Unique payment identifier - what is it? What is it for? These are the most common questions that entrepreneurs ask when paying taxes at the bank, when a bank employee asks to indicate this detail. This is puzzling. Where can I find it, how can I get it, and can I do without it? Thus, a tool created to simplify the procedure resulted in new issues that needed to be clarified.

What is a unique identifier?

A unique payment identifier is a 20-digit code that must be specified when paying off tax debts in the state information system (GIS). This makes it possible to easily and quickly pay taxes from your personal account on the tax service website. This approach greatly simplifies and speeds up the operation procedure. Payment occurs quickly, and therefore on time, which avoids delays, which means penalties and interest.

Using a unique identifier allows entrepreneurs, legal entities and individuals to pay taxes in a convenient way. But receiving and filling out tax documentation forms in this case has its own characteristics that must be taken into account. The problem also lies in the fact that the government information service itself has a complex, confusing structure that even an experienced user cannot always understand.

Identifier for online service

In this case, IDs are also required to recognize a specific person. It allows you not only to gain access to reading and transmitting information in a particular system, but also to specify the parameters and permissible privileges for a given user. In addition, each block of data in the online service has its own identifier, which makes it easier to find the necessary information among a large amount of data in a certain situation. A similar identifier is used in most popular social networks.

What is it for?

It is needed so that the Federal Tax Service knows when and from which person the money was received into the account. There are millions of users registered in GIS; it is difficult to determine from whom and for what purposes money is transferred. That is why, by order of the Ministry of Finance No. 107n dated November 12, 2013, the rules were changed, according to which a unique identifier for accrual payments appeared separately for taxes.

The tax service needs it in order to more effectively implement fiscal policy and identify persistent defaulters. Legal entities and individuals need it as the most convenient and fastest way to pay taxes. As a result, the government can control the actions of tax officials and stop cases when their actions exceed the powers delegated to them, which often happened in the past. Businessmen are less dependent on the will of an individual tax inspector and suffer from illegal extortions. The number of inspections carried out has been reduced.

Where to get it for legal entities and individuals

As a rule, individual entrepreneurs and organizations indicate “0” in field No. 22, since these entities independently calculate payments. These amounts do not require additional identification, therefore the distinctive codes indicated in the payment order are: KBK, INN, KPP.

In this regard, it is much easier for individuals. Every time an individual transfers taxes, payments, and fees to the state, the receipt notification index automatically becomes the identifier.

You can get the identifier in two ways:

- On the official website of the government service that administers the payment

- Check with the credit institution (bank) that makes the payment

To the last point, we must add that not every bank will provide a UIN. This will only happen if an agreement is signed between the person and the bank.

Who should indicate it?

Both ordinary citizens, entrepreneurs (individuals), and legal entities can indicate a unique payment identifier. This can be done when paying taxes directly in the information system account or through a bank. When transferring, you should take into account that payment through Sberbank has its own characteristics. They have their own special form, when filling it out, a unique identifier does not need to be specified. The UIN is indicated when paying taxes and state duties through the State Services service or a bank branch.

If an individual or legal entity fills out payment documents for the payment of taxes and fees, the payment deadline for which has not yet expired, then he may not enter a unique identifier, but insert a zero in the due date for entering the details. Although this method of filling out the line is permitted by law, when paying through a bank, the employee may require filling out the line with a 20-digit payment number and has the right to refuse to accept the payment. Therefore, it is important to know in which cases it must be indicated, and in which it is not necessary.

The UIP is indicated incorrectly. What to do?

The bank’s responsibilities do not include the procedure for verifying the correctness of the UIP. Having received a payment order for the transfer of funds with an incorrectly specified number, the credit institution will carry out the operation in any case. However, there are exceptions.

- The bank will cancel a payment order with an incorrectly specified UIP if the recipient and sender have accounts opened with this credit institution.

- The account to which funds are transferred under a payment order, where the UIP field is filled in incorrectly, is intended to identify the payment.

- The “Code” line of the payment order is not filled in at all. That is, in this window it is not that the wrong UIP is indicated, but it is empty.

Incorrect indication of the UIP can result in disastrous consequences for the payer. The thing is that this number serves as a kind of identifier for the purpose of the transferred funds. And if the code is not reflected correctly, then difficulties will arise with crediting the payment. They may be misdirected or get stuck in the recipient’s account.

For example, if the payer pays arrears on taxes and fees, then the tax office or fund will not be able to identify the real purpose of the funds. That is, the recipient may assume that the payer is fulfilling current obligations to the Federal Tax Service or funds and will not offset the arrears.

Accordingly, the payer’s debt will remain unpaid. Penalties will continue to accrue on it, which is why the amount of debt may increase significantly.

If the payer notices at the time that the UIP in the payment order is indicated incorrectly, then he can contact the payee with a request to find the funds and offset them for their intended purpose. If the error goes unnoticed, then the payer will learn about the incorrect indication of the UIP when performing the transaction only from a new request from the recipient.

Important! The amount of arrears, increasing due to incorrect reflection of the UIP, is not subject to recalculation, since the responsibility for the correct indication of the UIP lies with the payer.

It should be noted that there are few cases of incorrect indication of UIP. The thing is that the number is assigned by the payee, and the payment order is generated based on the submitted request automatically.

In what cases is it necessary to indicate it?

It should be noted that the identifier does not always need to be specified, but only in certain cases, which are described in the rules and regulations of the Bank of Russia (in particular, regulation No. 383-P). UIN - a unique payment identifier must be indicated in two cases:

- If it was indicated by the recipient of the funds and provided to an individual or legal entity obligated to pay them in accordance with the terms of the agreement. In this case, the identifier is assigned automatically.

- When transferring funds to the tax authorities. An entrepreneur or individual fills out special fields (lines) of the payment slip in paper or electronic form. In this case, filling causes some difficulties. After all, an entrepreneur does not always know his unique payment identifier number or where to get it.

In the second case, most taxpayers experience difficulties because they do not know where to get it and where to indicate it in the document. Incorrectly specified data leads to delays in payment, penalties and fines.

Payer ID - what is it?

There are individual entrepreneurs for legal entities, individuals and foreign organizations (IO). In this case, individual entrepreneurs are considered individuals.

For a legal entity, individual entrepreneur is the identification number of the payer (or taxpayer), that is, TIN. The TIN is usually indicated along with the reason code for registering the person with the tax authorities, i.e. KPP.

For an international organization, this is the KIO, that is, the code of the foreign organization, plus the checkpoint.

Payer ID of an individual

For individuals, the following can be used as identifiers:

- insurance number of a person insured by the Pension Fund of the Russian Federation (SNILS);

- series and number of passport or driver's license;

- series and number of the vehicle registration certificate received upon registration;

- other information permitted for use as personal identifiers, in accordance with the law (for example, military ID, sailor’s passport, etc.).

The individual ID code is a two-digit number. Allowed ID codes for individuals:

Where and how can I get an ID?

How can I find out information about the unique payment identifier, as well as whether the payment was accepted? You can check this both in your GIS personal account after registering in the system, and upon receiving a payment order in case of late payments. But this is an extreme case. The entrepreneur will know the number from the documents indicating the presence of a debt or fine to the tax authorities.

If there were no overdue payments, but you need to indicate the UIN, then you just need to send a request to the tax service to get a number.

Office 365 ID

Microsoft Office 365 is a product that combines a set of web services. In addition to programs from the Office 2016 line (Word, Excel, PowerPoint), it includes access to Exchange email, the ability to log into the Sharepoint portal, which allows you to design pages, as well as the Lync communicator, which provides the ability to conduct video conferences.

Spybot - Search & Destroy: removing malware from your computer

An ID in Office 365 is an email address . It is important to note that the address is different from the Microsoft account, that is, the accounts are divided into work (which is used in Office 365) and personal. On your first visit, you are given a temporary password that needs to be changed. Thus, the combination of login and password is a unique feature for identification in the system.

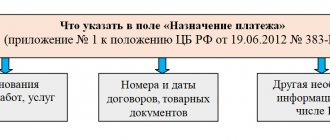

How to fill it out correctly?

When taxpayers make payments to the budget system of the Russian Federation, they fill out a payment order. In addition to the unique identifier, the entrepreneur must indicate:

- TIN;

- checkpoint;

- BIC of the institution through which the payment will be made;

- name of the bank, its legal address;

- the current account from which the transfer will be made;

- type of payment (code);

- date of the operation.

The number is entered into the line of the unique payment identifier - 22 (field code). Do not fill out only if payment occurs on time. In this case, enter “0” (zero) in this line.

Did you enter your UIN incorrectly?

The UIN allows the GIS GMP (State Information System on State and Municipal Payments) system to automatically account for payments. If an error is made in it, then the payment is not correctly identified, and, accordingly, the organization will remain obligated to pay a fine, and a penalty may also be charged.

To resolve this error you will need:

- Contact the fiscal authority to clarify payment.

- It is possible to re-execute the payment order to eliminate the debt and accrue penalties.

Thus, actions with the UIN index are quite simple. If you pay any tax deductions as a result of independently calculating their amounts, then you simply have nowhere to get this code.

Therefore, put a zero in field “22”; do not leave it empty, otherwise the bank will refuse to complete the transaction. If payment occurs at the request of the fiscal authorities, then they are obliged to provide you with a UIN.

What to do if the document already contains a UIN?

Sometimes, especially when making payments through specialized information systems, when filling out an order electronically in the line (its code is 22), a unique payment identifier appears on its own. How should we feel about this? Is this considered an error if funds are deposited on time? In fact, there is no error. You can pay either by indicating the ID number or by entering “0” in the line. They simply require you to indicate the identifier when payment is late, that is, at the request of the tax office.

Although it is possible to pay without restrictions, this approach is undesirable. An enterprise must distinguish between regular tax payments and those paid at the request of the tax authorities. This will help avoid confusion in reporting.

But even if it was not possible to find out and indicate the identifier in the order, this does not give the banks the right to refuse to accept it. The bank is obliged to accept and transfer funds, even if the UIP (unique payment identifier) is not specified. This rule is spelled out in official documents of the tax service. It clearly states that an individual or legal entity only needs to indicate their TIN and enter “0” in the line (code 22) of the unique payment identifier. In this case, the bank does not have the right to refuse to transfer the payment. But the entrepreneur must take into account that in the event of an error or delay, the bank is not responsible.

What is a UIN: assignment rules and instructions

UIN (UIP) stands for a unique identifier of charges (payments). To put it simply, this is a code that contains all the necessary information about the payment sent to the state budget and the correctness of its receipt.

When is it necessary to indicate the UIN

The decision on the need to indicate this detail in a number of cases was made in accordance with Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013. Thus, the following payment orders for transfers to the state budget must necessarily contain the UIN and payer identifier:

- sent from tax authorities, demanding payment of arrears, fines, penalties;

- fines for administrative violations;

- transfers to the budget (for example, fees for kindergarten or education);

- transfers under an agreement, when the recipient of the money assigns a UIN to the payment order in advance and notifies the counterparty about this (used in mutual commercial settlements of legal entities).

The form of the receipt, in which you must indicate the UIN - 504 510.

What identifier is indicated in personal income tax and tax collections?

The income statement does not indicate the UIN, but the payer identifier (IP):

- for a legal entity - TIN;

- physical - SNILS or other, including alternative, identifier of an individual;

- for a foreign organization (IO) - FIO code (FIO).

In line No. 22 “unique identifier of charges (payment)” you must enter “0”.

Attention! There is no need to form a UIN when paying land, property, or transport taxes. In these cases, in payment documents of Form N PD sent from the Tax Service, the index of the tax document must be indicated as the UIN.

A payment order can be issued directly on the website of the Federal Tax Service using the electronic service. In this case, the UIN will be assigned automatically.

Clarification on these issues was provided by the Federal Tax Service, which specified cases when indicating the UIN is not necessary.

Is it necessary to indicate the UIN in other payments?

In all other payment orders not sent to the state, municipal or city budget, it is not necessary to indicate a unique payment identifier. You must enter zero in the “code” field.

If the bank unlawfully demands to indicate the UIN on the payroll, employees must be reminded of the letter of the Federal Tax Service of the Russian Federation No. ZN-4−1/ [email protected] dated April 8, 2016.

How is UIN assigned?

According to the order of the FS FBN No. 48 dated February 28, 2014, it is necessary to assign not only UIP, but also individual entrepreneurs:

- for payments for state or municipal services, and other payments to the state budget;

- imposition of sanctions from the tax authorities and fines, according to the Code of Administrative Offenses (in this case, the UIN is usually indicated in the payment document itself;

- drawing up protocols on administrative violations (AP) sent to the magistrate.

The rules for assigning an identifier are contained in Appendix 1 of the order of the FS FBN.

The UIN (UIP) code contains 20 digits, the individual payer identifier contains 25.

Composition of the UIN code by category

- The first three categories contain the code of the chief administrator for state budget revenue (state body, local administration, local government self-government - Article 6 of the Budget Code of the Russian Federation).

- Digits 4 - 6: last three digits of the RPBS code (register of recipient of budget funds). (The register was created on the basis of Order of the Ministry of Finance No. 163n dated December 23, 2014).

- Digits 7 - 9: index of the structural unit (if the organization does not have structural divisions, zeros are entered).

- Level 10 - case code: 1 - if a decision is made to punish for an accident in the form of a fine under the Code of Administrative Offenses; 2 - if the case is transferred to a magistrate.

- Digits 11 - 14: year and month of registration of the AP.

- Digits 15 - 19: serial number of AP registration.

- Bit 20 is a control key.

Note: In the absence of administrative cases of violations, zeros are entered in the identifier fields intended for digits 10 to 19.

From here it is clear that in a simple receipt for a kindergarten there will be a “0” in the ten penultimate fields of the code.

Where can I get the Chief Revenue Administrator code?

The code of the chief administrator of state revenues is taken from the list established by Federal Law No. 359 - Federal Law of November 22, 2016.

The list of codes can be seen.

How to calculate the control key in the UIN code

The control key is a number from 0 to 9 and must occupy one digit (one field).

- To calculate the key, you need to assign a weight from one to ten to each digit (from the most significant digit, that is, the very first field, to the least significant one). After the 10th digit, they begin to assign weight again, starting from one.

- Each UIN digit is multiplied by the assigned weight and the sum of all products is added.

- The resulting amount is divided by 11. The remainder of the division is the control key.

- If during the calculation they receive a two-digit number, repeat the assignment of weight, but not from 1 to 10, but from 3 to 5 inclusive. Repeat the calculation. If this time the number is greater than 9, then in the 20th digit where the control key should be, put 0.

What does the code mean: decoding the identifier

The identifier is decrypted as follows:

- Numbers 1 to 3 indicate the code of the tax department to which the funds will be received.

- The number 4 indicates the type of payment. This place is always zero.

- Numbers from 5 to 19. Indicate the document code in the tax system. Each payer is assigned its own special code, based on the previous version of the document index.

- Digit 20. Its number determines which government agency is verifying the payment. Calculated taking into account the remaining 19 digits of the code.

The unique payment identifier is identical to the document index only if the index consists of 20 digits.

Indication of UIN and IP identifiers in settlement and payment documents

On January 1, 2014, new Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation, approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n (hereinafter referred to as the Rules, Order No. 107n)

came into force. in accordance with Order No. 107n, from March 31, 2014, the payment order for the transfer of payments to the budget system of the Russian Federation, as well as payments for state and municipal services, must indicate, among other things, the following identifiers:

— in detail 108 of the payment order — identifier of information about an individual (hereinafter referred to as individual entrepreneur);

— in detail 22 “Code” of the payment order — a unique accrual identifier (hereinafter referred to as UIN).

During the transition period from January 1, 2014 to March 31, 2014, the following identifiers may be indicated in a payment order for payments to the budget system of the Russian Federation, as well as payments for state and municipal services:

— details 108 of the payment order may indicate the individual entrepreneur;

— in detail 24 “Purpose of payment” of the payment order, the UIN may be indicated.

Letter of the Treasury of Russia dated December 19, 2013 No. 42-7.4-05/5.3-836 provided clarifications as directed by the UIN and individual entrepreneur in settlement and payment documents used for servicing the Federal Treasury, such as the Application for cash expenses (f. 0531801), Application for cash expenses (abbreviated) (f. 0531851).

According to the specified letter, from March 31, 2014, the Application for cash expenses (f.0531801) is filled out as follows.

The UIN identifier is indicated in section 2 “Details of the basis document”, while:

in column 1 “Type” the text “UIN” is indicated;

in column 2 “Number” the UIN value is indicated;

column 3 is not filled in;

in column 4 “Subject” the value “-“ is indicated.

The individual entrepreneur’s identifier is indicated in column 6 “Number of the basis document” of section 4 “Tax payment details”, provided that the value “19” is indicated in column 1 “Taxpayer status” of this section.

The application for cash expenses (abbreviated) (f. 0531851) is filled out as follows.

The UIN identifier is indicated in section 1 “Document details”, while:

in the field “name of the basis document” the text “UIN” is indicated;

the UIN value is indicated in the “Number” field.

The individual entrepreneur’s identifier is indicated in column 5 “Number of the basis document” of section 3 “Tax payment details”, provided that the value “19” is indicated in the “Taxpayer status code” field of this section.

When specifying the IP identifier, the signs “No” and “-” are excluded (not indicated).

If it is impossible to indicate the specific value of the UIN and IP indicator, a zero (“0”) is entered in the corresponding fields (columns) of payment documents intended to indicate the semantic meaning of these indicators.

What happens if you don't specify it?

Using the UIN number, taxes and other payments to the budget are automatically recorded. Information about payments to the budget is transferred to a single database. If you enter the wrong code or do not specify it, the system will not recognize the payment and the money will not be transferred. This is fraught with such troubles as:

- the company will incur debt to the budget and funds;

- penalties will continue to accrue;

- you will need to clarify the payment and find out its fate;

- the money will arrive to the budget or funds with a delay.

If a businessman does not have or does not know a unique payment identifier where to get it, he can use the support service in GIS at any time, rather than wait for the tax authorities to take action. If an entrepreneur does not have access to the Internet and the State Services electronic system, he can send a regular letter to the nearest tax office or appear in person to receive an identifier.

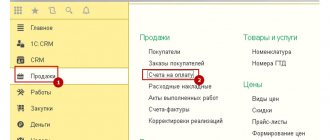

Indication of UIN and individual entrepreneur in the Application for cash expenses (form 0531801)

To fill out an Application for cash expense (f.0531801) for the transfer of payments to the budget system of the Russian Federation, as well as payments for state and municipal ones, the following operations are used in the document “ Application for cash expense ”:

- Transfers to budget revenues (302 10, 20, 30, 70, 90);

- Taxes and fees included in expenses (303 01, 02, 05-13);

- VAT in relation to tax agent transactions (303 04);

- Taxes and fees paid from profit (income) (303 03-05);

- Transfer of funds to the budget to compensate for damage, shortages, receivables from previous years, etc.

When selecting the specified operations, the “ Base document ” tab is available, on which the details for filling out section 2 “Base document details” of the Application for cash expense (f.0531801) are indicated.

According to the letter of the Treasury of Russia dated December 19, 2013 No. 42-7.4-05/5.3-836, in the “ Type of document ” column, the text “UIN” is indicated by choosing from the directory “ Types of primary documents ”; first, the corresponding position must be entered into the directory.

In the “ Number ” column you should enter the 20-digit UIN number, the “ Date ” column is not filled in, and in the “ Subject of the basis document ” column you should enter a dash.

The payer ID is indicated on the “ Tax payment ” tab of the “ Request for cash expense ” document.

When specifying code 19 in the line “ Taxpayer status (101) ”, you should enter the individual entrepreneur code in the line “ Basic document number (108) ”, in the left or right field.

This information will be reflected in the relevant sections of the printed form “ Application for Cash Expenses ” and in the upload file.

What documents are needed to obtain an ID?

It all depends on the form in which the document will be drawn up and how to pay. If this is a paper document, then you must send a written request to the tax authority. In the letter, indicate your passport details, INN and SNILS number. A unique payment identifier will be sent in a response letter. If a legal entity or individual comes to the department in person to receive this information, then these documents must be with him. They are required to fill out forms.

To receive details electronically, you must first register in the unified information system on the State Services website, indicating the same data as with a written request. After this, a letter will be sent to your place of residence with an access key. And only after this can you make a request to obtain a unique identifier. Usually this service is provided within a few hours after the application. No documents are required.

As you can see, there is nothing complicated when using the identifier. It won't be difficult to recognize him. To do this, you don’t need to collect a bunch of documents or certificates. But taxes can be paid in a convenient form and at any time. If previously legal entities and individuals had to spend time and money to make tax payments, then with its help they can be paid without leaving home or office, without interrupting work.