Accounting Objectives: Regulatory Regulations

Various regulatory documents regulate the goals, main objectives and principles of accounting, including:

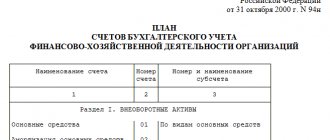

- Federal Law “On Accounting” No. 402-FZ dated December 6, 2011;

- Regulations on accounting and financial reporting in the Russian Federation (approved by order of the Ministry of Finance of the Russian Federation No. 34n dated July 29, 1998 (with amendments and additions);

- Accounting Regulations (PBU).

These documents, in addition to formulating accounting tasks, regulate the issues of accounting and reporting, determine the responsible persons for organizing accounting at the enterprise, etc.

The essence of accounting (concept, functions, goals and objectives)

To begin with, a little theory reflecting the essence of accounting.

In accordance with clause 4 of Order No. 34n of the Ministry of Finance of the Russian Federation dated July 29, 1998, accounting is understood as a system of collecting, recording and summarizing information about the property, obligations of a business entity, as well as their movement through regular documentary recording of business transactions carried out by the entity.

A similar definition of accounting is given in paragraph 2 of Art. 1 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ: accounting is the formation and reflection in documents of systematized information about accounting objects, as well as the preparation of reporting information based on this information.

The main objects of accounting (Article 5 of Law No. 402-FZ):

- facts of the economic life of the company;

- assets and liabilities;

- sources of capital;

- income and expenses;

- other objects - in accordance with federal legislation.

The main purpose of accounting is the formation of a set of information that allows the management of the company, its owners, shareholders and other interested parties to give a reliable assessment of its economic situation. Another significant goal of accounting is to facilitate the work of government bodies in terms of:

- monitoring the company’s compliance with legislation on accounting, taxes and fees (this task is solved by the Federal Tax Service - and is, therefore, the recipient of accounting information);

- collecting statistical data on the activities of various economic entities (this task is solved by Rosstat - sources of accounting information can also be sent there).

The main tasks of accounting:

- formation of a complete and reliable set of information about the activities of the enterprise, its economic situation;

- timely submission of documentation reflecting this information to interested parties;

- ensuring compliance of procedures performed to solve the first two tasks with legal norms and local regulations.

Main functions of accounting:

- control over economic processes at the enterprise, the procedure for managing capital;

- informing interested parties about the facts of the economic life of the enterprise and other information related to the activities of the company;

- carrying out analytical work aimed at identifying patterns in the formation of monetary indicators for certain accounting objects;

- providing the company's management with the opportunity to monitor economic activities in various structural divisions and make the necessary decisions to optimize it;

- preventing mistakes by management and company owners in business management;

- assistance in identifying reserves for business development by management and owners of the company.

ConsultantPlus experts explained in detail who has the right to conduct simplified accounting and how to do it correctly. Get trial access to the K+ system and upgrade to the Ready Solution for free.

The essence of accounting, the subject and scope of its application

For proper organization of accounting, it is important to understand the essence of accounting and the scope of its application, as well as the subject of accounting.

The essence of accounting is revealed by its definition, according to which accounting in an enterprise of any form of business is an orderly system of collecting, recording, analyzing and summarizing information about:

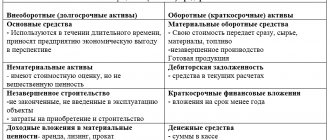

- property assets (in monetary equivalent),

- financial obligations of the enterprise,

- on the movement of financial flows of a business entity.

All transactions are reflected in accounting through continuous and continuous document flow.

Considering the essence and objectives of accounting, one should correctly understand its integral part - the subject of accounting.

The subject of accounting is the entire cycle of financial and economic activities of the company, including:

- formation of financial and material sources necessary for the implementation of the enterprise’s activities;

- distribution and placement of generated and raised funds.

The scope of accounting is extensive and is determined by its type or subtype.

The main area of application of accounting is the formation of complete and reliable information about the current financial situation and results necessary for the preparation of financial statements on the activities of the enterprise. It is necessary both for internal users - management, founders, accounting and warehouse employees who carry out current accounting of finances and assets, and for external users - services to which a business entity provides financial statements.

Another area of application is management accounting. This type of accounting provides for the generation of financial information exclusively for internal use by the company’s personnel - managers, economists, top managers who make decisions when determining the company’s production policy.

Tax accounting should also be noted. It is carried out in accordance with tax legislation and is necessary for the collection and analysis of information used in calculating taxable profit. Tax accounting may partially coincide with accounting.

Having examined the concepts and roles of the main components of accounting, you can see how the purpose, essence and main tasks of accounting are interconnected, and what is its role in the activities of the enterprise.

Contents of accounting

Accounting is mandatory for all business entities (with the exception of individual entrepreneurs and branches of foreign companies under certain conditions), and is an integral part of the overall management system for the financial and production processes of the enterprise.

The content of accounting consists of accounting objects, which include:

- financial obligations;

- property assets of the enterprise;

- income and expenses;

- business transactions carried out by an enterprise in its activities.

Accounting: its objects and main tasks

The main tasks of accounting are determined by the Law “On Accounting”, as well as the Regulations on Accounting. According to these regulations, accounting in an organization performs the following tasks:

- generates and systematizes comprehensive and reliable information about the progress and results of the company’s financial and economic activities;

- identifies and forms internal reserves to ensure the financial stability of the enterprise.

In addition, the task of accounting is to control:

- feasibility and financial justification of business transactions,

- use of material and intangible resources;

- compliance of economic activities with approved estimates, plans, standards;

- the presence and movement of tangible and intangible assets, liabilities of the enterprise;

- compliance with legal regulations in the course of financial and business transactions.

In addition to general tasks, regulatory documents highlight the tasks of accounting for production costs. These include:

- compliance with the chosen method of calculating the cost of services or products, and accounting for the costs of their production;

- differentiation of costs and their classification according to specific characteristics in the reporting period;

- systemic control over the formation of product costs and the effective use of resources, including material and intangible;

- reasonable and productive distribution of costs between interrelated reporting periods.

It should be noted that the main objectives and principles of accounting are aimed at improving accounting policies, as well as increasing the performance indicators and financial stability of the enterprise. Taking this into account, legislative documents draw the attention of users that one of the main tasks of accounting is to reflect complete and reliable accounting information about the financial and economic activities of an enterprise and its property status. Compliance with the principle of reliability allows for a timely and complete analysis of its activities to ensure the dynamics of development and financial stability.

Tutorial for beginners from scratch

A simple and understandable tutorial “Accounting from scratch in 14 days” for teaching the basics of accounting.

The tutorial includes:

- textbook of 70 lessons;

- a problem book of 110 problems with solutions and answers;

- example of accounting with year-end closing;

- current editions of PBU, Chart of Accounts, and the Law “On Accounting” in a convenient format.

We recommend:

- Lesson 4. How to quickly and easily make transactions?

- Lesson 5. What are primary documents and why are they needed?

- Lesson 6. Accounting policy of the organization - why is it needed and how to draw it up?

- Lesson 7. Accounting for authorized capital on account 80 - what is it and why is it needed?

- Lesson 8. Settlements with founders for contributions to the authorized capital (account 75)

- Lesson 9. Cash accounting (account 50)

- Lesson 9. Cash accounting (account 50)

- Lesson 10. Accounting for non-cash funds (account 51)

Purpose of Accounting

To prepare accounting and tax reporting, the law obliges business entities to adhere to established requirements when maintaining accounting records during the reporting period. Analyzing the goals and objectives of accounting, we can say that the most significant requirements of the legislation include the completeness and reliability of the information provided, generated in the process of work.

Thus, the tasks and purpose of accounting. accounting can be expressed in three components:

- Formation of objective and comprehensive accounting information based on primary data.

- Preventing the formation of negative results in the production and economic activities of the enterprise by analyzing the current situation and forming appropriate reserves.

- Providing reporting information on the financial activities of the company to the services and bodies established by law.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Basic principles of accounting

Achieving accounting goals, solving its problems and performing the functions noted above is implemented provided that those responsible for accounting follow the principles of accounting:

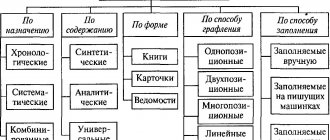

- regularity, reliability and completeness of information reflected in accounting sources;

- relevance and timeliness of generation of accounting documentation;

- the unity of the approaches used to the monetary measurement of accounting objects, as well as the generation of documentation;

- correctness of document flow generated within the framework of accounting.