Tax deduction for treatment: what is it?

The state takes care of citizens, including stimulating their spending to maintain a decent standard of living. One of the areas of such incentives is the exemption from income tax of part of the income spent on maintaining the health of a citizen and his family members.

If the tax was nevertheless withheld (for example, by the citizen’s employer), then it can be returned . To do this, you need to submit to the Federal Tax Service:

- Declaration in form 3-NDFL with deduction.

- Documents confirming the deduction.

- Return application.

The mechanism for returning personal income tax from the budget is described in detail in our article “How to return personal income tax for a tax deduction: a sample application for a refund 2020.”

IMPORTANT!

You can receive a personal income tax refund not only from the tax office, but also from the employer. To do this, you should receive a special notification from the Federal Tax Service.

General rules for processing 3-NDFL

The general rules for filling out 3-NDFL do not differ from the rules for entering information into other declarations. If the declaration form is filled out manually, grammatical errors and typos are unacceptable. Filling ink is blue or black. Amounts are indicated in kopecks, with the exception of the personal income tax amount - here the figure is rounded according to the rules of mathematics to a whole number.

The applicant is guaranteed an option to correctly fill out the document - using a special program that can be downloaded on the Federal Tax Service website.

For what years and what deduction can you get?

You can get your money back for treatment/medicines only for those years when they actually paid for. However, you can submit a declaration and return the money in the year following the year of payment. That is: if you paid for treatment in 2022, you can return the money in 2020.

Sometimes it happens that a person does not file a deduction immediately. This can be done later , but you will be able to return the tax for no more than the last 3 years . So, in 2022, you can apply for a medical tax deduction only for 2022, 2022 and 2022 inclusive.

IMPORTANT!

If you are filing a personal income tax return for previous years, the declaration should be submitted in the form that was valid for the year of filing ! For example, if in 2022 you decide to return personal income tax for treatment in 2018, then 3-personal income tax must be filled out on a form relevant for 2022.

The maximum deductible amount may vary depending on whether the treatment was “routine” or expensive.

The standard limit for social deductions is 120,000 rubles per year

KEEP IN MIND

In addition to the deduction for ordinary (not expensive) treatment, there are other types of social deductions. And a limit of 120,000 rubles is set for them in total . So, if you incur additional expenses during the year, for example, for additional pension insurance (which also gives you the right to a deduction), you can still claim a refund only from the amount of 120,000 rubles - both for treatment and insurance together. This means that if the treatment is not considered expensive, then only an amount not exceeding 120,000 rubles can be deducted from taxable income.

There is no deduction limit for expensive treatment

However, the fact that the treatment was expensive remains to be confirmed.

Determining what kind of treatment was used for deduction

An indication of the type of treatment (expensive or not) is in the document, which must be taken from the medical institution. It is called “Certificate of payment for medical services for submission to the tax authorities.”

This certificate really needs to be submitted to the Federal Tax Service along with other mandatory documents for deduction.

The current certificate form in 2022 looks like this:

The help contains the “Service Code” field. It is he who determines what treatment was provided:

- if the field contains “ 1 ” – medical services provided, i.e. with a deduction limit of 120,000 rubles;

- if “ 2 ” – the treatment received is considered expensive; You can claim a deduction for the full amount of expenses.

Is it possible to get a deduction for medications?

The deduction for treatment may include the cost of medications purchased for this treatment (Article 219 of the Tax Code of the Russian Federation). The conditions for deducting amounts spent on medicines are as follows:

- Purchased medications must be prescribed by a doctor. To confirm this fact, the recipient of the deduction needs to take a special prescription for each drug from the tax office.

- The person claiming the deduction must pay for all purchases himself (from his own funds).

- The fact of payment must be confirmed by documents - checks, bank card statements, etc.

The prescription for deduction for medications also has a prescribed form - No. 107-1/u.

NOTE

The prescription form for the tax office retains the name No. 107-1/u, but may be modified. The form, current in 2022, was approved by order of the Ministry of Health dated January 14, 2019 No. 4n. Prescriptions issued in 2022, for example, look a little different. But if you filled out a prescription in 2018 and claim the deduction in 2020, you don’t need to redo it.

IMPORTANT!

A prescription for the Federal Tax Service can be issued later than a prescription for a pharmacy, at the written request of the patient. A healthcare provider can issue such a prescription based on the prescription records in the medical record. It is permissible to take form No. 107-1/u for tax purposes within 3 years after the end of the year in which the medications were prescribed.

Letter No. 04-2-02/105 of the Federal Tax Service dated 02/07/2007 provides for the only exception when a prescription for deduction for medicines need not be filled out : this is when the patient was in a hospital and bought the necessary medicines there. In this case, it is enough to provide proof of payment for the drugs, a hospital extract and certificates of medical services.

Are purchased medications included in the deduction?

The deduction for treatment also includes medications purchased as part of this treatment (Article 219 of the Tax Code of the Russian Federation). It is important to remember that:

- Purchased medications must be prescribed by a doctor. To confirm this fact, the recipient of the deduction will need to take 2 copies of the prescription for each drug. One is for the pharmacy, the second is for the tax office.

- All purchases must be paid out of pocket of the person claiming the deduction.

- The facts of purchase and payment must be documented.

What are Lists of Services and Medicines and why are they needed?

The right to deduct personal income tax is not granted for absolutely all medical expenses, but only for those that the person really needed . For example, you cannot receive a deduction for plastic surgery , which the patient decided to do of his own free will, being in fact healthy.

In order to systematize the abundance of medical actions based on their real need for health and cost, the Government of the Russian Federation approved several lists:

- A list of “ordinary” medical services for which a limited deduction is provided (no more than 120,000 rubles per year). For these services, the certificate includes the service code “1” ( List of common medical services ).

- A list of expensive treatments for which the deduction is unlimited. The certificate will include the service code “2” ( List of expensive medical services ).

- List of medicines that are subject to deduction.

The list of medicines for which it was possible to obtain a deduction was used until June 17, 2019 . Law of June 17, 2019 No. 147-FZ in sub. 3 p. 1 art. 219 of the Tax Code of the Russian Federation were amended. They abolished the condition according to which drugs for deduction must be on the approved List.

This change in the Tax Code of the Russian Federation applies to income received after 01/01/2019. Thus, if you submit a deduction for 2018 and earlier, the medications for deduction will still be checked against the List.

The latest edition of the List of Medicines (approved by Decree of the Government of the Russian Federation dated March 19, 2001 No. 201) is still valid.

List of medicines

Note that there is usually no great need to understand the lists. Medical institutions that issue certificates and prescriptions issue them in accordance with the lists. The likelihood of an error (that the certificate will be given, but the tax authorities will not accept it) is minimal .

Is it possible to get a deduction for the treatment of relatives?

If you paid for the treatment of a family member, you can claim a tax deduction. To do this, several conditions must be met simultaneously:

- A relative is a member of your family according to the civil and family legislation of the Russian Federation (remember that this is a spouse, child, parents, etc.).

- It is possible to confirm family ties (for example, present a birth certificate for the child). In this case, a copy of the document confirming the family relationship must be submitted to the tax office along with a package of documents for deduction.

- It is possible to confirm that it was the applicant for the deduction who gave the money for treatment (paid from his own account, was included in the agreement with the medical institution as a payer, etc.).

- Expenses for the treatment of a relative meet the general requirements for recognition of a deduction (there is a certificate of medical services, prescriptions for medications, documents for payment, etc.).

Documents for personal income tax refund when deducting for treatment

Summarizing the above, we will compile a list of documents that must be provided to the tax authorities to confirm the deduction for treatment/medicines:

- Certificate of provision of medical services.

- A certificate stating that medical materials and components had to be purchased for treatment (if this was the case).

- Documents confirming actual payment for medical services (medical materials).

- Prescription in form No. 107-1/у for purchased medications.

- Documents confirming payment for medications (pharmacy receipts, card statements, etc.).

- Documents confirming family relations, if a deduction is received for the treatment of a relative.

In addition, you should submit to the Federal Tax Service:

- documents confirming the withholding of personal income tax (13%) from your income (for example, a certificate of income from the employer);

- application for personal income tax refund;

- Declaration 3-NDFL for deductions for treatment.

Documents for filing a tax deduction for treatment expenses

A refund can be issued only if the medical institution whose services were paid for by the taxpayer has the appropriate license. Otherwise, you will be able to file a tax deduction for treatment, but you will not be able to receive it.

The list of required documents depending on the type of costs incurred is shown in the table.

| Costs incurred | Documents for processing a personal income tax refund, confirming expenses for treatment |

| Payment for medical institution services, including expensive ones (Decree No. 458 dated 04/08/2020) | 1. Agreement for the provision of services with a medical institution licensed in accordance with the legal regulations of the state. 2. A copy of the license of the medical institution (organization or individual entrepreneur). As a rule, it is presented if the license details are not included in the contract. 3. Certificate of payment for medical services with code 1, if a refund for expensive treatment is issued - with code 2. The form was approved by order No. 289/BG-3-04/256 dated July 25, 2001. 4. Copies of payment documents that confirm expenses for the services of a medical institution |

| Purchasing medicines | 1. A prescription with a list of prescribed medications (approved form). It is better to check its correctness before submission. If it is filled out with errors, the deduction will be denied. 2. Documents that confirm the fact of purchase of medicines (receipts, payment orders, checks) |

| Payment of contributions under the VHI agreement | 1. A copy of the VHI agreement. 2. A copy of the license of the insurance company, on the basis of which it operates voluntary health insurance. 3. Copies of payment documents confirming the transfer of contributions |

The taxpayer must remember that if he submits a 3-NDFL declaration to return expenses for treatment, the purchase of medications or the payment of contributions under a VHI agreement not for himself, but for close relatives, he submits documents that confirm the relationship. For example, if medical services provided to a child are paid for, the supporting document will be his birth/adoption or guardianship certificate.

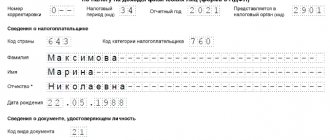

Sample of filling out the 3-NDFL declaration with a deduction for treatment

Let's look at the procedure for filling out 3-NDFL with a deduction for treatment using an example.

EXAMPLE

Petrov P.I. in February 2022, an urgent operation was required, which he performed for 200,000 rubles. In the certificate issued to Petrov at the hospital, the services provided to him were assigned code “2” - expensive. After the operation, Petrov took medications prescribed to him for six months, which he bought himself. In total, he spent 130,000 rubles on medicines. He has receipts from pharmacies, a hospital extract with prescriptions and prescriptions in form 107-1/u.

Petrov’s income for 2022 amounted to 460,000 rubles, personal income tax was withheld from them by Petrov’s employer (confirmed by a certificate of income from the employer). Other income and amounts to be deducted in 2022 from Petrov I.I. No.

To prepare the certificate, Petrov does not need all the sheets of the declaration, but only those on which he will enter the data. For 3-personal income tax with a deduction only for treatment, these will be:

- title page;

- Section 1;

- Section 2;

- Annex 1;

- Appendix 5.

We described how to fill out the title page of the 3-NDFL in 2022 in the article “What codes to put on the title page of the 3-NDFL declaration for 2019.”

What data to indicate in Section 1 of the 3-NDFL form in 2020, see our material “KBK and OKTMO in the 3-NDFL declaration for individuals.”

You may also be interested in “ Rules for filling out a declaration on paper ”

Petrov will start with Appendices 1 and 5, since other sheets should already contain final data.

For Appendix 1, data is transferred from documents confirming income and withholding personal income tax of 13%. Petrov will take them from the income certificate (2-NDFL) issued by the employer.

Section 2 will contain summary data for calculating your personal income tax refund.

Next, using the direct link, you can view and fill out 3-NDFL for free with a deduction for treatment in 2022.

EXAMPLE 3-NDFL 2022 WITH DEDUCTION FOR TREATMENT

How to fill out 3-NDFL for a tax refund for 2022?

To return personal income tax on dental treatment expenses, you need to fill out a tax return 3-NDFL and submit it to the Federal Tax Service either on paper or electronically through the taxpayer’s personal account. It is the latter option that individuals have most often used lately.

You can log into your personal account using your Taxpayer Identification Number (TIN) and password, or through your government services account. The declaration can be filled out directly in your personal account, or you can prepare it separately, and then upload the finished version in your account for the Federal Tax Service.

The 3-NDFL declaration can be downloaded from the link below in excel format or filled out in the special program Declaration 2022. Instructions for preparing 3-NDFL in the program for deductions for treatment.

When filling it out yourself without using a program or personal account, it is important to make sure that the form is up to date. In 2022, you need to fill out the 3-NDFL form, approved by Federal Tax Service Order No. ED-7-11 / [email protected] dated 08/28/2020.

The following must be attached to the 3-NDFL:

- contract for the provision of dental services;

- payment documents;

- TIN;

- passport.

The declaration form should be filled in:

- The title page is the first page that displays information about the reporting period, the taxpayer and the declaration;

- section 1 - is filled out on the basis of section 2 as one of the last, when all calculations have been made - shows the amount that the Federal Tax Service will have to return to the taxpayer in connection with the costs of dental treatment;

- appendix to section 1 - an application for a tax refund is generated, here you need to indicate the amount to be returned and the payment details to which the funds will need to be transferred; there is no need to prepare a separate application;

- section 2 - calculation of personal income tax for refund is carried out based on data on taxable income, withheld personal income tax and data on dental treatment expenses;

- Appendix 1 - shows income for the reporting year and personal income tax withheld from it, as well as information about the source of this income. If there were several sources, then data for each is shown separately;

- Appendix 5 - the required deduction is calculated - expenses for dental treatment, medications and expensive dentistry (prosthetics, implantation) are reflected separately, then all expenses are summed up.

Detailed completion of sections of the declaration for deduction for treatment.

Below is an example of filling out the 3-NDFL declaration under the following conditions:

- expenses for dental treatment - 70,000;

- medicine costs - 20,000;

- expenses for dental prosthetics - 150,000;

- annual income from the employer is 900,000, from which personal income tax is withheld = 117,000.

The total deduction amount is = 70,000 + 20,000 + 150,000 = 240,000.

Personal income tax to be returned = 13% * 240,000 = 31,200.

Filling example: