The job description of an accountant-cashier is intended to formalize the main aspects of the work process of an employee hired for a designated position. The document lists the entire range of factors that determine a specialist’s readiness to effectively perform his job duties. For this reason, although the need for instructions is not officially enshrined in legislation, this document is included in the standard list of labor documentation of the organization.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

Sample job description for accountant-cashier

General provisions

- The accountant-cashier is responsible for a complex of cash handling operations.

- An accountant-cashier is hired and dismissed by order of the director of the company.

- The accountant-cashier reports to the chief accountant.

- During the absence of the accountant-cashier, his functions are assumed by the assistant chief accountant.

A person applying for this position must meet the following requirements:

- completed secondary education in economics or completed additional professional training in this specialty;

- Work experience in the field of accounting and control operations - from 3 years.

The accountant-cashier is required to understand the following issues:

- accounting legislation;

- current standards for cash transactions;

- current charts of accounts and rules for correspondence between them;

- rules for processing payment documents;

- rules for checking primary documentation;

- cash handling standards;

- features of accounting used in the organization;

- principles of audit and inventory;

- preparation of cash status statements in response to relevant requests;

- making appropriate entries in the cash book;

- standards for interaction with bank employees on issues related to cash;

- rules for making non-cash payments;

- use of appropriate office equipment.

The accountant-cashier is guided by:

- legislation of the Russian Federation;

- internal documentation of the company;

- contents of this manual.

Functions

- Registration of transactions for cash acceptance and issuance.

- Compiling a list of unusable banknotes.

- Monitoring changes in norms and laws governing the sphere of cash circulation.

- Interaction with collectors and bank employees on cash transactions.

- Preparation and storage of documents for cash transactions.

- Informing the chief accountant about possible problems in his area of responsibility.

- Preparation of certificates and reports for your area of responsibility.

- Monitoring the situation with cash limits.

- Maintaining a cash book.

- Ensuring the storage of accepted cash, its issuance and accounting.

- Assistance in making remote payments.

- Monitoring the compliance of cash amounts with their documentation.

- Preparation of appropriate accounting entries.

- Participation in the development of the company's accounting policy.

- Entering relevant information into the company database.

Responsibility

An accountant-cashier may be held liable in the following cases:

- For violations of laws committed during the period of his working activity - in accordance with the standards defined in the relevant legislation.

- For violation of the company’s internal rules on confidentiality - within the limits specified in the relevant legislation.

- For failure to perform their functions, or their improper performance - in accordance with labor legislation.

Rights

The accountant-cashier has the following set of rights:

- Receive from employees information and documents that are needed to carry out their activities.

- Receive assistance in your activities from colleagues in accounting and other departments, with the consent of the relevant managers.

- Require the management of the accounting department and the company to create the conditions necessary to fulfill their duties.

- Provide the chief accountant with suggestions on possible ways to improve work in his area of responsibility.

- Sign the required payment documents.

- Get acquainted with those draft management decisions that affect its activities.

Working conditions

- The accountant-cashier receives from the company the opportunity to improve his qualifications by paying for the appropriate specialized training by the employer, but not more often than once every 2 years.

- The specialist’s work schedule is determined on the basis of relevant internal documents.

- Bonuses and benefits for the accountant-cashier are provided in accordance with the company's standards, enshrined in the relevant documents, within the limits given by labor legislation.

Rights

The accountant-cashier has the following rights:

- Make independent decisions and draw conclusions within your competence.

- Make necessary requests to managers and employees of departments personally or on behalf of the General Director and Chief Accountant in order to fully fulfill their functional responsibilities.

- Receive and process information, including that constituting a trade secret, to the extent necessary to perform its functions.

- Make suggestions for improving work related to the responsibilities defined in the job description. Within the scope of his competence, inform the chief accountant of all comments and shortcomings discovered during his work, and make recommendations for their elimination.

- Require senior management to assist in the performance of their duties within the scope of this instruction.

Why are instructions drawn up?

The job description is one of the documents regulating labor relations within the company. The instructions are drawn up for the purpose of:

- formalization of key working points;

- agreement between the specialist and the employer on the main aspects of joint work;

- possible use in legal disputes on labor issues;

- monitoring the quality and volume of the specialist’s work.

For both the specialist and his employer, the document serves not only to build working relationships, but also as a means of preventing internal conflicts in the enterprise.

Goals and objectives of an accountant-cashier

The goals, objectives and functions of this specialist are described in the job description.

Accountant-cashier

Goals:

- ensuring the safety of material assets: cash, strict reporting forms and securities

- maintaining complete accounting records of the movement of money in the organization’s cash desk and on its current accounts

- monitoring the validity of incoming and outgoing transactions

The smooth operation of other departments of the company and the entire enterprise as a whole depends on the accountant working at the Cash desk.

That is why the important tasks of a specialist working with funds are:

- timely execution of cash transactions

- timely completion of cash documentation

- interaction with all departments of the company and its contractors

Principles for writing a job description

The current legislation does not have established requirements for the preparation of job descriptions. This situation gives scope for employers to compile sections of the document based on their needs. In practice, employers use standard instructions, modifying them in accordance with the specifics of the company's activities. The instructions include 4 basic sections that specify the main areas of the specialist’s work:

- General section.

- Functions.

- Responsibility.

- Rights.

Large employers can add additional sections to these sections when certain points need to be spelled out more clearly. Thus, some instructions separately add sections about working conditions, job relationships, qualification requirements and conditions for assessing the quality of a specialist.

Requirements for employees can be prescribed based on the relevant professional standard, the procedure for application of which is defined in Article 195.3 of the Labor Code. Also, Article 57 of the Labor Code directly states that the qualification requirements for employees should be determined on the basis of the relevant professional standard. But such a requirement applies only to those jobs where employees are provided with special benefits and compensation, or restrictions are imposed on them. Otherwise, the employer can independently prescribe requirements for employees.

General section

A basic section dedicated to describing the main aspects of working interaction. Here they state the requirements for the candidate’s qualifications, the skills expected of him, who will replace him during his absence, and similar points. The main thing in this section is the list of skills that are required from a specialist. These skills must be consistent with his job responsibilities.

In small organizations, cashier duties can be performed by a full-time accountant. To do this, a corresponding agreement is concluded with a specialist, according to which, for an additional fee, the accountant also takes on the functions of a cashier.

Functions

Here is a brief description of the work assigned to the specialist. It is important not to overload a specialist with secondary responsibilities, which may interfere with his ability to perform basic functions.

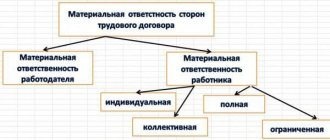

Responsibility

The section provides a general list of grounds for holding an employee accountable. Specific types of punishments are not described here, since the degree of guilt is determined only during the relevant proceedings.

Rights

The section provides a list of specialist rights. These rights are standard, but the employer may add additional opportunities for the accountant-cashier. So, you can delegate to him the right to attract other employees of the company to solve his problems.

Working conditions

One of those sections that are included in the instructions at the request of the employer. Its separate inclusion makes sense if the employer provides additional benefits, such as tuition or the provision of branded workwear.

After writing the document, its content must be agreed upon with the company management. Next, the DI is printed on letterhead. At the final stage, signatures are placed. The job description is signed by the hired specialist himself, the director of the company, as well as, if necessary, other persons with whom the appointment was agreed upon. There is no need to put the company seal in the DI.

What responsibilities do a cashier accountant have?

Accountant-cashier:

- is obliged to perform the official functions assigned to him in good faith and in a timely manner

- ensures the safety of cash, strict reporting forms, securities

- bears financial responsibility for all accepted valuables (money, securities, safety nets, work equipment, office supplies, etc.)

Responsibilities of an accountant-cashier

Also, the accountant-cashier is liable under the Civil and Criminal Code of the Russian Federation for damage caused to the company due to intent or negligence in work, as well as for non-compliance with internal regulations. The accountant-cashier must keep trade secrets and not disclose personal data.

Qualification of an “ordinary” accountant

To perform his job duties, an accountant, according to the professional standard, must know:

- practice of applying the legislation of the Russian Federation on issues of drawing up primary accounting documents, cost measurement of accounting objects, as well as on issues of remuneration;

- internal organizational and administrative documents of the company regulating the procedure for compiling, storing and transferring primary accounting documents to the archive;

- internal organizational and administrative documents of the company, regulating the features of grouping information contained in primary accounting documents, rules for storing documents and protecting information in an economic entity;

- the procedure for drawing up consolidated accounting documents in order to control and streamline the processing of data on the facts of economic life;

- fundamentals of the legislation of the Russian Federation on accounting (including regulatory legal acts on documents and document flow), on archiving, in the field of social and health insurance, pensions, on the storage and seizure of accounting registers, as well as civil, labor, and customs legislation;

- rules for cost measurement of accounting objects, methods of calculating depreciation adopted in the company’s accounting policy;

- methods for calculating the cost of products (works, services), compiling reporting calculations, calculating wages, benefits and other payments;

- all-Russian classifier of management documentation (in terms of the performance of labor actions);

- practice of applying the legislation of the Russian Federation on issues of monetary measurement of accounting objects;

- methods for calculating the cost of products (works, services);

- methods of accounting for costs of products (works, services);

- fundamentals of economics, technology, organization of production and management in an economic entity;

- fundamentals of economics, technology, organization of production and management in an economic entity;

- fundamentals of computer science and computer technology.

Requirements for instructions

This item includes the necessary knowledge of the candidate and the requirements for his level of training. This point is integral for candidates for the position, because gives an idea of how suitable they are for her. The clearest picture of this point can be obtained from the following table:

| Sub-clause | Content |

| Required knowledge | 1. Legislative acts, regulations and other documents of the Russian Federation regulating the organization or accounting of cash transactions. 2. Conducting cash transactions in accordance with existing standards established at the state level. 3. Work with the material assets of the enterprise, incl. cash; organization of document flow. 4. Work with electronic computer technology, knowledge of 1C. 5. Labor legislation; economics in the field of labor and management. |

| Level of training | A candidate for the position must have a higher specialized education in the field, as well as work experience in the relevant field for at least 1 year. |

Work experience requirements may vary depending on the profile of the company. For example, if it is engaged in the production of building materials, then the candidate must have experience working in a company with a corresponding profile. If an employee is needed urgently, then there may be no experience requirements.