New form of work book from 2023

Note! Order of the Ministry of Labor of the Russian Federation dated May 19, 2021 No. 320n approved a new form of work book. The order came into force on September 1, 2022, but the new forms can only be used from January 1, 2023. At the same time, old-style work books (as well as inserts) are valid without a time limit.

Work books must be issued to each employee if he works for more than 5 days and this work is his main job.

For an employee hired for the first time in 2022, the work book is opened in electronic form. This rule is the same for everyone, that is, the employee in this case has no choice.

Why then were new forms approved? It’s simple - they will be filled out if the employee has chosen the paper version of maintaining the Labor Code, and his current book has been lost or has become unusable. If there is no space left, an insert will be issued on a new form.

All basic information about the employee, the work he performs, transfers to other positions, incentives and dismissals is entered into the work book. Information about penalties imposed on the employee (reprimand, warning, fine) is not entered in the book.

Order HR services from 1C

Electronic format of the work book

Note! In 2022, the transition to electronic work books began. All working citizens can choose the format independently.

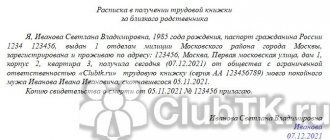

In accordance with the law of December 16, 2019 No. 439-FZ, by the end of 2020, each employee had to submit an application on how to keep his work book - paper or electronic. If the first option is chosen or the application was not submitted for some reason, then in 2022 its Labor Code is maintained in paper form. However, the right to choose remains with the employee. If he writes an application to switch to an electronic format of the work report, the employer will stop maintaining it in paper form.

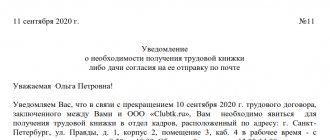

The Ministry of Labor explained the procedure for switching to electronic labor codes in a letter dated August 12, 2020 No. 14-2/OOG-12933. Each employer had to notify its employees about the possibility of switching to an electronic version of the document by October 31, 2022. If the employee chooses the second option, a paper Labor Code is issued to him within 3 working days. Before this, a record is made in it that the employee submitted to the employer an application for the transition to an electronic format of the work book.

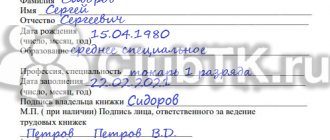

The procedure for making an entry about an employee’s choice of an electronic work book is as follows:

- in column 1 - the serial number of the entry;

- in column 2 - the date of issue of the work book to the employee;

- in column 3 an entry is made: “A written application has been submitted to provide information about labor activity in accordance with Article 66.1 of the Labor Code of the Russian Federation”;

- Column 4 indicates the employee’s application, and also reflects the date and number of his registration.

Then information about work activity, including the fact of filing an application for the transition to an electronic labor code, is sent to the Pension Fund of the Russian Federation as part of the SZV-TD form. Deadline - no later than the 15th day of the month following the one in which the employee wrote an application to change the format of the book.

After switching to an electronic TC, the employee will no longer be able to return to maintaining it on paper.

Is it possible and how to make changes to it?

Any corrections to information without accompanying written explanations on behalf of the person responsible for the Journal are unacceptable. Which is another type of protection against falsification of documentary information.

A notification that information in a line in a certain column has been corrected is recorded:

- in a special field for notes, if there is one in the Journal table (incorrect information is crossed out with one neat line, and in the note, the entry about the error is certified by a personal signature of the person responsible for the accounting book, a transcript of the signature, and the date of the procedure);

- line below, but in the same column where the inaccuracy was made (incorrect information is not crossed out, they only indicate in words that the entry with such and such a number is unreliable). The following is accurate information.

Maintaining a receipt and expenditure book to keep track of purchased and issued new work record forms is ignored by some heads of organizations. However, if it is discovered that such a document is missing, as well as being found to have violated the rules for filling it out, it is punishable by an administrative penalty.

Instructions for filling out a work book

By its order No. 320n, the Ministry of Finance changed some of the rules for maintaining and recording paper labor records. They, unlike the form, have already entered into force.

Reasons for filling out a work book

The work book is filled out on the basis of the following documents:

- order on hiring, transfer, promotion, dismissal;

- passport or other identity document;

- diploma, certificate, advanced training certificates and other documents confirming the education, qualifications and special knowledge of the employee.

Requirements for filling out a work book

When filling out a work book, you must take into account the following requirements:

- filling language – Russian;

- dates are indicated in Arabic numerals (for example, 01/01/2003);

- information must be entered carefully using a fountain or gel pen, a rollerball pen (including a ballpoint pen), or light-resistant ink (paste, gel) in black, blue or violet. Along with this, from September 2022, a stamp with a standard entry can be placed in the Labor Code and it is allowed to use a combined method - partly with a stamp, partly by hand. Also, recording can be made using technical means;

- no abbreviations are allowed (for example, pr. instead of “order”, disp. instead of “instruction”, etc.);

- It is not allowed to cross out previously made inaccurate, incorrect or other invalid entries in the sections “Information about work” and “Information about awards”;

Note: if such an error is made, it is corrected by making an entry under the next number in the format “The entry behind number such and such is invalid” and then, on the next line, the correct entry is indicated with duplication of the number and date of the order.

- in addition to periods of work, information about military service, training, advanced training and retraining is also entered into the work book;

- entries about bonuses paid monthly are not included in the work book.

Note! According to the new rules, the employee no longer needs to be familiarized with all the entries made in the work book, against signature on a personal card. The requirement to certify with his signature all entries made in the Labor Code during the period of work for this employer has also been canceled.

Results

The book intended for accounting for BSO is maintained by government agencies on a specially established form (form 0504045). Other legal entities and individual entrepreneurs have the right to use this form or create their own, subject to compliance with the mandatory requirements for the details of such a document.

The employee who makes entries in the BSO accounting book is appointed by order of the manager and is the financially responsible person.

Entries in the book are kept in chronological order. Attached to it are the BSO counterfoils and their damaged/unused forms. The general rules for drawing up a BSO accounting book are similar to the rules for drawing up a cash book. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of filling out a work book

When filling out a work book, it is important to consider the following features:

- Filling out the book begins with column 3, in which you must indicate the full and abbreviated name of the organization. Instead, it is permissible to put a stamp indicating the name. If an employee is hired by a branch, the name of the parent organization is indicated.

- After column 3, column 1 is filled in, which indicates the serial number of the entry. When making an entry, the order of continuous numbering must be observed. That is, if the previous entry was number 8, the next one will be number 9.

- In column 2, you must indicate the start date of work in accordance with the order.

- In column 3 (opposite the start date of work) it is necessary to indicate the position, specialty or profession, indicating the qualifications for which the employee was hired and the name of the department in which he will work.

- Column 4 indicates the date and number of the employment order.

How to seal and stitch

The purchased accounting book of receipts and expenditures of work book forms must have a numbered indicator seal without signs of damage, corresponding to GOST 31282–2004.

The lacing of the journal is performed by the person designated as responsible for making entries.

Sequence of the firmware procedure:

- Using a sharp needle or awl, make a hole in the left blank margin of the magazine, piercing all the sheets through. When determining the location of the punctures, you should take into account the ease of use of the book after flashing.

- Thread a harsh or otherwise strong thread through the resulting holes so that upon completion of the work, two ends of 7–8 in length remain.

- The threads are tied in a knot on the back of the book.

- A sheet of paper is glued over the knot and the remaining ends of the lacing.

- The surface of the pasted sheet is intended for a certification inscription about the number of pages in the book, the date of the firmware, information about the person who performed the procedure (full name in abbreviated and full format, signature).

Algorithm for the accounting ledger verification procedure:

- Number all pages in the journal (information about the number of pages must be presented in words and in the form of numbers).

- A certification inscription must be made (it is performed by the head of the organization, who confirms with his signature that the specified number of pages corresponds to reality).

- Before putting the Book into operation, fill out its title page.

- Enter the digital code found on the production seal in the line provided for this (without fixing the number from the seal on paper, even the magazine will not be considered sealed).

- They are stitching the book.

- Seal the lacing.

Work book form in 2022

Note! In 2022, the transition to electronic work books began. All working citizens can choose the format independently. By the end of 2022, each of them had to submit an application on which option to conduct their work. If for some reason the application was not submitted, then in 2022 a paper TC will be filled out. However, the employee still has the right to choose. If he writes an application to switch to an electronic work book format, the employer will stop keeping a paper one.

The work book form is valid in 2022 ().

Insert in the work book ();

Order HR services from 1C

This might be interesting

- Samples of filling out work books

An example of compiling a receipt and expenditure ledger

The columns in the book are very easy to fill out.

If the forms arrive at the enterprise, then fill out:

- The date the purchase was made

- Name of the company where the forms were purchased

- The name of the receipt document, its number and date. This can be either a delivery note, a sales contract or another document received upon purchase

- The number of forms purchased, their series. Numbers can be specified in the range from the first number to the last

- Total amount paid for all forms purchased

When the forms are issued for use, we take the following steps:

- We indicate the date when the forms are transferred to the HR department

- We indicate on the basis of which document the transfer takes place. For example, the HR department has requested forms to be issued to employees, then an application is drawn up. If the forms are subject to destruction for some reason, then an act is drawn up and its details are entered into the book

- Next, you should indicate how many forms are issued, indicate their series and the number of each form separately

- In the last column we indicate the cost of all issued forms

To more clearly present information about how you can fill out the book, let’s summarize the data in a table.

| No. | date | From whom it was received or to whom it was issued | Foundation _ | Coming | Consumption | ||||||

| Day | Month | Year | Quantity | Sum | Quantity | Sum | |||||

| Work book (series, number) | Insert (series, number) | Work book (series, number | Insert (series, number) | ||||||||

| 1 | 15 | 06 | 2018 | Documents LLC | Consignment note No. 15 dated June 15, 2018. | 5 items: Series TK – IV No. s 0050482 By 0050486 | – | 500,00 | – | – | – |

| 2 | 04 | 07 | 2018 | Application No. 3 dated 07/04/18 | – | – | – | – | 3 pieces: Series TK – IV № 0050482, 0050483, 0050484 | – | 300,00 |

As we can see from the table, it is necessary to enter the receipt of forms on one line, and the expense on the other. If there are several incomes and expenses, then a separate line is filled in for each of them.

Book of movement of work books and inserts in them

In addition to the work book, the employer must maintain documents on the accounting and movement of work books:

- book for recording the movement of work books and inserts in them ();

- receipt and expenditure book for accounting of work book forms and the insert in it ().

Note

: if the employer does not have accounting book data, he may be subject to a fine of 1,000-5,000 rubles. for officials and from 30,000-50,000 rubles. for the organization.

According to the provisions of Order No. 320n, employers can independently develop a form of books for recording work book forms and an insert in it, as well as a book for recording the movement of work books. At the same time, no one forbids keeping books according to current forms until they run out.

Misconduct and responsibility

The absence in the organization of the Register of documents allowing to determine the work experience of citizens, places of work and duration of activity gives the regulatory authority the right to impose a punitive administrative penalty in the form of a fine:

- from 500 to 5 thousand rubles (for officials);

- 30–50 thousand rubles (for an organization).

Filling out the Accounting Book is carried out only by an authorized person. If a violation of this rule is detected, a fine is imposed: from 3–5 thousand rubles (for citizens), from 10–20 thousand rubles (for officials).