Whose responsibility is the taxation of dividends?

The taxpayer for dividend income is the recipient.

This can be either an organization or an individual. In the first case, income tax is paid on dividends, in the second - personal income tax. However, the direct responsibility to calculate, withhold and pay taxes on dividends lies with the company that distributes profits and pays dividends, since in this situation it acts as a tax agent (clause 3 of Article 275 of the Tax Code of the Russian Federation). NOTE! The responsibilities of a dividend tax agent also arise if the organization that is the source of the payment applies special regimes (STS or Unified Agricultural Tax). And for a recipient of dividends working under a special regime, the use of this regime does not prevent them from receiving dividends minus tax on them.

For more information about the responsibilities of special regime officers regarding dividend tax, read the article “Who is a tax agent for income tax (responsibilities)?” .

An example of calculating personal income tax on dividends

Stroyservis LLC has two participants:

- Andreichenko L.M. owns 60% of the authorized capital;

- Mishin A.R. owns a share of 40% of the authorized capital.

The company decided to pay profit on July 7, 2016, the amount of profit was 180,000 rubles. Both participants were recognized as tax residents of the Russian Federation at the time of payment of dividends, therefore the personal income tax rate is 13%.

Let's calculate how much was accrued to Andreichenko L.M.: 180,000 * 60% = 108,000 rubles. The personal income tax amount will be 108,000 * 13% = 14,040 rubles. Minus tax, the participant will receive 93,960 rubles. We will do the same calculation for Mishin A.R.: (180,000 * 40% = 72,000) – (72,000 * 13% = 9,360) = 62,640 rubles.

In total, from the total amount of 180,000 rubles, participants will receive (93,960 + 62,640) 156,600 rubles, and Stroyservis LLC will transfer (14,040 + 9,360) 23,400 rubles to the budget. Personal income tax. Payments to the owners were made on July 20, 2016; accordingly, the deadline for tax payment was July 21, 2016.

In letter dated November 19, 2014 No. 03-04-07/58597, the Russian Ministry of Finance emphasized that personal income tax can be transferred from dividends paid to several individuals in one payment. The Tax Code of the Russian Federation does not contain requirements to issue a separate payment order for each taxpayer.

Algorithm for calculating tax on dividends

The formula by which taxes on dividends are calculated is given in paragraph 5 of Art. 275 of the Tax Code of the Russian Federation and has the following form:

N = K × Sn × (D1 – D2),

Where:

N - amount of tax on dividends to be withheld;

K is the ratio of the amount of dividends to be distributed in favor of their recipient to the total amount of dividends distributed by the organization;

Сн - tax rate;

D1 - the total amount of dividends distributed in favor of all recipients;

D2 - the total amount of dividends received by the organization itself in the current and previous reporting (tax) periods, provided that they were not previously taken into account when calculating income; This figure does not include dividends, which are subject to a zero income tax rate.

From 2022, a company that receives and pays dividends will calculate tax differently. From indicator D2 you need to exclude the amount:

- dividends taxed at a 0% rate from an international company that owns a share or contribution of more than 15% for more than a year;

- dividends from foreign enterprises that the company received through Russian organizations and to which it has the actual right. It does not matter whether such dividends were subject to income tax for the recipient or whether tax was calculated on them at a 0% rate.

NOTE! According to the above formula, both income tax on dividends paid to organizations and personal income tax on dividends in favor of individuals are calculated (clause 2 of Article 210 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 17, 2015 No. 03-04-06/34935).

However, it is not used when calculating taxes on dividends in favor of foreign companies and individuals - non-residents of the Russian Federation. For them, taxes are calculated based on the full total amount of dividends distributed by the organization (clause 6 of Article 275 of the Tax Code of the Russian Federation). If the final recipients of such a payment are individuals or legal entities who are residents of the Russian Federation, then the prohibition on using the above formula does not apply to payments to non-residents.

Personal income tax for non-residents

The personal income tax rate on dividends received by non-residents of the Russian Federation is higher than for residents and amounts to 15%. A common misconception is to believe that all Russian citizens are recognized as residents. This is wrong. The concept of a resident of the Russian Federation is given in Article 207 of the Tax Code of the Russian Federation, from which it follows that he is an individual who was actually in the territory of Russia for at least 183 calendar days over the next 12 consecutive months. There is no indication of citizenship in this definition, so a foreigner can also be a resident of the Russian Federation.

That is, the mere presence of Russian citizenship does not automatically give tax resident status. To avoid paying personal income tax at a rate of 15%, track the number of days you are outside of Russia. But if you were absent for more than 183 days for valid reasons, such as treatment or training, then the days of such absence are not counted.

In addition, regardless of the time spent in Russia, Russian military personnel serving abroad and civil servants sent abroad are recognized as residents. True, this clarification has no special relation to personal income tax on dividends, because military personnel and civil servants, in principle, cannot engage in business, combining it with service.

Otherwise, we must remember that the personal income tax rate for non-residents is higher than for residents, and for income tax on dividends the difference is relatively small - 15% versus 13%. But, for example, personal income tax on sold real estate for non-residents is as much as 30%, and not 13% for those who were in Russia.

Nuances of calculating taxes on dividends

When calculating tax on dividends, it is important to consider the following features:

- The total amount of distributed dividends (in the formula this is indicator D1 and the denominator of indicator K) includes, among other things, dividends in favor of:

- foreign - non-residents of the Russian Federation.

This follows directly from paragraph 5 of Art. 275 Tax Code of the Russian Federation.

- The total amount of dividends should include those from which the “profitable” tax is not withheld (paragraph 6, paragraph 5, article 275 of the Tax Code of the Russian Federation). In particular, dividends on shares that are state or municipally owned or that constitute the property of mutual funds and public legal entities (letter of the Ministry of Finance of Russia dated June 11, 2014 No. 03-08-05/28295).

- Dividends for past periods are taxed at the rate that is established on the date of issue of these dividends (letter of the Federal Tax Service of Russia for Moscow dated March 14, 2007 No. 20-08 / [email protected] ).

- Indicator D2 takes into account dividends (not counting those taxed at a zero rate) received from both domestic and foreign companies. Moreover, they are taken into account in the so-called pure form, that is, without the tax that the source of payment withheld from them (letter of the Ministry of Finance of Russia dated June 11, 2014 No. 03-08-05/28295).

- If the calculation results in a negative tax amount, then the agent does not need to pay tax. But he won’t be able to get the difference from the budget. This is directly stated in paragraph. 9 clause 5 art. 275 Tax Code of the Russian Federation.

- An organization paying dividends through tax agents must notify about the values of indicators D1 and D2 used in the calculation no later than 5 days from the date of determining the circle of persons entitled to receive dividends (if the organization is an issuer), but no later than the day of their payment each of the tax agents. Notification is carried out by sending information electronically or on paper or posting it on the website or in a payment document for the transfer of money (clauses 5.1 and 5.2 of Article 275 of the Tax Code of the Russian Federation).

See also the material “How to correctly calculate income tax on dividends?” .

Is it possible to get a property deduction from dividends 2022

to contents Income tax As mentioned earlier, the tax base for dividends is determined in accordance with Art. 275 Tax Code of the Russian Federation. Income tax is withheld at a rate of 13% on the day of payment of dividends, directly by the organization that issues them. (300,000 x 13%)

The amount of income eligible for the standard child tax credit has increased. This deduction is now valid for up to a month until the taxpayer’s income, taxed at a rate of 13% and calculated on an accrual basis from the beginning of the year, exceeds 350,000 rubles.

At what rates are taxes on dividends calculated?

If we talk about income tax, then its rate in relation to dividends depends on who the recipient is - a Russian or foreign company (clause 3 of Article 284 of the Tax Code of the Russian Federation).

If income is paid to a foreign company, dividend tax is calculated at a rate of 15%.

If the recipient is a domestic organization, in most cases a rate of 13% is applied.

An exception is the payment of dividends to an organization that, on the day the decision on payment is made, has continuously owned for at least 365 calendar days:

- at least half of the share in the authorized capital of the company paying dividends;

- or depositary receipts giving the right to receive at least half of the total amount of dividends paid.

A 0% rate applies to such dividends.

Read more about this in the article “Conditions for applying the zero rate on income tax when receiving dividends .

The right to a zero rate must be justified. This must be done by the taxpayer who receives the dividends. To do this, he submits to the Federal Tax Service documents confirming the date of origin of ownership of the share in the management company or depositary receipts. He must submit the same documents to the agent company along with confirmation of their submission to the tax office.

ConsultantPlus experts explained in detail what conditions must be met in order for a zero rate to be applied. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Read about current income tax rates here.

The personal income tax rate depends on the status of the individual receiving the income (Article 224 of the Tax Code of the Russian Federation):

- For a resident of the Russian Federation, dividend tax is withheld at a rate of 13%;

- from a resident of the Russian Federation upon payment of dividends in the amount of 5 million rubles. and more per year - 15%;

- non-resident - at a rate of 15%.

For more information about calculating income tax on dividends, read the material “Is personal income tax levied on dividends?” .

Read about personal income tax for non-residents here.

NOTE! You can transfer personal income tax withheld from dividends of several “physics” participants in one payment. For more information, see the article “How to transfer personal income tax on dividends” .

How to set the date of receipt of income when paying dividends in 1C: Accounting ed. 3.0?

Published 05/21/2021 08:58 Author: Administrator Have you already paid dividends for 2022? Most likely, when reflecting an operation in 1C, you have one flaw that is not visible to the naked eye. Which? See this post and check your registers!

Let's consider a conditional example: on March 1, 2022, the organization Confetprom LLC, at a general meeting of participants, decided to accrue and pay dividends in the amount of 500,000 rubles to the individual V.I. Kudryavtseva. The payment itself took place via bank transfer on March 18, 2022. How to reflect these transactions correctly?

Let's get started.

In the “Operations” section, click on the “Accrual of dividends” hyperlink. Let's fill in all the fields.

Let's check the correctness of the postings.

Everything is fine on the “Accounting and Tax Accounting” tab, the correct date is March 01.

We look at the following register “Calculations of taxpayers with the budget for personal income tax”.

We see that for some reason the date there is April 30, 2022, although we have a bank statement confirming that the payment of dividends occurred on March 18, 2022.

Let's check the postings and registers in the debit from the current account.

The first register “Accounting and tax accounting” is correct, the date is March 18.

And in the following registers April 30 appears again.

Why is this happening?

Let's turn to the legislation.

For an LLC, the period for issuing dividends is limited to 60 days from the date of the decision (Clause 3, Article 28 of Law No. 14-FZ).

On March 1, we accrued dividends, 60 days just start on April 30 (March 2 + 60 days). Therefore, 1C by default counts 60 days and sets this date.

Please note that the period for issuing dividends to the JSC is counted from the date on which the composition of shareholders is determined and is no more than (clause 6 of Article 42 of Law No. 208-FZ):

• 10 working days for payment to nominee holders and trustees;

• 25 working days for payment to other shareholders.

Now let’s figure out how to correct the payment date from April 30 to March 18?

Many people do this by manually adjusting dates, but there is an automated way.

Let's return again to the document “Accrual of dividends”.

In the upper right corner, find the “More” button and select the “Change form” command.

In the settings that open, we see that the “Payment date” field is not checked, i.e. it is hidden.

Let's check the box there and go back to the primary document. Let's make sure that the field we need actually appears.

We will correct the payment date from April 30 to March 18.

Let's go through the document and look at the postings.

The registers now display the correct date of March 18th.

Let's repost the debit document from the current account and also look at the postings.

And here in the registers it is no longer April, but March.

This is a simple way to fix this defect in 1C.

Author of the article: Irina Plotnikova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Marina 04.11.2021 02:53 Thank you

Quote

0 Irina 03.11.2021 18:26 I quote Marina:

Hello. Tell me how to correctly set the date if dividend payments for 2022 were made three times, 06/01/2021, 06/08/2021 and 06/23/2021. The accrual was dated April 26, 2021. When accruing, I set it to 06.26.2021, in June everything went as it should and the 6NDFL report itself was filled out correctly. Now, when creating 6NDFL for 9 months, the program took into account only one payment on 06/01/2021, the rest were not included in the register and stand as unpaid. I don’t understand where I made a mistake. We have 1C Accounting and 1C UT, when changes are made to UT, something often goes wrong in 1SB Accounting.

Marina, good afternoon!

You made several mistakes at once. Firstly, the 1C program: Accounting is very scrupulous in matters of salary. Therefore, you should not mix everything into one pile. If you paid dividends three times, then it is worth making a separate calculation of dividends for each dividend payment. Secondly, the payment period in the dividend accrual documents must coincide with the actual payment date! According to the legislation, for an LLC the period for issuing dividends is limited to 60 days from the date of the decision (clause 3 of Article 28 of Law No. 14-FZ). On April 26, you accrued dividends, 60 days just begin on June 26. Therefore, 1C by default counts 60 days and sets this date. However, you paid dividends on three different dates, so in your case you need to create three separate dividend accruals. They can all be the same date, 04/26/2021. But each of them must have its own payment date that corresponds to the real one. To change the payment date in the dividend accrual document, in the upper right corner, select the “More” - “Change Form” button. In the form settings that open, in the “Recalculation Result” subsection, check the box next to the “Payment Date” field. Now the payment date has appeared in the dividend accrual document itself and can be changed to the desired one. Therefore, now you should spread everything out, create separate dividend accruals, and repost bank statements correctly in chronological order. 1C: UT has nothing to do with this error Quote 0 Marina 11/02/2021 00:10 Hello. Tell me how to correctly set the date if dividend payments for 2022 were made three times, 06/01/2021, 06/08/2021 and 06/23/2021. The accrual was dated April 26, 2021. When accruing, I set it to 06.26.2021, in June everything went as it should and the 6NDFL report itself was filled out correctly. Now, when creating 6NDFL for 9 months, the program took into account only one payment on 06/01/2021, the rest were not included in the register and stand as unpaid. I don’t understand where I made a mistake. We have 1C Accounting and 1C UT, when changes are made to UT, something often goes wrong in 1SB Accounting.

Quote

0 Irina Tsvetkova 10/05/2021 14:19 personal income tax register

Quote

Update list of comments

JComments

How to report taxes on dividends

It is important for a tax agent not only to correctly calculate taxes on dividends, but also to report them to the Federal Tax Service.

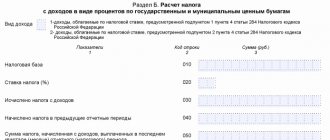

Income tax on dividends paid to domestic companies is reflected in the usual “profit” declaration:

- The tax calculation itself is in section A of sheet 03;

- breakdown of dividend recipients - in section B of sheet 03;

- amounts payable - in subsection 1.3 of section 1.

ConsultantPlus experts explained the nuances of filling out an income tax return when paying dividends. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Also in ConsultantPlus you will find a sample of filling out an income tax return for 2022 when paying dividends to an individual or organization. You can view the sample for free by signing up for trial access:

For the tax on dividends of foreign companies, a tax calculation (information) is provided on the amounts of income paid to foreign organizations and taxes withheld. Its form was approved by order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected]

The deadlines for submitting a profit declaration and tax calculations coincide (clause 4 of Article 310 of the Tax Code of the Russian Federation). Their last date is defined as the 28th calendar day from the end of the reporting period (clause 3 of Article 289, clause 2 of Article 285 of the Tax Code of the Russian Federation), and for the annual report - as March 28 of the next year (clause 4 of Article 289, Clause 4 of Article 310 of the Tax Code of the Russian Federation).

For more information about the deadlines for reporting profits, read the article “What are the deadlines for filing income tax returns?” .

Dividends paid to individuals are reflected in 6-NDFL, which from 2021 includes income certificates (formerly 2-NDFL), annually submitted to the Federal Tax Service and issued to the individual (clauses 2, 4 of Article 230 of the Tax Code of the Russian Federation). See an example of how dividends are reflected in the new 2-NDFL.

From the report for the 1st quarter of 2022, certificate 2-NDFL is submitted to the Federal Tax Service as part of form 6-NDFL.

For an example of filling out a new 6-NDFL with dividends, see ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

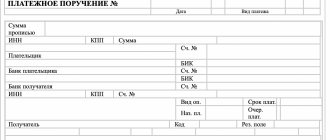

Details for paying personal income tax on dividends

The organization transfers personal income tax at the place of its registration. The details for payment are similar to the payment of personal income tax when deducted from wages. Personal income tax on dividends in 2022 is paid at KBK 182 1 0100 110. For tax at a rate of 15%, use KBK 182 1 0100 110

We remind you that from 2022, bank details for paying taxes have changed.

Read more about the new details in the article

If the final deadline for payment of personal income tax on dividends in 2022 falls on a weekend, payment must be made on the first working day after the weekend.

When making a payment, errors are possible, for example in the KBK, which can lead to arrears, penalties and fines. Late payment is subject to a fine of 20% of the amount. The way out of this situation is to clarify the payment order using a statement. In it - on the basis of paragraphs. 7 and 8 art. 45 of the Tax Code of the Russian Federation - we ask you to make a decision on clarification. We indicate the date and number of the payment order, the payment amount and type of tax, as well as information about the incorrect details in the payment order and the correct KBK data (or other incorrect information). We emphasize that this error did not result in non-transfer of tax to the budget. We attach a copy of the payment order to the application, which we verify.

Results

The tax on dividends is transferred to the budget by the legal entity paying them, withholding the amount of tax from the amounts accrued for payment. To calculate the amount of tax on payments to residents of the Russian Federation, a special formula is used that allows you to reduce the distributed amount of dividends by the amount received by the distributing person in a similar quality. When determining the amount of tax on payments to non-residents, such a reduction is not made. The rates applied to dividends paid to residents (13%) and non-residents (15%) also differ. Information about payments made is included in the profit declaration, calculation of 6-NDFL and income certificates, which from 2021 are included in 6-NDFL at the end of the year.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Income and deduction codes for personal income tax in 2022: table

- The deadline for submitting 2-NDFL with sign 1 or 3 is no later than April 1 of the year following the expired calendar year (Article 216, clause 2 of Article 230 of the Tax Code of the Russian Federation, clause 2.7 of the Procedure for filling out the 2-NDFL certificate).

- The deadline for submitting 2-NDFL with sign 2 or 4 is generally no later than March 1 of the year following the expired calendar year. During this period, you must not only submit the certificate to the tax authority, but also hand it over to the individual (Article 216, clause 5 of Article 226 of the Tax Code of the Russian Federation, clause 2.7 of the Procedure for filling out the 2-NDFL certificate).

- income that you paid to an individual in cash and in kind, as well as in the form of material benefits;

- tax deductions from these incomes provided to individuals (except for standard, social and property ones).

This is interesting: Cost of living in the Moscow region for subsidies for housing and communal services in 2022

Registration of dividend payments, what interest rate is applied when calculating personal income tax

The decision to pay dividends is made at the general meeting of shareholders of the company and is documented in the appropriate minutes. Attached to this document is a list of persons who have the right to receive a portion of the profit after its distribution.

The JSC protocol contains the following information:

- date, time and place of the meeting;

- Full name of the chairman and secretary of the meeting;

- the total number of votes of shareholders and the number of votes of meeting participants;

- a list of issues on the agenda and decisions taken on them.

The protocol indicates how much of the company's net profit will be used for payments, and the amount of dividends per share (it cannot be higher than the level recommended by the Board of Directors). The amount of payments for each investor is determined later. The calculation is made in accordance with the number of securities owned by a particular shareholder.

The amount of the liability is withheld by the tax agent immediately upon payment of dividends. To calculate its size, the following rates are applied:

- for residents of the Russian Federation - 13%;

- for non-residents of the Russian Federation - 15%.

According to the current legislation of the Russian Federation, a resident of the country is considered to be a citizen of Russia or a citizen of any foreign state who lives on the territory of the Russian Federation for a total of at least 183 days a year. If the taxpayer status changes during the year, when calculating personal income tax, the one that was in effect at the time of payment of dividends is taken into account.

Can dividend income be reduced by tax deductions?

So, as a general rule, the income of individuals is taxed at a personal income tax rate of 13% established by clause 1 of Art. 224 of the Tax Code of the Russian Federation, can be reduced by various types of tax deductions provided for in Art. 218 - 221 of the Tax Code of the Russian Federation (clause 3 of Article 210 of the Tax Code of the Russian Federation). In particular, taxpayers have the right to receive a property tax deduction in the amount of expenses actually incurred aimed at purchasing or constructing housing in the Russian Federation, but not more than 2,000,000 rubles. (clause 3, clause 1, article 220, clause 3, article 220 of the Tax Code of the Russian Federation)

The founder of the LLC receives a salary and dividends from the company. He recently bought an apartment. Is it possible to use 13% of the tax paid on dividends for a refund from the tax office on the 3-NDFL declaration for the purchase of an apartment? Simplified organization.

This is interesting: Benefits and measures of social support for the population in the Ryazan region