An order to work on a day off is an integral part of the work process if employees are involved in performing their duties on weekends and holidays. It is worth paying attention to the fact that such documents must be issued strictly with the consent of the employees.

We have coronavirus-free files! Let's hang in there, guys! Stay at home, wear masks (that's right), don't panic. Let's break through! 03/30/2020

- Form and sample

- Online viewing

- Free download

- Safely

FILES

Exceptions and reasons

If on a day off it is necessary to eliminate the results of an accident, prevent it, or military operations are underway, then an order can be issued without the consent of the workers, without their signature on the document. But these are exceptional cases. In most situations, the reasons are formulated as urgent work to be done. However, when preparing documentation you should be careful and use your imagination. If employees work on weekends very often and the reason is always the same, then this may attract undue attention to the organization of the labor inspection.

Preferential categories of employees

Hiring employees to work on their days off is a delicate matter. There are people who, according to labor legislation, cannot be called to night work at all or use any of their additional time free from work. These include pregnant women (those who have provided a certificate of pregnancy). Moreover, this applies to any terms and trimesters of their pregnancy. These exceptions also include teenagers (minor workers), disabled people of all categories, mothers who have children under 3 years of age.

Trade union organizations usually fight for the rights of such employees. They may well successfully challenge an order to work on a day off, even if it has all the necessary signatures.

Who can be called to work on a holiday?

The ban on hiring on holidays applies to:

- pregnant women (Article 259 of the Labor Code of the Russian Federation);

- minors (Article 268 of the Labor Code of the Russian Federation), exceptions are provided for workers in creative professions and athletes who have not reached the age of majority (Article 348.8 of the Labor Code of the Russian Federation).

Disabled people and women with children under 3 years of age can be involved in such work if (Article 113 of the Labor Code of the Russian Federation):

- the prohibition against it is not contained in the medical report issued by him;

- they do not refuse to work on a holiday (they are notified in advance of their right to refuse upon signature).

The number of persons who have the right to refuse to work on Art. 259 of the Labor Code of the Russian Federation adds:

- single parents raising children under 5 years of age;

- employees with children with disabilities;

- employees whose sick family members, according to a medical report, require care.

A Art. 264 of the Labor Code of the Russian Federation supplements this list:

- single fathers;

- guardians (trustees) of minors.

All other employees may be required to work on a non-working holiday.

The employee’s consent to engage (it must be in writing) will be required only in unforeseen situations and only when the situation is not an emergency (Article 113 of the Labor Code of the Russian Federation). It is necessary to receive it from the employee in advance - before issuing an order to work on a holiday. In agreement, the employee can express his wishes regarding his preferred payment option for work on a holiday.

If there is a trade union organization, the decision to organize work on a holiday, requiring the employee’s consent, must be agreed upon with this organization (Article 113 of the Labor Code of the Russian Federation).

How to obtain consent

If there are no obstacles to exit and the employee is ready to express his consent, then he can do this in several effective ways:

- Write a separate application indicating all the necessary details. It must clearly state that the employee agrees to work on days off, at what rate and for what time.

- Sign a written notice of the opportunity to refuse, drawn up on behalf of the employer.

- Right on the order to work on a day off, he puts his signature with the note “I agree to be hired to work.” The text can be worded differently, as long as it emphasizes unambiguous agreement. This is the only way the paper will be drawn up legally.

Paid or unpaid vacations

In addition, personnel surplus during the period of restrictions may be provided with both annual paid leave and unpaid leave. This is possible with the consent of a specific employee, which is documented in a statement to the employer indicating the period for which he requests to be granted the appropriate leave.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Regular attraction

If the entire work process is based on working on holidays and general weekends, then this must be noted in the employment contract and internal documentation of the organization. Such employees can be journalists, artists, professional athletes. In short, all those who work in the service and entertainment sectors.

Attention! If a schedule has been developed and Saturday and Sunday are working days for a specific employee, then there is no need to draw up an additional order about this.

We change the amount of earnings for an employee for the period of “non-working days”

In the face of financial difficulties, many entrepreneurs are faced with the acute question of whether the employee should be paid wages during declared “non-working days”, in what amount, and how the burden on the wage fund can be legally reduced.

Existing options for the amount of payments are directly related to the employee’s work schedule in accordance with the employment contract and the possibility of reaching the necessary agreements with the employee.

If the organization continues its activities, the employee continues to work in accordance with the employment contract, then no changes in remuneration occur.

When an employee switches to a remote work mode, if there is no change in the duration of working hours, then there will be no changes in the amount of remuneration.

However, if the parties come to an agreement to perform work on a part-time basis in accordance with Art. 93 of the Labor Code of the Russian Federation, remuneration for an employee will be made in proportion to the time he worked or depending on the amount of work he performed.

The corresponding agreement is drawn up simultaneously with the execution of the agreement to begin activities remotely.

For example: if the employee’s normal working hours included a 5-day work week from 9 a.m. to 6 p.m., then when working part-time remotely, the terms of the additional agreement can be formulated as follows:

“The employee is set the following working hours: the working week is five days, from Monday to Friday, from 10:00 to 17:00, with two days off (Saturday and Sunday). Duration of the working day: 6 hours. The start time of the working day is _____ hours, the end time of the working day is ____ hours. During the working day, the Employee is given a break for rest and eating for 1 hour.

The Employee’s remuneration during the period of validity of this additional agreement is made in proportion to the time worked.”

If the employee is transferred to remote mode not by agreement, but by order of the employer in accordance with Parts 2, 3 of Art. 72.2 of the Labor Code of the Russian Federation, incl. for another job requiring lower qualifications, the employee will have to be paid according to the work performed, but not lower than the average earnings for the previous job.

If the organization experiences downtime in accordance with Part 2 of Art. 157 of the Labor Code of the Russian Federation, such downtime is paid in the amount of at least two-thirds of the tariff rate, salary (official salary), calculated in proportion to the downtime.

For example: if an employee’s salary consisted of one salary of 30,000 rubles, then during downtime the salary is calculated at the rate of 2/3 of the salary - 20,000 rubles.

If the employee’s salary consisted of a salary of 30,000 rubles. and bonuses in the amount of 30,000 rubles, then during downtime, wages are also calculated only on the basis of 2/3 of the salary - 20,000 rubles.

It should be noted that the issue of the amount of payments during downtime may be unclear, taking into account the wording of the decrees of the President of Russia, according to which non-working days from March 30, 2022 to April 30, 2022 are established “with the preservation of wages for employees”, etc. 1 Recommendations of the Ministry of Labor and Social Protection of the Russian Federation dated March 26, 2022, according to which “the presence of non-working days in the calendar month (March, April 2022) is not a basis for reducing wages to employees.” However, since no changes have been made to the Labor Code of the Russian Federation, which is a federal law and has higher legal force than the decrees of the President of the Russian Federation, when determining the amount of payments for downtime, one should be guided by the norm of Art. 157 Labor Code.

Elements of an order to work on a day off

The law provides for a free form of this document. This means that the employer has the right to decide for himself how to formulate and create the document. However, the paper must meet a number of generally accepted rules and must contain:

- Name of company.

- The date of the order.

- City.

- Last name, first name, patronymic and position of the employee or several.

- Reason for attraction. For example, “due to an unforeseen production need.”

- Date of a weekend or holiday. If there are several of them, it is better to list each one separately.

- What the employee is entitled to for performing work duties during this time. According to labor legislation, an employee has the right to choose whether to receive financial compensation or an extraordinary day off (time off). If the second option is chosen, then a corresponding statement is written. It is registered separately.

An important point: even if an employee works part-time on a day off, he then takes the whole day off as compensation.

It is also worth noting that the form must be marked in the company’s internal documents as accepted for use. You can't invent something new every time. If this happens, then each time it must be accepted by a separate order, and this is not very convenient.

The procedure for attracting employees to work on holidays

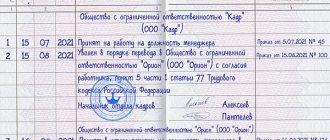

The employer determines the list of employees who need to be involved in going to work on a holiday. Employees give their written consent to leave. This can be a statement from the employee (in any form) or a note in the notice “I agree to be hired.” Consent is not required only in special cases listed in Art. 113 Labor Code of the Russian Federation.

If there is a trade union, the employer must take into account its opinion regarding the involvement of hired personnel to work on a holiday.

The manager must issue an order on working hours on holidays. The employees listed in the order become familiar with its contents. The fact of familiarization is confirmed by a signature on the order or familiarization sheet.

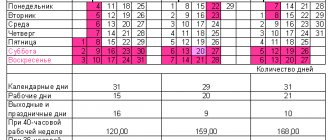

The employer keeps records of non-working holidays in the timesheet in the form T-12 and T-13. Work on holidays is paid at least double, or another day is provided for rest (Article 153 of the Labor Code of the Russian Federation).

In case of violations

If the inspection body notices inaccuracies or direct violations of the labor code in the interaction between the employer and the employee, then it has the right to hold the employer accountable for this.

For organizations, fines for improperly inviting employees to work on a day off range from 30 to 50 thousand rubles.

There are cases when during a judicial investigation it was proven that responsibility for violations lies with an official. Or we are talking about a private entrepreneur. Then these fines are much lower: from 1 thousand to 5 thousand rubles.