Registration of issuance of financial assistance

The package of documents for processing the issuance of financial assistance is not defined by law, and therefore the management of the organization needs to develop regulations for this business transaction. We offer the following package of standard documents:

- an employee’s application when going on vacation with a request to provide an additional payment for the vacation, if the procedure for its payment and amount are determined in the collective or employment agreement;

- an employee’s application with a request to provide financial support on any other grounds stipulated by a collective or labor agreement, or any other local regulatory act of the organization (the employee must attach to the application a document confirming the occurrence of circumstances that are the basis for this payment);

- payment order (issued after receiving an application for financial assistance (for any reason)).

These documents will be the basis for the accountant to accrue financial assistance (entries to be reflected in accounting will be indicated in the next section).

Legal aspects of payment of financial assistance

To avoid conflicts with regulatory authorities, a complete list of events for which a company can provide financial assistance, as well as documents accompanying its receipt, is usually recorded in industry agreements or a collective agreement. As a rule, the issuance of MP is made on the basis of an application from an employee and a corresponding order from the manager.

The source of payment is the company’s profit, incl. and unallocated. Such a decision can be made at a general meeting of founders and recorded in the minutes.

Financial assistance, accounting entries

The provision of material assistance is reflected by entries in the debit of accounting account 91 “Other income and expenses”, subaccount 2 “Other expenses” in correspondence with the credit of account 73 “Settlements with personnel for other operations” as part of payments to active employees, or account 76 “Settlements with various debtors and creditors" when providing financial support to other individuals.

It is allowed to reflect the accrual of financial assistance by posting a credit to account 70 “Settlements with personnel for wages”; this procedure should be fixed in the accounting policy of the organization.

Employee support can be in either monetary (1) or in-kind (2) form:

- Financial assistance was issued: posting in correspondence with the credit of account 50 “Cash” (when issued in cash) or account 51 “Current account” (when transferred to a bank account).

- Support was provided to the employee in kind: correspondent account - accounting of issued property, for example 10 “Raw materials and materials”, 40 “Finished products and goods”.

In cases where retained earnings are used to support employees, account 91 is replaced by 84, “Retained earnings (uncovered loss).”

Registration of financial assistance in connection with the birth of a child

To create a document, you need to create a new calculation type:

- Refer to the “Salary and Personnel” section, select “Salary Settings” - “Payroll” - “Accruals”.

- Proceed to enter information in the form that opens. As in the previous case, the user must enter the name of the calculation. On the “Personal Income Tax” tab, select “Taxable”. Enter manually or select from the directory the income code - 2762.

- Specify the type of income by selecting “Financial assistance for the birth of a child...” from the directory.

- On the “Income Tax” tab, select the “Not included in expenses...” method.

- Specify the method of reflection in accounting. As in the previous case, you can select it from the directory or create it yourself. Let's create a new way of reflection - in our case it is “Financial assistance in connection with the birth of a child.”

Please note: in this case, on the “Account” tab, you must select “Other income and expenses” - “Other non-operating income...”. When you select an account, a checkmark should be displayed next to it for reflection in tax accounting.

In the “Salaries and Personnel” section - “All accruals” - “Create”:

- Select the month for calculating financial assistance.

- Please indicate your organization.

- Select an employee using the “Add” button.

- Click on the “Accrue” button and select “Financial assistance in connection with the birth of a child.” Please note: the maximum tax-free amount is RUB 50,000.

In the new window, enter the accrual amount and confirm the action by clicking on the “OK” button. The bottom of the form will provide information about the amount of deduction available to the employee. If it exceeds the amount of 50,000 rubles, the deduction amount will be equal to 50,000 rubles.

The accrual form will provide information on the amount of financial assistance. It will also indicate the amount of taxes (if the limit of 50,000 rubles is exceeded).

Let's look at the situation using an example. Romashka LLC needs to provide financial assistance to employee A.N. Mikhailova. in the amount of 80,000 rubles. In our case:

- The size of the tax base for calculating personal income tax will be calculated as the difference between the planned payment amount and the available limit (80,000 rubles – 50,000 rubles = 30,000 rubles).

- The personal income tax amount will be = 30,000 * 13% = 3,900 rubles.

- The amount of insurance premiums = 30,000 * 30.2% = 9060 rubles.

In order to save the accrual, click on the “Post and close” button. Based on this document, you can create a payment to an employee from the cash register or a payment from the company’s current account.

Personal income tax

The employer must withhold personal income tax from the amount of financial support provided to its employees (Article 210 of the Tax Code of the Russian Federation), with the exception of:

- amounts of one-time financial support not exceeding 4,000 rubles per calendar year (clause 28, article 217 of the Tax Code of the Russian Federation);

- the amount of a one-time payment from the employer, but not more than 50,000 rubles (clause 8 of Article 217 of the Tax Code of the Russian Federation), paid to parents at the birth of a child (adoptive parents, guardians). Limit of 50,000 rubles. is subject to application by the employer in relation to each of the parents (Letter of the Ministry of Finance of Russia dated July 12, 2017 No. 03-04-06/44336).

In all other cases, it is necessary to reflect the accrual of personal income tax on financial aid by posting to the debit of account 73 “Settlements with personnel for other operations”, account 70 “Settlements with personnel for wages” or account 76 “Settlements with various debtors and creditors”, in correspondence with the loan Account 68 “Calculations for taxes and fees.”

Amounts of assistance provided by employers to close relatives of their deceased employee, even a former or retired employee, are not subject to personal income tax (Clause 8 of Article 217 of the Tax Code of the Russian Federation). We also received exemption from personal income tax for amounts paid in connection with emergency situations, the victims of which were employees or their close relatives (clauses 8.3, 8.4 of Article 217 of the Tax Code of the Russian Federation), and one-time payments made to an employee retiring (clause 8.5 Article 217 of the Tax Code of the Russian Federation).

In cases where assistance is provided to employees in kind and it is impossible to withhold personal income tax until the end of the calendar year, the employer must notify the tax authorities of this fact no later than March 1 of the following year (clause 5 of Article 226 of the Tax Code of the Russian Federation).

We understand the withholding and calculation of personal income tax

The bonuses will have to be taxed in full and there are no exceptions for them.

We list some exceptions from the taxable base, the list is incomplete, others can be found in Article 217 of the Tax Code, with references to items specifically from it in parentheses.

- Financial assistance paid to a working or former employee (if his dismissal is related to retirement) - in the amount of up to 4,000 per year (clause 28).

- Assistance provided by an organization to an employee at the birth (adoption, receipt of guardianship) of a child (up to a year after birth) - up to 50,000 rubles (clause 8).

- Any assistance to veterans and disabled people of the Great Patriotic War; for former prisoners (detailed list in paragraph 33) - up to 10,000 rubles during the year.

- Any other gifts from organizations and individual entrepreneurs received by the taxpayer during the year in a total amount not exceeding 4,000 rubles (clause 28).

By the way! You can give gifts to the child and another relative of the employee, not just himself. There will be a limit of 4,000 per year for each person. The main thing is to draw up a gift agreement in the name of the appropriate person.

Insurance premiums

Insurance premiums, on the basis of Art. 421 of the Tax Code of the Russian Federation, and contributions “for injuries” (Article 20.1 of Law No. 125-FZ): when financial assistance is accrued - posting to the debit of accounting account 91 “Other income and expenses”, subaccount 2 “Other expenses” in correspondence with the credit of the account 69 “Calculations for social insurance and security.”

Lump sum payments in the form of financial assistance are not subject to insurance premiums on the same grounds as for personal income tax (Article 422 of the Tax Code of the Russian Federation).

At the same time, the employer must take into account that employee support expressed in kind is also the basis for calculating insurance premiums and “injury” contributions.

Reflection in accounting for financial assistance for vacation

Please note that the accrual of financial assistance for vacation is reflected in the same order as the vacation pay itself. The same applies to insurance premiums and injuries.

If a reserve has been created in the company, then the payment of financial assistance for vacation is made by debiting account 96 “Reserves for upcoming expenses.”

If the company does not create a reserve for vacation pay, the accrual of financial aid is made by posting to cost accounts as part of expenses for ordinary activities or other expenses.

The payment of financial assistance itself is reflected by the following posting:

Debit 70 – Credit 50, 51

You can read more about the payment of financial assistance for vacation in the article “Payment of financial assistance for vacation.”

Important

In order to take into account financial assistance for vacation as a labor expense, such payment must be provided for in an employment contract, collective agreement or local regulations of the employer and related to the employee’s performance of his job function (depend on the amount of salary, compliance with labor discipline, etc.).

Financial assistance for the birth of a child in the amount of 50,000 rubles in 1C: ZUP ed. 3.1

Published 06/04/2021 08:05 Author: Administrator Did you know that in addition to state-guaranteed payments at the birth of a child, parents have the opportunity to receive financial assistance in the amount of 50 thousand rubles from the employer? Moreover, both parents (guardians) can receive such a payment at once! Moreover, under certain conditions, this type of financial assistance is not subject to personal income tax or insurance premiums, which only benefits employers! In this publication, we will consider in what cases such tangible support is paid to young parents, the procedure for its registration, taxation and reflection in the 1C program: Salaries and personnel management ed. 3.1.

Let us note the most important thing : financial assistance for the birth of a child is not the obligation of the employer, but his right and payment is made only if it is stipulated in the regulations of the organization:

• employment contract;

• collective agreement;

• local regulations of the company.

Both the mother and father together can receive financial assistance from the employer, even if they work in the same company.

The source of financial assistance is the company’s own funds, its current profit or retained earnings from previous years.

To pay financial assistance, the employee writes an application in any form, attaching supporting documents (a copy of the birth certificate).

The document is only needed to confirm that the child is a newborn, because Payments for children under one year of age are not subject to personal income tax and insurance contributions . When paying financial assistance at birth upon reaching the age of one year, only the amount of 4,000 rubles is not taxed. - clause 8, art. 217 Tax Code of the Russian Federation.

If you have not previously been subject to financial assistance at birth in the amount of 50 thousand rubles. based on the total amount paid to both parents or to one parent, amounts paid to both parents are currently exempt.

This is explained in the Letter of the Ministry of Finance of Russia dated September 26, 2017 No. 03-04-07/62184 and in the Letter of the Federal Tax Service of Russia dated October 5, 2017 N GD-4-11/ [email protected]

According to paragraphs. 3, paragraph 1, art. 422 of the Tax Code of the Russian Federation are not subject to insurance contributions for the amount of financial assistance for the birth of a child paid by the employer, not more than 50,000 rubles. for each child during the first year after birth.

Thus, insurance premiums are not charged for birth assistance paid by the employer, provided that two conditions are met:

1) payment amount up to 50 thousand rubles;

2) the payment was made within the first year after his birth.

Let's look at the calculation and payment of such financial assistance step by step in 1C: ZUP ed. 3.1.

Employee of Karamelka LLC Pirogova E.S. I wrote an application for financial assistance for the birth of a child. The child is not one year old. The collective agreement of Karamelka LLC provides for the payment of financial assistance at birth in the amount of 50,000 rubles. at the expense of the enterprise.

Initial setup of the 1C program: ZUP ed. 3.1

To enable the possibility of calculating financial assistance, enable the setting in the “Payroll calculation” section.

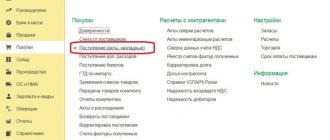

Step 1. Go to the “Settings” - “Payroll” section.

Step 2. Click on the hyperlink “Setting up the composition of charges and deductions.”

Step 3. In the “Financial Assistance” subsection, check the box – “Financial assistance is paid to employees.”

As a result of these actions, a journal for entering financial assistance will appear in the “Salary” section.

When you select an accrual, the types of financial assistance predefined by the program are activated, incl. "Financial assistance at the birth of a child."

Let's look at its settings.

Step 4. Go to the “Settings” - “Accruals” section.

Step 5. Open the “Financial assistance for the birth of a child” accrual card.

On the “Basic” tab, the purpose of the accrual is set to “Material assistance” and that it is accrued by a separate document of the same name.

Step 6. Go to the “Taxes, fees, accounting” tab.

In the personal income tax section it is established that income code 2762 is taxed - “Material assistance provided by employers to their employees at the birth (adoption) of a child”, with the default deduction code 508.

Setting up insurance premiums – “Financial assistance at the birth of a child, partially subject to insurance premiums.”

In the “Income Tax” settings section, the switch is set to the “Not included in labor costs” position, because This payment is of a social nature.

Let's check the accrual effect.

Calculation of financial assistance for the birth of a child in 1C: ZUP.

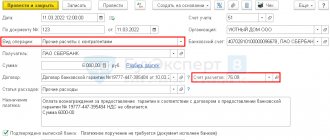

We will accrue financial assistance for the birth of a child to employee E.S. Pirogova. in the “Salary” section - “Financial assistance”.

Step 1. Having opened the “Material Aid” journal, click “Create”.

Step 2. Select the type of financial assistance from the directory - “Financial assistance for the birth of a child.”

Select an employee (in our case, this is Elena Stepanovna Pirogova).

To apply deductions, indicate the number of children (in our example, one). The amount of financial assistance in our example is 50,000 rubles.

The program will automatically set applied personal income tax deductions and a discount on insurance premiums for this amount - 50,000 rubles.

Let’s assume that the employment contract at Karamelka LLC provides for the payment of financial assistance in the amount of 100,000 rubles.

The screenshot clearly shows that a deduction and discount were applied in the amount of 50,000 rubles, and personal income tax was charged on the remaining amount, thereby reducing the amount payable to the employee.

If in the first example, when calculating Pirogova E.S. amount of financial assistance in the amount of 50,000 rubles. when calculating insurance premiums, this amount is not fully taxed, then in the second option, the discount on insurance premiums is calculated only in the amount established by law of 50,000 rubles. Those. Insurance premiums are calculated from the remaining amount.

Insurance premiums are calculated using the document “Calculation of salaries and contributions” when calculating wages for all employees of the organization.

The screenshot shows that when accruing Pirogova E.S. amount 100,000 rub. Insurance premiums are calculated from the amount minus the discount on insurance premiums (100,000 – 50,000 = 50,000 rubles).

Payment of financial assistance for the birth of a child

Form the payment of financial assistance to employee Pirogova E.S. can be done directly from the financial assistance accrual document or the “Material Aid” document journal.

Let’s focus on paying the accrued amount according to the conditions of the example – 50,000 rubles.

Step 1. In the “Material Aid” journal, highlighting the line with the document, click the “Pay” button.

Step 2. In the payment assistant that opens, click “Post and close.” In the future, the document is available in the “Payments” section.

By clicking the “Open Statement” button, a document will open where you can print it.

Financial assistance to E.S. Pirogova, an employee of Karamelka LLC. paid.

Author of the article: Olga Kruglova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments

Results

We must not forget that providing financial assistance to employees to solve their life situations is the good will of the manager and cannot be considered remuneration (letter of the Federal Tax Service of the Russian Federation dated April 27, 2010 No. ШС-37-3/ [email protected] ).

Consequently, such transfers cannot be taken into account in the organization’s expenses and reduce the base for calculating tax under the simplified tax system. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Types of financial assistance according to KVR and KOSGU

| Type of assistance | KVR | Sub-article KOSGU |

Payments for the repair of residential premises to disabled people of the Great Patriotic War, veterans of the Great Patriotic War, spouses of deceased (deceased) disabled people of the Great Patriotic War,veterans of the Great Patriotic War who have not remarried, orphans and children without parental care, orphans and children without parental care | 321 | 262 |

One-time material (monetary) assistance to citizens left without means of subsistence as a result of natural disasters, man-made disasters and other emergency circumstances, unemployed citizens,other citizens in difficult life situations | 321 | 262 |

One-time material (monetary) assistance in connection with unforeseen monetary expenses incurred by non-working pension recipients,families with minor children who find themselves in difficult life situations | 321 | 263 |

One-time material (monetary) assistance to citizens for partial payment of the contribution for major repairs of common property in apartment buildings | 321 | 262 |

Food assistance, including in the form of hot meals, to citizens who find themselves in difficult life situations | 244 | 342 |

Material assistance to citizens who find themselves in difficult life situations | 244 | 345, 346 |

Distribution of durable goods to non-working pensioners and disabled people, families with minor children who find themselves in difficult life situations | 244 | 346 |

One-time material (monetary) assistance for partial reimbursement of the costs of a notary’s visit to the home of non-transportable persons in dire need | 321 | 262 |

Expenditures by local authorities on social assistance are not considered public regulatory obligations, since the amount of this assistance, indexation rules and payment procedures are not established by law. Therefore, cash payments are carried out according to KVR 321 “Benefits, compensation and other social payments to citizens, except for public regulatory obligations.” If we are talking about purchases in favor of citizens, then such expenses are carried out, as usual, according to KVR 244 and the corresponding KOSGU code.

Expenses for providing material assistance to people who find themselves in difficult life situations are included in subsection 1003 (clause 18.2.10 of the Procedure for the formation of the CBC, approved by order of the Ministry of Finance dated 06.06.2019 No. 85n).