Accounting is a system for collecting and recording data expressed in monetary terms and reflecting debts or obligations, the state of the enterprise’s property. This is done through the permanent recording of all business transactions in special registers for recording homogeneous economic data. One of these accounts is account code 57, which stands for “transfers in transit.” For a clearer understanding of what is happening, it is recommended to learn in more detail the basic information about what transfers in transit are, account 57, postings in this register.

The audit process and why it is needed

Inspections pursue understandable goals - control of reporting for the economically stable existence of the organization. The legality and reliability of the information provided by the accountant are the basis for the correct accounting of the company’s money. The audited company must comply with the following rules:

- provide reliable information on account balance 57;

- timely transfer income from the organization’s activities;

- correctly reflect the accounting of foreign exchange transactions.

The audit is based on a thorough study of all primary accounting registers that lead to the appearance of entries in the “Transfers in Transit” account.

Accounting characteristics

57 accounting account is a way of modern description of the process of transferring funds to bank accounts. Almost every trading organization transfers amounts from the cash register and proceeds for the reporting period to the account. The use of account 57 begins with such operations, which allows for more reliable and continuous accounting.

In addition to the funds transferred by the organization, transfers in transit include amounts sent from buyers on account of goods or services received, but which did not manage to be credited to the current account before the end of the reporting period. Funds allocated for currency conversion are also debited in account 57.

***

The organization's funds in transit are account 57. They are intended to be credited to the current/currency account, as well as to the company's cash desk, but have not yet reached their destination. The account is used for collection, acquiring or buying/selling currency. To account for movement in each specific currency, a separate sub-account is used.

If, for example, cash was transferred to the collector in the evening on the last day of the period, it will be credited to the current account in another period - only on the next day. That is, they will represent a debit balance on account 57 and will be taken into account in the total amount of line 1250 “Cash and cash equivalents” of the balance sheet.

Account application

Account 57, according to the order of the Minister of Finance of the Russian Federation, serves as a source of information about the movement of money in ruble and foreign currency equivalent. It is used in cases where the transfer of funds to a bank account is delayed for a period of 1 day or more from the moment of sending. In addition to the bank, the organization uses the services of savings banks and post offices for settlement transactions.

It is necessary to have a basis in the form of primary accounting documents. These are receipts from executive agencies, as well as accompanying statements for the delivery of proceeds to collectors and other accounting registers. The movement of foreign currency funds must be organized separately from other transfer operations.

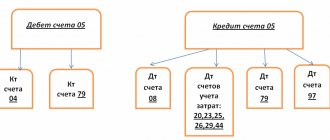

Correspondence with other accounts

Account 57 is active, which means that any inflow of funds is recorded in debit, and write-off is recorded in credit. At the end of the reporting period, a debit balance is formed, or the account is closed if the funds in transit have managed to transfer to the main bank accounts. Based on the characteristics of the account, it is possible to distinguish between its correspondence in debit and credit with other accounts.

Account “Transfers in transit” is debited to the following accounts:

- monetary (accounts 50, 51 and 52, “Intra-economic settlements”);

- settlements with buyers and creditors (accounts 62, 64, 76);

- settlements with dependent organizations (account 78);

- sales of products (accounts 45 and 46);

- profit and loss (account 99).

Closing account 57 - loan correspondence - is most often performed from the account. 50, 51, 52 and 64, 73. Complete posting confirms the fact that funds have been credited to the destination account.

Accounting for funds in transit

Accounting for cash and settlements Read more: Accounting for production costs

7.3 Accounting for funds in transit

Information on the movement of funds (transfers) in the official currency of the Republic of Belarus and foreign currencies in transit is summarized on account 57 “Transfers in transit.”

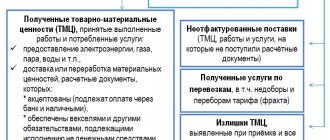

This account takes into account:

· proceeds from the sale of goods by divisions engaged in trading activities, deposited in the cash registers of credit institutions or post office cash desks for crediting to the current or other account of the enterprise, but not yet credited for their intended purpose;

· funds transferred from the current account for the purchase of foreign currency;

· currency sent for sale at auction with the allocation in analytical accounting of operations on mandatory, voluntary sale and conversion;

· cost of goods sold and services provided with payment by debiting money from plastic bank cards.

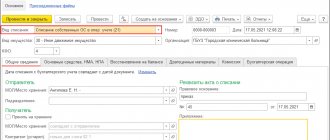

The basis for registering funds under account 57 “Transfers in transit” are receipts from credit institutions, post offices, copies of accompanying statements for the delivery of proceeds to collectors, etc.

Analytical accounting for account 57 “Transfers in transit” is carried out by responsible accounting employees in accordance with their job descriptions for each document (operation) with separate accounting of transfers in foreign currency.

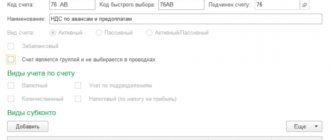

7.4 Accounting for other calculations

Accounting for settlements is carried out in accordance with the established procedure in accordance with the Civil Code, Banking Code, current legislative and regulatory acts regulating issues of financial, economic, foreign economic activity, taxation, etc., local legal acts.

The use of non-monetary forms of payment is limited by the limits established by legislative acts and local legal acts.

NGDU keeps records of settlements in the corresponding subaccounts of the following accounts:

· account 60 “Settlements with suppliers and contractors”;

· account 62 “Settlements with buyers and customers”;

· account 66 “Settlements for short-term loans and borrowings”;

· account 67 “Settlements for long-term loans and borrowings;

· account 68 “Calculations for taxes and fees”;

· account 69 “Calculations for social insurance and security”;

· account 71 “Settlements with accountable persons”;

· account 76 “Settlements with various debtors and creditors”;

· account 78 “Settlements with branches (structural divisions)”;

· account 79 “On-farm expenses”.

Periodically, as necessary, before drawing up the annual accounting report, on the date of the annual inventory, it is mandatory that accounting employees whose job responsibilities include maintaining accounting records of all types of payments draw up in the prescribed manner acts of reconciliation of calculations and send them to confirm receivables and payables to the relevant debtors and creditors.

These accounting employees carry out subsequent monitoring of debt confirmation by all debtors and creditors.

Acts confirming receivables and payables are stored within the established time limits in the accounting archive.

In accordance with the Law on Accounting and Reporting (Article 12), the amounts of receivables identified during the inventory for which the statute of limitations has expired, in accordance with the decision of the General Director on the basis of documents drawn up in the prescribed manner, are written off by the accounting department for financial results to account 92 "Non-operating income and expenses."

The amount of receivables written off at a loss is recorded in off-balance sheet account 007 “Debt of insolvent debtors written off at a loss” for five years to monitor the financial condition of the debtor and the possibility of its collection.

The amounts of accounts payable and depositories identified during the inventory, for which the statute of limitations has expired and all possible measures have been taken to collect them in accordance with the current legislation, in accordance with the decision of the General Director, are written off to the financial results in account 92 “Non-operating income and expenses.”

Information on settlements with the budget for taxes, fees and deductions paid by NGDU and taxes on the income of NGDU personnel is reflected in the corresponding subaccounts of account 68 “Calculations for taxes and fees”.

Taxes, fees and deductions are calculated centrally on the basis of information presented in the form of development tables necessary for drawing up declarations (calculations) on taxable items.

Information on settlements for social insurance and pension provision is reflected in account 69 “Calculations for social insurance and provision”.

Information on settlements with the Belarusian Republican Unitary Insurance Company "Belgosstrakh" for insurance premiums for compulsory insurance against industrial accidents and occupational diseases is reflected in balance sheet account 76 "Settlements with various debtors and creditors", subaccount 07 "Settlements for compulsory accident insurance in production."

Information on settlements with NGDU employees for amounts issued to them for reporting purposes for business trips and administrative expenses is summarized in account 71 “Settlements with accountable persons.”

The dispatch of employees on a business trip is formalized by order of the head of the oil and gas department with the issuance of a travel certificate in the prescribed form.

Employees who received cash on account are required to submit an advance report on the amounts spent to the accounting department no later than three working days upon returning from a business trip.

The balance of unused funds will be returned within the same period.

Cash issuance on account is only subject to a full report on the amounts previously received for travel and other expenses.

In case of failure to submit reports on the expenditure of accountable amounts within the prescribed period or failure to return the balances of unused advances to the NGDU cash desk, the accounting department has the right to deduct them from the wages of employees in the prescribed manner.

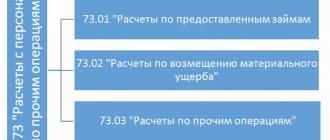

If amounts not returned by employees cannot be withheld from the employee’s wages, they are reflected in account 73 “Settlements with personnel for other operations.”

Account 76 “Settlements with various debtors and creditors” summarizes information on settlements for various transactions with debtors and creditors, analytical accounting is maintained for each debtor and creditor.

Subaccount 11 of account 76 “Settlements with various debtors and creditors” takes into account the amounts (value of property) of sponsorship (gratuitous) assistance transferred to organizations that receive these funds. On account 76 “Settlements with various debtors and creditors”, these expenses are taken into account until a report on their intended use is received. As of the date of receipt of the report on the intended use of sponsorship (gratuitous) assistance funds, the following is recorded in the accounting records of NGDU:

Debit account 92 “Non-operating income and expenses” - Credit account 76 “Settlements with various debtors and creditors.”

Other cases of providing sponsorship (free of charge) assistance in subaccount 11 of account 76 are not taken into account and are attributed immediately to the appropriate source.

Reflection of turnover within the Unitary Enterprise between the central office of the Unitary Enterprise and separate divisions not allocated to an independent (separate) balance sheet, as well as between separate divisions not allocated to an independent (separate) balance sheet, is carried out using the free account code 78 “Settlements with branches ( structural divisions)".

Reflection of turnover within the Unitary Enterprise between the central apparatus of the Unitary Enterprise and separate divisions allocated to an independent (separate) balance, as well as between separate divisions not allocated to an independent (separate) balance and separate divisions allocated to an independent (separate) balance, between separate divisions allocated to a separate balance sheet, carry out using account 79 “On-farm settlements”.

Accounting for cash and settlements Read more: Accounting for production costs

Information about the work “Organization of accounting at an oil and gas industry enterprise”

Section: Accounting and Auditing Number of characters with spaces: 99875 Number of tables: 2 Number of images: 0

Similar works

Organization of accounting at the enterprise

39996

8

1

... expensive. The organizational management structure of Samaradorstroy OJSC is presented in Fig. 1. Figure 1. Organizational management structure of OJSC Samaradorstroy Organization of accounting at OJSC Samaradorstroy The general director of OJSC “...

Working capital in the field of activity of the enterprise

143365

53

4

… = 1.3 t. As we can see from the calculations given above, the average monthly labor productivity remained unchanged for all three years. This indicates the uniformity of the NGDU operation. 3. WORKING CAPITAL IN THE FIELD OF OPERATIONS OF THE ENTERPRISE For the production of one or another product in the national economic system there is a primary link called the enterprise. Industrial enterprise, including...

Financial regulation of enterprises

108206

7

1

... covering seasonal costs and inventories and temporary needs for funds associated, for example, with exceeding production targets. The main source of data for analyzing the financial activities of an enterprise is the reported balance sheet and appendices to the balance sheet. Movement of the authorized capital and other reporting forms that detail the content of its individual articles and allow you to study ...

Payroll in the oil and gas industry

63673

2

0

… . The salaries of specialists and employees usually consist of 2 parts: official salary and bonuses for qualitative and quantitative performance indicators. Remuneration for specialists, office workers and junior service personnel in the oil and gas industry is carried out according to the regular salary system. The basis of this system is the staffing table and salary chart, in which ...

Postings to account 57 when depositing money from the cash register

The transfer of money from the cash desk using the “Transfers in transit” account is carried out in the case when the duration of the operation will take more than 1 day. Amounts are deposited from the organization’s cash desk in the following cases:

- you need to top up your current account;

- to avoid exceeding the cash limit;

- you need to transfer money to your corporate card account.

Additionally, you can consider the situation when a transfer occurs from one current account of an organization to another.

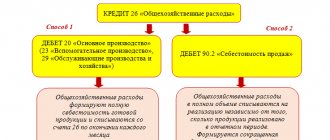

Accounting entries are also prepared using account 57. Basic quotes for correspondence between accounts 50, 51 and 57

| Dt | CT | Amount, rub. | Characteristics of an accounting transaction |

| 57 | 50 | 20.000 | money in rubles was handed over from the cash register for transfer to a bank account |

| 51 | 57 | 20.000 | the transferred money was successfully credited to the bank account |

| 57 | 51.01 | 140.000 | the amount was transferred from current account A to current account B |

| 51.02 | 57 | 140.000 | funds were transferred from current account A (51.01) to current account B (51.02) |

| 57 | 50 | 85.000 | money is sent to a corporate card account |

| 55.01 | 57 | 85.000 | funds have been received into the organization’s corporate card account |

It is important not to forget to use account 57 when transferring amounts from the cash register to the bank account. It is possible that posting Dt 51 Kt 50 more simply describes the process of transferring the cash contents of the cash desk to a bank account, but this operation is not reliable. After all, funds are not credited at the same moment when they were sent. Only after the actual execution of the transaction is it possible to carry out such a quotation.

Regulatory regulation of transfers in transit

Using the account 57 to display information about funds transferred to credit institutions, but not yet credited for the purpose of the organization, is carried out in accordance with the current Chart of Accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94.

According to the instructions, account 57 can correspond with cash accounts 50 (51, 52), as well as 62, 76, 79, 90, 91 by debit 57.

The credit of the 57th account interacts with accounts 50, 51, 52, 62, 73.

In addition, the need to deposit cash proceeds in excess of established limits with the bank is regulated by Bank of Russia Directive No. 3210-U dated March 11, 2014 and other regulatory documents.

Currency operations

Accounting for foreign currency funds is carried out on active account 55. Circulation is carried out both in rubles and in foreign equivalents in various payment forms, except for bills. Each of the payment forms involves opening a corresponding sub-account.

When converting currency, companies use account 57. Depending on the type of operation being carried out, sub-accounts are opened:

- 57.1 – currency for sale;

- 57.2 – currency for sale deposited by the bank;

- 57.3 – funds in rubles for the purchase of foreign currency.

It is worth noting that account 57.3 remains open until the organization purchases currency in the amount of transferred rubles.

Subaccount 52.2 reflects currency transactions that are carried out outside the Russian Federation on the accounts of foreign companies. It is debited when transfers are made by foreign firms in favor of the organization, as well as when bank interest is calculated for the use of funds. The account credit shows transactions related to:

- transfer of funds to the main bank account of the company;

- fee for servicing a foreign currency account;

- payment of expenses to employees of the organization;

- transfer of funds related to the maintenance of a foreign branch.

Payment of expenses to employees can be made from account 52.2 only with special permission from the Bank of the Russian Federation.

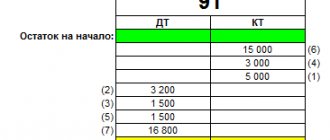

The exchange rate difference arising on account 57 is written off to the credit of subaccount 91 “Other income”. If it is negative in the reporting period, the account corresponds with the debit of subaccount 91 “Other expenses”. Postings are made only on the basis of an accounting certificate.

When is 57 count used?

This accounting account should be used only in cases where it takes a certain amount of time, but not less than one day, to carry out an income or expense transaction on a DMC. That is, if the operation of crediting or debiting money from a company’s DMC takes two or more days, then the company is obliged to use account 57 in accounting.

Let us note situations in which it is not necessary to use accounting account 57:

- Organizations receiving revenue in cash, the amount of which does not exceed the established cash limit.

- Firms that use exclusively non-cash payments.

- Companies that spend the proceeds on paying salaries to staff, issuing travel allowances, and making payments to suppliers.

Postings for currency transactions

Currency transactions are an important component of monetary accounting and settlements.

To transfer funds in foreign equivalents, organizations use accounting account 57. The transactions common in the process of conducting transactions are considered in the table: Currency transfers in transit

| Dt | CT | Characteristics of an accounting transaction |

| 57.3 | 52 | currency transferred for conversion into rubles |

| 91 | 57.1 | The total from the sale of foreign currency was written off in rubles |

| 76 | 57.2 | after transferring funds to a foreign branch, the currency in rubles was written off from the account |

| 57 | 91.1 | positive difference in the exchange rate is recognized |

| 91.2 | 57 | a negative difference in the exchange rate is recognized |

Correct preparation of correspondence accounts will reduce the risk of errors in accounting registers and financial statements.

Account characteristics

Synthetic account 57 belongs to the group of active accounting accounts. Consequently, when a money transfer is sent to a DMC, a debit accounting entry is generated, and when money is credited to a DMC, a credit entry is generated.

The accounting provides subaccounts:

- 57-01 - information on transactions involving transfers of money in ruble equivalent is generated for this subaccount;

- 57-02 - subject to reflecting information on the movement of foreign currency in transit;

- subaccount 57-03 - summarizes information on operations performed using payment cards, that is, on acquiring operations.

IMPORTANT!

When creating a cash flow statement, take account 57 into account. That is, funds in transit are subject to reflection in these statements. Include debit turnover on the account in the DS movement report. 57. Please note that transactions in foreign currency should be converted into rubles in accordance with the procedure established by PBU 3/2006.

Acquiring operations

Acquiring is the process of paying for goods or services using a special card. Payment can be made either through online resources or during a regular purchase in a store. Payment cards are plastic cards of the VISA, MasterCard and other classes issued and serviced by the bank. The POS terminal serves as a means of communication between the service user and the banking organization.

The company using acquiring operations enters into an agreement with the bank. The latter is due a set percentage of the commission for the instant payment services provided. The transfer of revenue to the organization occurs only after receiving a fiscal receipt - slip. This is a document confirming a payment transaction using a payment card. One of its copies is transferred to the accounting department of the organization.

Reflection of acquiring in accounting

Profit from the sale of goods or provision of services through payment through a POS terminal is transferred to the company’s account only after a bank verification and deduction of commission.

To correctly reflect accounting transactions, use “Transfers in transit” - account 57. The transactions that occur in this case can be seen in the table:

Acquiring Accounting

| Dt | CT | Characteristics of an accounting transaction |

| 57 | 90.1 | Profit from sales paid by bank card is recognized |

| 90.3 | 68 | VAT is charged on the amount received |

| 51 | 57 | the amount of profit is credited to the organization’s bank account |

| 91.2 | 57 | reflects the company's expenses for acquiring services |

Depending on the method of accrual of income, its recognition will be carried out at different times. The accrual method implies the use of posting Dt 57 Kt 90.1, regardless of the period in which the funds were received, and considers the date of receipt of income as the date of sale. If the company uses the cash method, the amount is written off to income when the money from the sale is credited to account 51.

How to close account 57 in accounting

When funds are credited and written off, or when there is an exchange rate difference during a foreign exchange transaction, there is a need to close. How to close account 57? If material resources are received on one day and spent on another, then such an operation will be called a transit operation. The formation of transactions by currencies must be carried out in accordance with Accounting Regulations 3-2006, which determines the recalculation of amounts from foreign currencies into the Russian ruble. The differences that arise will relate to the expenses and income of the organization, which are written off to 91 accounts.

Schematic of active and passive registers

The transactions that should occur when account 57 is closed suggest:

- Debit 57 Credit 91.1 – plus the difference when the Central Bank exchange rate increases;

- Debit 91.2 Credit 57 – minus the difference when the Central Bank rate decreases;

- Debit 91.2 Credit 57 – bank commission amount.

An example of acquiring accounting at an enterprise

Let's consider the process of accounting for non-cash payment by bank card at a conditional enterprise X. The cashier at the end of the work shift generates a Z-report, which contains the following information: the amount of revenue from sales by bank transfer - 180,000 rubles. (of which VAT is RUB 27,457.63). The data is transmitted to the accountant who makes the following entries:

- Dt 57 Kt 90.1 – receipt of revenue from sales via bank cards is reflected – RUR 180,000.

- Dt 90.3 Kt 68 – VAT charged on sales – RUB 27,457.63.

- Dt 51 Kt 57 - money was received into the company’s account minus the commission - 177,300 rubles.

- Dt 91 Kt 57 – shows the commission for banking services provided 1.5% = 2700 rubles.

57 accounting account is one of the main cash accounts used by the enterprise to make payments in rubles and foreign currency.

Example of invoice registration 57

The store received cash revenue of 50 thousand rubles for the shift. At the end of the shift, the collectors arrived, with whom the store had an agreement for the provision of services with a commission of 0.5%. Part of the proceeds - 30 thousand rubles - was paid using acquiring (there is a service agreement with the bank at 0.2%). As a result, the accountant generated the following entries:

- Dt. 50 – Kt. 90.01 – 50,000 rubles – cash revenue was reflected in accounting on the basis of PKO.

- Dt. 57-02 – Kt. 50 - 50,000 rubles - money is transferred to collectors on the basis of the transfer sheet.

- Dt. 51 – Kt. 57-02 – 50,000 rubles – the proceeds were deposited into the current account. The client received a statement from the bank.

- Dt. 91.2 – Ct. 51 – 250 rubles – collection services, commission.

- Dt. 57 – Kt. 90 – 30,000 rubles – money received through acquiring.

- Dt. 51 – Kt. 57 – 30,000 rubles – crediting of acquiring proceeds.

- Dt. 91.2 – Ct. 51 – 60 rubles – bank commission for acquiring services.

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 50 | 90.01 | 110 000 | Reflection of revenue | KO-1 |

| 57.02 | 50 | 110 000 | The funds were transferred to the collector | KO-2, receipt for bag |

| 51 | 57.02 | 110 000 | Funds are credited to the account | Bank account statement |

| 91.02 | 51 | 220 | Bank commission for receiving and transferring funds | Bank account statement |

| 57 | 51 | 100 000 | The funds were written off for transfer to an account at Nimex CJSC | Statement from the sending bank on the account |

| 51 | 57 | 100 000 | Reflection of cash receipts | Statement of the recipient bank on the account |

Linden LLC is engaged in the sale of goods. At the end of the working day, the total amount of revenue is RUB 400,000.00, including VAT RUB 61,016.95:

- Cash payment – RUB 210,000.00, including VAT RUB 32,033.90;

- Cashless payment – RUB 190,000.00, including VAT RUB 28,983.05;

- Bank commission – 1.5%.

| Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| 50 | 90 | 400 000,00 | Revenue receipt | Cash register |

| 57 | 90 | 190 000,00 | Reflection of revenue by bank transfer | Money orders |

| 90.03 | 68 | 61 016,95 | VAT charged on sales | Packing list |

| 51 | 57 | 187 150,00 | Receipt of funds by bank transfer, taking into account bank commission. | Bank statement |

| 91 | 57 | 2 850,00 | The bank's acquiring commission is reflected | Bank statement |

READ MORE: Accounting in an Orthodox parish close account 74