How to use the calculator?

Select the year for which you want to calculate contributions. If you have been operating as an individual entrepreneur for less than a year, then indicate the beginning of the activity and its end:

- — start of the individual entrepreneur’s activities — date of registration in the Unified State Register of Individual Entrepreneurs;

- — end of the individual entrepreneur’s activity — date of registration of termination of business activity.

Then, in the “Income” field, enter the amount of income for the year if it exceeds 300 thousand rubles:

- - according to the simplified tax system, this is income without taking into account expenses;

- — on UTII and a patent, we look at the imputed annual income on which the tax is paid, or the amount of income assumed by the patent;

- — on OSNO this is the amount of income that needs to be reduced by tax deduction.

At the bottom of the calculator on the right you will see the amount of contributions due. The calculation is done automatically, you don’t need to press anything additional.

When to pay

The due date for payment of the first installment of contributions is December 31 of the year for which contributions are paid.

Taking into account the fact that in 2016 December 31 is a Saturday, the payment deadline is postponed to the first working day after the weekend. At the time of writing, the transfer of holidays in 2022 has not been approved by the Government of the Russian Federation, so it is not possible to name the exact payment date. Presumably this will be January 9, 2022. However, you should not postpone payment of contributions until the last days of the year, much less pay them next year. Pension Fund branches often charge penalties on contributions that, in their opinion, did not arrive on time. Because for some reason they rely not on the date the payment was sent (as required by law), but on the date it was received in the PF account in the treasury. Many entrepreneurs prefer to pay penny fines rather than challenge the fund’s unlawful actions.

The deadline for payment of the second part of contributions is set on April 1 of the year following the billing year. Those. for 2016, this part will have to be paid no later than April 3, 2022 (since April 1 is a Saturday).

Premiums can be paid at once, in full, or divided into parts, as is convenient for the policyholder. Paying in installments makes sense to reduce taxes on contributions evenly. Since contributions reduce the tax of the period in which they are paid, one-time payment of contributions can lead to unfavorable consequences - the inability to reduce the tax in the required amount. This applies primarily to UTII payers, since this tax has a short tax period - a quarter. And if you pay the entire amount of contributions at the end of 2016, it will be impossible to reduce the tax for the 1st, 2nd and 3rd quarters of 2016, since contributions were not paid in these quarters. The same will happen if you pay all contributions at the beginning of the year. Thus, to reduce the individual entrepreneur’s tax on UTII, it is recommended to pay contributions once a quarter[4]. Individual entrepreneurs using the OSNO or simplified tax system are in a more favorable situation, because the tax period for the simplified tax system and personal income tax is one year. Well, individual entrepreneurs who use PSN generally don’t care in what installments they pay, because the cost of the patent cannot be reduced by the amount of contributions.

How to calculate insurance premiums?

The amount of contributions consists of a fixed part for pension and health insurance and an additional 1% contribution, which is paid on income exceeding 300 thousand per year. Additional contributions are paid for pension insurance.

fixed contributions even if he does not conduct business and does not receive income. Every year, officials must set the amount of fixed contributions again. In our table you can see what amounts of contributions Russian entrepreneurs have made over the past four years.

| 2020 | 2019 | 2018 | 2017 | |

| to the Pension Fund of Russia | 32,448 rubles | 29,354 rubles | 26,545 rubles | 23,400 rubles |

| in FFOMS | 8,426 rubles | 6,884 rubles | 5,840 rubles | 4,590 rubles |

| sum | 40,874 rubles | 36,238 rubles | 32,385 rubles | 27,990 rubles |

An additional 1% contribution is paid by those individual entrepreneurs who earn more than 300 thousand rubles per year. The amount of income is determined by the taxation system, we have already written about this above.

The amount of contributions to pension insurance for 2022, consisting of a fixed part and 1% over 300 thousand rubles, should not exceed 218,200 rubles, for 2022 - 241,716 rubles.

Fixed payment: restrictions

Amount of contributions to the Pension Fund

Since 2014, individual entrepreneurs have calculated a fixed amount of pension contributions based on the minimum wage.

From this year, the amount of contributions to the Pension Fund also depends on the amount of income received by the entrepreneur in the billing period. If the entrepreneur’s annual income does not exceed 300,000 rubles, then the amount of the contribution to the Pension Fund is determined as follows:

The minimum wage as of January 1, 2016 is 6,204 rubles (Article 1 of the Federal Law of December 14, 2015 No. 376-FZ).

EXAMPLE

Let's calculate a fixed payment to the Pension Fund in 2016. The tariff for insurance contributions to the Pension Fund budget in 2016 is 26%. The annual income of an entrepreneur does not exceed 300,000 rubles. He must pay 19,356.48 rubles to the Pension Fund (6,204 rubles × 26% × 12).

If an entrepreneur’s annual income is more than 300,000 rubles, then he will have to pay an additional 1% to the Pension Fund on income exceeding this amount. 1% is calculated on income (income from sales and non-operating income listed in Article 346.15 of the Tax Code) without reducing them for expenses taken into account in “simplified” activities (letter of the Ministry of Finance of the Russian Federation dated March 27, 2015 No. 03-11-11/17197 , ruling of the Supreme Court of the Russian Federation dated July 28, 2016 No. 306-KG16-9938). Moreover, regardless of what object of taxation the individual entrepreneur applies.

The total amount of contributions to the Pension Fund transferred for themselves by entrepreneurs with an income above 300,000 rubles is limited by a maximum amount. It is calculated as follows (clause 2, clause 1.1, article 14 of Law No. 212-FZ):

In 2016, the specified limit is 154,851.84 rubles (6,204 rubles × 8 × 26% × 12).

In a word, if an entrepreneur’s income exceeds 300,000 rubles, then he calculates the amount of insurance premiums taking into account the excess income, and then compares the resulting value with the maximum amount of insurance premiums that can be transferred to the Pension Fund.

If the calculated fixed payment exceeds the maximum, a fixed amount of 154,851.84 rubles is paid to the Pension Fund. EXAMPLE

In 2016, the income of an individual entrepreneur working without employees amounted to 8,500,000 rubles. The amount of the insurance contribution to the Pension Fund will be 101,356.48 rubles. (RUB 6,204 × 26% × 12 + (RUB 8,500,000 – RUB 300,000) × 1%). RUB 101,356.48 < RUB 154,851.84 Therefore, the entrepreneur will pay 101,356.48 rubles to the Pension Fund budget.

note

Since July 1, 2016, the minimum wage has increased and is currently 7,500 rubles. But despite this, in order to pay a fixed insurance payment, it is necessary to apply the value of the minimum wage that was established on January 1 of the current year, namely 6,204 rubles.

The amount of insurance contributions to the FFOMS

The amount of insurance contributions to the FFOMS is determined as follows (clauses 1 – 1.2 of Article 14 of Law No. 212-FZ):

The rate of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2016 is 5.1%.

Thus, self-employed individual entrepreneurs in 2016 paid 3,796.85 rubles to the FFOMS (6,204 rubles × 5.1% × 12 months).

Summarize.

If the annual income of a self-employed entrepreneur does not exceed 300,000 rubles, the minimum total amount of insurance contributions to the budgets of the Pension Fund and the Federal Compulsory Medical Insurance Fund in 2016 is 23,153.33 rubles (19,356.48 rubles + 3,796.85 rubles).

If the annual income of a self-employed entrepreneur exceeds 300,000 rubles, then the maximum possible contribution in 2016 is 158,648.69 rubles (154,851.84 rubles + 3,796.85 rubles).

note

Self-employed individual entrepreneurs do not pay contributions in case of temporary disability and in connection with maternity to the Social Insurance Fund of the Russian Federation. But they have the right to voluntarily enter into legal relations under compulsory social insurance and transfer insurance contributions for themselves (clause 5 of Article 14 of Law No. 212-FZ).

Read in the taker

For information on the procedure for calculating and paying contributions by self-employed entrepreneurs, read the “STS in Practice” berator.

Individual entrepreneur insurance premiums for less than a year

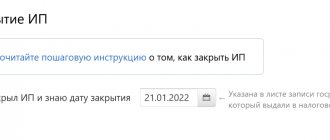

If an entrepreneur registered or closed an individual entrepreneur in the middle of the year, then insurance premiums are calculated based on the real time of activity in the status of an individual entrepreneur. To calculate, you need to know the number of full months of activity and the number of days in an incomplete month of activity. The date of registration of an individual entrepreneur and the date of registration of termination of business activity do not need to be counted:

- — the first day of the individual entrepreneur’s activity — the date of registration in the Unified State Register of Individual Entrepreneurs;

- — the last day of the individual entrepreneur’s activity — the date of registration of the termination of business activity.

The amount of contributions will decrease in proportion to the number of days per year in individual entrepreneur status. Calculate contributions for less than a full year using a calculator.

If income for less than a full year exceeded 300 thousand rubles, calculate an additional 1% contribution to pension insurance from the excess amount.

Taxation systems for individual entrepreneurs in 2022

Since entrepreneurs are small businesses, the state is trying to reduce the tax burden of such businessmen and simplify accounting. Differentiation of tax rates makes it possible to encourage the population to open their own business in industries that are important to society. In this regard, each taxation system for individual entrepreneurs in 2022 has many nuances, which we will discuss below.

The types of taxation for individual entrepreneurs in 2022 are as follows:

- general taxation system (OSNO);

- simplified taxation system (STS), within which tax can be calculated on income or on income minus expenses;

- single agricultural tax (USAT);

- patent tax system (PTS);

- professional income tax (PIT);

- automated simplified taxation system (AUST) is a new type of simplified taxation system, which will become available from mid-2022.

OSNO is the basic or main tax regime. The remaining tax systems are called special tax regimes, since each of them has its own scope and conditions of application, nuances and regional characteristics. In addition, special regimes provide for exemption from payment of a number of taxes that individual entrepreneurs pay on OSNO: VAT, personal income tax on business activities, property tax, but if it is not included in the cadastral list.

For convenience, we have summarized key information about the tax regimes of individual entrepreneurs in a table:

| Tax regime | Who can apply | Object of taxation | Tax rate | Reporting |

| BASIC | All individual entrepreneurs with any number of employees and type of activity | 1.Income of an individual, with the possibility of applying a tax deduction 2.Added value for VAT 3. Average annual value of property for property tax purposes. | from 13% to 30% from 0% to 20% up to 2% | Tax records are maintained in KUDiR. Reporting: 3-NDFL at the end of the year and quarterly VAT return. |

| simplified tax system in variants a) Income b) Income minus expenses | Individual entrepreneurs with incomes below 164.4 million rubles/year and no more than 100 employees (*) | a) Income b) The difference between income and expenses | a) 6%, regional authorities have the right to rate up to 1%; b) from 5% to 15% - by decision of regional authorities | Accounting is maintained in KUDiR, reporting is one annual declaration. If there is income, the individual entrepreneur pays tax advances every quarter, and at the end of the year - the final payment. |

| Unified agricultural tax | Only agricultural producers, no more than 300 employees. | Difference between income and expenses VAT at a rate of up to 20% (you can get an exemption from paying it) | 6% | Accounting is kept in KUDiR, reporting is one annual declaration of the Unified Agricultural Tax. The individual entrepreneur pays advances on taxes, and at the end of the year - the final payment. If VAT exemption is not received, reporting on it is submitted. |

| PSN | Individual entrepreneurs with income below 60 million rubles/year and the number of employees is no more than 15 people. | Potential income is determined by local law. | 6% | Accounting is carried out in the income book; there is no need to submit a declaration. An individual entrepreneur buys a patent for a period of 1 to 12 months within a calendar year |

| NAP | Individual entrepreneurs without employees with incomes of up to 2.4 million rubles per year who provide services, perform work or sell goods of their own making. | Revenue from the provision of services (work) or sale of goods. | 4% if the client is an individual; 6% if the client is an organization. | There is no reporting, tax is paid based on notifications from the Federal Tax Service. |

(*) Note: standard limits for the simplified tax system can be increased to 219.2 million rubles and up to 130 employees, but in this case the tax rates are higher: 8% for the “Income” object and 20% for the “Revenue minus expenses” object.

For the convenience of paying taxes and insurance premiums, we recommend opening a current account. Moreover, now many banks offer favorable conditions for opening and maintaining a current account.

Responsibility for non-payment of contributions

If you are late in paying your contributions, the individual entrepreneur may receive a fine of 20% of the unpaid amount. The fine will increase to 40% if officials determine that the failure to pay was intentional. In addition, for each day of delay, penalties are charged in the amount of 1/300 of the refinancing rate for the period from 1 to 30 (inclusive) calendar days of delay and 1/150 of the refinancing rate from 31 days of delay.

The web service Kontur.Accounting has everything for convenient work

- Easily keep records and create a primary account

- Send reports via the Internet

- The service will calculate taxes and remind you about payment

- Calculate salaries, sick leave, vacation pay

Try for free

What fees does the individual entrepreneur pay?

Entrepreneurs pay two types of fixed contributions for compulsory insurance for themselves:

- “pension” contributions to the Pension Fund,

- for health insurance in the Federal Compulsory Medical Insurance Fund.

Payment of contributions is mandatory under any taxation system, and it does not matter whether the entrepreneur has income in the reporting year. If an individual entrepreneur does not operate, contributions to the Pension Fund and the Compulsory Medical Insurance Fund still need to be paid (letter of the Ministry of Labor of the Russian Federation dated August 14, 2015 No. 17-4/OOG-1177). An entrepreneur may simultaneously be an employee of another employer, but this does not mean that he does not need to pay insurance premiums “for himself.”

An entrepreneur can be exempted from paying fixed contributions during certain periods without terminating the status of an individual entrepreneur, but only if he did not conduct entrepreneurial activity (Article 14 of Law No. 212-FZ of July 24, 2009). These are the documented periods:

- military conscription service,

- childcare for children up to one and a half years old (but not more than three years in total),

- time spent caring for a disabled or elderly person,

- the period (up to 5 years) when the spouses of contract servicemen lived with them in areas where it was impossible to find employment,

- period (up to 5 years) of residence abroad with spouses who are diplomatic workers.

Individual entrepreneurs are not required to pay insurance contributions to the Social Insurance Fund for themselves, but in order to be able to receive payment for hospital benefits from the Social Insurance Fund, if such a need arises, they can transfer contributions voluntarily. To do this, you need to register with the Social Insurance Fund branch at your place of residence and pay an annual fee, which in 2016 is equal to 2158.99 rubles. Individual entrepreneurs do not transfer contributions for “injuries” to the Social Insurance Fund for themselves.

KBK

Budget codes are perhaps the only thing that individual entrepreneurs should pay special attention to in 2016. The point is that there are changes here.

Fixed contribution to the Pension Fund for all merchants – 392 1 02 02140 06 1100 160.

Additional payment to the fixed contribution (income for 12 months - more than 300,000 rubles) - 392 1 0200 160.

Fixed contribution to the federal health insurance – 392 1 02 02103 08 1011 160.

These were the KBK of fixed contributions for individual entrepreneurs for 2016.

Your payments

We are talking about the category of businessmen who work only for themselves and do not have employees. And, accordingly, they do not pay them income. Such payers, as before, make deductions from individual entrepreneurs’ insurance contributions to the Pension Fund of the Russian Federation and the federal health insurance system in strictly limited amounts and separately. This issue continues to be regulated by Art. 14 of the Law on Insurance Contributions No. 212-FZ.

The Pension Fund assures that the frequency of payment can be chosen from the following options:

- transfer all amounts at once;

- several payments per year, but no later than December 31 of the current period.