Documents confirming the acquisition of inventory items by the accountant

An accountable person is an employee who has received funds for business, administrative and other expenses.

To account for the money received for the purchase of goods and materials, the accountable person fills out an advance report, which indicates exactly what valuables, in what quantities and in what amounts were purchased.

ATTENTION! With effect from November 30, 2020, by the Bank of Russia’s instruction No. 5587-U dated October 5, 2020, the Central Bank introduced a number of changes to the procedure for conducting cash transactions. For example, an organization has the right to independently set the period for which funds are issued for reporting purposes.

You can see an example of filling out an advance report (AO), as well as a completed AO, in the material “Sample of filling out an advance report in 2022 - 2022”.

Supporting documents are attached to the advance report, i.e. documents confirming these expenses. Let's look at what documents these might be. An employee of an organization, having received money on account, can purchase goods and materials anywhere: in a retail chain, in a small organization, having received a sales receipt and, if available, a cash receipt as documents confirming the purchase. In this case, a sales receipt confirms the fact of purchase of goods and materials, and a cash receipt confirms their payment.

What should an accountant do if the accountant did not bring a cash receipt, see the material “Features of an advance report without a cash receipt.”

An important point is the acceptance of correctly completed documents.

For what exactly should be indicated in the documents submitted by the accountable person, see the material “Check the details in the accountable person’s documents so as not to be subject to personal income tax.”

If inventory items were purchased from an organization that is not a VAT payer, these documents are quite sufficient to accept an advance report and capitalize inventory items for it.

In order for the accountable person, when purchasing goods and materials, to act before the selling organization not as an individual, but as a representative of his enterprise, it is necessary to issue a power of attorney for this employee. The power of attorney must contain the date of issue and expiration date. The written power of attorney is registered in a special journal and handed over to the employee. By presenting a power of attorney to the seller, the employee acts on behalf of his organization. All documents provided to him by other enterprises will be issued in the name of his employer. By purchasing goods and materials in this way, he will receive both a delivery note and an invoice indicating the details of his organization, which will allow him to accept “input” VAT for deduction.

ConsultantPlus experts explained how to issue a power of attorney to receive goods and materials. Get trial access to the K+ system and upgrade to the Ready Solution for free.

Issuance of reports and reflection of transactions in accounting

Who can be reported to?

The accountable person can be an employee of the organization, including the manager and those working under a civil law contract. On the previously controversial issue of the possibility of issuing funds to “contractors,” an explanation was given by the Central Bank of the Russian Federation in 2014 (letter No. 29-R-R-6/7859 dated October 2, 2014).

Despite the fact that the Central Bank is not authorized to give such explanations, the letter included a reference to the Civil Code of the Russian Federation stating that from a legal point of view there is no difference what kind of agreement is concluded between an individual and an employer - labor or civil law. Consequently, the “contractor” is the same employee of the organization and has the right to take money on account.

Some organizations issue an order on a list of possible accountable persons; it may list either positions included in the staffing table or list accountable employees. The law does not require this. But if management wants to limit the circle of accountable persons, money cannot be given to other employees. Any order of the organization is mandatory.

From August 19, 2022, it can be issued on account to employees with arrears of the accountable amount issued previously. The amendment was introduced by the instruction of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U.

It is allowed to issue cash to several employees at the same time. The order is written one for several employees or individually for each.

Purchasing materials through an accountable person: postings

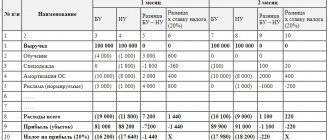

The accounting entries for the acquisition of inventory items by an accountable person will differ depending on the following factors:

- whether a power of attorney was issued to the employee on behalf of the organization;

- whether the seller of goods and materials is a VAT payer or not.

Let's consider each of these cases in detail.

How to compensate for overexpenditure on an advance report, read in ConsultantPlus. Trial access to the legal system is free.

Receipt of traceable goods through an accountable person in 1C: Enterprise Accounting ed. 3.0

Published 09/17/2021 08:21 Author: Administrator Product traceability is noticeably gaining momentum every day and affecting an increasing number of legal entities. Previously, we have already examined in detail the receipt of traceable goods from various counterparties, but we did not pay attention to the following situation: an organization’s acquisition of traceable goods through an accountable entity. Today we will close this gap and tell you how to reflect such an operation in the 1C program: Enterprise Accounting ed. 3.0 and who should be responsible for correctly filling out the accompanying documents.

In order to dot all the i's on this issue, let us turn to Letter of the Ministry of Finance of Russia dated 08.23.2021 N 27-01-22/67650 “On the national system of traceability of goods.”

So, let's start with the fact that the accountable person, making purchases on behalf of the organization, must present the company - the seller with a power of attorney, certified, as a rule, by the head of the organization. Consequently, the seller company, when selling traceable goods to such an accountable person, is obliged to issue an invoice in electronic form, indicating the RNPT in it.

In the opposite situation, when the “accountable” does not provide the company-seller with a power of attorney, the latter, assuming that the buyer is an individual, can stop traceability of the goods being sold. After all, the sale of a traceable product to individuals for personal needs is grounds for termination of traceability.

But we note that the situation we are considering involves the purchase of goods for business activities, therefore, there can be no talk of any cessation of traceability.

Therefore, in the above letter, the Ministry of Finance makes the following conclusion: in order for the seller company to comply with the law and be able to correctly draw up documents, purchasing organizations are required to ensure the receipt of an electronic invoice via telecommunication channels through an electronic document management operator.

This means that the Ministry of Finance places responsibility on this issue on the buyer organization. Consequently, the buyer organization is obliged not only to be able to accept an electronic invoice, but also to notify the seller company that the traceable goods are purchased in the interests of a legal entity.

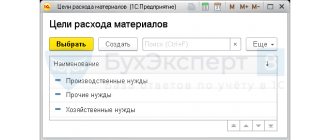

Now let's see how this situation should be reflected in the 1C program.

Don't forget to enable traceable goods functionality on the "Foreign Trade" tab in the "Main" - "Functionality" section.

To begin with, we will issue accountable funds to employee Ivan Ivanovich Ivanov.

To do this, we will use the document “Write-off from the current account”. Such a document can be either created in the program or downloaded from Client Bank.

So, let's go to the “Bank and Cash Office” section and then to the “Bank Statements” subsection.

In this document, among other things, it is worth paying attention to the fields highlighted in color. So the transaction type should take the value “Transfer to an accountable person”, and the expense item should be “Issue of accountable amounts”.

Let's review the document and look at the accounting records generated by it. We see that our “accountable” received 20,000 rubles.

Let's create a balance sheet (TBS) for account 71 to once again make sure that the transaction is reflected correctly.

Vasilek LLC issued accountable funds to Ivan Ivanovich Ivanov for the purchase of a refrigerator for the office. Let us remind you that such goods are traceable, in accordance with Decree of the Government of the Russian Federation of July 1, 2022 N 1110.

Since the employee acted in the interests of a legal entity, he provided the seller company with a power of attorney. Let us remind you that such a document is not a primary accounting document, but serves as the basis for transferring to an employee the rights to act as a trustee of the company. Below is a sample of this power of attorney.

Important! The power of attorney should indicate the correct name of the company - the buyer, TIN and registration address, since this is the data the seller will indicate in the check and in the primary documents.

A sample power of attorney is available.

Ivanov I.I. fulfilled the employer’s instructions and reported for the purchase.

At the moment in the 1C program: Enterprise Accounting ed. 3.0 in the “Advance report” document, work with traceable goods is not automated. Perhaps in the future the developers will improve the functionality of expense reports, but it doesn’t exist yet. Therefore, we will use a trick: to reflect the payment to the supplier, we will use the “Advance Report” document, but we will reflect the receipt of the traceable goods with the “Receipt of Goods” document.

Let us remind you that the supplier company is obliged to transfer the invoice to the buyer organization not in paper form, but in electronic form. Consequently, the “Receipt of Goods” document will be loaded into the program automatically if the purchasing organization uses the “1C: EDF” service in its work. Otherwise, the accountant will need to enter the data manually.

In our example, Vasilek LLC uses the services of a third-party EDF operator and the document is not automatically loaded into the accounting program.

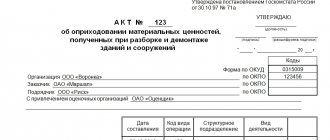

We will reflect the receipt of the traceable goods. To do this, we will create a new document “Receipt of goods”.

In the header of the document we will enter the data from the received UTD (Universal Transfer Document) from the supplier.

Let’s add a new element to the “Nomenclature” directory, paying attention to the lines highlighted in purple.

We can see from the special icon that the refrigerator we are purchasing is a traceable product, which means that the document requires the registration number of the product batch to be indicated. This number must be taken from the supplier’s documents.

Let's review the document and analyze the notes it made. The refrigerator was capitalized at the actual cost, according to the UPD, excluding VAT, and VAT was also allocated.

On the “Traceable Items” tab we see an entry made in the register of the same name with the form: Receipt.

Let's go to the "Operations with traceable goods" tab. Data about the purchased refrigerator will be reflected in the Purchase Book, as indicated by the column “Reflection in reporting”, since the buyer and seller, in our example, are VAT payers and apply a common taxation system.

Let's go to the "Bank and Cash Office" section and then to the "Advance Reports" subsection.

Let's create a new document.

Let's fill out the header of the document as follows:

• select from the “Individuals” directory the accountable person appearing in the example;

• indicate the required warehouse.

Next, let's move on to the tabular part of the document. Here we are interested in 2 bookmarks:

1. On the “Advances” tab, indicate the funds issued to the employee. For us, this operation was carried out by document “Write-off from the current account” No. 31 dated September 14, 2021.

2. On the “Payment” tab, we will reflect the funds paid to the supplier for the goods.

Let's review the document and analyze the transactions created by the program. We see that our “accountable” paid for the goods to the supplier Buttercup LLC. Also note that in the postings there was a necessary settlement document - our receipt of the refrigerator.

Let's check the correctness of our operations.

For clarity, let us again form SALT for accounts 71 and 60, we will see that there is no balance at the end of the period.

We remind you that due to the fact that Vasilek LLC is on the general taxation system, information about traceable goods will be included in the purchase book and, accordingly, in the VAT return.

We will also attach the full version of the purchase book:

If your organization is not a VAT payer, then you also need to report on the incoming traceable goods in a special “Report on transactions with goods subject to traceability.”

You can create it in the “Reports” – “1C-Reporting” section, selecting from the “Tax reporting” category.

Let us clarify that this report should be submitted to the Federal Tax Service no later than the 25th day of the month following the reporting quarter for all transactions with traceable goods.

Author of the article: Marina Alenina

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments

Posting - materials were purchased by an accountable person by proxy

If material assets were purchased by an employee by proxy from a seller who does not pay VAT, then the entries are as follows:

- Dt 71 Kt 50 (51) - money was given to the accountant;

- Dt 10 (15, 41) Kt 60 (account for accounting of settlements with suppliers) - reflects the receipt of material assets from a specific supplier;

- Dt 60 Kt 71 (account for accounting of settlements with accountable persons) - the accountable person paid these values to the supplier;

- Dt 50 Kt 71 - unspent accountable amounts were returned to the cash desk.

When an employee purchases materials by proxy from a VAT payer seller and has an invoice in the name of the purchasing organization, the accounting entries are as follows:

- Dt 71 Kt 50, 51 - money was issued on account;

- Dt 10 (15, 41) Kt 60 “Settlements with suppliers and contractors” - purchased goods and materials from a specific supplier (the cost of material assets is reflected without VAT);

- Dt 19 “VAT” Kt 60 “Settlements with suppliers and contractors” - VAT on acquired assets is reflected;

- Dt 68.2 “Calculations with the budget for VAT” Kt 19 “VAT” - VAT on acquired assets is accepted for deduction;

- Dt 60 (account for settlements with suppliers) Kt 71 “Settlements with accountable persons” - the accountable person paid these assets to the supplier;

- Dt 50 Kt 71 (mutual settlements with accountables) - unspent accountable amounts were returned to the cash desk.

Results

Accounting entries reflecting the receipt of material assets from the accountable person are formed on the basis of supporting documents received with the advance report from the employee.

They will depend on whether the employee presented the seller with a power of attorney from his organization, as well as on which company (VAT payer or not) the accountable person purchased the inventory items from. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.