Display indicating the billing document

Let's say we need to enter a tax adjustment. Let's create a new document and fill in its details, indicating the document of settlements with the supplier presented earlier.

Fig.2 Creating a new document

Fig.3 Creating a document

- If the first checkbox is not checked, then the tax will be reflected for deduction as in the receipt documents and to display the entry in the purchase book, you will need to additionally enter a generation document.

- Checking the second box means that tax credit transactions will be generated.

- Checking the third box indicates that when posting a document, its entry will be reflected in the additional list for the period specified by the user.

- If you check the fourth box, the settlement document will be reflected in accounting. It is installed when adjustments to the movement of a settlement document are needed.

You should carefully look at the “Operation code” field, since its value is selected manually from the proposed list.

Fig.4 Operation code

Let's go to the "Products and Services" tab. By clicking the “Fill” button, select the command we need.

Fig.5 Products and services

In this case, the list of valuables is filled out automatically from the specified primary document, where in the “Type of value” field, simply the type of material assets is indicated, without details. This is enough to display in the purchase book.

Fig.6 Type of value

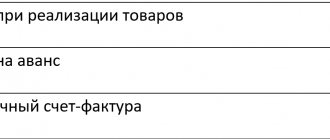

Having filled out the tabular part, we enter the adjustment amount with a plus or minus. To change the tax rate, two lines are entered - the first reversing entry, the second - indicating the new rate and amount. When updating a document, you do not need to enter an invoice based on it.

Fig.7 Data entry

Managing the period for accepting VAT deductions in 1C ERP

Content:

1. The need to transfer the VAT deduction to other periods

2. An example of deferred acceptance of VAT for deduction in 1C

Summary.

In this article we will look at an example of how you can transfer the deduction of VAT in 1C ERP to other months and not include VAT in the purchase book by the date of receipt of the invoice.

The need to transfer VAT deductions to other periods

In the 1C ERP 2.4 system, when posting an Invoice document, the received postings to the debit of account 68.02 are usually generated immediately - on the date of receipt of the document. However, this is not always convenient for the enterprise and sometimes it is necessary NOT to accept VAT on the invoice for deduction on this date, but later.

It would seem that after some time you can change the date of receipt in the document and accept VAT for deduction a few months later. But usually previous periods are already closed for changes - this practice is used in most companies. In this case, the Invoice document received will not be available for modification, or you will have to open the period and make changes to it. Therefore, in 1C ERP 2.4 it is possible to “postpone” the posting of the Invoice document received in order to accept them for deduction in subsequent periods. Let's look at a specific example.

An example of deferred acceptance of VAT for deduction in 1C

In January 2022, we registered an invoice from the supplier:

We carry out the document

. If you immediately reflect the document in regulated accounting, transactions will be generated in 1C Enterprise for accepting VAT for deduction:

However, the organization decides not to deduct VAT in 1C in this period. To do this, the system provides a mechanism that allows you to temporarily “block” VAT on an invoice.

To do this, when closing the month, in the VAT Accounting Assistant, call the workstation to block the acceptance of VAT for deduction in 1C:

In the workspace that opens, click the “Add” button:

A new document “Blocking VAT deduction” is created, which specifies the action – “Setting a blocking”:

Clicking the “Select” button will display a list of all posted invoices that can be accepted for deduction - or rather, a list of documents for receipt of goods and services on the basis of which invoices are issued:

In this list, check the boxes for the documents we need and click the “Move to Document” button:

We set the date in the document to the month in which we block VAT in 1C ERP! After filling out the document “Blocking VAT deduction”, we carry it out and close it. The workplace will display a list of documents for which VAT is blocked for deduction:

Now, during the further closure of the month, when the system generates postings for all documents in 1C Enterprise, there will be no postings for this invoice:

The month can then be closed to changes.

In April, it was decided to accept VAT deduction on the blocked invoice. The date of receipt cannot be changed in the invoice itself, because closed period:

In order to accept VAT for deduction on this invoice, you need to remove the blocking in the “Blocking the acceptance of VAT for deduction in 1C” workspace - by clicking the “Unblock” button:

In this case, the system creates a new document “Blocking VAT deduction”, but with the type of operation “Unblocking”:

And after this document is processed, the invoice disappears from the list of documents for which VAT is blocked for deduction:

Next, you need to complete the procedure for closing the month as usual in 1C ERP 2.4. After the operation “Reflection of documents in regulated accounting”, a debit posting will be generated for the previously blocked invoice 68.02 in the current period:

Specialist

Loseva Natalya

Display if there is no settlement document

When there are no settlement documents, you can omit them and leave the fourth checkbox unchecked. Then the field “Calculation document” is not required to be filled out. If necessary, the invoice can be registered separately.

Fig.8 Calculation document

An invoice is entered on the basis of reflecting VAT for deduction, for example, in situations where there is no primary receipt. At the same time, in “Goods and Services” the user independently fills in the data, similar to as shown above. If the fourth checkbox is still checked, then instead of the nomenclature, simply indicate the type of value, otherwise it is necessary to detail them, indicating for each item the price, VAT rate and its accounting account. To display payments in the purchase book, they can be specified on the “Payment Documents” tab.

Fig.9 Payment documents

VAT on one invoice can be claimed for deduction in parts in different periods

The use of VAT deductions in different tax periods, that is, in parts of the tax amount indicated in one invoice, does not contradict the norms of tax legislation. The Ministry of Finance of Russia reported this in letters dated 09/04/2018 No. 03-07-11/63070.

Let's take a closer look.

What conditions must be met in order to accept VAT as a deduction?

These conditions are formulated in Article 172 of the Tax Code. Here they are:

- purchased goods (works, services) must be acquired for production activities or other operations subject to VAT, or for resale;

- purchased goods must be “accepted for accounting,” that is, capitalized on the company’s balance sheet;

- the organization has documents confirming the right to deduct. In most cases, this is an invoice received from the supplier. In addition, VAT should be highlighted as a separate line in other settlement and primary documents (in invoices, certificates of work performed and services rendered, payment orders, etc.);

- on goods imported into Russia, VAT is paid at customs.

Transfer of VAT deduction

Since 2015, paragraph 1.1 of Article 172 of the Tax Code has been in force, allowing the transfer of tax deductions.

A tax deduction can be claimed no later than three years after the taxpayer has registered purchased (imported) goods (work, services, property rights). These rules apply to VAT deductions (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- presented by suppliers when purchasing goods (works, services), property rights in the territory of the Russian Federation;

- paid when importing goods into the territory of the Russian Federation in the customs procedures of release for domestic consumption, processing for domestic consumption, temporary import and processing outside the customs territory;

- paid when importing goods into the Russian Federation that are moved across its customs border without customs clearance.

Since the transfer of VAT tax deductions is legally legal, the Ministry of Finance comes to the following conclusion.

VAT can be deducted on the basis of one invoice in parts in different quarters within three years after the goods, works or services are registered.

Please note: according to the Ministry of Finance, you can exercise the right to deduct VAT within three years, counting from the end of the quarter in which the right to deduct arose. This period is not extended by the 25 days intended for filing a declaration based on the results of the corresponding quarter.

The rule that allows the VAT deduction to be applied not only in the period in which the right to it arose, but in subsequent periods, does not apply to all types of deductions. In particular, it is impossible to transfer VAT deductions presented by sellers to the taxpayer upon acquisition (paid upon import into the territory of the Russian Federation) of fixed assets, equipment for installation and (or) intangible assets (clauses 2 and 4 of Article 171 of the Tax Code of the Russian Federation). According to OS and intangible assets, VAT deductions are made after registration of fixed assets, equipment for installation and (or) intangible assets in full.

In addition, it is not possible to carry forward deductions of VAT transferred by the tax agent, paid on travel and entertainment expenses, advance VAT, VAT paid in the event of the return of goods, refusal of them, changes in conditions or termination of the contract. These deductions must be declared in the quarter in which the organization fulfilled the conditions provided for in Articles 171 and 172 of the Tax Code (see letter of the Ministry of Finance of Russia dated October 17, 2017 No. 03-07-11/67480).

Document movement report

Let's carry out the adjustment document and check what postings we have as a result.

Fig. 10 Document movements

We see that, having reflected the adjustment in the document, the program generated the necessary transactions. The document also made entries in the “Purchase VAT” accumulation register.

Fig. 11 VAT purchases

If the “Generate transactions” checkbox is not checked by the user, then when posting, entries will be made only in the “Purchase VAT” accumulation register.

Fig. 12 Generate transactions

Fig. 13 Changing VAT amounts manually

Thus, the program allows the user to make changes to VAT amounts manually. In this case, all changes are reflected in the reporting.