The expenses of an enterprise spent on the production of products and their subsequent sale are called costs. They can be constant or variable. The amount of fixed costs does not change over several reporting periods. These include expenses for rent, utilities, professional training and other costs, the amount of which remains unchanged in any case, even when production is suspended.

Unlike fixed costs, variable costs are variable costs; their size varies depending on production volumes. For example, the volume of raw materials sent for processing will certainly increase with an increase in product output. Let us remind you how to calculate variable costs.

Which costs are variable?

Variable costs are those costs that, during the manufacturing process of a product (or other production process), change in parallel with the dynamics of its output volumes.

However, not only production costs, but also costs not related to the production process can be called variables. An example of the latter are warehouse, packaging, and transportation costs. Conventionally, we can say that variable costs characterize the value of the product produced, while constant costs characterize the price of the company.

Plotting a graph

The graphical representation of the model reflects the logic of the relationship between the indicators that form the value of our indicator.

Fig. 1 Graph for finding the critical sales volume Qс

Observing this model, we note that:

- The OB line reflects the change in sales revenue. A direct relationship is formed - as sales volume increases, so does revenue.

- Line AD shows the change in fixed costs; it is parallel to the x-axis.

- Line AC reflects the change in total costs.

- The intersection point of the lines OB and AC determines the sales volume Qc at which revenue becomes equal to our total costs.

This is the break-even or profitability threshold, the critical sales volume or “dead point,” as the famous accountant I. Sher suggested calling the financial break-even point, that is, the minimum that ensures business break-even. Exceeding Qc means generating profit.

It requires special attention that the conclusions that can be drawn based on the analysis of the graph are not universal, because the relationship between income and expenses from the volume of production may not be linear, and the graph may look different.

Fig.2 Graphic representation of nonlinear dependence of indicators

It should also be taken into account that the income area is not infinitely large: with a certain saturation of the market, the relationship between the indicators changes. This fact may be expressed in the fact that overproduced products are not sold at the previously established price.

Automation of management accounting

We will ensure transparent management reporting and correct accounting of the break-even point.

Learn more

WA: Financier. Management Accounting

Own development from a leading 1C partner for automatic calculation of the break-even point

Learn more

What are variable costs?

Variable costs include costs for:

- purchase of raw materials and supplies;

- for components and spare parts for production equipment;

- related to the sale of finished products (for transportation, storage, etc.);

ConsultantPlus experts explained how to take into account transportation costs in tax accounting for the supplier and buyer. To do everything correctly, get trial access to the system and go to the Ready solution.

- for basic piecework wages for workers;

- for electricity and fuel, which are consumed during production.

What costs depend on production volume

As noted above, the costs of an enterprise, based on the principle of dependence on production volume, are divided into constant and variable. This is necessary to optimize and plan all expenses, as well as to facilitate the search for ways to reduce them.

Individual expenses increase with production growth, that is, they depend on its volume. They are called variables. The most obvious feature of the variable components of all expenses is manifested in proportional expenses, which grow in the same proportions as the size of output.

Example. To create the product you need 6 liters of material. The cost of this material is 150 rubles per liter. It turns out that when producing 100 units of a product, the costs will be the following amount:

100*150*6 = 90,000 rubles.

Let's assume that the production volume doubles, that is, the output will no longer be 100, but 200 units of product. Then the cost will change as follows:

200*150*6 = 180,000 rubles.

That is, there is a direct proportional relationship here. A twofold increase in output entailed a twofold increase in expenses.

In the example considered, the so-called “economy of scale” was not taken into account. Many suppliers provide volume discounts, which makes costs less proportional to production volumes.

Examples of fixed costs

In almost any organization, the structure of fixed costs contains the following items:

- Depreciation charges for fixed assets (if the accounting policy adopts the linear method, which provides for uniform transfer of value);

- Remuneration for permanent salaried employees;

- Mandatory contributions to the payroll funds of these employees;

- Financing the recruitment and training (retraining) of staff;

- Management costs and administration costs;

- Representation expenses;

- Payment to landlords for the use of warehouses, workshops, etc.;

- Payment for housing and communal services;

- Financing of socially oriented objects on the balance sheet of the organization;

- Payment of interest rates;

- Payment of property taxes;

- Transfer of land tax;

- Payment for services provided by third-party companies (security, cargo transportation, advertising agencies, etc.).

In relation to the cost of production, such costs are usually indirect. That is, between specific types of products they are distributed in proportion to some base.

Conditionally variable costs

Conditionally variable costs should include costs directly related to the volume of production and sales of commercial products. Throughout the entire production and economic activity of the company, they change in quantity, structure and quality.

Conditionally variable costs can also change due to changes in business activity, although, unlike variable costs, this does not happen so clearly.

An example of such costs is the payment of piecework wages to workers or interest to sales managers.

Variable Cost Analysis as Part of a Business Plan

As can be seen from the previous section, the amount of variable costs is the most important indicator for determining the feasibility of production. Despite the fact that their dynamics do not have the same impact on the cost structure of the final product, changes in variable costs do not cause, for example, an “economy of scale” and it would seem that everything is simple with the analysis of variable costs . But this is not always the case; microeconomic evidence suggests that determining the optimal value of variable costs is an equally important task of economic analysis.

Up to certain limits, an increase in the total value of variable costs will not affect their share in the cost structure. But you won’t be able to increase them indefinitely. To determine the optimal amount of all types of expenses and form an effective cost structure, it is necessary to conduct a comprehensive financial and technical and economic analysis based on all sections of the business plan.

If you are thinking about choosing a project, then pay attention to the business plan for a yarn store. This is a fairly profitable project that does not require significant costs.

Variable Cost Examples

According to financial reporting standards accepted in the international environment, variable costs in production are divided into indirect and direct. Indirect production costs include expenses that demonstrate a direct dependence on changes in the volume of economic activity, but due to a number of technological production nuances they cannot be directly attributed to the products produced by the enterprise. At the same time, direct variable costs in full, based on primary accounting data, can be directly attributed to the cost of production.

Read more about dividing costs into groups in our article “How to divide income tax expenses into direct and indirect?”.

Examples of direct variable costs are:

- for remuneration of workers involved in the production process, including accruals on their salaries;

- basic materials, raw materials and components;

- electricity and fuel used in the operation of production mechanisms.

Examples of indirect variable costs:

- raw materials used in complex production;

- costs for scientific development, transportation, travel expenses, etc.

We also advise you to familiarize yourself with the procedure for dividing expenses into indirect and direct for tax purposes. Read more about this in the article “How to divide income tax expenses into direct and indirect?” .

Classification of costs into fixed and variable

The calculations of the indicator we are considering are based on the amount of sales of goods produced and the costs incurred. In this case, the latter are divided into:

Variables depending on the quantity of manufactured products, which include:

- Volume of purchased materials, their cost;

- Payroll fund for production workers;

- Utilities, fuel and lubricants.

Constant (they are not affected by production volume). These include:

- AUP wage fund;

- Rent;

- Depreciation;

- Payments on credit and other obligations.

Results

Due to the fact that variable costs change in direct proportion to production volume, and the same costs per unit of finished product usually remain unchanged, when analyzing this type of cost, the value per unit of product is initially taken into account.

In connection with this property, variable costs are the basis for solving many production problems related to planning. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

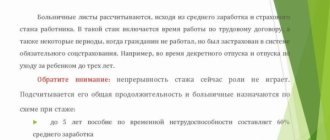

Variable costs in the break-even volume formula

The relationship between fixed and variable costs also affects such a basic parameter of investment analysis as the break-even point. The formula for this indicator is as follows:

Break-even point = fixed costs/(price - variable costs).

Thus, the break-even point shows what volume of products will need to be produced in order to cover at least fixed costs. Indeed, otherwise the activity of the enterprise will not only not be profitable, but also unprofitable. At the same time, it is possible (up to a certain point) to work ensuring the “recoupment” of only variable costs , receiving zero profit. From this we can conclude that the amount of coverage of variable costs is a certain minimum, below which the price set by the entrepreneur cannot fall. Otherwise, production will only bring losses.

One important practical conclusion follows from the above logical series:

If the value of variable costs is high enough, as a result of which both the cost price and the price of the final product will be high, then most likely your product will not be in demand on the market. A constant increase in costs and prices is possible only if there is one monopolist company in the market, and consumers do not have the opportunity not to purchase the product. In all other cases, competition forces manufacturers to minimize variable costs and “stretch” fixed costs due to economies of scale.

In addition to variable expenses, it is also important to evaluate the organization’s fixed expenses: the definition, types, and differences from variable expenses are given in the corresponding article.

An example of calculating the break-even point in physical terms for an atelier

Break-even point in monetary terms: calculation procedure

This option is used for businesses with a large range of goods or services. For example, shops and restaurants.

You will receive the amount you need to earn to break even and start making a profit.

Formula for calculation:

An example of calculating the break-even point in monetary terms for a household goods store

Suppose our individual entrepreneur is disappointed in the business of sewing bed linen and is considering the option of buying a small store with all sorts of small things for the home. The current owner states the following:

Average revenue is 200,000 rubles.

Fixed costs (seller's salary, premises rental) - 35,000 rubles.

Variable costs (purchase and delivery of goods) - 100,000 rubles.

We calculate the break-even point: (35,000 / (200,000 - 100,000))*200,000 = 70,000 rubles.

When selling goods for 70,000 rubles per month, the individual entrepreneur will cover all expenses and break even. If he earns more, he will start making a profit.

What is the break-even point

The break-even point shows at what point your revenue will cover your business's expenses. Subsequent sales will bring profit.

It can be expressed in money or goods. We will tell you in which case each option is used in the relevant sections of the article.

Planning the break-even point helps you understand:

- when will investments in launching a business or new direction pay off;

- what price of goods or services should be established;

- how the company’s financial condition will change as a result of certain changes (for example, with a seasonal decrease in demand).

In addition to the business owner, this indicator may be of interest to investors and creditors.

If you have several restaurants, shops, workshops, you need to make calculations for each division separately, since the revenue and expenses in them are different.

How to calculate them?

Fixed costs are calculated using the formula:

POSTz = Z salary + Z rent + Z banking services + Depreciation + Taxes + General household services

, Where:

- FOSTz – fixed expenses;

- W salary – costs for salaries of administrative and managerial personnel;

- Rent – rental expenses;

- 3 banking services – banking services;

- General expenses - other general expenses.

To find the average fixed cost per unit of output, you must use the following formula:

SrPOSTz = POSTz / Q,

Where:

- Q – volume of products (its quantity).

The analysis of these indicators must be carried out in dynamics, assessing the retrospective values at different periods of time, including with a joint analysis of other economic indicators. This will allow you to see the interconnection of processes characteristic of the enterprise, which means you can get a cost management tool in the future.

How to determine break-even by unit costs

The sales break-even point is the minimum price at which a company must sell a product to avoid losses. For example, a product with a break-even cost of $10 per unit should sell for just above that cost. Income above this price is the company's profit. The unit cost of production is the break-even point. This value forms the base price that the company uses to determine the market price level. To make a profit, a unit must be sold for more than its cost. For example, a company produces 1,000 units, cost $4 per unit, selling price $5 per unit. The profit is $5 minus $4 = $1 per unit. If the unit were priced at $3, the loss would be $1 per unit, $3 minus $4.

Example of calculating unit cost of production

Unit cost is determined by the sum of variable and fixed costs divided by the total number of units produced. Let's say total fixed costs are $40,000, variable costs are $20,000, and you produced 30,000 units. Total manufacturing costs are $60,000. Dividing $60,000 by 30,000 units gives a unit total cost of $2 per unit (40,000 + 20,000 = 60,000/30,000 = 2).

KEY POINTS

- Unit costs are the total costs associated with creating one unit of a product or service.

- The pricing methodology depends only on the policy of the enterprise.

- A large enterprise is able to reduce the cost per unit of production due to “economies of scale.”

- Analysis of the cost of gross profit forms the basic level of the market price offer.

- Profit maximization is possible by reducing unit costs and optimizing the market supply price.

- The break-even point is determined by the level of unit costs

How often should you calculate the break-even point of an enterprise?

- Before launching a business or new direction.

At this stage, you do not have numbers to calculate - take the desired revenue, the estimated average bill and costs. - In progress.

Every time suppliers raise prices, office rent becomes more expensive, employee salaries rise, or other expenses increase, you need to re-calculate the break-even point to make sure everything is in order.

Break-even point in physical terms: calculation procedure

This option applies if you sell one product (provide one service, perform one type of work), launch a new product, or conduct project activities.

You will receive the number of goods that need to be sold, services that need to be provided, or work that needs to be completed in order to break even and start making a profit.

Formula for calculation:

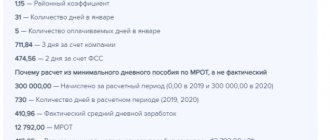

An example of calculating the break-even point in physical terms for an atelier

An individual entrepreneur wants to open a small production facility for sewing budget bed linen. He estimated that fixed costs (renting premises for a workshop, equipment maintenance, seamstresses’ salaries and deductions for them) would amount to about 100,000 rubles per month.

Variable costs for sewing one set of linen are 500 rubles.

The planned retail price of a set of linen is 1,000 rubles.

Break-even point: 100,000 / (1,000 - 500) = 200.

You need to sew and sell 200 sets of underwear a month to cover expenses and break even. With 201 kits sold, the business will begin to make a profit.

Knowing the break-even point in physical terms, you can obtain its monetary equivalent by multiplying the resulting number of units of goods by the cost of each. In our case, this is 200 * 1,000 = 200,000 rubles.