Mitigating circumstances (Article 112 of the Tax Code of the Russian Federation)

During the consideration of the audit materials or if other violations are detected, the tax authority must establish the presence of mitigating circumstances (subclause 4, clause 5, article 101, subclause 4, clause 7, article 101.4 of the Tax Code of the Russian Federation) and take them into account when imposing a fine. If there are mitigating circumstances, the amount of the fine may be reduced by at least 2 times compared to the amount provided for in the corresponding article of the Tax Code of the Russian Federation. This is directly indicated in paragraph 3 of Art. 114 Tax Code of the Russian Federation. According to paragraph 1 of Art. 112 of the Tax Code of the Russian Federation the following circumstances are recognized:

- committing an offense due to a combination of difficult personal or family circumstances;

- committing an offense under the influence of threat or coercion or due to financial, official or other dependence;

- difficult financial situation of an individual held accountable for committing a tax offense;

- other circumstances that may be recognized as mitigating by the court or tax authority considering the case.

If the tax authority did not take into account mitigating circumstances in order to reduce the fine in the act or, in the opinion of the taxpayer, they were not taken into account in full, you can apply to take into account mitigating circumstances and reduce the amount of the fine. The application must be submitted to the tax authority within a month from the date of receipt of the on-site or desk audit report (clause 6 of Article 100 of the Tax Code of the Russian Federation) or the report of an identified offense (clause 5 of Article 101.4 of the Tax Code of the Russian Federation).

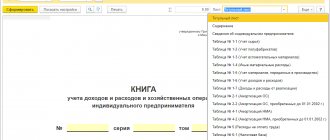

Sample petition to take into account mitigating circumstances and reduce the fine.

IMPORTANT! In paragraph 3 of Art. 114 of the Tax Code of the Russian Federation speaks only of the minimum limit for reducing sanctions. If the taxpayer does not agree with the amount of the fine imposed, he has the right to go to court. The Plenum of the Supreme Arbitration Court of the Russian Federation, in paragraph 16 of Resolution No. 57 of July 30, 2013, indicated that the court has the right to reduce the fine by more than 2 times.

When considering the case, the court will also examine the circumstances that the tax authority has already assessed at the stage of pre-trial appeal. And if he deems it necessary, he will reduce the fine again (letter of the Federal Tax Service of Russia dated August 22, 2014 No. SA-4-7/16692).

This means that in court it makes sense to declare all circumstances that seem to be mitigating, regardless of whether the tax authority took them into account when setting the fine or not.

You can read more about judicial practice on this issue in our material “Will the court reduce the fine by more than half if the tax authorities have already taken into account mitigating circumstances when imposing the punishment?” .

The court will make a decision about what other circumstances can be considered mitigating based on its internal conviction, which is based on an assessment of the evidence presented (Article 71 of the Arbitration Procedure Code of the Russian Federation). Different courts may evaluate the same circumstance differently, but an analysis of arbitration practice allows us to identify frequently occurring mitigating circumstances.

UrDela.ru

Part 1. The following are recognized as circumstances excluding a person’s guilt in committing a tax offense:

1) committing an act containing signs of a tax offense as a result of a natural disaster or other extraordinary and insurmountable circumstances (these circumstances are established by the presence of generally known facts, publications in the media and other methods that do not require special means of proof);

2) the commission of an act containing signs of a tax offense by a taxpayer - an individual who, at the time of its commission, was in a state in which this person could not be aware of his actions or manage them due to a painful condition (these circumstances are proven by submitting documents to the tax authority that in meaning, content and date refer to the tax period in which the tax offense was committed);

3) execution by the taxpayer (fee payer, tax agent) of written explanations on the procedure for calculating, paying a tax (fee) or on other issues of application of legislation on taxes and fees given to him or an indefinite number of persons by a financial, tax or other authorized government body (authorized official of this body) within its competence (these circumstances are established in the presence of a corresponding document of this body, in meaning and content relating to the tax periods in which the tax offense was committed, regardless of the date of publication of such a document).

The provision of this subparagraph does not apply if the specified written explanations are based on incomplete or unreliable information provided by the taxpayer (fee payer, tax agent);

4) other circumstances that may be recognized by the court or tax authority considering the case as excluding the person’s guilt in committing a tax offense.

Part 2. In the presence of the circumstances specified in paragraph 1 of this article, the person is not liable for committing a tax offense.

‹ Article 110 (Tax Code of the Russian Federation). Forms of guilt when committing a tax offense Up Article 112 (Tax Code of the Russian Federation). Circumstances mitigating and aggravating liability for committing a tax offense ›

Mitigating circumstances, according to the courts

- First time brought to justice.

Most often, the courts recognize tax liability for the first time as a mitigating circumstance (see the decisions of the Arbitration Court of the Far Eastern District dated May 29, 2017 No. F03-1665/2017 in case No. A59-4805/2016, the Arbitration Court of the Volga District dated May 26, 2016 No. F06 -8342/2016 in case No. A72-1808/2015, Arbitration Court of the North-Western District dated 08/10/2017 No. F07-7994/2017 in case No. A44-204/2017, Arbitration Court of the Ural District dated 07/13/2016 No. F09-7468 /16 in case No. A71-5004/2015, Arbitration Court of the East Siberian District dated July 30, 2015 No. F02-3273/2015 in case No. A78-7926/2014).

However, in some cases, judges believe that the conscientious behavior of the taxpayer is the norm of behavior and the absence of past decisions to bring the organization to tax liability is not a circumstance mitigating liability (see decisions of the Arbitration Court of the West Siberian District dated July 25, 2016 No. F04-3105/ 2016 in case No. A75-12477/2015, Arbitration Court of the Moscow District dated 08/07/2017 No. F05-9438/2017 in case No. A40-216834/2016, Arbitration Court of the Moscow District dated 07/07/2015 No. F05-8167/2015 in case No. A40-124360/14).

- Difficult material/financial situation.

The courts also recognize a difficult material (financial) situation as a mitigating circumstance for individual entrepreneurs (resolutions of the FAS Moscow District dated 02/06/2013 in case No. A41-39233/10, FAS West Siberian District dated 03/12/2013 in case No. A27-11755/2012 , FAS of the Ural District dated July 4, 2012 No. F09-5201/12 in case No. A76-12164/11), and for legal entities (resolution of the Arbitration Court of the West Siberian District dated February 13, 2017 No. F04-6898/2016 in case No. A45-15136/2015, Arbitration Court of the West Siberian District dated December 7, 2016 No. F04-26290/2015 in case No. A27-9477/2014, Arbitration Court of the Volga-Vyatka District dated June 7, 2016 No. F01-1895/2016 in case No. A82-4576/2014 (by decision of the Supreme Court of the Russian Federation dated September 30, 2016 No. 301-KG16-12246, the transfer of case No. A82-4576/2014 to the judicial panel for economic disputes of the Supreme Court of the Russian Federation was refused), Arbitration Court of the Far Eastern District dated October 5, 2016 No. F03-4598/2016 in case No. A59-571/20).

In order for this circumstance to be recognized as a mitigating factor, it must be documented (being in an unprofitable state for a long period of time, being bankrupt, having significant accounts payable, etc.).

To learn that a difficult financial situation may not be a basis for reducing the fine, read the material “Is the difficult financial situation of a company a mitigating circumstance?”.

- Lack of intent.

The lack of intent to commit a tax offense was recognized as a mitigating circumstance in the decisions of the Arbitration Court of the East Siberian District dated July 20, 2017 No. F02-3616/2017 in case No. A69-4165/2016, the Arbitration Court of the Far Eastern District dated March 2, 2016 No. F03-447/ 2016 in case No. A04-8405/2015, Arbitration Court of the West Siberian District dated November 24, 2016 No. F04-5485/2016 in case No. A27-5946/2016, Arbitration Court of the Moscow District dated September 28, 2015 No. F05-12811/2015 case No. A40-183946/14, Arbitration Court of the North-Western District dated 08.10.2017 No. F07-7994/2017 in case No. A44-204/2017, Arbitration Court of the North Caucasus District dated 05.24.2017 No. F08-3144/2017 case No. A32-29931/2015, Arbitration Court of the Central District dated April 20, 2017 No. F10-632/2017 in case No. A83-1159/2016.

To learn how to prove the presence of intent to commit tax evasion, read the material “Intentionally - unintentionally: tax authorities will focus on evidence of guilt in tax evasion.”

- Admission of guilt, repentance.

In the decisions of the Arbitration Court of the Ural District dated December 20, 2016 No. F09-11069/16 in case No. A71-1811/2016, the Arbitration Court of the East Siberian District dated October 6, 2014 in case No. A78-2081/2014, the Arbitration Court of the Far Eastern District dated 22.01 .2016 No. F03-6042/2015 in case No. A59-2647/2015, Arbitration Court of the West Siberian District dated 08.20.2015 No. F04-21836/2015 in case No. A27-23838/2014, FAS Moscow District dated 05.24.2012 case No. A41-7815/10, FAS East Siberian District dated June 10, 2009 No. A33-12490/08-F02-2564/09 in case No. A33-12490/08 the admission of guilt and/or remorse of the taxpayer was recognized as a mitigating circumstance.

- Social significance of the taxpayer's activities.

The socially significant activities of a taxpayer, recognized by the courts as a mitigating circumstance when imposing a fine, include, in particular:

- implementation of municipal orders for the management of municipal housing stock; operation by the taxpayer of water supply and sanitation systems in populated areas (resolution of the Arbitration Court of the East Siberian District dated April 28, 2017 No. F02-1554/2017 in case No. A58-95/2016);

- implementation of heat supply (resolution of the Arbitration Court of the Far Eastern District dated May 29, 2017 No. F03-1665/2017 in case No. A59-4805/2016);

- carrying out activities to protect property, including objects subject to state protection, social and life support facilities (resolution of the Federal Antimonopoly Service of the East Siberian District dated May 31, 2013 in case No. A58-5605/2012);

- activities of automobile (bus) passenger transport, subject to a schedule (resolution dated 10/05/2016 No. F03-4598/2016 in case No. A59-571/2016);

- construction of highways (resolution of the Arbitration Court of the West Siberian District dated May 30, 2016 No. F04-1832/2016 in case No. A81-2796/2015);

- implementation of educational activities financed from the budget (resolution of the Federal Antimonopoly Service of the Moscow District dated May 17, 2010 No. KA-A/40-3532-10 in case No. A40-117384/09-127-866);

- carrying out construction and repair work at socially significant facilities: stations, schools, kindergartens, etc. (resolution of the 4th Arbitration Court of Appeal dated April 28, 2014 No. 04AP-1289/2014 in case No. A78-7110/2013 (left unchanged by the FAS resolution East Siberian District dated July 11, 2014 in case No. A78-7110/2013), FAS Volga-Vyatka District dated September 28, 2011 in case No. A82-16380/2009).

In some cases, the status of a budgetary institution, financed from the federal budget or a city-forming enterprise, was also recognized by the courts as a mitigating circumstance (resolution of the Federal Antimonopoly Service of the Moscow District of February 13, 2014 No. F05-526/2014 in case No. A40-97815/13, Federal Antimonopoly Service of the West Siberian district dated 08/29/2012 in case No. A46-15485/2011, dated 04/28/2012 in case No. A27-4466/2011, FAS of the East Siberian District dated 05/31/2013 in case No. A58-5605/2012, FAS of the North-Western District dated 05/05/2012 in case No. A44-2249/2011, Arbitration Court of the West Siberian District dated 04/05/2016 No. F04-1076/2016 in case No. A27-12990/2015).

- Personnel problems.

In some cases, the courts recognize that the absence of an accountant (illness, vacation) may be a mitigating circumstance (see the resolution of the Federal Antimonopoly Service of the West Siberian District dated September 1, 2011 in case No. A45-22563/2010, the Federal Antimonopoly Service of the West Siberian District dated December 14, 2011 on case No. A27-6657/2011, FAS Central District dated May 21, 2012 in case No. A48-3647/2011).

Additional mitigating circumstances when imposing a fine for submitting a declaration in violation of the established deadline under paragraph 1 of Art. 119 of the Tax Code of the Russian Federation, courts recognize:

- Disproportionate amount of the fine to the nature and severity of the violation.

A mitigating circumstance for reducing the fine may be the disproportion of the size of the fine to the nature and severity of the violation. Disproportionality is established by the courts in relation to the amount of arrears, the consequences of the offense for the budget (see decisions of the Arbitration Court of the West Siberian District dated September 22, 2015 No. F04-23789/2015 in case No. A27-2046/2015, FAS North-Western District dated 05.03 .2012 in case No. A66-5375/2011, FAS of the Ural District dated 08/04/2009 No. Ф09-5377/09-С2 in case No. A76-28513/2008-33-833/45, FAS of the North-Western District dated 08/23/2012 in case No. A26-10442/2011).

- Insignificant period of delay in submitting the declaration.

This mitigating circumstance is indicated in the decisions of the Arbitration Court of the Volga District dated 02/04/2016 No. F06-4544/2015 in case No. A12-17954/2015, FAS Volga-Vyatka District dated 03/05/2012 in case No. A28-7219/2011, FAS East -Siberian District dated March 20, 2012 in case No. A74-2935/2011, FAS North-Western District dated August 20, 2012 in case No. A26-11937/2011, etc.

- Technical difficulites.

Computer failure, lack of communication, computer breakdown and other technical problems may be considered a mitigating circumstance when imposing a fine for late submission of a declaration (see resolutions of the Federal Antimonopoly Service of the North Caucasus District dated March 23, 2009 in case No. A32-17674/2008- 59/232, FAS Far Eastern District dated 03/07/2007, 02/28/2007 No. F03-A80/07-2/43 in case No. A80-81/2006, A80-36/2006, FAS Volga District dated 03/25/2010 in case No. A55-20621/2009, Federal Antimonopoly Service of the West Siberian District dated April 16, 2009 No. F04-2189/2009 (4443-A81-31) in case No. A81-2941/2008).

You can find out about liability for late submission of a declaration in the material “Art. 119 of the Tax Code of the Russian Federation: questions and answers.”

When imposing a fine for non-payment (incomplete payment) of tax under Art. 122 of the Tax Code of the Russian Federation, the following are often recognized as mitigating circumstances:

- Presence of overpayment.

When imposing a fine for non-payment (incomplete payment) of tax under Art. 122 of the Tax Code of the Russian Federation, the presence of overpayments on other taxes was recognized as a mitigating circumstance in the decisions of the Federal Antimonopoly Service of the West Siberian District dated July 10, 2012 in case No. A45-23284/2011, the FAS North Caucasus District dated May 13, 2011 in case No. A32-24703/2010, FAS North Caucasus District dated March 15, 2011 in case No. A32-18613/2010, FAS Moscow District dated December 13, 2011 in case No. A40-131669/10-127-759, etc.

- Independent identification and correction of errors in the declaration.

Mitigates liability for non-payment (incomplete payment) of tax under Art. 122 of the Tax Code of the Russian Federation, independent identification of errors and submission of updated declarations. This opinion was expressed in paragraph 17 of the information letter “Review of the practice of resolving cases by arbitration courts related to the application of certain provisions of part one of the Tax Code of the Russian Federation” dated March 17, 2003 No. 71, resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 26, 2011 No. 11185/10 on case No. A73-16543/2009, FAS Volga District dated January 20, 2011 in case No. A12-11813/2010, FAS Ural District dated October 29, 2012 No. F09-9462/12 in case No. A76-23342/2011, FAS Moscow District dated 12/14/2011 in case No. A40-2691/11-140-12.

- Repayment of arrears, penalties.

Payment of arrears and penalties is recognized as a mitigating circumstance that allows reducing the fine under Art. 122 of the Tax Code of the Russian Federation, in the resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 26, 2011 No. 11185/10 in case No. A73-16543/2009, the Arbitration Court of the North-Western District dated December 23, 2016 No. F07-11124/2016 in case No. A21-1832/2016 , dated 05/18/2016 No. F07-2764/2016 in case No. A21-3467/2015, Arbitration Court of the West Siberian District dated 06/16/2016 No. F04-2227/2016 in case No. A27-17694/2015, dated 12/01/2015 No. F04-25916/2015 in case No. A27-1744/2015, FAS Moscow District dated 06/09/2014 No. F05-5673/2014 in case No. A40-128346/13, etc.

- Minor period of delay in payment.

The Arbitration Court of the Moscow District, in its resolution dated March 13, 2017 No. F05-2050/2017 in case No. A40-53047/2016, considered an insignificant period of delay in tax payment as a basis for reducing the fine imposed by the tax authority under Art. 122 of the Tax Code of the Russian Federation.

Read about liability for non-payment of taxes in the article “Art. 122 of the Tax Code of the Russian Federation: questions and answers.

The fine for failure to submit documents, imposed under Art. 126 or 129.1 of the Tax Code of the Russian Federation, it is possible to reduce if the following circumstances exist:

- Large volume of requested documents.

In the decisions of the Arbitration Court of the Volga-Vyatka District dated December 12, 2016 No. F01-5330/2016 in case No. A79-5914/2015, FAS North-Western District dated April 14, 2014 in case No. A05-2850/2013, FAS West Siberian District dated 02/13/2014 in case No. A27-1027/2013, FAS Moscow District dated 04/03/2012 in case No. A40-77797/11-75-325, the presentation of a large volume of documents was recognized as a mitigating circumstance for reducing the fine, as well as issuing at the same time several demands with a large volume of documents (resolutions of the Federal Antimonopoly Service of the Moscow District dated April 16, 2014 No. F05-3008/14 in case No. A41-59084/12, dated April 3, 2012 in case No. A40-89503/11-99-406, FAS West- Siberian District dated July 23, 2012 in case No. A27-13437/2011, etc.).

Additionally, read the article “A large volume of requested documents is a good argument against a fine.”

- Insignificant period of delay in submitting documents.

A short period of delay in the submission of documents was recognized as a mitigating circumstance in the decisions of the Arbitration Court of the Volga-Vyatka District dated December 12, 2016 No. F01-5330/2016 in case No. A79-5914/2015, FAS Moscow District dated April 16, 2014 No. F05-3008/14 case No. A41-59084/12, dated 04/03/2012 in case No. A40-89503/11-99-406, FAS West Siberian District dated 02/13/2014 in case No. A27-1027/2013

Read about liability for failure to provide documents in the article “Art. 126 of the Tax Code of the Russian Federation: questions and answers.”

The considered list of mitigating circumstances is not exhaustive. Arbitrators may recognize any fact that is documented and capable of arousing sympathy as a mitigating circumstance. As a rule, when deciding to reduce a fine, courts consider a whole range of mitigating circumstances, so the more such circumstances a taxpayer can declare, the higher the likelihood of a positive judicial act.

Circumstances excluding, mitigating and aggravating guilt

Circumstances excluding a person’s guilt in committing a tax offense (Article 111 of the Tax Code of the Russian Federation):

- committing an act containing signs of a tax offense as a result of a natural disaster or other extraordinary and insurmountable circumstances;

- the commission of an act containing signs of a tax offense by a taxpayer - an individual who, at the time of its commission, was in a state in which this person could not be aware of his actions or manage them due to a painful condition;

- execution by the taxpayer (fee payer, tax agent) of written explanations on the application of legislation on taxes and fees given to him or an indefinite number of persons by an authorized government body (an authorized official of this body) within his competence (these circumstances are established in the presence of the relevant document of this body, in meaning and content related to the tax periods in which the tax offense was committed, regardless of the date of publication of such a document).

- other circumstances that may be recognized by the court or tax authority considering the case as excluding the person’s guilt in committing a tax offense.

Circumstances mitigating liability for committing a tax offense (Article 112 of the Tax Code of the Russian Federation):

- committing an offense due to a combination of difficult personal or family circumstances;

- committing an offense under the influence of threat or coercion or due to financial, official or other dependence;

- difficult financial situation of an individual held accountable for committing a tax offense;

- other circumstances that may be recognized by the court or tax authority considering the case as mitigating liability.

If there is at least one mitigating circumstance, the amount of the fine is subject to reduction by at least two times compared to the amount established by the relevant article of the Tax Code of the Russian Federation.

A circumstance aggravating liability for committing a tax offense is the commission of a tax offense by a person who was previously held accountable for a similar offense (within 12 months from the date of entry into force of a court or tax authority decision).

Circumstances mitigating or aggravating liability for committing a tax offense are established by the court or tax authority considering the case and are taken into account when applying tax sanctions.

The statute of limitations for bringing to justice for committing a tax offense is three years, after which the taxpayer cannot be held accountable for committing it.

0

The influence of mitigating and aggravating circumstances on the amount of the fine

The Tax Code provides that in the presence of mitigating circumstances, the fine must be reduced by at least 2 times, and in aggravating circumstances it increases by 100% compared to the amount established by the relevant article of the Tax Code. In this case, repeated prosecution for a similar violation is recognized as an aggravating circumstance (Articles 114, 112 of the Tax Code of the Russian Federation).

The Tax Code does not determine how the amount of a fine should be determined in the presence of mitigating and aggravating circumstances. There are court decisions that indicate that the presence of aggravating circumstances is not an obstacle to the use of mitigating circumstances (see the decisions of the Arbitration Court of the Volga District dated December 23, 2016 No. F06-16503/2016 in case No. A65-5156/2016, the Arbitration Court of the Central District dated 07/14/2015 No. F10-2166/2015 in case No. A64-4167/2014, FAS North Caucasus District dated 05/08/2013 in case No. A32-13690/2012, FAS Ural District dated 06/20/2011 No. F09-3151/11 case No. A76-16585/2010, FAS Volga-Vyatka District dated 03/05/2010 in case No. A82-9056/2009, etc.)

Article 111 of the Tax Code of the Russian Federation. Circumstances excluding a person’s guilt in committing a tax offense

1. The following are recognized as circumstances excluding a person’s guilt in committing a tax offense:

1) commission of an act containing signs of a tax offense due to a natural disaster or other extraordinary and insurmountable circumstances (these circumstances are established by the presence of generally known facts, publications in the media and other means that do not require special means of proof);

2) the commission of an act containing signs of a tax offense by an individual who, at the time of its commission, was in a state in which this person could not be aware of his actions or control them due to a painful condition (these circumstances are proven by submitting documents to the tax authority that in meaning, content and date refer to the tax (calculation) period in which the tax offense was committed);

3) execution by the taxpayer (fee payer, insurance premium payer, tax agent) of written explanations on the procedure for calculating, paying taxes (fees, insurance contributions) or on other issues of applying the legislation on taxes and fees given to him or an indefinite circle of financial, tax or by another authorized government body (an authorized official of this body) within its competence (these circumstances are established in the presence of a corresponding document of this body, in the meaning and content relating to the tax (accounting) periods in which the tax offense was committed, regardless of the date of publication of such document), and (or) compliance by the taxpayer (fee payer, insurance premium payer, tax agent) with the motivated opinion of the tax authority sent to him during tax monitoring.

The provision of this subparagraph does not apply if the specified written explanations, the reasoned opinion of the tax authority are based on incomplete or unreliable information provided by the taxpayer (fee payer, insurance premium payer, tax agent);

4) other circumstances that may be recognized by the court or tax authority considering the case as excluding the person’s guilt in committing a tax offense.

2. If the circumstances specified in paragraph 1 of this article exist, the person shall not be held liable for committing a tax offense.

< Article 110 of the Tax Code of the Russian Federation >Article 112 of the Tax Code of the Russian Federation

Results

Having received an act of prosecution for violation of tax laws in the form of a fine, analyze whether you have mitigating circumstances to reduce it. The list of mitigating circumstances discussed in the article is not exhaustive; any fact that is documented and capable of arousing sympathy can be recognized as a mitigating circumstance. As a rule, mitigating circumstances are assessed in a comprehensive manner, so the more you can declare, the greater the likelihood that the fine will be reduced by 2 or more times.

To submit a request to the tax authorities to reduce the fine, you have a month from the date of receipt of the act of prosecution, and numerous judicial practices on the use of mitigating circumstances will help you argue your position.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Tax Code of the Russian Federation, Article 111 of the Tax Code of the Russian Federation

1. The following are recognized as circumstances excluding a person’s guilt in committing a tax offense:

- 1) commission of an act containing signs of a tax offense due to a natural disaster or other extraordinary and insurmountable circumstances (these circumstances are established by the presence of generally known facts, publications in the media and other means that do not require special means of proof);

- 2) the commission of an act containing signs of a tax offense by an individual who, at the time of its commission, was in a state in which this person could not be aware of his actions or control them due to a painful condition (these circumstances are proven by submitting documents to the tax authority that in meaning, content and date refer to the tax (calculation) period in which the tax offense was committed);

- 3) execution by the taxpayer (fee payer, insurance premium payer, tax agent) of written explanations on the procedure for calculating, paying taxes (fees, insurance contributions) or on other issues of applying the legislation on taxes and fees given to him or an indefinite circle of financial, tax or by another authorized government body (an authorized official of this body) within its competence (these circumstances are established in the presence of a corresponding document of this body, in the meaning and content relating to the tax (accounting) periods in which the tax offense was committed, regardless of the date of publication of such document), and (or) compliance by the taxpayer (fee payer, insurance premium payer, tax agent) with the motivated opinion of the tax authority sent to him during tax monitoring.

The provision of this subparagraph does not apply if the specified written explanations, the reasoned opinion of the tax authority are based on incomplete or unreliable information provided by the taxpayer (fee payer, insurance premium payer, tax agent);

4) other circumstances that may be recognized by the court or tax authority considering the case as excluding the person’s guilt in committing a tax offense.

2. If the circumstances specified in paragraph 1 of this article exist, the person shall not be held liable for committing a tax offense.