Accounting for export transactions in 1C 8.3 Accounting - step-by-step instructions

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

The organization entered into an export contract with a foreign buyer LadystyleKz (Kazakhstan) for the supply of non-raw materials in the amount of 15,000 USD.

On February 15, the products “Kate” women’s sandals (1,000 pairs) worth 15,000 USD were exported to the buyer LadystyleKz.

In accordance with the contract, the transfer of ownership of the goods occurs at the moment the goods are transferred by the carrier to the buyer's warehouse. Delivery basis - DAP Almaty.

On February 18, the products were delivered to the buyer’s warehouse.

On February 20, the buyer of Ladystyle Kz transferred 100% postpayment for goods in the amount of 15,000 USD.

Conditional courses for example design:

- February 15, the exchange rate of the Central Bank of the Russian Federation is 62.00 rubles/USD;

- February 18, the rate of the Central Bank of the Russian Federation is 63.00 rubles/USD;

- On February 20, the exchange rate of the Central Bank of the Russian Federation was 69.00 rubles/USD.

Let's look at the step-by-step instructions for processing export operations in 1C 8.3. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Sales of finished products for export (EAEU) | |||||||

| Shipment of finished products for export | |||||||

| February, 15 | 45.02 | 43 | 258 356,16 | 258 356,16 | 258 356,16 | Shipment of finished products | Sales (act, invoice) - Shipment without transfer of ownership |

| Issuance of export invoices in foreign currency (VAT rate 0%) | |||||||

| February, 15 | — | — | 15 000 | Issuing invoices for shipment in foreign currency (VAT rate 0%) | Invoice issued for sales | ||

| Sales of shipped products | |||||||

| 18th of Febuary | 62.21 | 90.01.1 | 945 000 | 945 000 | 945 000 | Revenue from product sales | Sales of shipped goods |

| 90.02.1 | 45.02 | 258 356,16 | 258 356,16 | 258 356,16 | Write-off of product costs | ||

| Receipt of payment from a foreign buyer | |||||||

| February 20th | 52 | 62.21 | 1 035 000 | 1 035 000 | Receipt of payment from a foreign buyer to a transit account | Receipt to the bank account - Payment from the buyer | |

| 62.21 | 91.01 | 90 000 | 90 000 | 90 000 | Revaluation of receivables in foreign currency | ||

| Submission of a statistical report to the Federal Customs Service in electronic form | |||||||

| 28th of February | — | — | 15 000 | Submission of a statistical report to the Federal Customs Service in electronic form | Regulated report - Statistical form of accounting for the movement of goods | ||

For the beginning of the example, see the publication:

- Purchase of materials for production of products

Find out about the release of products with the write-off of materials according to specifications (without the subconto Products)

List of documents required for export registration

- Contract with all attachments, addenda and specifications

- Invoice, proforma invoice (6-12 pcs)

- Packing list, 6-12 pcs.

- Transport documents (CMR, TTH, 6-12 pcs.)

- Information about the contract (A unique number assigned by the bank to a contract amounting to more than 6,000,000 rubles; a transaction passport was previously provided)

- Technical description for the product, technical. Passport

- Certificate of origin (ST-1/ST-2 or Form A)

- Permits: veterinary or phytosanitary certificate (if necessary)

- In case of prepayment under the contract - documents confirming prepayment for the goods (payment order, bank statement)

- Documents confirming payment of customs duties (payment order).

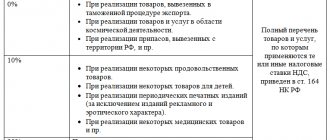

Regulatory regulation

When exporting, a 0% VAT rate is applied, which must be confirmed. To do this, you should collect a package of documents and submit it simultaneously with the VAT return to the Federal Tax Service.

Please note that exports to the EAEU countries (Russia, Belarus, Kazakhstan, Armenia, Kyrgyzstan) differ from shipments to non-CIS countries. The main regulatory document when working with partners from the EAEU is the Treaty on the Eurasian Economic Union dated May 29, 2014 (EAEU Treaty).

Taxation of export transactions is regulated by:

- Appendix No. 18 to the EAEU Treaty - the Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, performing work, and providing services (EAEU Protocol).

- The Tax Code of the Russian Federation in the part that is not regulated by the EAEU Protocol, as well as in cases where the Protocol makes reference to local legislation.

The moment of transfer of risks from the seller to the buyer according to Incoterms (Incoterms) and the moment of transfer of ownership of goods should not be confused.

The contract must indicate the moment of transfer of ownership, because according to this date:

- the asset is registered with the buyer;

- the buyer becomes indebted to the supplier for payment;

- Revenue in foreign currency is recalculated into rubles if there has been no prepayment.

When exporting non-commodity goods, there are different procedures for applying input VAT deductions depending on when they were purchased:

- until 07/01/2016 - VAT deduction at the time of confirmation of the 0% rate or not confirmation of it, if 180 days have passed for collecting documents, separate VAT accounting is maintained;

- from 07/01/2016 - VAT is deducted in the general manner; separate VAT accounting is not maintained (Federal Law dated 05/30/2016 N 150-FZ).

We will consider the export of non-commodity goods that were purchased and sold after 07/01/2016.

Services and place of sale.

When assessing VAT on services, the place of sale is of significant importance - the application of the zero rate in relations between business entities from different countries depends on this. Of course, the rules established by the organizers of the Customs Union contain certain nuances in this sense.

For example, the imposition of this tax on services for holding exhibitions depends on the purpose of these exhibitions. If they are carried out as advertising, then Art. 1 and 3 of the Protocol of December 11, 2009 “On the procedure for collecting indirect taxes when performing work and providing services in the Customs Union” (hereinafter referred to as the Protocol on Services). According to them, advertising services include services for the creation, distribution and placement of information intended for an indefinite number of persons and designed to generate or maintain interest in an individual or legal entity, goods, trademarks, works, services, by any means and in any form. The place of sale of advertising services provided to a taxpayer of a member state of the CU is always recognized as the territory of that state.

As a result, VAT for the provision of such services is levied in a member state of the Customs Union, the territory of which is recognized as the place of sale of services, in accordance with the tax legislation of this state (Letter of the Ministry of Finance of Russia dated June 26, 2012 No. 03 07 15/68 [2]).

But the place of sale of services for organizing exhibitions in the field of culture and art is determined by the place where these exhibitions are actually held (clause 3, clause 1, article 3 of the Protocol on Services). Article 3 of the Protocol on Services lists other types of work and services for which the place of sale is recognized as the territory of a CU member state.

For example, the place of implementation of development work performed by a Belarusian organization for a Russian organization is recognized as the territory of the Russian Federation, and taxation of this work is carried out in accordance with the Tax Code of the Russian Federation. According to Art. 161 of the Tax Code of the Russian Federation in this case, the Russian organization is a tax agent obligated to calculate and pay VAT to the budget of the Russian Federation (Letter of the Ministry of Finance of Russia dated July 5, 2013 No. 03 07 13/1/26068).

If the services are not listed in paragraphs. 1 – 4 p. 1 tbsp. 3 of the Protocol on Services, then in accordance with paragraphs. 5 clause 1 of this article, the place of sale of work (services) is recognized as the territory of a member state of the Customs Union, the taxpayer of which carries out the work (renders services) [3]. In this case, services are not subject to VAT in the Russian Federation (Letter of the Federal Tax Service of Russia dated May 31, 2012 No. ED-3-3/ [email protected] [4]).

Export of finished products in 1C 8.3

In our example, the transfer of ownership of finished products occurs not at the time of shipment, but at the time of delivery of the product to the buyer’s warehouse. Such a shipment is formalized by the document Sales (acts, invoice) transaction type Shipment without transfer of ownership in the section Sales - Sales - Sales (acts, invoices) - button Sales - Shipment without transfer of ownership).

Let's look at the features of filling out the Implementation document (act, invoice) following an example.

Document header

- Counterparty is a foreign buyer with whom a contract has been concluded. Selected from the Contractors directory.

When entering the Contractors of a buyer from the Eurasian Economic Union into the directory, you must provide the following data: PDF

- Country of registration - select KAZAKHSTAN from the drop-down list. Important for auto-filling the tabular part of the document Implementation (act, invoice) ;

- Tax number;

- Reg. number ;

- The TIN is filled out only for a foreign company that has registered for tax purposes in the Russian Federation. This is not our case.

- Agreement is a contract under which mutual settlements are carried out with a foreign buyer.

The agreement with the buyer in foreign currency must be completed as follows:

- Type of agreement - With the buyer ;

- Price in - USD , i.e. the currency in which the contract was concluded;

- Payment in - switch USD , i.e. payment currency.

In the Prices form in the document, the exchange rate is set from the Currency on the date of the document Sales (deed, invoice) .

Tabular part of the document

On the Products , information about the products being shipped is indicated (name, quantity, price, VAT rate, as well as accounting accounts, HS code, item group in the Subconto ):

- Nomenclature - products shipped to a foreign buyer are selected from the Nomenclature .

For goods (products) intended for export, be sure to fill out the following field in the nomenclature card:

- Commodity Nomenclature of Foreign , according to the Decision of the Council of the Eurasian Economic Commission dated July 16, 2012 N 54 - if the product (product) is a raw material , then the card with the Commodity Nomenclature of Foreign Economic Activity code should have the Commodity Commodity .

The unit of measurement of the nomenclature must correspond to that established by law for a given HS code. In our example, the Unit is par .

This is important for filling out the report Statistical form for recording the movement of goods (approved by Decree of the Government of the Russian Federation of June 19, 2020 N 891). The upload file is checked, among other things, for the correctness of the unit of measurement of the item according to the HS code.

- Commodity nomenclature code - the product code can be entered manually by selecting from the Commodity Nomenclature of Foreign Economic Activity Classifier or pre-filled in the item card. Then the value will be inserted into documents automatically.

- Price and Amount - the columns are filled in in currency, since the agreement was concluded in USD.

- % VAT - 0% , the VAT rate applied when selling goods for export.

- Transfer account - account 45.02 “Finished products shipped” is used to reflect movements of shipped finished products when the proceeds from their sale are not immediately recognized in accounting. In our example, this is due to the fact that ownership of the goods does not pass from the seller to the buyer at the time of shipment.

a member country of the EAEU is selected in the Counterparty card in the Country of Registration the following columns will be automatically filled Sales document (act, invoice)

- % VAT with a value of 0%;

- The HS code is a code from the nomenclature card.

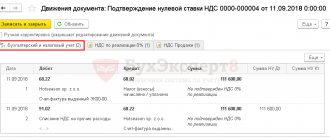

Postings according to the document

The document generates the posting:

- Dt 45.02 Kt - shipment of finished products without transfer of ownership at actual cost.

The document is filled out in the currency based on the contract. The amounts in the entries are reflected in rubles. This is due to the fact that accounting in the Russian Federation is carried out in rubles. The value of assets or liabilities in foreign currency is subject to conversion into rubles (clause 4 of PBU 3/2006).

Revenue in accounting and accounting records has not yet been recognized, since there is no transfer of ownership of the products from the seller to the buyer (clause 12 of PBU 9/99, clause 3 of Article 271 of the Tax Code of the Russian Federation).

The tax base for VAT in foreign currency is recalculated into rubles at the rate of the Central Bank of the Russian Federation on the date of shipment, i.e., the preparation of the first primary document addressed to the buyer (clause 3 of Article 153 of the Tax Code of the Russian Federation, clause 5 of the EAEU Protocol).

Control

Calculation of the tax base for VAT

Documenting

The organization must approve the forms of primary documents, including the document for the sale of goods. In 1C, for internal document flow, a consignment note in the TORG-12 form is used.

The form can be printed by clicking the Print button – Consignment note (TORG-12) of the Sales document (act, invoice) . PDF

As a rule, a foreign buyer is issued:

- invoice-proforma;

- invoice;

- invoice (VAT-invoice), etc.

Documents are prepared with translation into a foreign language. Such forms are not implemented in 1C and can be modified independently.

Sold it - paid the tax.

The goods were initially imported from a CU member state into the territory of the Russian Federation for participation in an exhibition or to a storage warehouse, but for the purpose of further sale. At the time of subsequent sale of such goods, it must be taken into account that, in accordance with clause 1.4 of Art. 2 of the Protocol on Goods, if a taxpayer of one CU member state acquires goods that were previously imported into the territory of this CU member state by a taxpayer of another CU member state, indirect taxes on which were not paid, then VAT is paid by the taxpayer of the CU member state to the territory from whom the goods were imported is the owner of the goods.

In this case, VAT is collected by the tax authority of the CU member state into whose territory the goods are imported, at the place of registration of the taxpayer - the owner of the goods. The owner is understood as a person who has the right of ownership of goods or to whom the transfer of ownership of goods is provided for by an agreement (contract) (clause 2 of the Protocol on Services).

Thus, in this situation, indirect taxes are paid to the tax authority by a Russian taxpayer purchasing such goods on the basis of an agreement (contract), including one concluded after the date of import of goods from the territory of another CU member state.

In accordance with Art. 147 of the Tax Code of the Russian Federation, the place of sale of goods is considered to be the territory of the Russian Federation if, at the time of the start of shipment or transportation, the goods are located on its territory. That is, in the general case, the territory of the Russian Federation is not recognized as the place of sale of goods shipped from the territory of another CU member state and intended for sale to Russian economic entities, and Art. 161 of the Tax Code of the Russian Federation in terms of establishing the obligation for Russian taxpayers to pay VAT as a tax agent does not apply.

If the goods were previously exported to participate in an exhibition or placed in a storage warehouse, then the place of sale of such goods is the territory of the Russian Federation and operations for their sale are recognized as subject to VAT in the Russian Federation. For these transactions, a zero tax rate is applied, subject to the submission to the tax authorities of the documents provided for in paragraph 2 of Art. 1 of the Protocol on Goods (Letter of the Federal Tax Service of Russia dated April 10, 2012 No. ED-4-3 / [email protected] [6]).

Issuance of export invoices in foreign currency (VAT rate 0%)

Despite the fact that a Russian invoice is not required for a foreign buyer and ownership of the products has not yet been transferred, the organization is obliged to draw up an invoice for export sales according to the general rules no later than 5 days from the date of shipment (clause 3 of article 168 of the Tax Code of the Russian Federation , clause 17 of the Rules for maintaining a sales book, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137).

It is allowed to draw up not only the SF, but also the UPD (Letter of the Federal Tax Service of the Russian Federation dated 07/06/2016 N ED-4-15/12070).

An invoice for shipped export goods is issued using the Issue an invoice at the bottom of the Sales document (act, invoice) .

The Invoice document issued is automatically filled with data from the Sales document (act, invoice) . Operation type code – “01” Sales of goods, works, services...”.

The invoice was issued in foreign currency, since the transaction is expressed in foreign currency (Clause 7, Article 169 of the Tax Code of the Russian Federation):

If the SF is not transferred to a foreign buyer, then the Checked (transferred to the counterparty) can be left unchecked. The presence of a checkbox is for reference information; it does not affect the movement of the document and the filling out of the purchase and sales books.

SF with a VAT rate of 0% does not by default enter the sales book simultaneously with sales, as happens when shipping on the domestic market. But only at the time of determining the tax base for VAT for export, if (clause 9 of Article 167 of the Tax Code of the Russian Federation):

- export confirmed within / later than 180 days - on the last day of the quarter in which supporting documents were collected;

- export is not confirmed within 180 days - on the last day of the quarter in which the sale took place.

The moment of determining the tax base for VAT is not specified in the EAEU Protocol, therefore, on this issue one should be guided by the Tax Code of the Russian Federation (clause 5 of the EAEU Protocol, clause 9 of Article 167 of the Tax Code of the Russian Federation).

In the Northern Federation, for shipment to the EAEU, it is necessary to indicate the HS code in column 1a “Product type code” (clause 15, clause 5, article 169 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated October 7, 2016 N 03-07-11/58589). PDF The data will be filled in automatically if the HS code was previously indicated in the nomenclature card and in the tabular part of the Sales document (act, invoice) in the HS Code .

The document does not generate postings according to BU and NU.

Documenting

The Invoice form was approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137. It can be printed by clicking the Print document Invoice or Sales (act, invoice ) button. PDF

What documents are needed to confirm the zero VAT rate?

To confirm the right to a zero VAT rate, a Russian supplier to OSNO must collect and submit to the tax office at the place of its registration a package of documents, the list of which is given in paragraph 4 of the Protocol. This package traditionally includes an agreement (contract), which is the basis for shipment. At the same time, the buyer under this agreement can also be a person who is not a taxpayer of a country that is part of the EAEU. The main thing is that the consignee is located in a member country of the EAEU.

In addition, the supporting documents include transport, shipping or other documents confirming the movement of goods from the territory of the Russian Federation to the territory of another EAEU state. Here it is necessary to take into account that if for certain types of movement of goods, including the movement of goods without the use of vehicles, the execution of these documents is not provided for by the legislation of the EAEU member state, then such documents do not need to be submitted to confirm the right to a zero rate.

As we can see, the fact that when moving goods and vehicles between the countries of the EAEU, customs inspection may not be carried out seems to have been taken into account. However, in practice problems still arise. Thus, tax authorities often require the submission of border control coupons at automobile border checkpoints to confirm the right to a zero rate. Is such a requirement legal? In paragraph 4 of the Protocol, as we remember, we are talking not only about shipping and transport documents, but also about other documents confirming the movement of goods, which are provided for by the legislation of the countries party to the agreement. In this case, the customs officer at the place of departure, on the front side of the departure control coupon, puts down the date and time of the end of customs control, signs, certifies the entry with an LNP stamp and transfers the control coupon to the carrier for border control (clause 59 of the instructions on the actions of customs officials, approved. Order of the Federal Customs Service of Russia dated May 26, 2011 No. 1067). It turns out that the border control coupon can indeed be used to confirm the 0 percent VAT rate for exports to the EAEU countries and its requirement does not contradict clause 4 of the Protocol.

Difficulties with documents that confirm border crossing may also arise for taxpayers sending goods via a delivery service (DHL, Fedex, UPS, etc.) or by regular mail. In this situation, to answer the question about the necessary documents, you will have to turn to the rather old, but still valid Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 07/06/04 No. 1200/04. It concludes that “other documents” for the purposes of applying the zero VAT rate mean those that are equivalent to transport and shipping documents in their content and include information about the method of delivery and the route of the goods, taking into account the type of transportation or characteristics of the cargo (for example, baggage and postal receipts, a list of wagons transported in one consignment note, documents for the transportation of items by a special communications service, etc.).

In our opinion, this means the following. If transportation is carried out by a delivery service (carrier), then to confirm the 0 percent VAT rate when exporting goods from Russia to the EAEU countries, it is necessary to submit shipping documents drawn up by the carrier and containing information about the delivery method and route, from which it would be clear that the goods moved from the territory of the Russian Federation to the territory of another country - a member of the Treaty. And if goods are sent by mail, then such a document can also be a receipt containing the details of the sender and recipient.

Go ahead. The third document that the Protocol requires to be submitted to confirm the zero rate is an application for the import of goods and payment of indirect taxes with a note from the tax authority of the EAEU member state into whose territory the goods were imported regarding the payment of indirect taxes (exemption or other procedure for fulfilling tax obligations). The form of this application can be found in another international document - Protocol of December 11, 2009 “On the exchange of information in electronic form between the tax authorities of the EAEU member states on the paid amounts of indirect taxes.”

Finally, the Protocol lists a bank statement as a document required to confirm the “right to zero”. But at the same time, a reservation is made that it is required unless otherwise provided by the legislation of a member state of the EAEU. Those. in this case, Russian exporters have the opportunity to take advantage of the rules of paragraph 1 of Art. 165 of the Tax Code of the Russian Federation, which does not require such an extract.

Summarize. The set of supporting documents for export to the EAEU countries must include only two documents: an application and an agreement (contract). If the movement of goods across the border is recorded by any document, this document is also included in the “confirmation package”.

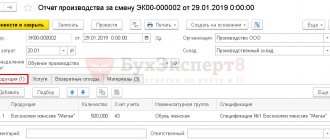

Sales of shipped products

Sales of shipped products for export in 1C 8.3 Accounting is prepared with the document Sales of shipped goods in the Sales – Sales – Sales of shipped goods section – Create button.

The document reflects the transfer of ownership of goods based on a previously completed shipment. It is convenient to enter it on the basis of the document Sales (deed, invoice) type of operation Shipment without transfer of ownership .

Let's look at the features of filling out the document Sales of shipped goods using the example.

- Number - the serial number of the document in 1C, assigned automatically when saving the document;

- from - the date of transfer of ownership of the product from the seller to the buyer under the contract. In our example, the date the carrier transfers the goods to the buyer’s warehouse;

- A shipment document is a Sales document (act, invoice) , which was previously issued for the shipment of products without transfer of ownership.

Postings according to the document

The document generates transactions:

- Dt 90.02.1 Kt 45.02 - write-off of production costs;

- Dt 62.21 Kt 90.01.1 - revenue from sales of products, where: the unpaid portion is assessed at the exchange rate on the date of sale from the Currency .

Control

Calculation of the ruble amount of revenue from the sale of finished products for export.

Please note that revenue in foreign currency is converted into rubles at the exchange rate of the Central Bank of the Russian Federation on the date of recognition of income, i.e., sale, but the rate also depends on the payment procedure.

In our example there was no prepayment. Revenue in accounting and accounting records is calculated at the exchange rate on the date of sale (clause 9 of PBU 3/2006; clause 8 of Article 271 of the Tax Code of the Russian Federation).

Tax base for VAT

According to the legislation, the tax base for VAT in foreign currency is recalculated into rubles at the rate of the Central Bank of the Russian Federation on the date of shipment (clause 5 of the EAEU Protocol), the rate on the date of transfer of ownership is not taken into account. Therefore, revenue in accounting and NU may differ from the tax base for VAT.

When converting revenue from foreign currency into rubles for:

- BU and NU rate is applied by the Central Bank of the Russian Federation on the date of the advance and on the date of sale (transfer of ownership) (clause 9 of PBU 3/2006, clause 8 of Article 271 of the Tax Code of the Russian Federation);

- To calculate the tax base for VAT, only the exchange rate of the Central Bank of the Russian Federation on the date of shipment (transfer) of goods is used (clause 3 of Article 153 of the Tax Code of the Russian Federation).

The tax base for VAT is determined at the rate of the Central Bank of the Russian Federation on the date of shipment, so it will differ from the sales amount in accounting and tax accounting in ruble equivalent if:

- there was an advance payment;

- the date of transfer of ownership does not coincide with the date of shipment.

In our example, there was no prepayment, and the revenue in accounting and accounting records does not coincide with the VAT tax base because the USD exchange rate is different on the date:

- shipments - 62 rubles;

- sale (transfer of ownership of products) - 63 rubles.

Income tax return

In the income tax return:

Revenue from the sale of finished products for export is reflected in the income from sales:

Sheet 02 Appendix No. 1:

- page 010 “Proceeds from sales - total”, including: page 011 “revenue from sales of goods (works, services) of own production.” PDF

Learn more about Setting up Accounting Policies in NU

The cost of finished products sold is reflected in direct expenses:

Sheet 02 Appendix No. 2:

- page 010 “Direct costs related to goods sold...”. PDF

How to confirm zero rate

The next point that needs to be addressed is procedural. How exactly and when should the collected supporting documents be submitted to the tax office?

The deadline is provided for in paragraph 5 of the Protocol. Exporters are given 180 calendar days from the date of shipment of goods to collect documents. If the documents are not collected within this period, the transaction will be subject to VAT in the usual manner, i.e. at a rate of 20 (10) percent based on the results of the tax period in which the shipment occurred. In this case, the tax is paid with penalties, which are accrued starting from the 181st day after shipment (resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 16, 2006 No. 15326/05 and dated March 11, 2008 No. 15079/07 in case No. A56-7714/2006).

If, in the future, supporting documents are nevertheless collected and submitted to the inspectorate, the paid tax can be offset or returned in the usual manner (i.e., according to the rules of Article of the Tax Code of the Russian Federation), which is also expressly stated in paragraph 5 of the Protocol. Well, if you cannot collect the documents, then the VAT paid can be taken into account as an expense when taxing profits. The fact is that such VAT is not subject to the prohibition established by pop. 19th century 270 of the Tax Code of the Russian Federation, since the tax was not presented to buyers, but was paid by the seller at his own expense. (letters of the Federal Tax Service of Russia dated December 24, 2013 No. SA-4-7/23263 and the Ministry of Finance of Russia dated October 20, 2015 No. 03-03-06/1/60045, dated July 27, 2015 No. 03-03-06/1/42961). As for the rules for submitting documents, they are regulated in the Procedure for filling out a tax return for value added tax (approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] ). This document states that when selling goods to the EAEU countries, Section 4 must be filled out in the tax return. Please note: for transactions for which it was not possible to collect documents within 180 days, you will have to submit an updated declaration for the shipment period. And the supporting documents we discussed above are included as an appendix to the declaration completed in this way.

Receipt of payment from a foreign buyer

In our example, postpayment is made. At the time of sale, a receivable from the foreign buyer was formed under Dt 62.21, calculated as of the date of transfer of ownership.

At the moment the buyer repays the debt under the contract in foreign currency, the receivables are revalued at the rate of the Central Bank of the Russian Federation on the day of payment (clause 7 of PBU 3/2006, clause 8 of Article 271 of the Tax Code of the Russian Federation). As a result, exchange rate differences arise.

Receipt of payment from a foreign buyer is registered with the document Receipt to current account transaction type Payment from buyer in the Bank and cash desk section – Bank – Bank statements – Receipt button.

Let's look at the features of filling out the document Receipt to a current account using our example.

Bank accounts must first be filled out : information about the Organization's currency account to which payment is received from the buyer must be entered.

Payment in foreign currency is credited to a transit foreign currency account.

In our example, settlements under the contract are carried out in foreign currency. PDF As a result of selecting such an agreement in the Receipt to Current Account , settlement accounts with the buyer are automatically set in the field:

- Settlement account - 62.21 “Settlements with buyers and customers (in foreign currency)”;

- Advances account - 62.22 “Calculations for advances received (in foreign currency).”

Since payment by the buyer is made in foreign currency, the document states:

- Bank account - a transit currency account in USD, into which funds are received from the buyer;

- Accounting account - “Currency accounts”, is installed automatically when selecting a foreign currency bank account;

- Amount - payment amount in currency according to the bank statement;

- VAT rate — 0%.

Postings according to the document

The document generates transactions:

- Dt Kt 62.21 - receipt of postpayment from the buyer to the transit currency account;

- Dt 62.21 Kt 91.01 - revaluation of receivables in foreign currency.

Control

Calculation of exchange rate differences when revaluing accounts receivable

Income tax return

In the income tax return:

Positive exchange rate differences are reflected in non-operating income: PDF

- Sheet 02 Appendix No. 1 page 100 “Non-operating income.”

Conditions of the export transaction

The more detail you write down the terms of the transaction in the contract, the fewer difficulties will arise during export. Even the smallest details should be discussed and recorded in advance.

Parties to the transaction

The parties to the transaction are: the seller of the goods and the buyer. In some cases, there is an intermediary in this chain. For example, you sell goods not directly, but to a cargo terminal or logistician.

Subject of the transaction

This is what you sell. The contract must specify and describe the product and its characteristics.

- Name of product;

- type of product;

- material of manufacture and characteristics;

- purpose of the goods.

It is necessary to describe the product in as much detail as possible. This will allow you to assign it the correct HS code, and will also save you from problems with a potential buyer and customs.

Product quantity and packaging

The contract must specify the quantity of goods, their weight or volume. Also indicate how the product will be packaged.

The information specified in the contract must correspond to the actual size of the supply. There is no need to make surprises for the buyer; an extra unit of goods in a shipment can result in a problem with customs.

Transaction amount and cost of goods

Indicate the cost of one unit of goods and the entire lot. It is important to specify the details of payment for the transaction in the contract:

- contract currency;

- currency in which the goods will be paid for;

- method of calculating payment when converting currency.

Currency control

Currency control is a set of measures that the state takes to ensure compliance with currency legislation, as well as the legitimacy of currency transactions.

Currency control in Russia is provided by: the Government of the Russian Federation and the Central Bank of the Russian Federation. Other authorized Russian banks also act as currency control agents.

Passing currency control is mandatory for all participants in foreign trade. It is regulated by the Federal Law “On Currency Regulation and Currency Control”.

Terms of payment

The contract must specify the following payment terms:

- procedure for making payments;

- payment stages;

- availability of prepayment or deferred payment;

- the procedure for returning advance payments in the event of a deal failure;

- how the payment is made.

Delivery conditions

It is worth agreeing on the delivery terms of Incoterms before drawing up the contract.

International commerce terms (Incoterms) are eleven generally accepted terms, abbreviated by the first three letters, that govern the international supply of goods. Application of these rules:

- establishes the rights and obligations of the seller and buyer in foreign trade;

- delineates responsibilities between them;

- delimits risks associated with cargo delivery.

Deadlines

Indicate the moment of shipment and the timing of delivery of the goods to the buyer.

It is best to tie delivery times to the time of receipt of advance payment. This is the safest option for the exporter.

The duration of the contract is usually one year, but it is always necessary to make a note “until the parties fully fulfill their obligations.”

Conditions for acceptance of goods

If you work without prepayment, then these conditions should be written down separately. For example, indicate the percentage of probable defects in the batch and other possible force majeure. This way the buyer will not be able to avoid paying for the goods.

Responsibility of the parties and resolution of disputes

Be sure to include ways to resolve disputes in the contract. For example, it will be difficult for you to sue the buyer according to the norms of foreign laws and in a foreign court. It is best to be on the safe side by specifying Russia as the place of concluding the contract.

In a separate paragraph, write down a list of circumstances that can be considered force majeure. Force majeure exempts the parties to a transaction from liability, so it is important to indicate by what rules these situations are determined.

It is recommended to register a certain percentage of the cost of the cargo, which will be charged as a penalty for each day the shipment is idle.

Requisites

Write down in detail the data and contacts of the parties to the transaction:

- country and city;

- company name, position, full name;

- telephone number, email address;

- the name of the bank with its contacts.

All business correspondence should be saved; this can be helpful in resolving possible disputes.

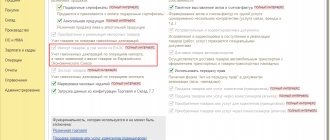

Submission of a statistical report to the Federal Customs Service in electronic form

When exporting to the EAEU, the Organization is obliged to submit to the Federal Customs Service (Federal Customs Service) a statistical form for recording the movement of goods (approved by Decree of the Government of the Russian Federation of June 19, 2020 N 891).

The statistical form in the Federal Customs Service is drawn up using the regulated report Statistical form for accounting for the movement of goods in the section Reports - 1C-Reporting - Regulated reports - the Create button - the All tab - the By Recipients folder - the Federal Customs Service folder.

The report is filled out manually by exporters. PDF

The report period must be selected before the report is recorded. If an incorrect period is selected, you must close the report without saving it and then create a new one.

Yellow cells are filled in manually. Data in green cells is calculated automatically based on the information entered into the report.

After filling out the Statistical form for accounting for the movement of goods, you should Write it down , then using the appropriate buttons, the report can be:

- unload,

- check the unloading,

- type,

- send to the Federal Customs Service.

The statistical form is submitted to the customs authorities by the 10th day of the month following the month of shipment or receipt of goods. It can be downloaded from 1C and sent from your personal account on the FCS portal

For failure to submit or untimely submission of a statistical form for recording the movement of goods to the Federal Customs Service, a fine will be charged (Administrative Code of the Russian Federation, Art. 19.7.13):

- for officials - from 10,000 rubles. up to 15,000 rubles;

- for legal entities - from 20,000 rubles. up to 50,000 rub.

What about imports?

The main provisions for the payment of customs VAT when importing goods remained the same compared to the provisions of the Agreement between Russia and Belarus of September 15, 2004, with the exception of the following points:

— new rules for determining the tax base have been introduced;

— the set of documents submitted to the tax authority is supplemented with an information message;

— there are no provisions on the specifics of paying mandatory payments during the transit of goods and exemption from VAT when importing goods for processing for the purpose of subsequent export of processed products outside the Customs Union.

The general principle of VAT is the calculation and payment of tax by the buyer to the budget of the state into whose territory the goods were imported.

It is important to remember that if goods are purchased on the basis of an agreement between a resident of a member state of the Customs Union and an organization not related to the Triple Alliance, but the goods are imported from the territory of Russia, Belarus or Kazakhstan, indirect taxes are paid by the party to the transaction on whose territory goods imported.

In accordance with the Protocol of December 11, 2009, the tax base for VAT is determined on the date of acceptance of imported goods for registration with the taxpayer based on the cost of purchased goods. The calculated VAT is paid no later than the 20th day of the month following the month in which imported goods were registered or the month in which the payment stipulated by the contract is due.

When importing, the Protocol of December 11, 2009 provides for the obligation to submit a set of documents along with the tax return :

— applications on paper (in four copies) and in electronic form;

— a bank statement confirming the actual payment of indirect taxes on imported goods, or another document confirming the fulfillment of tax obligations to pay indirect taxes, if provided for by the legislation of a member state of the Customs Union;

— transport documents provided for by the legislation of the CU member state, confirming the movement of goods to the territory of another CU member state. The specified documents are not submitted if for certain types of movement of goods the execution of such documents is not provided for by state legislation;

— invoices issued in accordance with the legislation of the CU member state when shipping goods, if their issuance (extract) is provided for by the legislation of the CU member state;

— contracts on the basis of which imported goods were purchased or produced;

- if the goods were shipped from the territory of one state, and the contract was concluded with a company of another state that is not part of the Triple Alliance, it is necessary to submit an information message from the supplier of the goods about the person from whom they were purchased (clause 6, clause 8, article 2 of the Protocol on the export and import of goods);

— commission agreements, orders or agency agreements in cases where they are concluded.

Calculation of VAT when exporting non-commodity goods to the EAEU

Next, using an example, we will consider different options for calculating VAT on the export of non-commodity goods that were purchased and sold starting from 07/01/2016.

The calculation of VAT on export supplies of non-commodity goods in 1C will differ depending on whether the 0% VAT rate is documented within 180 days or not.

Export confirmed within 180 days

Export not confirmed within 180 days

Previously unconfirmed exports were confirmed later than 180 days

VAT under simplified tax system

From a tax point of view, exports of goods to EAEU member countries are practically no different from “regular” exports to other countries. In this case, the VAT rate of 0 percent also applies. And it also needs to be confirmed by submitting a package of documents to the tax authority.

Buy the “Kontur.Declarant” service for generating and sending customs declarations

Please note: these responsibilities arise only for organizations and entrepreneurs on the general taxation system (OSNO). After all, in the list of exceptions established by art. 346.11 of the Tax Code of the Russian Federation for payers of the simplified tax system, there is no “export” VAT (as opposed to “import”). This means that for a “simplified” organization, entering foreign sales markets will not bring any special features in terms of taxation at all: no additional responsibilities for collecting documents, drawing up “zero” invoices, drawing up applications and special declarations in this case for they don't arise. Everything is as usual, as if the goods were sold to a Russian counterparty.