 + 865,000).

Thus, the maximum amount of maternity benefits in 2022 will be:

- RUR 322,191.78 – during normal childbirth (2301.36986 x 140);

- RUB 359,013.69 – for complicated childbirth (2301.36986 x 156);

- RUB 446,465.75 – with complicated multiple births (2301.36986 x 194).

The indicated maximum sizes will not change from January 1, 2022 due to the increase in the minimum wage. An increase in the minimum wage only affects the change in the minimum maternity leave. Also, the indicated amounts are not subject to indexation from February 1, 2022. These amounts will remain unchanged throughout 2022.

Amount of minimum maternity leave in 2021

When determining the amount of the minimum possible maternity benefits, one should be guided not only by Law No. 255-FZ, but also by the Regulations on the specifics of calculating benefits (approved by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375). With regard to the calculation of the minimum wage for compulsorily insured persons, the Regulations prescribe:

- apply a regional coefficient to the amount of this minimum (clause 11(1));

- the minimum wage value corresponding to the start date of maternity leave should be spread over 24 months and divided by 730 days (clause 15(3));

- do not take into account the fact of working part-time (clause 16).

For those who are voluntarily insured, the calculation of the average daily benefit amount will be different (clause 15.4 of the Regulations):

- the regional coefficient for the minimum wage is not used here;

- The amount of daily benefits is determined by dividing the federal minimum wage by the number of calendar days in the month the maternity leave begins.

What will be the minimum amount of maternity payments in 2021? The minimum wage has been increased to 12,792 rubles from 01/01/2021. Calculation from it will give the following values of the minimum average daily benefit:

- for compulsorily insured persons - 12,792 × 24 / 730 = 420.56 rubles;

- for voluntarily insured persons (in relation to months with the largest number of calendar days in them) - 12,792 / 31 = 412.65 rubles.

The full amount of the minimum maternity payment in 2022, as in previous years, depends on the duration of maternity leave, which in the standard situation is 140 calendar days. With it, the minimum maternity leave is equal to:

- for compulsorily insured persons - 420.56 × 140 = 58,878.40 rubles;

- for voluntarily insured persons - 412.65 × 140 = 57,771.00 rubles.

However, these amounts may be further reduced if the woman does not use maternity leave in full or is the adoptive parent of a newborn.

How is the minimum maternity benefit calculated for 2022?

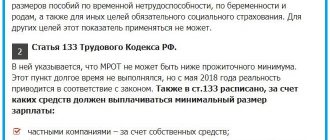

In general, maternity benefits are calculated based on the employee’s average earnings for the 2 years preceding the year of going on leave under the BiR. But if a woman’s income is small or non-existent, the benefit is calculated based on the minimum wage (clause 11(1) of the Regulations on the specifics of the procedure for calculating benefits, approved by Resolution of the Government of Russia dated June 15, 2007 No. 375).

This benefit is called the minimum benefit. The employee will not be able to receive less.

It is calculated using the following formula:

(minimum wage x 24: 730) x KDo

Where:

The minimum wage is the value established for each year by Law No. 82-FZ of June 19, 2000 “On the minimum wage.” To calculate the benefit, the minimum wage is taken as of January 1 of the year in which the employee goes on leave for employment and employment. The minimum wage as of 01/01/2020 is 12,130 rubles. (Order of the Ministry of Labor dated 08/09/2019 No. 561n). This value must be used when calculating benefits for employees going on maternity leave in 2020.

24 — number of months in the billing period. As when calculating benefits based on average earnings, when calculating benefits based on the minimum wage, a period of 2 years is taken.

730 is a fixed value. If, when calculating benefits based on average earnings, the actual number of days in 2 calculation years is indicated (730, 731 or 732), then when calculating benefits according to the minimum wage, this value is always equal to 730 and never changes.

KDo - the number of days of vacation according to the BiR. The duration of maternity leave depends on how many children the woman is pregnant with, how the birth went and where the employee lives. Most often, a holiday under B&R lasts:

- 140 - during pregnancy with 1 child and childbirth without complications.

- 156 - during pregnancy with 1 child and childbirth with complications.

- 196 - during pregnancy with 2 or more children (regardless of how the birth went).

Increased maternity leave under the BiR is provided for women living in the Chernobyl nuclear power plant area. Such employees are entitled to additional prenatal leave of 20 days (the total leave before childbirth is 90 days). You can find out more about the duration of leave under the BiR and the reasons for increasing it in this article.

The maximum maternity payment amount in 2022

The maximum amount of maternity leave depends on:

- on the size of the maximum permissible average daily earnings taken into account;

- the maximum possible duration of maternity leave.

The first of these values in 2022 is equal to the sum of the limits of income subject to insurance contributions established for 2022 and 2022 divided by 730 (clause 3.3 of Law No. 255-FZ):

(865,000 + 912,000) / 730 = 2434.25 rubles.

With standard maternity leave (140 days), the maximum amount of maternity leave in 2022 is: 2434.25 × 140 = 340,795 rubles.

But the vacation can be longer. Thus, in case of complicated childbirth, the benefit amount will be 379,743 rubles. (RUB 2,434.25 x 156 days), for multiple pregnancy - RUB 472,244.50. (RUB 2,434.25 x 194 days).

Its greatest length corresponds to 200 calendar days, at which the maximum amount of maternity leave in 2022 is equal to: 2434.25 × 200 = 486,850 rubles.

Minimum benefit amount for BiR in 2020

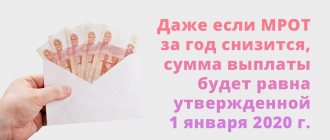

To determine the minimum amount of the BiR benefit, if the maternity leave began in 2022, the new minimum wage from January 1, 2022 is relevant - 12,130 rubles.

If maternity leave began on 01/01/2020 or later, then the minimum average daily earnings will be 398.794521 rubles. (RUB 12,130 x 24/730). Accordingly, the minimum amount of the BiR benefit for a standard maternity leave (lasting 140 days) will be 55,831.23 rubles. (RUB 398.794521 x 140 days).

Consequently, with different durations of maternity leave in 2022. There will be different minimum maternity payments:

- RUB 55,831.23 (398.794521 × 140 days) – in the general case;

- RUB 77,366.14 (398.794521 x 194 days) – in case of multiple pregnancy;

- RUB 62,211.95 (398.794521 x 156 days) – for complicated childbirth.

However, keep in mind that an employee can receive a BIR benefit less than the minimum value in 2022 if she works part-time.

Also, if the length of service of an employee going on maternity leave is less than 6 months, then she is paid a B&R benefit in an amount not exceeding the minimum wage for a full calendar month (Part 3 of Article 11 of Federal Law No. 255-FZ of December 29, 2006). This case will be discussed in detail in this article .

Results

The amount of maternity benefits is legally limited in size. Moreover, these restrictions apply to both its maximum and minimum size. Both values depend on 2 parameters: the average daily benefit amount and the duration of maternity leave. The average daily benefit amount is determined by the federal minimum wage (for its minimum amount) and the maximum values of the amounts of income subject to contributions (for its maximum amount).

Sources:

- Federal Law of December 29, 2006 No. 255-FZ

- Decree of the Government of the Russian Federation of June 15, 2007 No. 375

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

New billing period for maternity leave

Starting from 01/01/2020, the billing period changes, based on which the accountant calculates maternity payments. Now maternity benefits must be calculated based on average earnings for the two previous calendar years before the start of maternity leave. Next year, the average earnings of female workers are applied based on payments for 2022 and 2022. The billing period is determined in a special manner if:

- in the previous two years the woman did not work in the organization;

- The employee’s earnings for the billing period turned out to be below the current minimum wage.

Maternity payments, as before, amount to 100% of the employee’s average earnings. Nothing has changed on this issue. The duration of maternity leave must be determined on the basis of a sick leave certificate issued by a medical institution. Typically, sick leave is issued for 140 calendar days, but in case of complicated childbirth or multiple pregnancies, the period of maternity leave increases. In this case, the accountant must accrue additional benefits for additional days of maternity leave.

The calculation of average earnings includes all payments to the employee for the last two calendar years for which insurance premiums were calculated. If desired, the employee has the right to replace one or two years with previous ones if, for example, in 2022 or 2022 she was on maternity leave or maternity leave. The accountant has the right to make such a replacement only if, due to the replacement of years, the amount of benefits due for payment increases.