The job description of a leading accountant is a document that includes basic recommendations for a specialist, as well as his professional activities. The preparation of job descriptions is carried out by the management of the enterprise, relying on the internal regime, as well as documents operating at the state level. Ultimately, the quality of a specialist’s work depends on the job description. In this article we will look at how the job description of a leading accountant is drawn up in 2022, what rights, competencies and responsibilities need to be taken into account.

Overview of the job description of a leading accountant

The job description of a leading accountant of an enterprise consists of several sections, which may include lists, subparagraphs and explanations for a clearer structuring of information. The specified data is prescribed based on the individual requirements and focus of the company. It is important to note that the job description should not violate the rights of a specialist, therefore, when drafting, it is important to rely on the legislative documents of the Russian Federation.

The following table will help you get a general idea of the information included in the job description:

| Instruction point | General content |

| 1. General Provisions | The introductory part, which indicates the reasons for hiring, the management level of the company, etc. |

| 2. Functional responsibilities | This paragraph describes the specific duties that a specialist must perform without fail while at the workplace. |

| 3. Knowledge requirements | A point that is especially important for job applicants. Information about the required education, desired qualities of a specialist, etc. can be posted here. |

| 4. Relationships by position | This point is very important for the leading accountant, since it clearly indicates the persons with whom the specialist will need to cooperate in order to successfully perform his duties. |

| 5. Rights | The minimum rights of a leading accountant are specified in the legislative documents of the Russian Federation. At his own request, the employer can expand them, providing opportunities for employee development. |

| 6. Responsibility | Information is provided here about for which offenses and what nature the employee is responsible. |

| 7. Additional information | If the employer has additional information that is not included in any of the previous paragraphs, then it is indicated at the very end. |

To enter into force, the job description is studied and signed by the company’s management. As confirmation, the document is affixed with the company's seal, as well as the date of acceptance.

What legal regulations govern the preparation of DI for a leading accountant?

A job description is a significant element of personnel document flow in any modern enterprise.

However, its form is not fixed in any of the current regulations. Moreover, drawing up a DI is not required due to the provisions of the Labor Code of the Russian Federation. This document is needed mainly for convenient intra-corporate interaction between the management of the enterprise and hired employees. DI for an accountant can be compiled on the basis of current professional standards, which, in turn, are approved by federal regulations. These include:

- Qualification directory, introduced into business circulation by Decree of the Ministry of Labor of Russia dated August 21, 1998 No. 37;

- Order of the Ministry of Labor and Social Protection of Russia dated February 21, 2019 No. 103n.

It should be noted that the provisions of the second legal regulation are mandatory for use by employees of not all business entities, but only (as follows from the totality of the provisions of Article 195.3 of the Labor Code of the Russian Federation, Article 7 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, as well as the resolution Government of Russia dated June 27, 2016 No. 584):

- chief accountants of public joint-stock companies, insurance organizations, non-state pension funds, banks and non-credit financial organizations;

- outsourced accountants;

- accountants of state extra-budgetary funds, state and municipal institutions, unitary enterprises, state corporations, state-owned companies, as well as business companies owned more than 50% by the state or municipality.

The provisions of the regulatory legal acts discussed above, as well as the established practice of Russian personnel management, allow in the general case (which is legitimately considered by a private enterprise that does not fall under the criteria for the mandatory application of the specified professional standard) to form the following structure of the leading accountant’s DI.

General provisions of the job description of a leading accountant

General provisions are a mandatory part of any job description and include introductory information about the position, as well as the conditions for accepting the employee. In some cases, within the framework of general provisions, the requirements for a specialist, as well as his responsibilities, are indicated. This approach is not a mistake, but it significantly complicates the perception of information and reduces the quality of structuring.

General provisions of the job description of a leading accountant may include the following information:

- The first subparagraph briefly describes the content of the provisions. The following subsections describe them in more detail.

- Information about the conditions of employment, as well as the conditions for dismissal from work.

- Description of documents (both national and internal) that the accountant undertakes to be guided by in the performance of official duties.

- Information about managers who are the direct superiors of the leading accountant.

- Also, the current paragraph may indicate the actions for which the specialist is responsible; necessary knowledge, etc.

In this paragraph, it is recommended to indicate the officials (or person) who will perform the duties of the employee in his absence.

Read in more detail the instructions for new employees: → Job description of the chief accountant (sample filling, form 2022), → 5 components of the job description of an accountant (sample filling, form 2022), → Job description of an accountant of a budgetary institution (sample filling, form 2022), → Job description of an accountant for payments to suppliers (sample filling, form 2022), → Job description of a payroll accountant (sample filling, form 2022), → Job description of a deputy chief accountant (sample filling, form 2022)

Job responsibilities of a leading accountant

The specialist's responsibilities must be clearly and specifically defined. The accountant will be guided by this point in his work and the quality of the employee’s activities and the regulation of the company’s work as a whole depends directly on it. Please note that the actions specified under this paragraph should not exceed the competence of the specialist or violate his rights.

As an example, let's look at the presented list of job responsibilities:

- The leading accountant undertakes to deal with the receipt and expenditure of all documentation relating to material assets. At the same time, his task is to study the documents received and analyze them for correctness of preparation in accordance with the law.

- Handle advance reports from accountable persons regarding funds issued for business and travel needs. Analyze the correctness of documents and check whether funds were sent for their intended purpose.

- The specialist also undertakes to monitor the timeliness and accuracy of payroll calculations.

- The employee's responsibilities include a responsible approach to the preservation and use of all information at his disposal.

- Documentation processing by an accountant must be carried out in full and on time.

- Within the required time frame, the specialist must inform management about the progress of the work and its quality.

- During the performance of job duties, the specialist must comply with the regime established within the company, as well as comply with safety regulations.

The specified job responsibilities can be expanded in accordance with the profile of the company where the specialist works. For example, if a company is engaged in the production of food products, then the accountant’s responsibilities may include monitoring the volumes of products produced.

Professional standard for chief accountant

The chief accountant is required to prepare and present financial statements of an economic entity. This generic function includes:

- preparation of financial statements;

- preparation of consolidated financial statements (according to IFRS);

- internal control of accounting and preparation of accounting (financial) statements;

- maintaining tax records and preparing tax reports, tax planning.

First, the Standard classifies tax reporting as financial reporting. In principle this is fair. After all, the amounts of taxes received as a result of tax accounting are reflected in the accounting accounts. And secondly, the Russian Ministry of Labor believes that an ordinary accountant is not capable of maintaining tax records.

Based on the Standard, the only accountant of the company who prepares the statements should be called (in the employment contract and in the work book) the chief (paragraph 3, part 2, article 57 of the Labor Code of the Russian Federation).

Required knowledge and competence

The knowledge of a leading accountant should not be limited only to that gained during training. That is why the job description contains this clause - otherwise it would be enough to indicate the educational requirements of a potential employee. This section can indicate both specific and additional knowledge, as well as the desired characteristics of the employee.

We classify information about the necessary knowledge in the following table:

| Requirement | Description |

| Additional knowledge |

|

| Personal characteristics |

|

Qualification

To be hired, an accountant's resume must indicate that he has a specialist diploma. He must have a higher education with a specialist’s diploma, or preferably a master’s degree. Education must be in the appropriate direction. It is advisable that he complete advanced training courses.

Employers usually pay attention to specialists who have a minimum of two years of experience in this position. Especially when it comes to specialists of the first category.

Relationships by position

The official ties of a leading accountant are not limited only to the employees of his department. As a rule, in order to successfully perform their own job responsibilities, a specialist has to collaborate with employees of other departments, as well as with the company’s management directly. In addition, employees subordinate to the accountant are also mentioned in this paragraph. The section “Relations by position” indicates not only the persons with whom the leading accountant must cooperate, but also the issues that he undertakes to resolve jointly with them.

As an example, we can take the business relationship between the director of a company and a leading accountant. In the course of these relationships, the accountant can resolve issues related to obtaining various types of documents on tax accounting and taxation. Also, issues regarding the presentation of any information on the company’s taxation (including confidential information) are resolved directly with the director. Within a particular company, a specialist’s circle of connections may be larger or smaller.

In some cases, this section serves only as an addition. Therefore, managers of small enterprises may neglect this section when drawing up a job description.

The difference between the leader and the main

should not be confused with the chief accountant. The chief accountant reports directly to the director and heads the accounting department of the enterprise. All key issues are under his jurisdiction.

The leading accountant is a management specialist, but coordinates his decisions with the chief accountant ; he can be hired and fired by the director by an agreed decision of the director and the chief accountant.

The leading accountant

is subordinate to the chief , and all job responsibilities are transferred to his immediate supervisor during absence, vacation or illness.

Rights of a new employee

The rights of a leading accountant within the job description are one of the most important sections, which not only explains the overall picture of the position, but also opens up opportunities for creative implementation of job responsibilities. It should be taken into account that the main feature of the rights of a company employee is that they are fixed by the legislative framework of the Russian Federation. That is, even if there is no such section in the job description, the specialist will become familiar with his rights through official documents valid in the country.

The following rights can be distinguished, which are most often indicated in job descriptions:

- The specialist is given the right to familiarize himself with and study the documentation and project activities of the enterprise management in the event that they somehow affect his professional activities.

- The leading accountant has the right to receive any documentation and information, incl. confidential, for the successful performance of official duties.

- The leading accountant is given the right to cooperate with other employees to create projects as part of their job duties.

- The accountant is given the opportunity to analyze the quality of work of his department, as well as make business proposals for stabilizing and optimizing work at the enterprise.

- Within the limits of his competence, an employee can share any shortcomings identified in his work with the management of the enterprise.

- To improve the quality of their work, a leading accountant has the right to take advanced training courses.

The specified rights cannot exceed the competence of the specialist or go beyond the scope of his official duties.

Cookie Policy

1. General Provisions

1.1. An accountant belongs to the category of specialists. 1.2. An accountant is appointed to a position and dismissed from it by order of the Head of the Municipal Government Institution “Department for Education of the Medvensky District of the Kursk Region”. 1.3. The accountant reports directly to the head of the budget and financial reporting department. 1.4. During the absence of an accountant, his rights and responsibilities are transferred to another official, as announced in the order for the department. 1.5. A person who meets the following requirements is appointed to the position of accountant: education - higher or secondary specialized, knowledge of computer programs for accounting. 1.6. An accountant must know: - legislative acts, regulations, instructions, orders, other guidelines, methodological and regulatory materials on organizing accounting of property, liabilities and business transactions and reporting; — forms and methods of accounting at the enterprise; — plan and correspondence of accounts; — organization of document flow in accounting areas; — the procedure for documenting and reflecting on accounting accounts transactions related to the movement of fixed assets, inventory and cash. 1.7. The accountant is guided in his activities by: - legislative acts of the Russian Federation; — The Charter of the institution, Internal Labor Regulations, other regulations of the Institution; — Regulations on the accounting department of the organization; — orders and instructions from management; - this job description.

2. Job responsibilities of a leading accountant

The accountant performs the following job responsibilities: 2.1. Performs work on maintaining accounting records of property, liabilities and business operations (accounting for fixed assets, inventory, production costs, sales of products, results of economic and financial activities; settlements with suppliers and customers, for services provided, etc.) . Budget accounting is carried out using a journal-order form of accounting using the following registers: - a journal of transactions with non-cash funds; — journal of settlement transactions with accountable persons; — journal of settlement transactions with suppliers and contractors; — journal of wage settlement transactions; — journal of transactions on disposal and transfer of non-financial assets; — journal for other transactions. 2.2. Participates in the development and implementation of activities aimed at maintaining financial discipline and rational use of resources. 2.3. Receives and controls primary documentation for the relevant areas of accounting and prepares them for accounting processing. 2.4. Reflects on the accounting accounts transactions related to the movement of fixed assets, inventory and cash. 2.5. Accrues and transfers taxes and fees to the federal, regional and local budgets, insurance contributions to state extra-budgetary social funds, payments to banking institutions, funds to finance capital investments, wages of workers and employees, other payments and payments, as well as deductions for material incentives for enterprise employees. 2.6. Participates in conducting an economic analysis of the economic and financial activities of the organization based on accounting and reporting data in order to identify intra-economic reserves, implement savings regimes and measures to improve document flow. 2.7. Participates in the inventory of funds, inventory, settlements and payment obligations. 2.8. Prepares data on the relevant areas of accounting for reporting, monitors the safety of accounting documents, draws them up in accordance with the established procedure. 2.9. Performs work on the formation, maintenance and storage of a database of accounting information, makes changes to reference and regulatory information used in data processing. 2.10. Performs individual official assignments from his immediate superior.

3. Rights of the leading accountant

The accountant has the right: 3.1. Receive information, including confidential information, to the extent necessary to solve assigned tasks. Require all employees and accountable persons to correctly prepare primary documents. 3.2. Make proposals for improving work related to the responsibilities provided for in these instructions. 3.3. Within the limits of your competence, inform your immediate superior about all shortcomings identified in the course of your activities and make proposals for their elimination. 3.4. Request personally or on behalf of the chief accountant from department heads and specialists information and documents necessary to fulfill his official duties. 3.5. Require the management of the enterprise to provide assistance in the performance of their official duties and rights.

4. Responsibility of the leading accountant

The accountant is responsible: 4.1. For failure to perform and/or untimely, negligent performance of one’s official duties. 4.2. For failure to comply with current instructions, orders and regulations on maintaining trade secrets and confidential information. 4.3. For violation of internal labor regulations, labor discipline, safety and fire safety rules. 4.4. For offenses committed in the course of carrying out their activities - within the limits determined by the current administrative, criminal and civil legislation of the Russian Federation. 4.5. For causing material damage - within the limits determined by the current labor and civil legislation of the Russian Federation.

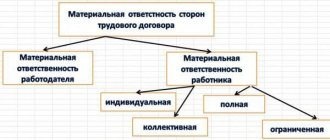

Responsibility of the leading accountant

Like any other employee of the company, the leading accountant is responsible for the implementation of his work, as well as some additional aspects of professional and other activities carried out at the enterprise. When drawing up this section of the job description, it is important to take into account not only the actions for which the employee is responsible, but also the level of sanctions imposed on him in a given situation. It is worth noting that if sanctions are not specified, then the offending employee will be held liable in accordance with the conditions specified in the legislative documents of the Russian Federation.

The main responsibility of the leading accountant is failure to perform or poor performance of his duties, for which the most severe sanctions are imposed, including dismissal. In addition, responsibility is assigned for violation of the norms and rules established by the internal regulations of the enterprise. Finally, the specialist is responsible for causing moral and physical harm to other employees of the company. The main points of this section can be regulated by the head of the enterprise. Moreover, the higher the position held by an employee, the greater responsibility he will take on.

A clear and specific description of this and other sections of the job description helps stabilize productivity in the enterprise, regulate management and improve efficiency.

Generalized labor functions

The professional standard “Accountant” distinguishes two positions - accountant and chief accountant. For each position, a generalized labor function is defined, which is detailed through a specific list of labor functions. Here is a general list:

- accounting;

– preparation and presentation of accounting (financial) statements;

– preparation and presentation of accounting (financial) statements of an economic entity that has separate divisions;

– preparation and presentation of consolidated financial statements;

– provision of accounting services to other economic entities, including the preparation of accounting (financial) statements.