An entrepreneur, like an ordinary individual, sometimes needs to confirm the amount of his income to government or credit institutions. A certificate of income may be required at social protection centers when receiving subsidies or assistance, at banks when applying for installment plans or loans, and in other situations. Tatyana Amelina, general director, understands how an individual entrepreneur can issue a certificate of income and what documents can replace it.

Tatiana Amelina

CEO

Certificate of income for an individual entrepreneur

For hired workers, the procedure is simple. Previously, they received such certificates in form 2-NDFL from the accountant at their place of employment. Now certificates for 2-NDFL have been canceled from the date of submission of reports for 2022, and the “Certificate of income and tax amounts of an individual” will become an appendix to form 6-NDFL. But for the workers themselves, this hardly complicated the process.

It is a little more difficult for an individual entrepreneur. The above-described option is not excluded for him if, in addition to his personal business, he works for someone under an employment agreement and receives taxable earnings. But regarding income from your activities, it is not so easy to draw up such a document; there is no approved form.

It turns out that in most cases an individual entrepreneur does not need a certificate! He can prove the authenticity of his income in other ways, depending on the tax regime in which the individual entrepreneur operates.

Individual entrepreneurs on the patent tax system (PSN)

When applying PSN, an individual entrepreneur has 2 types of income - actually received and expected, from which the value of the patent is calculated.

The estimated income is allowed to be confirmed by a Patent, which the individual entrepreneur receives after submitting an application to switch to the PSN.

To record/confirm actual income, there is a specialized format - the Income Book of individual entrepreneurs applying the patent taxation system (Appendix No. 3 to the order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n).

What document will replace the income certificate requested from the bank?

Many financial institutions are willing to accept other sources of information instead of a certificate, which contain information that allows them to approve a loan. But it is better to clarify in advance whether the bank you need to contact adheres to such a policy. What documents can an individual entrepreneur provide in exchange for an income certificate?

How can an individual entrepreneur confirm his income on OSNO?

Individual entrepreneurs on the general tax system pay tax on personal income and report to regulatory authorities through the 3-NDFL declaration. This form is considered direct evidence of the entrepreneur's income for the past year. That is, in this case, it is enough to provide the bank with a copy of the declaration submitted to the Federal Tax Service.

Sometimes you may need data on income for the current year, then the “Book of Income and Expenses” (KUDiR) will come to the rescue, from which you can make a copy. Therefore, it is convenient to maintain KUDiR in electronic format so that, if necessary, you can print and sign it to submit information where required.

How to confirm your income as an individual entrepreneur using the simplified tax system (USN)

Entrepreneurs on a simplified tax basis can use their declaration form established for the simplified tax system, which they submit annually to the Federal Tax Service. And, similarly with OSNO, a copy of KUDiR is suitable for information on income for the current year.

How an individual entrepreneur on a patent (PSN) can confirm his income

With a patent taxation system, a copy of the patent and the “Income Book” will be sufficient. Despite the fact that purchasing a patent seems to free the individual entrepreneur from all reporting, he is still required to take into account his income, since if the established limit is exceeded, working on the PSN will be considered illegal. Thus, for last year’s income you will need a copy of the corresponding book, for the current period - a display of the current AUC.

How can an individual entrepreneur on NAP (self-employed) confirm his income?

The professional income tax is a relatively recent regime open to self-employed individuals or entrepreneurs without employees (subject to a number of restrictions). Everyone working for NPD is registered in the “My Tax” system, where they post information about their business for the Federal Tax Service, and also receive information messages there.

The application works on both PCs and smartphones. It is there that you can make a request for a certificate of income for the reporting year, and quite quickly receive it in electronic form.

Former UTII

I would also like to mention entrepreneurship on the UTII system, which will be completely abolished in 2022. It was most difficult for people working in this regime - the quarterly declaration could not confirm income, and there was no separate accounting register. Entrepreneurs had to get out through copies of their primary documents or independently developed forms for recording income and expenses.

As you can see, in every tax regime there are plenty of documents confirming income, but not every bank is satisfied with such options, and then the individual entrepreneur will be forced to issue a certificate on his own behalf.

How can an individual entrepreneur confirm his income?

The standard solution for confirming one’s income is for a citizen to provide a certificate in form 2-NDFL. Taking into account the peculiarities of the individual entrepreneur’s activities, he will be able to obtain such a certificate only if he combines work in the company and entrepreneurial activity. If the individual entrepreneur does not cooperate with anyone, is subject to simplified or general taxation, the individual entrepreneur will be able to provide a copy of the 3-NDFL declaration to confirm income.

It is important that the 3-NDFL declaration contains a mark from the Federal Tax Service, or there is a receipt indicating that the document was accepted by the tax service operator. If this option does not suit the organization requesting the documents, a free-form income certificate can be used as a compromise option.

It should be taken into account that entrepreneurs may be subject to different taxation systems:

- basic taxation system (OSNO);

- simplified taxation (STS);

- have a single tax on temporary income (UTII);

- conduct business under a patent (PSN).

Remember, to confirm the income of an individual entrepreneur, it is advisable to initially discuss alternative options for confirming this position with the recipient of the documents (bank, government agency).

What to do when you need a certificate?

Some organizations require the provision of a certificate of income, since this is “hardwired” into their internal instructions or is based on the instructions of officials. In fact, presenting a certificate is much more convenient than carrying other documents or income books.

In this case, there are two ways:

- provision of a certificate from an individual entrepreneur on his own behalf and with his signature;

- presentation of a certificate from the Federal Tax Service, where the individual entrepreneur submits a tax return.

And although these options are not provided for by law, practice shows that in most cases they work.

Individual entrepreneur tax return for UTII

The tax period for UTII is a quarter. You must report to the Federal Tax Service on the results of each quarter no later than the 20th day of the month following the expired tax period.

The procedure for filling out the “imputed” declaration for 2022 was approved by Federal Tax Service Order No. ММВ-7-3/ [email protected]

For failure to submit a declaration on time, an individual entrepreneur on UTII is liable in accordance with Art. 119 of the Tax Code of the Russian Federation.

Important: registration of a “zero” declaration for UTII is not provided. The UTII tax is calculated not on the actual profit received, but on the imputed income. You need to pay taxes and submit a declaration, even if the company does not operate.

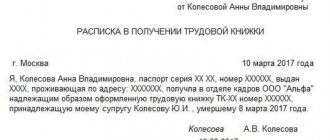

How to independently draw up a certificate of income for an individual entrepreneur

Due to the fact that there is no approved form, the income certificate can be drawn up arbitrarily. Of course, it is better to clarify in advance what requirements apply to documents in the organization where you will have to submit it.

You can issue a certificate on the individual entrepreneur’s personal letterhead, and if it is not available, at the beginning of the document it is worth mentioning key information about the individual entrepreneur (TIN, OGRNIP, address, contact phone number, possibly e-mail).

It is definitely recommended to include in the document the same details that apply to primary documentation:

- document name and date;

- Full name of the individual entrepreneur submitting the certificate;

- the amount of income with the obligatory indication of monetary units (rubles); in order to avoid mistakes, it is better to write the amounts in numbers and in words;

- position, full name, signatures of the persons who will endorse the document (in this case, your signature is enough, you can also enter an accountant, if you have one).

That is, in free-form certificates, the rules established for accounting documents apply. It is important to remember that income is confirmed precisely for the period that was requested for consideration at the place where the certificate was submitted. Therefore, you should include this information in the title, for example, “Income certificate for individual entrepreneurs for 2020.”

If a certificate is required for a long period, for example, 2018–2020, there is no need to prepare several documents for each year separately.

Typically, entrepreneurs draw up one document, unless the opposing party requests otherwise.

One more nuance: the right decision would be to draw up a certificate of income immediately before filing. This is most relevant when proof of income since the beginning of the current year is required. Otherwise, you will have to redo the document after time has passed.

Which banks issue mortgages for individual entrepreneurs?

A bank for an individual entrepreneur’s mortgage must be chosen based on the conditions: loan term, rate, down payment, and so on. Entrepreneurs who have a current account should first try to take out a loan from their bank.

Here are the mortgage conditions for individual entrepreneurs in 2022.

| Bank | Description | Interest rate | Loan terms |

Sberbank | New program “State support 2020”. Applies to new buildings only. The program was valid until November 1, 2022, then it was extended until July 1, 2022, after which it was extended again, but with changing conditions | from 6% | up to 30 years old |

| Buying secondary housing | from 7.9% | up to 30 years old | |

Opening | State program 2022. Preferential mortgage with state support for the purchase of an apartment in a new building | from 5.9% | up to 30 years old |

| Secondary housing. Mortgage for the purchase of an apartment or the last share in an apartment on the secondary real estate market | from 8.3% | up to 30 years old | |

| Housing in the Far Eastern Federal District | from 1% | up to 20 years | |

Alfa Bank | Housing under construction or finished. The maximum loan amount is 20 million rubles | from 6.05% | up to 30 years old |

VTB | Mortgage with state support. Maximum amount - 3 million rubles | from 4.3% | up to 30 years old |

| Ready-made housing or new building without a government program. Up to 60 million rubles | from 7.9% | up to 30 years old | |

Gazprombank | Mortgage with state support, family or preferential under one document | from 5.2% | up to 30 years old |

| Mortgage for a new building without government support. Maximum amount - 60 million rubles | from 7.9% | up to 30 years old |

Is it possible to request a certificate from the Federal Tax Service?

The Tax Code or the administrative regulations of the Federal Tax Service do not contain information about actions to certify the income of individual entrepreneurs by tax authorities. However, many regional inspectorates issue such certificates at the request of the taxpayer.

What is the procedure in this case:

- Draw up an application in any form for the issuance of an income certificate.

- Go to the operating room of the tax office, where declarations are submitted.

- One copy of the application remains with the tax office, the second with an acceptance mark is returned to the applicant.

- Within a month, you can receive either a certificate or an answer about the impossibility of issuing it.

- It will not be possible to appeal the actions of the inspectorate, since the issue is not regulated by law.

Sometimes a self-drafted certificate is also attached to the application, and the tax officer only verifies the data and certifies it with his signature and seal.

Declaration according to the simplified tax system income for 2022

More details

The declaration under the simplified tax system is submitted to the tax office at the place of residence of the individual entrepreneur until April 30.

The declaration can be submitted in person or through a representative with a notarized power of attorney, or sent by mail with a letter with the declared value and a description of the investment.

Attention ! You can generate a declaration according to the simplified tax system with a two-dimensional barcode, which is accepted by the tax authorities, on our website.

Subscribe to our Telegram channel so you don't miss important news for entrepreneurs.

Certificate for social protection authorities

Social security authorities ask to provide income data when it is necessary to assess the financial situation of a family and decide on local or federal benefits for its members. Current examples: receiving compensation for utility bills for low-income families, applying for guardianship benefits, and the like.

The law provides that income from business activities for the months of the calculated period is obtained by dividing the total amount of income for the period by the number of months.

In fact, the law allows the use of data from various reporting documents of an entrepreneur, be it declarations or accounting registers, to apply for benefits. However, regional social authorities often prefer to accept income certificates to provide benefits. The rules for their design are practically no different from those indicated in the sample above.

However, the period is usually three months; the document must indicate the amount of “dirty” income before taxes are deducted from them. Sometimes social security departments require you to indicate income by month in the form of a table; they may ask you to calculate the average income per month, so it is better to clarify the form of the requested form in advance.

Otherwise, the certificate is no different from those provided in other places. That is, in this case, the individual entrepreneur can make a certificate on his own. The main thing to remember is that you need to submit information for the three months preceding registration; you cannot take the current one.

To summarize the above

In 2022, individual entrepreneurs will be able, in the same manner, to independently draw up certificates or confirm income with other accounting documents, and submit requests to the Federal Tax Service inspectorate. The individual entrepreneur will be able to choose an option that is convenient for himself and acceptable to the requesting organization.

The main thing is that the certificate reflects information that corresponds to the facts (true information). After all, for documents containing incorrect data, the creditor may incur criminal liability under the Criminal Code of the Russian Federation. The culprit can be fined 120 thousand rubles, sent to perform labor service, and imprisoned for up to 2 years.

Therefore, it is better not to “play hide and seek” with creditors or government agencies, but to provide real indicators of your business activities through tax reporting and other government registers.

Rules for filling out a tax form

Declaration of the simplified tax system for individual entrepreneurs - as a sample of registration, where and when to submit

The tax form is filled out according to the standards and requirements presented on the official website of the Tax Service of the Russian Federation, as well as in each branch. The documents are filled out independently by the entrepreneur or employees in accordance with the relevant agreement.

For your information! The most important rule when filling out is to provide accurate information.

The income statement of an individual entrepreneur is filled out in black pen using capital letters or in Courier New font when printed. You need to write without using a proofreader to correct errors, and write each character in a new cell. Empty cells are marked with a dash. The report is not bound or printed on multiple sides.

It is better to start filling out the declaration from the second section. According to experts, it is more convenient to indicate the final results in the title page in order to avoid mistakes. All amounts are, as a rule, rounded. For example, not 10,102 rubles, but 10,100.

Note! The requirement does not apply to the UTII declaration. There the number is rounded to the nearest thousand.

Filling rules

Sample

Samples are given on the official website of the state and territorial tax service. There you can download them without any problems, just like mortgage documents. You can also take a sample during a personal visit to any branch of the Federal Tax Service of the Russian Federation. Available upon request.