Why pay insurance premiums?

Before telling where, who, when, and on what grounds insurance premiums must be paid, it is necessary to briefly outline their meaning.

The essence of mandatory fixed insurance payments is that the payer has to regularly transfer certain funds to policyholders, who subsequently, when insured events occur, make the necessary compensation for them. This guarantees citizens of the Russian Federation free assistance in difficult life situations, as well as a paid pension.

Contributions paid to the Social Insurance Fund

Insurance premiums in case of disability are calculated at legally established tariff rates and depend on the category of the insured. It is from these contributions that benefits are subsequently paid during sick leave or benefits for the birth of a child.

This type of contribution is distinguished separately because its calculation and payment is regulated by a separate law at the federal level. The tariff rate level is determined depending on the occupational hazard class of the activity carried out by the insurer.

Where to pay insurance premiums

The addressees of insurance premiums are:

Attention! At the moment, the only addressee of insurance premiums is the Federal Tax Service!

- of the Russian Federation or Pension Fund of the Russian Federation. In this case, money contributed to the Pension Fund is accumulated in special pension accounts of citizens and serves as the basis for a future pension;

- FFOMS or Federal Compulsory Medical Insurance Fund - payments are made here for all kinds of medical purposes;

- FSS or Social Insurance Fund is another fund to which payments are mandatory. From here, in the future, there is a reimbursement of funds due to payments to employees of organizations who went on maternity leave, as well as child care. This also includes, in cases provided for by labor legislation, deductions for insurance against various injuries received in the process of performing work tasks and occupational diseases.

As a rule, payments to the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund largely cover the costs of public medical institutions for medicines, equipment, transportation costs, staff salaries, etc.

At the same time, compulsory insurance is necessary for the free provision of services to the population. By:

- basic outpatient care;

- dentistry;

- Ambulance;

- vaccinations;

- prosthetics;

- some other types of medical care.

Nuances

There are many more subtleties in paying insurance premiums. First of all, these are different tariffs. Special rates are provided for:

- small and medium business;

- IT organizations of the Russian Federation;

- Skolkovo participants;

- NPO on the simplified tax system;

- some territories: Crimea, TASED, SEZ, port of Vladivostok;

- creators of cartoons, audio and video products.

In general, employers do not pay contributions for crew members of Russian ships.

In addition, it is important whether the employee works under a GPC agreement or an employment contract: in the first case, the employer is exempt from contributions for temporary disability and injuries, but pays contributions for pension and health insurance.

Payers of insurance premiums

As mentioned above, citizens are not required to pay their own contributions to various state insurance funds. Their employers should do it instead. In particular:

- organizations, enterprises, legal entities using hired personnel;

- individual entrepreneurs who do not involve other people in their business - in this case they must pay insurance payments for themselves personally;

- individual entrepreneurs, if they have hired employees or contractors under contracts, must make full contributions for each of them;

- individuals who do not have individual entrepreneur status, but are engaged in professional activities. These could be lawyers, doctors or lawyers;

- citizens who hire workers for daily services, such as housekeepers, drivers, gardeners, nannies or governesses.

Important! There are situations when the employer or payer for these insurances belongs to several of the above categories at once. For example, an individual entrepreneur privately uses the services of a maid and a security guard. In this case, the obligation to pay insurance premiums is differentiated and occurs on each individual basis.

For your information! Commercial organizations and individual entrepreneurs must pay insurance premiums, regardless of what taxation system they operate on.

Legal entities must calculate and pay insurance premiums monthly, but individual entrepreneurs in this case have a wider choice: they can make insurance payments monthly, quarterly or in a lump sum at the end of the year. Each individual entrepreneur independently determines the payment mode that is most convenient for him.

Objects under Article 420 of the Tax Code of the Russian Federation

Tax legislation provides for sets of objects for each of three groups of contribution payers:

Group 1: employers - companies and individual entrepreneurs

The objects of taxation of insurance premiums in 2022 for employers are:

Group 2: individual employers (not entrepreneurs)

For this group of contribution payers, the legislation provides for the following:

Group 3: Individual entrepreneurs, lawyers, appraisers, mediators, private notaries and other similar categories of persons engaged in private practice who do not make payments to individuals

What are the objects for this group of contribution payers, see in the figure:

At the same time, a number of payments are not recognized as subject to taxation with insurance premiums (clauses 4-8 of Article 420, Article 422 of the Tax Code of the Russian Federation).

From what payments are insurance premiums made?

The list of payments from which insurance premiums are calculated is strictly defined by law. This:

- employee salaries;

- monthly, quarterly and annual bonuses;

- compensation for vacation not used by the employee;

- vacation pay.

In addition, insurance deductions must be made from payments to citizens who are contractors of individual entrepreneurs and organizations, but only in cases where they do not have individual entrepreneur status. The basis for payments to private contractors are copyright and civil law contracts.

However, we must remember that there are types of payments for which insurance premiums are not made. The exceptions are:

- travel expenses (in full: for travel, rental housing, food, etc.);

- benefits paid to pregnant women, as well as young mothers;

- compensation for sick leave;

- financial assistance paid by employers to an employee, but only if its amount does not exceed 4 thousand rubles.

Contributions under other laws

Not only tax legislation determines the objects of taxation of insurance premiums:

Next, we will talk about the objects of taxation with insurance premiums levied on employers (companies, individual entrepreneurs and individuals), as well as private practitioners (notaries, appraisers, etc.) who do not employ hired labor.

It should be noted that the expressions “objects of taxation for calculating insurance premiums” or “object of taxation with insurance premiums” are not entirely correct - contributions and taxes are different independent concepts. Therefore, further we will use the expression “object subject to insurance premiums”.

Find out more about taxable objects for different taxes:

- “What is the object of VAT taxation”;

- “Object of taxation for corporate property tax”;

- “What is the object of taxation under the mineral extraction tax.”

Amounts of insurance payments

The amount of insurance contributions to each fund is strictly fixed and fixed as a percentage of employee salaries.

- Russian Pension Fund . Since 2014, this type of insurance does not need to be divided into savings and insurance parts, but must be paid in the amount of 22% of the insurance component in one payment;

- Federal Compulsory Health Insurance Fund . Here the fixed payment amount is 5.1% of the wages paid to the employee;

- Social Insurance Fund. In this case, the contribution amount is 2.9% of the accrued salary. Separately, policyholders must pay two more contributions to the Social Insurance Fund:

- in case an employee goes on maternity leave or to look after a child;

- in case of injuries sustained at work, as well as the development of occupational diseases.

It is worth noting that some categories of payers can count on lower insurance rates. For example, enterprises and individual entrepreneurs engaged in textile production or food production pay contributions to the Pension Fund of the Russian Federation at a rate of 20%.

And, on the contrary, some employers are required to make contributions in a higher amount, for example, for those employees who work in harmful and dangerous working conditions, hot shops, etc. - for them, contributions to the Pension Fund should be 9% higher than the standard rate.

For total amounts by year and more detailed information, see the individual entrepreneur insurance premiums page.

You can make an online calculation of your exact amount using a special individual entrepreneur insurance premium calculator.

Insurance premiums: types, rates, terms of accrual and payment

An employee’s remuneration is a remuneration for his work activity, which is calculated based on his qualifications, the complexity of the work performed, the number of hours worked, the quality of work and other criteria. In addition to wages, such remunerations include incentive and compensation payments.

According to the legislation of the Russian Federation, the employer pays mandatory amounts from such payments, which go to the country’s budget. They are called insurance premiums (hereinafter - IC).

What are insurance premiums?

The Tax Code, or rather its eighth article, says that these are payments that the state collects from employers for financial support for the implementation of the rights of insured persons to receive security for one or another type of compulsory social insurance.

Types of insurance premiums: what are they?

Article 8 of the Tax Code distinguishes between the following types of contributions for compulsory insurance:

—

for pension (OPS);

—

for medical (compulsory medical insurance);

—

for social - in case of temporary disability and in connection with maternity (VNiM);

—

on injuries (from accidents and occupational diseases).

SV are calculated from salaries and other payments to employees, which include (Article 420 of the Tax Code):

—

bonuses;

—

vacation pay and compensation for unspent vacation;

—

financial assistance more than 4000 rubles. per employee per year.

Payers of insurance premiums: who are they?

SV must be paid by all employers who pay wages and other payments to employees (clause 1 of Article 419 of the Tax Code of the Russian Federation).

Payment of contributions is made directly from the organization’s funds: this amount is not deducted from the employee’s salary.

Payers can be both legal entities (organizations and individual entrepreneurs) and individuals.

An important point: individual entrepreneurs pay SV not only for their employees, but also for themselves (clause 2 of Article 419 of the Tax Code of the Russian Federation).

Contributions are levied on payments to employees hired under an employment contract and (or) a civil law agreement (GPC).

If an employee is hired under a GPC agreement, then the employer does not need to pay compensation for VNIM and injuries. But you will still have to pay for compulsory medical insurance and compulsory health insurance.

Payments not subject to taxation

According to Article 422 of the Tax Code, contributions are not subject to taxation:

—

Benefits from the state: unemployment, temporary disability, pregnancy and childbirth and others.

—

Compensation payments: compensation for harm caused to health, payment for rent of residential premises, reimbursement of food costs, sponsorship of advanced training, etc.

—

Lump sum financial assistance – due to an emergency, natural disaster, death of a family member, birth of a child.

—

Income (except salary) received by members of communities of small indigenous peoples of the Russian Federation.

—

Financial assistance – up to 4,000 rubles. per employee.

—

Reimbursement of employee expenses for repaying loans and borrowings for the purchase or construction of housing.

—

Other types of compensation payments.

Maximum base of insurance premiums

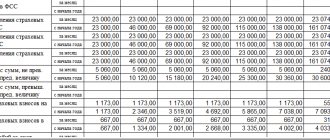

When calculating the amount of contributions, not only the rates are important, but also the maximum value of the base for them - that is, the maximum limits. The base limit is established only for contributions to mandatory pension insurance and VNiM. According to the SV for compulsory medical insurance and for injuries - no. In 2022, the maximum values of the SV base are as follows:

—

for OPS – RUB 1,292,000.

—

at VNiM – 912,000 rubles.

Insurance premium rates

In 2022, the following SV rates (tariffs) have been established.

| View SV | SV rates | |

| Employee income WITHIN the established maximum base amount | The employee's income is ABOVE the established base limit | |

| On OPS | 22% | 10% |

| On compulsory medical insurance | 5,1% | |

| At VNiM | 2,9% | Not credited |

For some companies, reduced (preferential) CB rates have been established. Companies that comply with the conditions of clause 5 of Art. have the right to use them. 427 Tax Code of the Russian Federation. For example, IT companies that develop computer software. They can use CB rates of 8% for compulsory medical insurance, 4% for compulsory medical insurance, 2% for VNiM.

And if payments to an employee exceed the maximum bases (limits), then there is no need to accrue SV for OPS and VNiM from payments to this employee.

As for the insurance policy for injuries, the rates for this type in 2020 remain at the same level. The rate depends on the professional risk class of the company. To calculate the SV in 2020, the organization needed to confirm its main type of activity by April 15, 2022 - so the Social Insurance Fund will set its tariff for the current year.

There are 32 tariffs in total, they are formed taking into account different areas of activity (Article 1 of Law No. 179-FZ). The minimum rate is 0.2%, it corresponds to the first class of pro-free. The maximum rate is 8.5%, corresponding to the thirty-second class.

Here are examples of injury rates in 2022.

| Occupational risk class | SV rate for injuries |

| First | 0,2% |

| Fifth | 0,6% |

| Tenth | 1,1% |

| Twenty fifth | 4,5% |

| Thirty second | 8,5% |

Procedure and terms of accrual and payment

SV for compulsory medical insurance, compulsory medical insurance and VNIM are paid to the Federal Tax Service at the location of the payers, SV for injuries - to the Social Insurance Fund. Contributions to the Pension Fund in 2020 are not paid at all.

If a company has separate divisions in other cities, then the CB is paid at the location of the parent company, except in cases where the “separate division” is vested with special powers.

SV is accrued monthly for each employee on the last day of the month, based on the base for calculating SV. And they are paid no later than the 15th day of the next calendar month. If the 15th falls on a weekend (Sat/Sun/holiday), then contributions are paid on the working day following the weekend. For example, CB for October must be paid no later than November 16.

You can pay earlier, but not later. For each day of delay, penalties are charged.

Paid CBs are issued in the form of separate payment documents.

Reporting on insurance premiums

So, the employer who has entered into an employment contract and (or) civil service contract with an individual and pays him remuneration is required to submit reports on insurance premiums. When accruing remuneration, he is obliged to calculate insurance premiums from them, pay them, and then submit reports to government agencies.

Organizations report on insurance premiums in any case: regardless of whether payments were made to individuals in the reporting period or not. If there have been no payments, so-called zero reports are submitted.

With individual entrepreneurs the situation is different. If an individual entrepreneur does not have employees and is not registered as an employer, then he does not submit reports on insurance premiums.

The reporting periods for all types of insurance premiums are the same: quarterly, half-year, nine months. The billing period is one year. At the end of each of the specified periods, SV payers must report on the base, the amount in which insurance premiums were calculated, and which payments were not subject to contributions.

Reporting forms for 2020-2021 consist of 4-FSS and a unified calculation of insurance premiums. 4-FSS is intended for calculating the base and contributions for injuries; it is submitted to the FSS. In a single calculation, SVs are calculated for pension, health insurance and in case of disability. This document is submitted to the tax service.

Deadlines for submitting reports

The deadline for submitting 4-FSS depends on the method of submission - paper or electronic. If the report is submitted on paper (for companies with an average headcount (SAH) or number of employees of less than 25 people), then the deadline is before the 20th day of the month following the reporting period. If the report is sent electronically (for companies with a capital account or the number of employees over 25 people), then the deadlines are increased by 5 days.

Employers submit a single calculation of insurance premiums by the 30th day of the month following the reporting period. Here, the deadline for delivery does not depend on the method of sending. However, there is also a requirement for the number of employees. Employers with SSC or more than 10 employees must submit the report electronically.

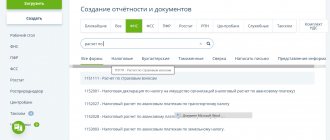

With services for submitting reports electronically from Taxcom, you will not miss a single report. The accountant's personal calendar will remind you of due dates, and the error checking system will prevent you from sending an incorrectly completed report. When filling out, there is a hint system that will help you fill out the form.

Taxcom offers a choice of three services for electronic reporting, depending on the size of the business, its needs and the accounting and information systems used.

Thus, the cloud solution ]Online-Sprinter[/anchor] is perfect for small and medium-sized businesses. This is a web office, in which you only need any PC and Internet access. Online Sprinter is an additional tab in the browser through which you can submit reports and correspond with the Federal Tax Service. Data is securely stored in a cloud archive.

There is no need to update the service: users always see only the current version of the software.

Form 4-FSS in Online Sprinter:

Form of a single calculation for SV in Online Sprinter:

The Dockliner solution is suitable for larger enterprises and those who are inclined to choose software solutions installed on their work computer. Data storage is carried out on the user's PC. At the same time, working in the service is as simple as in Sprinter.

Several employees can work in Documenter at the same time, which is convenient for companies with several accountants responsible for different areas of reporting. You can configure different access rights for them.

Dockliner has a background update mode that does not distract the PC user. The program can also automatically determine the type of document, sender and recipient - just transfer the document from a folder on your computer to the Documenter window. The service starts instantly even with a large database of documents.

And for those who are used to working in the 1C system, Taxcom offers to submit reports directly from it. Solution 1C: Electronic reporting supports most popular configurations of the 1C family. Thus, the solution allows you to work from the familiar interface of a familiar program, without transferring data and without re-entering it.

reporting

Send

Stammer

Tweet

Share

Share

Reimbursement of tax payments from insurance contributions

Fixed insurance premiums paid regularly and without delay can serve business representatives well in the future. For example:

- Individual entrepreneurs who do not have employees can reimburse paid taxes in 100% of the amount paid for insurance premiums;

- Individual entrepreneurs using the labor of hired employees have the right to reduce tax payments by 50% of the total amount of insurance premiums paid for employees;

- Enterprises and organizations , also if they pay contributions to state insurance funds on time, can offset them as tax compensation in the amount of 50% of payments for all employees.

That is, it is extremely beneficial for employers to make insurance payments in full and on time.

Thus, when calculating and making insurance premiums, you need to remember many factors. However, the first thing that should definitely not be forgotten is that all enterprises, individual entrepreneurs, just like ordinary citizens of the Russian Federation who use the services of hired personnel, or, in other words, who are employers, are required to pay the corresponding fixed insurance contributions to all extra-budgetary funds .