From the article you will learn:

Labor relations with an employee who does accounting must be regulated by a number of local regulations, including job descriptions, various regulations and rules. After all, an accountant, and especially a chief accountant, is one of the key figures in the organization. Of course, the main document in which it is necessary to specify all the rights and obligations of any hired employee is the employment contract. In our article you can find out exactly what you should pay attention to when hiring a specialist in the field of accounting, and also download a free employment contract with an accountant in 2022.

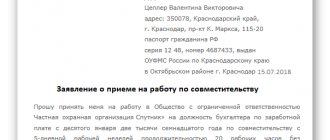

How to hire a part-time worker

According to Article 282 of the Labor Code, part-time work is the performance by an employee of other regular paid work under the terms of an employment contract in his free time from his main job.

What restrictions should employers keep in mind when hiring a part-time worker?

Separate part-time and overtime work

The main signs of part-time work:

- allowed only during free time from main work (after the end of daily work);

- the employee enters into a second employment contract;

- part-time work, regular and paid;

- payment is made based on the actual volume of work performed and is not limited to the maximum amount;

- part-time work is not limited to the category of personnel.

Employment contract with a part-time worker: what do you need to know?

What restrictions must be observed when hiring part-time workers?

How limited is part-time work?

Is it possible to hire an external part-time worker without a work book?

An employee can work in a branch of the same organization part-time remotely

Employment contract with a part-time HOA accountant: features

An agreement with a part-time HOA accountant can be concluded for an indefinite period. Moreover, an accountant can work under such agreements in several HOAs at the same time. It is also possible to become an HOA accountant for remote work.

In the contract with the HOA accountant, it is important to clearly indicate the employee’s job responsibilities, in particular, maintaining accounting and tax records, as well as interaction with the management organization. The right to sign documents can be secured in an order or power of attorney.

Dismissal of a part-time worker

Part-time workers are hired under specific conditions. Accordingly, the norms for their dismissal also have some nuances.

How to fire a part-time worker

Dismissal without a note in the work book

How to fire a part-time worker if you really need to

We pay severance pay to a redundant part-time worker

When an organization is liquidated or its workforce is reduced, the dismissed employee is paid severance pay in the amount of average monthly earnings. Is the payment of severance pay for internal part-time jobs additional or only for the main position?

Double benefit to a part-time worker upon dismissal due to liquidation

Should severance pay be paid to a part-time worker upon liquidation of the company?

Is it possible to become a part-time chief accountant without having a main job?

The Labor Code of the Russian Federation does not require an employee to prove the fact of his employment at his main place of work. And for an employer who hires a part-time worker without a main job, no liability is provided.

The position is confirmed by judicial practice:

- Appeal ruling of the St. Petersburg City Court dated November 11, 2015 No. 33-19039/2015;

- Appeal ruling of the St. Petersburg City Court dated November 3, 2016 No. 33-21952/2016.

It is also permissible to conclude a fixed-term employment contract with a part-time worker if this is based on the mutual consent of the employee and the employer.

The chief accountant can be hired part-time if he does not have a main place of work.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

Part-time leave

Part-time workers are provided with annual paid leave simultaneously with leave for their main job (Article 286 of the Labor Code of the Russian Federation).

If an employee has not yet worked at a part-time job for six months (and has already worked at the place of his main job), then in a “part-time” company he has the right to receive leave in advance.

When is leave due to an external part-time worker?

Part-time leave is “adjusted” to leave for the main job

Vacations for part-time workers: taking into account the features

Is it possible to hire a part-time worker full-time during his vacation?

The Ministry of Labor clarified the procedure for granting leave to part-time workers

Minimum duration of work for a part-time worker: is there one?

Features of an employment contract with a part-time chief accountant

Hiring a part-time chief accountant is not possible without drawing up an employment contract. It is concluded, according to the standard scheme, in writing and in two copies (one each for the employee and the employer).

Drawing up an agreement with a part-time chief accountant has its own characteristics:

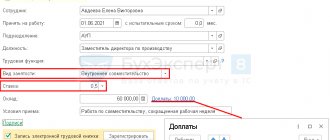

- The contract must stipulate the condition of employing the employee in a position specifically as a part-time worker (Article 282, Part 4 of the Labor Code of the Russian Federation).

- The agreement must contain information about the duration of the part-time worker’s working hours (no more than 4 hours per day). This limitation is established by Art. 284 Labor Code of the Russian Federation. At the same time, it is permissible to indicate in the contract a smaller number of working hours per day (for example, 2 hours). It is acceptable for a part-time chief accountant to work more than 4 hours a day if the employee’s main place of work is free from work duties. On such days he can work a full day (8 hours). If it is necessary to stay even longer, overtime work will take place (Article 99 of the Labor Code of the Russian Federation). During such overtime, it is important to ensure that during the reporting period the standard working hours established for a part-time worker are not exceeded.

- Particular attention should be paid to the section on wages in the contract. For part-time work, payment is made in the same way as for main employees, but adjusted for the number of hours worked. That is, the contract will need to specify allowances, benefits, sick leave, bonuses and other conditions.

- Leave for part-time employees is provided in the same manner as for main employees. The only condition is that the part-time employee’s vacation must coincide in time with his vacation at his main place of work.

- In the contract with the part-time chief accountant, it is recommended to include a condition on financial liability in full for damage caused to the employer (Article 243, Part 2 of the Labor Code of the Russian Federation).

Part-time sick leave

Payment for part-time sick leave in 2022-2022 depends on the place where the part-time worker was registered for work during the two years preceding the year of disability. It may turn out that it worked:

- With the same employers as in the year when you received sick leave.

- From other employers.

- With the same employers, but had other jobs.

It is more profitable for an external part-time employee working on a part-time basis to apply for benefits to the organization where he works full-time.

Sick leave benefit for part-time worker

Sick leave for pregnancy and childbirth of an external part-time worker: what do you need to know?

Part-time worker goes on maternity leave: how many sick leaves do you need?

Employment contract for internal part-time work

As a sample, you can download the part-time employment contract from the previous section for free and exclude from it:

- a list of documents for employment, with the exception of the case when an employee takes on a job that requires separate qualifications and is different from the main one - then documents on qualifications and admission will be required;

- a list of internal regulations for review (since the employee is already familiar with them); the exception is the same as in the previous subparagraph - instruction and testing of knowledge in MBT will be required;

- if there are no differences, you can exclude items with addresses and details.

Personnel reporting

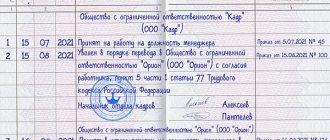

Information on labor activity in the SZV-TD form is compiled for each employee with whom an employment contract has been concluded. Including part-time workers.

Explanations on how to fill out the SZV-TD for a part-time employee of the Pension Fund of Russia were issued in a letter dated 03/05/2020 No. B-6181-19/10665-20.

SZV-TD for part-time workers: how to fill out?

Consider two features of the SZV-TD part-time worker

- Column 4 of the tabular part of the SZV-TD form “Labor function (position, profession, specialty, qualification, specific type of assigned work), structural unit” indicates part-time work.

- The o is not indicated and “An application for provision of information on labor activity has been submitted” is not filled out.

Types of part-time jobs

Part-time work can be internal and external (Article 60.1 of the Labor Code of the Russian Federation):

| Type of part-time job | Internal | External |

| Place of work | At the main employer | With an employer other than the main one |

| Maintaining a paper work record book, if a corresponding application has been submitted to the employer at the main place of work | At main place of work | At the main place of work, but with the possibility of recording a part-time job based on a copy of an order or certificate from a third-party employer |

| Maintaining an electronic work book (SZV-TD reports) | For all reasons: both in the main job and part-time | Only part-time |

| Documents for the employment of a part-time worker | Not required, because the employer already has them | Introduced:

|

Not only a third-party employee, but also one of your own can become a part-time chief accountant.

Considering that the position requires special knowledge, when hiring an external part-time worker, the employer has the right to demand a copy of the education document, for example, a diploma (Article 283 of the Labor Code of the Russian Federation).

Sometimes the director himself is allowed to become a part-time chief accountant:

| The manager has the right to become a part-time chief accountant | A manager cannot become a part-time chief accountant |

|

|

| Art. 7 of the Law of December 6, 2011 No. 402-FZ “On Accounting” | Part 3 art. 11.1 of the Law of December 2, 1990 No. 395-1 “On banks and banking activities” |

Do part-time workers participate in the calculation of the average headcount? Read here.

Atypical situations

Part-time business trip: what does the employer need to know?

Employers can send any employees, including part-time workers, on a business trip. The payment of a seconded part-time worker depends on what kind of part-time worker it is: external or internal.

How to pay for the downtime of a part-time worker?

Downtime for part-time workers is paid in the same manner as for workers at the place of their main job - in the amount of at least 2/3 of the average wage for their work.

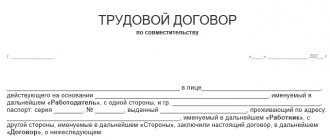

Where to download a free sample contract for external part-time work

You can download the 2022 external part-time employment contract for free by clicking on the picture below:

In addition to the above aspects, the proposed sample part-time employment contract provides for:

- determination of a part-time job;

- salary payment procedure;

- internship;

- list of documents for employment;

- list of internal regulations that must be read.

Operating hours information

If previously an employer could not oblige a part-time employee to work more than 4 hours a day, now the situation has changed a little. A part-time employee can work more than 4 hours a day if he does not currently have work in his main position. The main condition is not to exceed half the monthly norm of allotted working time.

Some employers, fearing that their employees may combine their main job with additional work in other companies, prescribe a ban on these actions in the employment contract. In fact, it is illegal. The labor inspectorate may have questions regarding such an employer.

- Author: Vladimir

Rate this article:

- 5

- 4

- 3

- 2

- 1

(0 votes, average: 0 out of 5)

Share with your friends!

Terms of the contract with the chief accountant

The employment contracts that employers sign with their employees must contain strictly defined conditions, but they are allowed to be supplemented depending on the position and specialty of the employee. When hiring a chief accountant, include in the contract additional conditions that do not contradict the requirements of the Labor Code of the Russian Federation. Include similar conditions in the contract with the cashier, even though he is not a manager. The only exception is the trial period.

In addition, the code provides for a number of special conditions in such a contract. In particular, with the chief accountant, as well as with the manager, it is allowed to establish an increased probationary period: instead of three months - six. Such a document can be concluded for a specific period or agreed upon for an indefinite period.

It is advisable to include the following conditions in the employment contract:

- probationary period when hiring (up to 6 months);

- conditions for termination of TD (at the initiative of the employer and the specialist himself);

- financial responsibility of the chief accountant (provided for by the job description);

- the duration of the contract (in some cases when concluding a fixed-term contract).

It should be noted that, according to the provisions of Article 59 of the Labor Code of the Russian Federation, employers have the right to enter into trade agreements with employees for a limited period only in certain cases. A list of such situations is given in this article. The contract with the chief accountant is included in this list, which means that by agreement of the parties, the contract can be concluded for a certain period: with the voluntary consent of the future chief accountant and the absence of pressure from management in this matter. True, it is almost impossible to verify this fact, therefore, if the company’s policy includes hiring chief accountants for three years, no regulatory authorities will be able to prevent this.

Let us remind you about the test, or, as it is often called in everyday life, the probationary period, which is regulated by the norms of Article 70 of the Labor Code of the Russian Federation. For all employees, the law allows testing of knowledge and skills within three months from the date of employment. For particularly important employees, which includes the chief accountant, this period is allowed to be doubled. Not only should such an initiative of the employer be written down in the TD, but also reinforced with an order.

As for financial liability, the position of chief accountant implies such responsibility by default, therefore the conclusion of a separate agreement on full financial liability for such a position is not provided for, but in the job description and in the contract such a condition must certainly be, as defined in part 2 of the article 243 Labor Code of the Russian Federation. This is a very important condition, and it cannot be neglected, since the courts refuse to allow employers to recover losses that the organization suffered as a result of the dishonest activities of the chief accountant. The chances of recovering damages drop even more if liability is not properly documented.

The contract with the chief accountant should include a condition on non-disclosure of any confidential (commercial, technical and personal) information about the company's activities. This condition will make it possible to hold an official accountable if a secret is violated.

Organization of working hours

The parties enter into an agreement to calculate working time standards. The employment contract is directly responsible for recording information. The agreement will also become the basis for determining the regime in this direction. Allow you to arrange it in the form of a schedule.

Part-time workers work a maximum of 4 hours a day. A 40-hour work week implies a 20-hour standard for the same positions. For certain positions, the norm is divided into two.

A full day is organized for such employees only if the main place has a day off. Vacations and other periods of release from duties apply the same rule. But the monthly norm still continues to work according to the old rules.

A part-time worker can come to another workplace full time. For example, if wages are delayed at the main place, which leads to a suspension of work. Or if the position is retained, but medical conditions force one to resign from responsibilities.

Part-time work is given a separate designation when drawing up time sheets. The same applies to positions that coincide in the same enterprise. Having two numbers for one employee is the norm.