Differences between an employment contract and a GPC agreement

Both the employment contract and the civil process agreement are concluded for the purpose of formalizing relations for a citizen to perform any work for an enterprise, however, in the first case, special working relationships arise that are not regulated by the Civil Code. The differences between the two types of agreements are as follows:

- according to the GPC, certain work or task is performed, while according to the labor employee, he performs a labor function and holds a position in the company;

- in labor relations, a citizen is obliged to comply with internal regulations, other local regulations, as well as orders and instructions from management. When concluding a GPC agreement, the principle of equality of parties applies;

- the employer has certain obligations in labor relations: payment of wages to the employee at least twice a month, payment of contributions, organization of labor and safety, certification of workplaces, etc. The relations of the parties in the GPC agreement are regulated only by agreement of the parties and the law, internal legal documents do not apply to them, payment of remuneration can be carried out in any manner that does not contradict the law, as agreed upon by the parties; There are no insurance contributions.

A GPC agreement must be distinguished from a fixed-term employment contract. Most often, working relationships are formalized on an indefinite basis; a fixed-term contract is concluded only if it is impossible to conclude an open-ended one. The difference between fixed-term contracts and GPC is based on the constancy of the functions assigned to the employee: the GPC agreement is concluded not just for a certain period, but to perform a specific task.

Here is a table of preferred formulations.

| Employment contract | GPC agreement |

| Names of parties: employee - employer | Names of parties: customer - contractor |

| Indication of positions according to the staffing table, indication of function, for example legal adviser | Indication of specific work, for example filing a statement of claim |

| Indication of a permanent nature, such as a reference to job descriptions | Indication of quantitative indicators, for example drawing up two statements of claim |

| Link to PVTR, mandatory compliance | Lack of reference to rules or other local regulations |

| Indication of the location of the workplace | A citizen is not provided with a job |

| Logistics and personal protective equipment are provided by the employer | We use our own materials, equipment, and personal protective equipment. |

| Payment of wages at least 2 times a month | Payment of remuneration is carried out in accordance with the agreement of the parties in the contract (it is advisable that the schedule does not coincide in dates with the salary payment schedule at the enterprise) |

| It is allowed to be involved in overtime work or sent on a business trip | Phrases about overtime work and business trips are unacceptable, this is an element of labor relations |

Sample GPC agreement

Employment using a GPC agreement

Unlike an employment contract, which is regulated by the provisions of the Labor Code of the Russian Federation, a civil contract is subject to the articles of the Civil Code of the Russian Federation. For this reason, there is no need to make an entry in the work book about the conclusion/termination of a civil law contract (CLA).

The object of a civil contract (CLA) is remuneration for specific work or service, the result of which will be established in the final accounting act. This form of arrangement without a work book requires weighing all the pros and cons, taking into account the interests of both parties:

- Remuneration under the GPC agreement is not included in the tax base of VNiM insurance. “Unhappy” payments are subject to payment only if the agreement of the parties obliges to mention this. For the employee, this will mean no sick pay in the event of an injury.

- Extension of the GPC agreement is not allowed and is not carried out on a regular basis.

- The GPC agreement does not provide for the implementation of social guarantees in the form of vacation pay, severance pay, etc. with mercenaries.

If the audit reveals even the slightest signs of an employment relationship under the GPA, including regular payments based on monthly acts, the contract will be qualified as an employment contract. Then the employer pays to the budget all due amounts of insurance premiums and penalties on them.

Important!

It is dangerous to replace an employment contract with a civil law one. An employee can file a complaint with the labor inspectorate or court. If the contract is recognized as an employment contract, the organization faces a fine of 50,000 to 100,000 rubles. In addition, the court may oblige you to pay the employee all the money due to him under the employment contract (Part 4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation, paragraph 24 of the Resolution of the Plenum of the Supreme Court of May 29, 2022 N 15, paragraph 15 of the Review of Judicial Practice of the Supreme Court court).

Working under an employment contract without a work book

The disadvantages of working without a book are much greater than the advantages. A definite advantage for the employer can be considered the almost complete absence of formalities and bureaucratic difficulties. The citizen receives relative freedom when performing a task, including the absence of inclusion in the hierarchical system of the enterprise. When drawing up a GPC agreement, it is much easier to terminate the relationship, which can be considered both pros and cons, depending on the situation (although here, too, you need to be careful and comply with the requirements of Article 310 of the Civil Code of the Russian Federation).

Disadvantages of not having a work book under a GPC agreement:

- vacations and sick leave are not paid, vacation is not provided at all, this is an element of the labor relationship;

- insurance contributions are not deducted, as a result of which the employee’s guarantees are reduced;

- lack of incentive and compensation payments, including bonuses;

- lack of liability of the employer in case of industrial injuries (if the damage is not caused by the fault of the customer).

Some experts mistakenly consider various types of civil law contracts as work under an employment contract without an entry in the work book. This is incorrect, since agreements of this type are purely civil in nature. Accordingly, the employer does not have to issue a book. For example, this applies to contracts for the provision of services or author's orders.

However, the Labor Code of the Russian Federation provides for three cases of concluding an employment contract without recording in the work book:

- registration of part-time work;

- remote employment;

- the employer is an individual.

What risks does an employee take when applying for employment under a GPC agreement?

From a legal point of view, a civil law contract is a completely acceptable alternative to a regular employment agreement. In certain situations, a contract or agency agreement may be more beneficial for the employee:

- a civil contract does not oblige the employee to visit the office every day - the assigned amount of work is carried out at any time convenient for the person;

- the performer does not have a direct supervisor, he acts on his own behalf and is responsible only to himself;

- The contractor is not tied to a specific company; if he has the potential, he can cooperate with several organizations, which will significantly increase his remuneration.

At the same time, a citizen working under a civil law contract is not protected from the whims of the customer by the provisions of labor legislation. The negative consequences of civil legal contracts are as follows:

- the performer does not have the right to any type of leave (annual, educational, maternity leave);

- in case of illness, time spent on treatment is not paid;

- an employee registered under a GPC agreement has a “gap” in his work experience;

- the remuneration received by the contractor under a civil contract is not subsequently taken into account when calculating average earnings (to pay for vacations or social benefits);

- if the assigned task is completed in violation of the deadline, the customer has the right to apply penalties to the contractor;

- The customer may, on his own initiative, terminate the contract at any time before its expiration. In the best case scenario, the contractor will receive only part of the amount due to him, in the worst case, he will be left without remuneration.

Applying for a job without a work book is possible. Ultimately, the guarantee of compliance with legal relations between an employee and an employer is not an entry in the work book, but a correctly completed contract. If an employee has a choice, then it makes sense to give preference to a standard employment contract. In situations where the employer insists on employment under a GPC agreement, you should protect yourself as much as possible by carefully studying the terms of the contract.

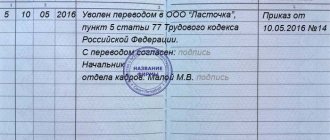

Part-time work

In accordance with paragraph 5 of Article 66 of the Labor Code of the Russian Federation (Part 5 of Article 66 of the Labor Code of the Russian Federation), when hiring a citizen to work in an organization who will perform part-time duties, information about this is entered into the book at his request. In this case, information can be indicated by the main place of employment. To do this, you must provide a document confirming the fact of part-time employment. For example, a certified copy of the employment order or a certificate from the second place of employment indicating details and other necessary data.

Sample contract for part-time work

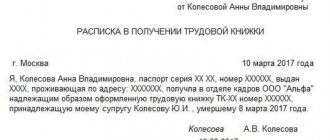

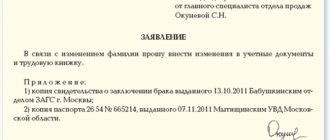

Remote employment

Work under a contract without a work book, in accordance with Part 6 of Article 312.2 of the Labor Code of the Russian Federation, is possible with remote employment, provided that the employee is employed for the first time (the employer is relieved of the obligation to issue a book). In order for the employer to realize this opportunity, a corresponding agreement between the parties is signed. It can be put on paper by adding a phrase to the document confirming this agreement. Or the employee draws up a statement asking not to include information about remote work in the document.

In this case, in accordance with Part 6 of Article 312.2 of the Labor Code of the Russian Federation, the main document confirming the employee’s length of service will be his copy of the agreement. Additional confirmation may be copies of orders for admission to remote work and dismissal issued by the employer. This conclusion can be drawn from an analysis of the provisions of Part 5 of Art. 312.1, part 2 art. 312.5 Labor Code of the Russian Federation. The employee organizes the recording and storage of such documents independently.

Instead of conclusions

A contract without an entry in the work book has its positive and negative sides:

- On the one hand, it allows you to have more freedom, more opportunities for self-realization, and even offers higher pay compared to permanent work for an employer.

- But on the other hand, it makes the employee more unprotected both in generally accepted social terms and in relation to the employer, who does not bear any responsibility to the employee and can terminate the agreement at any time without warning.

Employer is an individual

In accordance with paragraph 3 of Article 66 of the Labor Code of the Russian Federation, an individual who is not an individual entrepreneur does not have the right to make entries in employee books and register them for persons hired for the first time. A document confirming the period of employment with such an employer is a rental agreement concluded in writing (paragraph 2 of Article 309 of the Labor Code of the Russian Federation).

Individual entrepreneurs are not exempt from the obligation to make entries in this document in relation to each employee. This fact is confirmed by paragraph 1 of Article 309 of the Labor Code of the Russian Federation.

Employers - individuals without the status of individual entrepreneurs can also enter into employment contracts. Such an employer does not have the right to make entries in the work book, or issue a new one. Thus, evidence of a citizen’s activities in this case is only his copy of the contract. At the same time, the employer - an individual is also obliged to make contributions to the funds and issue an insurance certificate if such work is the first for the employee. The agreement can be concluded either for a certain period or be of an indefinite nature. Such an employer is obliged, in accordance with Art. 303 of the Labor Code of the Russian Federation, notify local authorities and register the agreement (at your place of residence).

Sample agreement: employer - individual

Exceptions to the general rule

According to Art.

65 of the Labor Code of the Russian Federation, a work book (or electronic information about work activity) is one of the mandatory documents that an employee must provide to the personnel service when applying for a position. The same standard lists cases when it is not necessary to provide a book:

- Hiring an employee without work experience (initial registration of the book, in accordance with Article 66 of the Labor Code of the Russian Federation, is carried out within 5 days from the date of admission).

- Concluding a part-time agreement.

- Absence of a book due to its loss, damage or other reasons (the document is drawn up by the new employer based on an application from the employee stating the reason for the absence of the book).

Read about correctly filling out an employee’s document in the material “Instructions for filling out work books.”

Analyzing labor legislation in more detail, we can find other cases when hiring without a work book is possible:

- Conclusion of a civil contract with a hired person (Article 11 of the Labor Code of the Russian Federation).

- Work for an individual not related to entrepreneurial activity (Article 309 of the Labor Code of the Russian Federation).

- Remote work (Article 312.2 of the Labor Code of the Russian Federation).

In all cases of work under an employment contract without a work book, confirmation of length of service in the Pension Fund will be the pension contributions transferred by the employer according to the employee’s SNILS, as well as a copy of the work agreement. Let us consider the features of such employment methods in more detail.

How are labor relations formalized?

The employment contract must reflect the following information regarding the employee and the employer:

- full name and place of residence of the citizen;

- details of his identity document;

- bank account details for payment;

- name of legal entity, full name Individual entrepreneur or citizen - employer;

- the name of the person authorized to represent the interests of the employer;

- employer's address;

- his bank details.

A complete list can be found in Art. 57 Labor Code of the Russian Federation. These are the usual details of the contract, but in this case special attention must be paid to filling them out.

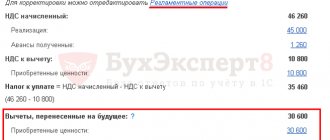

Taxes

According to the Tax Code of the Russian Federation, a single tax (personal income tax) is deducted from a citizen receiving income, regardless of whether he works under a TD or GPA, by the enterprise’s accounting department - in the amount of 13% of the amount earned. For foreigners working in the Russian Federation – 30%.

The employer pays insurance contributions to the pension fund and social insurance fund.

Thus, the following conclusions can be drawn:

- When applying for a job, find out whether the job is one-time or permanent, whether the employee is hired on staff or hired as an order executor.

- If the work is permanent, an entry in the work book must be made in order to be able to prove in the future that work took place at this enterprise. (Article 65 of the Labor Code of the Russian Federation)

- Conclude an employment contract with the director of the enterprise, which stipulates the main labor functions, obligations of the parties, social insurance conditions, tax deductions and the duration of the contract.

- If the work is one-time or a specialist is hired to complete the final task, a civil law agreement is concluded (Article 420 of the Civil Code of the Russian Federation).

- The GPC agreement provides the following benefits for the employee: optional submission to the disciplinary rules of the enterprise, independent performance of work, and the impossibility of imposing a disciplinary sanction.

- The advantages of the GPA for the employer are as follows: social insurance and vacation pay are not paid. There is no need to provide the contractor with a workplace and materials for work.

- If necessary, the GPA can be re-qualified in court as an employment contract with the possibility of providing the employee with social guarantees, accrual of length of service and provision of a job.

Re-qualification of a GPC agreement into a labor agreement in court

Often, at the request of citizens, contracts are requalified. In this case, the court, when deciding on the essence of contractual relations, based on practice, evaluates the following conditions:

- the nature of the work performed (one-time tasks or certain job responsibilities);

- working conditions (presence or absence of a workplace, provision of equipment and materials, compliance with labor protection);

- procedure for payment of remuneration (dates and frequency);

- formulations of responsibilities (according to the Labor Regulations or not);

- the presence or absence of social guarantees for the employee (payment of sick leave, etc.).

Responsibility of the employer for an employment contract without a work book

The article lists three cases where the possibility of concluding an employment contract without a book is legislated. In other cases, the employer must ensure that there is an entry in the book. Evasion of this obligation is punishable by law and faces certain consequences for the employer. This thesis is enshrined in Decree of the Government of the Russian Federation dated April 16, 2003 No. 225. In this regard, Article 5.27 of the Code of Administrative Offenses of the Russian Federation provides for fines for such an offense in the amount of 1,000 to 50,000 rubles. Repeated violation may result in a fine of 10,000 to 70,000 rubles, as well as disqualification of the manager. Moreover, payment of a fine does not relieve one from civil liability to the employee: obligations to properly formalize the relationship, payment of various compensations for the period of the relationship, etc.

Often, employers hide under civil law agreements relations that fall under the Labor Code of the Russian Federation. For example, concluding contracts for an author's order or for the performance of any services. Such violations may be discovered through an audit or as a result of a complaint received from employees. Inspectors are guided by the essence of the existing legal relations.

Often such cases go to court and are decided not in favor of the employer. This outcome is typical when inspectors come to the conclusion that the existing legal relationship between the customer and an individual is of a permanent nature and is subject to the Labor Code of the Russian Federation. Since when carrying out work under a GPC agreement, the employee is considered not to be socially protected, the court takes his side. In particular, the employee does not have the right to paid vacation and sick leave. The employer has no liability for compensation for damages in the event of a work injury, and pregnant women are not paid maternity leave. In addition, the contract can be terminated at any time. However, the employee does not receive notification of this in advance. Therefore, care should be taken in advance to ensure that employees are properly registered in order to avoid administrative liability and infringement of workers’ rights.

The article was prepared jointly with the United Consulting Group.

Features of employment without employment records

Each employee is required to have a work book, entries in which confirm the fact of work activity, experience in a specific position and length of service. The last point is especially important, since a person learns whether the period of work in a company that practices informal employment is included in the length of service after the fact, at the time of dismissal.

Working under an employment contract without a work book refers to cases of gross violation of the law and gives the injured employee the right to appeal to the labor inspectorate with a complaint about illegal actions with subsequent organization of an inspection.

An arrangement under an employment contract is a measure that allows you to record agreements between the employer and hired personnel. Having a document gives you the right to demand payment for sick leave, paid leave, and other social guarantees. If there is no contract, the employee remains without rights.

There is a company that does not want to provide employment without making a record; only in two cases is such a deviation from the rules allowed, in which an agreement is concluded, but records are not kept:

- Registration of a part-time worker (involves making an entry at the main place of work).

- Signing a GPC agreement (of a civil nature) on behalf of an individual (since records are made only by a legal entity or entrepreneur).

Sometimes, during employment, a work permit is not provided, however, the employer does not violate the law, since the person has just graduated from college or has lost the document. In both situations, the employing company undertakes the procedure for certifying the work record and makes an entry there after the main hiring.

Is employment official without a work permit?

You should not be deceived and believe the promises of an employer who claims that employment is possible without entering information into the employment form or without signing a contract.

Unofficial work means that the company does not pay social insurance contributions, does not make contributions to the Pension Fund or health insurance. Upon reaching retirement age, a person will not be able to confirm his own experience, i.e. Time spent working for an unscrupulous company will not be counted.

- An employer violates an employment contract: what should an employee do, how to sue

The employer, removing all responsibility for the hired personnel, becomes a violator of the law with all the ensuing consequences.

For an employee, consent to informal employment means:

- lack of legal protection and wage guarantees;

- lack of vacation, vacation pay, temporary disability benefits, etc.

Having received an industrial injury or mutilation, it is quite difficult to obtain compensation even through the courts.

When a company replaces a regular contract with an employee with a GPC agreement, the official should be prepared to receive a fine under administrative liability in the amount of 10 thousand rubles, and the company will pay a fine of up to 100 thousand rubles for each identified case of violations. Acceptance of an employee under a GPC agreement by a private entrepreneur also entails a fine.

Hiring a pensioner

Unlike citizens of working age, a pensioner does not need to earn seniority, since the status has already been assigned. Therefore, the situation is often viewed positively by the employee himself.

You can understand the employee - working as a pensioner under a contract on an official basis automatically deprives him of a number of privileges, and the contract states that...

However, in light of vigilant control by the Pension Fund, senior citizens risk getting into trouble not only in the form of deprivation of status, but also being brought to administrative responsibility for concealing income and changing status.