Home / Taxes / What is VAT and when does it increase to 20 percent? / Invoice

Back

Published: December 28, 2017

Reading time: 5 min

0

401

An invoice is a universal payment document on the basis of which mutual settlements occur between participants in trade turnover or the market for works and services.

- When and who needs an invoice without VAT?

- How to fill out an invoice without VAT?

Some of these counterparties have the right to fill out this document without indicating value added tax as a result of using the appropriate tax regime or selling goods that are not subject to such tax.

Differences between the Federation Council if there is no taxation on products

To create a document, use the form approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, with amendments dated August 19, 2017 No. 981, which came into force on October 1, 2017.

An invoice without VAT is issued on the same form and according to the same rules as an invoice with VAT. The only difference is that in columns 7 and 8, where the tax rate and amount are indicated, “Without VAT” must be written.

If all shipped products are exempt from tax, when registering the SF, in all lines in which the names are listed, in columns 7 and 8, you must indicate “Without VAT.” The same entry is made in the line “Total payable” in column 8. If in the sold batch one part of the product is subject to VAT, the other is not subject to taxation, the entry “Without VAT” is entered only opposite the corresponding items.

The lines where taxable goods are listed indicate the rate and amount of VAT. In the “Total payable” field in column 8, enter the total tax amount, including only taxable items. Invoices for received advances are issued in compliance with the same rules.

For more information about what an invoice is and when it is used, read our article.

Procedure for filling out an invoice without VAT

Resolution No. 1137 of December 26, 2011 has annexes, the first of which corresponds to the current invoice form. When issuing an invoice to your counterparties without VAT, you must use this form.

As usual, the form must contain information about the document number, current date, and parties involved. The change in filling out the invoice without VAT is noticeable only in the tabular part, where identical entries “without VAT” must be made in fields 7 and 8. This wording is entered in any convenient way - manually with a pen, using a ready-made stamp, on a computer.

Filling out the remaining columns and fields is no different from filling out the VAT form. In field 9, where the indicator about the total value of positions is reflected, the tax is not included, since it is not charged.

You cannot put zeros in fields 7 and 8, this will be a gross mistake that will entail unpleasant consequences for the seller.

Firstly, 0 in the field for indicating the rate may be perceived by tax authorities as a 0% rate, which is not applicable in the case under consideration. 0% is the tax rate for shipments of goods and materials for export, which must be confirmed by a significant package of documents.

Secondly, the tax office may take zeros as an error and charge VAT on the amount at a rate corresponding to the goods and services being sold.

The form is certified by the signatures of the chief accountant and manager. If there is no chief accountant, then the manager signs in this field. The form in question does not require printing. Drawed up in a single copy for presentation to the client.

The client, having received such an invoice, will not find the corresponding amount in the field for indicating the tax, and therefore will not reimburse VAT on such a document.

Is SF required if an organization operates without value added tax?

According to paragraph 3 of Art. 169 of the Tax Code of the Russian Federation, VAT payers are required to issue an invoice. SF is not issued if you work as an individual entrepreneur or legal entity that is not a tax payer.

When should such a document be issued?

A taxpayer who is a seller of goods or a provider of services is obliged to issue an invoice without VAT only if he uses the right to exemption from VAT in accordance with Art. 145 of the Tax Code of the Russian Federation (clause 5 of Article 168 of the Tax Code of the Russian Federation).

This right arises if a legal entity or individual entrepreneur:

- receives revenue of no more than 2 million rubles. for 3 consecutive months;

- does not sell excisable goods.

In other cases, is it possible for organizations that are not tax payers to issue tax invoices without VAT? According to the letter of the Ministry of Finance No. 03-07-09/8423 dated February 15, 2017, this is not necessary, but there is a right to this matter.

Read about who issues the invoice here.

Use Cases

The preparation of such a document is provided if:

- Only part of the goods sold is exempt from tax (Article 149 of the Tax Code of the Russian Federation). The company carries out transactions simultaneously with products subject to VAT and not subject to VAT. In this case, the accounting program will generate a general invoice and invoice for the entire batch of goods with the same total amount.

- If the entire batch of products sold is not subject to VAT , issuing an invoice along with invoices and acts makes it possible to create a convenient set of documents while maintaining the numbering.

Who fills out the form?

Only the seller of goods or the provider of services has the right to issue an SF. Thus, he documents the completion of the transaction.

When do you need to generate an invoice without VAT?

The Tax Code of the Russian Federation provides for the only case in which a VAT payer is obliged to generate an invoice without tax; it is defined in Article 145 of the Tax Code of the Russian Federation. If a legal entity or individual entrepreneur meets the criteria established by this article, then they lose the obligation to charge and pay VAT when performing operations for the sale of inventory, work, and services. However, they must still provide customers with an invoice. When filling out the columns dedicated to the tax rate and amount, write the phrase “excluding VAT”.

This article defines the conditions under which the seller does not charge VAT and does not highlight this amount in the invoice:

- Revenue is no more than 2 million rubles. (for 3 consecutive months);

- During this period, the seller did not sell goods subject to excise taxes.

Exemption from tax liability does not apply to transactions during which goods are imported into the Russian Federation. In relation to these transactions, the tax should be calculated based on paragraph 4, paragraph 1, article 146 of the Tax Code of the Russian Federation.

How to send it to the recipient?

When setting the SF, you must adhere to the following rules:

- If the document is drawn up in paper form, the first copy must be given to the buyer, and the second remains with the seller (read why both the seller and the buyer need the SF). In case of electronic exchange, which is carried out through an accredited operator, the SF is issued in only one copy.

- The period for issuing the document is 5 days from the date of delivery.

- According to the letter of the Ministry of Finance No. 03-07-09/85517 dated December 21, 2017, the names of goods, services and works must comply with the contract.

- If corrections need to be made, a new copy of the SF is created. In this case, the serial number and date of the original document are preserved.

What columns and lines are present in the form?

Information that must be present in the Federation Council is given in paragraph 5 of Art. 169 of the Tax Code of the Russian Federation.

- Lines 1-8 of the form are intended for the details (names, addresses, identification codes) of the participants in the transaction - the seller and the buyer, as well as the consignor and consignee, and indication of currency. The table shows the invoice part of the document.

- Columns 1-9 contain information about the product (name, units of measurement, quantity, price, cost with and without VAT, tax rate and amount, excise duty).

- Columns 10-11 – data on the origin of the goods.

Filling out column 7 of the document at different tax rates

When issuing an invoice to account for value added tax, some mandatory data must be entered. Column 7 contains information about tax rates. According to Article 172 of the Tax Code of the Russian Federation, amounts that are presented when purchasing goods in the Russian Federation on the basis of invoices can be deducted. According to the Rules for filling out an invoice, column 7 should display the tariff rate.

According to Article 164, this indicator is set as a percentage. Collection tariffs in other indicators are not provided for by the Tax Code. If there is no percentage sign in the column, this is not a basis for deducting the tax amount. In order to be able to accept the tax as a deduction, it is important that the invoice contains no errors that could prevent the identification of the seller or buyer.

Filling example

As of October 1, 2017, new requirements for the preparation of this document began to apply. The filling procedure is as follows:

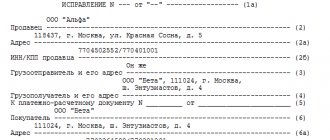

- In line (1) we indicate the serial number and date of issue. For all types of SF there is a common numbering. They are recorded in chronological order (it is allowed to add a letter designation to the number). When making corrections, in line (1a) we indicate the number of the correction; when filling out for the first time, a dash is added.

- Lines (2), (2a), (2b) contain information about the seller:

- for legal entities, it is necessary to indicate the full or short name, detailed address as written in the Unified State Register of Legal Entities, identification numbers (TIN/KPP);

- for individual entrepreneurs, the full name, address as entered in the Unified State Register of Entrepreneurs, TIN and registration information are entered.

- If the shipper and the seller are represented by the same organization, in line (3) you must indicate “The same.” If the shipper is another company or person, enter the full or short name and address. We put a dash if the invoice relates to work or services.

- In line (5) you need to indicate the payment document number only if there is an advance payment; if there is no prepayment, then this item remains blank.

- Information about the buyer is entered in lines (6), (6a), (6b) similarly to (2), (2a), (2b). If the buyer and the consignee are represented by the same organization, in field (4) you need to put the “Same” checkbox. If the consignee is another organization, indicate its name and address. If the invoice is for work performed or services provided, a dash should be included.

- In line (7) select the name of the currency. Accounting programs automatically enter the digital code.

- Line (8) is for the government contract ID. For other contracts it is not necessary to fill it out.

- The following columns are filled in in the table:

- Column 1 contains the names of goods, works or services.

- Column 1a indicates the product code. This field concerns only deliveries to the countries of the Euro-Asian Economic Union.

- Units of measurement are entered in columns 2-2a in accordance with OKEI. If the invoice concerns work or services, dashes should be added.

- In column 3 we indicate the quantity or volume based on units of measurement. If 2-2a is not filled in, there will also be a dash here.

- In column 4 the price per unit is entered as it is given in the contract.

- The total cost of each item excluding tax is reflected in column 5. The final line will contain the total cost of the entire delivery.

- Column 6 is filled in only for excisable goods. Here you need to indicate the amount of excise tax included in the price. In other cases, the note “Without excise duty” is made.

- When registering a SF without tax, in fields 7 and 8 you need to make the entry “Without VAT”. If some items are subject to tax, the rate and amount are entered opposite them.

- Column 9 reflects the cost of goods, works or services including tax.

- Column 10 must contain the digital product code. Columns 10, 10a, 11 are filled in for goods produced outside the Russian Federation.

- Columns 5, 8 and 9 of the bottom line contain the totals.

In the Federation Council, it is allowed to indicate two addresses (letter of the Ministry of Finance of the Russian Federation No. 03-07-09/85517 dated December 21, 2017). If the actual address, which differs from that recorded in the register, is recorded in the contract, it should be entered in an additional line.

Invoices without VAT are signed according to general rules. The paper form is certified by the signatures of the manager and chief accountant or authorized persons. If the document is issued by an individual entrepreneur, it must contain the personal signature of the individual entrepreneur or an authorized representative. More information about the invoice for individual entrepreneurs can be found here.

Certification of an invoice with a facsimile signature is not acceptable (letter of the Ministry of Finance No. 03-07-09/49478 dated August 27, 2015). When exchanging documents electronically, a certificate of the electronic signature verification key is required (letter of the Ministry of Finance of the Russian Federation dated September 12, 2016 No. 03-03-06/2/53176, Federal Tax Service of the Russian Federation dated May 19, 2016 No. SD-4-3/8904).

The invoice is certified only by one enhanced qualified electronic signature of the manager or authorized person. The electronic document does not require the signature of the chief accountant.

More details on filling out an invoice can be found here.

From the video you will learn how to correctly fill out an invoice if the company is not a VAT payer:

Sending a claim to a counterparty

Receiving an invoice late does not deprive the company of the right to reflect the amount of VAT paid to the supplier in the declaration and subsequently receive a deduction. Violation of the deadline does not cancel the deduction, since controllers in such a situation retain the opportunity to establish the basic parameters of the completed transaction. Key questions that inspectors need to answer:

· parties to the transaction (buyer and supplier, customer and contractor, etc.);

· object of the transaction (goods, services, etc.);

· price;

· VAT rate.

This procedure is established in paragraph 2 of paragraph 2 of Article 169 of the Tax Code of the Russian Federation. And secured by letters of the Ministry of Finance No. 03-07-09/28071 dated April 25, 2022, No. 03-07-11/16556 dated March 14, 2022 and No. 03-03-06/1/80379 dated October 18, 2022. That is, businessmen who want to receive a deduction will have a fairly strong position.

The simplest and most logical action in a situation where the supplier has violated the deadlines for issuing an invoice is to submit a written complaint. There is no template established by law; the document is drawn up in any form.

It is recommended that the emphasis in the complaint be on the following reasons that may prompt the supplier to fulfill its obligations:

Determining the date from which the regulatory period for sending documents from the supplier to the buyer is counted. In some cases, suppliers miss deadlines due to misinterpretation of the concept of “shipment.”

Threat of a fine to the supplier for the lack of an invoice from the buyer. There is no liability for violating the deadline for issuing a document or not transferring it to the counterparty. However, in accordance with paragraph 1 of Article 120 of the Tax Code of the Russian Federation and explanatory letters from the Ministry of Finance of the Russian Federation, failure to issue an invoice is a gross violation of the rules for recording income and expenses. The absence of even one document in a quarter leads to fines, the amount of which depends on the length of the period of non-issuance of invoices and the amount of VAT underestimated for this reason.

Most often, the supplier does not issue an invoice due to differences in shipping concepts. In this issue, there are nuances when transferring goods to the carrier, shipping in parts, and the time of transfer of ownership.

The fact is that the Tax Code of the Russian Federation does not have such a concept in principle. Article 39 of the Tax Code of the Russian Federation explains what the sale of goods or services is (this is a transfer of ownership). By turning to the Civil Code of the Russian Federation, you can find out from Article 509 that shipment is the actual transfer of goods. In accordance with Article 224 of the Civil Code of the Russian Federation, transfer means the delivery of goods to the buyer or carrier, who will deliver it to the counterparty. Also, transfer is the delivery of goods to a special company that will forward the goods to the client.

Attention! There is a good chance that when shipping in batches, the supplier will wait until the last part is shipped and then issue an invoice for the entire volume.

However, letters from the Ministry of Finance of the Russian Federation and the Federal Tax Service of the Russian Federation, starting from 2012, constantly explain that for the purposes of calculating VAT, the date of shipment is considered the day when the first primary document was generated in the name of the buyer, transport company or communications company (mail).

It's useful to study here:

- Federal Tax Service letter No. ED-4-3/ [email protected] dated April 11, 2012;

- letter of the Ministry of Finance of the Russian Federation No. 03-07-11/8067 dated February 9, 2018;

- letter of the Ministry of Finance of the Russian Federation No. 03-07-08/19635 dated March 16, 2020.

In the event of a transfer of ownership of the goods after they have actually been transferred to the buyer, the period for issuing and transferring the invoice to the counterparty is calculated from the moment of actual transfer of the goods, and not from the moment of transfer of ownership in accordance with the contract.

Attention! Thus, the supplier must prepare and transmit invoices no later than five days from the actual delivery of the goods, service or work product to the buyer or carrier.

In the case of works, the date of shipment is considered the day when the act of acceptance of their results by the customer was signed. In the explanatory documents, the Ministry of Finance of the Russian Federation draws attention to the fact that the act must be signed by the customer, and not by the contractor, since the customer may have comments in accordance with the Civil Code of the Russian Federation. The date of shipment for the provision of services is considered to be the day when the act was signed by the contractor. This is the difference in determining the time of shipment for works and services.

For a better understanding, you should study the documents:

- letter of the Ministry of Finance of the Russian Federation No. 03-07-11/5795 dated February 1, 2019;

- letter of the Ministry of Finance of the Russian Federation No. 03-07-14/14948 dated March 7, 2019;

- letter of the Ministry of Finance of the Russian Federation No. 03-07-11/88016 dated October 8, 2020.

For ongoing contracts, such as rent or utility services, the date of shipment is considered to be the last period for calculating VAT. As a rule, this is the last day of the month. This is explained in the letter of the Ministry of Finance of the Russian Federation No. 03-07-11/3435 dated January 23, 2019.

How to register?

An organization that enjoys the right to be exempt from VAT and is obliged to issue invoices registers them in a journal in the sales book with the note “Without VAT.” Other tax evaders are not required, but have the right to register the document in the sales ledger.

The buyer who receives such a document does not reflect it in the purchase book, since there is no tax. When issuing and receiving invoices from counterparties, it is necessary to carefully monitor changes in legislation governing the procedure for issuing and exchanging documents.

When else does an invoice without VAT apply?

The case discussed above is the reason for the mandatory generation of an invoice, despite the fact that there is no tax in it.

There are also situations in which a legal entity or individual entrepreneur has the right, on their own initiative, to fill out an invoice without VAT for presentation to the buyer:

- Transactions are carried out on which VAT is not charged (commodities, services, works are sold, the cost of which is not subject to tax under Article 149 of the Tax Code of the Russian Federation). The list of these operations is quite large and closed;

- The company is not a VAT payer due to the use of tax regimes different from the general system (STS, UTII, PSN, Unified Agricultural Tax).

In these cases, companies are not required to generate an invoice at all, but if clients ask, you can meet them halfway and write out a document in which you should write “without tax” in the fields dedicated to VAT (tax rate and amount).

It is difficult to say what motivates clients’ requests for an invoice in such situations. There is no tax allocated, there is nothing to reimburse the buyer. As a rule, such a request is related to the peculiarities of the counterparty’s document flow or an incomplete understanding of the situation. In the second case, an attempt can be made to explain to the buyer that the invoice is unnecessary in this case.

In such a situation, the seller can prepare an invoice without VAT or refuse this action; the choice remains solely with the seller. If the buyer is persistent in his desire to receive an invoice, even if it is without tax, then it is better to issue it; in this case, the seller loses nothing and does not acquire any obligations to pay tax.

If the invoice is filled out correctly, that is, in field 7 (rate), as well as in field 8 (VAT amount), the phrases “without tax” are entered, then the seller does not have the obligation to pay VAT; he also does not have to report to the Federal Tax Service using a VAT return. you won't have to. Moreover, there is no need to register the issued form in the sales book and other summary documents (unless the seller himself wishes to do so).