VAT in the cost of utilities

Services provided by public utility organizations are subject to VAT in the standard manner - at a rate of 20%. Such organizations include legal entities that deal with utility infrastructure systems or operate MSW disposal facilities.

If you purchase services directly from resource supply organizations, you will pay VAT in the standard manner. Another option is to purchase services through management organizations. There is a special rule for them.

Managing organizations of homeowners' associations, residential complexes, housing cooperatives and other consumer cooperatives can exempt the sale of utility services from VAT if the conditions are met (clause 29, clause 3, article 149 of the Tax Code of the Russian Federation):

- services were purchased from resource supply organizations or regional operators for the management of MSW at maximum unified tariffs;

- services are sold to consumers within the limits of their purchase price (including VAT).

If at least one of the conditions is violated, the management organization must charge and pay VAT.

The VAT exemption applies regardless of to whom the services are provided - individuals or legal entities, owners or tenants, residential or non-residential premises (letter of the Ministry of Finance dated January 23, 2017 N 03-07-11/2838). The management organization can refuse the benefit, pay VAT and accept tax deduction in the standard manner.

The amount of payment for utility services does not change if the management organization applies the benefit. If you purchase services directly from a resource supply company or management organization with or without a benefit, the amount will include VAT.

This is due to the fact that the management organization purchases services from resource supply companies already taking into account VAT. It does not add additional VAT when selling services to consumers, but takes into account the VAT charged by the resource supply company in their cost. Therefore, consumers pay a price for utilities that already includes VAT. For example, a power plant provided the management organization with electricity supply services at a tariff including VAT according to the tariff: 100 and 20 rubles, respectively.

If you purchase services directly from a resource supplying organization or from a management organization that has refused the benefit, you will pay a tariff increased by the amount of VAT - the same 120 rubles, where the tariff is 100 rubles and VAT is 20 rubles.

Rebilling expenses to a counterparty: tax consequences

Re-invoicing of individual expenses, reimbursement of expenses - relations between counterparties are very common.

Companies face this when:

—

for deliveries of goods – transportation costs are overcharged;

—

rent, leasing – utility costs and insurance costs are overcharged;

—

construction – the general contractor overcharges the contractor for electricity costs.

The practice is common. But are the tax consequences of such business transactions so harmless and what does the tax service think about this? Let's figure it out.

Fare

When reflecting expenses in accounting and tax accounting, an organization is guided, at a minimum, by PBU 10 “Expenses of an organization” and Chapter 25 of the Tax Code of the Russian Federation. These documents clearly state the requirements for recognizing expenses.

Expenses must be documented and economically justified, that is, related to the generation of income (clause 1 of Article 252 of the Tax Code of the Russian Federation). And the Law on Accounting states that every fact of the company’s economic life must be documented in primary accounting documents (Article 9 of the Federal Law of December 6, 2011 No. 402-FZ).

Depending on the fact of economic life, we create an appropriate package of primary documents. On the requirements for primary documents Art. 9 of Federal Law No. 402-FZ dated December 6, 2011 says the following. The required details of the primary accounting document are:

—

Title of the document;

—

date of document preparation;

—

name of the economic entity that compiled the document;

—

content of the fact of economic life;

—

the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

—

the name of the position of the person (persons) who completed the transaction, operation and the person(s) responsible for its execution, or the name of the position of the person(s) responsible for the execution of the event;

—

signatures of the persons provided for in paragraph 6 of this part, indicating their surnames and initials or other details necessary to identify these persons.

And already considering these requirements, we see that when re-billing expenses, the requirements set out in subparagraphs 3, 6, 7 are not met!

The above regulations refer to expenses incurred by the organization itself, and not by any other organization. And in this case, the Ministry of Finance and the Federal Tax Service of the Russian Federation have repeatedly commented on the impossibility of recognizing “other people’s” expenses.

Let's consider the letter of the Ministry of Finance dated 02/08/2019 No. 03-03-07/7618 “On accounting for income tax purposes of expenses in the form of reimbursement of expenses of another taxpayer,” where the agency directly states: “If the taxpayer reimburses the expenses of another taxpayer, then such expenses cannot be considered as expenses incurred to carry out the activities of the taxpayer himself, and therefore are not subject to accounting when forming the tax base for corporate income tax.”

Suppliers most often overcharge transportation costs, citing the fact that it is written in the contract: “... the buyer reimburses the supplier for the costs of delivering the goods.” Let's carefully consider this fact of economic life. The supplier, by delivering the goods, is the customer of transport services from the carrier company. The carrier issues primary documents on the fact of transportation to the supplier. That's right. The supplier accounts for transport services as part of the costs associated with the sale of goods. But what the supplier re-invoices to the buyer is a big question.

Paragraph 5 of Article 38 of the Tax Code of the Russian Federation says the following: “For tax purposes, a service is an activity whose results do not have material expression, but are sold and consumed in the process of carrying out this activity.”

According to the provisions of subparagraph 1 of paragraph 3 of Article 169 and paragraph 3 of Article 168 of the Tax Code of the Russian Federation, when selling goods (work, services), the taxpayer is obliged to draw up appropriate invoices for transactions recognized as the object of taxation, no later than five calendar days, counting from the day of shipment of the goods (performance of work, provision of services).

Thus, the supplier consumed the transport service at the time of its provision. What then is he trying to “resell”? Consumed service? The supplier “resells” and at the same time reflects income and forms a tax base for two taxes: corporate income tax and value added tax. But what does the buyer take into account under the guise of overbilled transport services? The question is open. Indeed, with such a reflection of distorted facts of economic activity, the supplier issues an invoice. Is it legal?

The Ministry of Finance of Russia in Letter dated 02.22.2018 N 03-07-09/11443 indicated that if, according to the terms of the contract, the seller of services for the provision of wagons for the transportation of goods undertakes to provide them, and the buyer pays for these services and reimburses the transportation costs incurred by the seller upon delivery (return) ) cars for (after) provision of services, then these reimbursable expenses for payment for services for the transportation of delivered (returned) cars provided by third parties are not taken into account by the seller when determining the tax base for value added tax and, accordingly, in the invoice issued services for the provision of wagons are not indicated to them.

“Input” VAT on goods (work, services) purchased to fulfill a contract (i.e. for activities subject to VAT), the cost of which is reimbursed by the counterparty, is deductible in the general manner (clause 1 of Article 172 of the Tax Code of the Russian Federation, Letters Ministry of Finance dated 04/22/2015 N 03-07-11/22989, dated 10/22/2013 N 03-07-09/44156).

Since the seller himself does not provide transportation services, he cannot simply reissue the invoice received from the carrier to the buyer on his own behalf (Letters of the Ministry of Finance dated 04/13/2016 N 03-07-09/21127, dated 10/22/2013 N 03-07-09/44156). Accordingly, the buyer does not have the right to deduct VAT from the cost of transportation on such an invoice.

Only intermediaries - agents and commission agents - can reissue invoices.

An option for organizing relationships between organizations, in order to avoid tax risks, at the negotiation stage, include the costs of delivering goods in the cost of goods.

Recycling collection

Is it possible to write off the recycling fee reimbursed to the counterparty as an expense? An organization that has reimbursed the supplier for the amount of the recycling fee it paid does not have the right to take into account the amount of such reimbursement in the “profitable” base.

In its letter dated August 14, 2019 No. 03-03-06/1/61449, the Ministry of Finance reminds that for income tax purposes, expenses include economically justified and documented expenses incurred in conducting activities aimed at generating income. In general, reimbursement of costs incurred by other organizations does not meet the criteria for “profitable” expenses.

Consequently, the amount of the fee reimbursed to the product supplier (the payer of the recycling fee) is not taken into account when determining the income tax base for the buyer of the product.

And there are many such examples.

On the lessee's accounting for reimbursement of the lessor's costs associated with the acquisition and transfer of the leased asset for income tax purposes

Quite often you have to deal with the fact that after a certain period of validity of the leasing agreement, the lessor recharges the lessee for any expenses. For example, insurance costs, payment of transport tax or property tax of an organization. And in this case, in a letter dated October 27, 2017 N 03-03-06/1/70590, the Ministry of Finance says that lease payments that are taken into account by the lessee when determining the tax base for the organization’s income tax should already include the amount of cost reimbursement lessor related to the acquisition and transfer of the leased asset.

Thus, we see that re-invoicing transaction costs is a very risky action for both parties to the contract. Most of the risks can be removed at the stage of discussing the terms of the contract.

tax reporting taxes

Send

Stammer

Tweet

Share

Share

Accounting for utilities for property owners

To take into account the costs of utility services, you need to obtain documents confirming them from the supplier: an agreement, an act of provision of services, a receipt, an invoice. Typically, suppliers issue invoices at the end of the month.

If utility costs relate to non-production objects, do not take them into account when calculating the tax.

The period for writing off expenses, including VAT, depends on the method of accounting for income and expenses - cash method or accrual method.

Using the accrual method , write off expenses in the period in which you received an invoice for payment or an act of provision of services from the resource supplying organization. If there is no invoice or act, write off the expenses as of the date stipulated by the terms of the contract.

Under the cash method, recognize expenses in the period in which they are paid.

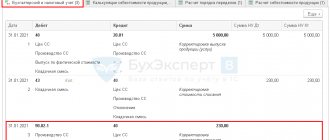

In accounting, create the following entries:

1. If you are a VAT payer:

- Dt 20 (23,25, 26, 29, 44, 91-2) Kt 60 (76) - an invoice for payment was received, an act of provision of services was signed;

- Dt 19 Kt 60 (76) - input VAT is reflected;

- Dt 68 VAT Kt 19 - input VAT accepted for deduction;

- Dt 60 (76) Kt 51 - utilities paid.

VAT on utilities is deductible in the standard manner. To do this, all conditions provided for in Art. 171 and art. 172 of the Tax Code of the Russian Federation: acceptance of services for accounting, their use in activities subject to VAT and the availability of documents with the allocated tax amount.

2. If you are not a VAT payer:

- Dt 20 (23,25, 26, 29, 44, 91-2) Kt 60 (76) - an invoice for payment was received, an act of provision of services was signed;

- Dt 19 Kt 60 (76) - input VAT is reflected;

- Dt 20 (23,25, 26, 29, 44, 91-2) VAT Kt 19 - input VAT is included in expenses;

- Dt 60 (76) Kt 51 - utilities paid.

Rebilling utility bills to the tenant: accounting and taxes

In the ruling of the Supreme Arbitration Court of the Russian Federation dated January 29, 2021 N 18186/07, the judges stated that the amount of compensation for payment of utility bills received from the tenant is not the income of the landlord, since in this case the costs of maintaining and using the leased premises are compensated, but the costs of Payments for utilities related to the operation of the leased premises are not expenses of the owner, since they do not lead to a decrease in its economic benefits since they are compensated by the tenant.

At the same time, more recent court decisions represent the opposite opinion. Thus, the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 25, 2021 N 12664/08 states that without providing non-residential premises with electricity, water, heat, and other types of utilities, the tenant cannot exercise the right to use the rented premises necessary for him to carry out his activities. Consequently, this service is inextricably linked with the provision of rental services, and the procedure for settlements between the tenant (in this case, the company) and the landlord for these services does not matter. The deduction of VAT from the cost of utilities compensated to the landlord is legal provided that the conditions for applying tax deductions provided for by the legislation on taxes and fees are observed (see also resolutions of the Federal Antimonopoly Service of the North-Western District dated 08/24/2021 N A56-44025/2021, the Federal Antimonopoly Service of the West Siberian District dated 04/28/2021 N A45-8185/2021).

We recommend reading: Can bailiffs seize property that is pledged to another person?

Accounting for utilities for landlords and tenants

Tenants of premises reimburse utility bills to the landlord. This can be done in one of three ways: include utilities in the rental amount, add them on top, or transfer them as part of an intermediary agreement. The procedure for paying and accepting VAT for deduction depends on the chosen method.

Utilities are included in the rent

This is the easiest way to reimburse utility costs for VAT purposes. If utility bills are included in the rent, then the entire amount of payment under the contract, including utilities, is taxed.

The landlord issues an invoice to the tenant for the full amount of the rent. Input VAT from utility service providers can be deducted in full on the basis of supporting documents.

The tenant has the right to deduct the entire amount of input VAT, including for utilities. An invoice from the landlord is sufficient for this.

Utilities are paid on top of the rent

If utilities are overcharged in excess of the rent, VAT is not charged on their cost, since there is no object of taxation. The landlord cannot deduct input VAT from service providers; it is included in the cost of utilities rebilled to the tenant.

In this case, the tenant also cannot accept tax as a deduction, since this operation is not recognized as a sale for VAT purposes, the lessor did not submit VAT and did not issue an invoice.

Utilities were rebilled under an intermediary agreement

Re-invoiced utilities are subject to VAT in the same manner as other invoiced expenses. In this case, the lessor does not charge, pay or deduct VAT. He re-invoices the tenant if he spent the expenses on his own behalf. If the expenses are purchased on behalf of the tenant, the service provider immediately issues an invoice to him.

Re-invoicing of services, postings, which is our income and expense

With such, albeit incomprehensible, formulations, it should follow that the intermediary must be a subscriber

from the energy supply organization, and you are

a sub-subscriber

. Although you don’t need an agreement with the e-organization for this. To do this, an agreement is drawn up between the e-organization and the intermediary as a subscriber, and in this agreement the sub-subscriber is determined. Deal with this because this is the essence of VAT. With this determination, the intermediary subscriber must issue you a s/f.

We recommend reading: Pensions and Benefits for Chernobyl victims 2022

The picture is as follows: A contract for electricity consumption has been concluded with an energy company, but the meter is ours, and energy metering goes through an intermediary company. issues electricity bills to us, we pay them directly to the Energy Company, sometimes we pay. We cannot receive bills directly from the Energy Company, because this substation belongs to the “Intermediary” and accounting must go through it.

Re-wiring Electricity

2 tbsp. 539 of the Civil Code of the Russian Federation). As a rule, the tenant is not the owner of the heating and power networks, and he does not have the appropriate equipment to obtain energy, fuel, and water. The likelihood of signing an agreement with the tenant is low.

The procedure for accounting and taxation of the tenant's utility expenses depends on how exactly payment for these services is made. In practice, a tenant can pay for utilities in different ways:

We recommend reading: Collection by Oral Order