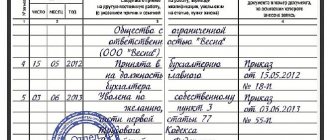

The deputy chief accountant is accepted for this position on the recommendation of the chief accountant, to whom he must subsequently report (see → job description of the chief accountant (2022)). The head of the enterprise puts his review on the application, on the basis of which the corresponding order is issued. The dismissal procedure follows the same principle. In this article we will analyze a sample job description for a deputy chief accountant in 2022, what rights and responsibilities are included in it.

Job description of deputy chief accountant (2022)

What should a deputy chief accountant be guided by in his work?

While performing his professional duties, the deputy chief accountant must be guided by the following regulations: methodological manuals; laws; regulations; company charter; internal orders and instructions; internal regulations; job description, etc.

The deputy chief accountant must thoroughly know and be able to apply in practice regulatory materials on accounting and tax accounting. This specialist must know the chart of accounts by heart. accounting in order to easily make entries when carrying out a particular business transaction. The deputy chief accountant must independently organize document flow, carry out all types of financial transactions, and introduce modern methods to optimize all labor and management processes.

Read and download also the job description: → accountant, → accountant of a budgetary institution, → payroll accountant, → economist, → human resources specialist.

Knowledge

Before starting to perform his tasks, an employee must familiarize himself with legislative acts, regulations and other methodological and guidance documentation that affects his activities and business operations carried out in the company. His knowledge should include accounting, its forms and methods, a plan of correspondence of accounts, reporting and organizing the circulation of documents in the company.

Before performing the duties of a deputy chief accountant, he must study the procedure for preparing documents, learn how to reflect transactions in the accounting accounts that relate to payments for the company’s services and the movement of banknotes. His knowledge should include an economic analysis of the company’s financial and economic activities, methodology, operating rules for the computer equipment used in the enterprise, market management methods and labor legislation. He must also know economics, management and labor organization rules. Including other rules and regulations established by the company.

Job description of deputy chief accountant. General provisions

Before starting to perform his duties, the deputy chief accountant must read the job description. After studying it, he signs this document, thus indicating his agreement with all the stated points. The job description is a document; the form can be developed by each company individually, since it is not approved at the legislative level.

This document must contain the following data: details of the organization, date and place of preparation, full name of the deputy chief accountant, list of rights and obligations. At the bottom of the document there is space for the signatures of officials, the company seal and the date of certification.

This section of the job description includes items that completely regulate the work of the deputy chief accountant. In particular, the procedure for hiring and dismissing a specialist for this position is described. The list of regulatory documents that the deputy must apply in his work is described in detail. The general section of the job description includes a clause that specifies what such a specialist should know and be able to do. The last paragraph addresses the issue of responsibility for the performance of one’s direct duties, as well as when performing the functions of a chief accountant.

Functions

The functional responsibilities of the deputy chief accountant include control over the accounting of business transactions and obligations of the company. This means accounting for services provided, settlements with customers, contractors and suppliers providing services to the company, and the movement of all financial assets of the organization in domestic and foreign currency.

The employee must maintain operational records of receipts and payments in cash equivalent. It carries out partial sales of the company's proceeds, sends free money to bank deposits and provides monthly operational data regarding the movement of funds through current and transit accounts.

Functions and responsibilities of the deputy chief accountant

If the company does not have a chief accountant for some reason, then his deputy will automatically take over his functions:

- exercises control over the maintenance of accounting and tax records;

- monitors the movement of funds in current accounts and in the cash register of the enterprise;

- fills out accounting registers based on primary accounting data;

- prepares tax and financial reporting;

- collects and analyzes information about the company’s work, and then conveys it to management;

- provides assistance to accounting department employees, monitors their work, etc.

The third section of the job description usually addresses the deputy's job responsibilities. The powers of this specialist include collecting and providing information to representatives of regulatory authorities, auditors, and investors regarding settlements with debtors and creditors. The deputy chief accountant must take an active part in analyzing the economic and business activities of his company. Using specialized software and various information storage devices, create, maintain and store accounting databases.

Basic requirements for a deputy chief accountant

The main requirements for candidates for the position of deputy chief accountant relate to the applicant’s professional skills and existing education. Typically, deputies are subject to the same requirements as the main specialist managers. So, according to Art. 7 of Law No. 402-FZ “On Accounting” dated December 6, 2011, the chief accountant must have a higher economic education and at least 5 years of work experience related to accounting. In relation to a deputy, the requirements may be reduced at the discretion of the employer, but their mitigation, as a rule, concerns only length of service.

Also among the requirements it is usually mentioned that an applicant for the position of deputy chief accountant must know:

- accounting legislation;

- basics of civil, financial and tax legislation;

- methodological, regulatory documents and instructions on the organization of accounting and reporting;

- rules for conducting inventory, inspections and documentary audits;

- procedure for processing accounting transactions;

- internal documents of the organization;

- basics of labor legislation.

In addition to the above, employers' requirements for candidates for the position of deputy chief accountant may include additional knowledge and skills of the applicant. For example, the work of a modern accountant is impossible without the use of a computer, so experience with a specific accounting program may be added to the list of requirements. Some organizations also state in their requirements knowledge of a foreign language (usually English).

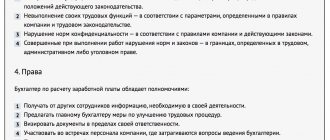

Rights, relationships and responsibilities of the deputy chief accountant

The final paragraphs of the job description discuss issues related to the rights of the deputy chief accountant and his responsibilities. He is obliged:

- familiarize yourself with all administrative documents issued by the manager and other officials;

- submit innovative proposals to management for consideration that would help optimize the work of the accounting department;

- demand from officials, in particular from the manager, all assistance and assistance in the performance of their professional duties;

- involve specialists from other divisions of the company in solving assigned tasks;

- immediately report to the chief accountant about all detected errors in the work of accounting employees;

- take effective measures to stabilize the financial situation in the company, etc.

When hiring a new employee, he is required to be familiarized with his job description, as well as the labor regulations.

Tasks

The responsibilities of the deputy chief accountant include the formation, maintenance and storage of an information database covering all accounting information. He may be tasked with changing regulatory and reference data that is used during information processing. Also, its tasks may include the generation of tasks or individual stages of work, the solution of which requires special computer technology. He must determine the possibility of implementing ready-made algorithms, projects, programs and other things that are necessary for the company to develop its own data processing system.

Additional section of the job description

For improper performance of his direct duties, or violation of job descriptions, the deputy chief accountant will be held accountable. His punishment is determined in accordance with the regulations of the Labor legislation. If criminal intent is revealed in the actions of the deputy, he will be brought to administrative or criminal liability.

An additional paragraph of the job description describes in detail the procedure for interaction of the deputy chief accountant with other officials: with the director, heads of departments, accounting employees, etc. It also describes the procedure for building relationships with regulatory authorities, auditing and outsourcing companies.

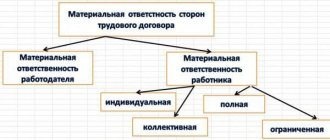

Responsibility

An employee may be held liable if he refuses to perform his duties or does not perform them properly. He is responsible for committing legal, administrative and criminal violations during the performance of his work within the limits of the current legislation of the country. And also for causing material damage to the company where he is employed. He is responsible for the quality and timeliness of tasks performed by his subordinates and for the disclosure of confidential information.

Relationships

In order to fully and efficiently fulfill the duties, rights and other aspects assigned to the employee, which are provided for in the instructions, the employee must interact with a number of officials, which includes the financial director, the head of the human resources department, their assistants and the chief accountant. He receives from them orders, orders, instructions, correspondence affecting his field of activity and other instructions. He must also provide them with certificates, information and other information related to the financial activities of the company.

To do this, he uses memos, reports and other accounting documentation. His responsibilities also include interaction with the heads of departments of the organization. He receives from them information, data, certificates, memos, and other documents he needs to carry out accounting. In turn, he provides them with all the necessary data that arises from accounting activities.