Home • Blog • All about EGAIS under 171-FZ • How to fill out and submit a declaration on alcohol in 2021-2022

Maxim Demesh

November 18, 2021

673

The declaration on alcohol in 2022 is submitted in accordance with the current resolution of the Federal Service regulating the circulation of alcohol on the market, signed on December 17, 2022 No. 396. Previously, entrepreneurs submitted reporting documentation in the outdated format No. 11, but from the first quarter of 2022, a new declaration on alcohol is submitted - The new alcohol declaration form is presented in form No. 7. The new requirements apply to all entrepreneurs who own retail outlets and public catering establishments that do not have a deferment when submitting reporting documents on sold alcoholic beverages. In this article, we will try to consider step by step the procedure for filling out and submitting alcohol declarations: how to correctly fill out documentation according to the new requirements, where and in what form to submit reports, deadlines for filing files, what responsibility awaits violators.

Who needs to submit declarations to the FSRAR?

Reporting documentation on alcoholic and alcohol-containing drinks is submitted to monitor the movement of these goods by special services, from the moment of production to delivery to the retail store. Guided by Resolution No. 396, the following market participants are required to fill out and submit such documentation using the new Form No. 7:

- Entrepreneurs who own stores that are located in hard-to-reach areas with unstable communications and do not transmit sales information to the Unified State Automated Information System.

- Catering restaurants selling alcoholic and alcohol-containing products.

- Entrepreneurs and companies supplying alcoholic beverages for sale on board airliners.

Businessmen selling beer and beer drinks are also required to submit sales reports to FSRAR. These declarations are filled out using the new form No. 8.

It is worth noting that those who sell alcohol in stores through online cash registers are exempt from submitting alcohol declarations, since by punching labeled goods through the cash register, the data is automatically transferred to the EGAIS system. This applies only to sellers of alcoholic beverages; those selling beer provide FSRAR reports as usual.

How to fill out an alcohol declaration?

Reporting documentation should be submitted in 2022 in accordance with the requirements specified in the resolution of the Federal Service for Regulation of the Alcohol Market. The new delivery form is slightly different from the previous one - not only the form number has changed, but also the content. Let's take a closer look at the procedure for filling out each section of the provided documentation.

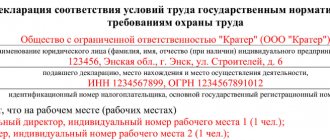

The changes affected not only the sections themselves, but also the title page. Previously, data on the directors and accounting department of the company was indicated here. Now you don’t have to provide this information; you only need to fill out the following fields:

- Manufacturer's tax identification number and checkpoint.

- Number of the quarter for which the report is being prepared.

- Legal address of the enterprise.

- Checkpoints and addresses of stores selling alcohol-containing products.

- Current contact information (email, phone, etc.).

- The date of submission of the alcohol declaration to the executive body, and accordingly its name.

- Ownership of the report (primary or adjustment).

Alcohol declarations provide insight into the movement of products from the manufacturer to receipt at the retail store. Accounting for alcohol-containing goods is carried out in deciliters, one unit of which is represented by ten ordinary liters. Previously, the submitted document contained two sections. According to the new resolution, these sections were amended and a third section was added.

Filling out section No. 1. Information regarding the movement of alcoholic beverages is indicated here, namely:

— Types of products sold, as well as their corresponding codes.

— Information about the manufacturer/importing person (TIN and KPP).

— Information on the quantity of alcoholic goods purchased.

— The quantity of goods sold, written off or returned to suppliers.

— Data on the deciliters of alcohol remaining in the warehouse at the end of the reporting quarter.

The main difference from the previous form: there is no term “import data” when filling out information about purchased goods.

Filling out section No. 2. You must provide information about the purchased products. Previously, this contained columns that contained all the information about the licenses of the supplying segments (number, start date, etc.). At the moment, this information is supplied to the Rosalkogolregulirovaniye system through incoming documentation, so it is not necessary to indicate it in reports. The following fields are required to be filled out:

— Type of product and its corresponding code.

— Data of the manufacturer, importing person or supplier (TIN and KPP).

— The price at which the product was purchased.

— Information from waybills and documents from customs.

— Volume of purchased products in deciliters.

Filling out section No. 3. In the new alcohol reporting section, it is necessary to include information on returns to supplying segments, which is listed below:

— Types of products and corresponding codes.

— Information about the manufacturer/importing entity (TIN and KPP).

— Details of the person receiving the delivery.

— Date of return to the supplier.

— Volume of returned goods in deciliters.

— Information from the TTN and documents from customs.

We have discussed in detail how to fill out an alcohol declaration, then let’s look at the issue of submitting reports to the relevant authorities.

How to submit an alcohol declaration in 2021-2022?

Submission of reporting documents on sold alcohol is carried out through the official website of Rosalkogolregulirovanie and is made in a certain xml format. But first, entrepreneurs need to check that the following prerequisites are met:

- A valid confirmed personal account on the official website of the FSRAR for filing declarations.

- Installed certified crypto provider (CryptoPro, VipNetCSP and others).

- Software for signing and encrypting xml files (for example, CryptLine, CryptoAPM).

- Downloaded certificate from Rosalkogolregulirovaniya.

- Availability of a valid electronic signature certificate.

Submission of reports on sold alcoholic products to executive bodies is as follows:

- 1. First, you need to record inventory balances at the end of the reporting quarter in the EGAIS program.

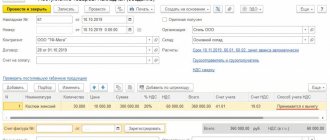

- 2. Next, you should check the data on invoices from suppliers. After reconciling the information on receipts and returns, it is necessary to fill out form No. 7, in accordance with Order No. 396. Entrepreneurs have the right to do this using any of the available options:

— Generate an Excel file, subsequently converting it into the required xml for uploading to the FSRAR website.

— Use one of the programs written to simplify filling out alcohol declarations.

— Use the services of a specialized company engaged in filling out and submitting such reports to executive bodies.

- 3. After drawing up, the finished declaration must be signed with a valid EPC, and also encrypted with a certificate from the Rosalkogolregulirovaniye service.

- 4. The finished signed and encrypted file can only be uploaded to your personal account on the website in the appropriate section, and then wait for the verification to complete.

If the declaration is submitted without errors, a protocol on the positive verification decision will appear in your personal account, which can be downloaded.

Declaration based on the previous one

Accountant Nadezhda has already submitted an alcohol declaration and wants to create a new one based on it. The cloud service Kontur.Alcodeclaration will help Nadezhda.

The accountant loads the XML file into Kontur.Alkodeclaration and moves sequentially from the first step to the sixth. Note that the old declaration and invoices can be downloaded from any program for submitting alcohol reports, for example, from Declarant-Alco.

Kontur.Alcodeclaration automatically fills in the details of the organization and supplier licenses, which are stored in a separate database and updated daily.

Next, the service transfers information about counterparties and balances from the previous period to the current one. The only hope is to enter the receipts and expenses of the current reporting period.

Before sending, the service checks the alcohol declaration for errors and corrects what can be processed automatically.

Ready.

Reports can be signed and sent to FSRAR without switching to the state portal. The accountant will receive the protocol on acceptance of the reports in Kontur.Alkodeclaratsii.

Read more about Contour.Alcodeclaration

When to submit alcohol reporting?

The deadlines for submitting the alcohol declaration in 2021-2022 are clearly stated in the FSRAR resolution. According to the order, entrepreneurs and companies selling alcohol-containing products are required to provide documentation on the following dates:

| Reporting quarter number | Primary reports | Corrective reports |

| 1 | no later than April 20, 2022 | no later than July 20, 2022 |

| 2 | no later than July 20, 2022 | no later than November 20, 2022 |

| 3 | no later than November 20, 2022 | no later than January 20, 2022 |

| 4 | no later than January 20, 2022 | no later than April 20, 2022 |

According to Order No. 396, entrepreneurs can submit adjustment reports later than the established deadlines in the following cases:

- 1. If there are instructions from the FSRAR, executive or regional bodies requiring the elimination of violations.

- 2. If there is a resolution of the executive bodies of regional authorities that control the issuance of licenses and retail trade in alcoholic beverages. In this case, it is necessary to submit the appropriate application from Appendix 11 of Resolution No. 396.

Reporting form for the 4th quarter of 2022

From 01/01/2021, the document that should be followed when submitting a declaration on alcohol in 2022 is the order of Rosalkogolregulirovanie dated 12/17/2020 No. 396. Here are 10 different forms, the procedure for filling them out and the rules for submitting them.

IMPORTANT!

From 04/16/2021, updated codes for types of licensed activities have been established for declarations on the volume of production, turnover or use of ethyl alcohol, alcoholic and alcohol-containing products. More details: new activity codes for alcohol declarations.

Fines for alcohol declarations in 2021-2022

Let's consider what kind of liability threatens for failure to submit alcohol declarations in 2021-2022. To prepare and fill out a new form for submitting a report, individual entrepreneurs and legal entities will require additional resources and significant time costs, since the number of sections has increased. For late submission, as well as refusal to submit reports, businessmen will bear the following types of liability:

- In case of evasion or untimely submission of reports, as well as provision of false information, entrepreneurs will be required to pay from 5 to 10 thousand rubles, and the legal entity, in turn, will pay from 50 to 100 thousand rubles.

- Information presented in reporting documents in incomplete form, as well as the entry of distorted data will lead to payments from 300 to 500 rubles for individual entrepreneurs; Legal entities face a fine of 3 to 5 thousand rubles.

- In case of untimely payment of an administrative penalty, according to the law of the Russian Federation, businessmen and officials can be arrested for 15 days.

- If a fined entrepreneur refuses to pay the penalty, the executive authorities can go to court and order to write off the funds from the debtor’s accounts.

Do not forget that if you submit incorrect declarations multiple times, entrepreneurs and enterprises may completely lose their license to sell alcohol, as FSRAR will submit the relevant decisions to the court.

Fines and administrative liability

Many additional resources are required to prepare and complete alcohol returns. In addition, it takes time to understand the new submission form, since you now need to fill out more sections and columns. For an incorrectly submitted declaration, as well as its absence, entrepreneurs and organizations can expect the following penalties:

- Evasion, untimely submission, as well as distortion of information may entail fines in the amount of 5,000 to 10,000 rubles for businessmen, and for legal entities - from 50,000 to 100,000 rubles.

- Providing information in incomplete or distorted form may result in fines ranging from 300 to 500 rubles for businessmen, and from 3,000 to 5,000 rubles for legal entities.

- Failure to pay administrative fines on time may result in a double fine and an arrest sentence of 15 days.

- If you refuse to pay the imposed fines, the funds will be forcibly written off through bailiffs.

- For repeated submission of incorrect reports, an entrepreneur or organization may be deprived of a license to sell alcoholic beverages through the court.

Conclusion

Entrepreneurs and companies will submit their alcohol declaration in 2022 using the recently approved form number seven, instead of the previous form eleven. Declarations help control the circulation of alcohol on the market, contain information about types and codes, production, importing and supplying persons, as well as the remaining alcohol in deciliters. Reports are submitted for each quarter: reporting dates are the twentieth of the month established by Order No. 396. The documentation is provided electronically in an encrypted file to the Rosalkogolregulirovanie website through the user’s personal account. There is no need to submit a paper version. If you want to reduce labor costs for filling out and sending a declaration, and also avoid making mistakes, you should use the services of specialists to avoid serious fines.

| Expert Director of Development . More than 7 years of experience in the implementation of online cash registers, EGAIS accounting systems and product labeling for retail organizations and catering establishments. Maxim Demesh |

Need help with filing alcohol declarations?

Don’t waste time, we will provide a free consultation and help you submit your declarations to the FSRAR as soon as possible.