Extracting transactions for settlements with budgets - what is it?

A statement of transactions for settlements with the tax office is a formalized document provided by the tax office. It contains information on all accrued and paid taxes, penalties and fines. If there are discrepancies between the data of the taxpayer and the Federal Tax Service, this document will help to verify.

To control the payment of taxes, it is recommended to order a Certificate of Payment Status and such a statement regularly after each payment. This will ensure that the payment has actually been accepted by the tax office. The certificate shows whether the individual entrepreneur has a debt or overpayment of taxes in one line for each tax. The statement contains detailed information and will help you understand the reason for the debt or overpayment.

How is the concept deciphered?

KRSB stands for budget settlement card and is a clearly grouped information resource that reflects information on accrued and paid tax payments. A taxpayer card is formed from tax reports submitted by a person to the Federal Tax Service. In controversial situations possible between the parties, this document allows you to identify discrepancies and control the payment of taxes. In accordance with uniform requirements, budget settlement cards are maintained for each taxpayer and for each individual type of tax. Each type of payment has its own code (KBK), and the code of the municipality where the tax revenues are received (OKTMO) is also taken into account. Different cards are provided for the taxpayer and the tax agent, so if the same person performs two tax functions at once, then two KRSB are issued for him, respectively.

How to order a Budget Statement

You can receive a tax statement electronically or personally contact the inspectorate with an application. The application indicates the details of the taxpayer, the name of the tax for which information is needed and the period of time. A sample application is in this document at the link https://iphelper.ru/wp-content/uploads/2018/02/Zayavlenie_na_vypisku_po_raschetam_s_budjetom.docx.

How to order a budget statement through your personal account

There is an option to order the document through the taxpayer’s personal account on the tax website. To connect to your personal account, you need to contact any tax office with your passport. You will be given a username and password to log into the system.

You can also log in to your personal account using an electronic signature. You can issue a signature at the certification center using the link.

After logging into the personal account of an individual, it is necessary to activate the entrepreneur’s personal account. Through the individual entrepreneur’s account you can order a Statement of settlements with the budget.

The statement is generated in the section My taxes, insurance premiums -> All obligations -> Statement of transactions for settlements with the budget.

Click image for a larger view

Select the item “Statement of transactions for settlements with the budget” at the bottom of the page

Next, select the reporting year. The statement includes information for only one year. If you want to check the last three years, you need to order an extract for each year separately.

Specify the grouping of payments, your tax number and the format of the statement.

Next, click the double arrow to select all taxes.

We sign and send.

The answer will arrive in a few days in the section on the main page “Notifications...”

Next, select “Information about documents...”

And there will be an answer

After receiving the extract, we proceed to deciphering and analyzing the information.

How to request a tax reconciliation

Reconciliation with the Federal Tax Service is carried out in accordance with the procedure given in the letter of the Federal Tax Service dated March 9, 2022 No. AB-4-19/2990. This procedure is temporary, it replaced the old regulations from the order of the Federal Tax Service No. 09.09.2005 No. SAE-03-1 / [email protected] The new permanent regulations have not yet been approved.

Typically, the process of reconciliation for taxes and fees is initiated by the taxpayer, although the Federal Tax Service also has this right. The key point when applying is not so much the method of sending the application, but its form. It can be paper or electronic. In the second case, the application is submitted through the individual entrepreneur’s personal account on the Federal Tax Service website or through the reporting program/service (according to TKS).

Personal appeal

The classic way to receive a reconciliation report is to write an application and submit it to the tax office. You can do this yourself, through an intermediary or by mail. For some time now, a request for reconciliation can be submitted through the MFC.

An application is drawn up on paper in free form. You must specify:

- your data – name, main codes, contacts;

- the period for which the reconciliation of calculations for taxes and fees is made. If it is not specified, then the act will be drawn up for the period from the beginning of the current year to the date of registration of the application. You can check for the previous 3 years;

- types of payments for which data needs to be compared (listed by KBK). If they are not listed, then a reconciliation will be carried out for all taxes and other payments that the taxpayer makes to the inspectorate where he applied. These are not only taxes, fees and contributions, but also penalties, fines and interest;

- method of obtaining the act. If you do not want to visit the tax office again, you can specify that it be sent by mail.

The same rules apply when applying for a reconciliation report by mail or through the MFC. The only difference is in the methods of presenting the document.

Having received a paper request, the Federal Tax Service Inspectorate prepares a reconciliation report within 5 working days. If the applicant has indicated that he will receive it in person, he must come for it at the appointed time and present documents certifying his authority. Otherwise, as well as in case of failure to appear for the act, it will be sent by mail.

Electronic request through the taxpayer’s personal account

If a taxpayer is registered on the Federal Tax Service website and has a personal account, then he can receive a reconciliation report with the tax office there. We tell you how to request it:

- select the section “Request certificates and other documents”;

- select “Act of joint reconciliation of calculations...”;

- indicate the date on which the data is compared;

- indicate the tax authority (or the option “in general for the taxpayer”), as well as, if necessary, the necessary BCCs;

- indicate the response format;

- we check the data and order a reconciliation with the budget for taxes and fees, not forgetting to connect the electronic signature medium.

The result must be no later than three working days from the date of registration of the electronic application. Its receipt can be tracked in the “Events” section of the Personal Account.

Electronic request through the reporting system

The submission of a joint reconciliation report for the TKS is regulated by Order of the Federal Tax Service of Russia dated June 13, 2013 No. ММВ-7-6/ [email protected] The nuances of drawing up a request in this case depend on what program or service is used. However, the principle is the same as when forming an application in the LC. For example, in the 1C:Reporting system you need:

- go to the “Reconciliations” section;

- select “Request reconciliation”;

- select “Calculation reconciliation report”;

- fill out the reconciliation request form according to the rules specified above.

The applicant will be able to receive the report within three working days from the date of the request.

How to read a budget statement

The extract contains the date and period that covers the information provided. Below it contains information about taxpayers and inspections: TIN, full name, address and Federal Tax Service number.

The table shows the basic calculation information.

Columns 1 and 2 indicate the dates the transaction was entered into the card and the payment deadlines. In this example, the first date, January 10, 2022, is the date when the individual entrepreneur submitted the declaration for 2022. The dates in column 2 correspond to the accrual of advance tax payments from the submitted declaration: April 25, July 25 and October 25.

Column 3 indicates the name of the operation. We see two transactions: “paid” and “accrued by calculation”. There are other operations, for example, “additional penalty for recalculation was accrued programmatically”

“Paid” – individual entrepreneur’s payments to the tax office.

“Accrued by calculation” is the tax that must be paid. The tax office makes accrued payments according to the declaration, from which it finds out when and how much the individual entrepreneur must pay.

Columns 4-8 indicate information about the document on which the entry was made. So, for a declaration, the date of submission to the tax office is indicated, and for a payment order, the date of debiting from the current account. The “Type” column contains encrypted documents:

RNAlP - accrued by calculation (information from the declaration or tax calculation).

PlPor - payment order.

PrRas - software calculation of penalties.

PS - collection

Column 9 “Type of payment” can include tax, penalties and fines.

Columns 10-12 indicate the amounts. The entrepreneur’s payments go into the “Credit” column, and the accrued tax goes into the “Debit” column.

Columns 13 and 14 “Balance of settlements” summarize the debt or overpayment on an accrual basis. The “+” sign indicates the taxpayer’s overpayment, and the “–” sign indicates the taxpayer’s overpayment. The settlement balance is divided into two columns: “By type of payment” and “By card payments to the budget.” The first contains information on a specific payment - only for tax, penalty or fine. In the second, the total for the card, taking into account tax and penalties.

A detailed transcript of the extract from the above example looks like this:

The simplified tax system tax extract with the object “income” contains information for the period from January 1, 2022 to October 13, 2022. 1. The balance of settlements as of January 1 in favor of the taxpayer (overpayment) is 82,126 rubles. 2. Based on the results of the submitted declaration under the simplified tax system for 2016, on January 10, 2022, the following liabilities were accrued: - for the 1st quarter of 2016, 1,920 rubles. for the period of April 25, 2016 - for the first half of 2016 RUB 10,295. for the period July 25, 2016 - for 9 months of 2016 RUB 69,911. due October 25, 2016 Total RUB 82,162. The obligations were repaid by the overpayment recorded as of January 1, 2022 and the balance of settlements with the Federal Tax Service is 0. 3. According to payment order No. 47 dated January 10, 2022, the amount of 114,760 rubles was received. in payment of tax. Balance RUB 114,760 in favor of the taxpayer (overpayment). 4. According to payment order No. 11 dated April 7, 2022, the amount of 1,720 rubles was received. in payment of tax. Balance RUB 116,480 in favor of the taxpayer (overpayment). 5. The tax liability for the year according to the declaration for 2016 is reflected in the amount of RUB 114,760. due for payment on May 2, 2022. The obligation was repaid by overpayment. The settlement balance is RUB 1,720. in favor of the taxpayer (overpayment). 6. According to payment order No. 55 dated July 6, 2022, the amount of 7,950 rubles was received. in payment of tax. Balance 9,670 rub. in favor of the taxpayer (overpayment). 7. According to payment order No. 66 dated October 5, 2022, the amount of 81,580 rubles was received. in payment of tax. Balance 91,250 rub. in favor of the taxpayer (overpayment). As of October 13, the tax balance is 91,250 rubles. in favor of the taxpayer (overpayment).

This overpayment does not mean that you can ask the tax office for a refund to your current account. If you look carefully, we see that the balance is 91,250 rubles. consists of three payments: – 1,720 from 04/07/2017 – 7,950 rubles. from 07/06/2017 – 81,580 rubles. dated 10/05/2017. These amounts are nothing more than advance tax payments, which are paid every quarter throughout the year. Before submitting the declaration, these payments are listed on the card as an overpayment, but after tax obligations are completed, they will be offset against the tax payment. The deadline for submitting a declaration under the simplified tax system for individual entrepreneurs is April 30 of the following reporting year, so in this example, the overpayment will “go away” after submitting the declaration already in 2022.

The meaning of the plus and minus signs in this document

The relationship between enterprises and tax authorities (IFTS) does not stop throughout the history of economic activity. This is regulated by the tax legislation of the Russian Federation.

Everything seems simple and clear, but in fact, very often technical, economic and financial disagreements arise between a business entity and the Federal Tax Service.

We will discuss why this happens and what needs to be done in this situation in this article.

Before considering the topic of the article in detail, we will answer the main question, what do the “plus” and “minus” signs mean in the Certificate on the status of tax calculations (hereinafter simply “Certificate”).

So, Help can be:

- “Neutral” - this indicates that your financial parameters fully coincide with those of the tax authorities;

- Certificate with a “plus” sign – your company has overpaid when making tax payments;

- A certificate with a minus sign means that your company has a debt to the budget when making tax payments.

Each enterprise from time to time needs to clarify the status of budget allocations . A familiar situation is when a company requests a certificate stating that it has no debt to the budget. But the issuance of this document from the tax authorities was refused due to existing debt.

In order for an enterprise not to find itself in such a “time pressure” situation, it is necessary to check its data with the Federal Tax Service after a certain period. In addition, this requires the reliability of the company’s accounting reports (inventory of budget calculations when preparing the annual accounting report).

A few points about the reconciliation procedure

The Federal Tax Service Inspectorate, in accordance with the approved Regulations, can initiate a reconciliation of contributions by companies to the budget:

- Quarterly for enterprises - large economic entities for a specific inspection;

- If your company has changed its legal and physical address. And the enterprise must change the Federal Tax Service;

- Liquidation of the company or its bankruptcy.

Reconciliation can be carried out at the initiative of the business entity. To do this, you need to send a letter to the tax authorities about the need for reconciliation, indicating the calendar period for reconciliation.

It is important to know! There are no legislative restrictions during the reconciliation period, however, tax inspectors most often carry out reconciliation for the last three years of the company’s operation.

If you need to reconcile the data on contributions to the budget at a later date, you can safely insist on this. Otherwise, you can always appeal the illegal refusal through a higher authority of the Federal Tax Service.

letter does not have a set format . You can state everything in any form and send it by courier or through the postal service and receive a notification.

It is, of course, possible to communicate by telephone , but in the event of serious disagreements, the resolution of disputes may be transferred to the courts. And compliance with or violations of the Regulations may have good reasons in this case.

Having received your letter, the tax inspector has only five days to create Section I of the Reconciliation Report. The section reflects the balance of tax deductions (calculations).

If the data (of the taxpayer's company) matches the reconciliation report, all you have to do is sign this document. The reconciliation time in the absence of disagreements, as a rule, takes no more than ten days (from the moment the letter was received by the inspectorate). In life, of course, everything is not as smooth as prescribed by regulatory documents.

Inspectors also do not always adhere to accepted rules. This may disrupt the deadlines for receiving the Certificate on the status of tax settlements and lead to some inconvenience in the company’s work.

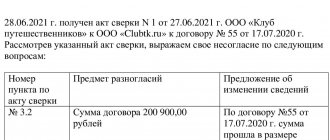

You have received a report, but the company’s accounting data does not match the tax office data:

- The company returns the Reconciliation Report to the Federal Tax Service indicating the discrepant amounts. As a result, you submit a Certificate of Disagreement. Next, you need to look for the reasons for the disagreements.

- After receiving Section I from the company, the Federal Tax Service must begin to form Section II for a more detailed reflection of the company’s budget transfers.

- After all disagreements have been resolved and if the amounts between the company (taxpayer) are in full agreement, the inspectors are obliged, again, to prepare Section I of the specified act and hand it over to the enterprise.

Let's summarize

The company must eliminate all possible contradictions and disagreements when fulfilling its tax obligations in the shortest possible time. And it is not always possible to achieve this only through official regulations .

It is necessary to constantly keep your finger on the financial pulse. The company's tax policy reflects its actual rating status. We must not forget this.

Answers to popular questions

What to do if the tax was paid by payment order with the correct details, but was never received by the tax office?

It happens. You must write an application to the tax office to search for payment. If the payment is not in the card for transactions with the budget, and you have a payment slip in your hands with a bank mark with the correct details, then we write the application in any form. For example, like this:

If errors are made in the payment slip, you can provide the correct details through your personal account in the My Mail section -> Contact the tax authority -> Budget payments -> Application for clarification of payments -> Other payments. In the form that opens, indicate the details of the payment order: number, date and amount.

In the found payment order, you can enter new correct details and immediately generate and send an application for payment clarification.

Still have questions? Need help deciphering your statement? Write to WhatsApp or Telegram and get a consultation.