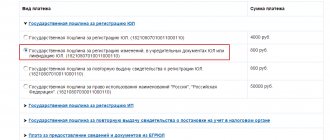

To receive an extract with an electronic signature from the Unified State Register of Legal Entities, you do not need to go to the MFC or the Federal Tax Service and pay a state fee of 200 rubles. A virtual analogue of a paper document can be requested on the tax website for free, indicating the name of the legal entity, INN or OGRN.

Next, we will tell you what you need to know about the electronic extract from the Unified State Register of Legal Entities - where you can and cannot use it, how the regular version differs from the extended one, how to request, download and print the document, and then check the enhanced digital signature at the tax office.

Order an electronic signature from us!

Leave a request and get a consultation.

When do you need an extract from the Unified State Register of Legal Entities with a qualified signature?

The Unified State Register of Legal Entities is the “encyclopedia” of the Federal Tax Service, which consists of detailed “dossiers” on all Russian organizations. Open and confidential information is entered into the Unified State Register of Legal Entities - from the name, INN and KPP to bank account numbers. Open data is publicly available, closed data can only be requested by the manager or an authorized person.

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!

Information about the company is provided in an extract - paper with a blue seal or electronic with a KEP. From a legal point of view, both options are equivalent (according to 63-FZ, paragraphs 1 and 3 of Article 6), but the virtual analogue cannot be used everywhere. For example, to participate in a closed or open competition/auction or to conduct a request for proposals under 44-FZ, you need a paper document with a “live” seal and signature of a Federal Tax Service employee.

An extract with an enhanced signature (EDS), received through the tax.ru website, is suitable for participation in electronic auctions, quotations and tenders, as well as for accreditation at federal government procurement sites. The document in PDF format can be used to file a claim in arbitration court and to obtain a bank loan. Information in electronic format is often requested by company managers, accountants and security officers in order to check counterparties.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

Other ways to obtain a document

In addition to personally contacting the tax office and filling out an application on the official portal of the Federal Tax Service, you can obtain an extract:

- On the government services website;

- Through the MFC branch;

- Through a commercial organization;

- Through an accredited center.

Registration of a document using these methods may take longer and vary in cost, and the resulting certificate does not always contain the tax authority stamp required for official submission.

Through the government services portal

You can order an electronic document through the government services portal created to provide reference information. State and municipal services are available to both individuals and legal entities. The data is distributed by region, subject, type, and contains the conditions for obtaining certificates.

You cannot directly obtain an extract from the Unified State Register of Legal Entities through government services. The Tax Service has only two services that provide the service. But the website contains detailed information about obtaining an extract, such as:

- Methods for submitting an application and receiving a completed document;

- Link to the official resource of the Federal Tax Service for submitting an application;

- Payment procedure and cost of extract;

- Lead times for the production of electronic and paper documents;

- Categories of persons who have the right to submit a request for an extract;

- Grounds for obtaining a document and grounds for refusal to issue information;

- Contacts and list of documents required to obtain an extract.

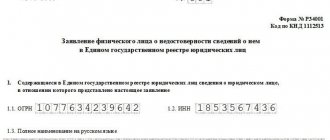

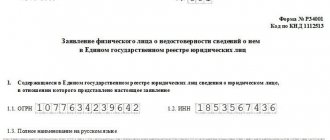

Refusal to receive an extract has several reasons, different for individual entrepreneurs, individuals and legal entities. For individuals, refusal occurs due to:

- Absence of signature and full name in the application submitted on paper;

- Postal address, including postal code, or email address (if the application is submitted via an online resource).

For legal entities and individual entrepreneurs, a refusal may be obtained due to:

- Inaccurate indication or failure to indicate in the application the data of the organization or individual entrepreneur submitting the request;

- Absence of the applicant’s TIN or OGRN (OGRNIP);

- Lack of email address or physical address (depending on the chosen application method);

- Absence of the signature and full name of the applicant on paper.

If the application is submitted on paper, then even if all the information is provided, the application will be rejected if the handwriting is illegible. The text of the application should be easy and understandable to read.

On the government services website, you can additionally file a complaint against a decision, action or inaction of a tax organization, officials or an organization authorized by the Federal Tax Service.

Through the websites of accredited centers

The main accredited center containing information about counterparties is Kontur.Focus (https://skb-kontur.com). The site contains documents in PDF format that are not certified by registration authorities. Here you can get the official extract from the Unified State Register of Legal Entities. The tax office did not certify it with its signature, however, for reference, the information is reliable and was formed on the basis of state register data.

To find the necessary data, enter the INN, OGRN, address or full name of the manager, the name of the company or individual entrepreneur in the search bar. Next, click “Find”, and select the desired organization from the resulting list:

The company card will open in a new window. To view it, you need to click “Download statement”, and to get information about another organization - “Request a new one”:

The required statement will open in any browser in PDF format:

The document is available both for saving on a PC and for printing.

Through commercial companies

The services of commercial organizations are used by both legal entities and individuals. Typically, the organization has all the necessary documents to provide services and submit documents to receive extracts, certificates, etc. The customer provides documents to a company employee at any time and in any form, or transfers a power of attorney to collect information and submit an application. The cost of such a service depends on the region, company, urgency and form of extract.

Receiving data from the MFC

Multifunctional centers for the provision of municipal and government services were created with the aim of:

- Simplifying the procedure for obtaining information;

- Reducing the period for obtaining information or services;

- Improving the quality of customer service.

The MFC operates on the one-window principle - a citizen makes a one-time request on one issue to one employee . To receive an extract from the Unified State Register of Legal Entities (the tax digital signature is present), you need to sign up to submit an application by phone or through the official portal of the MFC. On the specified day, the client comes to the office with a passport and a receipt for payment of the state duty. The application is submitted on a standard form indicating all the necessary details, data and the procedure for issuing the document. The applicant signs in blue ink and also indicates the date and full name.

An MFC employee checks the documents and, if everything is correct, accepts the application. The client is given a receipt confirming acceptance of the application indicating the deadline for issuing the statement. Usually it takes no more than a day to process the application. The completed extract is issued within 5 days from the date of receipt of the application. For urgent requests - within 24 hours.

An extract from the Unified State Register of Legal Entities is necessary to change internal documentation, draw up notarial transactions, check counterparties and issue accounting documentation, for internal control of the organization, etc. There are regular and extended statements, and they differ not only in the information they contain, but also in the ways of obtaining it. The electronic certificate is certified by an enhanced qualified signature of the Federal Tax Service and has full legal force. The document is accepted both on paper and on electronic media by any government organization.

What information about the legal entity does the extract from the Unified State Register of Legal Entities contain?

On nalog.ru you can request both a brief information about the company and a full official extract with a qualified signature. The first option has no legal force and is for informational purposes only, the second can be used for bidding and procurement. Brief information is available to everyone - no registration is required to receive it. The extended version is provided through your personal account only at the request of the manager or authorized representative.

Public information is needed to verify a legal entity. With its help, you can make sure that the company exists, pays taxes, is engaged in the declared activities and is not in the process of liquidation. If necessary, you can find out the name, address, details, as well as information about registration and registration with the Federal Tax Service.

An extended statement replaces a paper one - the file with an enhanced qualified signature contains all the information, including information about licenses and management composition. The data includes OKPO, OKVED codes, registration numbers in extra-budgetary funds, date of formation, as well as information about bankruptcy or liquidation processes.

Important: you can request an extended extract certified with digital signature only for your own company, a simple one - for any company.

We will issue an electronic signature for your business. We will help you install and configure it on the day you submit your application!

Leave a request and receive a consultation within 5 minutes.

OGRN code structure

The registration number of legal entities includes 13 characters. Individual entrepreneurs are registered more, so their code includes 15 characters. Decoding the code will allow you to find out whether the counterparty is a legal entity or individual entrepreneur, in what year and region the organization was registered and which tax office it belongs to.

Let's look at the decoding of OGRN using an example: 1-02-66-05-60662-0.

- The first digit will let you know the owner of the number. 1 - for legal entities, 2 - for government agencies and 3 - for individual entrepreneurs.

- The following numbers indicate the year of registration - 2002.

- The fact that the company is registered in the Sverdlovsk region is indicated by the region number 66.

- 05 - indicates the tax office code.

- 60662 - number of the decision on the organization of the enterprise. For individual entrepreneurs it includes 7 numbers.

- The last digit is the verification code.

The verification code allows you to verify the authenticity of the number yourself. This will help protect against scammers posing as a legitimate organization. The first 12 digits of the code must be divided by 11. The remainder of the division is written to the 13th position in the OGRN. In this case, it is 0. If the remainder is 10, then the last digit is also zero. If the check digit does not match, it will be clear that there is an error in the code or that it is not real.

How to obtain an extract from the Unified State Register of Legal Entities with an enhanced qualified signature

Let's look at how to request a legally significant certificate, for example, for bidding. This operation is available only to authorized users, so first we will talk about the registration procedure on nalog.ru.

You will need a CEP for the manager or authorized person. The signature must be issued by an accredited CA, the list of which is indicated on the Federal Tax Service website. You should also install a crypto provider, a browser plugin and drivers for working with electronic signatures. To create an account, you need to provide your details, leave an e-mail, sign the agreement with your electronic signature, receive an email with an activation link and follow it. After logging in, follow these steps:

- To receive an extended document with an enhanced qualified signature (EDS), click “Submit a new request for an extract.”

- Select "Legal entity" or "Individual entrepreneur".

- Write OGRN/INN.

- Click “Generate request”.

- Go to the list of requests, which indicates the number, date, criterion (TIN or OGRN), name of the legal entity/IP and status (formed or download).

Enhanced Qualified Signature

1,500 ₽ Add to favorites

1 500₽https://online-kassa.ru/kupit/usilennaya-kvalifitsirovannaya-podpis/

OrderMore details In stock

- 26 reviews

Electronic signature

1,500 ₽ Add to favorites

1 500₽

https://online-kassa.ru/kupit/elektronnaya-podpis/

OrderMore details In stock

To get a simple certificate, select “Legal entity” or “Individual entrepreneur” on the main page, and in the drop-down list click “Check yourself or counterparty”. You will be redirected to the service page “Providing information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs”, where you should enter the TIN, OGRN or company name in the search bar and select the region.

Any legal entity can request information about their organization without the help of intermediary services, many of which perform all the actions described in this article, but only on a paid basis. However, if you are a user of one of these services, you should not neglect this opportunity. For example, an information statement in PDF format can be obtained through the services Kontur.Extern or Kontur.Elba.

Important: a summary of the company can be viewed not only through nalog.ru, but also through the SBIS system. To do this, you need to open the organization’s card and click “Unified State Register of Legal Entities” (simple certificate) or “Extract with signature” (the second method is available only if you have the appropriate paid license).

How to open and print an extract from the Unified State Register of Legal Entities with an electronic signature

A virtual document has significance only in electronic form; when printed, its legal force is lost. However, in many cases a paper copy may be useful, for example, to file a claim in court. To open it on your computer, go to the list of requests (we described how to do this in the previous section) and click on the link with the word “Download”.

As a rule, a digitally signed statement becomes available for download within a few minutes after the request is generated, but the acceptable waiting period is 5 days, and the average is up to a day. To see the current status of the application, you can press F5 to refresh the page (if it is constantly open).

How is data processed and where does the document come from?

We do not process any data entered by users. We request a TIN or organization name by sending information to the Federal Tax Service database. It is she who is responsible for processing the source data.

On our side there is only a form for sending a request, the code of which is in the public domain - the Federal Tax Service does not prohibit third-party services from accessing its resources.

After entering the TIN or the name of the legal entity, the entered information is sent to the Federal Tax Service database. After processing, a response is received from there in the form of a PDF file with an extract.

The extract from the Unified State Register of Legal Entities itself is signed with a qualified enhanced electronic signature - this is an official document, exactly the same as one that can be requested from any other similar services.

Responsibility for the completeness and accuracy of information lies exclusively with the Federal Tax Service. Our service only transfers to users a file generated by the Federal Tax Service servers. We are not responsible for the accuracy of the information and do not make changes to the statements - the tax office is responsible for this.