Many enterprises in the course of doing business one way or another encounter foreign currency. Today, the most common foreign exchange transactions are settlements under loan agreements, as well as currency conversion. In the article we will look at the features of carrying out these operations and their reflection in transactions on account 52 using examples.

Concept of foreign exchange transactions

Currency transactions are transactions involving currency values. Operations carried out by enterprises with foreign currencies are regulated by legislative acts, in particular the Law on State Currency Regulation and Control.

Most enterprises carry out current foreign exchange transactions, which include:

- receipt of foreign currency as payment under agreements with non-residents;

- obtaining loans in foreign currency;

- sale of foreign currency earnings (mandatory and voluntary);

- conversion operations with currency (exchange of one currency for another at the current rate).

It is legally established that organizations authorized to carry out transactions with currency are banking institutions. By making the appropriate order to the bank, the company can sell the currency available on the current account, credit foreign exchange earnings, and carry out currency exchange. In addition, by concluding a loan agreement with a bank, an organization can receive borrowed funds in foreign currency.

Accounting for foreign currency conversion transactions

To carry out business activities, the enterprise periodically carries out foreign currency conversion operations. Use a specific example to show the correct calculation and reflection in the accounting records of an enterprise of foreign currency conversion operations.Answer

Foreign currency conversion is the exchange by banks of one type of foreign currency of a subject of foreign exchange transactions, bank, non-resident bank for another type of foreign currency at established exchange rates (clause 3.4.3 of the Instructions on the procedure for carrying out foreign exchange transactions with the participation of legal entities and individual entrepreneurs , approved by Resolution of the Board of the National Bank of the Republic of Belarus dated July 28, 2005 No. 112 (hereinafter referred to as Instruction No. 112)).

Foreign currency conversion refers to foreign exchange transactions (Article 12 of the Law of the Republic of Belarus dated July 22, 2003 No. 226-Z “On Currency Regulation and Currency Control”).

Since June 1, 2015, the conversion of foreign currency is carried out on the over-the-counter market (letter of the National Bank of the Republic of Belarus dated May 15, 2015 No. 32-16/277 “On the peculiarities of the functioning of the domestic foreign exchange market during the transition to the continuous double auction regime at the auctions of OJSC Belarusian Currency Exchange stock Exchange").

The procedure for converting foreign currency is defined in Instruction No. 112.

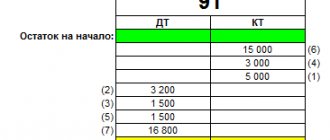

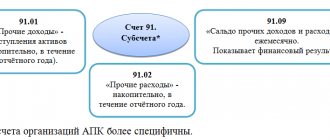

According to the National Accounting and Reporting Standard “The Impact of Changes in Foreign Currency Exchange Rates”, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated October 29, 2014 No. 69 (hereinafter referred to as the National Standard), exchange rate differences (including when converting foreign currency) are reflected in the credit (debit) ) account 91 “Other income and expenses”.

There are the following types of foreign currency conversion:

- foreign currency conversion upon receipt;

- currency conversion on the over-the-counter foreign exchange market with crediting to an account opened in another currency;

- currency conversion on the over-the-counter foreign exchange market when making a payment with conversion.

Accounting for foreign currency conversion transactions upon receipt:

No.

| date | Account debit | Account credit | Sum | Contents of the operation (calculation) | |

| 1 | 20.07.2015 | 57.3 | 62 | 16,528,000= 1000 euros | Receipt of revenue in foreign currency if there is an account in a currency other than the currency of receipt, National Bank rate 16,528 rubles/euro |

| 2 | 24.07.2015 | 52.1 | 90.7 | 16,316,640= $1080 | Crediting to the account of the currency received as a result of conversion conversion rate 1.08 NB rate 15,108 rubles/dollar income taken into account when taxing profits in accordance with clause 3.19(5) of article 128 of the Tax Code of the Republic of Belarus (clause 13 of Instruction No. 102) |

| 3 | 24.07.2015 | 90.10 | 57.3 | 16,615,000= 1000 euros | Write-off as expenses the cost of the currency used for conversion, as of the date of conversion, expenses taken into account when taxing profits in accordance with clause 3.26(3) of Article 129 of the Tax Code of the Republic of Belarus, NB rate 16,615 rubles/euro (clause 13 of Instruction No. 102) |

| 4 | 24.07.2015 | 57.3 | 91.1 | 87 000= | Revaluation of foreign currency funds in transit between rates for the period on the date of transfer of foreign currency for conversion and on the date of crediting foreign currency after conversion (16,615 - 16,528) * 1000 NB rate 16,615 rubles/euro (National Standard, clause. 15 Instructions No. 102) |

Accounting for foreign currency conversion transactions on the over-the-counter foreign exchange market with crediting to an account opened in another currency:

| No. | date | Account debit | Account credit | Sum | Contents of the operation (calculation) |

| 1 | 20.07.2015 | 57.3 | 52 | 16,528,000= 1000 euros | Transfer of foreign currency intended for conversion NB rate 16,528 rubles/euro |

| 2 | 24.07.2015 | 52 | 90.7 | 16,316,640= $1080 | Crediting to the account of the currency received as a result of conversion conversion rate 1.08 NB rate 15,108 rubles/dollar income taken into account when taxing profits in accordance with clause 3.19(5) of article 128 of the Tax Code of the Republic of Belarus (clause 13 of Instruction No. 102) |

| 3 | 24.07.2015 | 90.10 | 57.3 | 16,615,000= 1000 euros | Write-off as expenses the cost of the currency used for conversion, as of the date of conversion, expenses taken into account when taxing profits in accordance with clause 3.26(3) of Article 129 of the Tax Code of the Republic of Belarus, NB rate 16,615 rubles/euro (clause 13 of Instruction No. 102) |

| 4 | 24.07.2015 | 57.3 | 91.1 | 87 000= | Revaluation of foreign currency funds in transit between rates for the period on the date of transfer of foreign currency for conversion and on the date of crediting foreign currency after conversion (16,615 - 16,528) * 1000 NB rate 16,615 rubles/euro (National Standard, clause. 15 Instructions No. 102) |

Accounting for foreign currency conversion transactions on the over-the-counter foreign exchange market when paying with conversion:

| No. | date | Account debit | Account credit | Sum | Contents of the operation (calculation) |

| 1 | 20.07.2015 | 57.3 | 52 | 16,528,000= 1000 euros | Transfer of foreign currency intended for conversion NB rate 16,528 rubles/euro |

| 2 | 24.07.2015 | 60, 62, 76 | 57.3 | 16,316,640= $1080 | The cost of the currency transferred to the counterparty as a result of conversion conversion rate 1.08 NB rate 15,108 rubles/dollar (clause 13 of Instruction No. 102) |

| 3 | 24.07.2015 | 90.10 | 57.3 | 298 360= | Write-off of conversion costs expenses taken into account when taxing profits in accordance with clause 3.26(3) of Article 129 of the Tax Code of the Republic of Belarus (16,615 * 1000 – 15,108 * 1080) (clause 13 of Instruction No. 102) |

| 4 | 24.07.2015 | 57.3 | 91.1 | 87 000= | Revaluation of foreign currency funds in transit between rates for the period on the date of transfer of foreign currency for conversion and on the date of crediting foreign currency after conversion (16,615 - 16,528) * 1000 NB rate 16,615 rubles/euro (National Standard, clause. 15 Instructions No. 102) |

In the income tax return, income (losses) from foreign currency conversion are reflected in lines 4.1 and 4.2, respectively. That is, according to clause 3.19(5) of article 128 and clause 3.26(3) of article 129 of the Tax Code of the Republic of Belarus, if in general for the reporting quarter a loss was received from the conversion of foreign currency, then it is reflected in line 4.2, if received income - then it should be reflected on line 4.1.

(31 opinions)

Tags:

- foreign currency

Accounting for currency transactions

To account for foreign currency funds, enterprises use an accounting account. Let's look at the transactions for accounting for currency transactions using examples.

Obtaining a foreign currency loan

A loan agreement was signed between the bank and Admiral LLC, according to which the bank issues credit funds to Admiral LLC in the amount of USD 114,000. Funds are issued in 2 stages:

- Stage 1 - USD 57,000 issued 01..2015;

- Stage 2 - USD 57,000 issued on 10/01/2015.

The US dollar exchange rate (notional) is:

- as of 01..2015 - 65.10 rub./dollar. USA;

- as of 30..2015 - 66.12 rubles/dollar. USA;

- as of 10/01/2015 - 66.02 rubles/dollar. USA.

The following entries were made in the accounting of Admiral LLC:

| Dt | CT | Description | Sum | Document |

| 66 Loans received | Receipt of loan funds 1st tranche ($57,000 * 65.10) | RUB 3,710,700 | Bank statement | |

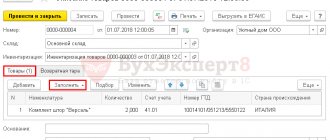

| 76 | 66 Unreceived loans | Reflection of the bank's debt for the 2nd tranche | RUB 3,710,700 | Loan agreement |

| 91/1 | Reflection of positive exchange rate difference from currency revaluation (USD 57,000 * (66.12 - 65.10)) | RUB 58,140 | Accounting certificate-calculation | |

| 91/2 | 66 Loans received | Reflection of negative exchange rate difference from the amount of debt of Admiral LLC to the bank (USD 57,000 * (66.12 - 65.10)) | RUB 58,140 | Accounting certificate-calculation |

| 76 | 91/1 | Reflection of positive exchange rate difference from the amount of bank liabilities ($57,000 * (66.12 - 65.10)) | RUB 58,140 | Accounting certificate-calculation |

| 66 Loans received | 91/1 | Reflection of the positive exchange rate difference from the amount of debt of Admiral LLC to the bank (USD 57,000 * (66.12 - 66.02)) | 5,700 rub. | Accounting certificate-calculation |

| 66 Loans received | Receipt of loan funds 2nd tranche ($57,000 * 66.02) | RUB 3,763,140 | Bank statement | |

| 76 | 66 Unreceived loans | REVERSE the amount of bank liabilities | RUB 3,710,700 | Bank statement |

| 76 | 91/1 | ONE HALF of the positive exchange rate difference from the amount of bank liabilities | RUB 58,140 | Bank statement |

Currency account posting

I just can’t find how to do this using standard methods.

Try the new free service for quick code analysis of typical configurations 1c-api.com

ATTENTION!

If you have lost the message input window, press

Ctrl-F5

or

Ctrl-R

or the “Refresh” button in the browser.

The thread has been archived. Adding messages is not possible.

But you can create a new thread and they will definitely answer you!

Every hour on the Magic Forum there are more 2000

Human.

- Articles

How to organize accounting on a foreign currency account

To correctly account for transactions with foreign currency, sub-accounts should be opened for account 52:

52-1 “Currency accounts within the country”;

52-2 “Currency accounts abroad.”

In addition, it is advisable to open second-order subaccounts for subaccount 52-1:

— 52-1-1 “Current foreign currency account”;

— 52-1-2 “Transit currency account”;

— 52-1-3 “Special bank account.”

The company has the right to open accounts in various currencies (US dollars, euros, etc.). In this case, it is better to record transactions for each type of currency in separate sub-accounts.

Commission of the bank

You have to pay a commission for the bank's account servicing services. The amount of the commission is established by mutual agreement between the bank and the client in the agreement for settlement and cash services. Payment can be made both in rubles and in foreign currency.

The commission can be withheld:

— bank of a Russian organization;

- a bank of a foreign company.

The commission is retained by the bank of the Russian organization

If the commission is retained by the bank of a Russian organization, the proceeds from the foreign company are received in the amount specified in the contract.

Expenses associated with paying for bank services are reflected in the following entries:

Debit 60 (76) Credit 51 (52)

— the commission was written off based on the bank statement;

Debit 91 subaccount “Other expenses”

Credit 60 (76)

— the amount of the commission is taken into account as part of other expenses.

Example 1. Mir CJSC entered into an agreement for the sale of products with an American company in the amount of $20,000. The proceeds were transferred to the foreign exchange account of Mir CJSC in March 2006. The amount of the bank’s commission was USD 200. Let's assume that the US dollar exchange rate on the date the commission was written off was 27.6 rubles/USD. The accountant of Mir CJSC wrote down:

Debit 62

Credit 90 subaccount “Revenue”

— 552,000 rub. (20,000 USD x 27.6 rubles/USD) - revenue from the sale is reflected;

Debit 52 subaccount “Transit currency account”

Credit 62

— 552,000 rub. (20,000 USD x 27.6 rubles/USD) - proceeds are credited to the transit currency account;

Debit 76

Credit 52 subaccount “Transit currency account”

— 5520 rub. (200 USD x 27.6 rubles/USD) - the commission amount is written off based on the bank statement;

Debit 91 subaccount “Other expenses”

Credit 76

— 5520 rub.

Selling currency in 1C 8.3: example, transactions

— the amount of the commission is taken into account as part of other expenses.

In tax accounting, a company’s expenses for paying for bank services can be taken into account either as expenses associated with production and sales (clause 25, clause 1, article 264 of the Tax Code of the Russian Federation), or as non-operating expenses (clause 15, clause

1 tbsp. 265 of the Tax Code of the Russian Federation). An organization has the right to independently determine in its accounting policy which specific group of costs it will include expenses for paying for bank services (clause 4 of Article 252 of the Tax Code of the Russian Federation).

The commission is retained by the bank of the foreign company

The bank of a foreign company can transfer proceeds to the foreign currency account of a Russian exporter, having previously withheld the commission amount from it. In this case, the amount of revenue received will differ from the amount reflected in the contract.

In such a situation, we advise you to stipulate in advance in the contract at whose expense the costs associated with the transfer of proceeds to a foreign currency account will be covered. If the contract stipulates that the costs of transferring the payment are incurred at the expense of the Russian organization, the bank commission is reflected by posting:

Debit 76 Credit 62

— the costs of transferring the payment are reflected.

This entry is made on the basis of a wire or telex message or a Community System for Worldwide Interbank Financial Telecommunications (SWIFT) funds transfer message indicating the amount of the fee withheld.

Example 2. Let's use the condition of the previous example, but with a caveat. Let us assume that, according to the terms of the contract, all costs associated with the transfer of money are paid by Mir CJSC. The American bank commission was also $200.

Thus, 19,800 US dollars (20,000 - 200) were received into the foreign currency account of the Russian company. On the same day, Mir CJSC received documents confirming the payment of a commission to a foreign bank.

The accountant of Mir CJSC made the following entries:

Debit 62

Credit 90 subaccount “Revenue”

— 552,000 rub. (20,000 USD x 27.6 rubles/USD) - revenue from the sale is reflected;

Debit 52 subaccount “Transit currency account”

Credit 62

— 546,480 rub. (USD 19,800 x RUB 27.6/USD)—revenue is credited to the foreign currency account minus the withheld commission;

Debit 76 Credit 62

— 5520 rub. (200 USD x 27.6 rubles/USD) - the commission of an American bank is reflected;

Debit 91 subaccount “Other expenses”

Credit 76

— 5520 rub. — the amount of the commission is taken into account as part of other expenses.

If the contract does not stipulate that the costs of transferring currency to the account of a Russian organization are made at its expense, the amount of the commission will be taken into account as uncollected receivables.

In this case, the Russian company will have to amend the contract and indicate that it is the company that pays the commission to the foreign bank. You will also have to re-issue the transaction passport. In this regard, we once again recommend that you stipulate in advance in the contract which party will cover the costs associated with the transfer of money.

Please note: the amount of VAT that is paid to suppliers and directly relates to the costs of production and sale of exported products can be reimbursed from the budget.

Such compensation is made only after the exporter’s account receives money in payment for the export contract (clause 2, clause 1, article 165 of the Tax Code of the Russian Federation).

However, tax inspectors often refuse to refund VAT, citing the fact that the proceeds did not go to the exporter’s account in full, but minus the bank commission. In this case, you have every right to go to court.

Courts usually support the position of exporters if, under the terms of the contract, a commission is paid by a Russian company.

Account abroad

Clause 8.1 currency conversion

Source: https://bookerlife.ru/valjutnyj-schet-provodki/