Form SZV-M is the basis for personalized registration of citizens. It is submitted by employers monthly in relation to each individual insured in the compulsory pension insurance system. The purpose of the form is to record the insurance period and calculate the pension. In May 2021, a new SZV-M form was approved, and some rules for displaying data in it were also clarified. Let's figure out how to fill out and submit this report.

Submit reports online

Who should be accountable for whom?

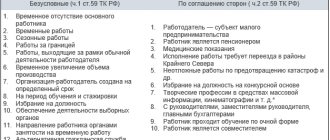

The SZV-M form must be submitted by all organizations and individual employers in 2022. It is drawn up in relation to those persons who are included in the compulsory pension insurance system, namely in relation to:

- employees under employment contracts;

- persons employed under civil contracts (except for self-employed NPA payers);

- persons with whom copyright contracts, contracts for the alienation / granting of rights to use copyright works and other licensing agreements have been concluded;

- the head of the organization, who is the only participant, members of the organization, owners of its property.

It is also necessary to submit the form if, for some reason, no payments were made to the insured persons and no activities were carried out during the reporting month. The rule is simple - if an agreement was in force with an individual for at least 1 day during the reporting month, it must be included in the SZV-M.

Recently, an end was put to the dispute about whether it is necessary to fill out a report for the founding director with whom the employment relationship has not been formalized. Yes, it's necessary! This directly follows from the resolution of the Pension Fund Board of April 15, 2021 No. 103p.

The same document approved a new report form and the procedure for filling it out (hereinafter referred to as the Procedure). It clearly stated that SZV-M reflects information about all persons who are subject to compulsory pension insurance in accordance with Article 7 of Law No. 167-FZ. And this includes the participant-manager, with whom an employment contract has not been concluded. So, even if all employees were fired from the organization or they were not hired at all, it is necessary to send SZV-M to the PRF.

But an entrepreneur submits this report only if he has employees under an employment contract or GPC (self-employed persons are not taken into account). Self-employed individual entrepreneurs should not submit SZV-M, as well as other persons who provide themselves with work (lawyers, arbitration managers, notaries and others) .

Features of inclusion of workers in SZV-M

- The report includes employees with whom employment contracts were concluded, were valid or terminated during the reporting period (the month for which the report is submitted).

- SZV-M does not need to be drawn up in relation to employees who had payments, but the contract with them was terminated before the start of the reporting period.

- The report must be generated even for those employees who were absent from the workplace, provided that the contract with them continued to be valid.

- A zero SZV-M is not drawn up, and therefore the report is not submitted by individual entrepreneurs (notaries and lawyers) who do not have employees.

- The report is required to be submitted by NPOs, public organizations and legal entities with one founder, even if an employment contract has not been concluded with him.

- SZV-M is subject to submission by an organization that is in the process of liquidation. In this case, the liquidator is included in the report.

Let us further consider which employees should be included in the report and which should not.

How and where to take SZV-M

A report must be sent to the Pension Fund on a monthly basis. The deadline is the 15th of the next month. That is, the form for August must be submitted before September 15, for September - before October 15, for October - before November 15, and so on. If the 15th falls on a weekend or holiday, the deadline is moved to the next business day.

The report can be compiled on paper or electronically. The paper form SZV-M can be submitted by employers who had no more than 24 insured persons inclusive during the billing month. If more, you need to report electronically.

The form is sent to the PRF branch where the employer is registered. There are separate rules for separate divisions of organizations that are independent insurers. They report to the fund branch at their location. But divisions that do not make payments to individuals do not submit SZV-M themselves - the parent company reports for them.

SZV-M is due for completion in 2022

Information on SZV-M must be submitted monthly no later than the 15th day of the month following the reporting month. The period is defined in Article 11 in paragraph 2.2 of Law No. 27-FZ of 04/01/1996.

If the deadline for submitting the report is the 15th day of the month following the reporting month and coincides with a weekend or non-working holiday, policyholders have the right to report on the next working day. Despite the fact that there are no Rules on the postponement of deadlines in the above Law, according to the letter of the Pension Fund of the Russian Federation No. 08-19/19045 dated December 28, 2016, it is allowed to apply the provisions of Article 193 of the Civil Code.

The law does not prohibit submitting a report early if you are sure that by the end of the month you will not hire new employees or individuals who are executors of the GAP. For example, in May for May or in December for December. If, after submitting the report, a new employee is hired in the reporting month, you will have to submit a corrective report.

How the SZV-M form has changed

As mentioned above, the resolution of the PFR Board No. 103p approved a new form of the SZV-M report. The document came into force on May 30, 2022. There are several changes to the form, which we will discuss further. It has been applied since the May report.

The form has become more compact and simpler due to the fact that explanations for the fields have been removed from it. Now all of them are contained in the Procedure for filling out the SZV-M - this is Appendix No. 2 to Resolution No. 103p. The rules for reporting data have also been clarified, although the changes are not too significant.

If the report is transmitted electronically, it must comply with the format from the resolution of the Pension Fund Board of December 7, 2016 No. 1077p and be signed with an enhanced qualified electronic signature.

Frequently asked questions about submitting and completing the SZV-M report

Is it necessary to take SVZ-M IP without employees?

Individual entrepreneurs or organizations that have at least one employee must report using the SZV-M form. Therefore, individual entrepreneurs without employees do not need to submit a SVZ-M report.

Do NGOs and public organizations without employees need to submit a report?

In accordance with the Letter of the Ministry of Labor of Russia dated March 16, 2018 No. 17-4/10/B-1846, brought to the attention of the Pension Fund Branches by the Pension Fund Letter dated March 29, 2018 No. LCh-08-24/5721, SZV-M must be submitted in relation to the chairman of the HOA , Civil Procedure Code, SNT, ONT, DNT (in the absence of a concluded employment or civil law contract).

Do newly created LLCs without employees, general director and bank account need to submit SZV-M?

In accordance with the Letter of the Ministry of Labor of Russia dated March 16, 2018 No. 17-4/10/B-1846, brought to the attention of the Pension Fund Branches by the Pension Fund Letter dated March 29, 2018 No. LCH-08-24/5721, SZV-M must be submitted in relation to the head of the organization , who is the sole founder, regardless of whether an employment contract has been concluded with him.

Instructions for filling out a new SZV-M

The form, as before, consists of four points (sections). The first contains the following data:

- The policyholder number that the Pension Fund assigned to him upon registration.

- Name. It can now be written in both shortened and full form. Previously, a short name was entered. It is allowed to indicate the name of the organization in Latin. Individual entrepreneurs indicate their full name.

- TIN and KPP (for individual entrepreneurs - only TIN). If the form is submitted in relation to a separate unit, then the checkpoint at its location is indicated.

Section 2 reflects the reporting period: month in MM format (for example, January – “01”, September – “09”), year – in YYYY format (“2022”).

In Section 3 of the SZV-M, the full name of the report type should be indicated: “Initial”, “Additional” or “Cancelling”. In the old form, a short code should have been indicated in this field - “output”, “additional” or “o” is selected if the monthly report is submitted for the first time. The “Additional” type should be specified when you need to supplement a previously submitted form. If you need to cancel information submitted with an error, select the SZV-M “Cancelling” type.

The data of insured individuals is reflected in section 4. The filling rules are as follows:

- Column 1 indicates the serial number of the record for a specific employee. The numbering of individuals in the report must be continuous, without omissions or repetitions.

- Column 2 contains the last name, first name and patronymic of the insured person. They must be indicated in full, in the nominative case.

- In column 3 - SNILS in the format: XXX–XXX–XXX–CC or XXX–XXX–XXX CC.

- Column 4 contains the TIN of the insured. The number may not be entered if the employer does not know it.

The finished report is signed by the head of the organization or an authorized person. It is mandatory to indicate the name of the signatory’s position, as well as a transcript. The individual entrepreneur certifies the form with a personal signature. The date should be entered in the format DD.MM.YYYY. If available, the seal of the organization or individual entrepreneur is affixed.

Common mistakes when filling out SZV-M

Most errors in SZV-M are associated with incorrect representation of insured persons. In particular, they often forget to include in the report:

- employees to whom no payments were made (for example, a person was hired under the GPC, but did not work in the reporting month);

- the only founder-manager without an employment contract;

- individual employees for other reasons.

To add data on forgotten insured persons, submit the SZV-M form with the “Additional” type. Only those who were forgotten to be included in the initial report are included in it.

However, if we are talking about the founder-director of a non-operating company (there are no other employees, SZV-M was not submitted), then you need to fill out a form of the “Initial” type for the owner of the business.

Sometimes exactly the opposite happens - extra people are included in the report. For example, self-employed NPA payers hired under GPC or already dismissed employees. In such a situation, submitting a form with the “Cancelling” type will help, in which you need to include those who were included in the original report by mistake.

It’s worse if an error is made in the employee’s data. In this case, you will have to submit two forms SZV-M:

- canceling – it cancels erroneous information;

- supplementary, which will include the correct data.

If the error is found by the policyholder independently and corrected by filing a SZV-M of the appropriate type before it was discovered by the Pension Fund, there should be no fine. Moreover, even if an error is discovered at the Pension Fund office, the employer will be released from liability if it is corrected in a timely manner. This must be done within five business days from the date of receipt of the error notification.

However, in practice, even with timely correction, sanctions cannot always be avoided. The Pension Fund of Russia considers the only error for which a fine is not imposed to be inaccurate data of persons included in the report. If you first forget to enter information about employees into it, and then, when the deadline for submitting the SZV-M has already expired, correct it (even on your own), then you will most likely be fined for this.

For example, a company filed a SZV-M for August on September 10, and then discovered that several employees were not included in the report. You can submit a supplementary form without sanctions until September 15, since the deadline for submitting the report has not yet expired. If you do this later, even before the Pension Fund finds the error, the company will be fined.

Composition of the form and rules for filling it out

The form includes 4 sections:

- details of the policyholder;

- reporting period;

- form type (code);

- information about insured citizens.

There are no separate rules on how to fill out the SZV-M, but filling out the form is quite easy. Detailed instructions are given in Resolution No. 103p.

In the first section, indicate the name of the organization, TIN, KPP and registration number with the Pension Fund.

In the “Reporting period” section, indicate the month for which the report is provided.

In the third, the type of form to be filled out is noted. If the form is filled out for the first time for the reporting period, it is marked as the original one. If you are submitting a supplementary report, select the “supplemental” type. If the previously sent report contained inaccuracies, submit a document with the “cancelling” type.

The fourth section is a table in which the full names of citizens who have contracts are indicated, their Taxpayer Identification Number (optional) and SNILS are entered.