How an exception occurs

The law provides a clear procedure. If the information in the Unified State Register of Legal Entities is marked as unreliable for more than six months, the registration authority makes a decision to exclude such legal entity from the Unified State Register of Legal Entities. Within three days after the decision is made, the decision is published in the State Registration Bulletin. The message must contain information about the procedure and deadlines for submitting applications by creditors, persons whose rights and interests may be affected by the exception, as well as information about the address to which applications must be sent. In addition to the journal, information can be obtained on the website www.nalog.ru in the section “Information published in the journal “Bulletin of State Registration”. If no objections are received within three months, the company will be liquidated without going to court.

procedure for excluding a legal entity from the Unified State Register of Legal Entities.

Finally, as part of the information about a legal entity, information will be available on the initiation of bankruptcy proceedings of a legal entity, on the procedures carried out in relation to the legal entity, applied in the bankruptcy case (clause “i.2”, paragraph 1, article 5 of the Federal Law of 08.08.2001 No. 129-FZ[2]).

These changes will be made to the Unified State Register of Legal Entities by the registering authority on the basis of the received ruling of the arbitration court to accept an application for declaring the debtor bankrupt, as well as information provided by the operator of the Unified Federal Register of Bankruptcy Information on the name of the debtor, his OGRN and TIN, on the introduction of the appropriate bankruptcy procedure (observation, financial recovery, external management), on declaring the debtor bankrupt and on the opening of bankruptcy proceedings, on the date of introduction of the corresponding procedure, on the termination of bankruptcy proceedings, on the approved external manager or bankruptcy trustee (full name of such arbitration manager, his TIN) and on the change the named information.

The above information must be provided by the operator of the Unified Federal Register of Bankruptcy Information no later than three days from the date of its entry into this register.

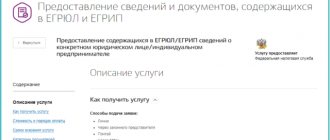

Thus, by using the service “Business risks: check yourself and your counterparty” on the website https://www.nalog.ru, you can avoid adverse consequences by protecting yourself from relations with an insolvent legal entity.

The rules for excluding a legal entity from the Unified State Register of Legal Entities by decision of the registration authority are also changing.

Firstly, a decision on the upcoming exclusion is not made if information about the bankruptcy of a legal entity is received.

Secondly, applications from an inactive legal entity, creditors or other persons whose rights and legitimate interests are affected in connection with the exclusion of an inactive legal entity from the Unified State Register of Legal Entities will be sent in a form approved by the Government of the Russian Federation and must be motivated.

Methods for sending such applications have been established: by post, directly submitted, sent in the form of an electronic document signed with an electronic signature, using public information and telecommunication networks, including the Internet. The consequence of receiving an application has not changed: as now, a decision to exclude an inactive legal entity from the Unified State Register of Legal Entities in this case is not made (Clause 4, Article 21.1 of Federal Law No. 129-FZ).

Please note: the decision to exclude an inactive legal entity from the Unified State Register of Legal Entities can be challenged if appropriate evidence is available. For example, in the Resolution of the AS PO dated January 28, 2016 No. F06-4935/2015 in case No. A72-3389/2015, the arbitrators established the fact that LLC had concluded several business lease agreements, which both at the time the contested decision was made by the registering authority and at the time of consideration of the case in court they were actually valid and were executed by the parties, including for them the LLC made rental payments in cash (using check orders), which is not prohibited by current legislation. As a result, the court declared the actions of the tax authorities illegal.

The legislator also provided that the registration authority does not have the right to make a decision to exclude an inactive legal entity from the Unified State Register of Legal Entities if there is information about bankruptcy (clause 7 of Article 22 of Federal Law No. 129-FZ). Consequently, the legislator excluded cases where the relevant information was received after the decision on the upcoming exclusion was made.

It should be noted that in the Resolution of the Constitutional Court of the Russian Federation of May 18, 2015 No. 10-P, clause 2 of Art. 21.1 of Federal Law No. 129-FZ was found to be inconsistent with the Constitution of the Russian Federation, since its provisions allow administrative exclusion (by decision of the registration authority) from the Unified State Register of Legal Entities of a legal entity that has signs of being inactive, in respect of which the court, at the request of a creditor, has introduced bankruptcy proceedings.

Obviously, the legislator, through the above changes, eliminated this shortcoming.

Thirdly, the established procedure for excluding an inactive legal entity from the Unified State Register of Legal Entities will also be applied in the following cases:

- the impossibility of liquidating a legal entity due to the lack of funds for the expenses necessary for its liquidation and the impossibility of assigning these expenses to its founders (participants);

- the presence in the Unified State Register of Legal Entities of information in respect of which an entry was made about their unreliability for more than six months from the date of making such an entry.

Other consequences of unreliability

1. Due to the presence of information about unreliability, organizations that conscientiously check their counterparties may refuse to work with such a legal entity.

A record of unreliability is a black mark and immediately transfers the company to the category of counterparties with a low level of reliability, which calls into question the deductions and expenses of the counterparties. Often companies learn that there is a note about unreliability in the statement from their counterparties. 2. Problems with banks are quite possible. The tax authority does not have the right to suspend transactions on an organization’s accounts based on the appearance of false information in the Unified State Register of Legal Entities, but no one can prohibit it from informing the bank about this. Sometimes the bank detects this on its own thanks to its internal control system and verification procedure for its clients. Considering the importance for banks of information about the identification characteristics of clients and the terms of bank account agreements, which determine the obligation of clients to inform the bank as soon as possible about changes in their details, including changes in address, director, participant, timely failure to submit such documents can be qualified as a significant violation of the banking agreement accounts.

The bank, guided by the provisions of Law No. 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism,” can either suspend operations on the current account until the information in the Unified State Register of Legal Entities is brought into order, or even terminate the banking service agreement. In this case, the probability of opening an account in another bank is reduced to zero.

3. Managers and participants of the company who own more than 50% of the share in the authorized capital, in respect of which there is a mark of unreliability of information, will not be able to carry out registration actions in relation to other legal entities (subparagraph f, paragraph 1, article 23 of Law No. 129-FZ) . As a rule, the first thing that comes to mind when a company has false information is to register a new legal entity and operate under a new flag. And here an unpleasant surprise awaits sluggish participants and directors in the form of a refusal of state registration.

4. It is impossible to carry out any registration actions with the organization itself, which has a record of unreliable data in the Unified State Register of Legal Entities. For example, change the director, sell a share or increase the authorized capital. The registration authority will refuse to register such changes until you put the information in the Unified State Register of Legal Entities in order.

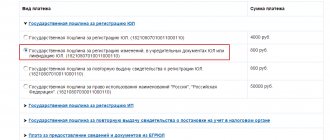

5. The head of a legal entity with false information in the Unified State Register of Legal Entities may be brought to administrative liability under Art. 14.25 Code of Administrative Offences. The fine will range from 5,000 to 10,000 rubles, and this is the smallest loss that can happen. But for repeat offenses, the punishment is more severe - it can be disqualification for a period of 1 to 3 years.

Arbitration practice on entering into the Unified State Register of Legal Entities a note about the unreliability of data

The decision of the tax authority to enter a “black mark” into the Unified State Register of Legal Entities can be challenged in court. We systematized court decisions in favor of business and in favor of the tax authorities according to different types of marks.

| Court findings | Source |

| Address invalid mark | |

| If there is no company sign on the building where the company is registered, this does not confirm that the address information is incorrect | Clause 2.4 of the Review of judicial practice on disputes involving registration authorities No. 1 (2018), sent by Letter of the Federal Tax Service of Russia dated March 29, 2018 No. GD-4-14 / [email protected] |

The reliability of the company's address is confirmed by the following circumstances:

| Clause 2.4 of the Review of judicial practice on disputes involving registration authorities No. 1 (2018), sent by Letter of the Federal Tax Service of Russia dated March 29, 2018 No. GD-4-14 / [email protected] |

| If employees are not at the company's location due to renovations at the premises or because they have irregular working hours, this does not indicate that the address is unreliable | Resolution of the Arbitration Court of the Volga-Vyatka District dated April 27, 2018 No. F01-1343/2018 in case No. A28-9627/2017 |

| The inaccuracy of the address cannot be justified by the fact that the company’s office is empty on a non-working day. The authenticity of the address can be confirmed by video recording proving that the company is using the premises at this address | Clause 2.3 of the Review of judicial practice on disputes involving registration authorities No. 3 (2018), sent by Letter of the Federal Tax Service of Russia dated October 12, 2018 No. GD-4-14/20017 |

Signs that together become the basis for recording an unreliable address:

| Resolution of the Arbitration Court of the Volga-Vyatka District dated February 12, 2019 No. F01-6972/2018 in case No. A28-654/2018 |

| An incomplete address (without indicating a specific premises) can be considered reliable if there is other evidence of reliability: a lease agreement, payment documents for rent, a letter from the owner, receipt of postal correspondence at the specified address At the same time, if a company has an incomplete address and does not provide the tax authorities with written evidence that the address is reliable within the prescribed period, a note indicating that the address is unreliable will be entered in the Unified State Register of Legal Entities. |

|

| A record of an unreliable address is illegal if, instead of the registering Federal Tax Service Inspectorate, a notification about the provision of reliable data to the company was sent by the territorial Federal Tax Service Inspectorate at the location of the company | Clause 2.5 of the Review of judicial practice on disputes involving registration authorities No. 1 (2018), sent by Letter of the Federal Tax Service of Russia dated March 29, 2018 No. GD-4-14/ [email protected] |

| If a company is in bankruptcy and does not have money to rent an office, this does not exempt it from providing reliable information about the address if there is a mark in the Unified State Register of Legal Entities indicating that the address is unreliable | Clause 2.3 of the Review of judicial practice on disputes involving registration authorities No. 2 (2018), sent by Letter of the Federal Tax Service of Russia dated 07/09/2018 No. GD-4-14/13083 |

| An entry about the unreliability of the address in the Unified State Register of Legal Entities may lead to the liquidation of the company at the request of a government agency (clause 3, clause 3, article 61 of the Civil Code of the Russian Federation) |

|

| A note about the unreliability of information about the participant and (or) head of the company | |

| Tax officials can make a mark of unreliability in the Unified State Register of Legal Entities if they find out that during the transfer of the right to a share in the authorized capital, the norms of the legislation on LLC and the norms of the LLC Charter were violated | Ruling of the Supreme Court of the Russian Federation dated September 6, 2019 No. 308-ES19-14573 in case No. A53-29680/2018 |

| Tax officials can make an entry in the Unified State Register of Legal Entities about the unreliability of information about the manager if they discover that the address information is unreliable | Ruling of the Supreme Court of the Russian Federation dated July 4, 2019 No. 303-ES19-3639 in case No. A73-7659/2018 |

These signs in themselves cannot be the basis for making an entry in the Unified State Register of Legal Entities about the unreliability of information about an LLC participant:

| Clause 2.4 of the Review of judicial practice on disputes involving registration authorities No. 4 (2018), sent by Letter of the Federal Tax Service of Russia dated December 28, 2018 No. GD-4-14/25946 |

| If the director or participant of an LLC declares to the Federal Tax Service that the information about him in the Unified State Register of Legal Entities is unreliable, tax authorities can make a note about unreliability without notifying the company about the clarification of the information and without checking the statement of this person |

|

| If the former head of a company declares that information about him as the current head of the company in the Unified State Register of Legal Entities is unreliable, this will not lead to him being automatically excluded from the Unified State Register of Legal Entities as the head of this company | Resolution of the Federal Antimonopoly Service of the North-Western District dated January 29, 2018 in case No. in case No. A56-22943/2017 |

How does a record of inaccuracy appear?

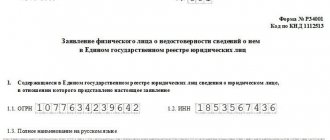

The basis for checking the information included in the Unified State Register of Legal Entities is the receipt by the registering authority of a statement about the unreliability of the information included in the Unified State Register of Legal Entities.

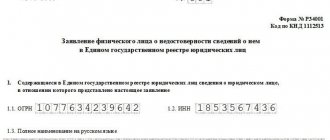

For example, the director of an LLC decided to resign and wrote a letter of resignation. And the company’s participants do not appoint a new director and do not exclude information about the old sole executive body from the Unified State Register of Legal Entities. Now the resigned director has a mechanism by which he can hasten the company’s participants to make appropriate changes to the Unified State Register of Legal Entities regarding the change of director. He has the right to submit an application to the registration authority in form No. P34001. The same can be done by a participant who has long ago submitted an application to leave the company, but is still listed among the participants of the company. Such applications are actively submitted by landlords who have not received rent for a long time, and the company is listed in the Unified State Register of Legal Entities at the address of the premises they own.

In addition to recognizing an address as a mass address, there are cases when the address obviously cannot be used to communicate with a legal entity. For example, military units, prisons, government bodies are located at the declared address, or the property has been destroyed and does not exist. The basis for verification is the lack of communication with the company at the address indicated in the Unified State Register of Legal Entities. This happens when the tax authority sends letters, but they are returned with the mark “the addressee has left” or “the address does not exist.” Then there is reason to go out for an inspection. The procedure is provided for by Order of the Federal Tax Service of the Russian Federation dated February 11, 2016 No. ММВ-7-14/ [email protected]

The inspection of the property is carried out by the inspectorate at the place of registration of the taxpayer in the presence of two witnesses or using video recording, of which a protocol must be drawn up. To obtain explanations, the tax authority may call any person who is aware of any circumstances relevant to verifying the accuracy of information included or included in the Unified State Register of Legal Entities. Quite often in such situations, the owner of the premises is interviewed.

How to avoid the appearance of an “untrustworthy” record

Before making an entry about unreliability, the tax authority must notify the legal entity itself, directors, and participants about this.

If you receive such a notification, you do not need to ignore it. The easiest way to solve the problem is at this stage, while the entry has not yet been made in the Unified State Register of Legal Entities. Most often, companies receive notifications due to inaccurate addresses. There could be many reasons for this. Most often this is a mass address. A mass address becomes when more than five companies are registered at it. And this may not happen intentionally. For example, if when registering a long time ago you indicated only the house number, but did not indicate the office or room number, such an address may automatically become a mass address due to the many companies registered in the office center. Currently, when registering legal entities, the address must be indicated with all its elements: this is the number of the house, (possession), building (building), apartment (office, room). Therefore, if you only have a house number, it is advisable to clarify the office number.

The situation looks completely different when the owner of the premises in which your organization is registered has submitted a corresponding application to the registration authority. Then you need to sort things out with the owner, perhaps you forgot to pay the rent or you really haven’t been at the address for a long time, then the address needs to be changed to the one that corresponds to reality.

Within a month after receiving the letter from the tax office, it is recommended to provide:

- lease agreement with the owner,

- a letter of guarantee with confirmation from the owner that the company is located at the address

- a copy of the certificate of ownership or a copy of an extract from the Unified State Register of Real Estate.

If you need to clarify the office number, form No. P 14001 is submitted with the documents to the registration authority.

Additionally, you can provide copies of payment orders for rent, photographs of the sign at the entrance, photographs of the office.

There are also situations when the company did not receive notifications from the registration authority, but information about unreliability appeared. To avoid such situations, regularly check your statement at least once every six months on the website www.nalog.ru, service “Business Risks: Check yourself and your counterparty.”