How and on what form is the SZV-M submitted?

Form SZV-M is the most frequently filled out report because it is submitted monthly (by the 15th day of the month following the reporting month).

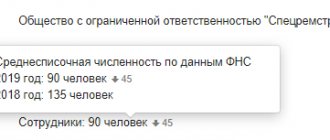

Individual entrepreneurs report using this form only if they have hired employees, but organizations are required to submit this report to the Pension Fund in any case, since they cannot exist without employees. Even if the company has a single founder with whom an employment contract has not been concluded (it is safer and as legal as possible to conclude an employment contract), then it is still required to provide information on him in the SZV-M form. I wonder what the abbreviation SZV-M means? Read about this in the article .

The form on which the information should be submitted has been approved since May 30, 2021 by Resolution of the Pension Fund Board of April 15, 2021 No. 103p.

You can view and download a sample form SZV-M in ConsultantPlus. If you don't already have access to this legal system, get a free trial:

From 01/10/2022 clause 2 art. 8 of Law No. 27-FZ states that this information is submitted exclusively in electronic form if the number of people on the list is more than 10. For SZV-M containing 10 people or less, a paper version of the submission is acceptable.

if you can send a report by mail from the article .

SZV-STAZH: when and to whom to cook

SZV-STAZH is a consolidated report in which employers include information about all employees with whom an employment contract or GPC agreement and various licensing agreements have been signed.

This report is submitted by all employers without exception at the end of the year (before March 1 of the year following the reporting period) or earlier, if it is necessary to submit information for an insured person who is going to retire. The form and requirements for filling it out will not change this year. When preparing reports, be guided by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p. More details: how to fill out the personalized accounting form SZV-STAZH

In what electronic format should I submit the SZV-M?

In order for the report file to be sent and read correctly by the receiving party, it must have a certain format. This format was approved by Resolution of the Pension Fund Board of December 7, 2016 No. 1077p. Let's pay attention to the structure of the file name that should be generated when unloading SZV-M.

As you can see, SZV-M electronic documents are submitted in xml format.

They are created in a specialized program. There are a lot of programs on the market with the help of which accountants not only create SZV-M, but also submit this form to the Pension Fund. In addition, free programs for generating the necessary reporting in the required formats are available for download on the official website of the Pension Fund of Russia.

As a rule, in programs that allow you to both create and send reports, the algorithm for checking all forms is already built-in. We tell you how to check SZV-M for errors for those who do not have electronic reporting.

Description

How to download the program:

- Video instruction

CheckXML is software developed with the support of the Russian Pension Fund. Its main task is to verify documentation prepared electronically for submission to the Pension Fund. The program does not allow you to create forms. There is other software for this. It only recognizes document types and identifies errors in them.

This program will save time for insurance agents and companies submitting documents to the pension fund. If there is an error, submitted files will be returned, resulting in wasted time not being corrected, resubmitted and reviewed. CheckXML will help you avoid unnecessary steps. It automatically recognizes the type of document and looks for possible errors in the completed data. For example, the program checks the correctness of the calculation of the combined length of service, and also identifies inaccuracies in the calculation of pension accruals and contributions. All errors found are displayed in the main part of the program window.

CheckXML is updated regularly. Taking into account changes in laws, document verification algorithms are also changing. Therefore, it is important to check that the latest version of the software is installed on your PC.

Functions and features of the CheckXML program:

- Verification of documents submitted to the Pension Fund of Russia

- Russian interface

- Automatic document type detection

- Compatible with older OS

- Regular updates

- Meets the requirements of the Labor Code of the Russian Federation

On our website you can download the current version of CheckXML for 2019. The files are taken from the official website of the Pension Fund. The program is compatible with all versions of Windows, including XP, and works even on weak PCs.

Official website: www.pfrf.ru

What errors can there be in SZV-M

Since the accountant creates the form on the Pension Fund of Russia website, can he also check the SZV-M on the Pension Fund of Russia website online? Let's say right away that yes, but for this you need to download the software. There are other ways to check SZV-M online. Let's look at this issue later in the article, and now let's look at what errors there are in SZV-M. After all, not all errors are detected by checking SZV-M online.

Accountants fill out SZV-M with special care and attention, since mistakes are very expensive - the fines for them are considerable and are often disproportionate to the mistake made.

Read the article about the penalties for incorrectly filling out SZV-M .

Errors that the program will not check include the legality of including a particular person in the SZV-M form. Only you know with which people you have employment or civil contracts, when they were concluded and when they will cease to be valid.

Also, the program will not check whether you have entered the correct code to indicate the month for which the calculation is being submitted. The exception is the case when the delivery period you set goes beyond the general deadlines for submitting these reports:

- if they set a period when SZV-M had not yet given up at all;

- if you set a period that has not yet arrived.

The rules for submitting the supplementary form SZV-M are described in the article .

Now let’s look at what errors are tracked programmatically and what SZV-M verification program does this in 2022.

How to fill out the SZV-M form

In 2022, the form approved by Resolution of the Pension Fund of April 15, 2022 No. 103p is in force.

Section 1:

- details of the policyholder. Full or abbreviated name in accordance with the constituent documents. Individual entrepreneurs write their last name, first name and patronymic;

- registration number in the Pension Fund of Russia. The number is indicated in the notification from the Pension Fund received upon registration;

- TIN of the organization or entrepreneur;

- Checkpoint. Entrepreneurs leave the field blank.

Section 2:

- reporting period of the calendar year. The serial number of the month is indicated (January - 01, February - 02, March - 03, etc.).

Section 3:

form information type (code). One of the types is indicated:

- “Initial” - if you are submitting a report for this month for the first time.

- “Additional” - if you need to supplement a report previously accepted by the fund. For example, if you forgot to include one of the employees.

- “Cancelling” - if you want to cancel some of the information from the original report.

Section 4 (tabular part):

- No. Numbering is continuous - ascending without gaps or repetitions (1, 2, 3, 4, etc.);

- last name, first name, patronymic (if any) of the insured person. In the nominative case, in full: you cannot abbreviate and write initials;

- SNILS of the employee;

- Taxpayer Identification Number (if any).

Free check from the Pension Fund website

We will show you how to check SZV-M online on the Pension Fund website.

First, we go through a simple path on the official website of the Pension Fund: main page - menu - employers - software. You can immediately follow the link.

We get to the following page:

You can check the SZV-M report online for free and not with the only program developed by Pension Fund specialists. For example, we download the Check PFR program or the PD software program to check the SZV-M.

Go to the latest version of the SZV-M verification program and save the ZIP archive of the version:

We go into the archive saved on the computer and run the PD software installer:

The program is installed on your computer; you must follow the instructions of the installation wizard. Once the installation is complete, the program will launch.

To check the SZV-M form, it is necessary that the file with it be downloaded to your computer. As already mentioned, you can get such a file by creating it in one of the specialized programs.

Click the “File” button:

Select the file to check:

The verification process starts immediately:

As you can see, the program did not find any errors. The form is ready for submission to the Pension Fund:

The Check PFR program works in a similar way. It also needs to be installed on your computer and the file you saved in advance must be entered.

Official version of CheckPFR from the developer's website

On the website page you can download Bukhsoft for free in one file. Technical support will help users update CheckPFR to the latest version at any time. The archive that should be downloaded includes:

- installer exe

- msxml6_xmsi

- detailed step-by-step installation instructions in .doc format

- user manual in .doc format

To install CheckPFR on your computer, just open the archive and run the .exe file, following the pop-up prompts. Silent installation will automatically unpack the components into the specified directory.

The program is distributed absolutely free of charge and is intended for use only in the Russian Federation.

For the program to work properly, you should regularly check for the latest updates. The official website releases information about the latest updates with a list of changes made to the program.

Reporting to the Pension Fund includes many forms that are constantly changing. These are forms of personalized accounting documents (SZV-6-4, ADV-6-5, ADV-6-2, SZV-6-1, SZV-6-2, SZV-6-3, ADV-6-3, ADV- 6-4); calculations for accrued and paid insurance premiums (forms RSV-1, RSV-2, RV-3), documents for the insurance certificate (forms ADV-1, ADV-2, ADV-3, ADV-9), documents for the pension co-financing program (forms DSV-1, DSV-3), form SPV-1, containing information on accrued and paid insurance contributions for compulsory pension insurance, as well as on the insurance experience of the insured person to establish a labor pension. It is unlikely that an accountant can independently keep track of the amendments that can be made to a dozen forms and update all these forms in a timely manner. Therefore, the best solution is to use a web service, where all changes are made centrally by a team of qualified experts, without any user participation. Such a web service is “PF Contour-Report”. The main functions of the service are generating reports to the Pension Fund and checking reports to the Pension Fund. In the “PF Contour-Report” you can calculate contributions to the Pension Fund (for example, filling out RSV-1). Since “Kontur-Report PF” is a web service, it is also possible to check reports in the Pension Fund online. Testing of reporting in the Pension Fund is carried out using the latest versions of verification programs that are used when receiving reports by Pension Fund specialists - CheckXML and CheckXML-Ufa. Moreover, with the help of “Kontur-Report PF” you can prepare and check the reports of the Pension Fund of Russia for free. To use the full-featured version of the service for free, just register in it and receive a promo code. Those who have prepared and verified the reports to the Pension Fund still have one more task: submitting pension reports. Please note: “Kontur-Report PF” only prepares and verifies reporting. The program for submitting reports to the Pension Fund is purchased separately. At the same time, the “Kontur-Report PF” service is available at no additional cost to many subscribers of the “Kontur-Extern” system, with the help of which, among other things, electronic reporting is submitted to the Pension Fund. Since “Kontur-Extern” is also a web service, it, in combination with “Kontur-Report PF”, allows you to completely close the question of “electronic reporting to the Pension Fund of Russia or online reporting by the Pension Fund of the Russian Federation.”

How to check SZV-M without downloading programs to your computer

There are free online services that allow you to check the SZV-M form without downloading any programs to your computer. The verification is carried out by the same programs that are presented on the official website of the Pension Fund. For example, a free online check is available on the Konturn-extern website:

To do this, the file with SZV-M must also be generated in the proper format and saved on the computer. To check it, click the “Reports” button:

Select the required file:

You can also add several files to scan and scan them all at once. Click the “Check” button:

After the check is completed, a positive or negative result will be given:

Many specialized services for preparing and sending reports provide the opportunity to test their capabilities for free for some time. They usually contain built-in verification programs. It should be understood that their built-in programs are the same as those presented on the official website of the Pension Fund.

Desk audit of reporting

Despite the fact that currently the process of checking completed SZV reports is quite streamlined, it is not possible to conduct a desk check of information online. After the corresponding protocol with the results of the audit arrives on the organization’s computer (by mail, in your personal account), you will only have to wait until the audit of a longer period is carried out.

So far, employees of the pension fund are conducting a desk audit.

Error codes when checking SZV-M

What errors the verification program detects and how it encodes them is indicated in the mentioned resolution of the Pension Fund Board of December 7, 2016 No. 1077p.

Gross errors prevent the submission of a report to the Pension Fund. Warnings may also be issued. For example, if an individual does not have a TIN, the program will pay attention to this and issue a warning, but will accept the report.

The following error and warning codes exist:

- 20 - warning in connection with the completion and correctness of the individual’s TIN;

- 30 - error in information about an individual: inconsistency or incomplete filling of full name, SNILS;

- 50 — the error is related to general flaws when filling out the form: incorrect format; inconsistency of full name or policyholder registration number; non-existent electronic signature; a period is indicated that goes beyond the scope of the SZV-M representation; a repeated form with the “original” type was submitted.

The data does not match - what to do?

During verification, some information may not match. What to do in such a situation? To do this, you should familiarize yourself with the most common mistakes. Errors are corrected depending on whether inaccurate information was omitted by the Pension Fund.

Critical errors:

- incorrect file format;

- incorrect signature;

- incorrect details.

The decision will require resubmitting the SZV-M or another document.

Errors for which corrections are necessary:

- start entering SNILS and TIN with double and single spaces;

- only zeros in the TIN;

- two hyphens and other punctuation errors in the full name, including the presence of two spaces near the hyphen in a double surname.

If the Pension Fund of Russia has accepted the document, it must be resubmitted with the “additional” type, otherwise – with the “outgoing” type.

Errors that require additions:

- inconsistency with SNILS;

- incorrect full name.

The document is re-submitted with the “additional” type for employees.

Warning errors:

- empty fields for recording TIN, patronymic, last name or first name;

- use of the letter "ё";

- use of apostrophes and parentheses;

- filling in Latin letters;

- presence of a dot in the patronymic.

These errors do not require correction if there are no other, more significant errors in the report.

How is CheckUFA different from CheckXML? Find out in this video.

Results

Before submitting the SZV-M form, it must be checked to avoid errors. If you have an electronic reporting service connected, it does this automatically. If you do not have electronic reporting, then you can check the SZV-M form by downloading a special program for free on the Pension Fund website or online using Kontur-extern.

Sources:

- Federal Law of April 1, 1996 No. 27-FZ

- Resolution of the Board of the Pension Fund of December 7, 2016 No. 1077p

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.