The software product “Analysis of the difference in VAT and Income Tax revenue in 1C: Accounting 8” received the “Compatible! Software system 1C:Enterprise". There is an extension version for Integrated Automation 2.0 and ERP.

It happens that an accountant is faced with a requirement from the tax inspectorate to explain discrepancies in the indicators of the income tax declaration (“Income from sales” + “Non-operating income”) and the VAT tax base for the year.

The requirement looks something like this: Are such discrepancies an error? How can I explain to the tax authorities their reason? In this article we will try to answer these questions and offer you a solution.

If you prefer to watch rather than read, there is a video version at the end of the article

And if you know how to compare databases, then go straight to the description of the development of automatic database comparison.

Why compare income by profit and by VAT?

The tax office compares VAT and profit returns to find income that the company forgot to charge with VAT.

In the simplest case (if we are analyzing the 1st quarter of the reporting period and we have no accounting difficulties), to reconcile we just need to carefully look at both declarations and check lines 010 + 020 (Sheet 02) in Profit and line 010 (Section 3) in VAT returns.

And this is quite easy to do.

Difficulties begin if we need to compare indicators over 9 months or over a year. Profit is easy to calculate - it is indicated in the declarations on an accrual basis. But with VAT there is already a problem - reporting is quarterly, which means we need to take all declarations from the beginning of the year and summarize their indicators.

VAT – 20%

The VAT rate has increased from 01.01.2019 from 18 to 20%. As usual, the transition period will last for some time, when, for example, payment was received at one rate, and shipment is carried out at a different rate.

Explanations on this issue are contained in the Letter of the Federal Tax Service dated October 23, 2018 No. SD-4-3/ [email protected] “On the procedure for applying the VAT tax rate during the transition period” with detailed explanations.

Experts have prepared a sample additional agreement to change the VAT rate . This template is convenient for making changes to contracts with counterparties.

The 2019 innovations regarding VAT, as well as complex and controversial issues of determining the tax base for this tax, will be discussed at a seminar that will be held on February 20 in Moscow. The event will be hosted by Tatyana Krutyakova, author of many books and publications on tax topics. Sign up for the seminar.

Why discrepancies may occur

Discrepancies do not necessarily mean errors - there are also “allowed” reasons for discrepancies.

- refunds to suppliers (increase the VAT base, but no profit)

- customer returns (reduce income in profit, but not in VAT)

- adjustments to implementations (different design options cause different discrepancies)

- VAT-free income

- different periods of income recognition for export sales

All this leads to the need to understand the discrepancies between VAT and profit

- becomes a very difficult task, requiring a deep dive into accounting, drawing up additional tables and additional checks.

Accounting for “foreign VAT”

Companies working with counterparties from neighboring countries often have questions about how to deal with VAT, which appears in the primary documents received from them. It is important to understand the following: despite the fact that this tax is called the same as Russian, it has nothing to do with our VAT. This is a tax of a foreign country; it is calculated and paid according to the laws of the country where the company’s partner is a resident.

Thus, the tax called VAT, which appears in the invoices of a foreign counterparty, is not deductible under any circumstances.

How should the “foreign VAT” that is presented to the buyer be reflected in accounting? The point is that it does not need to be taken into account separately. It forms the cost of purchased goods (works, services) and is included in income tax expenses.

In other words, for a Russian company it makes no difference which taxes are included in the cost of goods purchased from a foreign supplier, because the costs will take into account the full amount of the contract.

On the other hand, “foreign VAT” appears in a situation where, when paying for services rendered, a foreign partner, who is a tax agent, withholds this tax from the contract amount. For example, a Russian company provided services to a foreign enterprise, the cost of which was 1,200 conventional units (cu). However, the domestic company received 1000 USD The partner withheld the remaining amount in accordance with the laws of his country as a tax agent.

How should this transaction be reported in income? The Ministry of Finance believes that in full, including withheld foreign tax. That is, in our example, the Russian company must record income from the operation in the amount of CU 1,200. But the amount of tax withheld is 200 USD. can be attributed to expenses taken into account for calculating income tax. (letter of the Ministry of Finance dated May 18, 2015 No. 03-07-08/28428).

True, 21 of the Tax Code does not indicate on the basis of which document the withheld tax can be accepted as an expense. Therefore, in this matter one should be guided by the norms of Chapter 25 , and specifically Article 313 of the Code. It defines the documents on the basis of which income tax withheld by a tax agent can be offset against the tax payable by the taxpayer. Thus, if a foreign partner has withheld s as a tax agent, you should require a document from him confirming this process. If the latter is compiled in a foreign language, it will need to be translated into Russian.

Concept of a report for automatic comparison of VAT and Income Tax indicators

- During the analysis, we compare data from regulated reports. Moreover, the report includes the latest adjustment declarations

- Program credentials are used to calculate allowed differences

- Indicators are calculated in full rubles

- “Allowed differences” are divided into two groups:

- Carryover differences (differences in the moment of income recognition)

- Constant differences

is zero.

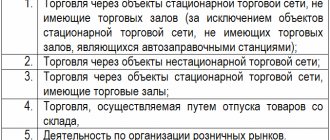

Implemented checks

- Not yet confirmed export sales

- Non-operating income (not subject to VAT)

- Returns to suppliers

- Customer Returns

- Adjustment of implementations (partially, full information is given below)

- Sales without VAT, UTII, Patent

- Transactions of gratuitous transfer

- Shipment without transfer of ownership

Detailed instructions for working with the report can be downloaded

and used even without access to the Internet

Examples of using the report

Video review of the development

Let's consider the work of the report using the example of one year of the organization's work

1st quarter

In the 1st quarter we see the following situation:

- adjustment declarations are used for analysis (k/1)

- in this quarter, the VAT rate of 0% was confirmed for the amount of 10,878,485 rubles (for income tax purposes, these sales were taken into account in previous quarters)

- For sales in the amount of 3,730,529 rubles, the 0% rate has not yet been confirmed

Result: there are no erroneous differences, all differences are “allowed”

2nd quarter

This quarter we see a similar situation with differences, but the indicators are already considered both quarterly and cumulatively - to facilitate reconciliation. Please note that indicators that are obtained by calculation are highlighted in gray (you will not find these figures in the declarations).

3rd quarter

In the 3rd quarter we see a difference of 33,700 rubles. If you analyze all the data, you can find the reason for the difference - the presence of non-operating income not subject to VAT.

Setting up other income not subject to VAT

There is a special setting in the VAT and Profit reconciliation report that allows you to specify a list of non-operating expenses that should not be subject to VAT and that must be included in the “allowed” differences.

If an item of other income is added to this list, then the detail “Not subject to VAT” is filled in (it can also be set in the directory itself).

This allows you to build SALT for the 91st account, grouped by VAT taxability. By default, this list is filled with unambiguously “allowed” differences. The user can independently supplement the list. In this case, we will add the article “Insurance compensation (MTPL)” to the exceptions.

As a result, we will receive a report in which there are no unresolved differences

4th quarter

In the 4th quarter we see that a whole range of “allowed” differences have been taken into account:

- unconfirmed export 0%

- returns of goods to the supplier

- returns of goods from customers

- non-operating income not subject to VAT

And still we get an unresolved difference.

Conclusion.

In this case, the difference means the presence of an accounting error in the VAT or Profit return. Additional data analysis (outside the scope of this report) will be required to find the error. Our primary recommendation is to update month closings, create a sales ledger, and refill tax returns.

"Fiscal" logic

As is known, tax legislation allows VAT to be deducted on goods (work, services), as well as property rights that are acquired to carry out transactions recognized as objects of taxation under this tax (clause 2 of Article 171 of the Tax Code). We are, in particular, interested in such objects as the sale of goods (work, services) and property rights, as well as the transfer of goods (performance of work, provision of services) for our own needs, expenses for which are in no way deductible when calculating income tax organizations. And all this applies only to operations carried out on the territory of the Russian Federation.

But, as often happens, tax authorities, without having time to authorize this or that action, formulate a number of conditions after which, if they are not met, it becomes either difficult or impossible to use benefits and deductions.

Thus, “in the world” there is a kind of unwritten rule: if the taxpayer does not have the right to take into account expenses incurred when forming the tax base for income tax, then one can forget about VAT deductions. In other words, tax authorities are ready to reimburse indirect taxes only if they consider the costs of purchasing goods, performing work, providing services or property rights to be economically justified.

Note. Tax authorities believe that if the taxpayer does not have the right to take into account expenses when forming the income tax base, then one can forget about VAT deductions.

It is impossible to limit ourselves to this rule alone to resolve the issue of the legality of deducting VAT. It does not say what serves as confirmation of the fact that goods (work, services), as well as property rights, were acquired for the specified purpose. Moreover, in the general case, VAT is charged on revenue generated according to accounting rules (Account Credit 90 “Revenue”). Consequently, confirmation of the fact of using what was purchased for taxable transactions can be considered the recognition of these costs as expenses for production and sales not in tax accounting, but in accounting. And there such costs are equal to the costs of ordinary activities.

The main argument that guides the tax authorities is related to clause 7 of Art. 171 of the Code: if in accordance with Ch. 25 of the Code, expenses are accepted for taxation purposes according to the standards; VAT amounts on such expenses are subject to deduction in the amount corresponding to the specified standards (clause 7 of Article 171 of the Tax Code of the Russian Federation). As a result, the tax authorities decided for themselves: if expenses are not accepted for income tax purposes, then VAT on them is not accepted for deduction.

As for construction and installation work for own consumption, those amounts of VAT that relate to property are subject to deductions:

- firstly, intended for carrying out transactions taxable in accordance with Chapter. 21 Code;

- secondly, the cost of which is subject to inclusion in expenses (including through depreciation deductions) when calculating income tax (clause 6 of Article 171 of the Tax Code of the Russian Federation). That is, here too the tax authorities see a contextual connection between VAT and income tax.

Not only tax authorities, but also the Russian Ministry of Finance proceed from the same logic when they demand that VAT be restored when writing off unfinished construction projects and under-depreciated fixed assets for stolen or otherwise lost goods.

But each time, one problem is confirmed - legislation is not always subject to logic. And if tax officials sometimes pull the blanket over themselves, the courts try to protect payers.

Note. A far-fetched condition

The Moscow Arbitration Court found that the applicant subleased the vehicle and received proceeds subject to VAT from the sublessee (OJSC Detsky Mir). In connection with these transactions, subject to VAT, the plaintiff incurred expenses for renting a vehicle and for its insurance. The tax authority did not deny this fact. In rejecting the controllers' reference to economically unjustified costs, the court of first instance was rightfully guided by Ch. 21 of the Tax Code of the Russian Federation, which does not contain such a condition for the application of tax deductions.

What differences can the report automatically detect?

- Export sales (waiting for confirmation of 0% VAT rate)

- Unconfirmed implementation 0%

- Returns to supplier

- Returns from buyer (current year)

- Adjustment of sales (by agreement of the parties, current year)

- Adjustment of implementation (correction in primary documents taking into account additional sheets)

- Non-operating income (you need to set up a list of income that is subject to VAT)

- Unconfirmed implementation 0%

- Income from core activities not subject to VAT (sale of UTII, excluding VAT)

- Free transfer

- Shipment without transfer of ownership

- Different VAT bases for sales of goods in foreign currency

- Returns from the commission agent

More than 12 different checks.

Algorithm for working with a report

- Refill the declarations (if you are not sure of their relevance), the report automatically analyzes discrepancies between the data of the profit declaration and tax accounting of income

- Set up a list of non-operating expenses (91.01) that are not subject to VAT (in the report settings)

- If the final difference between VAT and Profit revenue does not disappear, then this may indicate one of two things:

- you have manual correction of documents (analyze such documents)

- you have an accounting error and you need to look for it

- our report is not able to automatically find the difference that you have encountered (at the moment such situations are very rare, but hypothetically possible). If you find a situation that our report cannot automatically process, send us a detailed description in pictures and we will add it for free.

Important!

If you cannot identify the difference or find an error, then we will help you figure it out. To do this, we need a copy of your database or access to the server via RDP (the procedure can take considerable time).

The cost of this service: 10,000 rubles for 1 quarter.

VAT included in bad debts

Another case when VAT is included in expenses is if it is part of accounts receivable that are overdue and must be written off . This situation may arise as a result of an unpaid delivery or the transfer of an advance payment for which the goods were never shipped.

After three years, the debt becomes uncollectible and is written off as an expense.

In this case, the company has the right to write off the amount of receivables along with VAT. This procedure does not contradict the official point of view of the Ministry of Finance, as reflected in letter No. 3-07-05/13622 dated March 13, 2015.

It is worth paying attention to one nuance that arises when writing off bad receivables for prepayment. If the VAT presented upon its transfer was previously accepted for deduction, then when the receivables are written off, the tax must be restored. This is the position of the Ministry of Finance, however, many experts consider it controversial, since paragraph 3 of Article 170 of the Tax Code of the Russian Federation does not say anything about the restoration of VAT in this case.

The income tax base reflects not only written-off receivables, but also written-off accounts payable. It arises as a result of non-payment for shipped goods or failure on the part of the company to deliver on account of the advance received when the three-year statute of limitations for these transactions has expired. How to deal with VAT as part of such a “creditor” when writing it off? Let's look at this issue in more detail using specific situations.

If the company’s debt arose due to the fact that goods received were not paid for, then the amount of debt is charged to the income tax account in full, that is, together with VAT. At the same time, tax amounts accepted for deduction upon receipt of goods are not subject to restoration (letter of the Ministry of Finance dated June 21, 2013 No. 03-07-11/23503).

Another case is when accounts payable arose due to the fact that goods were not shipped against the advance received, on which VAT was paid . After the expiration of the limitation period, the amount of debt is included in the income that forms the income tax base. What should I do with the VAT previously paid on this amount? Logically, it should be excluded from income. However, the Ministry of Finance is of the opinion that the Tax Code does not allow reflecting this VAT in expenses (letter of the Ministry of Finance dated December 7, 2012 No. 03-03-06/1/635).

But according to many experts, there is another way out of this situation. They propose to take into account as income tax income not the full amount of the prepayment received, but the amount minus the VAT paid on it. In doing so, they refer to paragraph 2 of Article 248 of the Tax Code of the Russian Federation, which prescribes that the amounts of taxes presented by the taxpayer to the buyer should be excluded from income. However, if the company decides to take this path, it is very likely that it will have to defend its case in court.

How much does the extension cost?

Our report helps to understand the reasons for discrepancies between VAT and Profit in regulated reports and will answer the question of whether there is a problem.

The price includes a year of free support - if the configuration is updated or the form changes, we will fix everything.

For 1C:Accounting

Available in 1C:FRESH Extension only: 6,000 ₽ Extension + installation: 8,000 ₽

Order an extension

For 1C: Integrated automation 2 and ERP

Extension only: 10,000 ₽ Expansion + installation: 12,000 ₽

Order extension

Year of additional support - 3,000 ₽

If modifications are needed for changed configurations, the work is paid by the hour.

Updates

If you have access to support, the latest development version can be ordered here

Version 1.24

- Improved definition of returns for Income Tax and for separate divisions (the previous version may not have shown returns for the main tax authority if the place of registration changed during the reporting analysis period)

Version 1.23

- Added analysis of adjustments to implementation adjustments

- Identified issues have been fixed

- The development is adapted to the new profit declaration from the fourth quarter of 2022

Version 1.22

- Automatic determination of items of other income not subject to VAT (91.01)

- New difference: returns in the commission agent's report.

- New difference: adjustment of implementation (correction in primary documents) - analysis of additional records. sheets

- Improved analysis of Returns to suppliers (turnovers excluding VAT are taken into account)

- Improved analysis of Returns from customers (turnovers excluding VAT are taken into account)

- Improved analysis of Sales Adjustments (turnovers excluding VAT are taken into account)

- Improved opening of SALT according to 91.01 from settings (grouping of income by VAT)

Version 1.21

- We added automatic analysis of a new difference - sales in foreign currency (when offset with an advance payment).

- Fixed mechanisms for determining submitted reports

- We also adapted the report to the current version of 1C:Accounting

Version 1.20

- The analysis takes into account additional VAT sheets

- Fixed bug with finally unconfirmed VAT

- Minor bugs fixed

Version 1.19

In this version, we have updated the declaration forms, corrected several important details and made working with the report even more convenient:

1. The report has been updated for the Profit and VAT declaration forms from the 4th quarter of 2022, the diagnosis of filling errors has been improved due to the update of reporting forms 2. The verification of amounts in the Profit declaration and in accounting data for complex transactions has been corrected 3. The line “ has been highlighted in the analysis Proceeds from the sale of other property" 4. Simplified the work with setting the flag "Not subject to VAT" for other income. After setting the flag, you no longer need to re-open the discrepancy analysis; the new settings will be accepted automatically. 5. Added the ability to quickly open OSV for 91.01 from the report settings form

Version 1.17

- Fixed minor inconvenience of adding other income

- Improved determination of the required declaration in the presence of separate divisions

Version 1.16

- the long-awaited decoding of discrepancy indicators

- other income “Return of goods sold in the previous tax period” has been added to the default exceptions

Version 1.15

- added analysis of returns to the supplier (if it is made on the basis of an adjustment invoice)

- identified errors have been fixed

Version 1.14

The extension is adapted to the new form of the regulated Profit report from the 4th quarter of 2022 (1C: Accounting 3.0.75)

Version 1.13

- The extension is adapted to version 1C: Accounting 3.0.75

Version 1.12

We decided to make development even more convenient and transferred the functionality to the Extension. This will allow:

- more convenient to open development

- It’s more convenient to set up other income and expense items

- improve checking the compatibility of development with future versions of 1C:Accounting

But we haven’t forgotten about the development of functionality:

- We show differences only if there is something to show

- simplified setting up the item of other income from expenses (the “Not subject to VAT” flag)

- added a certificate for the indicator “Sales at a rate of 0%” (to open you need to click the “?” sign)

Version 1.11

- Added a new indicator “Sales of shipped goods” (actual transfer of ownership)

- We have finalized indicator 040 of section 4 of the VAT return. Now all the lines of this column are summed up

Version 1.10

- Added a new indicator “Shipment without transfer of ownership”

- Identified errors have been corrected

Version 1.9

- This release adds checking for discrepancies in gratuitous transfer transactions

Version 1.8

- We added revenue data for other operations (Appendix No. 3 to Sheet 02) to the analysis of the convergence of accounting and reporting data - this is usually the sale of fixed assets or intangible assets

- Added the ability to open regulated reports via hyperlink (in one click you can open everything you need for reconciliation)

- Added a description of the “Difference” column - the main reasons and necessary actions

Version 1.7

- The 2022 analysis shows a VAT rate of 20%

- The indicator “Confirmed export sales” (Section 4 line 020) in the 2022 reports has been corrected

- The difference of 1 ruble between SALT and the Profit Declaration is not controlled

Version 1.6

- Added control for discrepancies in revenue and other income according to accounting data (90.01 and 91.01) and according to the profit declaration data

Version 1.5

- Adjustments to sales taken into account (downward)

- Adjustments to sales downwards from sales from previous years have been taken into account

Version 1.4

- New indicators have been added to the allowed differences: Unconfirmed sales 0% (in case of additional VAT charges)

- Sales according to 90.01.1 without VAT

- Implementation according to 90.02.2 UTII and Patent

- the year-end closing mechanism was taken into account when analyzing accounts 90 and 91

- fixed determination of differences in returns to suppliers and from customers

Version 1.3

- the report has been prepared for use in cloud versions

- Fixed errors in report generation for users with limited rights

Version 1.2

- interface fixes

Version 1.0

- the extension contains the main functionality from BP 3.0

- While some checks have not been implemented, we will add according to user requests

Version 2.1

Fixed checks for:

- sales adjustments (downward)

- returns of goods

When is the deduction applied and what to do with income tax. VAT at estimated rate

VAT in a number of cases listed in paragraph 4 of Art. 164 of the Tax Code of the Russian Federation, is calculated by the seller from the income received at an estimated rate of 10%/110% or 18%/118%. But the Russian Tax Code says unfavorably about the buyer’s ability to deduct this VAT, although in reality the situation is not so bad. Let us consider this situation using the example of an operation involving the assignment by a new creditor of the property right of a claim under a sales agreement.

According to paragraph 2 of Art. 155 of the Tax Code of the Russian Federation, the tax base upon assignment by a new creditor who has received a monetary claim arising from a contract for the sale of goods (works, services) is determined as the amount of excess of the income received by the new creditor upon subsequent assignment of the claim or upon termination of the corresponding obligation over the amount of acquisition costs the specified requirement. Based on clause 4 of Art. 164 of the Tax Code of the Russian Federation, a calculated rate of 18%/118% is applied to the specified tax base. Let us analyze whether the subsequent creditor who acquired this right will be able to deduct this amount of VAT.

Clause 1 of Art. 172 of the Tax Code of the Russian Federation establishes that when purchasing goods (work, services), property rights from Russian sellers, only the VAT amounts presented by the seller are subject to deduction from the buyer. In accordance with paragraph 1 of Art. 168 of the Tax Code of the Russian Federation presented are the amounts of VAT accrued by the seller in addition to (“above”) the cost of goods (work, services) sold, property rights or calculated from the amount (“from within”) the advance received. Therefore, strictly speaking, of all the cases when, according to paragraph 4 of Art. 164 of the Tax Code of the Russian Federation, VAT is calculated not “from above” at a rate of 18% or 10%, but “from within” at a rate of 10%/110% or 18%/118%; only VAT calculated by the seller on the advance amount should be deducted. Consequently, the VAT calculated by the new creditor upon further assignment of the right of claim at the calculated rate cannot be accepted for deduction by the subsequent acquirer of the right.

A similar conclusion follows from the letter of the Ministry of Finance of Russia dated February 17, 2010 No. 03-07-08/40, which indicates the impossibility of deducting VAT charged by the original creditor to the new creditor.

However, this harmonious logic “collapses” (fortunately for taxpayers) when referring to clause 18 of the Rules for maintaining a purchase book used in calculations of value added tax, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 (hereinafter referred to as Resolution No. 1137). In this paragraph, when listing cases in which the invoice is drawn up in one copy (and, therefore, the buyer who does not receive the second copy has no right to deduct VAT), only the operations from Art. 162 of the Tax Code of the Russian Federation, and the operations specified in Art. 155 of the Tax Code of the Russian Federation are not mentioned (as are the operations specified in paragraphs 3, 4. 5.1 of Article 154 of the Tax Code of the Russian Federation, when VAT is also calculated from the inter-price difference). Clause 19 of Section II was also formulated. Maintaining a purchase book by the buyer in Decree of the Government of the Russian Federation of December 2, 2000 No. 914.

Consequently, although formally - within the terminology of the Tax Code of the Russian Federation - VAT, calculated at the calculated rate for the assignment of rights and the sale of goods, the cost of which includes the tax presented upon their acquisition, is not considered “presented”, for the purposes of deduction it in these situations is conditionally regarded as "presented" The difference between situations when, according to Art. 154, 155 of the Tax Code of the Russian Federation, VAT is calculated on the difference between prices, and Art. 162 of the Tax Code of the Russian Federation is that in the first case we are talking about amounts that are revenue from sales, i.e. directly forming the tax base, and in the second - about amounts that are not directly revenue and therefore do not form, but only “increase” tax base.

Thus, for all subsequent assignments of rights of claim under a sales contract, the seller of rights draws up an invoice with the inter-price difference at the estimated rate in two copies, and the acquirer of rights (the next assignee and creditor), having received the second copy of the invoice, accepts the VAT indicated in it to deduction.

But for income tax purposes, does the seller of rights reduce his income (inter-price difference) by the amount of VAT calculated on it?

Example

The new creditor assigns the right of claim, the acquisition costs of which amounted to 10,000 rubles. for 11,000 rub. VAT calculated by the seller of rights will be 152.54 rubles. (1000 rub. x 18%/118%). What amount of income must the seller of rights show in the income tax return: 1000 rubles, or 847.46 rubles. (1000 rubles - 152.54 rubles?

Of course, 1000 rubles, because according to paragraph 1 of Art. 248 of the Tax Code of the Russian Federation, when determining income, the amounts of taxes presented in accordance with the Tax Code of the Russian Federation by the taxpayer to the buyer (acquirer) of goods (work, services, property rights) are excluded from them.

Chapter 25 of the Tax Code of the Russian Federation does not define the meaning of the concept of “tax presented”, therefore it is necessary to refer to the wording of Art. 21 of the Tax Code of the Russian Federation, according to which VAT calculated at the estimated rate not on the prepayment amount is not considered claimed. And for the purposes of income tax, one cannot refer, as was the case with VAT, to the indirect hint of Resolution No. 1137 that in the event of an assignment of rights of claim, such VAT is considered as if presented.

However, reflecting income without excluding the amount of VAT from it does not lead to an increase in the tax base for income tax by the same amount, since it is simultaneously included in expenses taken into account for tax purposes. This is explained as follows.

In accordance with paragraphs. 1 clause 1 art. 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include amounts of taxes accrued in the manner established by the legislation of the Russian Federation, with the exception of those listed in Art. 270 Tax Code of the Russian Federation. In paragraph 19 of Art. 270 states that when determining the tax base, expenses in the form of amounts of taxes presented in accordance with this Code by the taxpayer to the buyer (acquirer) of goods (work, services, property rights) are not taken into account. VAT, calculated at the estimated rate for income tax purposes, as determined by us, is not presented, therefore, being accrued in accordance with the law (i.e., meeting the requirements of clause 1, clause 1, article 164 of the Tax Code of the Russian Federation) , it is included in tax expenses and is presented in the tax return for corporate income tax. On the same basis, the courts allow including in expenses taken into account for the purposes of taxation VAT accrued by the organization “at its own expense” (i.e. not presented and, accordingly, not received as part of payment from the buyer) for unconfirmed exports, based on the results of a tax audit, and even under agreements for the gratuitous use of property (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 9, 2013 No. 15047/12 (with which the Ministry of Finance of Russia agreed in letter dated July 27, 2015 No. 03-03-06/1/42961 and less explicitly - the Federal Tax Service Russia in a letter dated December 24, 2013 No. SA-4-7/23263), AS of the Volga-Vyatka District dated May 7, 2015 No. A11-4982/2014, AS of the West Siberian District dated October 6, 2015 No. A27 -19625, FAS of the Far Eastern District dated 06/19/14, No. F03-2381/2014, AS of the Moscow District dated 12/9/15, No. A40-10526/15).

The above explanations regarding income tax are also valid for the situation of debt repayment by the debtor, in which the tax base is also defined as the amount of excess of the income received by the new creditor upon termination of the corresponding obligation over the amount of expenses for the acquisition of the specified claim (Clause 2 of Article 155 of the Tax Code of the Russian Federation ). At the same time, as the Ministry of Finance of Russia points out, the new creditor does not issue an invoice to the debtor, since there is no corresponding situation provided for in paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, - there is neither shipment of goods (performance of work, provision of services), nor receipt of payment amounts, partial payment on account of upcoming deliveries of goods (performance of work, provision of services) (letter of the Ministry of Finance of Russia dated March 18, 2015 No. 03-07 -05/14390).

But, even if such an invoice had been issued, the debtor would still not have the right to a deduction on it, since he had already applied a deduction from the amounts payable at the time of acceptance for accounting of goods (work, services), property rights acquired from the first creditor.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up