Home / Bankruptcy of a legal entity in 2022: step-by-step instructions

Supervision Financial recovery External management Bankruptcy proceedings Settlement agreement

The process of declaring a legal entity insolvent (bankrupt) takes place according to a certain algorithm; it involves a wide range of persons, including: the debtor himself, creditors, the court, the insolvency practitioner and other participants in the case. For each party, the bankruptcy procedure presupposes the existence of an established procedure, strictly regulated by law. In this material we will tell you how, in accordance with the law, bankruptcy of a legal entity is carried out in 2022. Step-by-step instructions - a list of steps, the implementation of which entails the recognition of a financially insolvent organization as such officially, through the court. We will also consider in detail all the stages (procedures) that are provided for in bankruptcy.

Signs of bankruptcy

The list of grounds for opening bankruptcy proceedings and the specifics of their definition are reflected in Art. 3-6 of Law No. 127-FZ.

The question of declaring a legal entity insolvent may be raised in relation to a company in the following cases:

- The company’s inability to pay its obligations to creditors, including contractual obligations, debts on wages or taxes and other obligatory payments to the budget or extra-budgetary funds.

- The delay in fulfilling these obligations is more than 3 months.

- The amount of debt is at least 300 thousand rubles

At the same time, certain features of determining the amount of debt at the time of going to court or at the time of considering a bankruptcy application are prescribed in Art. 4.1 of Law No. 127-FZ.

When can the Federal Tax Service initiate the bankruptcy of a debtor?

The tax inspectorate has the right to initiate bankruptcy if the debtor has delayed payment of taxes for a period of three months and in the amount of 300,000 rubles for companies , 500,000 rubles for citizens.

3 months

late payment of taxes

300 000 ₽

debt amount for legal entities

500 000 ₽

tax debt for citizens

In general, these are the very signs of the onset of insolvency of the debtor, and there are no special features on the part of the tax authorities in a bankruptcy case. Therefore, debtors, in order to prevent the emergence of grounds for initiating bankruptcy proceedings, can apply to the tax office with an application to change the deadlines for paying taxes in the manner prescribed by the Tax Code of the Russian Federation.

Who initiates bankruptcy proceedings?

The following persons may apply to arbitration to declare a legal entity bankrupt:

- Directly the head of a legal entity mired in debt.

- Any of the creditors whose debt meets the grounds for initiating bankruptcy proceedings.

- The authorized body (FTS) for arrears of payments to the budget and extra-budgetary funds.

- A current or former employee to whom there is arrears of wages.

At the same time, at the time of application, the signs of bankruptcy described above must be confirmed. Even if the debtor partially repaid the debt to the creditor, but its amount still exceeds 300 thousand rubles, then this circumstance does not in any way cancel the right to go to court.

In addition, Article 9 establishes the debtor’s obligation to independently apply to the court for bankruptcy if the following circumstances occur:

- If repaying a debt to one or more creditors will make it impossible to fulfill other financial obligations or timely payment of taxes.

- The authorized body of the debtor company decided to go to arbitration with the debtor’s application.

- There are signs of insolvency, insolvency, or insufficient property to pay off existing debts.

- A possible foreclosure on the company's existing property will make it impossible to pay off its obligations.

- There are three months' salary arrears in respect of any number of employees.

In the listed cases, the manager is obliged to apply to arbitration on his own, without delaying the completion of such an action. Otherwise, he faces administrative, criminal or subsidiary liability if he is found guilty of failure to repay the claims of creditors due to his fault.

When is bankruptcy the only option?

Has the company accumulated so many debts that the company will not be able to pay them off, even if it sells all its property?

The management of the LLC has no other options other than bankruptcy. Various reasons can lead to such a disastrous outcome:

- sanctions and consequences of the economic crisis in the country;

- inflation consumed all profits;

- top managers chose the wrong development strategy;

- It was not a specialist who was put in charge of the company, but a thieves.

The law describes several signs of insolvency, upon the appearance of which the management of the LLC is obliged to file for bankruptcy:

- the total amount of material obligations to all creditors (including the Federal Tax Service, Social Insurance Fund, Pension Fund) exceeds three hundred thousand rubles (in relation to each creditor, the debt is more than ten thousand rubles);

- over the past three months, the debtor company has not paid a penny to any of the creditors;

- salaries to the company's employees, as well as other due payments, are also not made for a long period.

If there are signs of bankruptcy of an enterprise, and the management hesitates to apply to the arbitration court to declare bankruptcy, it risks falling under the provisions of the articles -.

How to apply for bankruptcy of a legal entity?

Depending on the applicant applying to arbitration to declare the debtor bankrupt, the content of the application may differ significantly.

It is strongly recommended that you engage experienced lawyers to prepare all the necessary documents, who will help you thoroughly analyze the situation and competently prepare the application and necessary documents.

Do you need the services of a bankruptcy lawyer?

Take advantage of free assistance from an experienced lawyer using the link below.

Consultation is possible online or in our Moscow office. ASK AN EXPERT

General details:

- Name of the court and its address.

- The applicant’s name, his address (legal, actual, for correspondence) and contact information.

- Name and details of the self-regulatory organization from which the arbitration manager is proposed.

- Request for bankruptcy.

- Signature of the authorized person, date, list of documents.

These are general details of a bankruptcy application that must be indicated regardless of who goes to court.

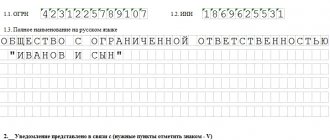

The debtor, declaring his bankruptcy, must indicate in the document in accordance with the provisions of Art. 37 of Law No. 127-FZ:

- Full registration information about yourself.

- The amount of debts and their structure, including the separate identification of various types of claims in accordance with the order of satisfaction - debts under contracts, wages, compensation for harm, etc.

- Justify the impossibility of settlement of your obligations.

- Information about all court cases, enforcement proceedings initiated in the name of the debtor, the amount of debt for each of them.

- Data on all account numbers, banks opened for the debtor.

In the application for declaring the debtor company bankrupt, the creditor, in addition to the above “general” details, will need to indicate:

- Information about the debtor: information from the Unified State Register of Legal Entities, address, contacts.

- Calculation of the amount of claims, including penalties, penalties, etc.

- Description of the essence of the obligation under which the debt arose, supporting documents.

- A reference to a court decision, if one is required to go to court as part of a bankruptcy procedure.

- Confirmation of the fact of the impossibility of satisfying your claims on the part of the creditor and justification for the occurrence of debt: confirmation of shipment of goods, completion of work, etc.

This is a list of mandatory information that must be reflected in the bankruptcy application by the creditor.

Main stages of bankruptcy

Each stage of a company’s bankruptcy is objectively determined by an analysis of the results of the previous stage.

Stage 1: observation

Approved by the court as a mandatory stage of any bankruptcy case immediately after accepting an application from the debtor or creditors in the arbitration court. The financial manager objectively analyzes the financial situation of the company that has filed for bankruptcy (Articles 62-75 of Law 127-FZ).

The managers of the company are allowed to work in the same, “pre-bankruptcy” mode. However, they can no longer freely dispose of the company’s assets. The financial manager now holds his finger on the pulse of transactions with the property and assets of the company, becoming, in fact, the main boss at the enterprise he is analyzing.

The stage lasts no more than seven months. The financial authority records all its considerations regarding the future candidate for bankruptcy in a special report. With him, he will have to speak at a meeting of creditors and defend his position in the dispute if creditors have objections. The report aims to provide a clear answer to two questions:

- Does the debtor have enough money and property to fully pay the creditors' claims?

- Is it possible to restore the profitability of an enterprise without leading to bankruptcy?

The report is actively discussed at a meeting of creditors, which is strictly recorded. The result is a report approved by the majority. Together with the minutes of the meeting, the financial authorities bring it to the judge, and he makes a decision:

- Proceed to the next stage of bankruptcy.

- Terminate the bankruptcy case, since it has been objectively proven that the company is able to pay itself.

Based on the results of the observation stage, the bankruptcy case can either be suspended (the parties have reached a settlement agreement and it is necessary to take a break so that the terms of this agreement begin to be fulfilled), or terminated (the court is convinced that the company’s resources are sufficient to fully repay the debts), or a transition to the next one is announced. stage of bankruptcy.

Stage 2: financial recovery (rehabilitation)

If from the report on the observation stage it became clear to the meeting of creditors, and then to the court, that the enterprise has real potential for development, but management needs time and relief on current loans to get back on track, the second stage of bankruptcy will be declared - financial recovery, or rehabilitation.

Measures to improve the company are described in Articles 76-92 of Law 127-FZ “On Bankruptcy”.

During reorganization, the effect of all penalties, including writs of execution, is frozen. No fines or penalties will be assessed for late payments. Dividends from the company's income are not paid to shareholders. You can dispose of assets only with the permission of the financial manager and only if the result of these transactions clearly has a positive impact on the solvency of the company.

Simply put, all possible relief on loans that will temporarily ease the debt burden on a potential bankrupt will be provided. Rehabilitation lasts no more than two years.

Methods of recovery of a debtor enterprise

The external manager always only gives written consent or prohibition to transactions that the company's management is going to conclude. Beforehand, he carefully studies the possible consequences and risks. If he sees a criminal motive in the deal proposed by the general director, he has the right to petition the court for the complete removal of the manager from office.

The financial authority has the authority to propose a program of action and insist on its application. Eg:

- reduce the size of capital investments and the company's investments in parallel projects;

- increase the efficiency of using available resources;

- reduce operating costs as much as possible;

- conclude agreements on restructuring existing loans;

- find new points of sale of products, etc.

Temporary ban (moratorium) on creditors' claims

The rehabilitation stage is valuable for the debtor in that a temporary ban is imposed on the claims of creditors. They do not have the right to go to court to collect debts. All claims are deferred pending the outcome of the bankruptcy.

A moratorium is declared only under a standard bankruptcy scheme; simplified bankruptcy is carried out without the introduction of such a ban.

However, the ban does not apply to debts on wages, alimony, compensation for harm to health, life, copyrights and claims for current arrears (Article 5 of the Law on Bankruptcy).

The moratorium is automatically lifted upon completion of the bankruptcy case.

Priority of creditors

There can be several categories of creditors. In case of bankruptcy, there is a strict order of satisfaction of their claims:

- The first to receive money are those who suffered physically and mentally due to the fault of the bankrupt. This also includes legal costs and the salary of the financial manager.

- Second in line for their money are the employees of the LLC, to whom the management owes wages or payment in the event of dismissal due to bankruptcy.

- In third place, banks, suppliers, and other creditors will receive money.

The queue is satisfied sequentially: those standing second in line do not have the right to receive money until they have settled with those standing first. Etc.

The financial recovery of an enterprise lasts no more than two years. If the company had money earlier, it can pay off and then the bankruptcy case will be closed. Thirty days before the end of the reorganization stage, the financial authorities draw up a report on the work done and the successes achieved and, just as after the observation stage, defend it before the next meeting of creditors, and then before the judge. Unsubstantiation is not allowed; the report is accompanied by a demonstration of accounting documents.

Are things going well, but are you still far from paying off your debts in full? The court will appoint external administration. Badly? Bankruptcy will be declared and the bankruptcy property will be auctioned.

Stage 3: external control

External administration is not a mandatory stage in a bankruptcy case. It is introduced at an enterprise if the financial manager has convincingly proven in his report that there are changes, there is potential, but it can be accelerated if the previous management is removed from management.

Articles 93-123 of Law 127-FZ allow the introduction of external management bypassing the reorganization stage. To put it simply: if the temporary manager, having analyzed the situation in the company, realized that recovery would not bring results, he recommends that the meeting of creditors introduce external management in the company immediately after the end of the observation stage.

The court appoints a crisis manager (external manager). He will develop an action plan and will work strictly according to it. Curtsies are cancelled. This is a tough new head of the company who cannot be contradicted. The old leadership is completely deprived of its voting rights. The plan usually contains the following measures:

- carefully take inventory of all company assets for hidden financial opportunities;

- close low-profit or completely unprofitable areas of work;

- repurpose. if possible, the economic activities of the enterprise;

- sell liquid assets;

- collect all receivables from the company;

- attract external capital from new shareholders;

- issue new shares of lower value;

- completely replace top and middle level managers in the company and hold a competition for their positions;

- reduce staffing;

- stop releasing products that don't sell.

The list goes on. For example, reducing employee salaries, reducing working hours, etc. are unpopular measures. External administration lasts up to eighteen months, sometimes the court can extend it for another six months.

Stage 4, sad: bankruptcy proceedings

At the stage of bankruptcy proceedings, there is only one way to avoid bankruptcy - by concluding a settlement agreement before the bankruptcy court officially declared bankruptcy. Later it is too late to negotiate. But it is hardly possible to reach an agreement in this situation: this involved the stages of observation, reorganization and external management. At the stage of bankruptcy proceedings, creditors no longer have faith in the debtor.

At this stage, the bankruptcy estate begins to be sold at electronic auctions, and the proceeds are used to pay debt obligations to creditors according to priority.

The external manager is replaced by a bankruptcy manager (if the meeting of creditors and the court decide so). He takes inventory of the bankruptcy estate and indicates the approximate value of each lot. He is assisted in this by invited independent appraisers.

Most often, the bankruptcy estate is not able to cover all the debts of the enterprise. But by the final stage of bankruptcy, hardly anyone expects this: at least they could get something back!

A bankrupt organization is liquidated by decision of an arbitration judge. The Unified State Register of Legal Entities of the Russian Federation is replenished with a corresponding entry, and the legal entity itself is deleted from it.

How to conduct bidding (auctions) for bankruptcy of legal entities

Anyone who correctly fills out the application form and makes a small contribution (up to 10% of the starting price for the lot) can participate in the auction.

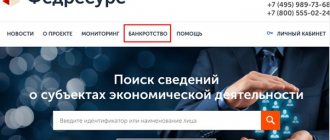

The portal of the Unified Federal Register of Bankruptcy Information is considered the largest electronic platform for electronic auctions. Here the bankruptcy trustee displays information about a specific bankruptcy and all lots.

The auction does not begin immediately; there is a two-month pause. The manager publishes a notice of upcoming auctions in Kommersant. This delay allows all interested parties to collect all documents and prepare for the sale.

Any item belonging to a bankrupt may be included in the lots:

- unfinished buildings;

- land plots;

- special purpose machines and equipment;

- buildings and structures;

- equipment and machines;

- shares and other bankrupt securities.

The prices for the displayed lots are low. It is published a few hours before the auction starts.

Stage 5. Settlement agreement

It is not entirely correct to call the conclusion of a settlement agreement a stage of bankruptcy, because it stands apart from other procedures. Because it is impossible to say from the beginning: will it appear in the bankruptcy case or will the parties not remember about it?

Both sides can propose to disperse amicably, but signing an agreement is possible only if there are no objections from either side. The agreement contains a new schedule for settlements with creditors: where, when and how much money will be transferred. What is the interest rate on loans, payment options using alternative methods, etc. Sometimes, when concluding a contract, third parties are involved who have their own interest in the business. They will pay off creditors, and in return will take a share in the enterprise won back from bankruptcy.

The settlement suspends the bankruptcy case for the periods specified in the agreement. If they come out and the debt is not repaid, the bankruptcy case is pulled out from under the cloth and sent back to proceedings.

“Hidden” stage of bankruptcy

There is also an unobvious stage of bankruptcy that precedes it. It is invisible to most short-sighted leaders, but its consequences are sad. Experts believe that the beginning of the hidden stage of bankruptcy of a legal entity is the deterioration of conditions for entrepreneurship. The difficulties are not yet critical, but if you do not pay attention to them, they will become so over time. Eg:

- debts are slowly growing, often this increase can no longer be controlled;

- The goods produced by the company stopped being sold;

- debtors begin to fall behind on payments;

- the organization begins to spend a lot on its maintenance.

If timely measures are not taken at this invisible stage, real bankruptcy may not be far off.

What role does the arbitration court play at the stages of bankruptcy?

Only an arbitration judge is authorized by law to make decisions during bankruptcy proceedings. This is the main actor in the process. The court is authorized:

- initiate, suspend and close bankruptcy cases;

- appoint and terminate stages of bankruptcy at the request of the parties and the manager;

- approve or refuse to approve the manager’s reports;

- extends the time of bankruptcy stages when expressly permitted by law;

- declares bankruptcy of the debtor;

- appoints a manager controlled and accountable to him.

All stages of bankruptcy take place within the framework of one court case.

Stages of bankruptcy of a legal entity - diagram

In addition to the text describing the stages of bankruptcy of a legal entity, a graphic diagram that clearly demonstrates the bankruptcy process is suitable:

Required package of documents

The list of documents for both the debtor’s and the creditor’s applications is separately prescribed in the provisions of Art. 38 and 40 of Law No. 127-FZ, respectively.

The debtor must attach to the bankruptcy application:

- Justification for the existence of debt: court decisions, decisions on enforcement proceedings, claims and other demands from creditors.

- Confirmation of inability to meet requirements: account statements with balances and cash flows, balance sheet.

- Constituent documents and extract from the Unified State Register of Legal Entities.

- A list of creditors with a full breakdown of all information - from the name and amount of debt to the full address.

- The founder’s decision or the minutes of the general meeting on the decision to apply to arbitration for bankruptcy, including documents on the election (appointment) of a representative to the court.

- Information about the value of the debtor’s property and other assets (the participation of an independent appraiser is required).

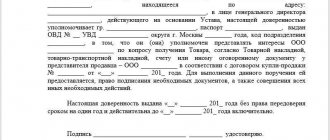

When applying to court for bankruptcy of a creditor (including an employee of a debtor company), in addition to the documents required by the Arbitration Procedure Code of the Russian Federation, you must also attach:

- Confirmation of obligations: court decisions, payslips, information from the FSSP, correspondence with the debtor.

- Evidence of debt: invoices, certificates of completion of work, invoices, etc.

- A power of attorney or other document confirming the authority of the creditor’s representative to go to court.

- Other documents.

If documents are provided in copies, they must be properly certified.

Who can be declared bankrupt

Debtors who fail to make payments on their obligations for more than 3 months may be declared completely insolvent bankrupt. Initiation of the procedure is possible at the request of the enterprise - voluntary bankruptcy or at the request of creditors, as well as authorized bodies. Among the latter, the declaration of insolvency is most often initiated by tax inspectorates, social authorities - the Pension Fund of the Russian Federation or the Social Insurance Fund, the labor inspectorate, and the court.

If an organization voluntarily files bankruptcy documents, the application is submitted to the arbitration court at the place of official registration of the debtor. The form is drawn up in writing, has a unified structure and is signed by the head of the company. Documents confirming the accumulated amount of liabilities must be attached - for example, for tax payments, these can be acts of reconciliation with the Federal Tax Service, decisions or demands for payment of amounts, etc. If there are requests, they should also be presented.

After a detailed consideration of the application and if the evidence presented is justified, the arbitration court may make a decision to initiate bankruptcy proceedings in a simplified or full manner. The sequence of further actions includes monitoring, financial recovery, bankruptcy proceedings directly for the repayment of debts and a settlement agreement.

The organizational and legal form and industry affiliation of a business do not in any way limit the right of a legal entity to initiate bankruptcy proceedings. LLCs, CJSCs, OJSCs, NPFs, individual entrepreneurs, heads of peasant farms, agricultural organizations, financial structures, insurance companies, mutual funds, NPFs, professional participants in the securities market, credit cooperatives (creditor bankruptcy), developers, banks, individuals (by personal bankruptcy of a citizen), etc. The full list is contained in Law No. 127-FZ.

Legal bankruptcy, protecting the interests of the debtor and creditors, includes measures for the financial rehabilitation of the enterprise under the control of the manager. If opportunities are sought for business reorganization, the work is aimed at strengthening the financial and economic activities of the organization with the gradual repayment of all debts and a return to normal functioning.

Bankruptcy procedures for legal entities

Bankruptcy cases for legal entities are complex and multi-stage. The legislation provides for 4 main bankruptcy procedures: supervision, financial recovery, external management and bankruptcy proceedings. Completion of a bankruptcy case is also possible by concluding a settlement agreement.

Each stage, in turn, consists of many actual and legal actions of the arbitration manager, the legal entity itself and creditors.

It is extremely rare that bankruptcy cases go through all stages. Most bankruptcy cases include monitoring and bankruptcy procedures, without encountering the need and possibility of introducing other procedures. Each bankruptcy procedure is introduced by a ruling of the arbitration court based on a decision of a meeting of creditors - after the court has analyzed specific circumstances and entails certain legal consequences. Let's look at each stage step by step.

Sample application for bankruptcy of a legal entity

There is no universal model for all cases of insolvency. On the Internet and on various legal websites you can find both brief and detailed sample statements taken from real cases.

Using them “blindly” without understanding the specifics of the bankruptcy procedure is fraught with consequences: an experienced lawyer should draw up a statement or, at a minimum, check it.

Below is a sample application for bankruptcy of a legal entity for your reference.

Application to the Arbitration Court for bankruptcy of a legal entity

The concept of bankruptcy of legal entities and bankruptcy procedures

From a legal point of view, bankruptcy is a special legal situation of a legal entity in which it is no longer able to fully meet its monetary obligations to creditors.

Insolvency or bankruptcy must be proven and confirmed in an arbitration court. It is the presence of outstanding monetary obligations that is a legal reason for creditors to go to court. The composition and amount of the debt is indicated taking into account the date when the interested party files a claim.

The legislation of the Russian Federation establishes the need to undergo several bankruptcy procedures. Their types are enshrined in the Civil Code of the Russian Federation:

- observation. The procedure and scheme of the monitoring procedure are aimed, first of all, at preserving the property owned by the debtor, as well as at the ongoing verification of its financial condition and economic activities;

- financial recovery. The essence of this procedure is that it gives the debtor a chance to improve his current economic situation, for example, through investments, and protect his own organization from further bankruptcy;

- external control. External management as a bankruptcy procedure consists of appointing an arbitration manager who temporarily assumes obligations to monitor the current economic activities of the organization;

- bankruptcy proceedings. This procedure should be understood as certain actions in relation to the debtor, aimed at promptly satisfying the creditors' claims in full. Bankruptcy proceedings are conducted by a bankruptcy trustee;

- settlement agreement. It is a bankruptcy procedure for a legal entity, in which bankruptcy proceedings may be terminated if the reason for this was a settlement agreement between the creditor and the debtor. The settlement agreement is concluded at the mutual request of the parties. The legal nature of the settlement agreement distinguishes it as a special document, which may be the main and only basis for canceling court proceedings.

Arbitration manager

An arbitration manager is a person appointed by an arbitration court, to whom all powers to dispose of the debtor’s property and funds are actually transferred.

Depending on the procedure, it may be called differently (bankruptcy manager), but this does not change the fundamental essence. Appointed at the request of the applicant, however, in case of violations or obvious abuses during the bankruptcy procedure, he may be removed from the case and even brought to administrative or even criminal liability.

IMPORTANT: There is a misconception that if you bring “your” manager first, he will openly play along with the applicant in the bankruptcy procedure. Alas, the main task of a manager is objectivity and impartiality. He may be more or less loyal, but he has no right to openly lobby the interests of an individual creditor or debtor.

The requirements for an arbitration manager are quite serious:

- at least 2 years of experience in management positions;

- higher economic or legal education;

- internship in an SRO and subsequent membership in the organization;

- no criminal record or disqualification for tax and financial offences.

For each stage of bankruptcy, Federal Law No. 127 specifies in detail all its powers, rights and obligations. There is no point in listing them all, but it is important to focus on the most significant and affecting the interests of both the debtor and creditors.

The arbitration manager is obliged:

- Take all possible measures to protect the debtor’s assets and his property, including challenging dubious transactions that undermined the debtor’s financial and property status.

- Conduct an analysis of the debtor’s financial and economic activities, assess solvency and possible prospects for debt repayment.

- Maintain a register of creditors' claims, interact with creditors regarding inclusion in the register, identify other creditors.

- Identify signs of fictitious or deliberate bankruptcy, as well as possible abuses on the part of the debtor.

During the bankruptcy procedure, the manager has the right to:

- On your own behalf, file lawsuits to challenge transactions and apply the consequences of their invalidity.

- Apply to the court to apply interim measures to protect the debtor’s property.

- Take measures to remove the head and other authorized management bodies of the debtor.

- Receive all documents and information related to the financial and economic activities of the debtor

- Object to claims made by creditors and participate in court hearings on this issue.

In a number of bankruptcy procedures, a number of powers are transferred to the manager to fully manage the debtor for the period of bankruptcy.

Observation: essence and features of the procedure

This is the first, basic procedure introduced for all debtors without exception, regardless of the initiator of bankruptcy.

The main task of the procedure is to assess the financial condition of the debtor, identify and register all of his creditors, maintain a register of claims and ensure measures to preserve the debtor’s assets.

During the procedure, an arbitration manager is appointed, who gives consent for the company to carry out transactions affecting more than 5% of the book value of assets.

It is also prohibited:

- Withdrawal from the membership.

- Making decisions by the management of the company on reorganization, liquidation, formation of branches and representative offices or their abolition, as well as on the payment of dividends to participants.

The procedure is introduced for a period of no more than 7 months, after which a decision on further actions is made.

Financial recovery: essence and methods

As the name suggests, the procedure is of a “health” nature and is aimed at preserving the company and restoring solvency.

A financial recovery plan is being developed with specific proposals for repaying the debt and restoring the company's solvency.

The plan is subject to approval by the meeting of creditors.

For the period of financial recovery:

- All creditor claims are submitted in accordance with the provisions of Federal Law No. 127.

- Measures to seize property and other interim measures are cancelled.

- Enforcement proceedings are stopped.

- A ban is introduced on the allocation of shares in the authorized capital and their sale.

- Strict control is introduced over any means of terminating the debtor's obligations.

- The accrual of fines, penalties and other financial sanctions is stopped.

The procedure is introduced for a period of no more than 2 years; an administrative manager is appointed for the entire period of the bankruptcy procedure.

All about bankruptcy of legal entities in the Russian Federation

The grounds for declaring an organization bankrupt, the definition of concepts, the procedure, the rights and obligations of the parties involved - all this is regulated by the articles of Federal Law No. 127-FZ.

The actual inability of a legal entity to fulfill its financial obligations to creditors, pay mandatory payments, and also pay employees, in accordance with the terms of the concluded employment contract, leads to the company resorting to bankruptcy proceedings.

External control

A more stringent procedure compared to financial recovery, during which all the reins of control of the debtor are completely transferred to an external manager.

During external management, a moratorium is introduced on any satisfaction of creditors' claims, and payments on all obligations are blocked, except for current payments.

But! The claims of creditors of the 1st and 2nd stages can be satisfied: payments for compensation for harm to health, wages, etc.

The manager develops an external management plan with a list of measures to restore the debtor’s solvency.

Duration of the procedure: no more than 18 months, extension for another 6 months is permissible, but the total period together with the period of financial recovery cannot exceed 2 years.

Author's podcast “The Investigator Will Call”

A project by our partners Andrey Shevchenko and Mikhail Kuchin, where they analyze the most resonant events in the country and their consequences for all of us.

Everything about new laws and high-profile cases in Russia and in the world is as accessible as possible and without tediousness.

Find out more

Stages of bankruptcy proceedings

Bankruptcy proceedings are introduced after the debtor is declared bankrupt and it is established that it is impossible to pay existing debts.

Inventory of property and formation of bankruptcy estate

During bankruptcy proceedings, the so-called “bankruptcy estate” is formed, which includes all the assets of the debtor.

All existing or returned property to the company is subject to inclusion in the bankruptcy estate.

Bankruptcy auctions

Property included in the bankruptcy estate is subject to sale at public auction.

Conventionally, the procedure for conducting such auctions consists of the following stages:

- Publication of information about upcoming auctions in the media. Published 30 days before the start of accepting applications.

- Accepting applications for auctions. Duration – no more than 25 days.

- Completion of applications acceptance and registration of bidders who have fulfilled all conditions. Duration – no more than 5 days.

- Conducting tenders, drawing up a protocol with the results and concluding an agreement with the winning bidder. Or the auction will be declared invalid.

- Publication of information about the results of the auction in the media, return of the deposit to the remaining participants.

When conducting repeated auctions, the value of the property can be reduced by no more than 10% of the original price. If repeated bidding does not produce results, a public offer is formed for a period of 30 days, after which over a certain period (3-5 days) the price is reduced by 10-20% of the original cost.

Settlements with creditors

The next stage is the proportionate satisfaction of creditors’ claims in accordance with the queue established by law:

- First of all, citizens are compensated for damage to life, health, and moral damage.

- Secondly, calculations of wages, severance pay, vacation pay, payment of remuneration to authors.

- In the third place, settlements are made with the remaining creditors.

Out of turn, at the expense of the bankruptcy estate, the claims of creditors for current payments are repaid primarily in front of creditors whose claims arose before the adoption of the application for declaring the debtor bankrupt.

Based on the results of the calculation, a report is drawn up, which is brought to the attention of creditors, the arbitration court and the SRO, which includes the arbitration manager.

After completion of settlements, the legal entity is finally considered liquidated, and the entry about it is excluded from the Unified State Register of Legal Entities.

Subsidiary liability of managers and owners in case of bankruptcy of an organization

The Bankruptcy Law establishes the possibility of bringing managers and owners of a company to subsidiary (additional) liability in the event of bankruptcy of this organization. Such liability does not always apply, but only when certain circumstances occur (the fault of managers and owners). For these purposes, the Bankruptcy Law introduced the concept:

A person controlling the debtor is a person who has or had, for less than three years before the arbitration court accepted the application for declaring the debtor bankrupt, the right to give instructions that are binding on the debtor or the opportunity, due to being in a relationship with the debtor of kinship or property, official position, or to otherwise determine actions of the debtor...

The persons controlling the debtor may include some managers (management staff) and owners of the company.

Vicarious liability may extend to persons who are recognized as persons controlling the debtor.

Settlement agreement

A settlement agreement can be concluded at any time and at any stage of bankruptcy. This is a special procedure aimed at resolving a dispute between a debtor and creditors, the result of which is the repayment of all claims from creditors.

The logical result of the court’s approval of the settlement agreement is the restoration of the debtor’s solvency. At the same time, satisfying the claims of creditors does not always mean concluding a settlement agreement.

So, under the terms of the agreement, the parties can most often agree on the following:

- Full repayment of the debt to the creditor, including on installment terms.

- Partial repayment of debt with forgiveness or cancellation of penalties.

- Repaying debt with property.

- Forgiveness of a debt in exchange for some kind of reciprocal action.

- Other terms of the settlement agreement.

The law does not limit the parties in choosing the terms of the agreement, but in some cases the court may reject its approval if it considers the terms to violate the rights and interests of one of the parties.

If the agreement is approved by the court, the bankruptcy case is subject to termination.