How is the minimum wage calculated?

The minimum wage is the basis for calculating wages for Russian citizens. The country has a single minimum tariff for calculating earnings, but in the regions the local government has the right to change the amount according to allowances and living conditions.

The base rate for calculating remuneration for work is established simultaneously throughout Russia. Taking into account the characteristics of each region, a regional minimum wage has been introduced in the country. Its amount includes:

- premiums for harmfulness, unfavorable working conditions;

- salary;

- regional coefficients;

- some types of bonuses: for high qualifications, length of service, etc.

Bonus payments must be transferred more than once and be more than just an incentive measure, since one-time cash rewards are not included in the minimum wage.

The regional type of the base amount cannot be set below the federal value. The indicator can only be increased. The basic rate also includes personal income tax, after which the employee will receive a lower salary. Since the minimum wage in Russia has been increased to 9,489 rubles since January 1, 2018, when receiving the lowest salary minus personal income tax, the employee will receive no more than 8,255.43 rubles.

Increase in the minimum wage from May 1: what payments will this affect?

Adjustments to the minimum wage affect the following indicators:

- minimum wage for hired personnel;

- the amount of social benefits paid by the Social Insurance Fund and employers.

The minimum wage has increased since May 1, and the income of employed persons should increase along with it. The amount of the minimum wage is taken as the basis when comparing the total accrued salary to an employee for a full month worked. If the monthly income is below the minimum wage, the employer is obliged to increase wages to the lower threshold established by the state. For comparison, the amount of total monthly earnings is taken for an employee who is employed full-time and has worked the entire reporting period according to the timesheet. The comparison is made based on accrued income before income tax and alimony are withheld from it.

Example

The minimum wage from May 1, 2022 is equal to 11,163 rubles; the employee was accrued 11,202 rubles in May. From this amount personal income tax was calculated - 1,456 rubles. (11,202 x 13%). The man received 9,746 rubles in his hands. (11 202 – 1456). There is no violation of the law; the employer accrued an amount of earnings that exceeded the minimum wage before tax.

If earnings, for example, are equal to 11,160 rubles, which is below the minimum wage as of May 1, the law prescribes that administrative measures should be applied to the employer in this situation. In the Code of Administrative Offenses of the Russian Federation in paragraph 6 of Art. 5.27 such an offense is punishable by warnings or payment of a fine. The amount of the penalty issued to officials is 10-20 thousand rubles, for individual entrepreneurs the amount of punishment is assigned in the range of 1-5 thousand rubles, for legal entities from 30 to 50 thousand rubles.

The increased minimum wage in Russia from May 1 directly affects the amount of sick pay, maternity benefits, and childcare benefits calculated by the employer. At the same time, this indicator is no longer linked to the amount of fixed insurance premiums that the individual entrepreneur pays for himself.

The minimum wage, from May 1, 2022, equal to the subsistence level, is taken as the basis for calculating sick leave and other benefits if:

- in the billing period the person did not have an income base;

- the average earnings turned out to be less than the current minimum wage;

- the employee’s insurance period at the time the grounds for payment arise is less than six months;

- the treatment regimen prescribed by the doctor was violated.

Minimum wage in the second quarter of 2022

The lowest rate for calculating earnings depends on the size of the subsistence minimum (LS) and according to Art. 133 of the Labor Code of the Russian Federation, the minimum wage has no right to be set below this indicator. Until mid-2018, the law was not observed and the monthly minimum wage exceeded the minimum wage.

The Government of the Russian Federation decided to raise the minimum wage from January 1, 2018 by 21.6% relative to 2022. Thus, the minimum wage in 2022 was 9,489 rubles, but the smallest indicator for the living standards of Russians for the second quarter of this period was more than this amount - 10,038 rubles. Therefore, the government decided to increase the minimum wage in 2018 to 11,163 rubles on May Day.

Now, when calculating the total amount of funds for VNIM, it is worth taking into account the base tariff of 11,163 rubles. But if the employee went on one or another vacation from May 1 of the previous period, then payments must be calculated from the previous minimum wage - 9,489 rubles.

At the regional level, the minimum wage also increased, taking into account the increase in the federal indicator. Since the municipality has the right to increase the local indicator, employees of this region have no right to earn less than this minimum wage. But if an employee receives remuneration less than the regional one, but more than the federal value, then the employer must raise the salary to the local level. To increase the rate, the head of the enterprise must enter into a regional agreement on the minimum wage. Otherwise, the employee will continue to earn the same amounts.

When the minimum wage increases, Russian companies automatically “conclude” a regional agreement, but if the management is against it, then the latter are given 30 calendar days to write a refusal request, clearly explaining their position. If one does not arrive, this means that the company agrees with the terms of the agreement.

Table of minimum wages in the regions of Russia in 2022.

In the past period, the minimum wage rate changed twice and since mid-2018 the amount has increased by almost 17.6%. Therefore, the minimum wage from May 1, 2018 was 11,163 rubles, since at the legislative level the minimum wage should be greater than or equal to the current subsistence level.

At the regional level, the geographical and socio-economic position of the territory was taken into account; in some cities the minimum wage was increased in 2022 from January 1 by region. The table presents the maximum threshold for work remuneration. From the first month of 2022, the salary must be equal to or greater than 9,489 rubles, and from May 1, 2022, the lower limit of remuneration for work is 11,163 rubles; the base for calculating remuneration cannot be lower than this value.

Table 1. Minimum remuneration level in Russian regions in 2022.

| Region (city and regional center) | Minimum wage, rub. | |

| from May 1, 2018 | ||

| Altai | 9729 | 11 163 |

| Amur Arkhangelsk Astrakhan Belgorod Vladimir Vologda Voronezh Jewish Autonomous Okrug Irkutsk Kamchatka Karachay-Cherkessia Krasnodar Kurgan Magadan Murmansk Nenets Autonomous Okrug Novosibirsk Omsk Orenburg Penza Primorsky Krai Samara Saratov Sakhalin Sverdlovsk Smolensk Stavropol Tambov Tver Tomsk Khabarovsk Yugra Chelyabinsk Yamalo-Nenets A About the Republic: Adygea Bashkiria Buryatia Ingushetia Kalmykia Mordovia Sakha North Ossetia Tyva Khakassia Udmurtia Chechnya Chuvashia Chukotka | 9489 9489 | 11 163 11 163 |

| Bryansk | 9550 — 10 615 | 11 163 |

| Volgograd | 11 228 | 11 228 |

| Transbaikal region | 11 490 | 11 490 |

| Ivanovo | 10 993 | 11 163 |

| Kabardino-Balkaria | 11 925 | 11 925 |

| Kaliningrad | 11 000 | 11 163 |

| Kaluga | 10 806 | |

| Kemerovo | ||

| Kirov | 10 159 | 11 163 |

| Kostroma | 10 723 | |

| Krasnoyarsk | ||

| Kursk | 10 196 | 11 163 |

| Leningrad | 11 400 | 11 400 |

| Lipetsk | 10 754,4 | 11 163 |

| Moscow | 18 742 | 18 742 |

| Moscow | 13 750 | 14 200 |

| Nizhny Novgorod Karelia Komi Ryazan | 10 000 | 11 163 |

| Velikiy Novgorod | 10 751 | |

| Eagle | ||

| Permian | ||

| Pskov | ||

| Dagestan | 9922 | 11 163 |

| Crimea Sevastopol | 9500 | 11 200 |

| Mari El | 10 047 | 11 163 |

| Tatarstan | 10 126 | |

| Rostov | ||

| Saint Petersburg | 13 500 — 17 000 | 13 500 — 17 000 |

| Tula | 11 440 — 13 520 | 11 440 — 13 520 |

| Tyumen | 9530 — 11 212 | 11 212 |

| Ulyanovsk | 12 000 | 12 000 |

| Yaroslavl | 9530 — 10 469 | 11 163 |

Minimum wage in Russia from May 1, 2022: regional aspect

In the territory of certain constituent entities of the Russian Federation, increased minimum wage values may apply (Article 133.1 of the Labor Code of the Russian Federation). This is possible if a regional agreement has been drawn up. Everyone who joined it is obliged to be guided by the regional minimum wage, and not the federal one. In order to maintain priority for the federal minimum wage limit, enterprise managers must, within a month after the publication of the text of the regional agreement, send a refusal to join in writing to the labor authority in their region.

For example, Moscow has set its own minimum wage - from May 1, 2022, the value of this indicator is 18,742 rubles. and corresponds to the cost of living in the city (Resolution No. 663-PP dated September 12, 2017, issued by the Moscow Government).

To approve the regional minimum wage, a tripartite agreement must be signed, the parties to which are:

- governmental body of a constituent entity of the Russian Federation;

- unification of trade union structures in the region;

- a united body of employers in a specific constituent entity of the Russian Federation.

If increasing coefficients or regional bonuses are used in the region, they are calculated in excess of the minimum wage and are not included in it.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What will the minimum wage affect?

The smallest base for calculating work remuneration affects the amount of compensation for sick leave, the period for child care and pregnancy, as well as maternity leave. The amount of compensation money and the conditions for receiving funds depend on the current base rate.

The amount of money for VNIM is calculated from the average pay per working day and length of service at the previous and current job. The minimum amount of payments for sick leave, maternity leave and child care for children under one and a half years old is calculated in proportion to the minimum wage in exceptional situations. Since the minimum wage for 2022 has increased, the amounts and terms of payments have increased.

Table 2. Impact of the minimum wage on benefits.

| Payment type | Influence |

| For temporary disability | The amount is calculated based on the minimum wage if the employee has less than two years of experience |

| Maternity | The amount of the benefit is calculated from the minimum wage if the employee has less than two years of experience |

| Child care up to one and a half years old | Calculated from the base tariff for calculating salary if the average profit for the employee’s labor exceeds the minimum wage |

Connection with a living wage

The living wage in Russia is an indicator designed to assess the standard of living of citizens and establish a base amount for calculating remuneration for the work of employees. The PM also forms the federal budget based on the needs of Russians, because it includes the consumer basket and funds for providing social support to citizens. The cost of the consumer basket includes prices for:

- food, non-food products and services;

- costs of rent, fees, taxes (NDFL).

Accordingly, in order for citizens to have enough funds to pay for the minimum amount of products, services, mandatory payments and taxes, the state must allocate at least this amount. This procedure is established by law. But until 2022 the law was broken. Therefore, since last year, Russian minimum wage officials have taken a course towards moving closer to the subsistence level. Thus, the minimum wage in 2022 until May of the previous period was 6% less, and after that the minimum wage level increased by 11.25% of the subsistence level. Now the minimum wage for 2022 is calculated so that citizens have funds to compensate for the consumer basket.

From the first increase in the minimum wage to the minimum wage, it was decided to establish equality between the indicators. Perhaps in 2022 and subsequent years the minimum wage will not lag behind the subsistence level.

What is a living wage and how is it related to the minimum wage?

The minimum wage is calculated and established based on the subsistence level, which is regulated by Law No. 134-FZ of October 24, 1997 “On the subsistence level in the Russian Federation.”

So, the cost of living is the cost of the minimum set of food and essential goods that are necessary to maintain human life. In other words, this is the amount of money on which a citizen can live for a month. Naturally, this includes the necessary contributions and payments.

It is noteworthy that the cost of living cannot be the same for everyone. It differs depending on which category a person belongs to. For example, a child, a pensioner or an able-bodied citizen. According to statistics, the lowest monthly expenses are observed among pensioners.

The cost of living is calculated both for Russia as a whole and separately for each region. Calculations are carried out every quarter, and changes are observed upward. The obtained data is approved by the Government of the Russian Federation, and in the regions - by local authorities, within the framework of established legislation.

Overall the picture looks like this:

- The rate per child is 10,160 rubles;

- For an able-bodied person – 11,163 rubles;

- For pensioners – 8,506 rubles.

The minimum wage and the cost of living are closely related. After all, a person should not receive a salary with which he cannot buy food, clothing and other necessary things.

For a very long time, the minimum wage lagged significantly behind the “food basket” indicators. The goal to equalize these values was set by the Government for 2022. However, we managed to complete the task ahead of schedule.

Thus, the main change in May 2022 was that the interrelated values of the minimum wage and the subsistence level were equalized to 11,163 rubles.

How often does the minimum wage increase?

Until 2022, the minimum wage in Russia was set according to inflation dynamics. The government reported that this has a positive impact on the federal budget. Therefore, the minimum wage did not change from the beginning of each year, but in January, June, July, May, September and other months.

According to Art. 133 of the Labor Code of the Russian Federation, the minimum tariff for calculating earnings directly depends on the cost of living, which did not meet the requirements of the code. This was explained by the fact that a gradual increase would not cause damage to the Russian economy. Thus, from April 2022, the minimum indicator became equal to the PM indicator. Since the cost of the consumer basket, which is included in the vital financial minimum, increases annually, a decision was made to annually index the minimum wage in Russia.

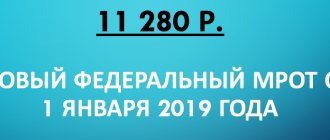

Thus, in 2022, the base rate for calculating work remuneration was determined from the beginning of January. Now according to para. 2 tbsp. 1 Federal Law No. 82 dated June 19, 2000 (as amended on December 25, 2018), the minimum wage in Russia is planned to be indexed according to the PM on January 1 of the corresponding year.

To track the dynamics of the minimum wage in Russia, a table of minimum wages by year has been developed

Minimum wage - what is it? Where is it used and who installs it?

To begin with, it is worth noting that the minimum wage is the minimum wage. It is the statutory amount that an employer must pay employees for a full month worked. Moreover, the amount of wages paid can naturally be higher than this value, but in no case lower. This condition is mandatory for all employers, regardless of what form of ownership they belong to. Failure to comply with the requirements established by law entails administrative liability.

At the moment, the minimum wage is 11,163 rubles. It should be noted that the minimum wage indicator not only serves as a guideline for calculating the minimum wage, but is also used in regulating labor relations. After all, the employee may not work a full month. The reason for this may be the presence of sick leave, going on maternity leave, etc. In this case, the calculation of the required earnings must be made in accordance with the provisions of the Labor Law.

Moreover, based on the minimum wage, various social payments are calculated. For example, child benefits, or unemployment.

The minimum wage is set both at the level of the entire country and separately for each region. However, the regional minimum wage should not be lower than the federal one.

As expected, the minimum wage value is proposed by the Government of the Russian Federation, then submitted for discussion to the State Duma, where the corresponding Law is adopted, approved by the Federation Council, and only after that signed by the President.

As for the regional minimum wage, an agreement is signed between the government of the region, territory or republic and the regional association of trade unions of workers and entrepreneurs. The validity period of such a document is three years.

It is worth noting that regional employers have the right to refuse to pay the established “minimum wage”. The entrepreneur must have a reasoned written refusal, and it must be agreed upon with the trade union organization of the enterprise. This letter is sent to the administration of the territory, region, republic within 30 days after the publication of the regional minimum wage in official publications and on the Internet.

It was already mentioned earlier that the minimum wage is established and operates on the basis of regulations. Therefore, it would not be amiss to note this legislative framework.

| No. | The legislative framework | Note |

| 1 | Federal Law - No. 82 dated June 19, 2000. Law “On the Minimum Wage”. | A document that was adopted a long time ago and is quite outdated. At the same time, he, like no one else, determines the scope of the minimum wage. According to the act, the minimum wage must be taken into account when regulating wages, determining the amount of benefits for temporary disability, pregnancy and childbirth, as well as for other purposes of compulsory social insurance. For other purposes, this indicator cannot be used. |

| 2 | Article 133 of the Labor Code of the Russian Federation | The article directly states that the minimum wage cannot be lower than the subsistence level, and also describes how the minimum wage should be paid. In addition, the article regulates how the minimum wage is established in the regions. |

| 3 | Article 129 of the Labor Code of the Russian Federation | Explains what wages are and what they consist of. Naturally, if an employee is entitled to compensation payments in the current month, then the amount of wages will be higher than the minimum wage, but if the presence of any additional payments is not provided, then the employee still should not receive a salary lower than the established minimum wage. |

| 4 | Resolution of the Constitutional Court of the Russian Federation dated December 7, 2017 N 38-P | This legal act is worth noting because in it the Constitutional Court of the Russian Federation determined whether regional coefficients are included in the minimum wage. The court explained that the minimum wage must be provided to all workers, regardless of working conditions. Accordingly, employers are required to pay employees the minimum wage plus the Republic of Kazakhstan. |

| 5 | Federal laws No. 41-FZ of March 7, 2018 and No. 421-FZ of December 28, 2017. | The Acts prescribe the established minimum wage as of May 1, 2018 , and also stipulate the rules for changing it. |

Thus, according to current legislation, the minimum wage includes:

- Official salary according to the employee’s qualifications;

- Compensation payments that allow employees to receive wages at the minimum wage level;

- Premium payments.

It should be emphasized once again that the wages received must be accrued strictly in accordance with all changes in force from May 1, 2022.