Change 1: application procedure for VAT refund

From July 1, 2022, legislators expanded the list of organizations that have the right to use the application procedure for VAT refund. Let us recall that the declarative VAT refund algorithm is based on the fact that the refund of the amount declared in the VAT return occurs even before the completion of the desk tax audit of the declaration. The application procedure for VAT refund is also called the “simplified refund procedure.”

From July 1, 2022, those whose obligation to pay VAT is secured by a guarantee (subparagraph “a”, part 5, article 2 of the Federal Law of November 30, 2016 No. 401-FZ) will be able to reimburse the tax by application. If in the future the compensation turns out to be unjustified, the guarantor will be obliged to compensate the budget for expenses. Thus, the risks associated with compensation are borne by the guarantor. However, we note that from July 1, 2022, the Tax Code of the Russian Federation will specify specific requirements that the guarantor must meet, namely:

- the guarantor may be a Russian organization;

- the total amount of value added tax, excise taxes, corporate income tax and mineral extraction tax paid by the guarantor during the three years preceding the year in which the application for the conclusion of the guarantee agreement was submitted, excluding the amounts of taxes paid in connection with the movement of goods across the border of the Russian Federation and as a tax agent, amounts to at least 7 billion rubles;

- the amount of the guarantor's obligations under existing guarantee agreements as of the date of submission of the application for concluding a guarantee agreement does not exceed 20 percent of the value of the guarantor's net assets, determined as of December 31 of the calendar year preceding the year in which the application for concluding a guarantee agreement was submitted;

- the guarantor on the date of submission of the application for concluding a guarantee agreement is not in the process of reorganization or liquidation;

- as of the date of submission of the application for the conclusion of a guarantee agreement, insolvency (bankruptcy) proceedings have not been initiated against the guarantor;

- the guarantor as of the date of submission of the application for concluding a guarantee agreement has no debts in paying taxes, fees, penalties and fines.

New VAT Declaration

The VAT declaration was approved by order of the Federal Migration Service of the Russian Federation dated December 20, 2016 No. ММВ-7-3/696 and came into force on March 12, 2022. This means that the declaration in the new form must be submitted from the first quarter of 2022.

However, if you need to submit an updated Declaration, it must be submitted in the form that was in force during the periods of the initial declaration. The Declaration has not changed significantly, and most of the changes affected the Kaliningrad region (since a special regime for calculating VAT applies when exporting goods from Kaliningrad). Let's take a closer look at the changes in the Declaration form.

- In Section 3, 4 new lines were added that relate to the Kaliningrad region (041, 042, 110, 115). In deductions under Section 3, a new line 185 was added (for the Kaliningrad region).

- In the deductions of Section 3, line 125 has appeared, the data of which is linked to line 120. It highlights the amount of tax presented to the taxpayer by contractors and developers when carrying out capital construction work. In early forms there was this line, then it was removed due to uselessness, now it has been restored, since this data turned out to be necessary for analytics. It is filled out by investors, to whom general contractors or developers present the amount of VAT, which is accepted for deduction. The general contractor, to whom subcontractors charge VAT, does not fill out this line, since construction is his normal activity.

- Nothing has changed significantly in Appendix 1 to Section 3. The filling procedure and terminology have changed. We exchanged real estate for fixed assets, because sea vessels, aircraft and engines for them, which are fixed assets, were added to the real estate. We excluded the address, since all addresses are in the tax database).

- Codes have been eliminated in Section 4 and Section 6.

- In Section 8 of the Purchase Book, Column 13 “Registration number of the customs declaration” was changed. Previously, there were restrictions on the number of sign spaces - a maximum of 30 gas customs declarations were placed, now there are no restrictions and line 150 is filled in “in a column”.

- In Section 9 of the Sales Book, Column 3a “Registration number of the customs declaration” reflects the customs declaration number for shipment from the Kaliningrad region to other regions of the Russian Federation (then a customs declaration is drawn up, the tax is paid to the tax authority). Column 3a corresponds to line 035 of Section 9.

- In Sections 10, 11, only the name of Column 10-12 has changed.

The new form of the Declaration was approved, but the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 (as amended on November 29, 2014) “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax” has not yet been approved and will not be approved until April 1, 2022. Because of this, taxpayers make many mistakes when filling out the Declaration: they are confused about how to reflect this or that transaction, they make mistakes in the transaction codes, how and in which columns they need to make an entry in the Sales Book and the Purchase Book.

Let's look at the typical errors found in the declaration.

Firstly,

errors arise when recording the import of goods by an importer through an intermediary. In the customs declaration, the intermediary indicates his data, which is sent to the Federal Tax Service. The importer indicates the customs declaration number in Column 3 of the Purchase Book, but forgets to fill out Columns 11 and 12 (at least the TIN of the intermediary). Therefore, the deduction cannot be verified.

Initially, the intermediary was asked to indicate the importer’s tax identification number in the customs declaration, but this turned out to be not always feasible. Then the importer was required to fill out Column 11 “Name of the intermediary” and Column 12 “INN of the intermediary” (at the same time, Column 11 is not always uploaded), then the Federal Tax Service program sees the intermediary and does not send an auto-request. Sometimes checking by TIN is done manually. The intermediary does not register anything in his Journal, but directly gives it to the importer. To avoid mistakes, when importing goods through an intermediary, we enter the transaction type code 20 and indicate the intermediary’s TIN in the Purchase Book.

Secondly

, an error when transferring property to the authorized capital. This error is a mistake of the tax authority (the reflection of the transaction in Resolution No. 1137 is incorrectly indicated). The seller is obliged to restore the amount of tax previously accepted for deduction. When restoring, the seller registers a document, for example, an invoice, which was accepted for deduction earlier; it is also permissible to indicate a certificate. The buyer, in turn, registers a document on the basis of which the property is transferred to the authorized capital, for example, a certificate of acceptance of the property. When a Declaration from a buyer with a Purchase Book is provided, the Federal Tax Service program sees the entry, but when the data is compared with the seller’s Sales Book, the program no longer sees the entry.

To avoid this error, the seller must register an act in the Sales Book that the buyer registers, which indicates the amount of the restored tax, and indicate the transaction type code 01, not 21, since this is a synchronous mirror transaction. Code 21 is the restoration code, with the exception of the transfer of property to the authorized capital (correct code 01), and restoration according to a corrective invoice (correct code 18).

Third,

errors are common in a single adjustment invoice. It is issued on the basis of two or more invoices, but in practice the number of invoices can exceed hundreds, and it is impossible to indicate primary invoices on the basis. Then in Column 3 and Column 5 of the Purchase Book we indicate the number and date of the single adjustment invoice (you cannot leave blanks or dashes). In the Purchase Book, code 01 is entered, which means that in the name of the seller we indicate the counterparty (and not our own organization, as with code 18). This operation will be reflected in the new Resolution No. 1137.

Also in the declaration it is necessary to take into account the following changes, which have not yet been approved, but must be taken into account when submitting the declaration for the first quarter of 2022.

Now, when a tax authority accepts a declaration, transaction codes are also automatically checked, since different codes fall into different sections. Therefore, for example, code 14 cannot be entered in Section 8 of the Purchase Book, and code 16 cannot be entered in Section 9 of the Sales Book.

Change 2: validity period of the guarantee agreement

From July 1, 2022, the validity period of the guarantee agreement for the application procedure for VAT refund, which we mentioned above:

- must expire no earlier than 10 months from the date of filing the tax return in which the amount of VAT to be refunded is declared;

- it cannot be more than one year from the date of conclusion of the guarantee agreement.

The corresponding amendments are provided for in subparagraph “d” of paragraph 5 of Article 2 of the Federal Law of November 30, 2016 No. 401-FZ. Please note that prior to this change, the bank guarantee must expire no earlier than eight months.

Don't miss out

After the VAT return has been submitted for reimbursement, the guarantee agreement must be valid for at least another 10 months. This rule is effective from July 1, 2022.

Zero VAT rate for transportation of passengers and luggage by rail within Russia

On January 1, 2022, the changes provided for by Federal Law No. 401-FZ of November 30, 2016 came into force, according to which transportation of passengers and luggage by rail within Russia is subject to VAT at a rate of 0%.

Until January 1, 2022, transportation was subject to VAT at a rate of 10%.

On January 1, 2022, amendments made to subclause 9.3 of clause 1 of Article 164 of the Tax Code of the Russian Federation came into force. Services for the transportation of passengers and luggage by public railway transport over long distances are subject to VAT at a zero rate.

To confirm your right to a zero VAT rate, you need to submit to the tax office a register of unified transportation documents defining the transportation route.

According to clause 5.3 of Article 165 of the Tax Code of the Russian Federation, the register must indicate:

- numbers of transportation documents,

- point of departure,

- destination,

- dates of service provision,

- cost of services.

If the destination or point of departure is located outside the Russian Federation, rail transportation will be subject to a zero VAT rate if they are issued with uniform international transportation documents. Subparagraph 4 of paragraph 1 of Article 164 of the Tax Code of the Russian Federation.

Read also “Zero VAT rate: application features”

Change 3: restoration of VAT when receiving subsidies

Taxpayers will need to restore VAT from July 1, 2022, regardless of which budget they received subsidies for reimbursement of expenses from. At the same time, the procedure for restoring and accounting for the restored tax amount remained the same. The amendments are provided for in paragraph 4 of Article 2 of the Federal Law of November 30, 2016 No. 401-FZ

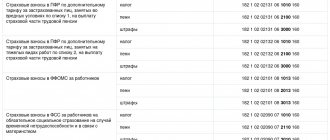

Note that previously VAT was restored if the subsidy came exclusively from the federal budget. Let us illustrate the essence of the change in the table:

| Amendment | |

| Was | It became |

| Amounts of tax accepted for deduction by the taxpayer on goods (work, services), including fixed assets and intangible assets, property rights, are subject to restoration by the taxpayer in the event that the taxpayer receives subsidies from the federal budget in accordance with the legislation of the Russian Federation to reimburse costs associated with payment for purchased goods (works, services), including tax, as well as reimbursement of costs for paying tax when importing goods into the territory of the Russian Federation and other territories under its jurisdiction. | Amounts of tax accepted for deduction by the taxpayer on goods (work, services), including fixed assets and intangible assets, property rights, are subject to restoration by the taxpayer in cases where the taxpayer receives subsidies for reimbursement of costs from the budgets of the budget system of the Russian Federation in accordance with the legislation of the Russian Federation (including tax) related to payment for purchased goods (work, services), taking into account tax, as well as reimbursement of costs for paying tax when importing goods into the territory of the Russian Federation and other territories under its jurisdiction. |

That is, the point of the innovation is to introduce the obligation to restore VAT in the event of the allocation of subsidies (to cover previously incurred costs) from any budget (local, regional, federal).

The moment when the obligation to recover VAT arises is determined in paragraph 4 of paragraph. 6 clause 3 art. 170 of the Tax Code of the Russian Federation as the quarter in which the subsidy was received. Therefore, for the purpose of VAT recovery, it does not matter when the taxpayer accepted purchases (goods, works, services) for accounting and (or) paid them to the supplier (contractor, performer). VAT is restored in the quarter in which the subsidy funds are credited to the taxpayer's account.

It is worth noting that the amended wording of subparagraph 6 of paragraph 3 of Article 170 of the Tax Code of the Russian Federation still contains the words “including tax”. Consequently, if the subsidy is allocated without taking into account VAT and credited to the current account after 07/01/2017, then the taxpayer will not have the obligation to restore the VAT amounts previously accepted for deduction. In other words, from July 1, 2022, it will be possible to avoid the obligation to restore VAT only if the documents for the allocation of the subsidy state that the subsidy amount does not include VAT.

Don't lose sight. All VAT changes in one table

The table contains changes to legislation relating to VAT that came into force in the second half of 2016 and the beginning of 2022. Simple, convenient, at hand.

| Standard designation | As it was | How did it happen | Start of action of the new introduction | Regulatory act that introduced changes |

| Issuance of guarantees for third parties providing for the fulfillment of obligations in monetary form | In 2016, such a transaction was not subject to VAT only if it was carried out as a banking transaction, including by an organization that, in accordance with the legislation of the Russian Federation, has the right to carry out them without a license from the Central Bank | From 2022, the issuance of a surety (guarantee) will not be subject to VAT even if carried out by an organization that is not a bank (clause 15.3, clause 3, article 149 of the Tax Code of the Russian Federation) | 01.01.2017 | Federal Law of November 30, 2016 No. 401-FZ |

| Application procedure for VAT refund | To refund VAT in the specified order (by taxpayers whose total amount of VAT, excise taxes, income tax and mineral extraction tax for three calendar years prior to the year of filing the application for VAT refund was less than 7 billion rubles), a bank guarantee or bank guarantee is required | From July 2022, an alternative to a bank guarantee will be a third party guarantee (the latter must meet the requirements specified in clause 2.1 of Article 176 of the Tax Code of the Russian Federation) to secure the obligation to pay taxes (Article 176.1 of the Tax Code of the Russian Federation) | 01.07.2017 | Federal Law No. 401-FZ |

| Minimum period of bank guarantee for accelerated VAT refund | The validity period of such a guarantee must expire no earlier than eight months from the date of filing the declaration | According to the rules that came into force in 2022, the validity period of a bank guarantee is 10 months from the date of filing a declaration with the amount of tax to be reimbursed (clause 1, clause 4, article 176.1 of the Tax Code of the Russian Federation) | 01.01.2017 | Federal Law No. 401-FZ |

| Long-distance transportation of passengers and luggage by public railway transport | A VAT rate of 10% was applied to the provision of such services. | From 2022 (the norm will be valid until December 31, 2029), a 0% VAT rate is applied to such services (clause 9.3, clause 1, article 164 of the Tax Code of the Russian Federation). To confirm it, you must submit the documents specified in clause 5.3 of Art. to the tax authorities. 165 Tax Code of the Russian Federation | 01.01.2017 | Federal Law No. 401-FZ |

| Receiving a subsidy to reimburse the costs of purchasing goods, works, services | VAT needs to be restored when receiving such a subsidy from the federal budget | From July 2022, when receiving a subsidy of this type, VAT will have to be restored regardless of which budget it was allocated from (clause 6, clause 3, article 170 of the Tax Code of the Russian Federation) | 01.07.2017 | Federal Law No. 401-FZ |

| Services in electronic form provided by foreign Internet companies | Previously, the “Google tax” was not paid | From 2022, the services of foreign companies listed in paragraph 1 of Art. 174.2 of the Tax Code of the Russian Federation, are subject to VAT if the client is an individual and the place of sale of these services is recognized as the territory of the Russian Federation (clause 4, clause 1, article 148 of the Tax Code of the Russian Federation) | 01.01.2017 | Federal Law dated July 3, 2016 No. 244-FZ |

| VAT return filled out by foreign Internet companies | The tax return is submitted by foreign organizations subject to registration in accordance with clause 4.6 of Art. 83 of the Tax Code of the Russian Federation, to the tax authority through your personal account or via TKS no later than the 25th day of the month following the expired tax period. If the calculation and payment of tax under Art. 174.2 of the Tax Code of the Russian Federation are made by a tax agent, the tax return is submitted by the tax agent | Starting with reporting for the first quarter of 2022 | Order of the Federal Tax Service of Russia dated November 30, 2016 No. ММВ-7-3/ [email protected] | |

| List of codes for types of food products for which a reduced VAT rate applies | This list was approved by Decree of the Government of the Russian Federation dated December 31, 2004 No. 908. The product names here correspond to the OKP classifier | From 2022, the list of food products has been changed. The information is brought into compliance with the new OKPD2 product classifier. There are also meaningful | 01.01.2017 | Decree of the Government of the Russian Federation of December 17, 2016 No. 1377 |

| changes (for example, mushrooms and truffles are included in the list) | ||||

| Explanations for the VAT return | Explanations can be submitted on paper or electronically. | Explanations of errors or contradictions in an electronic VAT return during a desk tax audit can only be submitted electronically. Paper explanations will not be considered submitted (clause 3 of Article 88 of the Tax Code of the Russian Federation). Failure to provide explanations will result in a fine of 5,000 rubles. (clause 1 of article 129.1 of the Tax Code of the Russian Federation) | 01.01.2017 | Federal Law of May 1, 2016 No. 130‑FZ |

| Sales of waste paper | Previously, VAT on the sale of waste paper was accrued in the generally accepted manner | Since October 2016 (the norm is valid until December 31, 2018), the sale of waste paper (paper and cardboard waste, rejected and out-of-use printing products, paper and cardboard, as well as business papers, including documents with an expired shelf life) is not subject to VAT ( clause 31 clause 2 article 149 of the Tax Code of the Russian Federation) | 01.10.2016 | Federal Law of June 2, 2016 No. 174-FZ |

| Import and sale on the territory of the Russian Federation of breeding cattle, breeding pigs, sheep, goats, horses, poultry, eggs, as well as semen and embryos obtained from them | These products were subject to VAT at a rate of 10% | Since October 2016 (the norm is valid until December 31, 2020), these products are exempt from VAT if the taxpayer has a breeding certificate (subject to submission of a permit to the customs authority) issued in accordance with Federal Law dated August 3, 1995 No. 123-FZ, and its belonging to the list approved by the Government of the Russian Federation | 01.10.2016 | Federal Law dated June 23, 2016 No. 187-FZ; Decree of the Government of the Russian Federation of October 20, 2016 No. 1069 |

| Export operations | For export transactions, VAT is subject to deduction on the last day of the quarter in which documents are collected at a zero rate | For goods registered from July 1, 2016, exporters have the right to claim VAT deductions in the generally established manner, without waiting for confirmation. | 01.07.2016 | Federal Law of May 30, 2016 No. 150‑FZ |

| deduction of the zero VAT rate (clause 3 of Article 172 of the Tax Code of the Russian Federation). Exception: commodity exporters. Codes of such goods must be approved by the Government of the Russian Federation | ||||

| Export to the EAEU countries: about invoices | The exporter issues an invoice to the buyer in the generally established manner, if this is provided for by the legislation of the EAEU member state | Export of goods, the sale of which is not subject to taxation (exempt from taxation) in accordance with Art. 149 of the Tax Code of the Russian Federation, is also accompanied by the preparation of invoices (clause 1.1, clause 3, Article 169 of the Tax Code of the Russian Federation). “Shipping” invoices must indicate the code of the type of goods according to the Commodity Nomenclature of Foreign Economic Activity of the EAEU (clause 15, clause 5, article 169 of the Tax Code of the Russian Federation) | 01.07.2016 | Federal Law No. 150-FZ |

| Compensation under the business risk insurance contract | The Tax Code of the Russian Federation obligated to increase the VAT base by the amount of insurance payments received under insurance contracts for the risk of non-fulfillment of contractual obligations | Compensation under the specified insurance contracts is not subject to VAT (clause 4, clause 1, article 162 of the Tax Code of the Russian Federation) | 01.07.2016 | Federal Law dated April 5, 2016 No. 97-FZ |

| The VAT transaction type codes for the purchase ledger and sales ledger have changed | There were 26 codes approved by Order of the Federal Tax Service of Russia dated February 14, 2012 No. MMV-7-3/ [email protected] and Letter of the Federal Tax Service of Russia dated January 22, 2015 No. GD-4-3/ [email protected] | The list was reduced to 24 codes. The changes did not affect only codes 10, 18 - 20, 22 - 24, 27 and 28 | 01.07.2016 | Order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] |

It is also worth noting that in 2022, amendments to the invoice form and VAT registers are planned (in particular, to the journal of received and issued invoices, the sales book and the purchase book). The deadline for creating registers will be extended by five days - until the 25th.

The form of the VAT declaration will also change. But we will tell you about all this later, when the plans become reality.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Change 4: benefits for the sale of medical products

In accordance with paragraph 2 of Article 149 of the Tax Code of the Russian Federation, the sale of essential and vital medical products is not subject to value added tax. These products are listed in section. I of the List approved by Decree of the Government of the Russian Federation of September 30, 2015 No. 1042. Starting from 2022, these products are exempt from VAT upon submission of a registration certificate for a medical device to the tax authorities.

From July 1, 2022, it will be allowed to confirm the right to benefits not only with a registration certificate for a medical product, but also with a registration certificate for a medical product (medical equipment).

From July 1, 2022, in order to apply a benefit or a 10 percent tax rate on the sale of medical devices, you can submit a registration certificate of a medical device to the Federal Tax Service. In this case, such a certificate must be issued either according to the rules of the EAEU or according to the legislation of the Russian Federation.

It is worth noting that one of the amendments in paragraph 4 of subparagraph 1 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation is quite controversial. Indeed, from July 1, 2017, a complete exemption from VAT applies to any medical product, and not just the most important and vital ones. Therefore, it is not entirely clear to which medical products the 10% VAT rate will be applied. The fact is that, according to paragraphs. 4 p. 2 tbsp. 164 of the Tax Code of the Russian Federation, a rate of 10% applies to medical devices, with the exception of medical devices, the sales operations of which are exempt from taxation in accordance with paragraphs. 1 item 2 art. 149 of the Tax Code of the Russian Federation. But it turns out that all medical products will be subject to the zero rate. What did the legislators mean?

Payment 2022 – shipment 2022

Now let's consider another situation: how to apply the VAT rate if payment took place in 2022, and shipment took place in 2022.

VAT is determined both at the time of receipt of the advance payment and upon further shipment. If an advance payment of 100 percent was received in 2022, and shipment occurs in 2022, then VAT on the advance payment in 2022 must be charged at a rate of 18 percent. The same amount can be deducted in 2022 after shipment of the goods.

VAT on shipments in 2022 must be calculated at a rate of 20 percent. In this case, the date of conclusion of the contract and the presence of prepayment do not affect the shipping rate.

If a partial prepayment was received in 2022, and the shipment took place in full in 2022, in 2022 VAT must be charged on the advance payment at the rate of 18/118.

In 2022, shipments should take place at a rate of 20 percent. You must deduct VAT on the partial advance in an amount calculated at a rate of 18 percent. EXAMPLE 2. HOW TO CHARGE VAT FOR PAYMENT IN 2022 AND SHIPMENT IN 2019?

The price in the contract is indicated including VAT: in the amount of 118,000 rubles, including VAT of 18,000 rubles. When the supplier receives an advance for the entire contract amount, he must pay VAT at a rate of 18%. This will amount to RUB 118,888. × 18/118 = 18,000 rubles. On the date of shipment, the supplier must provide an advance payment using the calculation method at a rate of 20%. This will be 118,000 × 20/120 = 19,666 rubles. Even if the price of the goods remains the same, the amount of VAT will increase. The difference can be covered either at the expense of the buyer or at the expense of the seller.

How will the difference arising due to the VAT increase be covered at the expense of the buyer or at the expense of the seller? The answer to this question must be found in advance; the parties can formalize the decision in an additional agreement to the contract. It is better to do this before the beginning of 2019.

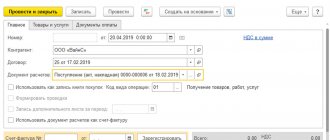

Change 5: new details in the invoice

From July 1, 2022, the invoice must indicate the identifier of the government contract, agreement, agreement (if concluded). For this purpose, a new line “8” appeared in the invoice. It is necessary to enter the identifier of the government contract for the performance of work, provision of services or supply of goods, as well as contracts or agreements on subsidies, investments from the budget, or contributions to the authorized capital. The adjustment invoice, in turn, from July 1, 2022, is supplemented with a new line 5 with the same name.

new invoice form

new form of adjustment invoice

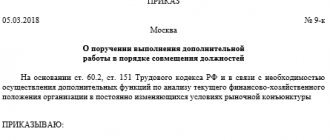

Change 6: New Invoice Format

From July 1, 2022, it is allowed to generate invoices in electronic form exclusively according to the new format approved by Order of the Federal Tax Service dated March 24, 2016 No. ММВ-7-15/155. Previously, it was possible to choose any of those approved by orders of the Federal Tax Service of the Russian Federation No. ММВ-7-6/93 of 03/04/2015 and No. ММВ-7-15/155 of 03/24/2016, but from July 1, 2022 only the latter remains in force.

The adjustment invoice from July 1, 2022 can also be transmitted only in a new format, which was approved by Order of the Federal Tax Service dated April 13, 2016 No. ММВ-7-15/189. For more information, see “Invoice from July 1, 2022: new form and format.”

When and to what budget to pay VAT

VAT is a federal tax, so it must be paid to the federal budget. VAT is the most popular tax for the state and provides up to 40% of all tax revenues.

Taxpayers pay VAT to the budget when selling value-added goods.

Read more in the material “Who is the VAT payer?”.

Payment of VAT is provided for legal entities and individual entrepreneurs under the general taxation regime (GST), as well as persons who are exempt from paying VAT or apply special taxation regimes (USN, UTII, Unified Agricultural Tax, PSN), but have issued an invoice to the buyer with the allocated amount VAT.

VAT administration is carried out by tax authorities and customs services (when importing goods from countries outside the EAEU).

The following articles will help you prepare a payment order for tax payment:

- “Where to pay VAT and how and where to find the correct details for payment?”;

- “Details for paying VAT in the payment slip in 2016-2017: how to fill out?”;

- “Payment order for VAT in 2022 - sample”.

VAT amendments from July 1: overview table

Now let’s summarize the VAT amendments that occurred from July 1, 2017, in the table:

| VAT from July 1, 2022: changes |

| We have expanded the possibilities for applying the application procedure for VAT refund (under a surety agreement). |

| The validity period of the guarantee agreement has been changed (it must be valid for at least another 10 months from the date of filing the VAT return). |

| They introduced the obligation to restore VAT in the event of the allocation of subsidies (to cover previously incurred costs) from any budget (local, regional, federal). |

| The procedure for obtaining benefits when selling medical products has been clarified. |

| The forms of invoice and adjustment invoice have been changed. |

| Electronic invoices can be generated using a single format. |