Basic concepts and procedure for submitting a declaration

The tax period is a calendar year.

return is submitted for 2022 by March 30, 2022.

The declaration form was approved by Order of the Federal Tax Service of the Russian Federation dated August 14, 2019 N SA-7-21/ [email protected]

Who is obliged to take:

Organizations that have taxable property:

- at average annual cost: must be accounted for as an item of fixed assets;

- may, among other things, be transferred for temporary possession, received under a concession agreement, or included in joint activities;

- can be accounted for in any account;

Accountant's calendar for the first quarter of 2022 for filing reports

Taxpayers using the simplified tax system calculate and pay property tax only if they have real estate taxed at cadastral value (clause 2 of article 346.11 of the Tax Code of the Russian Federation).

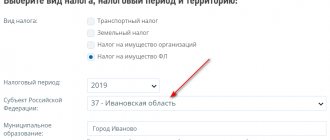

Property tax rates The law on property tax in a particular region can be found on the website nalog.ru. If the region has not set a rate, the maximum is used (Article 380 of the Tax Code of the Russian Federation).

- 2.2% - for real estate taxed at the average annual value;

- 2% - for property on which cadastral tax is paid.

Calculation based on average annual cost

But the tax base for the rest of the property is calculated based on its average annual value (clause 4 of Article 376 of the Tax Code of the Russian Federation). How is the average annual cost calculated? First you need to calculate the residual value of the property. This can be done using the formula.

Formula for calculating the residual value of property

The residual value is determined according to accounting data and is equal to the original price of the fixed assets minus accrued depreciation (clause 3 of Article 375 of the Tax Code of the Russian Federation). So, for example, in order to calculate the advance payment for the third quarter of 2016 for property, you need to determine the average cost (clause 4 of article 382, clause 1, clause 2 of article 383 of the Tax Code of the Russian Federation).

Formula for calculating average property value

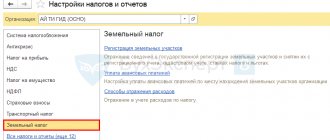

Property tax settings in 1C

First of all, indicate the taxation parameters for the organization as a whole in the section Directories - Taxes - Property Tax - Rates and Benefits.

Next, sequentially:

- Objects with a special taxation procedure — enter information on individual objects that have taxation features (for example, on assets taxed at cadastral value, on objects taxed at average annual value - cadastral number, benefit; on an object that is not subject to taxation, etc.).

- Payment of advance payments (previously Procedure for paying taxes locally) - check for the presence of the flag Advances are paid and payment deadlines in accordance with regional legislation for each place of registration with the Federal Tax Service. The tax payment deadline in the task list is reflected correctly - March 1.

- Ways to reflect expenses — make sure that the method for reflecting accrued tax in accounting and accounting expenses has been established.

About property tax benefits

Movable property registered as fixed assets from January 1, 2013 is exempt from property tax (Clause 25, Article 381 of the Tax Code of the Russian Federation). From January 1, 2015, objects registered as a result of:

- reorganization or liquidation of the company;

- transfer, including acquisition, of property between related parties.

Please note: the Ministry of Finance of Russia in letter dated February 9, 2015 No. 03-05-05-01/5111 explains that bringing the name of an organization into compliance with the Civil Code cannot be considered as a reorganization. This means that there are no grounds for refusing to apply the property tax benefit in the case where movable property was registered as a fixed asset from January 1, 2013. As of January 1, 2015, movable property registered as fixed assets during 2013-2014 will be deprived of benefits as a result of reorganization.

In letter No. 03-05-05-01/5030 of the Ministry of Finance of the Russian Federation dated February 6, 2015, it is explained that the property tax benefit provided for in paragraph 25 of Article 381 of the Tax Code can be applied even if the property was received from the municipality. Justification – paragraph 5 of Article 105.1 of the Tax Code. Direct and (or) indirect participation of the Russian Federation, constituent entities of the Russian Federation, municipalities in Russian organizations in itself is not a basis for recognizing such organizations as interdependent. And the letter of the Federal Tax Service of the Russian Federation dated March 13, 2015 No. ZN-4-11/4037 states that fixed assets made from materials acquired after January 1, 2013 from a related party are not subject to corporate property tax. After all, the inventories from which the fixed asset is made are not subject to property taxation on the basis of Article 374 of the Tax Code.

Checking taxable objects

Check the completion of the cards for fixed assets that are subject to taxation:

- at average annual cost—checked Real estate;

- at cadastral value - the object is included in the register Objects with a special taxation procedure.

You can also use the Universal Real Estate Report.

How to calculate the average annual cost: example

You can explain more clearly how to calculate the average annual cost by giving an example of calculating property tax for the year in numbers.

Let’s say an organization does not have taxable objects that require the accrual of a “cadastral” tax, but it has a land plot worth 4 million rubles. (recall that land is not depreciated either in accounting or tax accounting, clause 17 of PBU 6/01, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, clause 2 of Article 256 of the Tax Code of the Russian Federation). Rights to benefits established by Art. 381 of the Tax Code of the Russian Federation, the organization does not. Additional benefits have not been introduced in the region.

As of 13 dates in 2022, according to accounting data, the following figures occur:

| date | Total residual value of real estate according to accounting data (difference between account balances 01 and 02), rub. | Residual value of taxable objects (minus the cost of the land plot), rub. |

| 01.01.2020 | 44 413 922 | 40 413 922 |

| 01.02.2020 | 44 021 121 | 40 021 121 |

| 01.03.2020 | 44 640 004 | 40 640 004 |

| 01.04.2020 | 44 453 140 | 40 453 140 |

| 01.05.2020 | 44 506 491 | 40 506 491 |

| 01.06.2020 | 46 598 376 | 42 598 376 |

| 01.07.2020 | 47 628 001 | 43 628 001 |

| 01.08.2020 | 51 205 154 | 47 205 154 |

| 01.09.2020 | 51 538 272 | 47 538 272 |

| 01.10.2020 | 51 573 566 | 47 573 566 |

| 01.11.2020 | 76 959 070 | 72 959 070 |

| 01.12.2020 | 86 514 140 | 82 514 140 |

| 31.12.2020 | 86 215 603 | 82 215 603 |

Adding the numbers in the far right column of the table above will give the amount of 668,266,860 rubles. Dividing it by 13, we get the average annual value of property recognized as taxable, which corresponds to 51,405,143 rubles. This will be the taxable base.

An example of calculating advance payments and corporate property tax at the average annual cost from ConsultantPlus The Sigma trading organization applies a general taxation system. The organization's balance sheet contains property, the tax base for which is determined at the average annual cost. The tax rate according to regional legislation is 2.2%. Sigma does not have any property tax benefits. You can view the entire example in K+. It's free.

If the organization had property that was eligible for benefits, then the table would have 1 more column with its value for each of the specified dates. In relation to the data in this column, to obtain the average annual cost, it would be necessary to make a calculation similar to the above. Based on its result, the tax base calculated above could be reduced.

See also: “Formula for calculating the average annual cost of fixed assets.”

Calculation of property tax in 1C

Tax calculation for the year is carried out as a routine operation when performing the Month Closing for September from the Operations .

After completing the operation, tax calculation data for the reporting period is recorded Property Tax Calculation

A posting is generated in accordance with the Method of reflection in expenses (Main - Taxes and reports - Property tax - link Methods of recording expenses).

Postings

After carrying out the regulatory operation Calculation of property tax, generate a certificate of the same name. PDF

Tax base for property tax

Organizational property tax (advance payments thereon) is calculated based on the tax base established for a particular taxable object. The basis for calculating property tax for organizations can be the average annual value of a fixed asset or the cadastral value of an object.

1. Average annual (average) cost of fixed assets, which is calculated based on the residual value formed in accordance with the established accounting procedure.

From January 1, 2015, if the residual value includes a monetary assessment of future future costs associated with this property (valuation reserves formed in accounting), its residual value for property tax purposes is determined without taking into account such costs (clause 3 of Art. 375 of the Tax Code of the Russian Federation as amended by the Law of April 2, 2014 No. 52-FZ).

2. From January 1, 2014, in relation to individual real estate objects, when calculating tax, their cadastral value as of January 1 of the tax period is applied (clause 1 of Article 378.2 of the Tax Code of the Russian Federation). Such objects include:

- administrative, business and shopping centers;

- non-residential premises intended for offices, retail facilities, catering and consumer services;

- real estate of foreign organizations that do not operate in the Russian Federation through permanent representative offices.

Please note: from January 1, 2015, such objects include residential buildings and residential premises that are not taken into account on the balance sheet as fixed assets in the manner established for accounting.

A separate non-residential building (structure, structure) is recognized as both an administrative and business center and a shopping center if at least 20% of the total area of such a building provides for the placement of offices and related infrastructure (including centralized reception premises, meeting rooms, office equipment, parking), retail facilities, public catering facilities and (or) consumer service facilities (clause 4.1 of article 378.2 of the Tax Code of the Russian Federation).

The authorities of a constituent entity of the Russian Federation must, no later than the 1st day of the next tax period, determine a list of objects for which property tax will be calculated based on the cadastral value, send it to the tax authorities at their location and post the information on the official website of the constituent entity of the Russian Federation (clause 7 of Art. 378.2 of the Tax Code of the Russian Federation) (letter of the Ministry of Finance of Russia dated November 29, 2013 No. 03-05-04-01/51779). If this is not done within the prescribed period, the owner of the property will have the right to calculate the tax based on the average annual value of the property, and not on the cadastral value.

note

The list of real estate objects for which the corporate property tax base depends on the cadastral value is compiled one-time no later than the 1st day of the next tax period (clause 7 of Article 378.2 of the Tax Code of the Russian Federation). It is not allowed to add new buildings to it after the start of the tax period (Letter of the Federal Tax Service of the Russian Federation dated October 16, 2015 No. BS-4-11 / [email protected] ).

Real estate objects identified during the tax period that were not included in the list as of January 1 of the year of the tax period are subject to inclusion in the list determined by the authorized executive body of the subject for the next (next) tax period (paragraph 1, clause 10, article 378.2 Tax Code of the Russian Federation).

If an object was included in the list by mistake, which was recognized by the court (for example, due to non-compliance with the criteria for classifying a real estate object as an object for which the tax base is determined based on the cadastral value), it is subject to exclusion from the list determined for the corresponding tax period. Information about this must be posted on the official website of the tax service or on the official website of the constituent entity of the Russian Federation on the Internet (depending on which website the list was originally posted on). For objects excluded from the list, the tax base is determined based on the average annual cost.

A newly formed real estate object (for example, when dividing one into two) is subject to taxation at the cadastral value determined as of the date of registration of such an object for state cadastral registration. Tax accrual on such objects must begin before inclusion in the list approved by the constituent entity of the Russian Federation (paragraph 2, clause 10, article 378.2 of the Tax Code of the Russian Federation).

From January 1, 2015, the possibility of adjusting the tax base for property tax, calculated based on the cadastral value of the property, was introduced. Read more about this in the berator

Payment of property tax and preparation of a declaration

It is convenient to pay tax and create a declaration from the Main - Organizational Objectives section.

We recommend that you first create a declaration using the appropriate button.

Then click the Pay to generate a payment order to pay the tax.

Directory of Payment Orders 2021

We looked at how to set up and calculate property tax for 2022, tax payment deadlines, and the tax register for property tax in 1C 8.3 Accounting.

Property tax and special tax regimes

Firms using the taxation system for agricultural producers (UST) are exempt from corporate property tax.

Firms using the simplified taxation system (STS) are exempt from corporate property tax, calculated on the basis of the tax base in the form of the average annual value of property (Article 346.11 of the Tax Code of the Russian Federation as amended by Law No. 52-FZ of April 2, 2014).

For some types of activities, a company can be transferred to pay a single tax on imputed income (UTII). There is no need to pay tax on the value of property used in these types of activities. Taxes are paid on the rest of the property as usual.

A company can use the same property both in normal activities and in those transferred for payment of UTII. In this case, tax is paid only on part of its value. This portion is proportional to revenue from ordinary activities in the firm's total revenue.

Organizations that apply a special regime in the form of paying UTII are not exempt from paying corporate property tax on objects that are used in “imputed” activities, and the tax base for which is calculated based on the cadastral value (clause 4 of Article 346.26 of the Tax Code of the Russian Federation as amended by the Law dated April 2, 2014 No. 52-FZ).

Results

The basis for calculating property tax exists in two versions. One of them is the average (average annual) cost. The calculation of the average annual value is the arithmetic average of 13 values of the residual value of taxable property, determined at the beginning of each month of the year and on the last day of the accounting year. The presence of preferential property will require a similar calculation of the value attributable to it, the result of which can be taken into account in reducing the average annual value of property subject to taxation.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.