Regional minimum wage

In addition to the federal minimum wage, which is valid throughout Russia, some regions determine their own minimum wage or regional minimum wage. If the authorities of your region have established their own minimum wage, be guided by it when issuing wages. It doesn't affect anything anymore.

If the regional minimum wage exceeds the minimum wage, then it should be used.

We found the minimum wage for some regions. If yours is not on the list, write in the comments, we will try to help.

To make sure that the minimum wage is up to date, follow the link in the table.

| Region | Minimum wage size, ₽ |

| Moscow | 21,371 from January 1, 2022, 20,589 in 2021 |

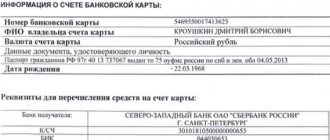

| Saint Petersburg | 21500 from January 1, 2022 |

| Sevastopol | 13,890 from January 1, 2022, 12,792 ₽ in 2021 |

| Altai region | 16,638 from January 1, 2022 (x regional coefficient), 13,000 in 2021 |

| Bashkortostan | 14,200 from January 1, 2022 (x regional coefficient), 12,792 in 2021 |

| Volgograd region | 15,419.30 from January 1, 2022, 14,159.6 in 2021 |

| Irkutsk region | 13,890 from January 1, 2022 (x regional coefficient), 12,792 in 2021 |

| Kabardino-Balkaria | 13,890 from January 1, 2022, 12,998 in 2021 |

| Karelia, Republic | 13,890 from January 1, 2022 (x regional coefficient), 12,792 in 2021 |

| Kemerovo region | 18,826.5 from January 1, 2022 (x regional coefficient), 17,031 in 2021 |

| Krasnodar region | 14,584.5 from January 1, 2022, 12,792 in 2021 |

| Crimea, Republic | 13,890 from January 1, 2022, 12,792 in 2021 |

| Kursk region | 13,890 from January 1, 2022, 12,792 in 2021 |

| Leningrad region | 14,250 from December 1, 2022, 13,315 in 2022 until December 1 |

| Moscow region | 16,300 from January 1, 2022, 15,500 in 2021 |

| Nizhny Novgorod Region | 13,890 from January 1, 2022, 12,792 ₽ in 2021 |

| Novgorod region | 13,890 from January 1, 2022, 12,792 ₽ in 2021 |

| Novosibirsk region | 13,890 from January 1, 2022 (x regional coefficient 1.2), 12,792 in 2021 |

| Perm region | 13,890 from January 1, 2022 (x regional coefficient), 12,792 in 2021 |

| Pskov region | 13,890 from January 1, 2022, 12,792 in 2021 |

| Rostov region | 16,668 from January 1, 2022, 15,350.4 in 2021 |

| Sverdlovsk region | 13,890 from January 1, 2022 (x regional coefficient), 12,792 RUR in 2021 |

| Stavropol region | 13,890 from January 1, 2022 (x regional coefficient), 12,792 in 2021 |

| Tomsk region | 13,890 from January 1, 2022 (x regional coefficient), 12,792 in 2021 |

| Tula region | 14,800 from January 1, 2022, 14,200 ₽ in 2021 |

| Tyumen region | 13,890 from January 1, 2022 (x regional coefficient), 12,871 in 2021 |

| Khabarovsk region | 13,890 from January 1, 2022 (x regional coefficient), 12,792 in 2021 |

| Khanty-Mansi Autonomous Okrug | 13,890 from January 1, 2022 (x regional coefficient), 12,792 RUR in 2021 |

| Chelyabinsk region | 13,890 from January 1, 2022, 12,792 in 2021 |

| Yamalo-Nenets Autonomous Okrug | 13,890 from January 1, 2022 (x regional coefficient), 12,792 RUR in 2021 |

Minimum wage in Moscow from January 1, 2022

The minimum wage in Moscow from January 1, 2022 is determined by the Moscow tripartite agreement on the minimum wage for 2019-2021 (text [21 Mb .PDF]), registered with the Moscow City Hall under number No. 77-1094 dated October 1, 2022. The agreement establishes that the minimum wage in Moscow depends on the subsistence level of the working population in Moscow. Once every three months, the cost of living is subject to review by city authorities, who decide to change it or maintain it at the same level.

With an increase in the cost of living in the capital, an increase in the minimum wage follows. The new minimum wage begins to be applied on the 1st day of the month following the month in which the next decree of the Moscow government on the cost of living comes into force. In cases where the cost of living has remained at the same level or its value has decreased, the minimum wage in Moscow remains at the same level. This provision is enshrined in clause 3.1 of section 3 of the trilateral agreement.

Decree of the Moscow Government No. 2207-PP dated December 15, 2020 established the cost of living for the working population of the capital in the amount of 20,589 rubles. Respectively

The minimum wage in Moscow from January 1, 2022 is 20,589 rubles.

The minimum wage in Moscow cannot be lower than 20,589 rubles. This value is effective from January 1, 2022.

The established minimum wage will remain in place until it exceeds the subsistence level of the working population of Moscow or the Moscow government changes the rules of the game. However, organizations financed from the federal budget must be guided by the federal minimum wage (Article 133.1 of the Labor Code of the Russian Federation), which is 12,792 rubles.

Minimum wage in Moscow and salary

The minimum wage is the minimum wage that an employer, whether an organization or an individual entrepreneur, is required to pay to its employees for a fully worked month. This provision is specified in Art. 133 Labor Code of the Russian Federation. However, with clean hands, an employee can receive less than the minimum wage - minus personal income tax and other deductions, such as alimony.

However, the employee's salary may be less than the minimum wage. This is due to the fact that the total salary cannot be , which, in accordance with Art. 129 of the Labor Code of the Russian Federation includes:

- remuneration for work;

- various compensation payments, including regional coefficients and other additional payments and allowances;

- all kinds of incentive payments, including bonuses.

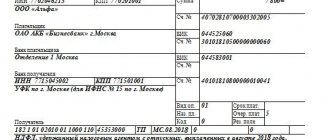

For organizations and individual entrepreneurs, it is possible not to apply the Moscow regional minimum wage, but to adhere to the federal minimum wage, which from January 1, 2022 is 12,792 rubles.

To do this, it is necessary to issue a reasoned refusal and send it to the Moscow Tripartite Commission at the address: 121205, Moscow, st. Novy Arbat, 36. This must be done within 30 calendar days from the date of publication of the agreement. The company must justify its refusal with compelling reasons (Article 133.1 of the Labor Code of the Russian Federation). For example, an emergency situation, a business crisis, or the fact that you have just started your work. Without compelling reasons, the authorities will not allow wages to be set below the regional minimum.

If the organization does not send a refusal on time, then it is considered that it has automatically joined the agreement. In this case, the salary of employees must be set not lower than the Moscow minimum wage.

But even if the tripartite commission accepted the refusal, there is a possibility that tax inspectors will call the director of the company to the salary commission. They will ask you to explain why the organization's wages are below the regional minimum wage. And if the director ignores the call, an on-site inspection is possible. The Federal Tax Service of Russia instructs subordinates to pay special attention to companies whose salaries do not reach the regional subsistence level (letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12722).

If the company has not waived the Moscow regional minimum wage, but does not comply with it, then a fine of 50 thousand rubles is possible (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation)

Please note that the regional minimum wage is the regional minimum wage. To calculate various social benefits, it is necessary to use the federal minimum wage.

Minimum wage and salary

Under an employment contract, pay an employee a salary not lower than the minimum wage. The salary is not the money that he receives in his hands, but the amount before deduction of personal income tax.

Let's say you run a business in Moscow. They hired an employee and established a salary of 21,000 rubles in the employment contract. Without personal income tax, the employee will receive 18,270 rubles. This is legal because the amount before tax is not lower than the regional minimum wage.

Salary consists of salary, bonuses, allowances and compensation. Each of these parts individually may be below the minimum wage if the total amount corresponds to it.

When can you pay less? If the employee works part-time.

For example, the minimum wage for work at 0.5 rates is half the minimum wage. Let's say you work in Moscow and have hired a part-time waiter. From Monday to Friday he works 4 hours a day. The minimum salary you must pay him is 10,294.5 rubles.

How to calculate the regional coefficient? Regional coefficient is a salary supplement for those who work in the Far North and equivalent areas. They are listed in the resolution.

The law does not really say whether the regional coefficient should be included in the minimum wage salary or added on top. But the Constitutional Court decided: it is necessary to set wages no lower than the minimum wage and only add regional coefficients and a percentage bonus on top.

What is included in the minimum wage for Muscovites

The minimum wage in Moscow for an employee who is registered as a full-time employee is the sum of the salary for the position or tariff rate, bonuses, allowances and other social payments that are fixed in the employment agreement.

The following payments are not included in the “minimum wage” (Articles 147, 151, 152, 153, 154 of the Labor Code of the Russian Federation):

- work related to life-threatening and/or harmful working conditions;

- combining professions or positions;

- overtime work;

- for performing work duties on holidays and weekends, at night.

The above additional payments are calculated on top of the minimum wage. However, the employee should take into account that he will be paid “net” the amount minus personal income tax = 18,781 – (18,781 x 13%) = 18,781 – 2441.5 = 16,339.5 rubles.

The employer has the right not to apply the Moscow minimum wage indicator, but to switch to the federal size of 11,280 rubles. To do this, a written refusal to join the regional agreement is sent with justified arguments and reasons why the employer needs this. As a rule, they indicate that it is not possible to adhere to the Moscow minimum wage due to losses, late payments from counterparties, a decrease in the number of orders, etc. At the same time, it is important not to miss deadlines. A letter of refusal is sent for consideration to the commission in Moscow within 30 days after the official publication of the new PM indicator.

Minimum wage and insurance premiums for individual entrepreneurs in 2022

In 2022, individual entrepreneurs pay 43,211 rubles in fixed insurance premiums + 1% of income over 300 thousand rubles - this amount does not depend on the minimum wage.

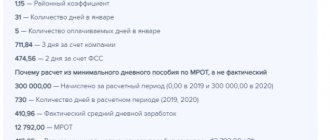

From 2022, insurance premiums do not depend on the minimum wage. In 2022 and earlier, the fixed part was calculated using the formula:

Contributions for the year = minimum wage x 12 x 31.1%

For the calculation, we used the federal minimum wage, which was in effect at the beginning of the year. On January 1, 2022, the minimum wage was 7,500 rubles, so for 2022, individual entrepreneurs paid 27,990 rubles + 1% of income over 300 thousand.

Minimum wage in Moscow

In the city of Moscow, the minimum wage is established by agreement of 3 parties: the Moscow government, Moscow trade unions and the capital's employers' association. The amount of the minimum income for the city is reviewed quarterly and is set depending on the subsistence level of working citizens of the city. Moreover, if in any quarter the cost of living decreases, the minimum wage does not decrease, but remains the same.

Indicators of the minimum wage in Moscow over the years showed a steady positive trend:

| Change date | Minimum size |

| 01.01.2014 | 12600 rubles |

| 01.06.2014 | 14,000 rubles |

| 01.06.2015 | 16500 rubles |

| 01.11.2015 | 17300 rubles |

| 01.01.2017 | 17561 ruble |

| 01.07.2017 | 17642 rubles |

| 01.01.2018 | 18742 rubles |

| 01.11.2018 | 18781 ruble |

| 01.07.2019 | 19351 ruble |

From October 1, 2022, Moscow established a minimum income level for working Muscovites in the amount of 20,195 rubles.

Minimum wage in the Moscow region

The determination of the minimum wage for the Moscow region and the signing of the agreement are carried out by the regional government, the regional association of trade unions and employers of the Moscow region. Unlike the capital, the minimum wage in the region is set regardless of the cost of living; it is a fixed amount. But the minimum wage in the region also exceeds the minimum indicator established at the federal level.

The amount of the minimum wage in the Moscow region by year:

| date | Minimum size |

| 01.01.2015 | 12000 rubles |

| 01.01.2016 | 12500 rubles |

| 01.11.2016 | 13750 rubles |

From May 1, 2022, the minimum salary in the Moscow region is 14,200 rubles. The amount differs from the capital’s figure, although many residents of the region do not always agree with this state of affairs.

Is it possible to pay a salary less than the minimum wage?

If an employer deliberately evades paying employees salaries in accordance with the norm established by legislators, then they will have to pay a fine. Article 133 of the Labor Code states that an employee who has fulfilled all labor and temporary standards is prohibited from paying income below the minimum level. The Labor Inspectorate conducts scheduled and unscheduled inspections in organizations. If non-conformities are identified, the organization will pay:

- for the first non-compliance with the law, 30-50 thousand rubles or suspension of work activity for up to 3 months;

- for repeated non-compliance - 50-80 thousand rubles.

For an official of an organization, the amount of the fine ranges from 1 to 5 thousand rubles. For an individual entrepreneur - up to 5 thousand rubles or suspension of activities for a period of up to 90 days.

In this case, the fine is imposed only for one employee. If income was not paid to two employees, then the amount is doubled. When clarifying the details of the violation, the court may reveal deliberate non-compliance with the law. If this happened for 2 or more months and there were serious consequences for employees, then the manager may be prosecuted and fined up to 500 thousand rubles.

If the salary does not reach the required level, the employer needs to increase the remuneration by making changes to the staffing table. Or establish an additional agreement with hired employees.

If a citizen works part-time or part-time, then income is calculated depending on the amount of actual time worked. With this calculation, the employee’s salary may be below the federal or regional minimum.

5 / 5 ( 2 voices)

about the author

Klavdiya Treskova is an expert in the field of financial literacy and investment. Higher education in economics. More than 15 years of experience in banking. He regularly improves his qualifications and takes courses in finance and investments, which is confirmed by certificates from the Bank of Russia, the Association for the Development of Financial Literacy, Netology and other educational platforms. Collaborates with Sravni.ru, Tinkoff Investments, GPB Investments and other financial publications. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

What it is

Minimum wage or minimum wage is a term that was introduced in order to regulate payments to workers of different qualifications, categories, positions and specializations. It is this that is the lower limit of the monthly payment, which is established in each specific state. It is the minimum wage that is used to calculate various benefits, including maternity leave, sick leave, childbirth, as well as fines, taxes and other financial payments.

When a person gets acquainted with this terminology, the first question that quite legitimately arises is whether the amount of wages can be less than the minimum wage.

So, today the situation is as follows: about 30% of the country’s working population receives a salary that is less than the minimum wage. But, according to the Russian government, in 2022 they are implementing certain measures that are designed to eliminate this imbalance, or rather to equalize the minimum wage and the cost of living.

Who installs it and how?

According to Federal Law 82, which was adopted in 2000, this parameter throughout the Russian Federation can be established by the federal or regional government. In this case, the federal parameter is established only by the federal government, and the regional one - at a tripartite meeting of a special regional commission (Article 133.1).

In accordance with the content of the law, the exact date of change in the minimum wage does not have a fixed value and is set to any date during the calendar year. And the very intention to change it is announced by a special decree of the government of the Russian Federation.

Return to content