Writing off materials in accounting is a process that has certain specifics and takes place according to established rules. In step-by-step instructions we will look at:

- how to write off materials in 1C 8.3 Accounting step by step;

- rules for writing off office supplies, spare parts and production materials;

- what to do with low-value consumables;

- what document is used to write off materials from use?

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Write-off of spare parts - nuances in 1C 8.3

Account 10.05 “Spare parts” takes into account spare parts for repairs and replacement of worn-out parts of machines and equipment.

How to write off spare parts in 1C 8.3? Similar to how general business materials are written off: with the document Material Consumption .

In this case, the main thing is to determine what costs spare parts are written off to and correctly fill in the data using the link Cost account .

For example, if spare parts are used for routine repairs, then Cost Account as follows:

- Spare parts accounting from 2021

- OS upgrade

- Reserve for OS repairs in tax accounting

Methodological guidelines

In accounting, the procedure for writing off materials is regulated by PBU 5/01 “Accounting for inventories.” According to clause 16 of this PBU, three options for writing off materials are allowed, focused on:

- the cost of each unit;

- average cost;

- the cost of the first acquisition of inventories (FIFO method).

In tax accounting, when writing off materials, you should focus on Article 254 of the Tax Code of the Russian Federation, where under paragraph number 8 options for the valuation method are indicated, focusing on:

- unit cost of inventory;

- average cost;

- cost of first acquisitions (FIFO).

The accountant should establish in the accounting policy the chosen method of writing off materials for accounting and tax accounting. It is logical that in order to simplify accounting, the same method is chosen in both cases. Write-off of materials at average cost is often used. Write-off at unit cost is appropriate for certain types of production where each unit of materials is unique, for example, jewelry production.

Typical postings for write-off of materials

| Account debit | Account credit | Wiring Description |

| 20 | 10 | Write-off of materials for main production |

| 23 | 10 | Write-off of materials for auxiliary production |

| 25 | 10 | Write-off of materials for general production expenses |

| 26 | 10 | Write-off of materials for general business expenses |

| 44 | 10 | Write-off of materials for expenses associated with the sale of finished products |

| 91.2 | 10 | Disposal of materials when they are transferred free of charge |

| 94 | 10 | Write-off of the cost of materials if they are damaged, stolen, etc. |

| 99 | 10 | Write-off of materials lost due to natural disasters |

Before writing off materials in 1C 8.3, you should set (check) the appropriate accounting policy settings.

Write-off of materials during construction

Account 10.08 “Building materials” takes into account materials used for construction, installation and repair work, if the organization is not engaged in construction. In a construction organization, such materials are accounted for in account 10.01 “Raw materials and materials”.

If materials required for installation (installation) and used as part of the installed equipment are purchased, then the costs for them are taken into account in the same way as the costs for equipment: according to Dt account 07 “Equipment for installation”. As a rule, this is equipment that requires fastening to the supporting structures of buildings, for example, to a wall or floor. If this is simply the construction of fixed assets, then the materials are accounted for in the subaccounts of account 10 “Materials”.

To write off materials during the construction of fixed assets, use the document Material consumption (Warehouse - Material consumption (Requirements-invoices)):

On the Materials , specify the list of materials used in construction.

Using the Cost Account , enter:

- Cost account - 08.03 “Construction of fixed assets”;

- Construction objects - Warehouse : a construction object where all costs for creating an operating system are collected;

- Cost item - cost item Type of expense Material costs ;

- Methods of construction - Economic , since construction is carried out on our own.

Filling out the Construction Methods is mandatory for correct accounting, since construction and installation work performed on an economic basis for one’s own consumption must be subject to VAT at the end of the quarter (clause 3, clause 1, Article 146 of the Tax Code of the Russian Federation).

VAT accrual for construction and installation work using self-employed methods

Postings according to the document

The document generates transactions

- Dt 08.03 Kt 10.08 – the cost of materials is taken into account when determining the initial cost of the fixed assets.

Application of various methods for assessing inventories upon their disposal. Which is more profitable?

Currently, for accounting purposes, the following methods are used to estimate the cost of inventory:

- at the cost of each unit;

- at average cost;

- at the cost of the first acquisition of inventories (FIFO method).

These methods are listed in PBU 5/01 (approved by order of the Ministry of Finance dated June 9, 2001 No. 44n). For tax accounting purposes, an organization may use the following methods for assessing inventories upon disposal:

- valuation method based on the cost of a unit of inventory;

- average cost valuation method

- valuation method based on the cost of first acquisitions (FIFO);

- valuation method based on the cost of recent acquisitions (LIFO).

In particular, these methods are used for tax purposes in the following cases:

- when determining the amount of material costs when writing off raw materials and supplies used in the production (manufacturing) of goods (performing work, providing services), the methods are enshrined in paragraph 8 of Article 254 of the Tax Code of the Russian Federation;

- When selling purchased goods, the methods are enshrined in clause 3, clause 1 of Art. 268 Tax Code of the Russian Federation;

- When selling or otherwise disposing of securities, the methods are enshrined in clause 9 of Art. 280 Tax Code of the Russian Federation.

Note that the difference in the number of methods used to evaluate inventories for accounting purposes and for tax purposes arose relatively recently.

The LIFO method has been excluded from the accounting rules for inventory assets since January 1, 2008 on the basis of Order of the Ministry of Finance of the Russian Federation dated March 26, 2007 N 26n “On amendments to regulatory legal acts on accounting.” This is explained by the desire to bring domestic accounting standards closer to international ones. However, for tax purposes, four methods of valuing inventories are still used. Let us briefly describe each of the methods.

The cost of each unit is used to estimate inventories used by the organization in a special manner (precious metals, precious stones, etc.), or inventories that cannot normally replace each other. This method is used in exceptional cases or with a small range of inventory items. It is characterized by particular labor intensity, provided that it is used in enterprises with a large product range.

For example. The company produces cabinet furniture. The balance at the beginning of the stained glass month is 5 sheets in the amount of 125,000.00 rubles. During the month, the following was purchased: 3 sheets of stained glass for the amount of 84,000.00 rubles. Transportation costs are included in the cost and amount to 3,000 rubles. Within a month, 2 sheets from the remainder were used, 1 sheet from the supply of stained glass.

Let's determine the actual cost of the balance: 125,000 / 5 = 25,000 rubles per sheet; Let's determine the actual cost of receipt: (84,000 + 3,000) / 3 = 29,000.00 rubles per sheet;

The cost of raw materials consumed in the production process per month will be: 25,000 * 2 + 29,000 = 79,000 rubles. As the example shows, when using this method there is no need to make additional calculations. If it is possible to accurately determine which materials are used in production, the use of this method has advantages, since materials are written off at their real cost, without deviations.

The average cost calculation is made by dividing the total cost of a group (type) of inventory by its quantity, which consists of the cost and the amount of balance at the beginning of the month and the inventory received during the month. This method is the most common and is included in standard versions of accounting programs.

For example, an organization is engaged in the production of cabinet furniture. The balance of chipboard at the beginning of the month is 300 sheets in the amount of 600,000.00 rubles. During the month, receipts were made in several batches, including:

- 100 sheets in the amount of 180,000.00 rubles;

- 50 sheets in the amount of 105,000.00 rubles.

Used during the month: 410 sheets of chipboard.

Let's calculate the average cost of one sheet of chipboard: (600,000 + 180,000 + 105,000) / (300 + 100 + 50) = 885,000 / 450 = 1,966.67 rubles per sheet. Let's calculate the cost of chipboard written off for production: 410 * 1,966.67 = 806,334.70 rubles. The balance of chipboard at the end of the month will be 300 + 150 – 410 = 40 sheets in the amount of 40 * 1,966.67 = 78,666.80 rubles.

Under the FIFO method , inventories that are the first to enter production (sale) are valued at the cost of inventories that were first acquired in time, taking into account the cost of inventories listed at the beginning of the month. Thus, the sequence of write-offs when applying this method is as follows: first, balances at the beginning of the period are written off, then the first batch, then in order. Otherwise, this method can be called a conveyor method. In conditions of rising prices for purchased materials, the cost of purchased products is minimal, while the assessment of inventories and profits is maximum. And when prices fall, on the contrary, inventories and profits are minimized.

When applying the FIFO method when calculating the cost of materials released into production, you can use one of the following methods: The first method is based on writing off the cost of each batch in order: first, the value of the balance is written off, if the amount of materials written off is greater than the balance, the first received batch is written off, then the second and subsequent ones. The balance of materials is determined by subtracting the cost of written-off materials from the total cost of materials received during the month (taking into account the balance at the beginning of the month).

The second method is based on determining the balance of materials at the end of the month at the price of the most recent purchase. The cost of materials written off for production is determined by subtracting the resulting value from the total cost of materials received during the month (taking into account the balance at the beginning of the month). Using the conditions of the previous example, we will calculate using the FIFO method using two options.

Option 1: Written off for production: 300 sheets in the amount of 600,000.00 rubles; 100 sheets in the amount of 180,000.00 rubles; 10 sheets worth 21,000.00 rubles. Total: 801,000.00 rubles. The balance at the end of the month is 40 sheets in the amount of 84,000.00 rubles.

Option 2: The balance of chipboard at the end of the month is 40 sheets (300 + 150 – 410), the entire balance from the second batch. Accordingly, the cost of the balance is: 84,000.00 rubles; Let's calculate the cost of written-off chipboard: 600,000 + 180,000 + 105,000 – 84,000 = 801,000.00 The average cost of one sheet of chipboard written off for production is 801,000 / 410 = 1953.66 rubles per sheet.

Under the LIFO method , inventories that are the first to be produced (sold) are valued at the cost of the last in the acquisition sequence. The LIFO method is the opposite of the FIFO method. In conditions of rising prices - a minimum estimate of reserves and profits. In conditions of falling prices - maximizing inventory valuation and profit.

There are two ways to calculate the cost of materials released into production using the LIFO method. The methods are similar to those above for the FIFO method, with the difference that for the first calculation option the cost of the last received batch is used, then the batches are written off in reverse order. The cost of the earliest purchased batch is used to determine the closing balance. For brevity, we will use the last method of calculation.

The conditions of the example are the same. The balance of chipboard at the end of the month is transferred from the balance at the beginning of the month, since 410 sheets of chipboard were used for production, of which 50 sheets were from the last batch, 100 sheets from the first batch, 260 sheets from the balance at the beginning of the month. So, the balance will be 40 sheets at a price of 2000 rubles per sheet, in the amount of 80,000.00 rubles.

Let's determine the cost of chipboard used for production: 600,000 + 180,000 + 105,000 – 80,000 = 805,000.00 The average cost of 1 sheet of chipboard written off for production is 1963.41 rubles. Let us make a reservation that in practice there are two options for using methods of average estimates of the actual cost of inventory items when released into production or written off for other purposes:

The first involves a weighted assessment based on the average monthly actual cost, in this case the quantity and cost of materials at the beginning of the month and all receipts for the month (reporting period) are included in the calculation. The second method is based on determining the actual cost of the material at the time of its release (rolling estimate); in this case, the calculation of the average estimate is made based on the quantity and cost of materials at the beginning of the month and all receipts until the time of release.

Thus, the choice of the date on which the inventory is assessed determines the difference between the weighted and rolling assessment. The use of a rolling assessment must be economically justified and supported by appropriate computer technology.

Options for calculating average estimates of the actual cost of materials for accounting and tax accounting purposes should be disclosed in the organization’s accounting policies. Let's compare the results:

| Index | Average cost method | FIFO method | LIFO method |

| Written off for production (RUB) | 806 334,70 | 801 000,00 | 805 000,00 |

| Average cost of items written off in production (RUB) | 1 966,67 | 1953,66 | 1963,41 |

| Balance at the end of the month (RUB) | 78 666,80 | 84 000,00 | 80 000,00 |

| Average cost of materials in balance | 1 966,67 | 2 100,00 | 2 000,00 |

In the example given, there is no clear tendency for differences in the obtained values when using different methods of estimating inventories, since the conditions of the example provide for fluctuations in the purchase price of materials. So the cost of the balance at the beginning is 2,000.00 rubles; in the reporting period, materials were purchased at prices of 1,800.00 and 2,100.00 rubles.

Subject to a steady increase in prices, the most profitable, undoubtedly, is the LIFO method, since the cost of written-off inventory items increases, and profit, accordingly, decreases. When prices decline, the exact opposite pattern occurs when applying the FIFO method. To avoid jumps, accountants, as a rule, choose the method of writing off inventories at average cost for both accounting and tax purposes. This method is time-tested and does not cause difficulties in calculations, and also gives average indicators for any changes in prices on the market.

To make the right management decisions in the field of inventory management, there is a need to choose a method for assessing inventories for accounting purposes. For tax purposes, one or another method of assessing materials is used to optimize taxation, in particular to reduce income tax payments, provided that the method that provides for writing off the maximum of possible expenses to reduce the tax base is chosen.

Consequences of applying different methods of inventory valuation for accounting and tax purposes.

How to take into account the differences that arise when applying different methods of valuing inventories for accounting and tax purposes. In this case, it becomes necessary to apply the requirements of PBU 18/02.

So, the organization uses different methods for valuing inventories for accounting purposes and for tax purposes. What differences arise?

If the amount of expenses reflected in the accounting records exceeds the amount of expenses accepted for taxation, a deductible temporary difference arises, and, as a consequence, a deferred tax asset (DTA). If the amount of expenses reflected in the accounting records is less than the amount of expenses accepted for calculating income tax, a taxable temporary difference arises, and, as a consequence, a deferred tax liability. Let's look at how differences arise based on our example data.

When calculating by the average cost method, the amount attributable to the cost is 806,334.70 rubles, with the FIFO method - 801,000.00 rubles, with the LIFO method 805,000.00 rubles.

| Applicable assessment of the MPP for the purposes | Differences that arise | SHE/IT | |

| Accounting | Taxation | ||

| At average cost 806,334.70 | Using the FIFO method 801,000.00 | Deductible temporary difference | SHE |

| At average cost 806,334.70 | Using the LIFO method 805,000.00 | Deductible temporary difference | SHE |

| Using the FIFO method 801,000.00 | At average cost 806,334.70 | Taxable temporary difference | IT |

| Using the FIFO method 801,000.00 | Using the LIFO method 805,000.00 | Taxable temporary difference | IT |

The optimal method for assessing inventories for tax accounting purposes in organizations using a simplified taxation system is the FIFO method, since the method of assessing inventories at average cost for the purposes of tax accounting of expenses under the simplified tax system does not allow compliance with the requirements of Art. 346.17 of the Tax Code of the Russian Federation, regarding control of payment of expenses. At the same time, the organization retains the opportunity to keep track of inventories “on average” in accounting.

Of course, the emergence of differences between accounting and tax accounting leads to a complication of the accounting process, as a consequence to a greater number of errors. However, market conditions, the presence of multiple approaches by users of financial statements (for example, it is beneficial for an organization to show profits in order to pay larger dividends) and recent changes in legislation increase the number of situations when these differences arise. In addition, if the range of materials (goods) is small and the accountant has the option of batch accounting, you should think about whether the weighted average valuation method is convenient and practical from a tax point of view.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

M-29 in 1C 8.3 - where it is located, how to register

In construction organizations, the question often arises about the M-29 form in 1C 8.3 - where is it located, how to use M-29 to formalize the write-off of materials in 1C 8.3?

Form M-29 (Report on the consumption of materials in construction) was approved by Order of the Central Statistical Office of the USSR dated November 24, 1982 N 613, which is no longer in force, and is not mandatory for use. In addition, the list of details of this form does not meet the requirements for primary documents, and it cannot confirm expenses in NU.

M-29 can be used for internal use, if convenient, but it is not available in the 1C 8.3 program. If it is necessary to fill it in the program, this can be done by modifying the configuration or external processing (extension).

Creation of fixed assets using our own resources (construction and installation works)

Write-off of materials for production

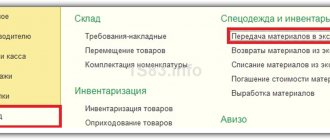

There are several ways to write off materials for production in 1C 8.3:

- document Material consumption in the section Production - Material consumption (Requirements-invoices);

- document Product release ( Production reports ) in the Production section - Production reports for the shift.

Consumption of materials

The document Consumption of materials in 1C 8.3 is used if materials are written off in total quantities to production, without dividing them into a specific output.

The organization produces women's shoes.

On February 10, the materials were written off for production according to the invoice request:

- blanks for soles - 2,000 pcs.;

- fabric - 500 m².

Accounting is maintained using the Products on account 20.01. When calculating the cost, the planned cost of finished products is used.

The organization’s accounting policy for accounting and accounting regulations establishes a method for writing off materials at average cost.

How to write off materials for production in 1C - step-by-step instructions →

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Write-off of materials for production | |||||||

| February 10 | 20.01 | 10.01 | 380 000 | 380 000 | 380 000 | Write-off of materials for production | Material Consumption - Material Use |

Complete the Material Consumption in the Warehouse - Material Consumption (Invoice Requirements) section.

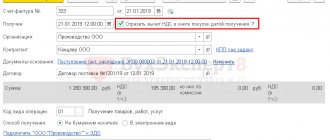

If you use the Products on account 20.01, then set the switch Indicated - In the header . This analytics can only be completed using the Cost Account .

- on the Materials , indicate information about the materials used, their quantity, and account;

- follow the link Cost account , fill in: Cost account - 20.01 “Main production”, i.e. an account that records direct costs related to production;

- Nomenclature groups - type of product, in our example Women's shoes ;

- Cost items - cost item Type of expense in NU - Material costs ;

- Products - finished products for the production of which materials will be used

Postings according to the document

The document generates transactions:

- Dt 20.01 Kt 10.01 - the cost of materials is written off as production costs using the Average .

- Document Requirement-invoice

- Product release options and their differences when calculating costs

- Release of finished products at planned prices using a new method: using the Products subconto. Materials are written off without specifications

- Release of finished products without planned prices using a new method: using the Products subconto. Materials are written off without specifications

Product output (Production report)

Let's look at the nuances of writing off materials when choosing the Product Release (Production Report) :

On February 28, Kate Sandals (1,000 pairs) were produced. Materials are written off for production according to specification No. 1, consumption rate for 1 pair:

- blanks for soles - 2 pcs.;

- fabric - 0.5 m².

Write-off of materials simultaneously with the release of products in 1C →

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Production of finished products | |||||||

| 28th of February | 43 | 20.01 | 400 000 | 400 000 | 400 000 | Release of finished products at planned cost | Product output (Production report) |

| 20.01 | 10.01 | 380 000 | 380 000 | 380 000 | Write-off of materials for production | ||

In our case, we write off the write-off immediately at the time of production (production release).

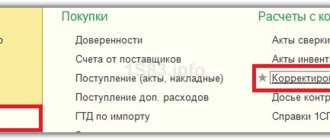

Reflect the release of the GP in the document Production Report for a Shift in the section Production - Production Reports for a Shift.

In the document, indicate Cost Account , which takes into account direct costs and the name of the finished product.

In this document, materials to be written off are indicated by link in the Materials . If you filled out the Specifications , the Materials will automatically be filled in with data on the materials used, their quantity, accounting accounts and cost items.

Postings according to the document

The document generates transactions:

- Dt Kt 20.01 - products are capitalized;

- Dt 20.01 Kt 10.01 - the cost of materials is written off as production costs using the Average .

If within a month after the write-off of materials there are still more materials arriving at the warehouse, then the calculated cost when writing off the inventory at the end of the month will be adjusted.

- Product release options and their differences when calculating costs

- Release of finished products at planned prices using the old method: without using the Products subconto. Materials are written off according to specifications

Act on write-off of inventories - sample form F-0504230 (OKUD)

Organizations must write off inventories using a write-off act. For this document, a special form 0504230 of the act on write-off of inventories is provided, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n, which allows you to register write-offs using all existing methods.

In the header of the act, its number in order, the date of preparation, the composition of the commission that carried out the write-off procedure and the order by which this composition was approved are indicated.

In the tabular form that follows, data on the consumption of inventories is recorded: names, codes, consumption rates, actual consumption, reasons that led to the write-off, Dt and Kt for accounting entries. At the bottom of the table the total results are summed up, followed by the conclusion of the commission and the signatures of all its members indicated in the header of the act.

You can download the form for the act on write-off of inventories OKUD 0504230 on our website:

You can also download a completed sample act on write-off of inventories.

Write-off of low value in 1C 8.3

Currently, the concept of “SME” is not used in legislation, and such assets are accounted for in accordance with the accounting policy:

- as fixed assets;

- as non-essential assets.

Let's look at how to write off an IBP in 1C 8.3 Accounting using the example of writing off (putting into operation) business equipment.

On June 06, 1 piece of business equipment was transferred to the Sales Department: Canon DR-C225W office scanner. materially responsible person manager Kotelkov I.I.

According to the accounting policy for accounting, objects worth up to 100 thousand rubles. period of use over 12 months. are classified as non-essential assets. The costs of their acquisition are recognized as expenses of the period in which they are incurred.

Writing off materials for the needs of the organization - step-by-step instructions →

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Write-off (transfer into operation) of household equipment | |||||||

| June 06 | 10.21.2 | 10.21.1 | 16 000 | Write-off of low-value items | Transfer of materials into operation | ||

| 44.01 | 10.21.1 | 16 000 | 16 000 | Write-off of the cost of an object in NU | |||

| MC.04 | 16 000 | Reflection of the cost of inventory in operation on an off-balance sheet account | |||||

The transfer of materials for the needs of the organization, which must be taken into account off-balance before they are actually written off, is formalized with the document Transfer of materials into operation (or Consumption of materials - Transfer to employee ) in the Warehouse .

On the Inventory and household supplies , indicate the materials transferred for operation ( Type of item - Low-value equipment and supplies ), the materially responsible person (MRP) to whom they are assigned and the method of cost accounting.

Postings according to the document

The document generates transactions:

- Dt 10.21.2 Kt 10.21.1 - the cost of the object in the accounting record is written off;

- Dt 44.01 Kt 10.21.1 - the cost of the object is written off in the NU upon issue from the warehouse

- MC.04 - the cost of inventory in operation is reflected off the balance sheet.

Acquisition of low-value objects with a useful life of more than 12 months

Important score 20

The account we are talking about is used in a variety of ways in accounting. It records the costs of manufactured products, construction work, and services. This is an active account that collects costs on a debit basis and reflects the write-off of the cost of products received on a credit basis. Account 20 may have a debit balance if there is work in progress.

The loan may reflect not only the write-off of production costs, but also some other transactions. Example: the company uses the received products for its own needs - Dt 10 Kt 20. At the end of the reporting period, the “work in progress” is usually inventoried, checking the actual availability in the departments with accounting data.

Costs are reflected on this account: all material, salary amounts, depreciation charges on equipment in production, etc.

Sub-accounts can be opened for the account by department, for example, in agriculture these are “Crop production”, “Livestock production”, “Industrial production”, “Other main production and activities”. Analytics is carried out by types of costs and products (works, services). Records can be kept by teams, workshops, sections, product groups, or other groupings necessary to obtain objective data can be used.

We remind you! According to the new FSBU 5/2019, it is prohibited to include management and storage costs in the actual cost of inventories (except for cases where they are directly related to production). Costs from account 26 to account 20 cannot be transferred. They are written off to account 90.

When closing account 20, one of three methods is used: at actual cost, at planned (standard) costs, or direct sales of products. Postings are generated using accounts 40, 43 and 90 of accounting. The method of writing off costs on account 20 is established by the company's accounting policy.

Decommissioning of materials from service in 1C 8.3

November 28, Canon DR-C225W office scanner, 1 pc. written off from the sales department.

Decommissioning of materials from service in 1C 8.3 →

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Write-off (transfer into operation) of household equipment | |||||||

| November 28 | MC.04 | 16 000 | Write-off of inventory in use from an off-balance sheet account | Disposal of materials from service | |||

Write off material from service using the document Write-off of materials from service (or Write-off of goods, materials - Write-off from employee ) in the Warehouse .

In the document, indicate in the required tab the material being written off, as well as the document according to which it was transferred for operation, and the MOL.

Write-off of inventories and non-essential assets

Postings according to the document

The document generates the posting:

- Kt MTs.04 - write-off from off-balance sheet accounting of the cost of inventory transferred for operation.

We looked at the write-off of materials, inventory items, low-value items, spare parts, and office supplies in 1C.

Test yourself! Take the test:

- Test. Write-off (transfer into operation) of business equipment as part of distribution costs

- Test. Write-off of materials for general business needs

- Test. Purchase and use of materials (household equipment) for non-production purposes

- Test. Accounting and analytical accounting of materials: legislation and 1C