To make it easier for banks to identify legal entities and individual entrepreneurs who evade taxes and launder criminal proceeds, the Central Bank has developed a special manual, having agreed on it with the Federal Tax Service.

You will come under suspicion if VAT is not included in your payments, you make payments to the Russian Post and transfer money to individual cards.

Salary on an individual’s card, and without VAT? Suspicious...

We'll tell you how banks will analyze transactions on your accounts and who will get into development.

Manual - to help

The Central Bank has developed Methodological Recommendations on approaches to managing the risk of legalization (laundering) of proceeds from crime and the financing of terrorism by credit institutions No. 5-MR dated February 16, 2018.

The purpose of the manual is to help banks identify clients with questionable transactions. We are talking about those who launder proceeds from crime, do not pay taxes and customs duties, and withdraw funds from the Russian Federation.

The assessment of clients' activities will be carried out using the criterion of payment of taxes, in particular VAT.

What does it mean? Banks need to identify clients on whose accounts taxes are not paid or are paid in insignificant amounts that are not comparable to the scale of activity of the account holder.

When compiling the manual, the Central Bank was guided both by the results of its supervisory activities and by the information received as part of information interaction with the Federal Tax Service.

Income with VAT, expense without VAT

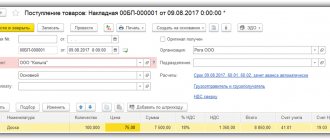

As a result of an analysis by credit institutions of transactions on the bank accounts of individual clients, it may be revealed that the majority of funds are credited to clients’ bank accounts with the allocation of VAT, and written off by clients in favor of counterparties without VAT.

This is bad, the Central Bank notes. According to the Federal Tax Service, these transactions are often carried out by clients in order to implement schemes aimed at avoiding paying VAT, or deliberately understating the amount of such tax, including schemes that provide for the taxpayer to obtain grounds for deduction and subsequent reimbursement of VAT.

Is the sale of medical equipment exempt from VAT?

When selling medical equipment or accessories for it, including those imported into the Russian Federation, it is subject to VAT exemption if a registration certificate is issued for it based on the list approved by Decree of the Government of the Russian Federation dated September 30, 2015 No. 1042.

Please note that from July 1, 2017, the right to a benefit is confirmed by a registration certificate for a medical product issued in accordance with the law of the Eurasian Economic Union. In addition, until December 31, 2021, the benefit can be confirmed by presenting a registration certificate for a medical product (registration certificate for a medical product (medical equipment), issued in accordance with the legislation of the Russian Federation (clause 1 of article 1 of the law dated 03/07/2017 No. 25 -FZ). Such a certificate must be presented to the Federal Tax Service by the taxpayer selling this equipment. This also applies to accessories for this equipment. The registration certificate must indicate that it is issued for a set of specific equipment (for example, a dental chair with a set of tools for it) .

Impact and cutting instruments (drills, burs, cutters) intended for dental treatment are subject to VAT exemption according to the list approved by Decree of the Government of the Russian Federation dated September 30, 2015 No. 1042.

What should banks do?

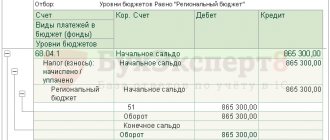

The Central Bank instructs banks a weekly basis to determine the ratio of the amount of funds received into clients’ bank accounts, including VAT, and funds debited from clients’ bank accounts, excluding VAT.

If all receipts to the client’s account include VAT, and all write-offs do not include VAT, then the amount of VAT payable to the budget should be:

10% of debit turnover on transactions taxed at a VAT rate of 10%;

18% of debit turnover for transactions taxed at the VAT rate of 18%;

from 10% to 18% of debit turnover for transactions taxed at different VAT rates.

| Receipts to the account with VAT | Account debits without VAT | VAT rate | Share of VAT payable to the budget (in % of account turnover) |

| 100% | 100% | 10% | 10% |

| 18% | 18% | ||

| 10% and 18% | from 10 to 18% |

Suspicious clients

The Central Bank classifies as suspicious those clients to whose accounts the majority of the money is credited with VAT included, and written off in favor of counterparties without VAT. This, according to the Central Bank of the Russian Federation, indicates the taxpayer’s avoidance of paying tax or the illegal receipt of grounds for a VAT deduction and its subsequent reimbursement.

The Central Bank even gives percentages typical for banking transactions of suspicious clients: 70% and 30%. Clients into whose accounts more than 70% of the money comes with VAT, and less than 30% of the total amount of money written off are written off with VAT, are considered suspicious.

This ratio is recommended to be used at the initial stage of applying the method. In the future, banks are allowed to change the ratio of such payments, taking into account the risk assessment of each individual client.

The Central Bank of the Russian Federation also draws attention to the fact that if all money received with VAT is written off from the account without VAT in full, the client will be required to pay tax in an amount equal to the corresponding rate. Thus, for transactions taxed at a rate of 18%, the amount of VAT payable will be 18% of debit turnover. For transactions taxed at a rate of 10% - 10% of debit turnover, etc.

Banks are now required to monitor these ratios on a weekly basis. If the ratios raise doubts about the payer’s integrity, he will be asked for documents confirming payment of tax in the specified amounts.

Who will they start with?

At the initial stage of applying these methodological recommendations, the Central Bank invites banks to pay increased attention to those transactions on the client’s account, in which the share of payments related to the crediting of funds with VAT in the total volume of funds credited to the client’s bank account is more than 70%, and the share payments related to the write-off of funds with VAT is less than 30% of the total amount of funds written off from the client’s bank account.

| Receipts from VAT in total receipts | VAT write-offs in total write-offs | |

| When you are guaranteed increased attention from the bank | 70% | 30% |

In the future, when analyzing payments including VAT and excluding VAT on the client’s bank accounts, the credit institution can change the ratio of such payments taking into account the client’s risk assessment , the scale and nature of its activities.

On certain issues related to the calculation and accounting of VAT

Description of the situation

Based on the Accounting Policy of the Bank, for tax purposes, VAT is charged to expenses by the Bank in accordance with paragraph 5 of Article 170 of the Tax Code of the Russian Federation. The Bank includes tax amounts paid to suppliers on purchased goods (works, services) as expenses accepted for deduction when calculating income tax. In this case, the entire amount of tax received from transactions subject to taxation is subject to payment to the budget.

At the same time, the amounts of VAT presented to the Bank when purchasing goods (payment for work, services) are recorded separately on personal accounts of the second-order balance sheet account 60310 “Value added tax paid” at the time such goods (work, services) are accepted for accounting or put into operation fixed assets and intangible assets On the last working day of the reporting month, the amount of VAT paid is debited to BS 70606 (according to symbol 26411 (taxes and fees attributable to expenses in accordance with the legislation of the Russian Federation)).

For transactions subject to VAT, the Bank maintains logs of received and issued invoices, books of purchases and sales in accordance with Decree of the Government of the Russian Federation No. 914 and Article 169 of the Tax Code of the Russian Federation.

Based on paragraph 11 of the Government of the Russian Federation of December 2, 2000 N 914 “On approval of the Rules for maintaining logs of received and issued invoices, purchase books and sales books when calculating value added tax”), invoices are not registered in the purchase book, received for the amount of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights acquired exclusively for the implementation of operations specified in paragraphs 2 and 5 of Article 170 of the Tax Code of the Russian Federation.

Questions

Based on the above, does the Bank have the right to:

1) In accordance with paragraph 11 of the Decree of the Government of the Russian Federation dated December 2, 2000 N 914, do not register received invoices in the Purchase Book, but stitch them in chronological order in a separate stitch, which will significantly reduce the Bank’s labor costs;

2) do not assign the amount of VAT paid to BS 60310, but reflect it as part of the Bank’s expenses when purchasing goods (payment for work, services), or as part of the book value of fixed assets and intangible assets put into operation, since the amount of tax paid to suppliers purchased goods (works, services), the Bank includes in costs accepted for deduction when calculating income tax.

Consultants' opinion

1. The Bank has the right not to register invoices received from sellers of goods (works, services) in the Purchase Book and stitch them in chronological order in a separate binder.

2. The choice of the method of accounting for VAT as part of production and sales costs is the prerogative of the Bank. The bank independently determines whether to accept VAT for deduction, guided by paragraph 2 of Article 171 of the Tax Code of the Russian Federation, or to charge it as expenses in accordance with paragraph 5 of Article 170 of the Tax Code of the Russian Federation. The decision made by the Bank must be enshrined in the Accounting Policy for tax purposes.

The approach to accounting given in the text of the question contradicts the essence of recognizing VAT paid in accordance with paragraph 5 of Article 170 of the Tax Code of the Russian Federation and the requirements of regulations in the field of accounting.

Justification of the consultants' opinion

Regarding question 1.

From the content of Articles 313 and 169 of the Tax Code of the Russian Federation, it follows that an invoice is a document used to justify tax deductions for VAT according to the rules of Chapter 21 of the Tax Code of the Russian Federation, and cannot be used for the purposes of tax accounting for income tax (Resolutions of the Federal Antimonopoly Service of the North-Western District dated 19.05.2004 No. A26-9155/03-27, FAS of the East Siberian District dated 03.07.2006 No. A33-28961/05-F02-3184/06-S1; Resolution of the Ninth Arbitration Court of Appeal dated 17.10.2005 No. 09AP-11090/05-AK, left unchanged by Resolution of the Federal Antimonopoly Service of the Moscow District dated January 24 (31, 2006) No. KA-A40/14234-05). As noted in the Letter of the Ministry of Finance of Russia dated January 21, 2005. No. 03-03-01-04/2/9, “...for the acceptance of value added tax amounts for profit tax purposes, the presence of invoices is optional, provided that the fact of the implementation of these expenses is confirmed by primary documents and the implementation of these expenses for the purpose of generating income” . A similar point of view was expressed in Letters of the Ministry of Finance of Russia dated 08/27/2004 No. 03-03-01-04/2/5, dated 08/30/2006. No. 03-04-03/22 and dated July 13, 2005. No. 03-03-04/2/28. For this reason, banks have the right to be guided by the content of paragraph 5 of Article 170 of the Tax Code of the Russian Federation, regardless of whether they have a seller’s invoice.

Based on paragraph 7 of Resolution No. 914, the purchase book , intended for recording invoices issued by sellers, is maintained by buyers in order to determine the amount of VAT to be deducted (refunded) in the prescribed manner.

Considering that banks that apply the norm of paragraph 5 of Article 170 of the Tax Code of the Russian Federation for the purposes of calculating VAT do not accept tax amounts on purchased goods (work, services) for deduction, invoices received by banks from sellers of goods (work, services) should be kept in the journal of received invoices without recording in the purchase book .

This conclusion was stated by the Russian Ministry of Finance in a Letter dated May 12, 2009. No. 03-03-06/2/103 and is based on the norms of paragraph 11 of Regulation No. 914, according to which invoices received, including for the amount of payment, partial payment for upcoming deliveries of goods (performance of work) , provision of services), transfer of property rights acquired exclusively for the implementation of operations specified in paragraphs 2 and 5 of Article 170 of the Tax Code of the Russian Federation.

Thus, according to the consultants, the Bank has the right not to register invoices received from sellers of goods (works, services) in the Purchase Book and stitch them together in chronological order in a separate file.

According to the general rule established by paragraph 1 of Article 252 of the Tax Code of the Russian Federation, the taxpayer has the right, when calculating the tax base for income tax, to reduce the income received by the amount of expenses incurred, provided that such expenses are not named in Article 270 of the Tax Code of the Russian Federation, their incurrence is documented and they are justified. In this case, any expenses are recognized as expenses, provided that they are incurred in activities aimed at generating income.

Subparagraph 1 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation includes the amounts of taxes and fees, customs duties and fees accrued in the manner established by the legislation of the Russian Federation , with the exception of those listed in Article 270 of the Tax Code of the Russian Federation. As mentioned above, by paragraph 5 of Article 170 of the Tax Code of the Russian Federation, the legislator granted banks the right to reduce profits subject to taxation by the amounts submitted by suppliers for purchased goods (works, services) VAT.

Performing a special function defined by the legislator in the above norm, the invoice is not a primary accounting document in the interpretation given by Law No. 129-FZ . Consequently, the date of registration and issuance of an invoice to the Bank is not a basis for non-recognition of VAT amounts when taxing profits. The basis (documentary evidence) for recognizing expenses in the form of amounts of VAT paid are contracts, payment documents, which highlight the amount of VAT accepted as expenses.

Financial department specialists hold a similar position on this issue. So, for example, in the Letter dated January 12, 2010. No. 03-07-05/01 explains the following:

“...for banks that apply the above procedure for calculating value added tax and, accordingly, do not carry out tax deductions for this tax, an invoice, including an invoice in which amounts are expressed in foreign currency, is not a mandatory document serving the basis for inclusion in the costs accepted for deduction when calculating corporate income tax, the amounts of value added tax paid when purchasing goods (works, services).

The basis for recognizing these expenses for profit tax purposes are contracts, invoices, certificates of work performed (services rendered) and payment documents in which the amount of value added tax is highlighted as a separate line.”

Regarding question 2.

According to the general rule established by paragraph 1 of Article 54 of the Tax Code of the Russian Federation, taxpayers - organizations calculate the tax base at the end of the tax period on the basis of accounting data and (or) on the basis of other documentary evidence of these objects subject to taxation or related to taxation.

In accordance with paragraph 14 of Article 4 of Law No. 86 FZ, the accounting and reporting rules for the banking system of the Russian Federation are established by the Bank of Russia.

Clause 1.6 of Appendix No. 10 to Regulation No. 302-P establishes that the initial cost of property acquired for a fee, including used property, is recognized as the amount of actual costs of the credit institution for the acquisition, construction (construction), creation (manufacturing) and bringing to condition in which it is suitable for use. It has been established that the specific composition of costs for construction (construction), creation (manufacturing), acquisition of property (including tax amounts) is determined in accordance with the legislation of the Russian Federation, including regulations of the Ministry of Finance of Russia.

Regulatory acts of the Ministry of Finance of the Russian Federation that determine the specific composition of costs for construction (construction), creation (manufacturing), acquisition of property are, in particular, PBU 5/01 and PBU 6/01 and methodological guidelines for accounting for inventories and fixed assets revealing their content . The specified regulations of the Ministry of Finance of the Russian Federation, regarding the formation of the initial cost of property, establish the following:

— “ The actual cost of inventories purchased for a fee is the amount of actual costs for the acquisition, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation)” (clause 6 of PBU 5/01);

— “ The initial cost of fixed assets acquired for a fee is recognized as the amount of actual costs for the acquisition, construction and production, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation)” (clause 8 of PBU 6/01 ).

A similar norm is established by paragraph 1 of Article 257 of the Tax Code of the Russian Federation: the initial cost of a fixed asset is defined as the amount of expenses for its acquisition, construction, production, delivery and bringing it to a state in which it is suitable for use, with the exception of taxes included in expenses.

At the same time, the characteristics of balance sheet accounts 60309 “Value added tax received” and 60310 “Value added tax paid” provide for the reflection of tax amounts in the manner determined by the accounting policy of the credit organization in accordance with the legislation on taxes and fees (clause 6.8 of Part II of Regulation No. 302-P).

The procedure for including VAT paid and other refundable taxes in the initial cost of property (work, services) is determined by Chapter 21 of the Tax Code of the Russian Federation.

Thus, according to paragraph 5 of Article 170 of the Tax Code of the Russian Federation, banks have the right to include in the costs accepted for deduction when calculating corporate income tax, the amount of VAT paid to suppliers on purchased goods (work, services) , and the entire amount of VAT received by them on transactions subject to taxation, subject to payment to the budget. In this case, the method of forming the initial cost of fixed assets is determined by the credit institution independently.

Therefore, if the accounting policy for the purposes of accounting establishes the method of forming the initial cost of fixed assets in accordance with the norms of paragraph 5 of Article 170 of the Tax Code of the Russian Federation , VAT paid upon the acquisition of fixed assets is not included in the initial cost of fixed assets .

The application of paragraph 5 of Article 170 of the Tax Code of the Russian Federation is a right , but not an obligation of the bank. And if he has not chosen a special norm for calculating and paying VAT, then he is obliged to calculate and pay VAT on a general basis in accordance with Articles 170 - 172 of the Tax Code of the Russian Federation (hereinafter referred to as the general procedure). This right is supported by judicial acts (Resolution of the FAS Povolzhsky District dated October 12, 2006 No. A65-3733/2006-SA2-41, Resolution of the FAS Povolzhsky District dated October 26, 2006 No. A55-19060/05).

When using the general procedure for calculating and paying VAT in accordance with paragraph 2 of Article 170 of the Tax Code of the Russian Federation, the bank has the right to apply tax deductions for purchased goods (work, services) only if the purchased goods (work, services) are used by it for transactions subject to VAT taxation . If the purchased goods (work, services) are used by the bank for transactions that are not subject to taxation (exempt from taxation), and, as a rule, this is the vast majority of transactions carried out by banks, then, by virtue of paragraph 2 of Article 170 of the Tax Code of the Russian Federation, the VAT charged to the bank on the purchased goods (works, services), is subject to inclusion in the cost of such goods (works, services).

In addition, when applying the general procedure by virtue of paragraph 4 of Article 170 of the Tax Code of the Russian Federation, if a bank purchases goods (work, services) related to both taxable and non-VAT-taxable transactions, VAT subject to deduction is determined in the proportion in which they are used for carrying out taxable and non-taxable transactions. The procedure for calculating this proportion is established by the bank independently in its accounting policy for tax purposes, taking into account the provisions of paragraph 5 of paragraph 4 of Article 170 of the Tax Code of the Russian Federation.

Therefore, the bank, applying the general procedure , must be guided by the following rules:

- for goods (works, services) purchased only for transactions subject to VAT, he has the right to apply VAT deductions in full;

- for goods (work, services) purchased only for VAT-free transactions, he does not have the right to apply deductions, and the VAT presented by sellers is taken into account in the cost of such goods (work, services);

- for goods (works, services) purchased simultaneously for VAT-taxable and non-VAT-taxable transactions, he determines part of the VAT to be deducted according to the proportion, and the rest is taken into account in the cost of these goods (works, services).

Thus, a feature of the general procedure for calculating VAT is the mandatory maintenance of separate accounting of VAT amounts for purchased goods (works, services) and the fixation of the parameters for calculating the proportion for the distribution of VAT in the Bank’s Accounting Policy for tax purposes.

VAT accounting method is the prerogative of the Bank. The bank independently determines whether to accept VAT for deduction and take it into account in the cost of goods (work, services), guided by paragraph 2 of Article 171 of the Tax Code of the Russian Federation, or charge it to expenses in accordance with paragraph 5 of Article 170 of the Tax Code of the Russian Federation.

As follows from the text of the question, the Bank's accounting policy establishes the procedure for recognizing VAT amounts paid as part of expenses associated with production and sales, in accordance with paragraph 5 of Article 170 of the Tax Code of the Russian Federation.

Consequently, the formation of the initial cost of property acquired by the Bank, expenses from the provision of services to the Bank, performance of work should be carried out based on the principle laid down by paragraph 5 of Article 170 of the Tax Code of the Russian Federation: without including in them the amounts of VAT paid. Thus, the approach to accounting given in the text of the question contradicts the essence of recognizing VAT paid in accordance with paragraph 5 of Article 170 of the Tax Code of the Russian Federation and the requirements of regulations in the field of accounting.

We consider it appropriate to draw the Bank's attention to the following circumstance.

The possibility for to simultaneously apply two VAT accounting options to various assets - according to paragraph 5 of Article 170 of the Tax Code of the Russian Federation (do not include VAT in the cost of property, but immediately charge it to expenses) and according to paragraph 2 of Article 170 of the Tax Code of the Russian Federation (include VAT in the initial cost of property when accepting it for accounting) - assumes the presence of different ways to determine the tax base for VAT when selling property: either in accordance with paragraph 1 of Article 154 of the Tax Code of the Russian Federation, i.e. based on the value of the property being sold based on market prices excluding VAT, or in accordance with paragraph 3 of Article 154 of the Tax Code of the Russian Federation - in the form of the difference between the price of the property being sold and its value (including VAT).

An analysis of the existing clarifications of the Russian Ministry of Finance and arbitration practice on this issue showed the following.

Until 2008, specialists from the Ministry of Finance of Russia in a Letter dated May 31, 2007. No. 03-07-05/30 expressed the opinion that, on the basis of paragraph 5 of Article 170 of the Tax Code of the Russian Federation, banks have the right to include in the costs accepted for deduction when calculating corporate income tax, the amount of VAT paid to suppliers on goods (works, services), including fixed assets and intangible assets acquired for the main production activities of banks. Therefore, in relation to property not used in banking activities, VAT amounts are taken into account in the cost of such property.

At the same time, the main financial department of the Russian Federation concluded that when a bank sells property not used in banking activities, the VAT tax base should be determined in the manner established by paragraph 3 of Article 154 of the Tax Code of the Russian Federation. A similar procedure for calculating VAT is applied when selling property received by the bank as compensation to repay a loan.

However, starting from 2008 , specialists from the Ministry of Finance of Russia changed their position to the completely opposite (Letters of the Ministry of Finance of Russia dated 02/08/2010 No. 03-07-05/04, dated 09/21/2009 No. 03-07-05/47, dated 17.09 .2009 No. 03-07-05/45, dated 09.14.2009 No. 03-07-05/42, dated 01.04.2008 No. 03-07-05/16) and indicated that banks applying the procedure for calculating VAT in accordance with paragraph 5 of Article 170 of the Tax Code of the Russian Federation, it is not necessary to determine the tax base when selling property in accordance with paragraph 3 of Article 154 of the Tax Code of the Russian Federation.

At the same time, according to the Ministry of Finance of Russia, banks that apply the norm of paragraph 5 of Article 170 of the Tax Code of the Russian Federation for the purposes of calculating VAT, the amount of VAT on acquired property, both used for production activities and intended for resale, is not taken into account in the value of the property, but includes included in expenses when calculating corporate income tax. (Letter dated January 21, 2008 No. 03-07-05/41).

Despite the existence of the above-mentioned opinion of specialists from the Ministry of Finance of Russia regarding the inability of banks to apply paragraph 3 of Article 154 of the Tax Code of the Russian Federation when determining the tax base for the sale of goods, arbitration practice on this issue is in favor of taxpayers who apply paragraph 5 of Article 170 of the Tax Code of the Russian Federation and have taken advantage of the procedure for determining the tax base in in accordance with paragraph 3 of Article 154 of the Tax Code of the Russian Federation.

In the Resolution of the Federal Antimonopoly Service of the Central District dated December 22, 2009. in case No. A36-955/2009, the issue was considered regarding the legality of determining the tax base by the bank in accordance with paragraph 3 of Article 154 of the Tax Code of the Russian Federation when selling property received under a compensation agreement [1].

The court concluded that it was legal for the bank to include the VAT amount in the cost of the property on the basis of paragraph 2 of Article 170 of the Tax Code of the Russian Federation, and, accordingly, the bank’s use of the procedure for determining the tax base, in accordance with paragraph 3 of Article 154 of the Tax Code of the Russian Federation, is also legal.

Similar conclusions on the issue under consideration are contained in the Determination of the Supreme Arbitration Court of the Russian Federation dated January 26, 2007 No. 296/07 in case No. A40-13686/05-115-8, the Resolution of the Federal Antimonopoly Service of the Central District dated March 21, 2008. in case No. A62-2821/2007, Resolution of the Federal Antimonopoly Service of the Moscow District dated May 28, 2010. No. KA-A40/5229-10-P in case No. A40-46466/08-90-173.

Based on the above, in the opinion of the consultants, the Bank, which has approved in its Accounting Policy for tax purposes the procedure for accounting for VAT amounts in accordance with paragraph 5 of Article 170 of the Tax Code of the Russian Federation, when deciding on the application of paragraph 3 of Article 154 of the Tax Code of the Russian Federation when selling property (for example, received under compensation agreement), it is necessary to determine the legality of accounting for the value of property without allocating and assigning the amount of VAT to expenses in accordance with paragraph 2 of Article 170 of the Tax Code of the Russian Federation and be prepared to challenge this procedure by the tax authorities. At the same time, taking into account current arbitration practice, we read that it is likely that the legality of the Bank’s actions will be confirmed in court.

Documents and literature.

1. Tax Code of the Russian Federation - Tax Code of the Russian Federation (Part I) dated July 31, 1998. No. 146-FZ and (Part II) dated 05.08.2000 No. 117-FZ;

2. Law No. 86-FZ - Federal Law of the Russian Federation dated July 10, 2002 No. 86-FZ “On the Central Bank of the Russian Federation (Bank of Russia)”;

3. Decree No. 914 - Decree of the Government of the Russian Federation dated December 2, 2000. No. 914 “On approval of the rules for maintaining logs of received and issued invoices, purchase books and sales books when calculating value added tax”;

4. PBU 5/01 – Accounting Regulations “Accounting for Inventories”, approved by Order of the Ministry of Finance of the Russian Federation dated 06/09/2001. No. 44n;

5. PBU 6/01 – Accounting Regulations “Accounting for Fixed Assets”, approved by Order of the Ministry of Finance of the Russian Federation dated March 30, 2001. No. 26n;

6. Regulation No. 302-P – Regulation of the Bank of Russia dated March 26, 2007. No. 302-P “On the rules of accounting in credit institutions located on the territory of the Russian Federation.”

[1] In the said Resolution, the FAS of the Central District took the side of the taxpayer-bank in resolving the controversial issue under consideration, justifying its decision with the following conclusions.

In accordance with subparagraph 3 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation, banking transactions are not subject to taxation.

Having analyzed articles 149, 143, 146, 154, 170 of the Tax Code of the Russian Federation, the FAS of the Central District came to the conclusion that the Tax Code of the Russian Federation, as a general rule, gives organizations the right to choose the method of accounting for “input” VAT: to accept for deduction (reimbursement) in the cases provided for in the articles. 171, 172, 176 of the Tax Code of the Russian Federation, taken into account in the cost of purchased goods (work, services), property rights (clause 2 of Article 170 of the Tax Code of the Russian Federation), attributed to costs that reduce taxable profit (in particular, for banks) (clause 5 of Article 170 Tax Code of the Russian Federation).

As the court pointed out, the right granted to banks by paragraph 5 of Article 170 of the Tax Code of the Russian Federation to include in the costs accepted for deduction when calculating corporate income tax, the amount of VAT paid to suppliers on acquired property stems from the fact that most of the property acquired by banks is used by them for transactions not subject to taxation; transactions subject to taxation (not exempt from taxation) constitute an insignificant part for banks.

At the same time, the systematic interpretation of Article 170 of the Tax Code of the Russian Federation in conjunction with the application of the principle of interpretation of irremovable ambiguities of tax legislation in favor of the taxpayer (clause 7 of Article 3 of the Tax Code of the Russian Federation), in the opinion of the court, does not exclude the possibility of simultaneous application by the bank to various assets (in particular, financial and non-financial ) two options for accounting for VAT: according to paragraph 5 of Article 170 of the Tax Code of the Russian Federation (do not include VAT in the cost of property, but immediately charge it to expenses) and according to paragraph 2 of Article 170 of the Tax Code of the Russian Federation (include VAT in the initial cost of property when accepting it for accounting). Moreover, in the case of the sale of property, the tax base must be determined accordingly in accordance with paragraph 1 of Article 154 of the Tax Code of the Russian Federation, i.e. based on the value of the property being sold based on market prices, or in accordance with paragraph 3 of Article 154 of the Tax Code of the Russian Federation - in the form of the difference between the price of the property being sold and its value.

At the same time, Chapter 21 of the Tax Code of the Russian Federation does not establish a mechanism for including paid VAT in expenses in accordance with paragraph 5 of Article 170 of the Tax Code of the Russian Federation (at a time or through depreciation charges), and the norm established by paragraph 5 of Article 170 of the Tax Code of the Russian Federation is a right, not an obligation of the taxpayer, therefore the application The specified procedure is subject to enshrinement in the accounting policies of the organization.

Considering that the bank did not include the amount of “input” VAT in the costs when registering the sold property on its balance sheet, in this case the bank did not lawfully apply the norms of paragraph 5 of Article 170 of the Tax Code of the Russian Federation for the purposes of calculating VAT, but took into account the amount of VAT in the value of the property.

In addition, Chapter 21 of the Tax Code of the Russian Federation does not contain imperative norms defining a special procedure for accounting for the purposes of taxation of fixed assets and other material assets of credit institutions, but allows for the presence of property accounted for together with VAT (clause 3 of Article 154 of the Tax Code of the Russian Federation) and does not require separating VAT from the cost of acquired property, giving organizations the right to determine the procedure for tax accounting for VAT in their accounting policies.

Suspicious transfers

The manual contains a list of transfers from customer accounts without VAT that are suspicious. Presumably, such payments are aimed at avoiding taxes.

Such payments include:

- transfers of funds to the accounts of branches of the Federal State Unitary Enterprise "Russian Post";

- transfers of funds to the accounts of paying agents and bank payment agents;

- transfers of funds by legal entities from their bank accounts to bank accounts of individuals, transactions for which are carried out using bank cards;

- transfers of funds to the accounts of persons engaged in tour operator and travel agency activities and other activities related to organizing travel (tourism activities).

Which operations from clause 3 of Art. 149 of the Tax Code of the Russian Federation are exempt from VAT?

In accordance with paragraph 3 of Art. 149 of the Tax Code of the Russian Federation exempts from VAT taxation:

- sale by religious organizations of literature and items related to religion (the list is approved by the Government of the Russian Federation);

- sale of goods, services and work produced by organizations and societies of disabled people (the list is approved by the Government of the Russian Federation); at the same time, the number of disabled people in such societies should be at least 80%;

- bank operations: attracting household deposits and cash services;

- maintaining bank accounts of organizations;

- buying and selling currencies and precious metals;

- servicing bank cards;

NOTE! As of June 1, 2018, banking transactions with precious stones are excluded from the list of transactions not subject to VAT.

See here for details.

- sale of entrance tickets (on strict reporting forms) to sporting events and provision of stadiums for rent;

- operations on loans of money and securities;

- carrying out R&D at the expense of the budget of the Russian Federation or support funds under the Law “On Science” dated August 23, 1996 No. 127-FZ to create new technologies and products - these include the development of new designs of machines and equipment, instruments, testing them and obtaining practical results from their use;

For more information about documents confirming VAT benefits for R&D, see the article “VAT exemption can be partially waived .

Who is the most suspicious

Banks will take a closer look at all clients who make payments without VAT and pay VAT to the budget in an amount less than specified in the recommendations of the Central Bank. But some types of businesses will be more likely than others to be suspected of tax evasion under the above conditions.

To whom will banks pay increased attention:

- agricultural sector and trade in timber, construction materials, including the export of grain crops, vegetable oils, fish (crustaceans and mollusks), timber, as well as the supply of agricultural raw materials and timber for domestic processing, where clients, as a rule, specialize in resale agricultural crops, fish (crustaceans and mollusks), timber, building materials and have the main or additional activity of “Wholesale trade of grain, unprocessed tobacco, seeds and feed for farm animals” (OKVED 46.21), “Wholesale trade of other food products, including fish, crustaceans and mollusks" (OKVED 46.38), "Wholesale trade in timber, building materials and sanitary equipment" (OKVED 46.73);

- transfers of funds in the field of providing freight transport services by road (OKVED 49.4);

- transfers of funds in the construction sector (section F according to OKVED);

- transfers of funds in the field of wholesale trade in scrap metal, including scrap of ferrous and non-ferrous metals;

- transfers of funds in the field of personnel provision;

- transfers of funds in the field of trade in precious metals and precious stones, jewelry made from them and scrap of such products.

Industries with a large number of fly-by-nights

Along with the signs of dubious clients, the Central Bank also provided in its manual a list of economic sectors in which schemes for obtaining illegal tax benefits involving shell companies are most often found. The regulator identifies the following areas:

- agriculture and trade in timber and construction materials;

- construction and provision of freight transport services by road;

- scope of personnel provision;

- trade in precious metals and stones, jewelry made from them and scrap of such products;

- wholesale trade in scrap metal, including scrap of ferrous and non-ferrous metals.

Consequences

So, the bank found out that the client pays too little VAT, or does not pay it at all. What's next?

And then the bank must analyze the relationships of such clients with its other clients to whom transfers are made.

The Bank will request from the listed clients documents (their duly certified copies) confirming that the client has paid VAT or confirming the absence of grounds for paying VAT for the tax period in respect of which the information is requested.

What happens if the client does not provide the documents requested by the bank or the bank suspects their authenticity? In this case, it is recommended to refuse to accept payments from the client via Internet banking, if such a right is provided for in the agreement between the credit institution and the client.

In addition, the same actions of the bank are provided for clients for whom an entry has been made in the Unified State Register of Legal Entities about the unreliability of information about the legal entity.

At the same time, the Central Bank recommends resuming customer service using remote access technology to a bank account (including Internet banking), subject to the client providing the documents requested by the credit institution, on the basis of which the bank can conclude that there is no suspicion that the purpose of the transaction was is the legalization (laundering) of proceeds from crime, tax evasion, as well as the absence in the Unified State Register of Legal Entities of records about the unreliability of information about this client.

Request for documents by the bank and blocking of transactions

The main goal of the new manual is to combat shell companies that are used to obtain illegal VAT benefits. In accordance with it, banks are recommended from 2022 to tighten control over all operations in which VAT appears, as well as to suppress operations that fall into the category of questionable ones.

If the bank believes that the client is evading taxes, the client will be required to provide evidence of his good faith. For this purpose, documents will be requested confirming the payment of VAT or the absence of grounds for its payment.

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

1. The Central Bank of the Russian Federation has issued new methodological recommendations for banks. The main goal of the new manual is to combat shell companies that are used to obtain illegal tax benefits for VAT.

2. Banks are recommended to tighten control over all transactions in which VAT appears from 2022.

3. The Central Bank of the Russian Federation considers suspicious those bank clients to whose accounts the majority of money is credited with VAT included, and written off in favor of counterparties without VAT.

4. The Central Bank classifies bank transfers as suspicious transactions, in which there is a predominant write-off of money without VAT.

5. If the bank believes that the client is evading taxes, the client will be required to provide evidence of good faith. For this purpose, documents will be requested confirming the payment of VAT, or the absence of grounds for its payment.

If the organization/individual entrepreneur refuses to confirm payment of VAT or the submitted documents turn out to be unreliable, the client will face very sad consequences.

Thus, banks will simply refuse to accept orders from a client to conduct transactions on a bank account via Internet banking. The same applies to clients for whom the Unified State Register of Legal Entities contains a record of the unreliability of the information they provided. They will also not be able to use online banking. Operations will be resumed only if documents confirming the payment of VAT are provided.

At the same time, repeated refusal to carry out an operation gives the bank the right to unilaterally terminate all relations with clients. The bank will be able to terminate the agreement and close its bank account (paragraph 3, clause 5.2, article 7 of Federal Law No. 115-FZ “On Combating Legalization...”).

In the future, the client will be blacklisted, and it will be difficult or even impossible for him to open an account in another bank. It is also possible that all information about a suspicious client will be transferred to tax authorities and law enforcement officers.

Survey

Reconciliation of VAT accounting data

- Do you use the “VAT Accounting Data Reconciliation” service?

do not use 189 (43.35%) what is this? 136 (31.19%) I use it often, very convenient service 66 (15.14%) I rarely use it 45 (10.32%)

Thank you for participating in the survey! Every opinion is very important to us!