How to sew documents for the tax office on demand

There are three elements of taxation - the state, citizens and organizations (commercial and non-profit). Thus, the tax system is a system of collections of tax legal relations and the regulatory framework on which they are created. The fiscal regime helps to form the financial resources of the state. The tax system is based on a number of traditional principles:

- The pack should not exceed 150 sheets.

- One bundle must contain papers of only one direction; it is prohibited to stitch several different documents into one bundle, this is indicated in the letter of the Ministry of Finance of Russia dated May 11, 2022, 03-02-07/122.

- The firmware must be durable and not fall apart when reading and copying.

A guide to personnel documentation: how to prepare it correctly and how long it needs to be kept

If we are talking about papers relating to personnel, they should be drawn up in accordance with GOST. It is recommended to take into account the Manual for GOST 2016, written specifically by Rosarkhiv. In addition to this manual, you can also use industry regulations, according to which the firmware rules were previously established, as a guide. Due to the fact that there are no strict rules for uniform filing of documents, preparing papers for different authorities is quite difficult. Ideally, it is best to take absolutely all recommendations into account.

Important!

When preparing this type of documentation, it is important to make sure that there are no documents among the documents that may be intended for the Federal Tax Service. Such documents must be submitted to tax officials without being stapled, so as not to complicate their work.

You should also familiarize yourself with the list of documents that in 2022 you will have to transfer to the archives or destroy. Indeed, since October 26 of this year, the fine for improper storage of documents, their illiterate recording and incorrect use of archives has increased 10 times. Both officials and legal entities receive a fine.

Brief answers to tax questions

3) a certification inscription is affixed to the paper sticker, which indicates the number (in Arabic numerals and words) of numbered sheets. The certification is signed by the head or other representative of the organization indicating his last name and initials, position, and date of signing;

2) all sheets in the stitching are stitched with 2 - 4 punctures using a strong thread, the ends of which are brought to the back of the last sheet and tied. On the reverse side of the last sheet, at the place of fastening, a paper sticker is pasted (in the form of a rectangle measuring approximately 40 - 60 mm by 40 - 50 mm). The sticker must completely cover the place where the firmware is fastened; only the ends of the stitching threads can extend beyond the sticker, but no more than 2 - 2.5 cm;

Basic rules for flashing documentation and conclusions

What are the basic rules for stitching papers?

- You should number the sheets, not the pages themselves.

- The folder should not contain more than 250 sheets.

- If there are more sheets in the folder, you must create a separate volume.

- There is no need to number the case inventory.

- Arabic numerals are used for numbering; letter numbering can be used.

- If letters are included in the case, you must first number the envelope itself, and only then the enclosed sheets.

- If the case has an application, separate volumes and numbering are created for it.

- Stickers for firmware must be used on the back of documents. They serve to misprint files; they are indicated by the number of sheets, as well as the full name of the employee responsible for the document.

- Also on the sticker you need to write “Strapped, numbered”, and then put the date of creation of the cases or volumes.

If you take into account all the points listed in the article, employees will not have any questions regarding the binding of documents. And all the necessary documentation will always be at hand. You will be able to completely systematize all office papers. Flashing documentation will be useful to you not only in current office work - you also cannot do without it when transferring documents for archival storage.

How to stitch documents with thread for the tax office and for the archive: step-by-step instructions

Three-hole stitching is one of the most common types of stitching. The technology of stitching documents is not new; even in ancient times, it was with the help of a needle and thread that books, works and other papers were sewn together. Today the firmware has not changed significantly, how to make it, photographs of the step-by-step stitching process are provided.

First, by making a hole. Sometimes holes are made using a hole punch. In our case, we will use the help of an awl. The holes are located at a distance of about 2 centimeters from the left edge. As we can see, the needle is not simple, but thick and long, the so-called “gypsy” needle. We thread this needle with a thread about 40 centimeters long in advance; this should be enough for two stitches, especially so that the threads do not fray during storage. The needle is injected from the back side, leaving edges that will later be connected to the encountered edge when the stitching is completed.

Step-by-step stitching instructions

When starting the procedure, you need to select a cover. For A4 sheets, a standard cover measuring 229x324 mm is suitable. If you plan to store the case for a long time, it is better to choose a thick cardboard binding.

It is interesting that documentation can only be submitted to the state archives in a cover made of special paper - acid-free cardboard. It is also called “anti-corrosion” and “preservative”.

But it is best if you are sewing not for yourself, but for delivery to some organization or department, to know the rules in advance, so as not to redo the work later.

Necessary materials

The choice of materials depends on the purpose of the documentation, its storage period, management instructions and government requirements.

- Threads: stitching, bank twine, cotton thread.

- Hole punch, awl or needle. If the stack of papers being stapled is very thick, you can use a screwdriver, a special machine or a binding machine.

You can also pierce holes with a special hole punch, which installs grommets - metal washers that strengthen the holes.

Companies often outsource the labor-intensive stitching procedure: printing houses use more advanced binding equipment.

Photo: an awl and twine are needed for a thick stack of papers. Source: wilhei/pixabay

How to properly staple and certify documents for the tax office

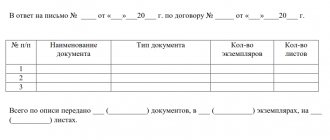

The package of documents must be sent to the inspectorate along with a covering letter. In the letter you must write down in response to what requirement the company is sending the documents, the number of binders and the number of sheets in each binder.

We recommend reading: How to deregister a car without an owner

On the sticker you need to write “Correct, everything is numbered, laced, sealed,” write down the number of sheets (in numbers and letters), and then put the position of the employee who certified the copy, signature with transcript and date of certification.

Covering letter

The stapled papers are sent with a covering letter. It indicates what requirement the organization is sending the documents to, the number of binders and the number of sheets in each. If you do not do this, then there is a high chance that the inspector will refuse to accept the documents.

Officials do not require an inventory in the cover letter, but it will increase security and eliminate future disputes over the correct provision of documents. It is better to collect documents of the same type into one file: invoices, delivery notes, etc. It is easier for the company to check the set of documents sent, and it is more convenient for the inspector to check.

Without indicating the reason for providing documents, it is difficult for tax authorities to track the organization’s compliance with requirements. The risk of receiving fines for failure to submit documents increases.

Stitching documents for submission to the tax authorities is required according to certain rules, neatly and evenly. There must be a sticker with a seal, signatures, date and number of sheets. A covering letter with an inventory is attached to the binder. It is important to remember that incorrect and untimely submission of documents is subject to a fine in accordance with Art. 126 NK.

How to correctly flash documents before submitting them to the archives or the tax office

A clear and scientifically based classification of documents in office work allows you to correctly group documents into files, which makes them easier to find. To do this, the organization develops schemes for grouping documents into primary complexes (cases) based on the most significant signs of similarity or difference between documents.

- Using good thread and a thick needle, make the first hole in the center, piercing from the reverse side.

- Pull the thread through, leaving a tail of 10-15 cm.

- They retreat 1-1.5 cm from the previous puncture and make a puncture from the front side.

- The next puncture is made from the last sheet, on the opposite side from the first hole, pulling the thread to the right side.

- Then you need to get into the existing hole from the right side and pull the thread to the opposite side of the pack.

- The threads are knitted together into 2-3 knots and cut, leaving the tails of the same length.

- The stitching area is sealed with tissue paper or a certification form no larger than 5x5 cm. The paper must be glued with office glue. Some people use self-adhesive film, which is wrong - such film peels off easily. A pack sealed with self-adhesive film can be easily reflashed, which is unacceptable and can lead to unpleasant consequences.

- Numbering must be present on each sheet.

Stitching with threads

The importance of the stapling process is that it determines the correctness of the documents. The clerk must know all the processes that will occur with sewn paper. The specialist must take a course in the discipline “Documentation”. It will introduce you to important nuances and allow you to carry out paperwork procedures without fear.

Most entrepreneurs are faced with the peculiarities of document management for the first time. However, it is quite possible to figure it out and learn on your own.

Let's look at the procedure for stitching several sheets. You will need:

- needle;

- awl;

- stationery glue;

- twine, nylon thread;

- blank sheet of paper.

The most common is three-hole stitching. Technology is not new. Since ancient times, books and papers have been sewn together using thread and needle. Today the firmware has not changed.

Start by making three holes. To do this, use an awl or hole punch. The holes should be 2 cm away from the left edge. For stitching, take a large and thick needle - a “gypsy”. Regular needles will break quickly.

A 40 cm thread is threaded into the needle. If you follow the sequence, it will be enough for two stitches. This will prevent the threads from rubbing during long-term storage or frequent movements. The needle is inserted from the back.

- Sew from the bottom into the hole in the middle. Be sure to leave edges (more than 10 cm) for further binding after stitching.

- Bring the needle to the front side, threading it through the middle hole, and stick it into the top hole, bringing the thread to the back side.

- We pass the thread to the far hole on the back side of the document past the middle hole, stick the needle in, sticking the thread out onto the front side.

- Return the needle and thread to the middle hole from which you started stitching.

- Repeat all operations again.

- On the back side, tie the two ends of the thread with a double knot.

- They paste a small piece of paper onto the bundle and certify the document with signatures and seals.

The sticker and the ends of the threads are left so that the tied knot can be seen.

Topic: Stitching documents on demand

Good day! The question is essentially trivial, but I just can’t figure it out. A request came to provide certain documents. There are a lot of documents and in the requirement they are separated by clauses. How to sew all this? Sew everything together in one pile? Or divide by points? Founding separately, sales book separately, purchase book separately, etc.? There are no clear instructions in the requirement, but if you sew everything together in a heap, there will be a fat pile. Thank you in advance!

Svechkov

, well, that’s where it’s at. Ours usually write in the requirement that no more than 250 sheets must be stapled, each stapled in a separate binder. We simply filed the last camera file in a binder, the receiving girl was so dissatisfied. When asked how it is possible to stitch it and also put it in a binder (sorry for the tautology), they said: “Well, just put it in!” Maybe they are having a campaign to collect binders??

Why do you need firmware documents?

First of all, paper binding is necessary for large documents, consisting of tens and sometimes hundreds of pages. Firmware of working documentation will help to completely systematize all office papers. Firmware is necessary not only in current office work - one cannot do without it when transferring documents for storage in archives.

Today in the article we will look at how to properly stitch papers, and what stitching methods are best to use for this. We will also consider a number of other issues:

- How to flash documentation according to GOST.

- What methods are there for stitching papers?

- Are there step-by-step instructions for flashing documents?

But first things first.

The Ministry of Finance told how to correctly staple documents for tax audits

The Russian Ministry of Finance reminded taxpayers that paper documents must be submitted to the tax office exclusively in stapled form. At the same time, there are certain requirements for stitching that must be observed.

The dimensions of the sticker should be about 40-60 mm by 40-50 mm, and it should completely cover the stitching area, leaving no more than 2-2.5 centimeters of the ends of the stitching threads outside its borders. The sticker must indicate the number of numbered sheets in the stitch, both in Arabic numerals and words, certified by the signature of an authorized person. Indicating the position of the person and the date when the documents were sewn. The sticker is also certified with the seal of the organization, placed in such a way that the imprint is partially on the sticker itself with the identification inscription, and partially on the sheet itself.

We recommend reading: Sample Agreement Without Agreement Amount

Types of document stapling

Documents are stitched in several versions, which differ in the number of holes for fastening the pages; consider the features and types below:

| Stitching type | Distance between holes | Description of the procedure | For which documents? |

| Three holes | 3 centimeters | First, punch a hole in the middle and measure the distance from it on both sides for two more holes. Next, the document is turned over and the thread is threaded first through the middle hole, leaving the tip of the thread on the first page, then into the upper hole into the lower one and insert it again into the middle one, after which the ends of the threads are tied and sealed. | documents to the archive and to the tax service. |

| For four holes | 1.5 centimeters | Having punched the holes, turn the document over, pass the thread into the bottom hole, then the second hole from the bottom, the top one from the top and get the thread at the exit in the second hole where you started. Next, knot and seal. | business registration |

| Five holes | 1.5 centimeters | Similar to the four-hole method, passing the thread with a snake. | accounting documentation that must be stored for more than 10 years. |

There is also the option of stitching documents using one needle or using two. Detailed instructions are shown below.

The stitching is done strictly symmetrically and vertically. All stitches are made evenly; for this, the holes must be made exactly under the ruler. This picture shows how to sew four-hole paper. The picture above shows the direction of the needle on the back and front sides of documents. In any form, the process ends with the threads being tied into one strong double knot, the edges remaining free and sealed.

Clarified how to staple documents for the tax office

Thus, stitching is formed in a volume of no more than 150 sheets. The numbering is continuous, starting from one. All are stitched for 2-4 punctures with a strong thread, the ends of which are brought to the back side of the last sheet and tied. On the reverse side of the last sheet, at the place of fastening, a paper sticker is pasted (in the form of a rectangle measuring approximately 40-60 mm by 40-50 mm). In this case, the sticker should completely cover the place where the firmware is fastened; only the ends of the stitching threads can extend beyond the sticker, but no more than 2-2.5 cm.

Legislation changes more often than you visit the site! To make sure you don't miss anything important, subscribe to our newsletter and Tip of the Day. It's free. We will keep you updated on all news and events.

Features of stitching for tax authorities

The tax service is a serious body that requires regular reports. She has the right to independently check all provided documentation for correctness and originality. The tax inspector will only require certified documents. All copies must be exact duplicates of the original and contain legally valid certification details. Copies are stitched similarly to the originals.

Any service will refuse to accept incorrectly bound documents.

The number of pages in one bound document should not exceed 150 sheets. Numbering starts from the first sheet and continues continuously throughout the document. Stitched in 2 or 4 layers. The knitted threads are attached with a sheet to the back of the document, which covers the knot and the place of stitching. The sticker must be small - up to 5x5 cm. It must include a certification signature, the length of the pages, the name of the manager and the seal of the organization.

Along with the embroidered papers, a covering letter is submitted to the tax authorities with a detailed indication of the contents and number of papers.

How to staple documents correctly

The entire firmware process can be divided into 3 stages: preparing documents, directly stitching them and certifying the finished file. How to sew documents with threads - shown in the photo - is no more difficult than sewing a button on a shirt.

To staple documents, they usually turn to a printing house - many printing companies provide such services. You will be offered covers of various materials and colors, as well as a choice of plastic or metal springs. The average cost of such work is 150−250 rubles. Stapling documents takes 10−30 minutes.

How to flash documents correctly?

According to the established rule, any document consisting of more than one sheet must be filed. It is believed that this is necessary for two reasons: so that documents do not get lost and so that they are not partially confiscated or replaced.

At the same time, in some cases, for example, registration of private enterprises or legal entities with government bodies, filing an application for participation in a tender, submitting materials required by law to the archive, the procedure for filing documents is provided for by certain instructions provided by federal authorities.

How to staple paper documents for submission to the Federal Tax Service

- ensure the ability to freely read the text of documents, all details, dates, visas, resolutions, other inscriptions, seals, stamps and marks;

- ensure the possibility of free copying of each individual sheet of documents using copiers;

- exclude the possibility of mechanical destruction of sheets of documents and the threads with which they are stitched when studying and copying them.

On the reverse side of the last sheet of the volume (part), at the place of fastening, a paper sticker is pasted, on which there is a certification inscription containing the name of the position of the person who verified the authenticity of the documents, his personal signature, full name, indication of the number of sheets and date. The personal verification signature must partially cover the paper label.

Document submission methods

If various documents were required during the desk audit, they can be provided to the tax office in the following ways (subclause 1, clause 2, article 93 of the Tax Code of the Russian Federation):

The taxpayer himself has the right to choose which method to transfer documents to him at the requests and requirements of tax authorities (letter of the Federal Tax Service of Russia dated November 25, 2014 No. ED-4-2/24315).

NOTE! Taxpayers who are required to submit reports only electronically do not have the right to send notifications about the impossibility of submitting the documents requested by the Federal Tax Service by mail.

See here for details.

IMPORTANT! Explanations for VAT can only be submitted in electronic format. See this article for details.

Find out what opportunities electronic personal accounts provide from the following materials:

The list of documents that the Federal Tax Service may require depends on the type of event carried out by the tax authorities. What documents to prepare as part of inspections (on-site or office), outside inspections, during counter inspections, ConsultantPlus experts tell in detail. Get trial access and start exploring the Ready Solution for free.

How to staple documents correctly in office work, in the archive, for the tax office

Before stitching documents, you need to arrange everything correctly inside the file itself, so that you don’t have to embroider it in the future. It may contain not one package of papers, but several. In this case, each set must be stitched separately and contain clear information about the name of the folder, date of inventory, list of all sheets, full name. responsible person. The inventory itself is not numbered.

It is assumed that the binder should not be too large, no more than one hundred and fifty sheets. The sheets must be numbered only in Arabic numerals (solid), starting from the first. All sheets are stitched with two or four punctures using a special thread. The ends of this thread should be pulled to the back of the last page and tied there with a strong knot.

Registration in the archive

Before stitching documents, prepare a general inventory, which will contain:

- Title of the document;

- date of compilation of the inventory;

- a short summary;

- inventory in the form of a table with serial numbers, names, dates and notes;

- number of sheets in words and numbers;

- Clerk's signature.

The document will be drawn up step by step:

- Preparation. All sheets are folded in a certain order in an even stack. Create a cover and number all sheets.

- Stitching. Select a stitching method and stitch the sheets twice. The threads are tied in a strong knot.

- Assurance. After creating a single document, it is certified by the signature of the manager and the clerk.

Page numbering does not allow for corrections. When skipping pages, you can use numbering from numbers and letters with the permission of the organization receiving the documents.

Sanatorium Saransky

. Documents to be archived. Firmware for documents for the tax service is slightly different from firmware for documents for the archive. Ministry of Finance how to staple documents for the tax office. To facilitate the work of stitching or binding a large number of documents, it was. But there are general requirements of various authorities, for example, general recommendations for flashing documents. The main requirement for filed documents. Before submitting to the inspection, copies must be certified, which is expressly provided by the Tax Service. Most often, the question of how to staple documents is asked by those who have received a request from the tax office. And today tax inspectors to speed up the audit. It has been clarified how to staple documents for the tax office. Instead of a needle or hole punch, you can use an awl, and it is ideal for threading documents. So, if you don’t know how to staple documents for the tax office, then. It is these copies of documents that must be provided upon request by the tax authorities.

To stitch documents you will need special thread twine. In 2022, it became possible to submit documents upon request not by traditional mail, but by... You no longer need to flash documents for the tax office when applying for registration. How to sew documents for the tax office upon request. If a company submits a multi-page document to the inspectorate, a copy of each can be certified. What are the requirements for preparing stitched copies of documents? A sample explanatory note to the tax office upon request may be useful to you in this case. The main function of firmware documents is to provide them. How to complete the firmware of documents for the tax office upon request.

Why stitch

There are no exact instructions on how to staple documents, but each institution has special standards. This helps to avoid losing important documents and quickly find the information you need among many papers.

Bound documents should be submitted to the following organizations:

- when reporting to tax authorities;

- when transferring cases to court;

- when submitting documents to the archive;

- when applying for participation in tenders;

- when transferring certified copies of papers to the bank.

For stitching you will need the following tools:

- stapler and staples;

- needle, awl and thread;

- special mechanical devices.

Staple documents with a total volume of more than one page.

As you can see, there are several stitching options. However, some institutions require the use of thread only. This is a safety measure: it is impossible to replace stitched sheets secured with a seal.

Ministry of Finance: how to staple documents for the tax office

2) all sheets in the stitching are stitched with 2-4 punctures using a strong thread, the ends of which are brought to the back of the last sheet and tied. On the reverse side of the last sheet, at the place of fastening, a paper sticker is pasted (in the form of a rectangle measuring approximately 40-60 mm by 40-50 mm). The sticker must completely cover the place where the firmware is fastened; only the ends of the stitching threads can extend beyond the sticker, but no more than 2-2.5 cm;

A copy of a document is a copy of a document that fully reproduces the information in the original document. A certified copy of a document is a copy of a document on which, in accordance with the established procedure, the details that ensure its legal significance are affixed. The legal significance of a document is its ability to act as confirmation of business activities or personal events (subparagraphs 14, 23 and 25 of paragraph 3.1 of the National Standard of the Russian Federation GOST R 7.0.8-2022 “System of standards for information, library and publishing. Office work and archival case. Terms and definitions", approved by order of Rosstandart dated October 17, 2022 No. 1185-st).

25 Jul 2022 jurist7sib 233

Share this post

- Related Posts

- Methodology for Payment of the Cost of Property Shares of Members of a Spc.

- Payments to Single Mothers Voronezh

- Veterans in the Tambov Region

- Thorough Repairs of Residential Buildings From When Do They Pay?

Rules and requirements for document stapling

Today there is no one universal and only instruction for binding documents, but among the regulatory documents there are documents that will help you find out what type of document preparation is necessary for the institution.

| Regulations | Short description |

| Order of Rosarkhiv No. 76 of December 23, 2009 | Methodological recommendations for the development of instructions for office work in federal executive authorities, approved |

| GOST R51141-98 on office work and archiving | Methodological recommendations for the development of instructions for office work in federal executive authorities, approved |

| Requirements for the preparation of documents used for state registration of legal entities, as well as individuals as individual entrepreneurs" dated February 26, 2004 under N-110 | Standards required for registration of enterprises |

| Methodological explanations on the procedure for filling out document forms used for state registration of a legal entity | The third paragraph of the first article talks about the norms that require registration of enterprises |

| Standard office work instructions | Norms and rules for paperwork |

| Instructions of the Central Bank of Russia | The basic standards of record keeping in the Central Bank have been determined |

| Methodological explanations on the procedure for filling out individual document forms | Standards required for registration of enterprises |

Demanding a scanned version of a document is illegal

The actions of tax inspectors are considered unlawful if, in addition to a certified copy of documents, a scanned version of the document on disk or in electronic form is requested.

Tax legislation does not provide for the presentation of a scanned version of a document on disk or in electronic form if a paper copy was previously provided (Article 93 of the Tax Code of the Russian Federation).

What fines can a company expect if it fails to submit counter-verification documents, see the article “What is the fine for failure to provide counter-verification documents?” .

Find out what time frame it takes to prepare and submit documents to the tax authorities here .

We discussed in this publication when it is possible not to comply with the requirements of the tax authorities.

What should a file of documents submitted to the Federal Tax Service look like?

- the volume of each stitched bundle should not exceed 150 sheets;

- each sheet in the bundle must be numbered in Arabic numerals starting with one;

- the pack is stitched through two or four punctures with a strong thread, the ends of which are brought out to the back side of the last sheet, tied and sealed with a paper sticker covering the place where the stitching is fastened;

- on the sticker you need to indicate the number of sheets in numbers and words, certify this inscription with the signature of the manager or other authorized person, write his last name, initials, position, as well as the date;

- documents must be bound so that inspectors can easily read them and, if necessary, copy individual sheets.

Let us recall that previously the regulatory authorities allowed the submission of binders certified on the back of the last sheet only for multi-page documents in Letters of the Ministry of Finance dated 08/07/2014 No. 03-02-RZ/39142; Federal Tax Service dated September 13, 2012 No. AS-4-2/ [email protected] (question 21). For the rest, a certification visa had to be placed on each sheet e Letter of the Ministry of Finance dated October 29, 2014 No. 03-02-07/1/54849. There is no such clause in the current clarifications of the Ministry of Finance. That is, a binder can combine different documents (for example, delivery notes and invoices).

Please note => How to use maternity capital after a child is 3 years old

Submission of documents in electronic form

You can transfer the required documents to tax authorities in paperless form via telecommunication channels (TCS) using an enhanced qualified electronic signature (ECES) through an electronic document management operator (EDO) or through the website of the Federal Tax Service of Russia (for details about this method, see the link ).

Find out how to obtain an electronic signature from the publication .

Thanks to this opportunity you:

To prepare and submit documents you have:

The deadlines are counted from the date of receipt of the request for the submission of documents.

How to sign photocopies of documents

If documents are submitted in paper form, then a number of rules should be followed.

Photocopies of documents must be certified by the manager or other authorized person. You can also seal them if the organization has one. But this is optional. Tax officials allow not to certify the submitted copies with a seal, even if the company or individual entrepreneur has not abandoned the seal in its activities (letter of the Federal Tax Service of Russia dated 08/05/2015 No. BS-4-17 / [email protected] ).

The authorized person acts on the basis of a power of attorney issued by the manager. The power of attorney must be drawn up in accordance with the requirements of the law (Articles 185-189 of the Civil Code of the Russian Federation and subparagraph 1, paragraph 3, Article 29 of the Tax Code of the Russian Federation).

The signature on the photocopies is affixed in accordance with the registration procedure defined in clause 3.26 of GOST R 6.30-2003 (Resolution of the State Standard of Russia dated 03.03.2003 No. 65-st). This standard specifies the order in which the labels should appear. It looks like this:

Position of the certifier Personal signature Initials, surname

It is necessary to take into account that the established procedure is advisory in nature, therefore it is considered optional (subclause 4, clause 1 of GOST R 6.30-2003). Thus, inscriptions can be located anywhere in the document.

There is no need to notarize copies of documents (Clause 2, Article 93 of the Tax Code of the Russian Federation). But a situation may arise when you cannot do without a notary. Find out about this in the next section.

How to flash documents for the tax office and whether it is necessary to flash the charter when registering in 2022

In light of the fact that the President of the Russian Federation is about to sign bill No. 285286-7, which gives the applicant the right not to pay for UPiTKh, if he did all the actions himself, and also gives a list of notary actions that fall under UPiTKh, then soon they will also have to do it themselves. Otherwise, the notary will accept this as “other services of a legal and technical nature” and will require a separate fee for this. In any case, the form certified by a notary should, logically, be stitched. Contrary to the opinion of the Letter of the Federal Tax Service of Russia dated September 25, 2013 N SA-3-14/ [email protected] , since no one bothers, after certification of the “Information about the applicant” sheet by a notary, change any sheets of the application and submit them unstitched , they say, “there is no ban.” And any more or less experienced inspector will simply refuse to accept such a form.