BLITZ! K1 is a federal coefficient, updated annually. The value for 2022 is 2.005 . K2 is a regional coefficient; it needs to be clarified with local governments; it is different for each region. It depends both on your region (sometimes even on the municipal area) and on the type of activity you are engaged in.

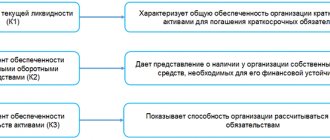

Before finally choosing any tax regime, novice entrepreneurs, and even those who simply decided to switch from one tax scheme to another, should first thoroughly study the features of each of the taxation systems operating in Russia, since all of them have their own subtleties and nuances. UTII is no exception. For example, when calculating the single tax on imputed income, an accountant must take into account the special adjustment coefficients K1 and K2.

Coefficient K1: what is it and what is it for?

The correction coefficient K1 or, as it is also called in professional language, the deflator coefficient displays the amount of inflation. It is established for a period of one year and is subject to application throughout the Russian Federation.

According to the law, the Ministry of Economic Development of Russia is responsible for calculating the K1 coefficient, and by special order it is obliged to publish its value for the next year, no later than November 20 of the current year. If this procedure was not carried out, then last year’s values are automatically extended.

The essence of calculating the K1 coefficient is quite simple: the coefficient for the past year is multiplied by the coefficient for the coming year. True, the preliminary work is much more complicated: ministerial workers have to conduct a thorough analysis of the cost of the consumer basket and its changes during the year. As practicing accountants note, K1 grows every year, which in general is not surprising, since prices for goods and services also increase from year to year.

Tax base: basic profitability and physical indicators

When calculating the Unified Tax on imputed income, regulators take into account the basic profitability for a particular type of activity. Basic yield is an estimated monthly income corresponding to some specific physical indicator. In turn, the unit of physical indicator can be:

- individual entrepreneurs and employees,

- shopping places,

- vehicles (cars and others),

- area of retail premises, i.e. square meters.

To make it clearer, let’s give examples: for veterinary and household services, the physical indicator will be the number of employees, for grocery chains - square meters, for transport enterprises, in turn, the number of cars involved in work, etc.

Tax base = basic profitability x physical indicators.

A separate material contains a table of the values of basic profitability and physical indicators depending on the type of business activity.

Important! It happens that during the tax period there is a change in the value of a physical indicator. In such a situation, this change must be taken into account to calculate the amount of UTII from the beginning of the month in which it occurred.

The physical indicator and basic profitability of each type of activity falling under UTII are established in the corresponding article of the Tax Code of the Russian Federation.

ATTENTION! It is the basic profitability that needs to be adjusted by the coefficients K1 and K2. Thanks to these coefficients, it is possible to take into account the influence of external factors on the profit received by businessmen.

By the way, since the basic income is calculated based on a monthly period, then when determining the tax base, which for UTII, as is known, is equal to a quarter, it must be increased three times (i.e. by three calendar months).

EXAMPLE OF CALCULATION

Let's compare how the tax burden of UTII payers will change with an increase in the K1 indicator. Let’s imagine that an individual entrepreneur provides shoe repair services and has 2 shoemakers working for him. The basic profitability of its activities (“household services”) per month, according to the Tax Code of the Russian Federation, will be 7,500 rubles. Let K2 be equal to 1 in a given region, and the maximum tax rate is 15%. For simplicity of calculations, we will assume that the entrepreneur does not enjoy benefits for compensation for paying insurance premiums.

Let's calculate what tax an individual entrepreneur must pay for the 1st quarter of 2018, when the K1 indicator of last year is still in effect - 1.798. First, let's calculate the tax base: (7500 × 1 × 1.798 × (2 + 2 + 2 (persons)) × 3 = 242,730 rubles. Multiply it by the tax rate: 242,730 x 15% = 36,409 rubles (with rounding, as required by the Tax Code of the Russian Federation).

Now let's see how this indicator changes with the growth of K1 to 1.868 - let's calculate the amount of UTII payment for the 2nd quarter. The tax base will be (7500 × 1 × 1.868 × (2 + 2 + 2 (persons)) × 3 = 252,180 rubles. We take 15% of this amount: 252,180 x 15% = 37,827 rubles.

Thus, the quarterly payment will increase by 1,418 rubles, and at the end of 2022, this individual entrepreneur will have to pay approximately 4,254 rubles more than before.

Dimensions K1 and K2

The values of K1 and K2 UTII in 2022 should be considered separately. K1 - federal deflator coefficient. Tax legislation stipulates that it is approved by the federal government, taking into account the growth of inflation. Below is a table that allows you to understand how this indicator has changed over recent years. Although some time ago officials made concessions and did not increase the coefficients, now they are not making any concessions to business.

| Period | K1 value | Details of orders of the Ministry of Economic Development of the Russian Federation that approved the indicators |

| 2020 | 2,009 | From 10/21/2019 No. 684 |

| 2019 | 1,915 | From 10/30/2018 No. 595 |

| 2018 | 1,868 | From October 30, 2017 No. 579 |

| 2017 | 1,798 | From 03.11.2016 No. 698 |

| 2016 | 1,798 | From 11/18/2015 No. 854 |

| 2015 | 1,798 | From October 29, 2014 No. 685 |

| 2014 | 1,672 | From 07.11.2013 No. 652 |

| 2013 | 1,569 | From 10/31/2012 No. 707 |

Material on the topic 30 facts about UTII

If we talk about the adjustment coefficient K2 in 2022 for UTII, then it is approved by the regional authorities. The legislative and executive authorities of a constituent entity of the Russian Federation are authorized to take into account as much as possible all the conditions in which entrepreneurs work: the “profitability” of the location of the object, transportation routes, the number of potential buyers, their solvency, seasonality and work schedule.

In paragraph 7 of Art. 346.29 of the Tax Code of the Russian Federation established that the limits of the K2 coefficient for UTII for 2022 are from 0.005 to 1. That is, regional authorities are allowed to either lower the maximum tax amount for business or maintain it at the maximum level. The constituent entities of the Russian Federation themselves use the regional deflator to influence the decisions of entrepreneurs on where it is more profitable to open a business and in what specific area. Based on the established indicators, it is easy to notice that for rural areas the K2 coefficient for UTII for 2022 is lower than for cities, and the provision of household services, for example, is much more profitable than passenger transportation. By offering lower taxes to those individual entrepreneurs and companies that agree to work in small localities, officials stimulate business development in a certain area and area.

But since the indicators are approved by local authorities, the K2 adjustment coefficient in 2022 for UTII in St. Petersburg differs from that in force in the Leningrad region or Karelia. Moreover, even in the suburbs of the Northern capital, the values differ depending on the type of business activity and the basic profitability assumed by officials.

Let's look at specific examples of how K2 UTII differs in 2020 in St. Petersburg and the Sosnovoborsky urban district of the Leningrad region (separate values are approved in each district) depending on the type of activity and place of service provision. We emphasize that the list presented is incomplete. The given values are excerpts from the current version of the Law of St. Petersburg dated June 17, 2003 No. 299-35 and the decision of the Council of Deputies of the municipal formation of the Sosnovoborsky urban district of the Leningrad Region dated October 16, 2007 No. 130.

| Type of business activity | K2 coefficient values in St. Petersburg | K2 coefficient for UTII for 2022 in the Leningrad region (only for Sosnovoborsky urban district) | ||

| for municipal districts | for cities and towns | if the salary is more than the regional minimum wage or the individual entrepreneur does not have employees | with wages less than the regional minimum wage | |

| Shoe repair | 0,4 | 0,2 | 0,31 | 0,63 |

| Provision of veterinary services |

|

|

| 1,0 |

| Advertising on vehicles | 1,0 | 1,0 | 0,21 | 0,42 |

| Repair, maintenance and washing of vehicles | 1,0 | 1,0 | 0,52 | 1,0 |

| Cargo transportation | 1,0 | 1,0 |

| 1,0 |

| Transportation of passengers | 0,25 | 0,25 |

|

|

It is important to understand that you do not need to independently calculate K2 UTII in 2020 - this is not provided for by law. Entrepreneurs, of course, have the right to “not bother” and pay taking into account K2, which is equal to 1. But this will lead to overpayment, and it is difficult to return the excess amount.

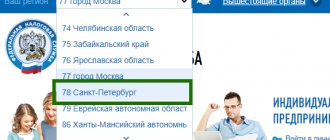

Therefore, find out the indicator you need in your case in advance. Our table K2 on UTII for 2022 by region with links to the current legislation in each subject will help with this.

| 01 | Adygea |

| 02 | Bashkortostan |

| 03 | Buryatia |

| 04 | Altai Republic |

| 05 | Dagestan |

| 06 | Ingushetia |

| 07 | Kabardino-Balkarian Republic |

| 08 | Kalmykia |

| 09 | Karachay-Cherkess Republic |

| 10 | Karelia |

| 11 | Komi |

| 12 | Mari El Republic |

| 13 | Mordovia |

| 14 | The Republic of Sakha (Yakutia) |

| 15 | Republic of North Ossetia-Alania |

| 16 | Tatarstan |

| 17 | Tyva |

| 18 | Udmurtia |

| 19 | Khakassia |

| 20 | Chechnya |

| 21 | Chuvash Republic |

| 22 | Altai region |

| 23 | Krasnodar region |

| 24 | Krasnoyarsk region |

| 25 | Primorye |

| 26 | Stavropol region |

| 27 | Khabarovsk region |

| 28 | Amur region |

| 29 | Arkhangelsk and Nenets Autonomous Okrug |

| 30 | Astrakhan |

| 31 | Belgorod |

| 32 | Bryansk |

| 33 | Vladimir |

| 34 | Volgograd |

| 35 | Vologda |

| 36 | Voronezh |

| 37 | Ivanovo region |

| 38 | Irkutsk region |

| 39 | Kaliningrad |

| 40 | Kaluga |

| 41 | Kamchatka Krai |

| 42 | Kemerovo region |

| 43 | Kirov |

| 44 | Kostroma |

| 45 | Mound |

| 46 | Kursk region |

| 47 | Leningrad region |

| 48 | Lipetsk |

| 49 | Magadan |

| 50 | Moscow region |

| 51 | Murmansk |

| 52 | Nizhny Novgorod Region |

| 53 | Novgorod |

| 54 | Novosibirsk |

| 55 | Omsk |

| 56 | Orenburg |

| 57 | Oryol Region |

| 58 | Penza |

| 59 | Permian |

| 60 | Pskov |

| 61 | Rostov |

| 62 | Ryazan |

| 63 | Samara |

| 64 | Saratov |

| 65 | Sakhalin |

| 66 | Sverdlovsk |

| 67 | Smolensk |

| 68 | Tambov |

| 69 | Tver |

| 70 | Tomsk |

| 71 | Tula region |

| 72 | Tyumen |

| 73 | Ulyanovsk |

| 74 | Chelyabinsk |

| 75 | Transbaikal region |

| 76 | Yaroslavl |

| 77 | Moscow |

| 78 | Saint Petersburg |

| 79 | Jewish Autonomous Region |

| 86 | Khanty-Mansiysk Autonomous Okrug - Ugra |

| 87 | Chukotka Autonomous Okrug |

| 89 | Yamalo-Nenets Autonomous Okrug |

| 91 | Crimea |

| 92 | Sevastopol |

Coefficient K2: conditions and its features

This coefficient, which is also a correction coefficient, unlike K1, takes into account many external factors that can in one way or another affect the business activities of an enterprise or individual entrepreneur working on UTII.

These factors include:

- operating hours of an organization or individual entrepreneur;

- seasonality;

- employee salaries;

- range of goods, services and work performed;

- profitability;

- specific place (address, area) of commercial activity;

- the area of advertising and information fields used and their type;

- other factors.

The above conditions, which are taken into account by the K2 coefficient, are not limited in any way, so the list can be continued.

This is due to the fact that K2 is established in each region individually by representative bodies of city districts, municipal districts, etc. taking into account the characteristics of these territories.

By the way, according to the law, regions may not set this reduction factor, but, as a rule, local authorities still accommodate representatives of small and medium-sized businesses, who mainly work on UTII.

FOR YOUR INFORMATION! The correction factor K2 is considered reducing. Its role is to equalize traders working in different conditions.

For example, this is important for those who do business not in big cities, but in small villages and towns. This coefficient is developed by local authorities and depends on the economic situation in the region. Moreover, representatives of the business community have the right to influence the size of the coefficient through direct appeal to municipal authorities.

This coefficient can be equal to 1, if there are no plans to apply a reduction, or it can be less than 1, then in the tax calculation formula it will turn out to be preferential. If the exact size of K2 for your region has not yet been clarified, and you need to make a preliminary calculation of UTII, it is better to calculate K2 equal to 1. The minimum value of the K2 coefficient is 0.005.

ATTENTION! Coefficients K1 and K2 are established for one year and are subject to annual recalculation.

If the interested authorities establish the value of K2 in all details, then this is very convenient for taxpayers. Otherwise, when municipalities regulate only its individual components, tax entities have to independently calculate the final size of this coefficient by multiplying its established values.

Types of activities in the Lipetsk region that fall under UTII

The types of activities of UTII are specified in Article 346.26 of the Tax Code of the Russian Federation . However, regional authorities may make adjustments to this list. The list of activities in the Lipetsk region is reflected in the Decision of the Lipetsk City Council of Deputies No. 333 of September 13, 2011 “Changes to the regulations on the single tax on imputed income for certain types of activities in the city of Lipetsk.” In addition, the following regulations are in force in the Lipetsk region.

| Area | Normative act |

| Gryazinsky Municipal District (MUR) | Decision of the Gryazinsky District Council of Deputies (RSD) No. 24 of November 27, 2015 |

| Dobrinsky MUR | Decision of the Council of Deputies (SD) of the Dobrinsky Municipal District (MUR) No. 106-rs dated 08.11.16 |

| Zadonsky MUR | Decision of the SD of the Zadonsk MUR No. 370 dated 12/23/11 |

| Khlevensky MUR | Decision of the Board of Directors of the Khlevensky MUR No. 65 of 10.31.08 |

| Usmansky MUR | Decision of the Board of Directors of the Usman MUR No. 6/70 dated 10/22/08 |

| Dankovsky MUR | Decision of Dankovsky RSD No. 251 dated 04.08.05 |

| Krasninsky MUR | Decision of the RSD of the Krasninsky MUR No. 7/97 dated 10.10.08 |

| Lebedyansky MUR | Decision of Lebedyansky RSD No. 145 dated 10.25.14 |

| Lev-Tolstovsky MUR | Decision of Lev-Tolstovsky RSD No. 170 dated July 27, 2005 |

| Dobrovsky MUR | Decision of Dobrovsky RSD No. 150-rs dated June 21, 2005 |

| Lipetsk MUR | Decision of the Lipetsk RSD No. 128 of 07.29.05 |

| Chaplyginsky MUR | Decision of the Board of Directors of the Chaplyginsky MUR No. 101 dated November 25, 2008 |

| Volovsky MUR | Decision of the SD of Volovsky MUR No. 105 dated May 15, 2009 |

| Dolgorukovsky MUR | Decision of Dolgorukovsky RSD No. 137-rs dated June 24, 2005 |

| Izmalkovsky MUR | Decision of the Board of Directors of the Izmalkovsky MUR No. 464-rs dated 12/26/12 |

| Stanovlyansky MUR | Decision of the Stanovlyansky RSD No. 99 of 09.09.05 |

| Terbunsky MUR | Decision of Terbunsky RSD No. 152 dated 06/28/05 |

| Yelets city | Decision of the BoD of the city of Yelets No. 313 dated November 25, 2008 |

| Yeletsky MUR | Decision of the BoD of Yeletsky MUR No. 311 dated 10.31.12 |

Reasons for adjusting the K2 coefficient

Under some circumstances, the value of the K2 coefficient for some specific enterprises or individual entrepreneurs may be changed. In particular, this is possible if:

- the work of the enterprise or individual entrepreneur was carried out for less than the tax period (for example, only two months out of three quarterly months). Moreover, if such an adjustment is not specified in local legislative norms, this cannot serve as a basis for its cancellation;

- the company’s activities did not occur every day, for example, due to sanitary days and weekends, or according to a schedule approved within the organization;

- there was a forced suspension of activities caused by objective reasons. These include force majeure, cases of accidents and repair work, temporary disability of employees, suspension of activities by court decision, etc.

To ensure that tax officials do not suspect a desire to evade paying taxes, these facts must be supported by relevant documents.

IMPORTANT! If for some time an individual entrepreneur or an enterprise located on UTII for some reason did not have contracts and transactions, but, nevertheless, actually carried out commercial activities, then this cannot serve as a legal basis for non-payment of the Unified Tax on imputed income.

In other words, if there are no valid explanations for the lack of income, you will still have to pay this tax.

Deflator coefficient for 2018-2019 for UTII

UTII is a special tax regime introduced in 1998. Entrepreneurs and organizations can switch to imputation at their own request. The special regime ceased to be coercive in 2013.

Now, in order to switch to imputation, a company must meet a number of criteria established by Chapter. 26.3 Tax Code of the Russian Federation. There are restrictions on the size of the company, number of employees, type of activity and some others.

Imputation is chosen because of the simplicity of accounting and reporting: keeping accounting (for individual entrepreneurs), submitting complex tax returns - VAT, personal income tax, income, since the imputed person is exempt from paying these taxes. From July 2022, all impostors, with rare exceptions, are required to work with an online cash register.

Read about the use of online cash registers for UTII in the material “Using an online cash register for UTII (nuances)” .

The single tax is calculated based on the physical indicators of the imputed profitability of the business, the tax rate and the coefficients for UTII.

UTII coefficients are determined in different ways: the K1 coefficient for UTII for 2018-2019 (deflator coefficient), as for previous years, is established by the Ministry of Economic Development, and the size of the K2 coefficient for calculating UTII must be sought in local legislative acts.