What documents does the Federal Tax Service request?

The right of the inspectorate to request information from organizations and entrepreneurs is enshrined in the Tax Code.

The Federal Tax Service may be interested in both the taxpayer’s documentation and information about the company’s counterparties or information about a specific transaction. The inspectorate has the right to request information about a specific transaction not only from its direct participants, but also from third parties who have the necessary information.

The Federal Tax Service receives the necessary information on the basis of a written request regarding the taxpayer himself and regarding his counterparties. When responding, it is necessary to comply with the deadlines established by law and send the answer on time. The law does not contain restrictions on the number of documents requested. The law provides for a fine for failure to provide a response to the request of the Federal Tax Service - the request cannot be ignored.

The Federal Tax Service has the right to demand documents (clauses 6 – 9, 11, 12 of Article 88 of the Tax Code of the Russian Federation):

- when conducting an audit - according to the period or tax being audited;

- when requesting a counterparty - only for the requested person, if the organization being inspected is not your counterparty, but you have the requested information, you will have to provide it;

- You have the right to request only those documents that the organization is obliged to prepare and maintain.

Usually they require confirmation of benefits and deductions, reduced tariffs, contracts and issued invoices in relation to counterparties.

The requirement can come from any inspection where the company is registered

According to the norms of the Tax Code of the Russian Federation, in order to request documents related to the activities of the taxpayer, the tax authority sends a corresponding order to the inspectorate at the place of registration of the enterprise.

At the same time, officials pay attention to clause 1 of Art. 83 of the Tax Code of the Russian Federation, which states that for the purposes of tax control, registration of taxpayers is carried out:

- at the location of the organization;

- at the location of its separate divisions;

- at the location of the real estate and transport owned by it;

- on other grounds provided for by the code.

Thus, a taxpayer may be required to submit documents from any of the inspectorates where he is registered.

Letter of the Ministry of Finance of the Russian Federation dated 08/06/2019 No. 03-02-08/59105

Editor's note:

Please note that documents at the request of the Federal Tax Service should be sent to the address of the inspection that requested them. This rule applies even if inspectors are conducting an inspection on the company’s premises at the same time and have the originals of the requested documents at their disposal. Thus, a company from Chelyabinsk failed to challenge a fine of 17 thousand rubles for failure to fulfill the duty imposed by the fiscal authorities. Having received a request for documents under the TKS, the taxpayer responded to it in the same way, informing the Federal Tax Service about the presentation of the originals to its representatives located on the territory of the enterprise.

The court stated that the documents were not submitted to the Federal Tax Service within the prescribed period and left the fine in force (Resolution of the Arbitration Court of the Ural District dated January 29, 2019 No. F09-9273/18).

When should they be sent?

If they check you, the answer is provided within the following time frame (clause 6 of article 6.1, clauses 1, 3 of article 93 of the Tax Code of the Russian Federation):

- 10 days from the date specified in the request (if received in person), or from the date of its receipt via electronic communication channels;

- 16 days from the day the inspection sent the request by mail, if the letter was received earlier than 6 days from the date of its sending, the period will be 10 days from the date of its receipt;

- 11 days from the date the request is posted in the taxpayer’s personal account.

If a counterparty or other person is being checked, the response is sent within (clauses 1, 1.1, 5 of Article 93.1 of the Tax Code of the Russian Federation):

- 5 days from the date specified in the request (if received in person), or from the date of its receipt via electronic communication channels;

- 11 days from the date when the inspection sent the request by mail, if the letter was received earlier than 6 days from the date of its sending, the period will be 5 days from the date of its receipt;

- 6 days from the date the request is posted in the taxpayer’s personal account.

Outside the framework of tax audits, the deadlines for submission are similar to the deadlines for auditing a taxpayer.

When calculating deadlines, only working days are considered.

If it is not possible to send a response within the specified period, notify the tax authority in the form approved by Order of the Federal Tax Service No. ММВ-7-2/ [email protected] dated 04/24/2019. The law provides for liability for a late response to a request from the Federal Tax Service, even if the delay is small.

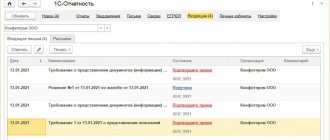

Sample request from the Federal Tax Service:

So what is the article for oncoming traffic - 126 or 129.1?

Let's do a little experiment. Let’s imagine that you have received a request to provide documentation for a counterparty that is undergoing an on-site inspection.

For information about what documents can be requested as part of “meetings,” read the article “Tax authorities can request any documents from a counterparty .

In total, 500 documents were requested - 250 invoices and delivery notes. You sent them to the inspectors at the wrong time. How much will you be fined? For 5,000, 10,000, or maybe even 100,000 rubles?

Agree, there is something to think about. After all, the difference in size is colossal. Moreover, the last amount (a fine of 100,000 rubles and even more) is completely real: as we were able to verify, 100,000 rubles. - this is only 500 “late” documents for 200 rubles. And if documents are checked as part of an on-site audit over several years, a large number of requested papers is a common practice. So let's figure it out.

According to paragraph 4 of Art. 93 “Request for documents during a tax audit”, an audited person who refuses to send the requested documentation to the Federal Tax Service during a tax audit or who sent it to the tax authorities later than the deadline established by the Tax Code of the Russian Federation is considered a violator who will have to answer under Art. 126 of the Tax Code of the Russian Federation.

If we turn to paragraph 6 of Art. 93.1 of the Tax Code of the Russian Federation “Request for documents (information) about a taxpayer, payer of fees, payer of insurance premiums and tax agent or information about specific transactions”, we will see the following wording: refusal of a person to send to the Federal Tax Service the papers requested during a tax audit or sending them in violation terms is qualified as a violation, entailing the imposition of sanctions under Art. 126 of the Tax Code of the Russian Federation. Illegal failure to report (or report in violation of the deadline) the required information is also considered a violation, for which you will have to answer under Art. 129.1 Tax Code of the Russian Federation.

Analyzing the wording of these articles, we can make an unambiguous conclusion that the request for documentation within the framework of Art. 93 of the Tax Code of the Russian Federation applies only to cases when it is requested from the taxpayer who is directly being audited. The wording of Art. 93.1 of the Tax Code of the Russian Federation indicates situations when papers are requested not from the person being checked, but from someone who has any information about the person being checked or a specific transaction. And these are precisely counter checks.

It follows that for failure to provide information for oncoming traffic, you will be fined under Art. 129.1 of the Tax Code of the Russian Federation in the amount of 5,000 to 20,000 rubles, and for documents - under Art. 126 of the Tax Code of the Russian Federation, but at what point? We read the article and it becomes clear that liability in case of oncoming collisions can only arise under clause 2 (this is a 10,000 ruble fine), but not under clause 1, since clause 2 of this article talks about requests for data about the payer . As for paragraph 1 of Art. 126 of the Tax Code of the Russian Federation, it is applicable if the documents were requested directly from the person being inspected. So the fine, calculated on the basis of 200 rubles. for a document, in the event of oncoming traffic, of course, this cannot happen.

For the opinion of the main tax department, see our material “The Federal Tax Service explained how they are fined for failure to submit documents on oncoming traffic.”

Read about how “counter meetings” are carried out in the article “Features of conducting a counter tax audit” .

The chief accountant is not obliged to provide the inspectorate with the employee’s work history

The Federal Tax Service imposed a fine of 300 rubles on the chief accountant of the company under Part 1 of Art. 15.6 of the Code of Administrative Offenses of the Russian Federation for the fact that she did not submit to the inspection the documents requested in relation to one of her employees:

- application for a job;

- resignation letter;

- employment contract;

- The order of acceptance to work;

- personal card.

The chief accountant challenged the fine, and the court overturned it.

The fact is that the demand contained a reference to Art. 93.1 Tax Code of the Russian Federation. This meant that the inspection was interested in information about another company being inspected or about a specific transaction.

The chief accountant decided that the requested documentation did not relate to either one or the other. The company has no relationship with the audited organization. The listed documents do not relate to a specific transaction. The inspection did not indicate in its request what connection there is between this employee and the organization being inspected or a specific transaction.

Therefore, the accountant did not comply with the request. Moreover, she informed the inspectorate about the refusal, explaining the reasons. Additionally, the accountant wrote that the employee’s work documents contain his personal data, which the company has no right to transfer to anyone without his consent.

The judges came to the conclusion that the chief accountant was absolutely right. The documents listed in the request cannot be recognized as those that the company (its official) is obliged to submit to the tax authority.

In accordance with paragraph 11 of Art. 21 of the Tax Code of the Russian Federation, taxpayers have the right not to comply with unlawful acts and requirements of tax authorities.

Thus, the fine was imposed illegally.

Resolution of the Supreme Court of the Russian Federation dated April 26, 2019 No. 9-AD19-10

How to provide explanations

Explanations can be submitted to the Federal Tax Service on paper or electronically via TKS. An exception is clarifications requested during a desk audit of a VAT return. They can only be submitted electronically using TKS. If submitted on paper, they will be considered unsubmitted (Letters of the Federal Tax Service dated December 3, 2018 N ED-4-15 / [email protected] , dated January 11, 2018 N AS-4-15 / [email protected] ).

You can attach to the explanations extracts from accounting registers and other documents confirming the arguments that you give in the explanations (clause 4 of Article 88 of the Tax Code of the Russian Federation).

If the explanations or updated declaration requested during the desk audit are not submitted to the Federal Tax Service within five days, the organization will be fined 5,000 rubles. For a repeated violation within a calendar year, the fine will be 20,000 rubles. (clauses 1, 2, article 129.1 of the Tax Code of the Russian Federation).

Information on a specific transaction

Now let’s consider the case of sending “non-verification” demands. We are talking about a request for data on a specific transaction that has aroused interest among tax authorities (clause 2 of article 93.1 of the Tax Code of the Russian Federation). The Tax Code does not clarify the term “specific transaction.” This means that we will have to turn to judicial practice again.

As the Arbitration Court of the North Caucasus District indicated, paragraph 2 of Article 93.1 of the Tax Code of the Russian Federation obliges taxpayers to send documents and information on specific agreements with specific counterparties. At the same time, the taxpayer to whom the request was received may not be a party to such an agreement (Resolution No. F08-213/2019 dated February 22, 2019).

Draw up GPC agreements using ready-made templates Draw up for free

This approach means that tax authorities cannot request information regarding transactions that are carried out outside the framework of agreements (transactions). Examples of such operations are receiving budget subsidies, paying dividends, making contributions to the organization’s property or its authorized capital (see letter of the Ministry of Finance dated July 17, 2013 No. 03-01-18/28094).

This is where the prohibitions probably end. As in the case of requesting data on counterparties, the Tax Code does not contain any restrictions on the composition of documents or information that can be requested in relation to a specific transaction. It is also not prohibited to request documents or information on several transactions (ruling of the Supreme Court of the Russian Federation dated October 26, 2017 No. 302-KG17-15714). At the same time, as already noted, the circle of persons from whom documents (information) can be requested on the basis of paragraph 2 of Article 93.1 of the Tax Code of the Russian Federation is virtually unlimited: the addressee can be either a participant in the transaction or other persons who have the necessary data on the transaction.

At the same time, on the basis of paragraph 2 of Article 93.1 of the Tax Code of the Russian Federation, it is impossible to request documents (information) that do not relate to a specific transaction. According to the form of the request for the submission of documents (information), it must contain information that allows identifying the transaction in respect of which data is requested (letter of the Ministry of Finance dated October 15, 2018 No. 03-02-07/1/73833, see “Counter” check : should inspectors indicate the details of the requested documents").

But at the same time, the courts also treat the issue of identifying a transaction quite liberally: the inspectorate is not at all obliged to indicate in the request the details (date, number) of the contract. It is enough to indicate the parties and the type of contract. The requirement is justified if, based on the list of requested documents, the taxpayer is able to independently determine all the information identifying a specific transaction (Resolution of the AS of the Ural District dated September 27, 2018 No. F09-5656/18).

ATTENTION

No instructions from other Federal Tax Service Inspectors are attached to the “transaction” request. This rule applies even if the counterparty to the transaction and the recipient of the request are registered with different inspectorates (resolution of the AS of the West Siberian District dated 03.17.21 No. F04-421/2021 in case No. A45-17306/2020).

Two reasons for requesting documents

“Non-audit” requests can be received by the accounting department in two situations.

Firstly, such requests have the right to be initiated by the inspectorate, which carries out a tax audit of the counterparty (that is, another taxpayer associated with the addressee of the request).

Secondly, the inspection may request documents or information outside the framework of any tax audit, but during other tax control activities (Clause 1 of Article of the Tax Code of the Russian Federation). For example, when checking accounting and reporting data or during a pre-audit analysis (decision of the Supreme Court of the Russian Federation dated 09.23.20 No. 307-ES20-13138 in case No. A56-51770/2019, resolution of the Federal Antimonopoly Service of the Ural District dated 06.25.12 No. F09-5408 /12 in case No. A71-11479/11). But in such cases, the circle of interests of inspectors is legally limited to a specific transaction.

Determine the likelihood of an on-site tax audit and receive recommendations on the tax burden

Let's look at each of these grounds in more detail.