Primary accounting documents are drawn up to register the facts of economic life in the company. The forms are compiled in free form and stored in paper form or in an electronic document management system (EDF). The procedure for working with the primary office is regulated by Art. 9 402-FZ of the Russian Federation.

In this article we will look at cases that should not be allowed when working with primary documents in order to avoid penalties.

Lack of primary documents

Partner companies exchange scans of signed documents. Subsequently, the copies are replaced with signed originals, which are sent by mail. The procedure for signing and the terms of dispatch are fixed in the agreement between the counterparties.

The tax office will fine a company if, during an audit by the Federal Tax Service, a business transaction is reflected in the organization’s records, but the primary accounting document is missing.

Therefore, it is important to monitor partners in the field of timely sending of original originals.

The absence of a primary accounting document is regulated by Art. 120 Tax Code of the Russian Federation. For violation, the organization will be charged:

- 10 thousand rubles for a one-time violation;

- 30 thousand rubles for repeated violation within one tax period;

- 20% of the amount of unpaid tax, but not less than 40 thousand rubles if the violation resulted in an underestimation of the tax base.

In accordance with Art. 15.11 Code of Administrative Offenses of the Russian Federation, the official will receive a fine :

- from 5 to 10 thousand rubles for a single violation;

- from 10 to 20 thousand rubles or disqualification of the position for a period of one to two years - in case of repeated violation.

Also, the Federal Tax Service has the right to remove from the tax base those expenses that are not documented. In this case, the organization will have to pay additional income tax.

A primary accounting document lost during a natural disaster or force majeure must be restored. In this case, the operation is considered unconfirmed and does not relieve the organization from liability.

Procedure for loss of documents

Taking the right actions immediately after discovering a loss will help you avoid problems with regulatory authorities. Let's consider the sequence of measures taken:

- Creation of a commission. Its participants will be involved in establishing the causes of the loss. The conclusions must be stated in the act. It must indicate the circumstances of the incident.

- Creation of supporting documents. The company needs to present papers confirming the circumstances of the loss. If documents are missing, you need to send a statement to the police, and then get a certificate of initiation of a case. If papers are lost as a result of a fire, you need to draw up a report of the fire, and also take a certificate from the Ministry of Emergency Situations.

- Compiling an inventory of the missing primary item. Filling out the inventory is a voluntary step. However, it is still advisable to do this, since additional supporting documents will become an argument in favor of the company.

- Measures to restore documents. If no corrective action is taken, the company may be accused of dishonesty. We will consider the paper recovery algorithm in the next section.

Question: Is it legal to hold an organization liable under clause 2 of Art. 126 of the Tax Code of the Russian Federation for failure to submit lost documents (information) within the prescribed period at the request of the tax authority under Art. 93.1 of the Tax Code of the Russian Federation outside the scope of tax audits? View answer

IMPORTANT! When supporting documents (for example, a certificate of initiation of a case) are received, you must check them for errors. If the papers contain errors, the regulatory authorities will not take into account the argument about the loss of the primary document. Let's look at an example of judicial practice. The organization provided documents indicating that the primary site burned down. However, an error was made in the fire certificate. In particular, the address is incorrect. Because of this, additional taxes and penalties were assessed. You can get acquainted with the case in more detail by reading the resolution of the AS of the Ural District No. F09-9606/15 dated February 1, 2016.

Lack of required details

In accordance with 402-FZ dated December 6, 2011, the primary accounting document must contain the required details :

- Title of the document;

- date of compilation;

- name of the organization that compiled the document;

- content of the fact of economic life;

- the value of natural or monetary measurement;

- positions of the persons who made the transaction;

- those responsible for processing the transaction;

- signatures of the participants' faces.

The Federal Tax Service pays special attention to the signatures of the parties, the absence of which indicates a failed transaction. In this case, the inspectorate will assess additional taxes.

Damage to documents

It is possible for a primary accounting document to be damaged when stitched or pierced to be entered into the archive. When carrying out such actions, details of accounts or acts may be damaged.

The primary document will be accepted by the Federal Tax Service, even if the document is damaged, if based on the remaining data it is possible to identify:

- seller;

- buyer;

- name of goods, works or services;

- property rights;

- price.

In other cases, you need to make a request for a duplicate document from your partner.

In what cases are scans of primary documents allowed and in what cases are they prohibited?

Art. 9 402-FZ contains information that primary accounting documents are prepared only on paper or electronically.

Digital documents are signed with a qualified electronic digital signature (UKES). It is this type of signature that gives digital documents legal force and confirms their authorship. Astral-ET and 1C-ETP from Kaluga Astral Center are suitable for signing digital documentation, exchanging documents between counterparties and submitting reports to government agencies.

The federal law does not include text that allows the use of primary scans. Working with scanned copies and registering them as primary documents is prohibited by law.

However, there are exceptional cases for which the use of scans is permitted, as indicated by the letter of the Ministry of Finance dated 04/22/2020 No. 03-01-10/32570. The document allows you to account for and process expenses based on scanned images of documents while the organization does not have the opportunity to obtain their original copies. This is due to the aggravated epidemiological situation in the country. Many accounting employees switched to remote work, while employers did not have time to connect to electronic document management. For such a case, the tax service has taken the above measures.

To prevent an organization from being fined for using scans during a pandemic, it is necessary to make changes to the company’s accounting policies. It should indicate that, based on government regulations, work with primary documents is carried out using scanned images. After the epidemiological situation in the country improves and the company’s accounting employees leave the remote work mode, the company undertakes to exchange original documents.

Not all details are filled in

As arbitration practice shows, in such cases the courts often take the side of taxpayers.

PRIMEROO transferred funds to the foreign partner to pay for consulting services. However, the act confirming the provision of services did not contain all the necessary details. During the on-site inspection, tax inspectors regarded this as a violation of the Federal Law “On Accounting” and excluded the amount paid to the foreign partner from the cost price. As a result, it was decided to charge additional tax, as well as collect penalties and fines from the enterprise. did not agree with the inspection's decision and appealed to the arbitration court. Having studied the case materials, the court sided with the enterprise. He, in particular, pointed out that “minor deficiencies in the preparation of primary documents ... do not indicate the absence of a business transaction, as well as the absence of expenses for the company to pay for consulting services.”

Due to the abolition of the mandatory use of unified forms of primary documents, companies should reduce the number of disputes with inspectors. Controllers will no longer be able to “remove” expenses due to improperly executed documents, since the requirement to use standard forms of documents does not exist from January 1, 2013 (Article 9 of the Federal Law of December 6, 2011 No. 402-FZ).

Are fines possible for scanned copies of the primary document?

Penalties can be received if the company's accounting policy does not stipulate the use of scanned images of primary accounting documents. Organizations also use scans, assuming that they will receive the originals. If after the pandemic the company still does not receive original copies of documents, then the Federal Tax Service will fine the company for the lack of primary documentation and assess additional taxes.

To avoid penalties, you must connect to an electronic document management operator. Registration of primary documents in electronic form provides the following advantages:

- use of legal electronic copies that are signed by UKEP;

- instant data transfer between counterparties;

- saving time for participants in electronic document management.

Astral Group of Companies offers modern products for sending primary electronic accounting documents to counterparties: Astral.EDO and 1C-EDO. These services allow you to interact with partners and regulatory authorities while complying with tax laws. A 24-hour support service will help clients launch an EDI system, connect counterparties to exchange files, or send reports to government agencies.

How to choose an accountant

When hiring an accountant or choosing an outsourcing company, focus on an objective assessment of the applicant’s professional qualities, and not on recommendations from friends.

How to check the qualifications of an accountant when applying for a job

Written test

To weed out incompetent specialists, we recommend conducting a written test among candidates for the position of accountant.

Many accounting websites offer professional test options for accountants. Select a test that matches your company's activity, or use our test option with answers.

The questions in the tests can be complex, designed for a high level of theoretical training of a specialist. If the applicant correctly answered only 2/3 of the questions, then this is already a good result and should be admitted to the next test.

If during testing an accountant answered 60% of the questions correctly, this is a good result.

Knowledge of accounting news

When starting to search for a competent specialist, subscribe to the accounting newsletter, for example: “Glavbukh”, “Clerk.ru”, “Glavnaya Ledger” or ppt.ru.

When interviewing a candidate, select a news item from the newsletter and ask the candidate what he thinks about it. For example: “I heard that the State Duma has adopted a bill to exclude movable property from the list of objects of taxation starting next year. What do you know about this?

Competent accountant up to date with accounting news

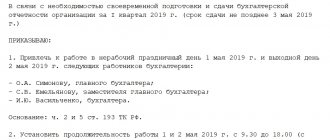

Dates of dismissal from previous jobs

Be sure to pay attention to the dates the candidate left his previous jobs. If these dates fall at the end and beginning of the reporting period, this is an alarming signal. Perhaps the accountant started accounting and quit in order not to submit reports and avoid responsibility.

Critical dates for dismissal of an accountant: from March 20 to April 20, from June 20 to July 20, from September 20 to October 20, from December to the end of January. A responsible specialist will not allow you to leave behind “tails” that create problems for the manager. It is worthwhile to find out the reason for the accountant’s dismissal during such periods.

The responsible accountant will not resign at the beginning and end of the reporting period

A small trading organization was choosing an accountant who would keep records as a single person. Of the 57 people who came for the interview, only 8 were able to correctly answer 2/3 of the questions from the accounting test. During the subsequent conversation, only 2 of the 8 remaining were able to comment on the accounting news. The remaining 49 “professionals”, who could not even answer the test questions, are currently doing accounting somewhere.

Recommendations for choosing an outsourcing company

Some small business owners do not hire in-house accountants and use specialized accounting firms. This allows you not to depend on vacation or sick leave and reduces the organization’s expenses for social contributions.

Here are some tips on what to look for when choosing an outsourced accounting firm:

1. Read the company’s website - there should be accounting news there.

Every accounting firm that respects its clients has a website where it posts accounting news and useful information for entrepreneurs. Often, through a personal account on such a site, an entrepreneur has access to his accounting registers and documents.

2. Study the recommendations and reviews about the company on the outsourcer’s website - they must be real.

Please note the review dates. If they are all in the same time interval and there is no replenishment of the “collection”, perhaps they were collected on purpose. Check with the reviewers whose reviews are posted to see if they are currently employed by the accounting firm you are interested in.

3. Find out the scope of activity of most of the companies that the company serves - it’s good if yours is the same.

It’s great if among the outsourcer’s clients there are organizations conducting activities similar to yours. If there are no such organizations, it may turn out that the firm's accountants will not know the industry nuances of your type of activity.

4. Study the contract and the full list of services that will be provided as part of the fulfillment of the obligation to maintain accounting records.

This will help determine the boundaries of the outsourcing company’s responsibility and eliminate further disputes.