You can be involved in work on weekends without the consent of the employee:

- to prevent an industrial accident, catastrophe or natural disaster;

- to prevent accidents, destruction or damage to property;

- to perform work the need for which is due to the introduction of a state of emergency, urgent work under emergency circumstances.

Creative workers from cinema, theater, media, etc. can be recruited to work on weekends and holidays according to the rules established by the collective agreement.

On this topic:

Will time off for working on a weekend affect my salary?

In other cases, employment on weekends and holidays is permitted with the written consent of the employee and taking into account the opinion of the trade union.

Disabled people and women with children under three years of age can be recruited to work on weekends and holidays only with their consent, unless such work is prohibited for medical reasons.

These employees must be informed in writing of their right to refuse to work on a weekend or holiday.

Legal holidays: what to consider for the employer

Every working citizen has the right to a weekly rest - a period of time established by the internal rules of the enterprise when one can legally not attend the place of work and not perform work duties. The mechanism for determining the number of days off is prescribed in the Labor Code:

It happens that production and technical conditions do not allow the entire workforce to suspend work at an enterprise on weekends. In this case, the Labor Code of the Russian Federation allows for a different regime of weekly rest: each group of workers, in accordance with the internal labor regulations (internal labor regulations), rests alternately on different days of the week.

ConsultantPlus experts spoke about the nuances of wages on weekends for salaried employees. Study the material, get trial access to the K+ system and go to the Ready-made solution. It's free.

When planning work and rest time, the employer should follow the four main rules of the Labor Code of the Russian Federation on weekends:

We will talk further about who can and cannot be called to work on a day off, as well as who has the right to refuse to work on their legal day of rest.

How, according to the law, you need to pay for work on weekends and holidays

To avoid misinterpretation and abuse by employers, the law clearly and consistently develops a procedure for paying for work on weekends and holidays.

First of all, it should be especially noted that calendar holidays that fall on working days should in no case be taken as a basis for reducing the salaries of employees.

And if the company’s personnel are forced, due to some special circumstances, to go to work on a weekend or holiday, then this must be compensated. There are three options:

- IN double size wages for the following categories of workers:

- those who receive a fixed salary;

- those who are on the so-called “deal”, i.e. piecework wage system;

- those employees whose work is paid in accordance with the tariff rates adopted within the company.

- Other increase for weekends and holidays. This path is possible if the enterprise has a collective agreement or a corresponding local regulation. In addition, individual additional payments are possible if this is stipulated in specific employment contracts.

- You can compensate for working on a day off by giving the employee time off at a time convenient for him in the near foreseeable future. At the same time, no double payment for a day off is made. This method of compensating for a day off requires the written consent of the employee.

Attention! Regarding payment for holidays, there is one more subtlety that needs to be remembered: even if an employee works part-time or part-time, he must receive double pay for holidays!

At the same time, it does not matter whether for the employee the holiday is a non-working day or a scheduled working day.

Non-working and working holidays: how to pay

We perceive a holiday primarily as additional time for relaxation. However, not every holiday allows you to legally not go to work:

Non-working days and holidays have been approved for 2022. See our 2022 production calendar in this publication.

Payment for working holidays is made in the usual manner (as an ordinary working day). Pay on non-working holidays has some nuances:

- for salaried employees, the presence of non-working holidays in a calendar month is not grounds for a salary reduction;

- Shift employees for working according to a schedule on a non-working holiday are entitled to additional remuneration, the amount and procedure for payment of which are established by internal local regulations of the enterprise.

Thus, the legislation also establishes specific rules for holidays:

The mechanism of remuneration on holidays is mainly influenced by the operating mode of the enterprise. For example, no “holiday” additional payments will be required if all employees are paid based on salary, there are no shift workers and there is no need to be called to work during holidays.

The employer should also not forget that he cannot always invite the entire workforce to work on a holiday or day off - there are restrictions and prohibitions in this matter established by labor legislation.

We explain how sick leave and vacations that fall on holidays are paid in the following materials:

- “How to calculate vacation if it falls on holidays”;

- “How sick leave is paid on holidays.”

Limitations and tolerances

The legislator's approach to the issue of work on non-working days is reflected in Art. 113 of the Labor Code of the Russian Federation: it is prohibited to call employees to work on their legal days off and officially established non-working holidays. However, there are several exceptions to this rule:

The employer is not allowed to call pregnant employees to work by the prohibition enshrined in Part 1 of Art. 259 Labor Code of the Russian Federation. In addition, there are several categories of employees who have the right to refuse to work on weekends and non-working holidays:

Labor legislation limits the employer's desire to burden the workforce with responsibilities 365 days a year, but allows that in some cases it is impossible to do without work on holidays and weekends. Therefore, according to the Labor Code of the Russian Federation, hiring employees to work on non-working holidays is permissible if it is necessary to ensure:

- continuity of the technological process at the enterprise;

- carrying out urgent loading, unloading and repair work;

- service to the population.

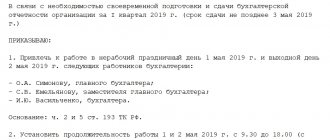

To be called to work on non-working holidays and weekends, the employer must issue a written order. Verbal orders in such a situation have no legal force.

Find out more about restrictions and prohibitions from the materials on our website:

- “Offsetting overpayments of taxes: the new restriction does not always apply”;

- “The land plot is limited in use: is there a land tax?”

What are considered weekends and holidays?

The definition of holidays is simple: non-working holidays are legally established days when all working citizens rest in the general manner.

Are compensation and incentive payments when paying for work on weekends and non-working holidays?

It's a little more difficult with the weekends.

As the law states, every employee has the right to have days off.

The number of days off depends on the internal operating mode of the organization. If it is on a five-day week, then it means its employees have two days off, Saturday and Sunday, if the company has a six-day week, then it has one day off - necessarily Sunday.

If necessary, some hired employees may be given any other days of the week as days off.

But, according to the Labor Code of the Russian Federation, this must be specified in internal regulations or in collective and labor agreements. If everything is done as it should be, then work on generally accepted weekends, that is, Saturday and Sunday, will not be paid in a special manner, since these days will be equated to regular working days.

How to pay for work on weekends or non-working holidays if another day of rest (time off) is not provided ?

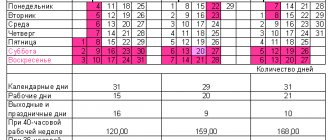

Weekends and holidays for the current year are clearly presented in our production calendars, and every employer should rely on this data when calculating wages.

As mentioned above, every hired employee is entitled to a weekly uninterrupted rest. In most organizations it is two consecutive days off. But at some enterprises, the weekend schedule may differ from the generally accepted one, which is usually caused by production needs. True, in such cases, the transfer or reduction of days off must be supported by documentation. The documents justifying changes in holidays primarily include:

- order from the company's management. This order must clearly state the reasons for overtime work on weekends and holidays, as well as the position and name of the employees who must do it;

- written consent from the employee.

At the same time, it should be remembered that there are categories of persons who, under no circumstances, by order of management, can be involved in work on weekends and holidays.

Is it possible to take into account expenses for income tax purposes related to the payment of compensation to employees for the days of departure on a business trip and arrival from it that fall on weekends (holidays) (clause 3 of Article 255 of the Tax Code of the Russian Federation)?

These are women expecting a child, minor workers (until they reach 18 years of age, but only if they are not representatives of creative professions - they can work on weekends and holidays), as well as workers with some medical contraindications, etc. .

However, in case of voluntary consent expressed in writing, these categories of employees may be allowed to work outside of normal hours.

At the same time, they must be informed, against signature, of their right to refuse work at any time.

Salary for work on a weekend or holiday with a salary and with piecework payment

How to pay wages on holidays with a salary is indicated in Art. 153 Labor Code of the Russian Federation.

Look at the formula for calculating salary based on salary.

The same article defines regulatory approaches to payment for holidays with piecework wages:

Whether it is necessary to calculate a double tariff for working on a weekend or a holiday, taking into account bonuses and allowances, we will tell you in this publication.

The legislation limits only the lower acceptable limit of wages on weekends and holidays and reserves the right of participants in the labor process (employer and employees) to agree on and establish specific additional payments or salary calculation schemes in such situations. The results of such approvals and decisions must be enshrined in writing in the internal local acts of the enterprise and/or employment contracts.

In Art. 153 of the Labor Code of the Russian Federation describes two principles that must be taken into account when paying labor on weekends and non-working holidays:

The situation is somewhat different with the calculation of wages on holidays with a shift work schedule.

Salary

The procedure for remuneration on a day off or a non-working holiday is established by Art. 153 Labor Code of the Russian Federation. According to general rules, work on such days is paid at least twice as much:

- for piece workers - no less than double piece rates;

- employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate;

- employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary for a day or hour of work) in addition to the salary, if work on a weekend or non-working holiday was carried out within the monthly working time norm, and in the amount at least double the daily or hourly rate (part of the salary for a day or hour of work) in addition to the salary if the work was performed in excess of the monthly working time standard.

The presence of non-working holidays in a calendar month is not grounds for reducing wages for salaried employees.

Payment for work on a weekend or holiday for creative workers specified in the List of professions and positions of creative workers in the media, cinematography organizations, television and video film crews, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works is determined by a collective agreement, local act, or employment contract.

All employees are paid at an increased rate for hours actually worked on a weekend or non-working holiday. If part of the working day (shift) falls on a weekend or holiday, the hours actually worked on the weekend or non-working holiday (from 0 to 24 hours) are paid at an increased rate.

At the request of the employee, instead of increased pay, he may be given another day of rest (time off). We'll talk about this a little later.

So, let’s consider in order the algorithm for calculating wages for working on a weekend or holiday.

The procedure for remuneration of work on weekends and holidays for piece workers

Pay on weekends and holidays for piece workers is calculated using the following formula:

| Pay on weekends and holidays | = | Piece rate | X | 2 | X | Quantity of products produced |

If an institution uses a piecework-bonus wage system, it is also recommended to take into account the bonus amounts when calculating compensation for work on a weekend or holiday (Resolution of the Constitutional Court of the Russian Federation of June 28, 2018 No. 26 P).

The procedure for remuneration on weekends and holidays for employees whose work is paid at hourly tariff rates

Payment of labor on weekends and holidays to employees whose work is paid at hourly tariff rates is calculated as follows:

| Pay on weekends and holidays | = | Employee's hourly wage rate | X | Number of hours worked on a weekend or holiday | X | 2 |

If, in addition to the hourly wage rate, compensation and (or) incentive payments are made to the employee, they must be taken into account when calculating compensation for work on a weekend or holiday.

Nuances of calculating “holiday” wages during a shift work schedule

How to calculate salary on holidays with a shift schedule? In this case, it is necessary to take into account the features of shift work that can be organized (Article 103 of the Labor Code of the Russian Federation):

- to improve the efficiency of the enterprise (ensuring full utilization of equipment, increasing the volume of products or services provided);

- when the duration of production processes exceeds the permissible duration of daily work.

In such conditions, the workforce is divided into groups, each of which works according to a schedule. How shift work will be organized is determined in the internal local regulations of the enterprise. There are many options: two working days of 12 hours each alternate with the same number of days off, one working day after three days off, etc. The only limitation is that working two shifts in a row is prohibited (Article 103 of the Labor Code of the Russian Federation).

Pay on holidays with a shift work schedule has some nuances:

- Days off can be provided not only on Saturday or Sunday, but also on other days of the week (Part 3 of Article 111 of the Labor Code of the Russian Federation), therefore, work shifts that fall on Saturday or Sunday are not paid at an increased rate and are considered regular working days with payment in a generally established manner.

- Work on non-working holidays is paid at least double the amount (taking into account the principle of proportionality, which was mentioned earlier).

Paying employees at night has important features. Find out which ones exactly from the advice from ConsultantPlus. Get free access to K+ and go to the HR Guide to find out all the details of this procedure.

How is payment made on a day off if the employer was forced to invite an employee to work outside of the schedule? The general rules of Part 1 of Art. 153 of the Labor Code of the Russian Federation, when work on a legal day off is paid at an increased rate.

See an example of salary calculation for shift work.

Results

Labor legislation prohibits working on a weekend or holiday, with the exception of certain cases.

If you do have to work, wages must be paid at an increased rate - no less than double the hourly rate for piece workers or no less than double the hourly rate for each hour for workers whose work is paid at the rate. With a shift schedule, days off do not require double pay, unless the employee is called to work on his legal day off. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Additional payment to wages for night work

The legislation establishes that work at night should be paid at a higher rate than work during normal hours. The surcharge for night work from 10 pm to 6 am must be at least 20%.

If an employee always works at night, or each shift contains the same number of night hours (for example, a night watchman), then there is no point in calculating additional payment for night hours: it is easier to immediately set the tariff rate for the shift taking into account night work and reflect this in the labor contract. agreement

And if the employee has a shift schedule, and the shifts fall at different times (contain different numbers of night hours), then it is necessary to keep records of night hours and calculate additional payment for them.