Distinctive features of the UTII system

The imputed income tax system is distinguished by the following:

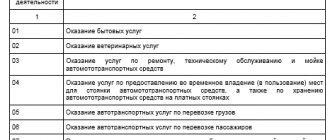

- its use is possible for certain types of activities, the list of which is given in paragraph 2 of Art. 346.26 Tax Code of the Russian Federation;

- it cannot be applied to activities that require payment of a trade tax;

- its use is available only to taxpayers with a small number of employees (up to 100 people);

- it is chosen voluntarily, can begin and cease to be used in any month of the year, and allows for the possibility of combining with other modes;

- with it you need to register and deregister as a UTII payer;

- payment of UTII by organizations involves replacing the payment of several taxes: profit tax (for legal entities) or personal income tax (for individual entrepreneurs), VAT and property tax (except for that calculated from the cadastral value);

- payment of UTII does not exempt you from paying taxes other than those being replaced and submitting reports on them;

- The procedure for calculating and paying UTII is subject to the uniform rules established by the Tax Code of the Russian Federation, requiring quarterly reporting and quarterly payment of tax.

Find out about the rules for applying UTII in the material “Who can apply UTII (procedure, conditions, nuances)”

Key rules for using imputation

Not only companies, but also individual entrepreneurs who carry out certain types of activities have the right to switch to imputed income. Officials have enshrined at the legislative level a list of types of activities that give the right to apply a simplified taxation regime.

The second key condition for the transition is permission from the municipality. That is, local authorities must provide for the possibility of applying an imputed tax.

IMPORTANT!

If the taxpayer chose “imputation”, registered, but did not conduct any activity and did not receive income during the reporting period, then the tax will still have to be paid to the budget! That is, the established tax obligations do not depend on total income, unlike other simplified tax regimes.

They do not pay imputation only in two cases:

- the entrepreneur or company has officially ceased its activities or been deregistered;

- the physical indicator on the basis of which the amount of tax is calculated has been lost.

Single tax payment deadline (2021)

Organizations and individual entrepreneurs using UTII are required to submit a declaration to the inspectorate at the end of the tax period (quarter) and pay the tax.

The deadline for filing a tax return is set by the Tax Code of the Russian Federation until the 20th day (inclusive) of the month following the reporting period. The deadline for paying UTII does not coincide with the deadline for filing the declaration, falling on a later date of the same month.

Check whether you have correctly calculated the amount of tax to be paid using the Tax Guide from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The deadlines for paying UTII are also specified in the Tax Code of the Russian Federation. In paragraph 1 of Art. 346.32 of the Tax Code of the Russian Federation it is noted that payment of UTII must be made before the 25th day (inclusive) of the month following the tax period. In this case, the rule applies to postponing the payment deadline and submitting the declaration to the next next working day in the case when the reporting date falls on a weekend or non-working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

What are the deadlines for submitting and paying UTII in 2022?

Reporting on it goes to:

- 01/20/2021 - for the 4th quarter of 2022.

The deadlines for paying UTII in 2022 are as follows:

- 01/25/2021 - for the 4th quarter of 2022.

ConsultantPlus experts explained in detail what taxpayers should do in connection with the abolition of UTII from 2021. Get trial access to the legal system and move on to the Typical Situation. It's free.

Compliance with payment deadlines will allow you to avoid fines for late payment of UTII.

There will be no more UTII

Federal Law No. 178-FZ dated June 2, 2016, with amendments to the Tax Code of the Russian Federation, from January 1, 2022, completely abolished the UTII special regime.

Namely, the provisions of Ch. 26.3 of Part 2 of the Tax Code of the Russian Federation, which regulated this special regime. Thus, it is neither possible nor possible . are also no transition periods for imputation after January 1, 2022 .

there are still certain transitional provisions (Article 4 of Federal Law No. 373-FZ dated November 23, 2020). Basically, they relate to income and expenses (especially material ones) transferred to 2022 from UTII, as well as insurance payments (contributions), benefits, and input VAT.

The Federal Tax Service of Russia, in letter dated November 20, 2020 No. SD-4-3/19053, discussed these and other points in detail.

For a full review of this letter, see our material “ Official clarifications of the Federal Tax Service on all issues of abolition and transition from UTII from 2021. ”

Also see “ How to take into account income from UTII when switching to the simplified tax system from 2022. ”

Let us note that it was originally planned that UTII would be abolished as early as January 1, 2022. However, small businesses were then massively indignant and the authorities decided to postpone the abolition of the imputation.

Procedure for paying UTII in case of suspension (termination) of activities

There are often situations when, for some reason, the activities of the imputation in the 4th quarter of 2022 are suspended or terminated by the decision of the manager or individual entrepreneur. Is it worth paying UTII for such a period?

To be a payer of imputed tax, you must simultaneously comply with the following two conditions (clauses 1, 2 of Article 346.28 of the Tax Code of the Russian Federation):

- carry out activities that fall under UTII in accordance with the norms of the Tax Code of the Russian Federation and local legislation;

- be registered with the tax authority as a payer of imputed tax.

When an activity is suspended (terminated), the first mandatory condition is actually violated. The taxpayer then ceases to receive income. This situation can be misleading about the need to pay tax. However, it must be paid, since it is possible to terminate activities on UTII only in a certain order, and until the end of this procedure, the UTII payer remains imputed. After all, the tax for him is calculated not on real, but on imputed, i.e., potentially possible income (Articles 346.27, 346.29 of the Tax Code of the Russian Federation).

The procedure for terminating activities on the imputation is not limited to the cessation of receiving income from it. It is also necessary to submit an application to the tax office for deregistration as a UTII payer. And only after deregistration can you stop paying a single tax (Article 346.28 of the Tax Code of the Russian Federation).

Read more about the procedure for deregistering UTII in the material “What is the procedure for deregistering a UTII payer who has ceased activity .

KBK for payments under UTII

In order to transfer tax to the budget, you need to know the KBK code. The KBK code is a series of numbers that must be indicated in the payment order so that the payment goes to a certain budget, for example, to the regional or federal one. Incorrectly specified BCC will result in the payment going to the wrong place. Accordingly, the tax office may fine the taxpayer for late payment of tax. Important! Please note that KBK codes change frequently, so please check the latest information before sending a payment.

| Payment according to UTII | KBK |

| Payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) | 182 1 0500 110 |

| Penalties for UTII | 182 1 0500 110 |

| Interest on the relevant payment | 182 1 0500 110 |

| Amounts of monetary penalties (fines) | 182 1 0500 110 |

| Payment amount for tax periods expired before January 1, 2011 (recalculations, arrears and debt on the corresponding payment, including canceled ones) | 182 1 0500 110 |

| Penalties on UTII for tax periods expired before January 1, 2011 | 182 1 0500 110 |

| Interest on the corresponding payment for tax periods expired before January 1, 2011 | 182 1 0500 110 |

| Amounts of monetary penalties (fines) for tax periods expired before January 1, 2011 | 182 1 0500 110 |

Payment of UTII: judicial practice

It is with the suspension or termination of the imputed activity that controversial situations considered by the judicial authorities are most often associated.

The Supreme Arbitration Court of the Russian Federation noted that temporary suspension of activities is not a basis for exempting a legal entity (IP) from fulfilling the obligations assigned to it as a payer of UTII and from paying imputed tax (clause 7 of the information letter of the Presidium of the SAC of the Russian Federation dated 03/05/2013 No. 157). This position applies to cases when activities on UTII are suspended (except for cases of termination of activities due to loss of physical indicators).

Thus, organizations and individual entrepreneurs lose the obligation to file a declaration and pay UTII only after deregistration with the tax authorities as taxpayers. In other cases, the obligation to pay remains.

Read about the tax consequences in the event of suspension of an “imputed” activity in the article “Is it legal to demand payment of UTII if the activity was not carried out? ”

Tax calculation: basic yield and deflator coefficients

The amount of tax under UTII is determined as the product of the tax base and the tax rate. The tax base for UTII is determined for each type of activity and depends on the basic profitability, physical indicator and adjustment coefficients K1 and K2. You can read more about calculating the tax base in this article.

The article “Basic UTII yield in 2018” explains what basic yield is and how to calculate it.

Read about the procedure for calculating physical indicators here.

You can learn about the specifics of calculating the physical indicator “number of employees” from the material “How to take into account the AUP when combining OSN and UTII with the physical indicator “number of employees.”

Read about the correction coefficients in the publications under the heading “UTII Coefficients (K1, K2)”.

You can learn about the features of calculating UTII for an incomplete tax period from the materials:

- “Imputed income does not depend on the number of days actually worked”;

- “How to calculate the tax base for UTII for the first quarter of application of the special regime?”;

- “If a new business is started in the middle of the month, UTII is calculated only for days worked”;

- “An example of calculating the tax base for UTII in the event of the start of a new type of “imputed” activity not from the first day of the calendar month.”

Read about the features of calculating UTII when carrying out certain types of activities in the articles:

- “Use of UTII in retail trade in 2017-2018”;

- “The procedure for calculating UTII for passenger transportation.”

You can read about the calculation of UTII for cargo transportation here.

Read about reducing the UTII tax base for insurance premiums in the publications:

- “The procedure for reducing UTII by the amount of mandatory insurance contributions”;

- “How to reduce UTII by contributions if you have several retail outlets”;

- “A one-time payment of a fixed payment may be unprofitable for UTII.”

For information on how the accrual and payment of UTII is reflected in accounting, see the article “Enterprises for the accrual and payment of UTII.”

Results

The deadline for paying UTII in 2022 is set on the 25th day of the month following the reporting quarter. The last time you need to pay this tax is for the 4th quarter of 2022 - no later than 01/25/2021. Failure to comply with the tax remittance deadline threatens the taxpayer with penalties.

To calculate penalties, use our calculator.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.